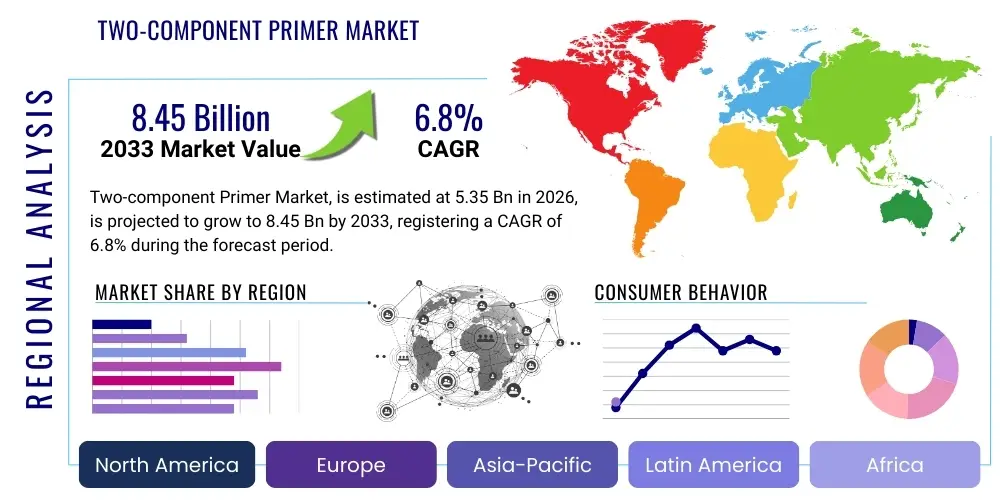

Two-component Primer Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441912 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Two-component Primer Market Size

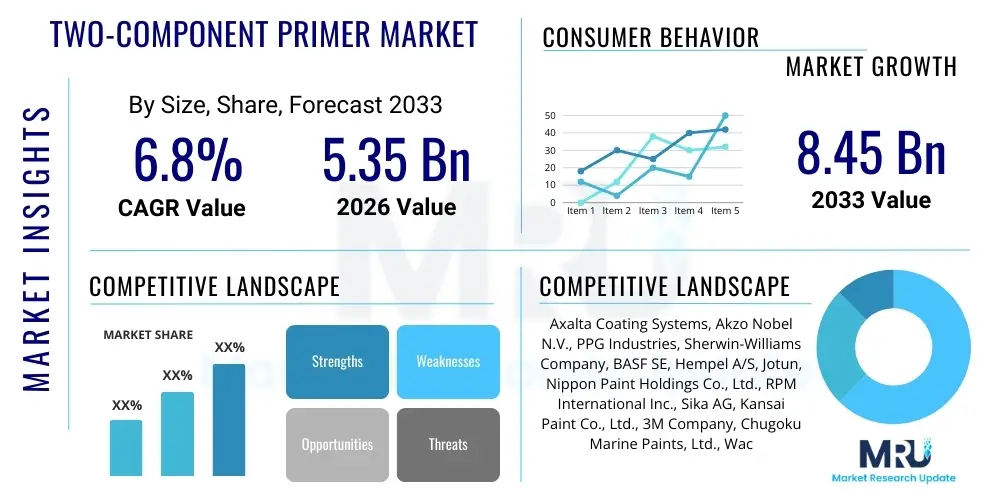

The Two-component Primer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $5.35 Billion in 2026 and is projected to reach $8.45 Billion by the end of the forecast period in 2033.

Two-component Primer Market introduction

Two-component primers, commonly based on epoxy, polyurethane, or sometimes acrylic chemistries, represent high-performance coating solutions designed to provide superior adhesion between a substrate and the subsequent topcoat layer, while also offering robust barrier properties against corrosion, chemicals, and abrasion. These systems require the mixing of two separate components—a resin base and a hardener/curing agent—just prior to application. This chemical reaction ensures exceptional cross-linking density, resulting in films with unmatched mechanical strength and durability compared to traditional single-component primers. The specialized formulations are critical in environments where coating failure due to moisture ingress, thermal cycling, or high mechanical stress is unacceptable, making them indispensable across sophisticated industrial and protective applications. These primers are particularly valued for their ability to adhere effectively to challenging substrates such as aluminum, galvanized steel, composites, and plastics, which often exhibit poor receptivity to standard paint systems. The core product characteristic is the superior adhesion promotion, which is achieved through the formation of strong chemical bonds with the substrate surface, thereby extending the service life of the entire coating system significantly. Furthermore, many two-component primers incorporate anti-corrosive pigments, such as zinc phosphate or chromates (though the latter are increasingly being phased out due to regulatory pressures), enhancing their role as primary protectors of metal structures. Major applications span critical infrastructure, including bridges and oil pipelines, the marine sector for ship hulls and decks, the automotive refinish industry for body repair, and the aerospace sector where stringent performance standards are mandated.

The primary benefits driving the adoption of these primers include exceptional chemical resistance, high durability, fast curing times, and superior anti-corrosion protection, which directly translates into reduced maintenance costs and extended asset lifecycles for end-users. Their resilience against harsh operating conditions, such as extreme temperature fluctuations, exposure to corrosive chemicals, and high humidity, positions them as the material of choice over conventional alternatives. This performance profile ensures that assets like offshore platforms, chemical storage tanks, and high-value vehicles maintain structural integrity and aesthetic quality for longer periods. The key driving factors fueling market expansion are multifaceted, anchored significantly by the escalating global demand for high-performance coatings in the rapidly expanding construction sector, particularly in emerging economies where large-scale infrastructure development is underway. The stringent regulatory push towards enhanced worker safety and environmental sustainability, which favors solvent-free or high-solids epoxy and polyurethane systems, is also contributing substantially to market growth, promoting innovation in VOC-compliant formulations. Additionally, the increasing production of light vehicles and aircraft globally, combined with the rigorous maintenance demands of existing fleets, necessitates durable priming solutions that can withstand environmental degradation and fatigue, thereby solidifying the critical role of two-component primers in modern industrial value chains.

Two-component Primer Market Executive Summary

The Two-component Primer Market is characterized by robust growth, driven primarily by the escalating demand from the automotive, infrastructure, and protective coatings sectors, coupled with continuous technological advancements aimed at improving cure speed and reducing volatile organic compound (VOC) emissions. Current business trends indicate a strong movement towards high-solids and 100% solids epoxy and polyurethane systems, which not only align with global environmental regulations but also offer superior film build and enhanced cost-efficiency for large-scale industrial applicators. Furthermore, strategic mergers and acquisitions among key market players are shaping the competitive landscape, focused on integrating specialized chemistries and expanding regional distribution networks to capture niche markets, particularly in powder coatings and specialized anti-corrosion segments. The COVID-19 pandemic caused temporary disruptions in supply chains and construction activity, but the subsequent global focus on infrastructure revival and increased spending on automotive refinish and maintenance has catalyzed a rapid market rebound, highlighting the essential nature of these primers in asset protection and repair. This trend is further supported by the growing preference for advanced composite materials in aerospace and wind energy, where high-adhesion primers are non-negotiable for ensuring structural integrity and longevity. Regional trends reveal a distinct shift in manufacturing and consumption patterns, with Asia Pacific (APAC) emerging as the central growth engine due to rapid urbanization, massive governmental investments in transportation and energy infrastructure, and the expansion of domestic automotive and shipbuilding industries in countries like China, India, and South Korea. North America and Europe, while mature, maintain high demand for premium, regulatory-compliant, and specialized two-component primers, particularly those focused on niche applications such as aerospace and advanced protective marine coatings, where performance specifications are exceptionally high. The stringent environmental standards in these regions necessitate continued innovation in waterborne and solvent-free formulations, pushing manufacturers towards sustainable product portfolios.

Segmentation trends reveal that the Epoxy segment maintains market dominance, attributed to its unparalleled strength, chemical resistance, and versatility across industrial, marine, and protective applications, especially in metal structures requiring severe anti-corrosion defense. However, the Polyurethane segment is poised for the fastest growth, primarily due to its superior UV resistance, flexibility, and rapid curing times, making it increasingly popular in the architectural, automotive refinish, and floor coating markets where aesthetic quality and quick turnaround are critical. Application-wise, the Protective Coatings category represents the largest end-use sector, driven by the need to maintain crucial assets such as power plants, chemical processing facilities, and oil & gas pipelines, which face continuous exposure to aggressive environments. The Automotive & Transportation segment is also displaying significant expansion, fueled by both original equipment manufacturing (OEM) and, more powerfully, the increasing sophistication and necessity of the automotive refinish market, which relies heavily on two-component primers for achieving factory-grade durability and finish quality during repair operations. Material science advancements, including the incorporation of nanotechnology to enhance barrier properties and adhesion, are driving premiumization within these segments. Overall, the market trajectory is highly positive, underlined by the inelastic demand for protective solutions in critical industries and the continuous development of next-generation primer formulations that offer greater efficiency, lower environmental impact, and superior application characteristics, ensuring the market's resilience against economic fluctuations.

AI Impact Analysis on Two-component Primer Market

Common user inquiries concerning the influence of Artificial Intelligence (AI) in the Two-component Primer Market primarily revolve around operational efficiency, customized formulation development, and predictive maintenance applications. Users frequently ask if AI can optimize chemical reaction parameters to accelerate cure times, how machine learning algorithms are utilized to predict the long-term adhesion performance of new formulations, and whether AI-driven quality control systems can reduce batch variation and material waste during manufacturing. A significant theme is the expectation that AI and associated digital twins will revolutionize the research and development (R&D) cycle, allowing chemists to simulate thousands of formulation variations virtually, minimizing costly and time-consuming physical lab trials, particularly concerning complex multi-component systems. Concerns often focus on the upfront investment required for integrating AI into legacy manufacturing plants and the need for specialized data infrastructure to handle the massive datasets generated during chemical testing and production. Overall, the key themes indicate high expectations for AI to drive efficiency gains in manufacturing, dramatically accelerate the pace of sustainable product development, and enable highly accurate predictive performance modeling for end-use applications, thereby shifting the industry toward smart, data-driven formulation and application strategies.

- AI optimizes raw material sourcing and inventory management, minimizing supply chain volatility and reducing production costs for resin bases and hardeners.

- Machine learning accelerates the R&D process by predicting optimal ratios and curing agents, thus developing new, environmentally compliant, high-solids primers faster.

- Predictive quality control systems use visual recognition and process data to ensure batch-to-batch consistency and reduce defects in the manufacturing of both components.

- AI-driven simulation models analyze application parameters (temperature, humidity, substrate type) to recommend precise, customized application protocols for end-users, ensuring optimal field performance.

- Digital twins of industrial assets leverage sensor data and primer performance profiles to facilitate predictive maintenance schedules, signaling when recoating or repair is necessary before critical failure occurs.

DRO & Impact Forces Of Two-component Primer Market

The Two-component Primer Market is propelled forward by significant drivers, notably the robust global rebound in construction and infrastructure spending, particularly in Asia Pacific and the Middle East, where high-performance anti-corrosion coatings are non-negotiable for long-term project viability. The stringent environmental regulatory framework, particularly in Europe and North America, mandates a shift from solvent-borne to low-VOC and high-solids formulations, paradoxically driving innovation and market demand for advanced two-component systems that meet these standards while maintaining superior performance. A primary restraint facing the market is the fluctuating price volatility of key petrochemical raw materials such as Bisphenol A (BPA) for epoxies and various isocyanates for polyurethanes, which creates uncertainty in manufacturing costs and impacts pricing strategies for downstream customers. Furthermore, the specialized nature and requirement for precise mixing and application techniques for two-component systems sometimes present a barrier to entry or adoption in less technically sophisticated regions, requiring extensive applicator training and strict adherence to technical data sheets, which adds complexity compared to simpler, single-component alternatives. However, the market is poised to capitalize on substantial opportunities, primarily through the expansion into niche sectors such as powder primers for automotive body structures, specialized primers for composite materials used in wind turbines and aerospace, and the development of sustainable, bio-based hardeners that address consumer and regulatory demands for greener chemistries. These market dynamics collectively form a complex set of impact forces where the strong performance benefits and regulatory push for sustainability largely outweigh the restraints associated with raw material costs and application complexity, resulting in a net positive trajectory for market expansion and premiumization of specialized products.

Segmentation Analysis

The segmentation of the Two-component Primer Market provides crucial insights into the diverse chemical compositions, application methods, and end-user requirements that drive demand across various industries. Analysis typically segments the market by resin type, distinguishing between Epoxy, Polyurethane, and other specialty chemistries like acrylics or polyaspartics; by technology, focusing on Solvent-borne, Water-borne, and Powder systems; and by end-use application, encompassing Protective Coatings, Automotive & Transportation, Industrial Wood, and Marine. This detailed categorization highlights the dominant role of epoxy primers due to their superior anti-corrosion properties critical for infrastructure, while simultaneously recognizing the rapidly growing share of polyurethane primers valued for their elasticity and UV stability in sectors like architectural coatings and automotive refinishing. Understanding these market splits is essential for manufacturers to tailor product development and marketing strategies, ensuring that specialized formulations meet the stringent performance specifications unique to each vertical, such as high chemical resistance in protective coatings versus aesthetic finish quality and rapid curing times required in automotive repair facilities. The shift toward high-solids and waterborne technologies, primarily driven by evolving environmental regulations, is a cross-segmental trend that significantly influences product innovation across all primary chemical types and application categories.

- By Resin Type:

- Epoxy

- Polyurethane

- Acrylic

- Others (Polyaspartic, Hybrid)

- By Technology:

- Solvent-borne

- Water-borne

- High Solids/100% Solids

- Powder Coatings

- By End-Use Application:

- Protective Coatings (Infrastructure, Oil & Gas, Power Generation)

- Automotive & Transportation (OEM and Refinish)

- Marine (Shipbuilding and Maintenance)

- Industrial Wood Coatings

- Aerospace

- Construction (Flooring and Specialty)

Value Chain Analysis For Two-component Primer Market

The value chain for the Two-component Primer Market commences with the upstream segment, dominated by major petrochemical and specialty chemical producers who supply crucial raw materials such as epichlorohydrin, Bisphenol A (BPA), various isocyanates (MDI, TDI, HDI), solvents, performance additives, and anti-corrosion pigments. Raw material procurement is critical and highly sensitive to global oil price fluctuations and supply disruptions, defining the initial cost structure and the subsequent pricing power within the downstream segments. Key activities in the upstream phase involve the polymerization and chemical synthesis of high-purity resins and hardeners, requiring significant capital investment and adherence to complex chemical manufacturing standards. The midstream manufacturing phase involves the formulation and compounding of the two-component systems by specialized coating manufacturers, where core intellectual property lies in optimizing pigment dispersion, rheology modification, and ensuring chemical compatibility and long-term storage stability of the components. This phase focuses heavily on R&D to meet specific performance criteria, such as low-VOC compliance, rapid cure rates, and adhesion to novel substrates like carbon fiber or difficult alloys.

The distribution channel facilitates the journey of the finished product to the end-user, utilizing a mix of direct and indirect methods tailored to the specific application sector. Direct sales channels are typically employed for large-scale industrial projects, major infrastructure contracts, and bulk supply to Original Equipment Manufacturers (OEMs) in the automotive or aerospace sectors, where technical support and customized logistical solutions are paramount. Conversely, indirect channels, relying on specialized distributors, wholesalers, and retail paint stores, cater primarily to the smaller-volume end-users, such as independent automotive refinish shops, small construction contractors, and maintenance, repair, and overhaul (MRO) operations. Distributors play a crucial role by providing local inventory, technical training on product mixing and application, and managing complex regulatory requirements related to hazardous materials transportation and storage. Downstream activities involve the professional application of the primers by skilled technicians or automated industrial processes, followed by subsequent topcoat application, where the quality of the primer directly determines the overall protective performance and longevity of the final coating system, thereby closing the loop and establishing a feedback mechanism for product improvement.

Two-component Primer Market Potential Customers

The potential customer base for the Two-component Primer Market is highly diversified, encompassing industrial entities that require superior surface protection against environmental degradation, chemical exposure, and mechanical stress. The primary buyers are large infrastructure developers and asset owners who commission the protection of critical structures such as bridges, highways, water treatment plants, power generation facilities, and pipelines—assets where coating failure poses significant safety and financial risks. Additionally, the marine industry, including shipyards, dry docks, and marine maintenance operators, constitutes a major end-user segment, relying heavily on specialized epoxy primers for underwater hulls and ballast tanks to prevent corrosion and biofouling. This customer segment is driven by stringent classification society standards and the high operational costs associated with dry-docking and recoating operations, prioritizing long service life and high barrier properties.

Another crucial customer segment is the automotive and transportation sector, comprising both major automotive OEMs utilizing two-component primers for body-in-white protection and, more critically, the extensive global network of automotive refinish and body repair shops. These repair facilities demand primers that offer rapid preparation time, exceptional filling properties, and flawless adhesion to various metallic and plastic body panels, ensuring the repair seamlessly matches the OEM finish. Furthermore, manufacturers in the aerospace industry represent a highly lucrative but technically demanding customer group, requiring primers certified for extreme conditions (high altitude, rapid temperature cycling) and specialized adhesion to advanced composite materials and aluminum alloys used in aircraft structures, necessitating highly regulated and specialized product formulations. The broad appeal of two-component primers lies in their superior performance guarantees, positioning them as essential protective materials across high-value, high-stress environments where performance durability is the chief purchasing criterion.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $5.35 Billion |

| Market Forecast in 2033 | $8.45 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Axalta Coating Systems, Akzo Nobel N.V., PPG Industries, Sherwin-Williams Company, BASF SE, Hempel A/S, Jotun, Nippon Paint Holdings Co., Ltd., RPM International Inc., Sika AG, Kansai Paint Co., Ltd., 3M Company, Chugoku Marine Paints, Ltd., Wacker Chemie AG, Dow Inc., HB Fuller, Ashland Global Holdings, DIC Corporation, Evonik Industries, Valspar Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Two-component Primer Market Key Technology Landscape

The current technology landscape in the Two-component Primer Market is primarily focused on achieving higher performance standards while aggressively addressing environmental sustainability requirements, fundamentally driven by global regulatory pressures, particularly the reduction of Volatile Organic Compounds (VOCs). Traditional solvent-borne systems, while providing robust performance, are gradually being supplanted by High-Solids and 100% Solids epoxy and polyurethane formulations. High-solids technology minimizes the solvent content, offering applicators the ability to achieve thicker film builds in a single coat, thereby reducing application time and overall material consumption while complying with air quality regulations. The development of faster-curing hardeners, such as modified polyamines and polyaspartic chemistries, is a significant technological trend, allowing for quicker turnaround times in high-throughput environments like automotive refinishing and quick-setting industrial floor coatings, which enhances productivity and reduces downtime for end-users. Furthermore, advancements in specialized additives, including nanoparticle-based rheology modifiers and advanced anti-corrosion pigments free of heavy metals, are actively being integrated to enhance performance characteristics like scratch resistance, flexibility, and anti-corrosion efficacy without compromising environmental compliance.

A crucial area of innovation involves the expansion of Water-borne two-component systems. Historically challenging due to adhesion issues and longer drying times, modern water-borne epoxy and polyurethane primers leverage advanced emulsification and dispersion techniques to deliver performance parameters increasingly comparable to their solvent-borne counterparts, making them highly attractive for indoor architectural and industrial wood applications where low odor and minimal environmental impact are prioritized. The emergence of Powder Primers, particularly in the automotive OEM segment, represents a key manufacturing technology shift, offering near-zero VOC solutions and excellent coverage and transfer efficiency. These powder systems are increasingly being utilized as pre-treatment primers or e-coat primers for enhanced chip resistance and corrosion protection on metal substrates before liquid topcoats are applied. Finally, digitalization and smart coating technologies are emerging, involving the integration of sensors or specialized pigments within the primer layer itself to monitor curing conditions, detect early signs of corrosion, or verify coating thickness and integrity after application, thereby enhancing the reliability and lifespan monitoring of coated assets in remote or critical environments.

Regional Highlights

- Asia Pacific (APAC): APAC represents the fastest-growing and largest regional market, primarily driven by massive government-led investments in infrastructure (roads, rail, ports, and energy generation), especially in China, India, and Southeast Asian nations. The rapid expansion of the automotive manufacturing sector, coupled with booming shipbuilding activities, fuels high demand for both epoxy protective coatings and polyurethane systems. Regulatory environments are evolving quickly, pushing regional manufacturers to adopt higher performance, low-VOC solutions to meet international standards.

- North America: The market here is mature and characterized by high demand for premium, specialized formulations, particularly in the aerospace, defense, and oil & gas sectors. Growth is sustained by rigorous maintenance schedules for aging infrastructure and strict environmental regulations (EPA and CARB), which necessitate widespread adoption of high-solids, low-VOC, and water-borne two-component primers across protective and architectural end-uses. Technological leadership in R&D continues to drive market value.

- Europe: Europe is defined by stringent REACH regulations and a strong commitment to sustainability, making it a key hub for innovation in bio-based and solvent-free primers. The automotive refinish sector is a major consumer, demanding fast-cure, high-quality polyurethane primers. The region's focus on renewable energy infrastructure (offshore wind turbines) necessitates advanced, durable two-component epoxy and polyaspartic primers for harsh marine environments, ensuring steady, value-added growth.

- Latin America (LATAM): The LATAM market is experiencing steady growth, linked to increasing urbanization and moderate investments in energy and transportation infrastructure, particularly in Brazil and Mexico. Price sensitivity is higher in this region, leading to a balanced demand for both economical solvent-borne systems and increasingly popular high-solids variants. Political and economic stability fluctuations often impact major project timelines, influencing short-term market dynamics.

- Middle East and Africa (MEA): This region is a vital market for high-performance protective primers, driven by substantial investment in the oil and gas infrastructure, petrochemical processing plants, and major construction projects in the UAE and Saudi Arabia. The extreme climatic conditions (high temperature, high salinity) mandate the use of the most robust two-component epoxy anti-corrosion systems, ensuring that demand for ultra-durable, premium-priced protective coatings remains consistently high.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Two-component Primer Market.- Axalta Coating Systems

- Akzo Nobel N.V.

- PPG Industries

- Sherwin-Williams Company

- BASF SE

- Hempel A/S

- Jotun

- Nippon Paint Holdings Co., Ltd.

- RPM International Inc.

- Sika AG

- Kansai Paint Co., Ltd.

- 3M Company

- Chugoku Marine Paints, Ltd.

- Wacker Chemie AG

- Dow Inc.

- HB Fuller

- Ashland Global Holdings

- DIC Corporation

- Evonik Industries

- Valspar Corporation

Frequently Asked Questions

Analyze common user questions about the Two-component Primer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for high-solids two-component epoxy primers?

The primary driver is the stringent global environmental regulation (e.g., VOC emission limits) combined with the need for high-performance protective coatings. High-solids epoxy primers minimize solvent use while providing superior film thickness and anti-corrosion properties crucial for infrastructure and industrial assets.

How do polyurethane two-component primers differ in application from epoxy primers?

Polyurethane primers are generally favored for applications requiring superior flexibility, abrasion resistance, and excellent UV stability, such as automotive refinish and exterior architectural use. Epoxy primers, conversely, offer superior chemical resistance and structural adhesion, making them ideal for subsea, industrial floor, and heavy-duty protective applications where UV exposure is not the primary concern.

Which geographical region exhibits the highest growth potential for the Two-component Primer Market?

Asia Pacific (APAC), particularly driven by countries like China and India, demonstrates the highest growth potential due to massive ongoing infrastructure development, rapid industrialization, and expansion in both the automotive manufacturing and marine sectors, creating immense demand for robust protective coating systems.

What are the key technological advancements shaping the future of two-component primers?

Key technological advancements include the successful formulation of high-performance water-borne systems, the development of faster-curing polyaspartic and modified polyamine hardeners, the integration of nanotechnology to enhance barrier properties, and the shift towards bio-based and non-isocyanate chemistries for improved sustainability and safety.

What are the risks associated with improper mixing of two-component primer systems?

Improper mixing, specifically incorrect ratio of resin to hardener, results in catastrophic coating failure. This can manifest as poor adhesion, significantly reduced chemical and abrasion resistance, non-curing (tackiness), shortened pot life, or drastically diminished physical properties, ultimately compromising the asset's protection and leading to costly rework.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager