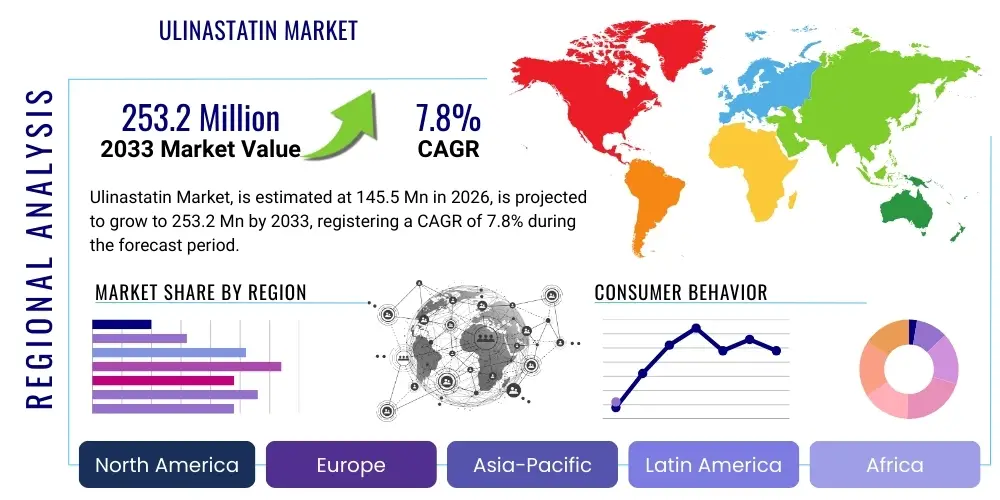

Ulinastatin Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442100 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Ulinastatin Market Size

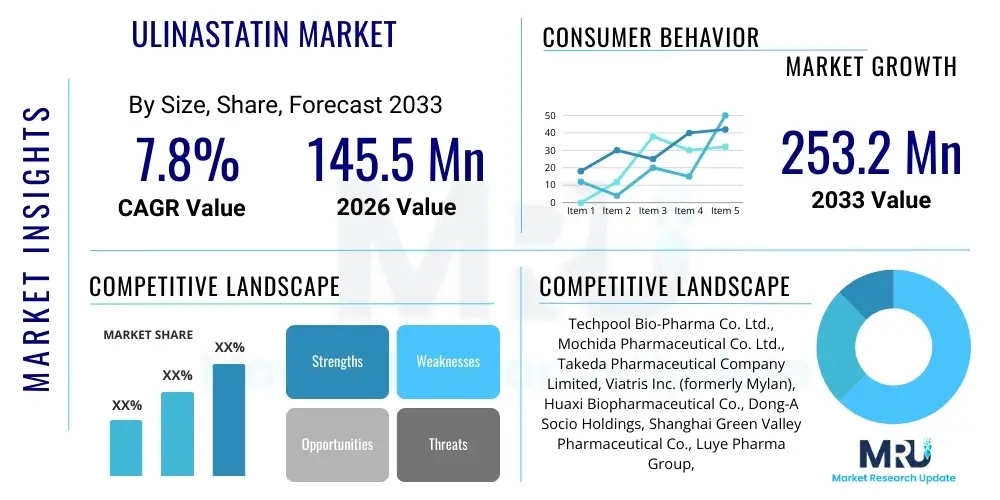

The Ulinastatin Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at $145.5 Million in 2026 and is projected to reach $253.2 Million by the end of the forecast period in 2033.

Ulinastatin Market introduction

Ulinastatin, a Kunitz-type serine protease inhibitor, is a critical therapeutic agent primarily derived from human urine or produced recombinantly. Its fundamental mechanism involves inhibiting various proteolytic enzymes, such as trypsin, chymotrypsin, elastase, and thrombin, which are often excessively released during severe inflammatory conditions like acute pancreatitis, sepsis, and septic shock. This broad-spectrum inhibitory action helps stabilize cellular membranes, reduce inflammatory cytokine storms, and mitigate systemic inflammatory response syndrome (SIRS), thereby improving patient outcomes in critical care settings. The established clinical efficacy of ulinastatin, particularly in reducing mortality and shortening hospital stays for patients with severe acute pancreatitis, underscores its importance in hospital formularies across major global markets, especially in Asia Pacific.

The product is typically administered intravenously, necessitating stringent manufacturing and purification processes to ensure high biological activity and safety. Major applications center around acute pancreatitis, where the drug counteracts the auto-digestion process initiated by premature activation of pancreatic enzymes. Beyond pancreatitis, uological investigation into its potential applications in treating severe sepsis and hemorrhagic shock is expanding, driven by its anti-inflammatory and vascular protective properties. The market benefits from increasing global incidence of lifestyle-related gastrointestinal disorders, better diagnostic capabilities leading to earlier intervention, and rising healthcare expenditure in emerging economies focused on critical care infrastructure.

Key driving factors supporting market expansion include robust clinical evidence demonstrating effectiveness in severe inflammatory states, particularly in regions where treatment protocols favor enzyme inhibition. Furthermore, advancements in biotechnology for recombinant ulinastatin production are improving scalability and reducing reliance on traditional urinary extraction methods, leading to greater supply stability and potentially lower manufacturing costs. The growing geriatric population, coupled with the rising prevalence of conditions predisposing individuals to pancreatitis and sepsis, solidifies the sustained demand for effective critical care pharmaceuticals like ulinastatin, propelling investment in R&D and market penetration efforts across North America and Europe.

Ulinastatin Market Executive Summary

The Ulinastatin market is characterized by moderate growth, primarily driven by its established role in critical care and oncology support therapies, juxtaposed against regulatory scrutiny and the emergence of competing anti-inflammatory biologicals. Business trends indicate a strategic shift among key manufacturers towards recombinant production methods to ensure purity and sustainable supply, moving away from traditional extraction processes. This transition is capital-intensive but promises higher margins and reduced batch-to-batch variability, appealing to stringent regulatory bodies in Western markets. Furthermore, collaborative research partnerships between pharmaceutical companies and academic institutions are focusing on optimizing drug delivery systems and exploring novel therapeutic combinations to broaden Ulinastatin’s application portfolio beyond pancreatitis into indications such as acute respiratory distress syndrome (ARDS) and organ protection during major surgery.

Regionally, the market exhibits significant asymmetry. Asia Pacific, particularly China and Japan, remains the dominant revenue contributor due to deep clinical adoption, established treatment guidelines that endorse Ulinastatin, and substantial local manufacturing capabilities. North America and Europe, while representing high-value markets, show slower adoption rates, largely attributed to the presence of alternative treatments for sepsis and the necessity for extensive phase III trials required for broader regulatory approval in these regions. However, increasing awareness of its specific benefits in attenuating systemic inflammation, especially post-surgical or trauma-induced, is gradually fueling interest, prompting companies to initiate strategic regulatory filings and explore orphan drug designations where applicable, aiming to penetrate these lucrative Western geographies more effectively.

Segment trends highlight the dominance of the Acute Pancreatitis application segment, which accounts for the largest share of market revenue. However, the Sepsis and Septic Shock application segment is anticipated to register the fastest growth rate during the forecast period, fueled by the urgent global need for effective therapies against multi-drug resistant infections and inflammatory complications. In terms of dosage form, the Injection segment remains paramount due to the critical nature of the treated conditions requiring immediate systemic delivery. The Hospital Pharmacy distribution channel maintains its leading position, reflecting the drug’s primary use in inpatient critical care settings, although the expanding role of specialty pharmacies and centralized procurement models is beginning to influence purchasing patterns and logistics efficiency across different healthcare systems globally.

AI Impact Analysis on Ulinastatin Market

Common user questions regarding AI's influence on the Ulinastatin market frequently revolve around how artificial intelligence can optimize drug discovery processes, predict patient response heterogeneity, and enhance clinical trial efficiency for new applications. Key themes include the potential for AI-driven target identification related to protease inhibition pathways in complex diseases like ARDS or multiorgan failure, concerns about data privacy when integrating real-world evidence (RWE) for post-market surveillance, and expectations for personalized dosing regimens guided by machine learning algorithms that analyze patient biomarkers and genetic profiles. Users are particularly interested in whether AI can accelerate the notoriously slow and expensive Phase II and III trials required for Ulinastatin’s approval in new, high-prevalence indications outside of its traditional Asian strongholds, thus overcoming existing market entry barriers.

- AI accelerates drug target identification by analyzing vast proteomic datasets relevant to inflammatory pathways modulated by Ulinastatin.

- Machine Learning (ML) algorithms optimize clinical trial design, improving patient selection criteria for trials investigating Ulinastatin in sepsis or ARDS.

- AI tools enhance manufacturing yield and quality control in recombinant Ulinastatin production, minimizing batch failures and reducing costs.

- Predictive analytics support personalized medicine initiatives, determining optimal Ulinastatin dosing based on real-time patient physiological data and inflammatory markers.

- Natural Language Processing (NLP) is utilized for extracting insights from electronic health records (EHRs) and scientific literature, aiding pharmacovigilance and generating RWE.

- AI modeling simulates drug interactions and efficacy in complex inflammatory cascades, reducing reliance on lengthy in-vivo studies.

DRO & Impact Forces Of Ulinastatin Market

The Ulinastatin market dynamics are significantly influenced by a favorable confluence of clinical acceptance and increasing critical care needs, counterbalanced by inherent supply chain complexities and intense competition from newer biological therapies. Major drivers include the drug's proven efficacy in mitigating the severity of acute pancreatitis and septic shock, supported by extensive clinical experience, especially within Asian healthcare protocols. Restraints largely center on the high cost of goods sold (COGS) associated with purification, particularly for traditionally derived urinary ulinastatin, and the rigorous regulatory hurdles required for widespread adoption in Western markets accustomed to synthetic or small-molecule alternatives. Opportunities are substantial in exploring new indications, such as perioperative organ protection and treating pediatric inflammatory conditions, alongside expanding market penetration through strategic licensing agreements and local manufacturing in high-growth regions like Latin America and the Middle East.

Key impact forces shaping the competitive landscape involve the regulatory environment and technological substitution. Regulatory approvals in major markets like the FDA and EMA create high-impact opportunities but require substantial investment in long-term safety and comparative effectiveness studies. Conversely, technological innovation in producing high-purity recombinant variants exerts a strong positive influence, minimizing reliance on biological sourcing risks. The market is also heavily influenced by reimbursement policies; where Ulinastatin is included in national essential drug lists or receives favorable insurance coverage, its market uptake is accelerated. The impact force of substitute biologicals, such as specific cytokine inhibitors or novel anti-inflammatory peptides, necessitates continuous R&D investment to maintain Ulinastatin's clinical relevance and demonstrate superior cost-effectiveness in specific critical care scenarios.

Overall market trajectory is dictated by the ability of manufacturers to address the supply stability issue through recombinant technology adoption while simultaneously investing in clinical evidence that justifies Ulinastatin’s inclusion in global standard treatment guidelines for sepsis management. The interplay between clinical validation (driver) and regulatory fragmentation (restraint) will define the geographic expansion rate. Furthermore, the emerging opportunity for Ulinastatin in managing inflammatory complications associated with novel pathogens, demonstrated during recent global health crises, presents a long-term demand catalyst that could significantly alter its current market valuation and adoption profile in the coming years.

Segmentation Analysis

The Ulinastatin market segmentation provides a granular view of market dynamics based on therapeutic use, drug delivery format, and point-of-sale distribution channels. The analysis reveals distinct adoption patterns across different clinical settings and geographic regions, allowing stakeholders to identify high-growth sub-markets and tailor their commercial strategies. The core segmentation revolves around differentiating the primary clinical indications, with Acute Pancreatitis serving as the bedrock revenue driver, while the high unmet need in severe sepsis is driving substantial future expansion. Technological differentiation, specifically between urinary-derived and recombinant products, although not always explicitly reported, underlies pricing power and geographical market acceptance.

- By Application:

- Acute Pancreatitis (Mild, Moderate, Severe)

- Sepsis and Septic Shock

- Acute Respiratory Distress Syndrome (ARDS)

- Others (e.g., Hemorrhagic Shock, Perioperative Organ Protection)

- By Dosage Form:

- Injection (Lyophilized Powder)

- Infusion Solution

- By Distribution Channel:

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies/E-Commerce

Value Chain Analysis For Ulinastatin Market

The Ulinastatin value chain is highly specialized, beginning with complex upstream activities involving either the collection and processing of human urine or, increasingly, advanced biotechnological processes for recombinant protein expression in microbial or mammalian cell systems. Upstream analysis focuses heavily on supply chain integrity, quality control, and minimizing biological contamination risks. For urinary-derived Ulinastatin, sourcing materials ethically and ensuring viral clearance are paramount, leading to high production costs. Recombinant production, on the other hand, demands significant upfront investment in bioreactors and purification chromatography techniques, but offers greater long-term scalability and consistency, a major factor for manufacturers aiming for global regulatory approvals.

The midstream activities encompass drug formulation, sterile filling (primarily as lyophilized powder for injection), packaging, and stringent quality assurance protocols necessary for critical care products. Manufacturing complexity is relatively high due to the protein nature of the drug, necessitating specialized cold chain management from the production facility to the point of distribution. Downstream analysis involves managing the specialized distribution channels. Given Ulinastatin's primary use in emergency and critical care, the distribution network heavily favors direct hospital procurement and high-volume institutional sales through specialized wholesalers and distributors capable of handling temperature-sensitive pharmaceuticals. The complexity of logistics often restricts the use of general retail channels, except for potential outpatient follow-up in certain regions.

The distribution network structure is dominated by direct channels, where manufacturers or large national distributors supply directly to centralized hospital pharmacies and governmental procurement agencies, especially in Asian markets where large tenders are common. Indirect channels exist through regional specialty distributors, which handle the last-mile delivery to smaller clinics or remote hospitals. The efficiency and reliability of these distribution channels are vital, as delays in delivery can have fatal consequences in critical care scenarios. The overall value addition occurs significantly at the manufacturing and purification stage, followed by clinical validation, which allows for premium pricing in regulated markets, ensuring robust profitability for market leaders who control intellectual property and scalable manufacturing platforms.

Ulinastatin Market Potential Customers

The primary end-users and buyers of Ulinastatin are institutions specializing in acute patient care and high-acuity medical treatments. These customers include tertiary care hospitals, specialized emergency departments, and intensive care units (ICUs) that treat conditions such as severe acute pancreatitis, sepsis, multi-organ dysfunction syndrome (MODS), and hemorrhagic shock. Within these institutions, the key decision-makers influencing procurement are critical care physicians, gastroenterologists (for pancreatitis), hospital procurement managers, and pharmacy and therapeutics (P&T) committees responsible for formulary inclusion and therapeutic guidelines. The purchasing criteria are heavily weighted towards clinical efficacy, demonstrated reduction in patient mortality rates, and cost-effectiveness relative to alternative sepsis and inflammation management protocols.

Beyond acute care settings, Ulinastatin is increasingly being utilized in specialized surgical centers for perioperative administration to mitigate reperfusion injury and systemic inflammatory response following complex procedures, such as major cardiac or vascular surgery and organ transplantation. These surgical teams represent a growing segment of specialized consumers focused on prophylactic use of the drug. Additionally, governmental and non-governmental health organizations are crucial customers, particularly in developing economies, as they often procure large volumes of essential critical care medicines through centralized tenders for national health programs, influencing market pricing and regional market penetration significantly.

Academic research institutions and specialized biotechnology companies also constitute a smaller, yet strategically important, customer base. They utilize Ulinastatin as a research reagent for investigating protease inhibition pathways, developing new delivery systems, and conducting comparative clinical studies against emerging anti-inflammatory agents. These customers are vital for validating new applications and generating the scientific evidence required for market expansion into novel therapeutic areas, ensuring the long-term clinical relevance of the product globally.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $145.5 Million |

| Market Forecast in 2033 | $253.2 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Techpool Bio-Pharma Co. Ltd., Mochida Pharmaceutical Co. Ltd., Takeda Pharmaceutical Company Limited, Viatris Inc. (formerly Mylan), Huaxi Biopharmaceutical Co., Dong-A Socio Holdings, Shanghai Green Valley Pharmaceutical Co., Luye Pharma Group, Hainan Xianming Pharmaceutical Co., Beijing SL Pharmaceutical Co., Ltd., Wockhardt Ltd., Novartis AG, Baxter International, Fresenius Kabi, Dr. Reddy’s Laboratories, Aurobindo Pharma, Hisun Pharmaceutical, Hualan Biological Engineering. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ulinastatin Market Key Technology Landscape

The technological landscape of the Ulinastatin market is characterized by a significant transition from traditional biological extraction methods to modern biotechnological manufacturing processes, specifically focusing on recombinant DNA technology. Originally, Ulinastatin was sourced from pooled human urine, requiring elaborate and costly purification techniques, including multiple chromatography steps (e.g., ion-exchange and affinity chromatography) and mandatory viral inactivation processes to ensure product safety and high purity. This urinary extraction method remains technologically relevant in certain localized markets but faces inherent limitations related to raw material variability, ethical sourcing, and scalability, making it less favorable for global market penetration in highly regulated regions.

The primary technological advancement driving market growth and stability is the adoption of recombinant protein expression systems. Manufacturers are increasingly utilizing genetically engineered host cells, typically yeast or E. coli systems, or sometimes mammalian cell lines, to produce Ulinastatin (or related recombinant protease inhibitors) with high consistency and significantly reduced risk of human pathogen transmission. Key technology challenges in the recombinant production landscape involve optimizing the yield of biologically active protein, ensuring correct folding of the complex Kunitz domain structure, and scaling up fermentation processes while maintaining stringent Good Manufacturing Practice (GMP) standards. Advancements in downstream processing, utilizing specialized high-resolution liquid chromatography (HPLC) and ultrafiltration technologies, are critical for achieving the pharmacological grade purity required for intravenous administration.

Furthermore, research and development are focusing on formulation technology, particularly stabilizing the lyophilized powder form of Ulinastatin to extend shelf life and improve reconstitution characteristics in critical care settings. There is also emerging interest in novel drug delivery technologies, such as sustained-release systems or targeted delivery mechanisms, though current applications remain predominantly in the immediate-release intravenous format. Process analytical technology (PAT) tools, including real-time spectroscopic monitoring and chemometric analysis, are being integrated into manufacturing lines to enhance process control, leading to higher efficiency, reduced waste, and compliance with increasingly demanding international quality standards, thereby positioning companies with advanced recombinant platforms for market leadership.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant market for Ulinastatin, primarily driven by strong clinical acceptance, established treatment protocols in countries like China, Japan, and South Korea, and the presence of major domestic manufacturers. China, in particular, accounts for a substantial share of global consumption, supported by extensive clinical experience in treating acute pancreatitis and favorable national reimbursement policies.

- North America: This region represents a high-potential, yet currently less penetrated, market. Adoption is constrained by stringent regulatory requirements and competition from alternative treatments for sepsis. However, increasing clinical evidence and efforts by manufacturers to secure FDA approval for specific critical care indications are expected to drive moderate growth, particularly in specialized trauma and critical care centers.

- Europe: Similar to North America, the European market is characterized by cautious adoption, though countries like Germany and France show pockets of usage. Market growth hinges on successful demonstration of superior outcomes compared to standard-of-care protocols and successful navigation of the EMA approval process, with a focus on cost-effectiveness in diverse national healthcare systems.

- Latin America (LATAM): LATAM is an emerging market fueled by improving critical care infrastructure and increasing healthcare expenditure. Demand is rising in major economies like Brazil and Mexico for effective sepsis and pancreatitis management, presenting long-term opportunities for strategic partnerships and low-cost manufacturing entrants.

- Middle East and Africa (MEA): Growth in MEA is driven by expanding medical tourism and government investments in modernizing healthcare facilities, particularly in the UAE and Saudi Arabia. Adoption is steady but dependent on securing centralized government tenders for essential hospital drugs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ulinastatin Market.- Techpool Bio-Pharma Co. Ltd.

- Mochida Pharmaceutical Co. Ltd.

- Takeda Pharmaceutical Company Limited

- Viatris Inc. (formerly Mylan)

- Huaxi Biopharmaceutical Co.

- Dong-A Socio Holdings

- Shanghai Green Valley Pharmaceutical Co.

- Luye Pharma Group

- Hainan Xianming Pharmaceutical Co.

- Beijing SL Pharmaceutical Co., Ltd.

- Wockhardt Ltd.

- Novartis AG

- Baxter International

- Fresenius Kabi

- Dr. Reddy’s Laboratories

- Aurobindo Pharma

- Hisun Pharmaceutical

- Hualan Biological Engineering

- Chongqing Pharmaceutical Group

- Shandong Luoxin Pharmaceutical Group

Frequently Asked Questions

Analyze common user questions about the Ulinastatin market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Ulinastatin primarily used for in clinical practice?

Ulinastatin is primarily utilized as a potent Kunitz-type serine protease inhibitor for the treatment of severe acute pancreatitis, where it mitigates pancreatic autodigestion and systemic inflammatory response syndrome (SIRS), significantly improving patient prognosis and reducing mortality rates in critical care settings.

How is the market supply chain for Ulinastatin evolving?

The supply chain is rapidly evolving from reliance on traditional urinary extraction methods, which pose scalability and purity challenges, toward advanced recombinant DNA technology. Recombinant production offers superior consistency, higher yields, and better adherence to global regulatory standards, securing long-term market stability.

Which geographical region holds the largest market share for Ulinastatin?

The Asia Pacific (APAC) region currently dominates the Ulinastatin market share, driven by widespread clinical adoption in countries like China and Japan, established treatment guidelines that endorse its use, and significant local manufacturing capacity supporting high-volume consumption.

What are the main restraints hindering Ulinastatin market growth in Western countries?

The main restraints include the rigorous and prolonged clinical trials required for broad regulatory approval (FDA/EMA) for indications like sepsis, intense competition from established alternative anti-inflammatory and anti-sepsis treatments, and the historical lack of local, cost-effective recombinant manufacturing infrastructure.

How is AI impacting the development and clinical use of Ulinastatin?

AI is impacting Ulinastatin development by accelerating the identification of new therapeutic targets related to protease inhibition, optimizing clinical trial patient recruitment, and facilitating the analysis of real-world evidence for personalized dosing strategies in critical care management.

What is the difference in application segments between acute pancreatitis and sepsis?

While both are inflammatory conditions, in acute pancreatitis, Ulinastatin directly inhibits pancreatic enzymes causing autodigestion. In sepsis, it modulates the generalized systemic inflammatory cascade by inhibiting various proteases and stabilizing mast cells, aiming to prevent subsequent organ dysfunction and septic shock.

What is the Compound Annual Growth Rate (CAGR) projected for the Ulinastatin market?

The Ulinastatin market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% during the forecast period spanning from 2026 to 2033, driven primarily by expanding applications in critical care and geographical market penetration.

Which technology is considered key for future market expansion?

Recombinant DNA technology, enabling the large-scale, consistent production of high-purity Ulinastatin, is considered the key technology for future market expansion, ensuring supply reliability and meeting stringent international quality and safety requirements.

What are the opportunities for Ulinastatin beyond its current primary indications?

Significant opportunities exist in exploring novel indications such as treating Acute Respiratory Distress Syndrome (ARDS), mitigating inflammatory damage during complex surgical procedures (perioperative protection), and managing specific types of hemorrhagic shock where systemic inflammation is a critical factor.

Who are the primary potential customers for Ulinastatin?

The primary potential customers are centralized hospital pharmacies and critical care units (ICUs) within tertiary care hospitals, specialized trauma centers, and government procurement agencies focused on acquiring essential medicines for acute disease management.

How do distribution channels influence Ulinastatin sales?

Due to the critical nature and need for controlled storage, sales are predominantly channeled through direct relationships with specialized hospital pharmacies and institutional procurement departments. Efficiency in cold-chain logistics significantly influences reliable supply and patient outcomes.

Are there generic versions of Ulinastatin available in the market?

Yes, particularly in markets like China and India where the product has been off-patent or manufactured based on similar proprietary techniques, generic or biosimilar versions exist, contributing to price competition and accessibility, particularly in high-volume critical care tenders.

What is the role of the Kunitz domain in Ulinastatin's mechanism of action?

The Kunitz domain is the specific structural motif within the Ulinastatin molecule responsible for competitively binding to and inhibiting active sites on various serine proteases, thereby neutralizing their destructive enzymatic activity during severe inflammatory responses.

Which dosage form is most common for Ulinastatin administration?

The most common dosage form is the lyophilized powder for injection, which is reconstituted into an intravenous solution prior to immediate administration. This form ensures stability during storage and rapid systemic availability, essential for critical conditions like sepsis and acute pancreatitis.

How does reimbursement policy affect Ulinastatin adoption globally?

Reimbursement policies are crucial; favorable inclusion of Ulinastatin on national essential drug lists or specific high-cost drug coverage lists, particularly in Asian countries, directly correlates with higher prescription rates and broader patient accessibility, significantly influencing regional market growth.

What is the significance of the shift to recombinant production?

The shift to recombinant production significantly improves supply reliability, ensures uniformity in product quality and purity, minimizes the ethical and biological risks associated with urinary sourcing, and facilitates compliance necessary for expansion into stringent regulatory territories like the U.S. and Europe.

What impact do lifestyle factors have on the Ulinastatin market?

Lifestyle factors, such as increased rates of alcoholism, obesity, and gallstone disease, lead directly to a higher global incidence of acute pancreatitis, thereby fueling the sustained demand for critical treatments like Ulinastatin used in managing these acute exacerbations.

Are there clinical guidelines supporting the use of Ulinastatin in severe sepsis?

While its use in severe sepsis is common, particularly in Asian clinical protocols based on local evidence, global guidelines, such as those in North America and Europe, often require more comprehensive Phase III data to fully endorse Ulinastatin as a first-line treatment, generating market friction.

How does Ulinastatin fit into the broader therapeutic area of protease inhibitors?

Ulinastatin is a cornerstone drug among protease inhibitors due to its broad-spectrum action against trypsin, elastase, and other inflammatory enzymes. It occupies a niche distinct from highly specific protease inhibitors, positioning it as a valuable option for conditions characterized by diffuse, multi-system inflammation.

What role do P&T committees play in Ulinastatin procurement?

Pharmacy and Therapeutics (P&T) committees in hospitals evaluate Ulinastatin based on clinical efficacy, safety profiles, comparative cost-effectiveness, and inclusion in established treatment pathways. Their approval is mandatory for the drug to be stocked and prescribed within the hospital formulary, making them key purchasing gatekeepers.

What is the estimated market size for Ulinastatin in 2033?

The Ulinastatin market is projected to reach an estimated value of $253.2 Million by the end of the forecast period in 2033, driven by increasing clinical applications and market penetration strategies.

What are the challenges faced by manufacturers in product purification?

For both urinary and recombinant sources, challenges involve ensuring the removal of impurities, achieving high protein homogeneity, preventing aggregation, and validating viral safety—all critical steps requiring advanced chromatography and process validation to meet injectability standards.

How is competition impacting pricing strategies?

Competition, particularly from local generic manufacturers in Asia and alternative biological anti-inflammatory agents globally, is driving pricing pressure. Leading innovators counter this by focusing on premium pricing in highly regulated markets based on intellectual property (IP) protection and superior recombinant purity.

What is the significance of clinical trials focusing on ARDS?

Clinical trials focusing on ARDS are highly significant because ARDS represents a massive, high-unmet-need indication driven by uncontrolled inflammation, where Ulinastatin's anti-inflammatory and vascular protective properties could offer a novel therapeutic approach, potentially unlocking a large new revenue stream.

Which segment is expected to show the fastest growth rate?

The Sepsis and Septic Shock application segment is anticipated to exhibit the fastest growth rate within the market, fueled by the rising global incidence of sepsis, antibiotic resistance challenges, and the urgent need for adjunctive therapies to mitigate systemic organ damage.

How does the historical year range (2019-2024) inform the market outlook?

The historical period (2019-2024) provides essential data on the market's resilience during global health crises, illustrating stable demand from critical care units and highlighting the accelerating transition toward recombinant manufacturing necessitated by supply chain volatility.

What technological tools are utilized for quality assurance in Ulinastatin production?

Quality assurance relies heavily on advanced analytical techniques such as high-performance liquid chromatography (HPLC) for purity assessment, mass spectrometry for structural confirmation, and process analytical technologies (PAT) for real-time monitoring of fermentation and purification processes, ensuring regulatory compliance.

What are the key differences between mild and severe acute pancreatitis treatment using Ulinastatin?

Ulinastatin is primarily reserved for moderate to severe acute pancreatitis, where the systemic inflammatory response is pronounced and life-threatening. For mild cases, conservative management is usually sufficient, limiting Ulinastatin's use mainly to high-acuity interventions to prevent progression to severe disease.

In the value chain, where is the highest value addition achieved?

The highest value addition is achieved at the upstream stage, specifically in the successful development and implementation of scalable recombinant manufacturing processes and the subsequent high-resolution purification required to produce a safe, biologically active pharmaceutical ingredient.

Why is Latin America considered a high-growth region for Ulinastatin?

Latin America is viewed as high-growth due to governmental commitment to upgrading critical care infrastructure, rising health expenditure, and an increasing prevalence of lifestyle diseases necessitating acute care intervention, creating significant, untapped demand for drugs like Ulinastatin.

What is the long-term strategic goal for Ulinastatin manufacturers?

The long-term strategic goal is to secure comprehensive regulatory approval in North America and Europe for novel, high-prevalence indications (like sepsis and ARDS) using evidence generated from high-purity recombinant products, thereby transforming Ulinastatin from a regionally dominant drug into a globally recognized critical care standard.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager