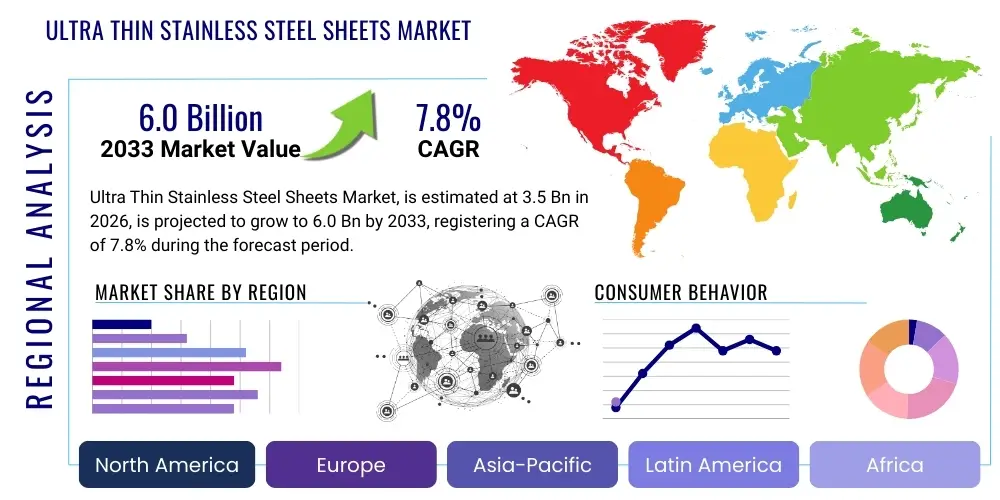

Ultra Thin Stainless Steel Sheets Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442539 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Ultra Thin Stainless Steel Sheets Market Size

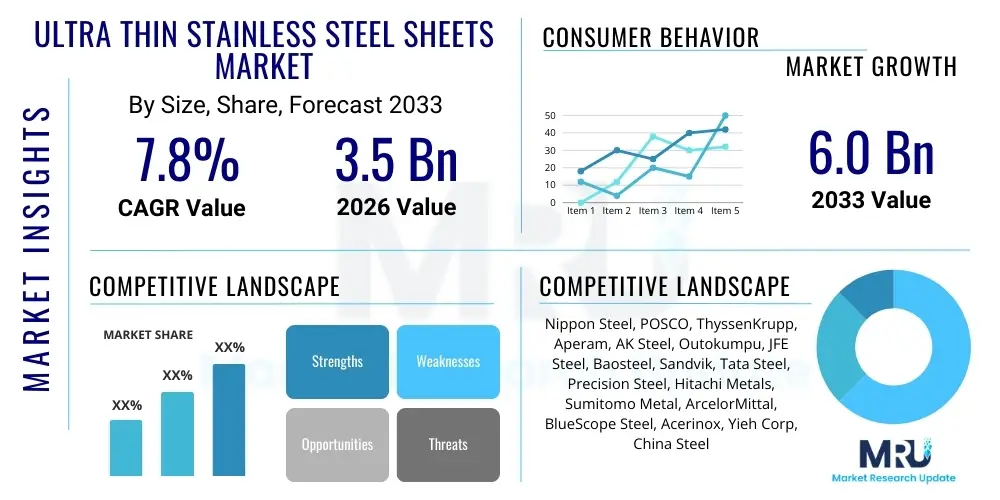

The Ultra Thin Stainless Steel Sheets Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 6.0 Billion by the end of the forecast period in 2033. This substantial expansion is primarily fueled by the escalating demand for miniaturization and lightweight components across high-tech industries, particularly consumer electronics, medical devices, and sophisticated aerospace applications. The unique properties of ultra thin stainless steel sheets, including exceptional strength-to-weight ratio, superior corrosion resistance, and high precision in thickness tolerance, position them as critical materials for next-generation manufacturing processes demanding stringent performance specifications.

Ultra Thin Stainless Steel Sheets Market introduction

The Ultra Thin Stainless Steel Sheets Market encompasses specialized stainless steel products characterized by thicknesses typically ranging from 0.01 mm up to 0.1 mm, often produced through rigorous cold rolling and annealing processes. These materials are essential for applications requiring both durability and minimal form factor, bridging the gap between traditional sheet metals and specialized foils. Product descriptions highlight grades like 304, 316L, and specialized martensitic or duplex stainless steels, tailored for specific functional requirements such as elasticity, magnetic properties, or biocompatibility. Major applications span high-density integrated circuit components, surgical instruments, flexible displays, battery casings in EVs, and structural elements in satellites, reflecting their necessity in sectors driven by technological advancement and performance optimization.

The core benefits driving market adoption include unmatched mechanical integrity at minimal thickness, superior resistance to aggressive chemical environments, and the ability to be precisely manufactured using highly controlled rolling technologies. These features enable the production of smaller, more efficient, and longer-lasting electronic and medical devices. Furthermore, ultra thin sheets facilitate energy savings in transport sectors due to weight reduction and enhance the thermal management capabilities in advanced electronic systems, contributing directly to improved product reliability and consumer safety standards. The combination of high utility and customization potential ensures continuous innovation within the product landscape.

Key driving factors accelerating the market trajectory include rapid technological shifts toward miniaturization (especially in 5G devices and wearables), stringent regulatory requirements for biocompatible materials in medical fields (driving demand for ultra-thin 316L), and significant investment in electric vehicle manufacturing, where lightweight, corrosion-resistant materials are crucial for battery protection and structural integrity. Economic development across Asia Pacific nations, coupled with increasing industrial automation and precision engineering capabilities, further stimulates consumption. The inherent advantages of stainless steel over alternative materials like aluminum or polymer composites in demanding high-heat or high-stress environments solidify its market position, pushing manufacturers to continuously refine production techniques for even finer tolerances and broader grade availability.

Ultra Thin Stainless Steel Sheets Market Executive Summary

The Ultra Thin Stainless Steel Sheets Market is characterized by intense technological competition and a strong focus on supply chain optimization to meet volatile demand from consumer electronics and automotive electrification segments. Business trends indicate a clear preference for specialized mills capable of achieving sub-0.05mm thicknesses with exceptional surface finishes, leading to consolidation among top-tier manufacturers who possess proprietary cold rolling and finishing technologies. Strategic partnerships between steel producers and high-precision component fabricators are becoming commonplace, enabling customized material development for cutting-edge products like flexible circuit boards and micro-electro-mechanical systems (MEMS). Furthermore, sustainability mandates are prompting innovation in material sourcing and energy-efficient production, adding complexity but also opportunity for leading market players to differentiate themselves through certified green production methods.

Regional trends highlight Asia Pacific (APAC) as the undisputed leader in both consumption and production, driven primarily by the massive electronics manufacturing bases in China, South Korea, and Taiwan, along with rapid urbanization and infrastructure development requiring advanced materials. North America and Europe maintain strong positions, focusing heavily on high-value applications in medical technology, aerospace, and sophisticated industrial machinery, often demanding tighter quality control and regulatory compliance (e.g., FDA approval for medical grades). Emerging markets in Latin America and the Middle East are showing accelerated growth, particularly in automotive component manufacturing and domestic electronics assembly, signaling diversification of global production hubs and new avenues for material suppliers.

Segment trends underscore the dominance of the 300 Series (especially 304 and 316L) due to their versatility and corrosion resistance, essential for critical applications. However, the 400 Series is gaining traction in specific automotive and industrial heating element applications where magnetic properties or higher heat resistance are required. In terms of application, the Electronics segment remains the largest consumer, driven by the continuous cycle of device upgrades and miniaturization. The fastest-growing application segment is anticipated to be Medical Devices, spurred by an aging global population and increasing investment in minimally invasive surgical tools and high-precision diagnostics. Thickness segmentation reveals a growing trend toward the 0.01mm-0.05mm category, reflecting the ultimate goal of component miniaturization across nearly all end-use sectors, necessitating significant R&D investment from material scientists and producers alike.

AI Impact Analysis on Ultra Thin Stainless Steel Sheets Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) can enhance the stringent quality control and complex manufacturing processes inherent in producing ultra thin stainless steel sheets. Key concerns revolve around achieving zero-defect production runs, optimizing energy consumption during cold rolling and annealing, and predicting potential material failures or deviations in real-time. The common expectation is that AI will revolutionize yield rates and reduce material waste, allowing manufacturers to maintain competitive pricing while meeting the increasingly demanding thickness tolerances (measured in micrometers) required by sophisticated end-users. Users also seek information on AI’s role in supply chain resilience, predicting raw material price fluctuations, and optimizing logistics for time-sensitive, high-value components, ensuring smarter operational decision-making throughout the value chain.

- AI-powered predictive maintenance minimizes equipment downtime in high-precision rolling mills.

- Machine Learning algorithms optimize annealing furnace temperatures, ensuring uniform microstructures and specific mechanical properties.

- Real-time visual inspection systems enhanced by deep learning reduce defect rates in surface finishing and flatness.

- AI assists in optimizing feedstock mixing and controlling impurity levels in specialty steel grades.

- Improved process modeling through AI enhances thickness consistency and width control, maximizing material yield.

- AI integration facilitates smarter inventory management and demand forecasting for customized ultra thin grades.

DRO & Impact Forces Of Ultra Thin Stainless Steel Sheets Market

The market dynamics are significantly influenced by a complex interplay of drivers, constraints, opportunities, and external impact forces. A primary driver is the pervasive trend of technological convergence and miniaturization across consumer and industrial applications, demanding materials that offer high performance in minimal space and weight. This is coupled with the robust expansion of the electric vehicle (EV) market, where ultra thin sheets are vital for efficient battery components, lightweight structural supports, and thermal management systems, creating a substantial, sustained demand pull. However, these drivers are counterbalanced by severe restraints, particularly the high capital expenditure required for setting up ultra-precision cold rolling facilities and the specialized expertise necessary for maintaining quality and precision at micron-level tolerances. The complexity of the manufacturing process often limits the number of qualified suppliers, contributing to supply chain vulnerability and high production costs, which can deter adoption in lower-margin industrial applications.

Opportunities for market expansion reside primarily in the development of new alloy compositions tailored for extreme environments, such as high-temperature aerospace applications or bioresorbable medical implants, areas where traditional materials fall short. Furthermore, leveraging advanced manufacturing techniques like additive manufacturing (though nascent) or highly integrated rolling technologies allows for the exploration of novel product forms and rapid prototyping for specific customer needs. Geographic expansion into developing markets with burgeoning electronics and automotive industries presents substantial growth avenues, provided manufacturers can navigate regional regulatory differences and logistical challenges effectively. The focus on circular economy principles also offers opportunities for specialized ultra thin sheet recycling, creating sustainable competitive advantages for environmentally conscious suppliers.

The impact forces influencing the market trajectory are multifaceted, encompassing regulatory scrutiny, global trade policies, and material science breakthroughs. Regulatory pressure concerning material safety and environmental compliance, particularly in Europe and North America, forces manufacturers to invest heavily in clean production technologies and certified material sourcing. Geopolitical instability and trade tariffs on specialty steel products introduce significant volatility in pricing and raw material availability (e.g., nickel and chromium), impacting profitability and long-term planning. Technological disruption, such as advancements in alternative composite materials or new battery chemistries that might bypass the need for stainless steel components, represents a potential long-term threat. Overall, the market remains highly responsive to technological adoption cycles in major consuming industries, necessitating continuous innovation in material properties and processing efficiency to maintain market relevance and competitive edge.

Segmentation Analysis

The Ultra Thin Stainless Steel Sheets Market is segmented based on critical functional and structural characteristics, encompassing dimensions (thickness), material composition (grade), and final application sector. This segmentation is crucial for understanding specific market niches and tailoring production capabilities to meet precise industrial requirements. The thickness segments reflect the continuous push towards miniaturization, with the thinnest sheets fetching premium prices due to the complexity of their manufacture. Grade segmentation highlights the functional specialization of the material, ranging from the general-purpose corrosion resistance of austenitic grades to the specific magnetic or strength properties of ferritic or duplex steels. The application analysis provides a comprehensive view of end-user demand patterns, identifying the fastest-growing sectors and the mature, yet stable, segments.

- By Thickness:

- 0.01mm to 0.05mm

- 0.05mm to 0.1mm

- Above 0.1mm (Up to defined ultra-thin limits)

- By Grade:

- 300 Series (Austenitic)

- 400 Series (Ferritic and Martensitic)

- 200 Series (Austenitic, Manganese-bearing)

- Specialty Grades (Duplex, PH Grades)

- By Application:

- Electronics (Smartphones, Wearables, Semiconductors)

- Automotive (EV Batteries, Sensors, Exhaust Systems)

- Medical Devices (Surgical Instruments, Implants)

- Aerospace and Defense

- Industrial Machinery

- Consumer Goods and Appliances

- Energy (Solar Cells, Fuel Cells)

Value Chain Analysis For Ultra Thin Stainless Steel Sheets Market

The value chain for ultra thin stainless steel sheets is intricate, commencing with the upstream sourcing of high-purity raw materials—primarily nickel, chromium, iron ore, and molybdenum—which determine the final grade and performance characteristics. Upstream analysis involves assessing the global mining and smelting operations, focusing on stable supply chains and minimizing price volatility, which directly impacts the high-cost production environment. Manufacturers specializing in ultra thin sheets often integrate backward to control the initial hot rolling and pickling processes, ensuring the highest quality slabs are available for the subsequent, highly sensitive cold rolling stage. The competitiveness at this stage relies heavily on energy efficiency, access to advanced melting technologies, and compliance with environmental regulations regarding material inputs.

The transformation phase is the most critical and capital-intensive part of the value chain, where conventional thick slabs are reduced through highly specialized cold rolling mills, often requiring multiple passes and intermediate annealing steps to achieve micrometer thicknesses without compromising material integrity or surface finish. This midstream activity necessitates specialized equipment (e.g., Z-mills or Sendzimir mills) and highly skilled technicians. Following rolling, the sheets undergo precise surface treatment (polishing, etching, or coating) and slitting to meet exact customer specifications. Quality assurance through automated inspection systems is mandatory due to the severe consequences of material failure in high-end applications like pacemakers or aerospace components, making technology adoption a key differentiator in the midstream segment.

Downstream analysis focuses on distribution channels and the ultimate end-users. Ultra thin sheets typically bypass general commodity distributors, moving through specialized metal service centers or directly to major Original Equipment Manufacturers (OEMs) in the electronics, medical, and aerospace sectors. Direct sales channels are dominant for highly customized grades or large-volume contracts with tier-one suppliers, ensuring technical specifications are meticulously met. Indirect channels, involving highly specialized service centers, focus on providing just-in-time delivery, small batch processing, and pre-cut blanks, catering especially to smaller fabricators or specialized component manufacturers. The proximity of these distribution hubs to major industrial clusters (e.g., Silicon Valley, Shenzhen, or major automotive hubs) significantly influences logistical efficiency and competitive responsiveness, thereby emphasizing the strategic location of service centers in the overall market matrix.

Ultra Thin Stainless Steel Sheets Market Potential Customers

Potential customers for ultra thin stainless steel sheets are highly specialized, technologically advanced entities prioritizing material performance, precision, and reliability over mere cost considerations. The primary end-users or buyers include global leaders in consumer electronics manufacturing, particularly those producing high-end smartphones, complex wearables, and advanced semiconductor packaging components. These companies require material flatness and thickness tolerances essential for miniaturization and high-density integration. The material’s corrosion resistance and non-magnetic properties are often mandatory specifications for these sensitive electronic applications.

Another major segment comprises manufacturers of high-precision medical devices and instrumentation. Buyers in this sector demand materials, such as specific grades of 316L, that meet strict biocompatibility standards (ISO 10993) and can withstand repeated sterilization processes without degrading. Applications range from minimally invasive surgical tools, catheter components, hypodermic needles, and sophisticated diagnostic equipment. Given the critical nature of these products, supply chain transparency, quality certifications, and long-term supply stability are paramount requirements for these specialized customers, often requiring suppliers to undergo lengthy qualification processes before being approved.

Furthermore, major automotive component suppliers, especially those focused on electric vehicle (EV) battery packs and advanced sensor systems, represent a rapidly expanding customer base. These customers seek lightweight, durable materials for battery casings, thermal management foils, and critical sensor diaphragms. Aerospace and defense contractors also constitute a high-value customer group, requiring ultra thin grades for high-performance structural parts, flexible shielding, and specialty components where weight reduction is directly correlated with fuel efficiency and mission performance. The common denominator among all these potential customers is the necessity for materials engineered to outperform conventional alloys in demanding, complex operating environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 6.0 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nippon Steel, POSCO, ThyssenKrupp, Aperam, AK Steel, Outokumpu, JFE Steel, Baosteel, Sandvik, Tata Steel, Precision Steel, Hitachi Metals, Sumitomo Metal, ArcelorMittal, BlueScope Steel, Acerinox, Yieh Corp, China Steel |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ultra Thin Stainless Steel Sheets Market Key Technology Landscape

The manufacturing of ultra thin stainless steel sheets relies heavily on proprietary cold rolling and finishing technologies that dictate the achievable thickness and material properties. Key technological advancements center around high-precision rolling mills, specifically specialized cluster mills like Sendzimir mills (Z-mills), which utilize multiple small work rolls supported by larger backup rolls to minimize roll deflection and achieve extremely fine gauge control (tolerances often less than ±3 micrometers). Continuous improvements in mill automation, leveraging advanced sensor technology and closed-loop control systems, are essential for maintaining the stringent flatness and gauge consistency required by demanding applications. Furthermore, the development of new tooling materials and lubrication techniques has extended the life of work rolls and minimized surface defects, directly translating into higher quality output and improved production efficiency across the manufacturing cycle.

Beyond the physical reduction process, advanced thermal processing—specifically bright annealing—is a critical technological differentiator. Bright annealing, performed in controlled inert atmospheres (often hydrogen), is necessary to recrystallize the highly strained material structure after severe cold work without causing surface oxidation. Technological innovations here focus on fast heating and cooling cycles to manage grain size effectively, ensuring the material achieves optimal mechanical properties (strength, ductility) while maintaining a clean, mirror-like surface finish. The control over the annealing process is crucial, as even minor temperature variations can lead to inconsistent material characteristics, rendering the ultra thin sheet unsuitable for high-precision components like diaphragms or spring applications.

Surface technology and post-processing are also vital components of the key technology landscape. Manufacturers are increasingly utilizing sophisticated surface treatment methods, including chemical etching, plasma coating, and laser texturing, to impart specific functionalities, such as enhanced adhesion, reduced friction, or tailored light reflectivity, necessary for specialized electronic or medical applications. Research and development efforts are currently focused on achieving nanometer-level control over surface topography to improve performance in extreme environments and enhance compatibility with subsequent manufacturing processes like deposition or bonding. The integration of continuous coil-to-coil processing lines, minimizing handling and contamination risks, further defines the technological competitive edge in this highly specialized material sector.

Regional Highlights

The global Ultra Thin Stainless Steel Sheets Market exhibits significant regional disparities in terms of production capability, consumption patterns, and technological maturity. Asia Pacific (APAC) commands the largest market share, predominantly due to the region's concentration of global electronics manufacturing hubs in countries like China, South Korea, Japan, and Taiwan. The sheer volume of smartphone, wearable device, and semiconductor production fuels immense demand for ultra thin materials (especially 304 and 316L grades in sub-0.05mm thicknesses). Furthermore, APAC’s rapidly expanding automotive sector, particularly in EV production and battery manufacturing (in China and South Korea), significantly boosts the consumption of thin stainless steel for crucial battery casing and protective elements. The region benefits from lower operating costs and governmental incentives supporting high-tech material production, driving innovation in local manufacturing technology.

North America and Europe represent mature, high-value markets characterized by demand for specialized, highly regulated grades, primarily driven by the aerospace and defense industry and the advanced medical technology sector. North American demand centers on high-reliability applications, often requiring stringent certifications and traceability, particularly in surgical instrumentation and sophisticated aerospace components. European consumption, spanning countries like Germany (industrial machinery and automotive R&D) and Switzerland (medical devices), focuses heavily on compliance with REACH regulations and demands for sustainable, high-quality materials. These regions are primary centers for material science research, pushing the boundaries of thickness reduction and specialized alloy development, often translating into premium pricing for locally manufactured or imported ultra thin sheets meeting exacting specifications.

Latin America (LATAM) and the Middle East & Africa (MEA) are emerging regions, exhibiting promising growth potential, albeit from a lower base. LATAM’s market growth is tied to the expansion of its domestic automotive assembly plants and a rising consumer electronics market, driven by urbanization and increased disposable income in countries like Brazil and Mexico. MEA's market expansion is linked to ambitious infrastructure projects, increasing healthcare spending (driving medical device adoption), and the nascent development of local manufacturing capabilities, particularly within the Gulf Cooperation Council (GCC) states. While currently reliant on imports from APAC and Europe, these regions are strategically important for future market penetration, requiring customized supply chain solutions that address logistical complexities and diverse regulatory frameworks. Overall, global market success requires a differentiated strategy tailored to the specific regulatory, technological, and application demands of each major geographic cluster.

- Asia Pacific (APAC): Market leader driven by mass production in electronics (smartphones, semiconductors) and rapid EV battery manufacturing growth (China, South Korea). Focus on high volume and competitive pricing.

- North America: Strong focus on high-value, high-specification sectors like aerospace, defense, and specialized medical device manufacturing. Emphasizes reliability and stringent regulatory compliance.

- Europe: Demand anchored by precision engineering, advanced industrial machinery, and premium medical devices (Germany, Switzerland). Emphasis on sustainability, quality standards, and innovation in specialty alloys.

- Latin America: Growth stimulated by expanding domestic automotive component manufacturing and increasing consumption of imported electronics. Developing market requiring localized distribution strategies.

- Middle East & Africa (MEA): Emerging market driven by infrastructure investment and growing healthcare needs. Currently characterized by reliance on high-quality imports for specialized applications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ultra Thin Stainless Steel Sheets Market.- Nippon Steel

- POSCO

- ThyssenKrupp

- Aperam

- AK Steel (now Cleveland-Cliffs)

- Outokumpu

- JFE Steel

- Baosteel Group

- Sandvik Materials Technology

- Tata Steel

- Precision Steel Warehouse

- Hitachi Metals

- Sumitomo Metal Industries

- ArcelorMittal

- BlueScope Steel

- Acerinox S.A.

- Yieh Corporation

- China Steel Corporation

- Ulbrich Stainless Steels & Special Metals

- Baoji Titanium Industry Co., Ltd. (Specialty Foil Division)

Frequently Asked Questions

Analyze common user questions about the Ultra Thin Stainless Steel Sheets market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications driving the demand for ultra thin stainless steel sheets?

The demand is primarily driven by miniaturization trends in high-tech industries. Key applications include sophisticated battery components in Electric Vehicles (EVs), casings and flexible circuit boards in consumer electronics (smartphones, wearables), and high-precision, corrosion-resistant components used in advanced medical devices and surgical instrumentation, where weight and spatial constraints are critical.

How does the manufacturing process for ultra thin sheets differ from standard stainless steel production?

Ultra thin sheet production requires highly specialized cold rolling technologies, such as Sendzimir mills (Z-mills), designed to achieve micrometer-level thickness tolerances with minimal roll deflection. Furthermore, precise bright annealing processes in controlled atmospheres are mandatory to restore material ductility and ensure a flawless surface finish without oxidation, which are not standard requirements for conventional thickness production.

Which stainless steel grades are most commonly used in ultra thin formats?

The 300 Series, particularly 304 and 316L, dominates the market due to their excellent corrosion resistance and formability, making them suitable for electronics and biocompatible medical devices. Specific applications also utilize the 400 Series (ferritic/martensitic) for magnetic or high-strength requirements, alongside specialty grades like Duplex stainless steels for enhanced resilience in corrosive environments.

What are the major challenges facing manufacturers in the Ultra Thin Stainless Steel Sheets Market?

Key challenges include managing the extremely high capital expenditure required for precision rolling equipment, controlling supply chain volatility and pricing of key alloying elements (nickel, chromium), and overcoming the technical difficulty of maintaining zero-defect quality and consistency at micrometer thickness levels, which requires intensive R&D investment.

Which geographical region holds the largest share in the Ultra Thin Stainless Steel Sheets Market?

Asia Pacific (APAC) currently holds the largest market share, predominantly driven by the dense concentration of global manufacturing facilities for consumer electronics and the rapidly scaling production of electric vehicle components and batteries across East Asia (China, South Korea, and Japan), leading to massive volume consumption.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager