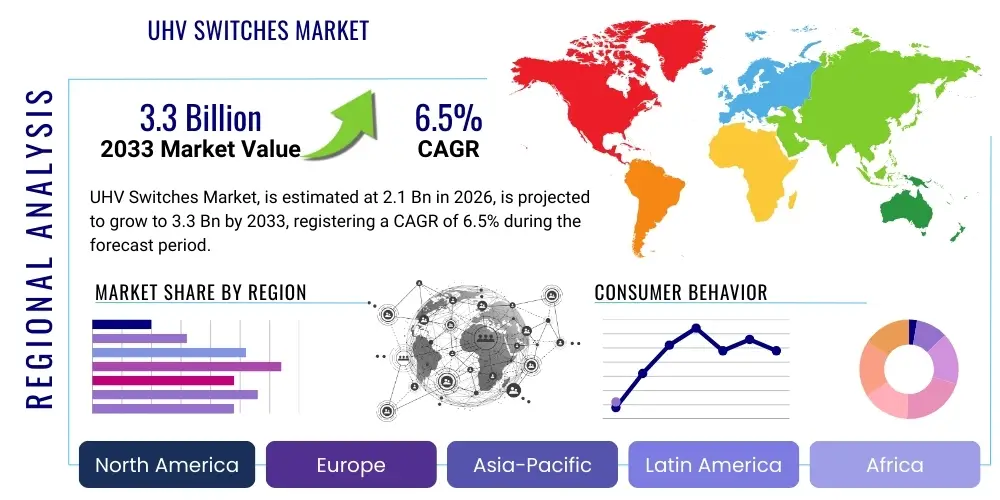

UHV Switches Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442138 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

UHV Switches Market Size

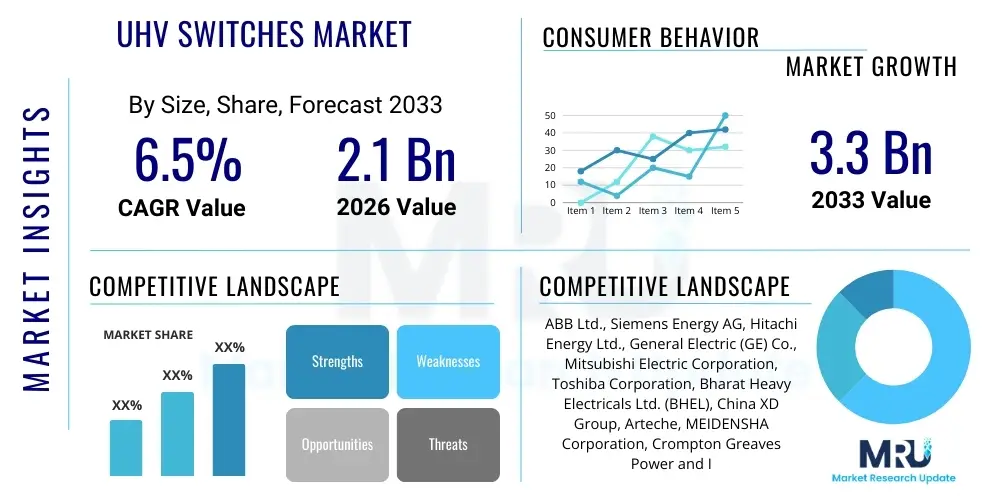

The UHV Switches Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 2.1 Billion in 2026 and is projected to reach USD 3.3 Billion by the end of the forecast period in 2033. This robust growth trajectory is primarily underpinned by global initiatives focused on expanding inter-regional and ultra-long-distance power transmission infrastructure, particularly in rapidly industrializing economies. The adoption of Ultra-High Voltage Direct Current (UHVDC) transmission lines requires sophisticated, reliable switching apparatus capable of handling extreme electrical stresses and ensuring system stability across vast geographical expanses.

UHV Switches Market introduction

The UHV Switches Market encompasses devices designed for system isolation, interruption, and protection in transmission networks operating at voltages typically exceeding 800 kV AC and ±800 kV DC. These crucial components, including high-voltage disconnectors, earthing switches, and specialized circuit breakers, are fundamental for maintaining the safety, reliability, and efficiency of modern bulk power transmission systems. The primary product characteristic is the ability to manage extremely high electrical and mechanical stresses, often requiring advanced insulation technologies such as Sulfur Hexafluoride (SF6) or increasingly, environmentally friendly alternatives (g3 or Clean Air solutions) for insulation and arc quenching. Major applications span across bulk power transmission corridors, large-scale power generation substations, and critical grid interconnection points, facilitating the seamless transfer of renewable energy from remote sources to densely populated load centers. Benefits include enhanced transmission capacity, minimized power losses over long distances, and improved grid stability, which collectively drive economic viability for large-scale energy projects. Driving factors include governmental mandates for renewable energy integration, rapid urbanization necessitating grid reinforcement, and cross-border power exchange agreements that rely on reliable UHV infrastructure.

UHV Switches Market Executive Summary

The global UHV Switches Market exhibits dynamic growth propelled by aggressive infrastructural spending in Asia Pacific, particularly China and India, where major UHVDC projects are essential for resource optimization and managing regional energy imbalances. Business trends show a strong shift towards modular and digitalized switchgear solutions, integrating advanced monitoring and diagnostic capabilities to predict maintenance requirements and minimize downtime. Key manufacturers are prioritizing research and development in sustainable insulation gases to comply with stringent environmental regulations targeting greenhouse gas emissions from SF6-based equipment. Regionally, while APAC dominates the demand landscape due to sheer scale of new installations, Europe and North America focus heavily on modernization, replacement of aging equipment, and integration of smart grid functionalities into existing UHV substations, driving premium pricing for advanced, sensor-equipped switchgear. Segment trends indicate increasing adoption of Gas Insulated Switchgear (GIS) due to its compact footprint and high reliability in demanding environments, contrasting with the traditional reliance on Air Insulated Switchgear (AIS). Furthermore, the voltage segment above ±1000 kV DC is poised for rapid expansion as transnational grids become more prevalent, requiring specialized ultra-high voltage disconnecting mechanisms.

AI Impact Analysis on UHV Switches Market

User inquiries regarding AI's impact on the UHV Switches Market frequently center on predictive maintenance effectiveness, optimization of asset lifespan, and automation of substation operations. Users are keen to understand how AI-driven analytics can transition maintenance schedules from time-based to condition-based, thereby reducing operational expenditure and preventing catastrophic failures associated with UHV equipment stress. Concerns also involve the cybersecurity implications of integrating intelligent systems into critical infrastructure and the need for standardized protocols for data handling and machine learning model deployment. The overarching expectation is that AI will significantly enhance the reliability and efficiency of UHV transmission grids, transforming how utilities manage complex switching operations and diagnose subtle equipment degradation, ultimately extending the operational life and maximizing the return on investment for these high-cost assets.

- Predictive Diagnostics and Condition Monitoring: AI algorithms analyze sensor data (temperature, acoustic signatures, partial discharge) from UHV switches to predict component failure with high accuracy, shifting maintenance strategy from reactive/preventive to prescriptive.

- Optimized Switching Operations: Machine learning models determine the optimal timing and sequence for switching operations under various load and grid stability conditions, minimizing mechanical wear and electrical stress on the equipment.

- Asset Performance Management (APM): AI platforms consolidate performance data across entire fleets of UHV switches, providing comprehensive insights into asset health and capital planning prioritization for replacement or refurbishment.

- Fault Isolation and Restoration: Rapid AI analysis assists in quickly identifying fault locations within UHV substations and expediting the isolation of the faulty switch, significantly improving system restoration times and grid resilience.

- Design Optimization: AI and simulation tools are used during the design phase to optimize insulation clearances, minimize electromagnetic interference, and enhance the mechanical endurance of switching mechanisms for ultra-high voltage applications.

DRO & Impact Forces Of UHV Switches Market

The UHV Switches Market dynamic is characterized by potent drivers stemming from necessity and economic policy, offset by technical restraints inherent in ultra-high voltage engineering, while environmental mandates present significant opportunities for innovation. Key drivers include massive investments in long-haul transmission infrastructure globally, especially the deployment of UHVDC corridors in Asia and South America to integrate remote renewable energy resources. Furthermore, the imperative for grid hardening and resilience against extreme weather events and geopolitical threats necessitates the replacement and upgrade of older, less robust substation components with modern UHV switches offering higher reliability and quicker interruption times. This demand is further amplified by stringent power quality standards that require minimal switching transients and high operational integrity.

Conversely, significant restraints limit faster market expansion. The primary challenge remains the exceptionally high capital expenditure required for UHV substation projects, compounded by the complexity and long lead times associated with manufacturing, testing, and installing UHV components. Technical barriers related to insulation integrity, particularly designing apparatus capable of withstanding transient overvoltages at 1000 kV AC and above, pose persistent engineering hurdles. Additionally, the regulatory landscape regarding the use of SF6 gas, a highly effective insulator but a potent greenhouse gas, acts as a restraint, forcing manufacturers to invest heavily in alternative technologies which may not yet offer the same performance reliability or cost efficiency as traditional SF6-based solutions.

Opportunities in the market are abundant, primarily revolving around technological advancements and regional expansion. The drive towards developing and commercializing eco-friendly switching solutions, such as those utilizing clean air, nitrogen/carbon dioxide mixtures, or fluoroketones, presents a major market opportunity for first movers. Moreover, the integration of advanced sensors (Internet of Things - IoT) and digital twin technologies into UHV switches creates new service revenue streams and improves asset management for utilities. Geographically, emerging economies in Southeast Asia, Africa, and parts of the Middle East are beginning their own large-scale grid modernization and expansion projects, opening substantial new markets for UHV switching apparatus suppliers capable of navigating complex local regulatory environments and providing specialized engineering support.

Segmentation Analysis

The UHV Switches Market segmentation provides a structural view of the diverse product landscape tailored to specific technical requirements, insulation methods, and operational purposes within the ultra-high voltage grid. Products are fundamentally differentiated based on the insulating medium employed, which directly affects component size, environmental footprint, and installation complexity. Further categorization focuses on the operational voltage levels, which determine the complexity of the design and materials science required for reliable performance. Finally, segmentation by application highlights the specific functional roles these switches play, whether in managing bulk power flow, protecting substation equipment, or facilitating regional grid interconnections, ensuring that utilities procure equipment optimized for their specific network architecture needs.

- By Type:

- Gas Insulated Switchgear (GIS)

- Air Insulated Switchgear (AIS)

- Hybrid Switchgear

- By Voltage Rating (AC):

- 800 kV

- 1000 kV

- Above 1000 kV

- By Voltage Rating (DC):

- ±800 kV

- ±1000 kV

- ±1100 kV and Above

- By Application:

- Power Transmission Substations

- Grid Interconnection and Tie Stations

- Power Generation and Evacuation Stations

- By Operating Mechanism:

- Disconnectors (Isolators)

- Earthing Switches (Grounding Switches)

- Load Break Switches (Specialized UHV applications)

Value Chain Analysis For UHV Switches Market

The value chain for UHV switches is complex and capital-intensive, starting with the upstream sourcing of high-purity raw materials. Upstream analysis involves the procurement of specialized materials such as high-grade ceramics, advanced polymers, high-performance copper and aluminum alloys, and crucial insulating gases (SF6 substitutes). Suppliers of these raw materials, often niche chemical or metallurgical firms, hold significant leverage due to the strict quality and performance requirements for UHV applications. The manufacturing stage, where core competencies in mechanical, electrical, and thermal engineering are applied, is dominated by a few global technology leaders who possess the necessary expertise and large-scale testing facilities to validate UHV equipment reliability. This phase includes precision manufacturing of contacts, insulating components, operating mechanisms, and tank enclosures, followed by rigorous type testing.

The downstream analysis focuses on the installation, testing, commissioning, and long-term service provision. Utilities and national grid operators are the primary end-users, relying on EPC (Engineering, Procurement, and Construction) firms for seamless integration of UHV switches into substations. The distribution channel is predominantly direct, involving close, long-term contractual relationships between the original equipment manufacturers (OEMs) and national utilities or large private power developers. Due to the highly customized nature, high cost, and strategic importance of UHV switches, indirect sales through third-party distributors are minimal, limited primarily to supplying spare parts or replacement components for existing installations rather than new project deployment.

The direct channel ensures technical specificity and accountability, allowing OEMs to provide comprehensive training, highly specialized maintenance, and timely engineering support throughout the asset's multi-decade lifespan. The indirect aspect largely involves specialized service contractors who perform routine inspections, advanced diagnostics, and periodic overhauls. Overall, the value chain is characterized by high barriers to entry, demanding intensive R&D, specialized manufacturing processes, and deep technical partnerships between manufacturers and grid operators to ensure system integrity and reliable power flow across the transmission network.

UHV Switches Market Potential Customers

Potential customers for UHV switches are primarily entities responsible for the establishment, operation, and maintenance of high-capacity electrical transmission infrastructure. These customers are highly sensitive to product reliability, operational lifespan, and compliance with national grid codes and international standards. Due to the scale and strategic importance of UHV projects, procurement decisions involve rigorous technical evaluation and extensive pre-qualification processes, prioritizing proven technological competence over minor cost advantages. The decision-making unit typically involves high-level engineering departments, procurement specialists, and executive management within utility companies, focusing on minimizing operational risk and maximizing asset utilization.

The largest customer base comprises national power transmission grid operators, often state-owned monopolies or highly regulated private utilities, responsible for the backbone of the electrical infrastructure. These entities drive demand through national grid expansion plans and inter-regional transmission projects, which inherently require UHV technology to minimize losses over long distances. A rapidly growing segment includes independent power producers (IPPs) and large renewable energy developers who require UHV switches to connect massive solar or wind farms located in remote areas (e.g., deserts, offshore sites) to existing high-voltage transmission networks, making efficient power evacuation possible. Finally, heavy industrial complexes with very high power demand, such as large metallurgical plants or chemical refineries that operate their own dedicated substations connected directly to the UHV grid, also constitute important, albeit smaller, customers for specialized UHV switching equipment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.1 Billion |

| Market Forecast in 2033 | USD 3.3 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB Ltd., Siemens Energy AG, Hitachi Energy Ltd., General Electric (GE) Co., Mitsubishi Electric Corporation, Toshiba Corporation, Bharat Heavy Electricals Ltd. (BHEL), China XD Group, Arteche, MEIDENSHA Corporation, Crompton Greaves Power and Industrial Solutions Ltd. (CG), Fuji Electric Co., Ltd., Hyundai Electric, Koncar, Pinggao Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

UHV Switches Market Key Technology Landscape

The technological landscape of the UHV Switches Market is undergoing significant evolution, driven by the dual pressures of environmental compliance and the need for enhanced performance characteristics at increasingly higher voltages. Traditional UHV switches rely heavily on SF6 gas for superior insulation and arc quenching capabilities; however, its high Global Warming Potential (GWP) is accelerating the shift toward sustainable alternatives. Manufacturers are heavily investing in developing "Clean Air" solutions, which utilize mixtures of nitrogen and oxygen, or advanced fluoroketone-based insulation (often marketed under proprietary names like g³), which maintain excellent dielectric strength while drastically reducing environmental impact. This innovation focuses on redesigning the mechanical and internal structure of the switchgear to handle the slightly reduced dielectric performance of these new gases without compromising system footprint or reliability.

Another pivotal technological trend is the integration of digital capabilities and advanced sensing systems directly into the switch apparatus. Modern UHV switches are equipped with fiber optic sensors for partial discharge monitoring, acoustic sensors for mechanical integrity checks, and precise temperature monitoring systems. This integration transforms the traditional passive switch into an active, intelligent asset capable of communicating real-time health data to centralized control systems. These digital inputs enable sophisticated predictive maintenance programs, utilizing edge computing and cloud-based analytics, minimizing unscheduled outages and optimizing the operating life of extremely expensive UHV components. Furthermore, the push for compact substation designs, especially in urban or space-constrained areas, is fueling the adoption of advanced modular Gas Insulated Switchgear (GIS) where UHV switches are encased in grounded metal tanks, leading to significant space reduction and increased immunity to environmental contamination.

The manufacturing process itself is incorporating advanced techniques, including highly precise 3D modeling and simulation to optimize electrical field distribution and mechanical stress tolerance under extreme operating conditions (e.g., short circuit current interruption or transient recovery voltage). For UHVDC applications, specialized technologies are required to manage the unique challenges associated with isolating DC lines, which do not have natural current zero crossings. This necessitates highly reliable, fast-operating mechanisms and sophisticated control systems to ensure fault clearance without causing unacceptable network disturbances. The continuous advancement in material science for high-performance insulating materials and contact materials is essential to guarantee the long-term reliability and minimize mechanical deterioration of these critical, infrequently operated components.

Regional Highlights

- Asia Pacific (APAC): APAC is the global powerhouse for UHV switch demand, primarily driven by China and India. China's massive UHVDC buildout, including projects exceeding ±1100 kV, designed to transmit power from remote hydro and coal-rich western regions to the densely populated eastern coasts, dictates the global technology trajectory. India is also significantly investing in its own national grid expansion, particularly high-capacity transmission corridors (HVDC and UHVAC) to integrate vast solar and wind projects. This region is characterized by high volume installations and a demand for localized manufacturing and robust supply chain support.

- Europe: The European market focuses heavily on modernization, replacement, and cross-border interconnection projects aimed at enhancing grid reliability and integrating renewable energy sources. Key drivers include stringent EU environmental regulations (driving the adoption of non-SF6 technology) and the development of super grids for energy security. While installation volumes are lower than APAC, the market commands premium pricing for advanced, digitized switchgear featuring high levels of integrated monitoring and diagnostic capabilities.

- North America: Driven primarily by aging infrastructure replacement, grid hardening efforts in response to climate change impacts (e.g., wildfires, extreme cold), and the need to connect remote renewable generation (e.g., wind farms in the Midwest) to coastal load centers. The market exhibits slower, steadier growth compared to APAC but shows a strong preference for high-quality, long-life assets and advanced automation, particularly focusing on cyber-secure substation solutions.

- Latin America: Growth is concentrated in countries like Brazil and Chile, which are developing large-scale transmission infrastructure, often UHVDC, to evacuate power from remote hydro and solar resources. The market is highly dependent on governmental funding and major utility investments, characterized by large, intermittent project awards and a reliance on international suppliers for specialized UHV components and project financing.

- Middle East and Africa (MEA): This emerging region is experiencing substantial growth in demand, driven by rapid urbanization and industrialization, necessitating grid expansion and interconnection between countries (e.g., Gulf Cooperation Council Interconnection Grid). Demand for UHV switches is tied to large, federally sponsored energy projects aimed at improving access to reliable electricity and supporting heavy industrial load growth.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the UHV Switches Market.- ABB Ltd.

- Siemens Energy AG

- Hitachi Energy Ltd.

- General Electric (GE) Co.

- Mitsubishi Electric Corporation

- Toshiba Corporation

- Bharat Heavy Electricals Ltd. (BHEL)

- China XD Group

- Arteche

- MEIDENSHA Corporation

- Crompton Greaves Power and Industrial Solutions Ltd. (CG)

- Fuji Electric Co., Ltd.

- Hyundai Electric

- Koncar KET

- Pinggao Group

- TBEA Co., Ltd.

- Shandong Taikai Investment Co., Ltd.

- Schneider Electric SE

- Zhejiang Electric Power Equipment Co., Ltd.

- Xian Electric Engineering Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the UHV Switches market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver for the growth of the UHV Switches Market?

The primary driver is the global necessity for constructing long-distance, high-capacity transmission corridors, particularly Ultra-High Voltage Direct Current (UHVDC) lines, which are essential for minimizing energy losses and integrating remotely located large-scale renewable energy generation facilities into existing grid systems efficiently.

How do environmental regulations impact the future technology of UHV Switches?

Environmental regulations, particularly those targeting the high Global Warming Potential (GWP) of traditional SF6 insulating gas, are forcing manufacturers to rapidly develop and adopt alternative, sustainable insulating media such as fluoroketone mixtures or 'Clean Air' technologies, significantly reshaping product design and material science investment.

Which geographic region dominates the demand for new UHV switch installations?

Asia Pacific (APAC), specifically driven by extensive UHVDC and UHVAC network expansion projects in China and India, dominates the demand for new UHV switch installations due to massive governmental investments in bulk power transmission infrastructure.

What is the difference between UHV Disconnectors and UHV Circuit Breakers?

UHV Disconnectors (Isolators) are designed to isolate a section of the circuit only when no current is flowing, ensuring visual physical separation for maintenance safety. UHV Circuit Breakers are designed to safely interrupt and extinguish high fault currents under load, protecting the system from damage, and are thus functionally distinct and more complex.

How is predictive maintenance implemented in modern UHV switching equipment?

Predictive maintenance is implemented by embedding IoT sensors (e.g., partial discharge, acoustic, temperature) within the UHV switchgear. These sensors continuously collect operational data, which is then analyzed by Artificial Intelligence (AI) algorithms to forecast component degradation and schedule maintenance precisely before failure occurs, optimizing asset lifespan.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager