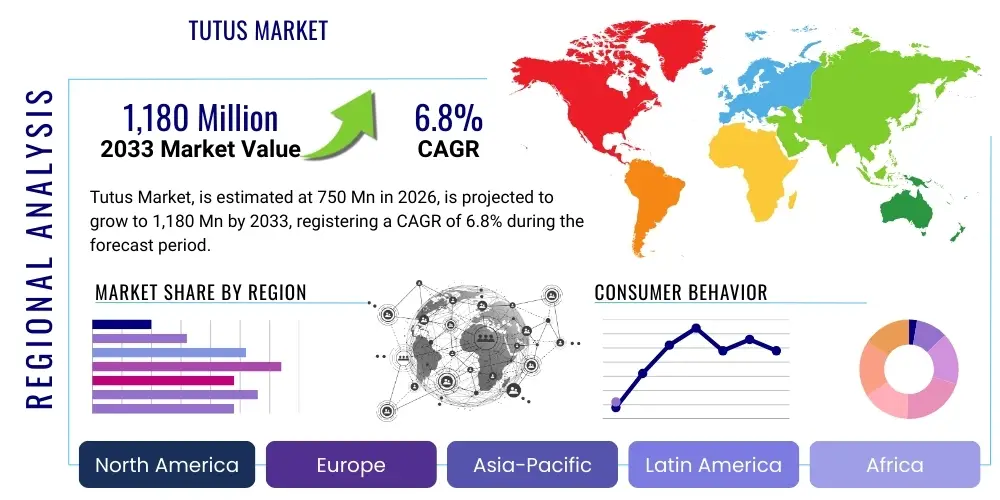

Tutus Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440963 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Tutus Market Size

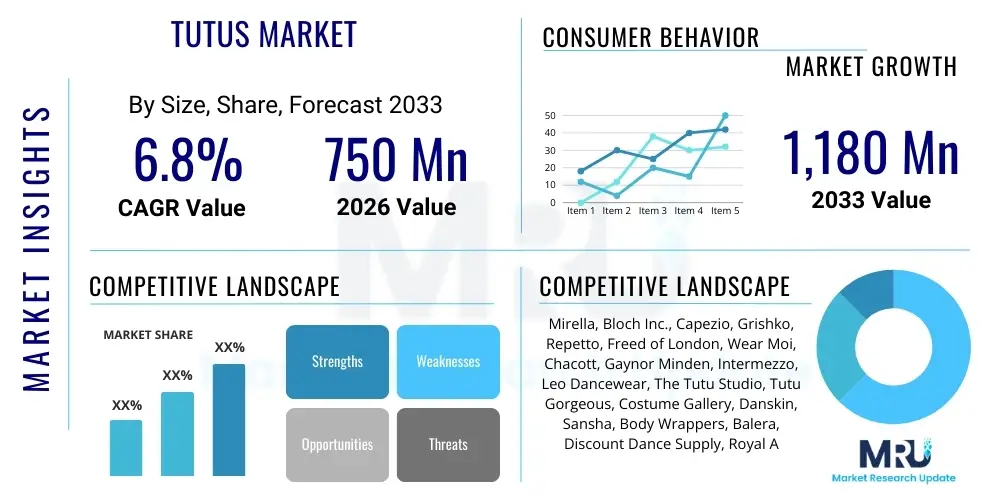

The Tutus Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $750 Million USD in 2026 and is projected to reach $1,180 Million USD by the end of the forecast period in 2033.

Tutus Market introduction

The Tutus Market encompasses the design, manufacturing, and distribution of specialized apparel primarily associated with ballet and theatrical performance, extending increasingly into high-end fashion, recreational fitness wear, and costuming. Historically defined by classical ballet attire, the modern market has diversified significantly, integrating advanced textile technology and personalized design aesthetics. This evolution is driven by the global resurgence in performing arts appreciation, the broadening accessibility of dance education, and the strong influence of performance wear on mainstream fashion trends. The core product remains the multilayered skirt, but innovation focuses intensely on ergonomics, material breathability, tensile strength, and durability, catering specifically to professional dancers who require highly specialized, precision garments that support complex choreography and demanding rehearsal schedules, as well as amateurs seeking quality and style that mimics professional standards. The structural integrity and material composition are paramount, determining the garment's visual effect and functional lifespan.

The primary applications for tutus span professional stage performances, rigorous rehearsal environments, extensive educational settings—including world-renowned dance schools and regional academies—and large-scale theatrical productions requiring complex wardrobe logistics. Furthermore, the burgeoning segment of customized luxury apparel, including bridal wear and high-fashion editorial usage, represents a significant growth vector, capitalizing on the garment's iconic status, intricate construction, and visual appeal. The product description now emphasizes lightweight construction using specialized, often proprietary, polymer-based mesh and netting, precise fit achieved through bespoke tailoring or advanced sizing algorithms, and the use of specialized materials—such as rigid, high-denier nylon tulle for classical styles (pancake or platter tutus) and softer, often silk-blended chiffons or technical nets for romantic styles—to ensure unimpeded freedom of movement while maintaining the desired silhouette and crucial structural integrity under dynamic conditions. This technical differentiation is a key competitive factor.

Major benefits driving market adoption include demonstrably enhanced performance capabilities for professional users through biomechanchanically optimized fit, superior aesthetic and visual quality for high-definition theatrical applications, and increased self-expression and comfort in fashion and recreational dance. Key driving factors are the rising global disposable incomes, particularly in Asian emerging economies, leading to increased parental expenditure on extracurricular activities like high-quality dance education. This demand is buttressed by aggressive marketing and product endorsement strategies executed by leading apparel brands entering the specialized dancewear segment. Furthermore, continuous technological advancements in textile manufacturing and garment assembly, such as seamless knitting and laser cutting, allow for greater customization at scale and dramatically improved garment lifespan, reducing the total cost of ownership for professional institutions. The steady global cultural appreciation for classical and contemporary ballet acts as a foundational stimulant for sustained, premium demand across all major geographical regions, solidifying the market's robust long-term growth trajectory and insulation from rapid fashion cycles.

Tutus Market Executive Summary

The Executive Summary highlights robust business trends characterized by significant vertical integration and strategic diversification among key market players. Manufacturers are increasingly controlling the entire supply chain, from sourcing specialized fabrics (like high-denier nylon and unique blends for stretch and rigidity) to managing sophisticated direct-to-consumer (D2C) sales platforms, thereby enhancing profit margins and achieving greater control over brand presentation and quality assurance. A crucial contemporary business trend involves incorporating sustainability, driven by increasing consumer demand for ethically sourced and environmentally friendly materials, prompting companies to invest substantially in recycled polymer fabrics and transparent production processes that minimize chemical usage and water consumption. Furthermore, collaborative partnerships between specialized dancewear manufacturers and globally recognized ballet companies or influential fashion designers are accelerating product innovation, enhancing brand visibility, and facilitating market penetration into adjacent lifestyle segments, moving the tutu from a niche, technical performance item to a broader, culturally significant fashion statement.

Regional trends indicate that North America and Europe remain the foundational, dominant revenue generators due to deeply established professional ballet ecosystems, high consumer spending power allocated to arts and leisure activities, and dense populations of dedicated, long-standing dance schools and conservatories. However, the Asia Pacific (APAC) region, specifically encompassing major economies like China, Japan, and South Korea, is strategically positioned and projected to exhibit the highest Compound Annual Growth Rate (CAGR) over the forecast period. This explosive growth is fundamentally fueled by massive governmental and private investment in cultural education infrastructure, the rapid professionalization of regional dance academies adopting international curricula, and the expanding presence and influence of Western dance forms within local educational systems. Emerging markets in Latin America and the Middle East are also displaying steady incremental growth, primarily driven by international touring ballet companies, increasing domestic theatrical investment, and the development of new cultural centers.

Segment trends reveal that the Application segment—specifically, the Recreational/Fitness category—is rapidly gaining substantial market share against the traditional, though highly profitable, Professional Ballet segment. This notable market share shift is directly attributable to the rise of specialized fitness routines incorporating dance elements, such as Barre, contemporary movement classes, and structured dance cardio, which utilize comfortable, durable, and stylish performance tutus and skirts. In terms of Material Type segmentation, there is a distinct and accelerating demand shift towards high-performance technical textiles that offer superior moisture-wicking properties, enhanced flexibility, and resilience against repeated washing and stress, gradually moving away from traditional natural fibers unless they are specifically required for historical or artisanal qualities. The Online Retail distribution channel continues to significantly outperform and displace traditional brick-and-mortar specialty stores, leveraging its capacity for global reach, sophisticated personalized fitting guides utilizing digital models, and superior inventory management systems crucial for catering effectively to a globally dispersed, highly specialized customer base.

AI Impact Analysis on Tutus Market

Analysis of common user questions regarding AI's impact on the Tutus Market centers predominantly on customization challenges, supply chain optimization efficiency, and personalized retail experiences within a historically artisanal sector. Key themes reveal user expectations for AI to solve historical fitting complexities inherent in performance wear by enabling non-invasive, precise 3D body scanning and automated pattern adjustments, thereby radically reducing the time and cost associated with multiple manual fittings required for bespoke garments. Users also frequently inquire about how sophisticated AI models can optimize inventory levels of highly niche, specialized materials—such as specific rigidities of imported French tulle or rare color dyes—and predict demand surges that are tightly correlated with specific regional or international performance schedules, major competition dates, or cyclical fashion influences. Concerns often revolve around the potential for design homogenization if AI focuses too heavily on standardized aesthetic optimization, posing a threat to the unique, high-touch, artisanal nature of luxury tutu production where human artistry is paramount. Users explicitly expect AI to act as an indispensable enabler for hyper-personalization, efficient global logistics, and material science breakthroughs rather than a direct replacement for highly skilled craftspeople and pattern makers.

AI is rapidly poised to revolutionize the highly specialized Tutus Market by addressing critical pain points related to production precision, fit consistency, and consumer engagement, transforming the bespoke ordering process. Advanced machine learning algorithms are currently being integrated into sophisticated Computer-Aided Design (CAD) and Computer-Aided Manufacturing (CAM) software suites. These algorithms are designed to analyze thousands of data points related to individual dancer morphology, dynamic movement profiles captured via motion sensors, and historical aesthetic preferences linked to specific choreographic styles. This analysis allows manufacturers to generate patterns that are biomechanically optimized for the specific performer, ensuring maximum comfort, zero restriction, and extended performance longevity without sacrificing the critical visual silhouette. Furthermore, AI-driven demand forecasting leverages complex variables—including historical sales data, social media sentiment analysis, seasonal performance calendars, and localized macroeconomic indicators—to accurately predict necessary stock levels for various raw materials and highly seasonal finished goods, drastically minimizing material waste and critically reducing lead times for essential custom-order high-value items where speed and precision are non-negotiable.

The impact extends significantly into the digital retail landscape and the overall consumer interface, providing scalable solutions for individualized service. Generative AI tools are now actively facilitating bespoke design creation, allowing costume designers, institutional buyers, and individual customers to visualize personalized tutu concepts in real-time. This includes instant experimentation with complex layering effects, precise color matching across various fabric textures, intricate embellishment placements, and structural element modifications, all rendered virtually before any physical production material is committed. This democratization of the preliminary design process, coupled with AI-powered virtual try-on technologies using Augmented Reality (AR) within e-commerce applications, dramatically improves the highly tactile and critical online shopping experience for performance garments where fit uncertainty is a major deterrent. For market players, this translates directly into measurable benefits: reduced return rates, significantly improved customer satisfaction due to enhanced precision, and the sustained ability to maintain premium pricing points based on offering unprecedented levels of customization, design complexity, and manufacturing precision derived from AI input.

- AI-driven 3D body scanning and automated bespoke pattern generation for precision fitting, minimizing reliance on multiple manual tailoring sessions and subsequent material alterations.

- Predictive demand forecasting based on specific global and regional performance schedules, deep social media trend analysis, and regional dance activity to optimize inventory of specialized, often imported, raw materials.

- Generative AI tools enabling customers and designers to visualize complex, highly customized tutu designs virtually, allowing instant rendering of layered tulle effects and structural placement before manufacturing initiation.

- Supply chain optimization using machine learning models to track volatile costs of specialized fabrics and ensure robust ethical sourcing transparency and compliance for luxury materials.

- Enhanced automated quality control during highly complex manufacturing via high-resolution computer vision systems detecting minute structural and aesthetic defects in layered tulle structures that human inspection might miss.

DRO & Impact Forces Of Tutus Market

The dynamics of the Tutus Market are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming the fundamental Impact Forces that shape industry profitability and competitive strategy. A primary Driver is the enduring global appreciation, increasing funding, and professionalization of ballet and contemporary dance, leading to consistent, high-value demand for top-tier, technically advanced performance wear. This core demand is further amplified by the rapid, governmental-backed expansion of dance education centers, particularly across APAC and Latin America, creating a significantly larger and rapidly growing consumer base for training and performance attire. Continuous technological advancements in textile engineering, providing superior lightweight, durable, and highly flexible composite fabrics, also act as a substantial driver, enabling innovative products that materially enhance dancer performance and the garment's operational lifespan. The influential cultural fusion of specialized dancewear into mainstream athleisure and street fashion continues to broaden the market appeal beyond its traditional, core niche boundaries.

Conversely, the market faces several significant inherent Restraints that limit volume scalability. The high cost associated with producing handcrafted, high-precision classical tutus, particularly those requiring substantial skilled artisanal labor, complex hand-sewing techniques, and expensive imported specialized materials, inherently restricts mass-market adoption and penetration into lower-income demographics. Furthermore, the market exhibits high seasonality and operational dependency on the performance cycles, competition schedules, and academic calendars of dance institutions, making consistent inventory management and sustained cash flow challenging for manufacturers reliant on peak-season sales. The increasing prevalence of low-quality, often unsafe, counterfeit products, particularly in the costume and amateur segments, poses a major threat, undermining legitimate, quality-focused manufacturers who invest heavily in material quality assurance, ethical production standards, and rigorous performance testing.

Opportunities abound for strategic market players through aggressive leveraging of sophisticated digital platforms and continuous material science innovation. The expansion and refinement of sophisticated Direct-to-Consumer (D2C) e-commerce channels present an unparalleled opportunity for highly specialized brands to efficiently reach niche global audiences without excessive reliance on traditional, localized retail intermediaries. Adopting and promoting sustainable and circular fashion practices offers a strong competitive and ethical advantage, successfully meeting the demands of environmentally conscious Gen Z and Millennial consumers who are increasingly willing to pay a premium for ethically sourced, transparently produced performance products. Additionally, strategic product diversification into related luxury accessories or tailored performance garments for adjacent movement arts (e.g., rhythmic gymnastics, professional ice dancing) allows companies to stabilize revenue streams and mitigate risks associated with the highly seasonal nature of peak ballet performance cycles. These collective forces of DRO strategically dictate the intensity of competition, the bargaining power dynamics between buyers and suppliers, and the long-term profitability potential within this specialized, high-value market ecosystem.

Segmentation Analysis

The comprehensive segmentation analysis of the Tutus Market provides granular and actionable insights into demand patterns across various critical product characteristics, distinct end-user applications, and optimized distribution methodologies. Understanding these defined market slices is absolutely crucial for stakeholders developing highly targeted marketing strategies, optimizing complex production schedules for seasonal demand, and identifying high-growth sub-markets ripe for immediate investment and penetration. Segmentation rigorously facilitates the customization of product offerings, ensuring that manufacturers can effectively and precisely cater to the distinct and often contradictory needs of professional international ballet companies, vast amateur dance schools, specialized theatrical costumers, and the increasingly influential fashion consumer seeking specialized, aesthetically driven performance-inspired apparel.

- By Material Type:

- Nylon Tulle (High rigidity, standard for classical styles)

- Polyester Tulle and Netting (Cost-effective, used for practice and theatrical styles)

- Specialty Fabrics (e.g., High-performance Stretch Mesh, Lycra Blends, Eco-friendly/Recycled Polymer Materials for sustainability)

- Cotton Blends and Natural Fibers (Less common but utilized for specific romantic styles and historical accuracy)

- By Product Style:

- Classical Tutus (Pancake, Platter, and Bell styles; highly structured and rigid)

- Romantic Tutus (Bell-shaped, long and flowing, utilizing soft netting)

- Practice/Rehearsal Tutus (Durable, simplified construction, often short-length)

- Custom and Theatrical Design Tutus (Bespoke, unique non-standard materials and structures)

- By Application/End-User:

- Professional Performance (Major Ballet Companies and Opera Houses; focus on high-end customization)

- Dance Education (Academies, Schools, and Training Programs; focus on durability and compliance)

- Recreational/Fitness (Barre, Contemporary Dance, and Fitness Classes; focus on comfort and fashion integration)

- Costume and Fashion (General Theatrical Use, High Fashion Editorial Shoots, Luxury Bridal Wear)

- By Distribution Channel:

- Online Retail (Brand-owned Websites, Dedicated E-commerce Platforms)

- Specialty Dancewear Stores (Localized Brick-and-Mortar, providing fitting services)

- Department Stores and Boutiques (Primarily targeting the Fashion Segment)

- Direct Sales to Institutions (High-volume B2B transactions with Ballet Companies/Schools)

Value Chain Analysis For Tutus Market

The Value Chain Analysis for the Tutus Market is uniquely characterized by a high degree of technical specialization and dual manufacturing pathways at multiple stages, transitioning from bulk textile manufacturing upstream to highly detailed, often artisanal and manual finishing downstream. Upstream activities primarily involve the rigorous procurement and complex refinement of specialized raw materials. This includes securing high-quality, specific-denier nylon and polyester for rigid tulle, importing delicate silks and specialized chiffons, and sourcing advanced stretch fabrics with moisture-wicking properties. Suppliers of these technical textiles possess significant leverage and power within the chain, as the exact quality, performance characteristics, and visual effect of the final performance garment are directly and unequivocally tied to the precise raw material specifications, particularly regarding required stiffness, optimal weight, and complex dye compatibility. Efficient, optimized inventory management of these highly specialized and often volatile-priced fabrics is critically important, as bespoke customization often requires holding a wide variety of specific colors, rigidities, and fabric types ready for rapid deployment.

The midstream processes of the tutu value chain are distinctly segmented into two diverging operational approaches: the automated, streamlined mass production of practice wear and standardized romantic styles, which benefits significantly from advanced computerized cutting technology and automated assembly lines; and the highly specialized, extremely labor-intensive, and time-consuming creation of classical performance tutus. The latter requires expert pattern makers and highly skilled seamstresses to hand-layer, gather, and secure dozens of tulle layers, often incorporating bespoke corsetry and intricate hand-embellishment work. Operational efficiency in this segment hinges not on speed, but on the flawless precision of artisanal craftsmanship. Downstream activities involve managing complex distribution channels, which are increasingly and fundamentally bifurcated between high-volume, global e-commerce operations (efficiently handling recreational and educational sales) and the highly personalized, institutional sales channel (directly serving professional ballet companies that demand bespoke fittings, credit accounts, and direct liaison with specialized costume departments).

Distribution channels are absolutely crucial for sustained market success and require a nuanced strategy. Direct channels, primarily through brand-owned online stores and flagship boutiques, allow companies to capture significantly higher profit margins and maintain strict, consistent brand control, while simultaneously gathering invaluable first-party customer data essential for sophisticated personalized marketing and product development insights. Conversely, indirect channels, typically specialty dancewear retailers, offer localized, expert fitting services, crucial for initial sizing and ensuring correct style selection, support that remains essential for new dancers and large educational institutions making bulk purchases. Due to the inherent complexity of the product—which demands precise, non-negotiable sizing and fitting accuracy for performance—distribution strategies must effectively and seamlessly combine the logistical efficiency, cost benefits, and global reach of online platforms with the essential, high-touch, expert support provided by physical specialty retailers, rigorously ensuring that performance garments meet the exacting standards required for high-level artistic and athletic performance.

Tutus Market Potential Customers

The potential customer base for the Tutus Market is highly diverse, segmented broadly across professional, educational, recreational, and high-fashion demographics, each of these segments characterized by unique and distinct purchasing criteria, decision-making processes, and consumption patterns. The most critical, though not volume-dominant, segment comprises professional ballet companies, major opera houses, and national theaters, which function as large, institutional buyers. These customers prioritize absolute engineering precision, verifiable material performance, extreme durability under rigorous stage and travel conditions, and scrupulous adherence to highly specific artistic directorial requirements and historical accuracy. Purchasing decisions for this segment are typically centralized and driven by professional costume designers and wardrobe managers who seek long-term, reliable partnerships with manufacturers capable of consistently delivering complex, highly consistent, and rapid-turnaround custom orders, often requiring specialized contractual commitments and minimal post-purchase tailoring or modification to ensure immediate stage readiness.

A substantial volume segment consists of dance students, encompassing absolute beginners through highly advanced academy members enrolled in structured training programs. These customers’ purchasing decisions are primarily influenced by dance instructors, school uniform policies, and the requirements of various regional and national certification bodies. Their purchasing drivers are fundamentally focused on achieving high value for money, ensuring durability for heavy daily practice use, prioritizing comfort during extended training sessions, and strict compliance with established school dress codes and uniform mandates. The primary decision-makers here are typically parents or the students themselves, who rely heavily on direct recommendations from highly trusted teachers, specialized fitting advice from retailers, and the established reputation of the brand for consistent quality, ethical material sourcing, and reliable, standardized sizing across product lines. This segment heavily utilizes the convenience of the online retail channel but often requires the foundational expertise of specialty store staff for initial fittings and expert guidance on style appropriateness.

The rapidly expanding third segment involves recreational dancers, dedicated fitness enthusiasts (especially those participating in specialized Barre or contemporary dance-fitness programs), and the fashion-conscious consumer seeking performance-inspired aesthetics. These distinct end-users prioritize contemporary style, high comfort levels, expansive color availability, and seamless integration into broader, luxury athleisure or street-fashion wardrobes. Their purchasing behavior is often highly impulsive, strongly driven by immediate social media trends, targeted influencer marketing, and strategic brand collaborations with high-profile figures. For these diverse buyers, the tutu or related performance skirt is often less a technical performance garment and more a critical statement fashion piece, making the Distribution Channel segment of high-end department stores, online fashion aggregators, and luxury boutiques increasingly relevant and critical for market penetration. Understanding these increasingly nuanced and shifting needs allows market players to effectively tailor material usage, set agile pricing strategies, and develop marketing narratives that resonate specifically across these distinct and highly profitable customer groups.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $750 Million USD |

| Market Forecast in 2033 | $1,180 Million USD |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mirella, Bloch Inc., Capezio, Grishko, Repetto, Freed of London, Wear Moi, Chacott, Gaynor Minden, Intermezzo, Leo Dancewear, The Tutu Studio, Tutu Gorgeous, Costume Gallery, Danskin, Sansha, Body Wrappers, Balera, Discount Dance Supply, Royal Academy of Dance (Licensing). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Tutus Market Key Technology Landscape

The Key Technology Landscape in the Tutus Market is rapidly evolving, driven by the unwavering imperative to achieve superior performance metrics, unparalleled precision fit, and robust sustainability standards without compromising aesthetic quality. The most impactful technological advancements are strategically concentrated within material science innovation and sophisticated digital manufacturing processes. Textile innovation focuses intensively on developing lightweight, highly durable, and highly moisture-wicking synthetic fabrics that successfully mimic the specific rigidity and tactile feel of traditional luxury materials while simultaneously offering enhanced breathability, flexibility, and dynamic movement characteristics. This complex process necessitates the adoption of specialized heat-bonding techniques, ultrasonic welding, and precision laser-cutting technology for the multiple, delicate layers of tulle and netting, rigorously ensuring precise structural symmetry and minimizing material fraying, which is absolutely essential for maintaining the critical structural integrity of complex classical designs throughout intense, repetitive stage use.

Digital design and manufacturing technologies are fundamentally and irrevocably altering the traditional production process for tutus. The advanced integration of high-resolution 3D body scanning technology and sophisticated parametric design software allows for the immediate creation of precise, virtual models of individual dancers. This crucial digital step enables custom tutus to be engineered with micron-level dimensional accuracy and biomechanical optimization long before any physical fabric is cut or committed. This digital pre-engineering dramatically reduces the excessive fitting time, the associated labor costs, and the significant material waste that are typically inherent in traditional bespoke tailoring methods. Furthermore, modern, advanced manufacturing facilities increasingly utilize computerized pattern layout algorithms and automated assembly systems, particularly for the intricate task of assembling the multiple, voluminous layers of netting, thereby ensuring absolute consistency across large production runs of standard practice wear and simplifying the complex scaling of previously bespoke, customized designs into limited production runs.

E-commerce technology plays a vital and sophisticated supporting role, utilizing immersive Augmented Reality (AR) and Virtual Reality (VR) interfaces to offer highly engaging and personalized shopping experiences globally. These innovative technologies allow customers, particularly costume designers and institutional buyers, to virtually 'try on' performance wear and critically view the exact interaction of different fabrics, embellishments, and structural supports under various simulated stage lighting conditions—a crucial functional feature for specialized theatrical garments. Supply chain technology, including strategic integration of IoT sensors for tracking inventory and potentially blockchain for enhanced transparency, is increasingly employed to meticulously track the provenance of high-value, specialized materials and ensure robust quality control. This technological enforcement assures premium customers of verifiable ethical sourcing and actively combats the threat of product counterfeiting, thereby safeguarding and securing the intrinsic brand value of premium performance wear manufacturers in this highly specialized and globally dispersed market.

Regional Highlights

Regional analysis underscores the heterogeneous consumption patterns and highly differentiated manufacturing hubs characterizing the global Tutus Market. North America, encompassing the United States and Canada, remains a dominant and highly mature market segment, driven by the presence of globally renowned, high-budget ballet companies and an expansive, well-funded dance education infrastructure. The demand profile is characterized by a strong focus on innovation, particularly in sustainable material solutions, rapid D2C fulfillment capabilities, and personalized consumer experiences, often leveraging digital technologies for custom orders. The region's high disposable incomes allow manufacturers to successfully deploy premium pricing strategies for technically superior, high-performance apparel. Furthermore, demand in North America is highly sensitive to the cyclical nature of seasonal performance schedules and trends originating from major fashion centers like New York, necessitating exceptional supply chain agility and quick responsiveness from both local and international suppliers.

Europe maintains its historical and cultural preeminence in the classical ballet segment. Countries such as the UK, France, Italy, and Russia house centuries-old, established ballet traditions and support highly specialized artisanal manufacturers and ateliers who maintain traditional techniques. The European market is characterized by a strong, inelastic demand for handcrafted quality, often demonstrating a preference for time-honored construction methods and traditionally sourced materials, such as high-grade silk netting and artisanal embroidery. While technological innovation is increasingly integrated, there remains a deep respect for heritage craftsmanship, allowing smaller, high-end ateliers that cater specifically to institutions like the Paris Opera Ballet or the Bolshoi Theatre to coexist profitably alongside larger, industrialized manufacturers serving the broader educational segment. Moreover, stringent European regulatory standards concerning textile safety, material content disclosure, and ethical labor practices significantly influence the sourcing and manufacturing decisions undertaken by market players operating across the continent.

The Asia Pacific (APAC) region is emphatically positioned as the engine of future market expansion and is forecasted to achieve the highest Compound Annual Growth Rate (CAGR) during the projection period. This explosive growth is strategically fueled by burgeoning middle classes in economies such as China, South Korea, and Japan, substantial governmental investment in promoting cultural education, and the rapid proliferation of high-standard international dance academies establishing regional branches. APAC exhibits exceptional growth rates, not only in formal educational attendance but also in the swift adoption of Western cultural aesthetics into local fashion and lifestyle trends, substantially boosting the recreational and fashion-oriented tutu segments. To efficiently capture this volume growth, major global manufacturers are aggressively establishing localized production facilities and distribution partnerships in APAC to reduce burdensome logistical costs, navigate complex import duties, and better cater to region-specific sizing standards and nuanced style preferences, making this region a crucial strategic focus for global players aiming for long-term revenue diversification. Latin America and the Middle East & Africa (MEA) represent emerging growth regions where demand, primarily institutional and localized, is dependent on macroeconomic stability and the successful development of professional performing arts infrastructure.

- North America: Dominant market share focused on high-tech materials, D2C retail expansion, and robust recreational dance sectors. Key countries include the United States and Canada, driving innovation in performance fabrics.

- Europe: Strong market driven by heritage, unparalleled artisanal craftsmanship, and established professional ballet companies. Major markets are the UK, France, Germany, and Russia, setting global quality standards.

- Asia Pacific (APAC): Highest expected CAGR, driven by cultural investment, expanding middle-class expenditure on dance education, and significant fashion adoption in countries like China, Japan, and South Korea, necessitating localized sizing.

- Latin America (LATAM): Growing potential driven by increasing institutional presence and government support for the arts in major economies such as Brazil and Mexico, focusing on affordable performance wear.

- Middle East & Africa (MEA): Emerging market focused on luxury performance wear associated with major cultural events and rapid development of regional performing arts centers, often relying heavily on imports.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Tutus Market.- Bloch Inc.

- Capezio

- Grishko

- Repetto

- Freed of London

- Mirella (Subsidiary of Bloch)

- Wear Moi

- Chacott

- Gaynor Minden

- Intermezzo

- Sansha

- Body Wrappers

- Leo Dancewear

- The Tutu Studio

- Tutu Gorgeous

- Balera

- Discount Dance Supply (Retailer/Own Brand)

- Costume Gallery

- Danskin

- Royal Academy of Dance (RAD - Influencer/Licensor)

Frequently Asked Questions

Analyze common user questions about the Tutus market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a classical tutu and a romantic tutu?

The primary difference lies in length, structure, and material. A classical tutu (platter or pancake style) is short, flat, and rigid, typically constructed with many layers of stiff tulle and often subtle wire support, designed to stand horizontally from the hip to showcase precise, technical leg movements. A romantic tutu is significantly longer, soft, bell-shaped, and flowing, typically made of softer tulle or chiffon netting, falling to mid-calf or ankle, creating an ethereal, dramatic aesthetic that purposely obscures the dancer's legs.

How are sustainable practices being integrated into tutu manufacturing?

Manufacturers are strategically adopting sustainable practices by sourcing specialized recycled nylons and polyesters for tulle production, rigorously minimizing fabric waste through advanced computer-aided pattern nesting programs, and ensuring ethical labor practices in bespoke tailoring workshops. A key focus is also placed on designing highly durable products to increase garment lifespan and reduce the need for frequent replacement, thereby supporting long-term circular fashion models within the high-performance performance wear industry.

Which distribution channel offers the highest growth potential for tutu sales?

Online Retail (e-commerce, D2C) offers the highest scalable growth potential. This digital channel allows specialized brands to efficiently reach niche global audiences, provides sophisticated, interactive sizing guides and virtual try-on features, and supports complex custom ordering processes efficiently, effectively bypassing the geographical and logistical constraints inherent in traditional, localized specialty stores, particularly benefiting penetration into fast-growing emerging markets.

What impact does 3D printing technology have on bespoke tutu customization?

While 3D printing technology is not typically used for the textile layers themselves, it is increasingly utilized for creating custom structural components, such as specialized, lightweight corsetry inserts, complex non-traditional embellishments, or precise frameworks necessary for supporting elaborate theatrical or fashion-forward designs. This technology enhances precision and personalization while concurrently reducing the overall bulk and weight of traditional, heavy supportive elements.

Is the Tutus Market primarily driven by professional performance or educational demand?

Historically driven by the prestige and technical demands of professional performance, the contemporary market is now experiencing its most significant volume growth driven by the vast global expansion of educational and recreational demand. While professional performance sets the standard for quality, driving material innovation and aesthetic trends, the enormous global expansion of dance schools and amateur programs accounts for the overwhelming majority of unit sales, particularly in the highly profitable practice wear and entry-level performance styles.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager