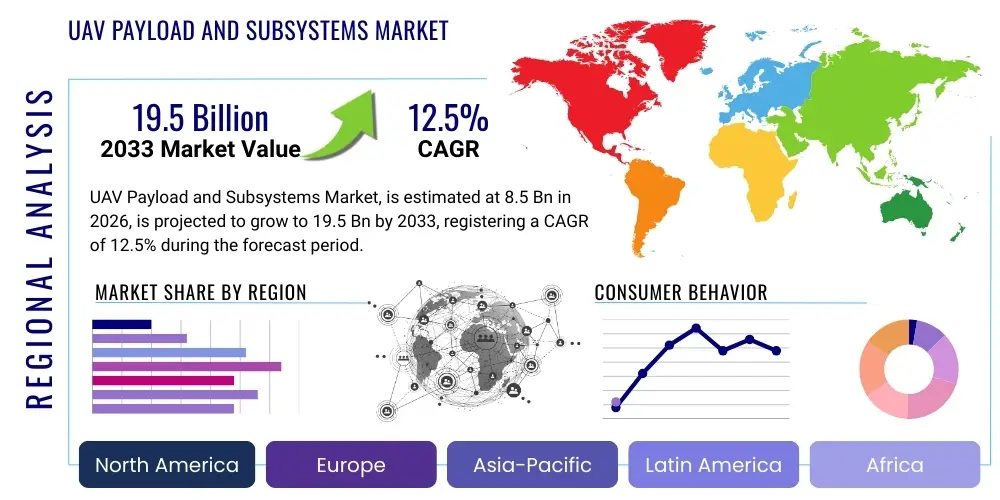

UAV Payload and Subsystems Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443290 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

UAV Payload and Subsystems Market Size

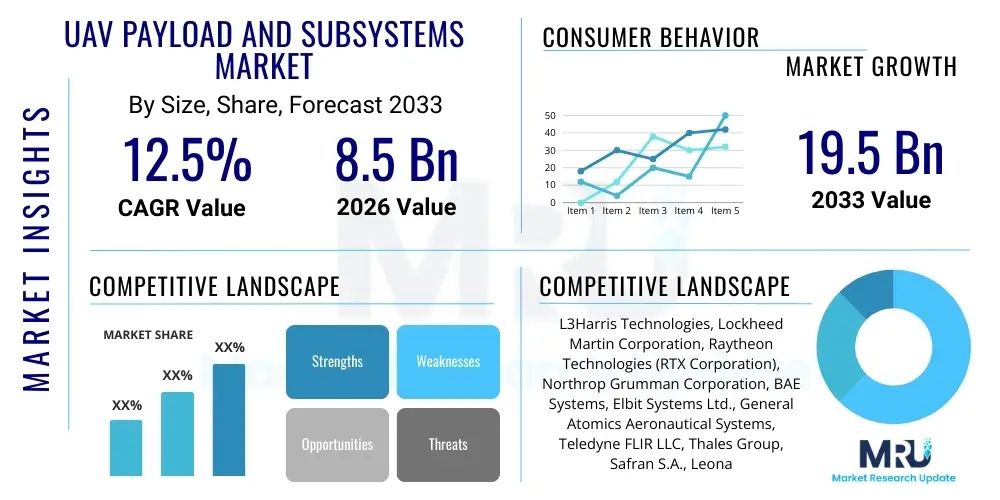

The UAV Payload and Subsystems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 8.5 Billion in 2026 and is projected to reach USD 19.5 Billion by the end of the forecast period in 2033.

UAV Payload and Subsystems Market introduction

The Unmanned Aerial Vehicle (UAV) Payload and Subsystems Market encompasses the complex array of sensors, communication equipment, armament, and flight-critical components necessary for modern drone operations across military, commercial, and governmental sectors. Payloads refer primarily to the mission-specific equipment carried by the UAV, such as Electro-Optical/Infrared (EO/IR) sensors for surveillance, Synthetic Aperture Radar (SAR) for mapping, LiDAR systems for surveying, communication relays, and weapon systems. These components transform the basic aircraft platform into a functional tool capable of executing complex tasks, driving operational effectiveness and mission versatility. The evolution of miniaturization and increased computational power packed into these payloads is fundamentally expanding the application spectrum of UAVs, moving beyond traditional military reconnaissance into high-precision commercial applications like infrastructure inspection and agricultural monitoring.

Subsystems constitute the essential flight architecture that ensures the safe and reliable operation of the UAV platform itself. Key subsystems include advanced Flight Control Systems (FCS), sophisticated Propulsion Systems (electric, internal combustion, or hybrid), robust Data Links and communication modules, high-capacity Power Management Systems (PMS), and reliable Ground Control Stations (GCS). Technological advancements in these subsystems—particularly in battery efficiency, autonomous navigation algorithms, and secure, high-bandwidth data transmission—are critical market drivers. The seamless integration and interoperability between specialized payloads and these foundational subsystems are paramount to mission success, demanding sophisticated engineering and stringent quality control from manufacturers.

The primary applications of the UAV Payload and Subsystems Market span across Defense and Security, where UAVs perform Intelligence, Surveillance, and Reconnaissance (ISR), targeting, and combat roles; Commercial Applications, including precision agriculture, infrastructure inspection (pipelines, power lines, wind turbines), mapping and surveying, and media production; and Civil Government utilization for search and rescue operations, disaster response, and law enforcement surveillance. The benefits derived from these integrated systems include reduced operational risk for human personnel, significantly lower operational costs compared to manned aircraft, enhanced data collection capabilities due to persistent flight duration, and the ability to access hazardous or remote environments. Driving factors include increasing defense spending on unmanned technologies, regulatory easing for commercial BVLOS (Beyond Visual Line of Sight) operations, and the continuous innovation leading to lighter, more powerful, and multi-functional payloads.

UAV Payload and Subsystems Market Executive Summary

The UAV Payload and Subsystems Market is experiencing robust expansion, fundamentally driven by pervasive technological convergence and evolving strategic requirements across global defense architectures and rapidly maturing commercial industries. Business trends indicate a strong move toward open-architecture systems that facilitate easier integration of third-party payloads and subsystems, reducing time-to-market for specialized solutions. Furthermore, there is a distinct emphasis on miniaturization and modularity, allowing smaller UAV classes (like tactical and mini-UAVs) to carry highly capable sensor packages, which historically were restricted to larger platforms. Supply chain resilience, particularly concerning microelectronics and specialized sensor components, remains a critical focus area for market players aiming to mitigate geopolitical risks and ensure stable production scaling to meet surging demand.

Regional trends highlight North America and Europe as dominant markets, primarily due to established defense procurement cycles, high investment in sophisticated ISR capabilities, and early adoption of commercial drone services in logistics and infrastructure. However, the Asia Pacific (APAC) region is projected to register the highest growth rate, fueled by rapid military modernization efforts in countries like China, India, and South Korea, coupled with massive infrastructure development projects requiring advanced mapping and inspection services. The Middle East and Africa (MEA) market is seeing significant growth, predominantly in security and border surveillance applications, often involving procurement of advanced weaponized platforms and electronic warfare payloads to address regional conflicts and asymmetrical threats.

Segment trends reveal that the Electro-Optical/Infrared (EO/IR) segment holds the largest market share within the payload category, given its universal necessity for surveillance and reconnaissance across all end-user groups. Nevertheless, the Synthetic Aperture Radar (SAR) and LiDAR segments are expected to witness exceptional growth rates, driven by the increasing need for all-weather, high-resolution 3D mapping capabilities for complex commercial surveying tasks and military intelligence gathering. Within subsystems, the Flight Control Systems segment, bolstered by advancements in autonomous capabilities and AI-driven path planning, is leading innovation. The End-User segment shows the Military & Defense sector maintaining the largest expenditure, yet the Commercial sector is rapidly closing the gap, propelled by expanding regulatory frameworks supporting high-value applications in sectors such as energy, construction, and agriculture.

AI Impact Analysis on UAV Payload and Subsystems Market

Common user questions regarding AI's influence on the UAV Payload and Subsystems Market center on key themes such as "How does AI enhance sensor data processing speed?", "What are the ethical implications of AI-enabled targeting systems?", and "To what extent can AI improve the longevity and reliability of flight subsystems?". Users are primarily concerned with how Artificial Intelligence transitions UAVs from remotely piloted platforms to genuinely autonomous systems capable of complex, cognitive decision-making at the edge. The analysis reveals a high expectation that AI will drastically reduce the burden on human operators by automating sophisticated tasks like target recognition, anomaly detection during infrastructure inspection, and dynamic route optimization based on real-time environmental factors. Key concerns revolve around data security, the necessity for robust validation and verification (V&V) of AI algorithms used in flight control, and the acceleration of the autonomous warfare doctrine enabled by advanced, AI-integrated payloads and fire control systems.

- AI-driven Edge Processing: Enables real-time analysis of sensor data (EO/IR, LiDAR) onboard the UAV, reducing latency and bandwidth requirements for data transmission to the ground control station.

- Autonomous Navigation and Swarming: AI algorithms facilitate dynamic path planning, obstacle avoidance, and coordination of multiple UAVs (swarms) without continuous human intervention, demanding smarter flight control subsystems.

- Predictive Maintenance: AI tools analyze telemetry data from propulsion and power systems to forecast component failure, significantly improving subsystem reliability and reducing operational downtime.

- Automated Target Recognition (ATR): Machine learning models significantly enhance the precision and speed of identifying objects or threats, particularly critical for ISR and weaponized payloads.

- Enhanced Cyber Resilience: AI is being integrated into communication and data link subsystems to detect and neutralize cyber threats and jamming attempts dynamically.

- Cognitive Electronic Warfare (EW): AI enhances EW payloads by autonomously learning and adapting jamming and spoofing techniques in complex electromagnetic environments.

DRO & Impact Forces Of UAV Payload and Subsystems Market

The UAV Payload and Subsystems Market is powerfully influenced by key dynamics including technological maturation, regulatory landscapes, and strategic global defense shifts. Drivers are fundamentally centered on increased global military investment in next-generation unmanned systems, especially those offering persistent and sophisticated ISR capabilities, alongside the rapid commercialization of drone technology for efficiency gains across diverse industries like construction, energy, and logistics. Restraints primarily involve stringent and complex regulatory hurdles concerning airspace integration and Beyond Visual Line of Sight (BVLOS) operations, as well as the high initial cost associated with advanced sensor payloads and proprietary subsystem integration, which can hinder adoption by smaller commercial entities. Opportunities abound in the development of multi-sensor fusion capabilities, hybrid propulsion systems extending endurance, and the expansion into emerging markets such as automated drone delivery and urban air mobility (UAM) security. These forces collectively define market momentum, driving innovation while imposing constraints that mandate industry collaboration with regulatory bodies.

The market impact forces dictate the trajectory of technological development and procurement. Increasing demand for high-end military surveillance platforms that integrate advanced capabilities such as Hyperspectral Imaging and standoff electronic warfare systems is forcing manufacturers to invest heavily in miniaturization without sacrificing performance. Simultaneously, the economic imperative of the commercial sector demands highly reliable, standardized, and cost-effective subsystems suitable for mass production and deployment across large fleets. Geopolitical tensions accelerate the adoption of weaponized payloads and advanced counter-UAV (C-UAV) subsystems, ensuring that defense expenditure remains a cornerstone of market growth. This push-pull dynamic—military complexity versus commercial scalability—creates a bifurcated market requiring suppliers to maintain distinct product lines tailored for differing performance, cost, and reliability requirements, yet often leveraging common underlying component technologies for economies of scale.

A critical impact force is the accelerating pace of technological obsolescence, especially in the realm of computing and sensor technology. To remain competitive, manufacturers must prioritize agile product development cycles and modular designs that allow for rapid subsystem upgrades without necessitating the replacement of the entire platform. Furthermore, the rise of open-source flight stacks and standardized communication protocols is democratizing access to drone technology, challenging legacy providers and fostering a vibrant ecosystem of specialized subsystem developers. The necessity for secure data links and protected flight control systems, given the escalating threat of signal jamming and cyberattacks on UAV operations, mandates continuous investment in robust encryption and resilient communication hardware, acting as both a driver for specialized security subsystem development and a cost constraint for overall system affordability.

Segmentation Analysis

The UAV Payload and Subsystems Market is systematically segmented based on the type of equipment, the function performed, the platform carrying the technology, and the ultimate end-user sector. This segmentation provides a granular view of market dynamics, revealing which technologies are witnessing the fastest adoption and where strategic investments are concentrating. Key segments include the Payload Type (defining mission capability), Subsystem Type (defining operational performance), End-User (defining application environment), and UAV Type (defining platform constraints). The complexity of integration means that advancements in one segment, such as miniaturized sensor payloads, directly drive demand and innovation within related subsystems, such as higher-capacity power management and enhanced data link solutions to handle the increased data throughput.

The payload segmentation, spanning ISR, Weaponry, and Communication, is fundamental as it represents the mission value proposition of the UAV. The subsystem segmentation, covering critical areas like propulsion and control, addresses the core challenge of extending flight endurance, improving reliability, and enhancing autonomous flight safety. Geographically, the market is analyzed across major regions to understand the influence of varying defense budgets, regulatory environments, and commercial drone adoption rates. This detailed breakdown aids stakeholders in identifying niche opportunities, understanding competitive positioning, and tailoring product development strategies to align with the specific needs and procurement cycles of military versus commercial clientele across different global territories.

- By Payload Type:

- Electro-Optical/Infrared (EO/IR) Systems

- Synthetic Aperture Radar (SAR) and LiDAR

- Communication and Navigation Systems (e.g., GPS, Data Links, Transponders)

- Electronic Warfare (EW) and SIGINT Payloads

- Weapon Systems and Missile Payloads

- Hyperspectral and Multi-spectral Sensors

- Custom Scientific Payloads

- By Subsystem Type:

- Flight Control Systems (FCS)

- Propulsion Systems (Engine, Motor, Fuel Cells, Batteries)

- Data Links and Communication Subsystems

- Ground Control Stations (GCS) and Associated Software

- Power Management Systems (PMS)

- Airframe and Structure Components

- By End-User:

- Military & Defense

- Commercial (Agriculture, Construction, Energy, Media, Logistics)

- Government & Civil (Law Enforcement, Firefighting, Search and Rescue)

- By UAV Type:

- Fixed-Wing UAVs

- Rotary-Wing UAVs (Multi-rotor and Single-rotor)

- Hybrid VTOL UAVs

Value Chain Analysis For UAV Payload and Subsystems Market

The value chain for the UAV Payload and Subsystems Market begins with upstream activities focused on raw material procurement, specialized component manufacturing, and foundational technology development. This stage includes sourcing high-grade materials (composites, aerospace alloys), manufacturing complex semiconductors for sensor arrays, and developing specialized algorithms for flight control software. Key upstream players include specialized component suppliers (e.g., microchip manufacturers, battery cell producers, high-performance lens suppliers). The effectiveness of this upstream phase dictates the reliability, weight, and performance metrics of the final subsystem or payload. Maintaining robust supplier relationships and securing proprietary intellectual property in sensor technology are critical competitive factors at this initial stage.

Midstream activities involve the integration and assembly of these components into functional subsystems and payloads. This includes the manufacturing of Flight Control Systems, integrating EO/IR cameras with stabilization gimbals, and assembling propulsion units. Major UAV manufacturers and specialized payload providers dominate this phase, focusing heavily on rigorous testing, certification, and quality assurance to meet stringent aerospace and military standards. The integration process is complex, demanding highly skilled engineering teams to ensure optimal communication between the payload (mission hardware) and the flight subsystem (platform hardware). Optimization of Size, Weight, and Power (SWaP) characteristics is the central technical challenge during midstream production.

Downstream activities center on distribution, sales, integration into the final UAV platform, and post-sales support, encompassing maintenance, repair, and overhaul (MRO). Distribution channels vary significantly; direct sales are predominant for large military procurement programs, often involving long-term contracts and tailored integration services. Indirect channels, utilizing specialized distributors and system integrators, are more common in the commercial sector, where off-the-shelf payloads and standardized subsystems are required for rapid fleet deployment. The final integration of the payload onto the UAV platform and comprehensive training for end-users represent the concluding steps, emphasizing customer satisfaction and ensuring operational readiness. Post-sales support, driven by data analytics and predictive maintenance tools, is increasingly important for maximizing the operational lifespan of expensive payloads and critical flight subsystems.

UAV Payload and Subsystems Market Potential Customers

Potential customers for UAV payloads and subsystems are broadly categorized into three major domains: sovereign defense organizations, multinational commercial enterprises, and diverse governmental agencies. The Military & Defense sector is the largest and most demanding customer base, prioritizing high-performance, resilient, and often weaponized payloads, along with specialized electronic warfare and secure communication subsystems. Their procurement cycles are long, heavily regulated, and focused on maintaining technological superiority, demanding systems capable of operating in contested environments and complying with strict security standards like ITAR or equivalent national regulations. Key buyers include Ministries of Defense, armed forces branches (Air Force, Army, Navy), and intelligence agencies globally, all seeking ISR and precision strike capabilities.

The Commercial sector represents the fastest-growing customer segment, encompassing large corporations in sectors such as oil and gas, utilities, telecommunications, agriculture, and construction. These customers seek highly efficient, cost-effective payloads like high-resolution LiDAR, multi-spectral cameras, and inspection-grade EO/IR sensors to enhance operational efficiency, reduce human risk, and improve data accuracy. Their purchasing decisions are primarily driven by Return on Investment (ROI), ease of operation, scalability for fleet deployment, and compatibility with industry-standard data analysis platforms. Potential commercial buyers include major infrastructure maintenance companies, large-scale farming operations utilizing precision agriculture techniques, and logistics giants exploring drone delivery solutions.

Governmental and Civil organizations form the third significant customer group, including law enforcement agencies, border patrol services, coast guards, and national mapping/surveying institutions. These entities typically require reliable, high-end surveillance and mapping payloads, robust data links for emergency response scenarios, and durable flight subsystems for operations under challenging conditions (e.g., disaster relief). The focus here is often on public safety, rapid deployment capabilities, and adherence to civil aviation regulations. These customers often procure systems designed for dual-use (military/civilian) applications, prioritizing platforms that offer versatility and established performance track records in complex operational environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.5 Billion |

| Market Forecast in 2033 | USD 19.5 Billion |

| Growth Rate | CAGR 12.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | L3Harris Technologies, Lockheed Martin Corporation, Raytheon Technologies (RTX Corporation), Northrop Grumman Corporation, BAE Systems, Elbit Systems Ltd., General Atomics Aeronautical Systems, Teledyne FLIR LLC, Thales Group, Safran S.A., Leonardo S.p.A., AeroVironment, Inc., Israel Aerospace Industries (IAI), Textron Systems, Collins Aerospace (Raytheon Technologies), Honeywell International Inc., Insitu (Boeing Subsidiary), DJI (Commercial Subsystems), Velodyne Lidar, Inc., Maxar Technologies |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

UAV Payload and Subsystems Market Key Technology Landscape

The current technology landscape in the UAV Payload and Subsystems Market is defined by a relentless push towards maximizing operational efficiency and autonomy while adhering to strict SWaP (Size, Weight, and Power) constraints. Key technological advancements are converging around sensor fusion and highly integrated systems. For payloads, this involves combining outputs from disparate sensors—such as fusing EO/IR imagery with LiDAR point clouds and SAR data—to create a comprehensive, multi-dimensional view of the operational environment. This fusion requires extremely high-speed, embedded processing capabilities utilizing dedicated FPGAs (Field-Programmable Gate Arrays) or specialized AI chips (Application-Specific Integrated Circuits or ASICs) located directly at the edge, reducing reliance on high-bandwidth communication back to ground control.

In the subsystem domain, the focus is heavily directed toward enhancing flight endurance and system reliability. This includes the maturation of hybrid propulsion systems, which combine the high energy density of internal combustion engines with the responsiveness and redundancy of electric motors, significantly extending mission duration beyond traditional battery limits. Furthermore, flight control systems are adopting advanced control algorithms rooted in deep reinforcement learning to handle complex flight maneuvers, manage unexpected disturbances, and perform autonomous decision-making necessary for BVLOS operation and navigation in GPS-denied environments. Cybersecurity is no longer an auxiliary feature but a fundamental technology, integrated into the architecture of data links and GCS software to resist sophisticated jamming, spoofing, and remote hijacking attempts, using quantum-resistant encryption protocols.

Another pivotal technological trend involves the standardization and modularity of interfaces. The adoption of open-architecture standards, such as the Sensor Open Systems Architecture (SOSA) framework used in defense, is facilitating faster subsystem upgrades and promoting competition among specialized component vendors. This approach allows end-users to swiftly swap mission payloads based on operational requirements, utilizing standard communication buses (e.g., Ethernet or custom high-speed serial links) and standardized power interfaces. The development of smaller, lighter, and more powerful power management systems, often utilizing solid-state battery technology or compact fuel cells, is the underpinning technology enabling longer flight times and heavier, more sophisticated payload carriage across the entire spectrum of small- to medium-sized UAV platforms, democratizing access to high-end capabilities.

Regional Highlights

- North America: This region maintains its dominance due to substantial R&D investments by the U.S. Department of Defense and homeland security agencies, driving demand for high-end, weaponized, and advanced ISR payloads (e.g., advanced SAR and electronic warfare systems). The U.S. also leads in commercial adoption, particularly in energy inspection and precision agriculture, supported by a mature technology ecosystem and pioneering regulatory efforts toward BVLOS operations. Companies here are focused on securing supply chains and developing AI-integrated autonomous flight subsystems for military applications.

- Europe: Characterized by significant joint defense initiatives (e.g., EDA projects) and rising demand for sophisticated C-UAS (Counter-UAS) subsystems, the European market is stable. Key focus areas include secure data links, standardization efforts for pan-European airspace integration, and the growth of commercial inspection services in heavily regulated industries like construction and utilities. Western European nations, notably the UK, France, and Germany, are prioritizing investments in domestic industrial capacity for UAV subsystems and sensors to achieve strategic autonomy.

- Asia Pacific (APAC): Expected to be the fastest-growing region, driven by rapid military modernization programs, particularly in China and India, focusing on acquiring advanced long-endurance platforms equipped with state-of-the-art ISR and precision strike capabilities. Commercial growth is accelerating rapidly, fueled by large-scale infrastructure projects requiring extensive mapping (using LiDAR/SAR payloads) and robust use of agricultural drones. Local manufacturing capabilities for basic subsystems are expanding, reducing reliance on Western suppliers, though complex sensor technology remains primarily imported.

- Middle East and Africa (MEA): Growth is primarily fueled by pervasive security concerns, border surveillance requirements, and regional conflicts, leading to high procurement rates of tactical and MALE (Medium Altitude Long Endurance) UAVs equipped with advanced EO/IR and weapon payloads. The MEA market is heavily reliant on foreign defense technology imports, though regional strategic alliances are leading to local assembly and maintenance capabilities for flight subsystems and standard payloads.

- Latin America: This region represents an emerging market focused primarily on internal security, law enforcement surveillance, and agricultural monitoring. Demand is focused on cost-effective, reliable EO/IR payloads and standardized flight subsystems. Budget constraints often favor lower-cost platforms and dual-use technologies, driving partnerships with established global providers offering accessible, scalable solutions suitable for large territorial coverage.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the UAV Payload and Subsystems Market.- L3Harris Technologies

- Lockheed Martin Corporation

- Raytheon Technologies (RTX Corporation)

- Northrop Grumman Corporation

- BAE Systems

- Elbit Systems Ltd.

- General Atomics Aeronautical Systems

- Teledyne FLIR LLC

- Thales Group

- Safran S.A.

- Leonardo S.p.A.

- AeroVironment, Inc.

- Israel Aerospace Industries (IAI)

- Textron Systems

- Collins Aerospace (Raytheon Technologies)

- Honeywell International Inc.

- Insitu (Boeing Subsidiary)

- DJI (Commercial Subsystems)

- Velodyne Lidar, Inc.

- Maxar Technologies

- General Electric Aviation

- Quantum Systems GmbH

Frequently Asked Questions

Analyze common user questions about the UAV Payload and Subsystems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the rapid growth of the UAV Payload Market?

The market is primarily driven by increasing global military spending on autonomous ISR capabilities, the rapid relaxation of regulations permitting commercial BVLOS operations, and technological advancements leading to miniaturized, powerful, multi-spectral sensors and AI-enabled edge processing, significantly enhancing mission versatility and efficiency across defense and commercial sectors.

How is Size, Weight, and Power (SWaP) optimization influencing subsystem design?

SWaP optimization is a crucial design paradigm, particularly for small and tactical UAVs. It drives the demand for lightweight composite materials for airframes, high energy density power sources (advanced batteries and fuel cells), and highly integrated avionics and flight control systems that minimize footprint while maximizing endurance and payload capacity.

Which payload technology is expected to see the highest CAGR in the forecast period?

While EO/IR remains the largest segment by revenue, the Synthetic Aperture Radar (SAR) and LiDAR segments are projected to exhibit the highest Compound Annual Growth Rate. This growth is spurred by the necessity for all-weather, high-resolution mapping, surveying, and 3D modeling capabilities, crucial for both high-end military surveillance and demanding commercial infrastructure inspection applications.

What role do open architectures play in the UAV Subsystems Market?

Open architectures, such as the SOSA standard, are critical as they promote modularity, interoperability, and competition. They allow military and commercial users to integrate best-of-breed subsystems and payloads from different vendors quickly, thereby reducing proprietary lock-in, accelerating upgrade cycles, and lowering the overall total cost of ownership for sophisticated UAV platforms.

How are commercial applications reshaping the demand for UAV subsystems?

Commercial applications are shifting demand toward cost-effective, scalable, and highly reliable subsystems suitable for fleet management. This includes robust, standardized flight control systems, efficient electric propulsion units, and secure, consumer-grade ground control stations that prioritize ease of use and compliance with civil aviation regulatory requirements, contrasting with the bespoke, high-cost military systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager