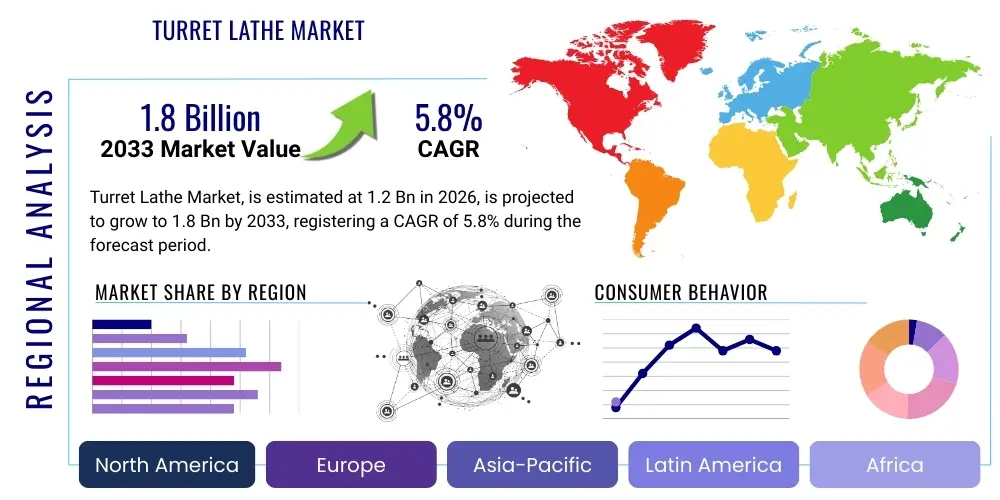

Turret Lathe Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441686 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Turret Lathe Market Size

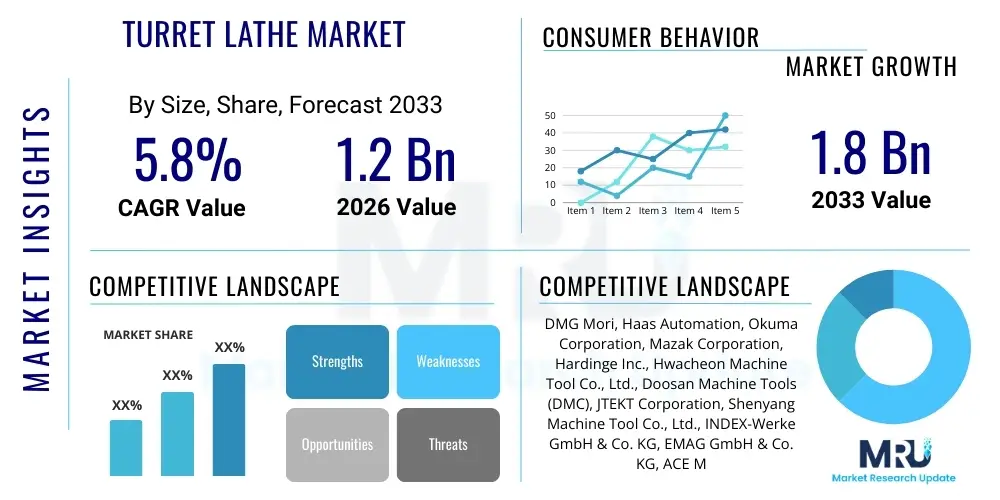

The Turret Lathe Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 1.8 Billion by the end of the forecast period in 2033.

Turret Lathe Market introduction

The Turret Lathe Market encompasses the manufacturing, distribution, and utilization of high-precision machine tools primarily designed for repetitive production of complex parts. Turret lathes, whether manually operated or controlled by Computer Numerical Control (CNC) systems, are distinguished by their hexagonal turret, which holds multiple cutting tools, allowing rapid sequencing of machining operations such as turning, boring, threading, and facing without the need for manual tool changes. These machines are crucial in industries requiring high volume, intricate component fabrication, offering significant advantages in terms of reduced setup time, superior accuracy, and enhanced repeatability compared to standard engine lathes. The evolution of this market is deeply intertwined with advancements in materials science and the imperative for light weighting and component miniaturization across various manufacturing sectors.

The core application of turret lathes lies in mass production environments where identical parts must be generated quickly and consistently. Major industries leveraging this technology include automotive manufacturing for engine components, axles, and transmission parts; aerospace for critical structural components and specialized fasteners made from exotic alloys; and general engineering sectors producing hydraulic fittings, valves, and mechanical components. Benefits derived from deploying advanced turret lathe systems include optimized cycle times due to automated tool indexing, minimization of human error through CNC programming, and the capacity to handle demanding tolerances essential for modern high-performance machinery. The inherent flexibility of modern CNC turret lathes allows for efficient batch processing of diverse components with minimal retooling.

Driving factors sustaining the market's trajectory include the global resurgence in manufacturing activities, particularly in emerging economies focused on infrastructural development and localized production capabilities. The ongoing transition towards Industry 4.0 principles necessitates machine tools that can seamlessly integrate into automated production lines, boosting demand for sophisticated CNC turret systems equipped with real-time monitoring and diagnostic capabilities. Furthermore, increasing capital expenditure in sectors like medical device manufacturing and precision instrumentation, which demand extremely tight dimensional control and surface finishes, continues to fuel the adoption of high-accuracy turret lathes. The continuous push for operational efficiency and labor cost reduction mandates investment in highly automated and reliable machining platforms.

Turret Lathe Market Executive Summary

The Turret Lathe Market is currently experiencing robust growth driven by the convergence of industrial automation and the necessity for precise component manufacturing across global value chains. Business trends indicate a decisive shift toward highly automated CNC turret lathes equipped with features like live tooling, subspindles, and sophisticated thermal compensation systems, reflecting manufacturers' efforts to achieve unattended operation and higher component complexity in a single setup. Key industry stakeholders are focusing heavily on developing software integration solutions that enable seamless connection with Manufacturing Execution Systems (MES) and Enterprise Resource Planning (ERP) platforms, optimizing production scheduling and resource management. Mergers, acquisitions, and strategic partnerships centered on software capabilities and regional expansion remain prevalent strategies among market leaders aiming to consolidate technological superiority and geographical reach.

Regional dynamics highlight the Asia Pacific (APAC) as the epicenter of market expansion, primarily fueled by massive industrialization initiatives in China, India, and Southeast Asia, coupled with substantial governmental support for domestic manufacturing hubs. North America and Europe maintain a strong market presence, characterized by high adoption rates of advanced, specialized, and highly customized CNC turret lathes, primarily serving high-value sectors such as aerospace, defense, and specialized machinery. While APAC focuses on volume and expanding industrial capacity, Western markets emphasize precision, digitalization, and productivity enhancements, utilizing technologies that reduce energy consumption and improve material utilization rates, aligning with stringent environmental regulatory frameworks.

Segment trends reveal that the CNC segment dominates the market due to its inherent advantages in achieving complex geometries and superior repeatability, gradually displacing manual and semi-automatic models in production-intensive environments. Within the product type segmentation, horizontal turret lathes maintain the largest market share owing to their traditional versatility and widespread adoption across general engineering applications, although vertical turret lathes (VTLs) are seeing accelerated uptake in heavy industries for processing large, heavy components that require stable clamping. Application-wise, the automotive sector remains the primary end-user, but significant growth is anticipated from the aerospace and medical industries, driven by their stringent quality control standards and the demand for machining exotic and difficult-to-machine materials like titanium and specialized superalloys.

AI Impact Analysis on Turret Lathe Market

User inquiries regarding the integration of Artificial Intelligence (AI) into the Turret Lathe Market frequently center on predictive maintenance, optimization of cutting parameters, and enhanced quality control during high-volume production runs. Key themes revolve around how AI can mitigate costly downtimes by forecasting component failure, whether machine learning algorithms can dynamically adjust spindle speeds and feed rates for optimal material removal rates and tool life, and the potential for deep learning to analyze sensor data for immediate defect detection and autonomous process correction. Users are particularly concerned with the complexity of implementing AI-driven solutions on legacy equipment and the required data infrastructure, while simultaneously seeking assurance that AI will lead to demonstrable improvements in overall equipment effectiveness (OEE) and precision manufacturing consistency.

- AI-driven Predictive Maintenance (PdM): Algorithms analyze vibration, temperature, and power consumption data from the turret lathe components (spindle, axis drives, turret mechanism) to predict imminent failures, enabling timely intervention and minimizing unplanned downtime.

- Dynamic Machining Optimization: Machine learning models process real-time cutting conditions, tool wear status, and material characteristics to autonomously adjust speeds, feeds, and depth of cut, maximizing metal removal efficiency while extending tool longevity.

- Enhanced Quality Control (In-Process Metrology): AI systems interpret high-frequency sensor data and camera imagery to detect anomalies or deviations in surface finish or dimensions immediately after machining, reducing scrap rates and ensuring 100% compliance with tolerance specifications.

- Process Planning and Simulation: AI facilitates the rapid generation and validation of complex CNC programs and tool paths, minimizing programming errors and significantly reducing the time required for job setup and first-part approval.

- Energy Consumption Reduction: Optimization algorithms adjust machine operation parameters to achieve required precision while minimizing energy draw, contributing to sustainable manufacturing goals and reduced operational costs.

- Autonomous Error Correction: AI enables the machine to learn from past machining errors and automatically compensate for variations such as thermal drift or tool deflection during ongoing operations, ensuring high consistency without human intervention.

DRO & Impact Forces Of Turret Lathe Market

The Turret Lathe Market dynamics are fundamentally shaped by powerful synergistic forces encapsulated by Drivers, Restraints, and Opportunities. A primary driver is the pervasive demand for high-precision components across resilient industrial sectors like automotive electrification (requiring tight-tolerance components for electric motors and battery assemblies) and aerospace (demanding components manufactured from specialized materials under rigorous safety standards). This is compounded by the global competitive landscape, which mandates continuous operational efficiency improvements and reduced production lead times, making highly automated, multi-axis CNC turret lathes essential investments for manufacturers seeking cost leadership and product quality superiority. The necessity to machine complex geometries in fewer setups further propels the adoption of advanced turret technologies incorporating features like Y-axis milling and multiple tool stations.

However, the market faces significant restraints, notably the high initial capital expenditure associated with purchasing sophisticated CNC turret lathe systems, which can be prohibitive for small and medium-sized enterprises (SMEs) lacking substantial financial backing. Furthermore, the reliance on specialized, highly skilled labor for programming, maintenance, and operation of these advanced machines poses a major challenge, exacerbated by the growing global shortage of qualified CNC technicians and mechanical engineers. Economic volatility and trade uncertainties also impact capital spending decisions in large manufacturing economies, leading to sporadic delays or cancellations of major machine tool procurement projects. The ongoing maintenance complexity and the need for specialized spare parts also contribute to the total cost of ownership, acting as a frictional force on market growth.

Opportunities for market expansion are abundant, particularly through the penetration of emerging markets characterized by rapid industrialization and the establishment of new manufacturing supply chains. Technological advancement in additive manufacturing (AM) also indirectly creates opportunities, as hybrid manufacturing systems that combine AM processes with high-precision turning capabilities are developed, utilizing turret lathe technology for final finishing and tolerance achievement. The development of subscription-based or leasing models (Equipment as a Service, EaaS) could significantly lower the barrier to entry for smaller firms, driving adoption. The growing emphasis on smart manufacturing and the integration of Industrial Internet of Things (IIoT) sensors provide lucrative avenues for market players to offer value-added services focused on data analytics, remote monitoring, and performance optimization, moving the market toward service-centric models.

Segmentation Analysis

The Turret Lathe Market is comprehensively segmented based on several critical dimensions, including technology (CNC vs. Conventional), product type (Horizontal vs. Vertical), and the specific industry application (End-User). This segmentation is crucial for understanding the varied demands and consumption patterns across different manufacturing landscapes globally. The Technology segment, particularly the CNC category, remains the cornerstone of market growth due to its capability to deliver high accuracy, superior speed, and complex simultaneous operations required by modern industrial standards. The dominance of horizontal configuration is attributable to its versatile application range, while the end-user segmentation clearly indicates the automotive industry's persistent, high-volume requirement for turning processes.

- By Technology

- Conventional (Manual) Turret Lathes

- CNC (Computer Numerical Control) Turret Lathes

- By Type

- Horizontal Turret Lathes

- Vertical Turret Lathes (VTLs)

- By Operation

- Ram Type Turret Lathes

- Saddle Type Turret Lathes

- By End-User Industry

- Automotive

- Aerospace and Defense

- Heavy Machinery and Industrial Equipment

- Electrical and Electronics

- Medical Devices and Precision Instruments

- General Machining and Job Shops

Value Chain Analysis For Turret Lathe Market

The value chain for the Turret Lathe Market commences with upstream activities focusing on the sourcing and processing of core raw materials and sophisticated components. Key upstream elements involve the procurement of high-grade cast iron and steel alloys for the machine structure (bed, headstock), high-precision bearings, ball screws, linear guides, and complex electronic components such as servo motors, drives, and specialized CNC controllers (e.g., Fanuc, Siemens, Heidenhain). Component suppliers must adhere to extremely tight quality tolerances, as the performance and longevity of the final turret lathe are directly dependent on the quality of these integrated components. Manufacturers often establish long-term relationships with specialized component providers to ensure supply chain stability and quality consistency.

The manufacturing and assembly phase involves the precise machining of the machine body, meticulous alignment of the turret and spindle, and the integration of electrical and electronic control systems. Direct distribution channels, where major machine tool builders sell directly to large-scale end-users (like automotive OEMs or Tier 1 suppliers), are common for high-value, customized CNC systems, allowing for better control over installation, training, and after-sales service. Conversely, indirect distribution utilizes authorized distributors, dealers, and regional representatives, particularly for standardized models or penetration into fragmented markets and smaller job shops, leveraging the distributors' local market expertise and established customer networks.

Downstream activities center on installation, commissioning, programming, maintenance, and the provision of consumables and tooling. The service component is critical, encompassing operator training, preventative maintenance contracts, and technical support, often generating substantial recurring revenue for machine tool providers. Furthermore, the downstream includes specialized tooling suppliers (e.g., holders, inserts, cutting fluids) whose innovation supports the continuous performance improvement of the lathes. The efficiency of this downstream ecosystem, particularly the responsiveness of technical support and spare parts availability, significantly influences customer satisfaction and repeat purchase decisions within the capital equipment sector.

Turret Lathe Market Potential Customers

Potential customers, or end-users, of turret lathes span a wide array of manufacturing industries that require high-volume production of rotational components with stringent accuracy requirements. The largest buyer cohort historically belongs to the automotive manufacturing sector, including Original Equipment Manufacturers (OEMs) and their extensive network of Tier 1 and Tier 2 suppliers, utilizing turret lathes for producing engine blocks, brake discs, gears, shafts, and specialized chassis components. The transition toward electric vehicles (EVs) continues to necessitate the turning of new materials for battery casings and motor components, ensuring sustained demand from this segment.

The aerospace and defense sector represents a highly lucrative but demanding customer segment, characterized by low volume but extremely high value, where turret lathes are essential for machining turbine blades, landing gear components, specialized fasteners, and structural parts from difficult-to-machine materials like titanium, Inconel, and high-strength aluminum alloys. These customers prioritize machine rigidity, thermal stability, and the ability to maintain micron-level tolerances under continuous operation, often favoring advanced multi-axis CNC turret lathes with integrated measuring systems. The defense industry, driven by modernization efforts, maintains a consistent demand for reliable, high-precision machining capability.

Furthermore, general precision engineering and job shops form a broad, essential customer base. These entities provide contract manufacturing services across various industries, utilizing the versatility of turret lathes to handle diverse batch sizes and material types, ranging from simple bushing manufacturing to complex hydraulic valve bodies. The increasing demand for precision components in the medical device sector—for surgical instruments, implants, and diagnostic equipment—also positions this area as a rapidly growing segment, requiring machines capable of exceptional surface finish and adherence to stringent industry regulations regarding material traceability and process validation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 1.8 Billion |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DMG Mori, Haas Automation, Okuma Corporation, Mazak Corporation, Hardinge Inc., Hwacheon Machine Tool Co., Ltd., Doosan Machine Tools (DMC), JTEKT Corporation, Shenyang Machine Tool Co., Ltd., INDEX-Werke GmbH & Co. KG, EMAG GmbH & Co. KG, ACE MICROMATIC Group, Tornos Group, Takisawa Machine Tool Co., Ltd., Tsugami Corporation, PUMA Machine Tools, Ganesh Machinery, Colchester Machine Tool Solutions, KNUTH Machine Tools. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Turret Lathe Market Key Technology Landscape

The contemporary Turret Lathe Market is defined by continuous technological innovation aimed at enhancing speed, precision, flexibility, and integration capabilities. A cornerstone technology is the widespread adoption of high-performance CNC systems, which have evolved beyond basic axis control to incorporate sophisticated features such as conversational programming, advanced collision avoidance algorithms, and five-axis simultaneous machining capabilities. Furthermore, the integration of live tooling (powered tools on the turret) has transformed standard turning machines into full-scale turning centers, enabling complex milling, drilling, and tapping operations without transferring the workpiece to a separate machine. This multi-tasking capability significantly reduces overall production time and minimizes cumulative machining errors associated with multiple setups, a crucial requirement for industries demanding zero-defect manufacturing standards.

Another crucial technological advancement involves thermal management and structural design improvements. Modern turret lathes utilize specialized casting materials (often polymer concrete or heavily ribbed cast iron) and sophisticated cooling systems to maintain thermal stability throughout extended high-speed operation, directly influencing component accuracy. High-speed spindle technology, featuring direct-drive motors and advanced bearing technology, allows for faster material removal rates and superior surface finishes. The development of automated material handling systems, including bar feeders, gantry loaders, and robotic arms, is transforming CNC turret lathes into fully autonomous cells, facilitating lights-out manufacturing and significantly boosting overall productivity by reducing reliance on constant manual supervision.

The shift toward Industry 4.0 principles necessitates advanced connectivity and data processing technologies. Turret lathes are increasingly equipped with numerous sensors (vibration, acoustic, temperature, power) that feed real-time operational data into machine monitoring platforms utilizing the Industrial Internet of Things (IIoT). This connectivity enables precise condition monitoring, remote diagnostics, and the application of machine learning algorithms for optimizing tool change schedules and detecting potential process deviations before they result in scrapped parts. Furthermore, the adoption of digital twin technology allows manufacturers to simulate complex machining processes virtually, optimizing tool paths and verifying program integrity before actual cutting begins, thereby enhancing efficiency and reducing material waste during the setup phase.

Regional Highlights

- Asia Pacific (APAC): The APAC region commands the largest market share and is anticipated to exhibit the fastest growth rate over the forecast period. This dominance is attributed to rapid, large-scale industrialization, particularly in countries like China, which is the world's largest machine tool consumer and producer, and India, which is witnessing massive governmental investment in manufacturing infrastructure (e.g., 'Make in India' initiatives). The automotive and electronics manufacturing sectors in South Korea, Japan, and Taiwan continue to drive demand for highly accurate CNC turret lathes. The region's competitive labor costs, coupled with increasing adoption of advanced automation to counteract rising domestic labor expenses, solidify its position as the engine of market expansion.

- North America: North America represents a mature yet highly valuable market segment, characterized by high technological penetration and significant demand from the high-precision aerospace, defense, and specialized machinery industries. The region heavily favors high-end, multi-axis CNC turret lathes that offer complex machining capabilities and seamless integration with existing factory digitalization efforts. Driven by reshoring initiatives and investment in advanced manufacturing techniques, the North American market focuses intensely on efficiency and quality. Capital expenditure decisions are highly influenced by productivity gains and the capacity of machines to handle advanced materials critical to modern aircraft and medical technologies.

- Europe: Europe holds a strong position in the global market, driven primarily by Germany, Italy, and the UK, countries renowned for their robust automotive, industrial equipment, and precision engineering sectors. The European market exhibits high demand for energy-efficient, environmentally compliant, and highly rigid machine tools. Strict regulatory requirements and a strong focus on sustainability propel innovation in machine design and operational monitoring systems. European manufacturers often invest in custom-built, specialized turret lathes designed for niche high-tolerance applications, prioritizing long-term machine reliability and maintenance support over initial cost.

- Latin America (LATAM): The Latin American market, while smaller in comparison, is showing moderate growth, particularly in Brazil and Mexico. This growth is linked to localized automotive production and expansion in the resource extraction and infrastructure development sectors. Demand is often focused on dependable, medium-complexity CNC lathes suitable for general machining and maintenance operations. Market development is sensitive to macroeconomic conditions and foreign direct investment levels, making price competitiveness a significant factor for market penetration.

- Middle East and Africa (MEA): The MEA region is experiencing gradual growth, mainly driven by investments in energy infrastructure, defense manufacturing, and diversification efforts away from oil dependency, particularly in the UAE and Saudi Arabia. The market primarily targets large state-owned enterprises requiring robust VTLs for handling large components related to oil and gas equipment, valves, and power generation turbines. Adoption rates for advanced CNC technology are accelerating as regional governments prioritize localized high-tech manufacturing capability.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Turret Lathe Market.- DMG Mori AG

- Haas Automation, Inc.

- Okuma Corporation

- Mazak Corporation

- Hardinge Inc.

- Hwacheon Machine Tool Co., Ltd.

- Doosan Machine Tools (DMC)

- JTEKT Corporation

- Shenyang Machine Tool Co., Ltd. (SMTCL)

- INDEX-Werke GmbH & Co. KG

- EMAG GmbH & Co. KG

- ACE MICROMATIC Group

- Tornos Group

- Takisawa Machine Tool Co., Ltd.

- Tsugami Corporation

- Ganesh Machinery

- Colchester Machine Tool Solutions

- KNUTH Machine Tools

- PUMA Machine Tools

- Goodway Machine Tool Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Turret Lathe market and generate a concise list of summarized FAQs reflecting key topics and concerns.What primary technological factor is currently driving the growth in the Turret Lathe Market?

The key growth driver is the continuous advancement and integration of Computer Numerical Control (CNC) systems with multi-tasking capabilities, such as live tooling and Y-axis functionality. These technologies enable single-setup completion of complex parts, significantly enhancing production efficiency and reducing cycle times, which is critical for the automotive and aerospace sectors.

How does the segmentation between Horizontal and Vertical Turret Lathes affect market adoption?

Horizontal Turret Lathes hold the largest market share due to their versatility in handling standard cylindrical parts. However, Vertical Turret Lathes (VTLs) are experiencing accelerated growth in heavy industries, as their vertical configuration is ideal for machining large, heavy workpieces (e.g., turbine components) that require gravity-assisted stabilization and easier loading/unloading processes.

What role does the Industrial Internet of Things (IIoT) play in modern Turret Lathe operations?

IIoT integration is paramount for enabling smart manufacturing by equipping turret lathes with sensors that collect real-time data on performance, vibration, and temperature. This data is used for crucial functions like predictive maintenance, optimizing tool life, remote diagnostics, and improving overall equipment effectiveness (OEE) across the factory floor.

Which geographical region offers the most significant growth potential for Turret Lathe manufacturers?

Asia Pacific (APAC), led by manufacturing expansion in China and India, offers the highest growth potential. This is driven by massive industrial capacity expansion, significant government support for localized production, and rapidly increasing demand for high-volume precision components across sectors like automotive and consumer electronics.

What are the primary restraints impacting the wider adoption of advanced CNC Turret Lathes?

The primary restraints are the high initial capital investment required for advanced CNC machinery and the persistent global shortage of highly skilled technical personnel, specifically CNC programmers and maintenance engineers, necessary to operate and sustain these complex manufacturing assets efficiently.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager