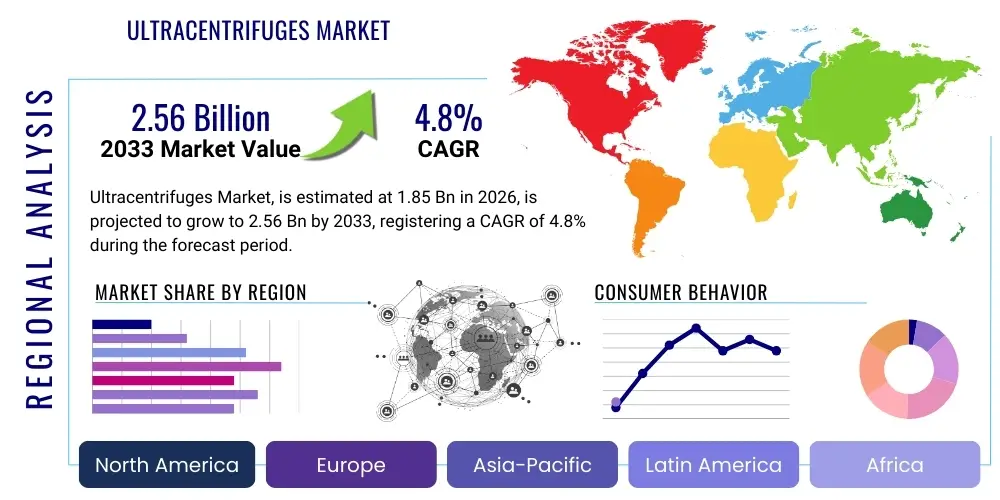

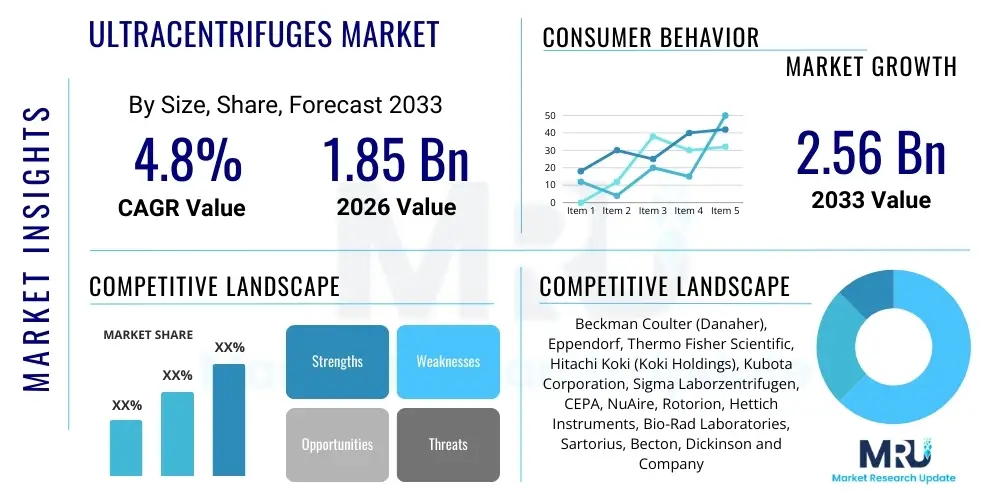

Ultracentrifuges Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441205 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Ultracentrifuges Market Size

The Ultracentrifuges Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at $1.85 Billion in 2026 and is projected to reach $2.56 Billion by the end of the forecast period in 2033.

Ultracentrifuges Market introduction

The Ultracentrifuges Market encompasses sophisticated laboratory instrumentation essential for high-speed separation, purification, and analysis of complex biological and non-biological samples. These specialized centrifuges operate at extremely high rotational speeds, generating gravitational forces (g-forces) exceeding 1,000,000 times the force of gravity, enabling the resolution of nanoparticles, macromolecules, and cellular organelles that standard centrifuges cannot achieve. Key products include analytical ultracentrifuges (AUC), used primarily for characterizing molecular weight and conformation in solution, and preparative ultracentrifuges, utilized for large-scale isolation of viruses, proteins, lipoproteins, and subcellular components in fields such as proteomics, genomics, and drug discovery. The primary benefits of employing ultracentrifuges lie in their precision, high resolution, and capacity to handle delicate biological materials without denaturation. Major applications span fundamental research in biochemistry and molecular biology, pharmaceutical development for vaccine production and gene therapy vector preparation, and quality control in industrial biotechnology. The market growth is principally driven by the escalating demand for advanced bioseparation techniques, rapid expansion in biopharmaceutical research and development (R&D), and increased global investment in life sciences infrastructure, particularly concerning emerging fields like personalized medicine and regenerative therapies, which rely heavily on high-purity isolation methods.

Ultracentrifuges Market Executive Summary

The Ultracentrifuges Market is characterized by robust growth stemming from accelerated R&D activities across the globe, focusing heavily on large molecule therapeutics and sophisticated viral vector purification techniques crucial for gene therapy. Business trends indicate a strong move toward advanced automation, continuous flow centrifugation systems, and specialized rotors designed for high throughput screening (HTS) in academic and industrial settings, emphasizing efficiency and reproducibility. Key manufacturers are investing heavily in connectivity features and intuitive software interfaces to enhance user experience and data integrity, aligning with broader laboratory digitalization trends. Regionally, North America maintains market dominance due to substantial governmental and private funding for biomedical research, alongside the presence of major pharmaceutical and biotechnology clusters. However, the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, fueled by expanding clinical trial volumes, improving healthcare infrastructure, and growing biosimilar manufacturing capabilities in countries like China, India, and South Korea, which necessitates high-performance separation equipment. Segment trends show preparative ultracentrifuges commanding a larger market share due to their applicability in large-scale therapeutic production, while analytical ultracentrifuges are growing rapidly, driven by the increasing regulatory requirement for detailed characterization of biopharmaceuticals, including protein aggregates and nanoparticle formulations, thus ensuring stringent quality control measures are met throughout the development pipeline.

AI Impact Analysis on Ultracentrifuges Market

User queries regarding the impact of Artificial Intelligence (AI) on the Ultracentrifuges Market frequently center on optimization of run protocols, predictive maintenance, and enhanced data analysis capabilities derived from sedimentation velocity and equilibrium data. Users are keen to understand how AI can reduce experimental time, minimize material wastage through automated fault detection, and standardize complex separation processes across different laboratory settings. A primary concern is the integration complexity and the requirement for specialized data science expertise to leverage AI tools effectively with existing centrifugation hardware and software. The expectation is that AI algorithms will transform the analytical ultracentrifuge sector by providing real-time, high-fidelity interpretation of sedimentation profiles, facilitating rapid characterization of novel biomolecules, and predicting optimal gradient densities and run durations based on sample composition and target purity levels. Furthermore, AI-driven process control is anticipated to significantly improve the scalability and reliability of biomanufacturing processes utilizing preparative ultracentrifugation, ensuring consistent yield and purity for therapeutic products, thereby speeding up the overall drug development lifecycle.

- AI-driven optimization of ultracentrifuge run parameters, reducing protocol development time and enhancing separation efficiency for novel samples.

- Predictive maintenance analytics, utilizing machine learning (ML) to monitor rotor stress, motor health, and temperature fluctuations, thereby minimizing unexpected downtime and extending equipment lifespan.

- Automated data processing and analysis for analytical ultracentrifugation (AUC) profiles, providing rapid determination of molecular weight distributions, oligomerization states, and aggregation kinetics.

- Integration of laboratory automation systems with AI algorithms to manage sample throughput and ensure traceability during large-scale biopurification campaigns.

- Enhancement of quality control (QC) in biomanufacturing by using AI to detect subtle inconsistencies in centrifugation outcomes, crucial for gene therapy vector production.

DRO & Impact Forces Of Ultracentrifuges Market

The Ultracentrifuges Market dynamics are heavily influenced by the synergistic interplay of sustained scientific research funding and the rapidly advancing fields of biopharmaceuticals and cell and gene therapy, which act as primary market drivers. However, these forces are moderated by significant restraints, predominantly the high initial capital expenditure required for purchasing and installing these sophisticated instruments, along with the necessity for highly trained personnel to operate and maintain them, leading to a bottleneck particularly in emerging and smaller academic laboratories. Opportunities are arising through the development of specialized, compact, and automated benchtop ultracentrifuges that address space constraints and simplify operation, along with the growing demand for analytical services outsourced to contract research and manufacturing organizations (CRO/CMO). The overall impact forces are high, driven by the non-substitutable role of ultracentrifugation in specific, critical high-resolution separation tasks, such as lipoprotein fractionation or high-titer virus harvesting. The market exhibits inelastic demand, meaning that while cost remains a barrier, the indispensable nature of the technology in regulated and advanced research environments ensures stable, continuous procurement, especially within key pharmaceutical and governmental institutions globally.

Segmentation Analysis

The Ultracentrifuges Market segmentation provides critical insights into the varied requirements and adoption patterns across end-user industries and product types, reflecting the specialized nature of centrifugation technology. Segmentation by product primarily distinguishes between analytical systems, focused on detailed physical characterization, and preparative systems, designed for large-volume sample processing and isolation. Application-based segmentation highlights key usage areas such as proteomics, genomics, and increasingly, the purification of advanced therapeutics like viral vectors for gene editing. The end-user segment reveals the dominance of pharmaceutical and biotechnology companies due to intensive R&D budgets, closely followed by academic and research institutes which drive fundamental science discoveries. This granular analysis is crucial for stakeholders to tailor marketing strategies and product development to address the specific throughput, speed, and capacity requirements demanded by diverse operational settings, ranging from clinical diagnostics to full-scale bioproduction.

- By Product Type:

- Preparative Ultracentrifuges

- Analytical Ultracentrifuges

- By Component:

- Instruments (Ultracentrifuges units)

- Rotors (Fixed-angle, Swinging-bucket, Vertical)

- Accessories and Consumables

- By Application:

- Proteomics and Genomics

- Cell Fractionation

- Virus Purification (e.g., AAV, Lentivirus)

- Lipoprotein Separation

- Nanoparticle and Nanomaterial Research

- By End User:

- Pharmaceutical and Biotechnology Companies

- Academic and Research Institutes

- Hospitals and Diagnostic Centers

- Contract Research Organizations (CROs) and Contract Manufacturing Organizations (CMOs)

Value Chain Analysis For Ultracentrifuges Market

The value chain for the Ultracentrifuges Market begins with upstream activities centered on the procurement and precision engineering of highly specialized components, including ultra-high-speed motors, vacuum systems, temperature control units, and, crucially, high-strength alloy materials such as titanium and aluminum used for rotor manufacturing. Manufacturing involves stringent quality control to ensure operational safety at extreme g-forces and often requires specialized cleanroom assembly environments. Distribution channels are typically a combination of direct sales models, particularly for high-end analytical systems sold to major pharmaceutical clients requiring extensive technical support, and indirect channels relying on established regional distributors and third-party scientific equipment suppliers for servicing smaller academic laboratories. Downstream activities involve installation, comprehensive user training, routine maintenance contracts, and the supply of high-value consumables like specialized tubes and separation media. The strong reliance on specialized technical support means that direct engagement between manufacturers and end-users remains a dominant and high-value element of the chain, influencing customer loyalty and repeat purchases, especially regarding rotor longevity and safety certifications.

Ultracentrifuges Market Potential Customers

The primary consumers and end-users of ultracentrifuges are institutions and corporations engaged in high-level biological separation and characterization requiring supra-centrifugal forces. Pharmaceutical and biotechnology companies constitute the largest buying segment, utilizing preparative ultracentrifuges extensively for manufacturing processes, particularly in scaling up the purification of viral vectors essential for gene therapies, therapeutic proteins, and recombinant vaccines where high purity and yield are paramount. Academic and governmental research institutions represent the second major customer base, leveraging both analytical and preparative units for fundamental research in virology, structural biology, and biochemistry, focusing on detailed macromolecular analysis and subcellular component isolation. Furthermore, growing demand emerges from Contract Research Organizations (CROs) and Contract Manufacturing Organizations (CMOs) who provide outsourced bioproduction and analytical services to the biopharma sector, investing in high-throughput ultracentrifuge systems to meet stringent client demands for quality and scalability. Specialized clinical diagnostic laboratories, particularly those dealing with lipid profiling and specific biomarker isolation, also constitute a niche but growing customer segment demanding reliable separation technologies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.85 Billion |

| Market Forecast in 2033 | $2.56 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Beckman Coulter (Danaher), Eppendorf, Thermo Fisher Scientific, Hitachi Koki (Koki Holdings), Kubota Corporation, Sigma Laborzentrifugen, CEPA, NuAire, Rotorion, Hettich Instruments, Bio-Rad Laboratories, Sartorius, Becton, Dickinson and Company (BD), Andreas Hettich GmbH, Alfa Wassermann. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ultracentrifuges Market Key Technology Landscape

The technological evolution within the Ultracentrifuges Market is primarily focused on enhancing speed, safety, automation, and data acquisition capabilities. Modern ultracentrifuge units incorporate advanced vacuum systems that minimize rotor friction, allowing for speeds up to 150,000 revolutions per minute (RPM) and generating g-forces exceeding 1,000,000 x g. A crucial technological advance is the development of lighter, stronger carbon fiber rotors, which offer improved safety standards and longevity compared to traditional metal alloys, reducing overall rotational mass and handling risks. Furthermore, instruments now feature integrated sophisticated temperature control systems essential for maintaining the viability and integrity of sensitive biological samples throughout lengthy separation runs. In analytical ultracentrifugation (AUC), key technologies involve multi-wavelength detection systems (such as UV/Vis absorbance and fluorescence optics) that allow for real-time monitoring of sedimentation profiles, providing detailed hydrodynamic and thermodynamic data on macromolecules in solution. The shift toward interconnected, digitally enabled instruments capable of remote monitoring and diagnostics, coupled with intuitive touchscreen interfaces and robust data management software, defines the current competitive technology landscape, improving laboratory efficiency and regulatory compliance.

Regional Highlights

- North America: Dominates the global market share, driven by extensive research budgets allocated by the National Institutes of Health (NIH) and other funding bodies, coupled with the dense presence of leading pharmaceutical and biotechnology headquarters in the U.S. and Canada. This region leads in the adoption of analytical ultracentrifugation (AUC) for advanced biotherapeutic characterization and quality control, leveraging a mature regulatory framework that encourages high-precision instrumentation.

- Europe: Represents a significant market characterized by strong academic research output, particularly in structural biology and virology, supported by institutions like the European Molecular Biology Laboratory (EMBL). Growth is robust in key economies such as Germany, the UK, and Switzerland, bolstered by substantial investment in vaccine development and biosimilar manufacturing infrastructure demanding high-capacity preparative ultracentrifuge systems.

- Asia Pacific (APAC): Exhibits the fastest market expansion rate, driven by significant government investments in developing indigenous biomanufacturing capabilities, particularly in China and India. The rising number of clinical trials, the establishment of world-class research hubs, and increasing foreign direct investment in the region’s life sciences sector are accelerating the demand for high-performance laboratory equipment across both academic and industrial segments.

- Latin America (LATAM): Growth is steady but moderate, primarily concentrated in Brazil and Mexico, fueled by expanding healthcare access and growing local pharmaceutical production. The adoption rate is linked to improving economic conditions and increased regional focus on public health issues requiring advanced diagnostic and research capabilities, though capital expenditure limitations often necessitate careful strategic purchasing.

- Middle East and Africa (MEA): Currently holds the smallest market share, but is experiencing targeted growth spurred by government initiatives to diversify economies through investments in healthcare and biotechnology research, notably in Saudi Arabia and the UAE. Market development is primarily focused on establishing advanced university research facilities and specialized diagnostic centers utilizing basic and medium-capacity ultracentrifuge systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ultracentrifuges Market.- Beckman Coulter (A Danaher Company)

- Thermo Fisher Scientific Inc.

- Eppendorf AG

- Hitachi Koki (Koki Holdings Co., Ltd.)

- Kubota Corporation

- Sigma Laborzentrifugen GmbH

- CEPA (Carl Padberg Zentrifugenbau GmbH)

- NuAire, Inc.

- Rotorion (Shanghai Luxi Precision Instruments Co., Ltd.)

- Hettich Instruments, LP

- Bio-Rad Laboratories, Inc.

- Sartorius AG

- Becton, Dickinson and Company (BD)

- Andreas Hettich GmbH & Co. KG

- Alfa Wassermann Separation Technologies

- QIAGEN N.V.

- Tomy Seiko Co., Ltd.

- Kawasumi Laboratories, Inc.

- Labconco Corporation

- Hermle Labortechnik GmbH

Frequently Asked Questions

Analyze common user questions about the Ultracentrifuges market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the fundamental difference between preparative and analytical ultracentrifuges?

Preparative ultracentrifuges (PUCs) are designed primarily for isolating and purifying large quantities of samples, such as organelles, viruses, or large proteins, based on mass and density, often using density gradient methods. Analytical ultracentrifuges (AUCs), conversely, are used for quantitative characterization of macromolecules, determining physical properties like molecular weight, shape, and purity in solution through real-time optical monitoring during sedimentation, essential for regulatory submissions.

Which specific applications drive the highest demand for preparative ultracentrifuges currently?

The highest current demand for preparative ultracentrifuges is driven by the burgeoning field of gene therapy and vaccine manufacturing. These processes critically require high-efficiency purification of viral vectors (like Adeno-Associated Virus or Lentivirus) and other biological nanoparticles to achieve the high titers and exceptional purity standards mandated for human therapeutics, which cannot be reliably achieved using standard centrifugation techniques.

What are the primary safety concerns associated with operating ultracentrifuges?

The main safety concern is catastrophic rotor failure due to the extreme rotational speeds (up to 150,000 RPM). This risk is mitigated through advanced vacuum technology, temperature control, and rigorous rotor lifespan management. Users must strictly adhere to loading balance protocols, never exceed rated rotor speeds for specific models, and inspect rotors for corrosion or stress cracks before each run to prevent mechanical failure and ensure operator safety.

How is technological innovation affecting the cost and accessibility of ultracentrifugation?

Technological innovation is trending towards increased automation and the use of specialized carbon fiber rotors, which, while initially raising the purchasing cost, reduce long-term operational costs through improved durability and reduced maintenance. Furthermore, the development of benchtop models and simplified operational software is enhancing accessibility for smaller labs and improving throughput efficiency, thereby increasing the value proposition despite the high initial investment required.

What are the key growth opportunities for the Ultracentrifuges Market in the Asia Pacific region?

The key growth opportunities in APAC stem from massive governmental investment in bioclusters and life science R&D, particularly in China, South Korea, and India. The rapid expansion of local biopharmaceutical and biosimilar manufacturing bases, coupled with rising demand for high-quality, domestically produced vaccines and therapeutics, necessitates significant procurement of high-performance preparative ultracentrifuges to meet stringent global quality standards and production volumes.

Elaboration on Key Market Drivers and Restraints

The core driver sustaining the Ultracentrifuges Market expansion lies in the irreplicable role of ultracentrifugation in advanced biomedical research and therapeutic production. Specifically, the global acceleration of gene therapy development, which relies fundamentally on separating and concentrating recombinant viral vectors (such as AAV and lentiviruses) from host cell debris and media components, mandates the use of preparative ultracentrifuges for high purity and scalability. The precision afforded by density gradient ultracentrifugation remains the gold standard for achieving the required therapeutic grade purification. Furthermore, the persistent and growing investment in proteomics and structural biology research, essential for understanding disease mechanisms and developing targeted therapies, continuously fuels the demand for analytical ultracentrifuges (AUC) to characterize protein-protein interactions, monitor aggregation kinetics, and confirm the structural integrity of novel drug candidates before clinical trials. This scientific necessity ensures that the market is shielded from complete substitution by alternative, lower-resolution separation technologies.

However, the market’s inherent high entry barrier acts as a significant restraint, limiting broader adoption. Ultracentrifuge instruments and their compatible components, especially high-capacity titanium and carbon fiber rotors, represent substantial capital expenses for research institutions. Beyond the initial purchase price, the operational costs are high, including specialized maintenance, vacuum system upkeep, and the requirement for highly skilled laboratory technicians who possess expertise in setting up complex density gradients and interpreting sophisticated data outputs from AUC runs. This combination of high capital and human resource requirements makes procurement decisions protracted and budget-dependent, particularly challenging for smaller academic laboratories or startups in developing regions. Consequently, market growth, while steady, is somewhat constrained by institutional budget cycles and the scarcity of specialized workforce training globally.

Opportunities for market penetration are largely centered on innovation that addresses these cost and complexity issues. The emergence of smaller, benchtop ultracentrifuges with simplified interfaces and reduced footprint makes the technology more accessible for routine diagnostics and lower-throughput applications. Moreover, the increasing trend of outsourcing biopurification and characterization activities to specialized Contract Manufacturing Organizations (CMOs) and Contract Research Organizations (CROs) provides a high-growth pathway. These specialized service providers consolidate purchasing power, invest in state-of-the-art, high-throughput systems, and offer efficient services to clients who cannot afford the capital investment or operational complexity of owning their own units. This outsourcing model effectively transforms capital expenditure into operational expenditure for end-users, thereby expanding the reach and utilization of ultracentrifugation technology across the life sciences industry value chain.

Detailed Analysis of Ultracentrifuges Segmentations

Focusing on the segmentation by Product Type, the Preparative Ultracentrifuges segment consistently dominates the market revenue share. Preparative units are essential workhorses in large-scale bioproduction due to their capacity to process voluminous samples required for isolating clinical-grade materials. The demand here is directly correlated with the global production capacity increase for complex biological products, including monoclonal antibodies, therapeutic proteins, and, most notably, the explosion in demand for adeno-associated virus (AAV) vectors used in gene therapy delivery. Manufacturers are focusing on larger capacity rotors and continuous flow systems to meet industrial throughput demands, ensuring high g-forces can be maintained over extended periods to maximize yield and purity in regulated manufacturing environments. This segment's stability is tied to the long-term clinical pipeline success of large molecule drugs, making it a critical barometer for the biotech sector's health.

Conversely, the Analytical Ultracentrifuges (AUC) segment, while smaller in terms of total volume, exhibits faster growth driven by increasingly stringent regulatory requirements for characterizing biopharmaceutical products. AUC is irreplaceable for detailed analysis of aggregation state, molecular weight distribution, and solution behavior of protein therapeutics, providing essential data for IND (Investigational New Drug) applications and subsequent regulatory filings. Key innovations in this segment involve advanced detection systems, such as fluorescence-based AUC and multi-wavelength capabilities, which improve resolution and enable the study of complex, multi-component systems with high sensitivity. The market for AUC is highly technical, primarily servicing R&D departments in major pharmaceutical companies and leading academic structural biology labs. The necessity of AUC for demonstrating biotherapeutic stability and quality assurance positions it as a high-value, high-growth niche within the overall market.

The End-User segment analysis reveals the Pharmaceutical and Biotechnology Companies as the most influential buyers due to their critical need for high-throughput, validated separation techniques across both discovery and manufacturing phases. These corporate users prioritize systems offering compliance features, robust data integrity, and validated performance necessary for cGMP (current Good Manufacturing Practice) environments. Their purchasing power and continuous investment in new drug pipelines ensure stable market demand. However, the Academic and Research Institutes segment is crucial for driving innovation and adopting new analytical technologies. Academic research often utilizes AUC for fundamental understanding of biological systems, serving as early adopters for cutting-edge instrumentation. The financial constraints in academia often lead to a greater reliance on shared core facilities, but their consistent demand for high-precision analytical tools remains vital for sustaining the overall technological advancement of the ultracentrifuges market landscape.

AEO and GEO Optimized Technology Description

Modern ultracentrifuge technology is defined by advancements in three core areas: Rotor dynamics, operational safety, and integrated data informatics. Rotor dynamics have been revolutionized by materials science, moving beyond traditional aluminum and titanium to lightweight, high-tensile strength carbon fiber composites. These composite rotors offer superior lifespan, are less susceptible to corrosion, and critically, reduce the overall kinetic energy stored in the system, significantly enhancing safety during ultra-high-speed operation. Furthermore, dynamic rotor balancing systems, often digitally managed, ensure precise alignment and vibrational control, allowing higher g-forces to be generated reliably, which is a key attribute sought by researchers purifying sensitive viral vectors for therapeutic applications.

Operational safety protocols and system monitoring constitute a second pillar of current technological focus, optimized for minimizing failure and human error. Ultracentrifuges now feature advanced imbalance detection systems that automatically abort runs if vibrational thresholds are breached, protecting both the sample and the instrument. Furthermore, sophisticated vacuum technologies maintain ultra-low pressure within the chamber, reducing air friction to near zero, which is essential for achieving maximum speeds and preventing sample heating. The integration of high-resolution temperature monitoring and control ensures that temperature-sensitive samples, such as living cells or fragile proteins, maintain their biological integrity throughout long separation cycles—a critical requirement for biopharma applications that frequently face audit and regulatory scrutiny.

The third major technological advancement lies in the seamless integration of digital control systems and data informatics, crucial for AEO/GEO compliance as users seek comprehensive data traceability. Modern instruments include user-friendly graphical interfaces, often touch-screen based, allowing precise programming and real-time visualization of run parameters. Analytical ultracentrifuges, specifically, incorporate advanced optical detection systems (like interference and absorbance optics) connected to powerful software capable of solving complex sedimentation equations. This software automatically processes raw data to determine molecular characteristics, reducing manual calculation errors and accelerating time-to-result, a feature highly valued by high-throughput research laboratories seeking rapid characterization and regulatory documentation support.

Competitive Landscape and Key Player Strategies

The Ultracentrifuges Market is dominated by a few established global players with deep historical roots in centrifugation technology, notably Beckman Coulter (Danaher) and Thermo Fisher Scientific, who leverage their comprehensive portfolio and extensive global distribution networks. The strategic competitive approach revolves around maintaining technological superiority in rotor innovation, particularly focusing on ultra-durable carbon fiber rotors and automated continuous-flow systems, which cater directly to the high-throughput needs of the burgeoning gene therapy sector. Key companies also employ aggressive strategies centered on enhancing software integration, offering predictive maintenance services, and ensuring full compliance with GLP/GMP standards to secure high-value contracts with major pharmaceutical manufacturers.

Mid-sized and specialized companies like Eppendorf and Kubota focus on niche markets, often specializing in high-performance benchtop models or specific rotor designs that offer competitive advantages in space-constrained laboratories or specialized research fields. Their strategy often involves rapid adaptation to market needs, offering modular systems, and competitive pricing, while maintaining high-quality manufacturing standards. These players often target academic and smaller biotech start-ups where flexibility and footprint size are critical purchasing factors. Consolidation remains a significant theme, with larger players acquiring smaller firms to integrate proprietary rotor technologies or specialized software analytics, thus broadening their intellectual property and market reach.

Looking ahead, competitive advantage is increasingly shifting from hardware specifications alone to the holistic solution offered, encompassing data management, connectivity (IoT/IIoT), and comprehensive after-sales support. Companies investing in AI-driven diagnostics and remote monitoring capabilities will capture significant market share by reducing customer downtime and optimizing performance. Furthermore, strategic partnerships with biopharma companies early in the R&D process—offering customized, scalable purification platforms—are vital for securing long-term supply agreements and embedding proprietary instrumentation into the industrial manufacturing workflow, ensuring sustained revenue generation across the forecast period.

Detailed Market Drivers

One of the most powerful and sustained drivers of the Ultracentrifuges Market is the global pivot towards personalized medicine and the rapid commercialization of cell and gene therapies. These cutting-edge therapies, including CAR T-cells and various gene editing tools, require immense quantities of highly purified viral vectors (like AAVs and lentiviruses) to ensure efficacy and patient safety. Ultracentrifugation, specifically rate-zonal and isopycnic density gradient separation, is often the required purification step necessary to achieve the ultra-high purity and concentration required for clinical-grade material. As more gene therapy candidates move into later-stage clinical trials and achieve regulatory approval, the demand for large-capacity, cGMP-compliant preparative ultracentrifuges accelerates exponentially, forming a fundamental infrastructural backbone for this high-growth biotech sector worldwide.

A secondary, equally critical driver is the consistent and substantial increase in research and development expenditure allocated to life sciences globally, particularly within established economies like North America and Europe, and rapidly expanding ones in APAC. Governmental and private funding for fundamental research in structural biology, biochemistry, and molecular virology relies heavily on the capabilities of both analytical and preparative ultracentrifuges. Academic institutions and major research centers continuously upgrade their core facilities to remain competitive, purchasing new generations of AUCs for detailed biophysical characterization of novel protein structures, aggregation states, and nucleic acid interactions. This continuous investment ensures a steady baseline demand for new instruments, driven by the need to replace aging equipment and adopt the latest high-speed, high-safety technologies available on the market.

Furthermore, the rising incidence and complexity of infectious diseases worldwide contribute to market growth by spurring vaccine and antiviral research. Ultracentrifugation is indispensable in virology research and vaccine production, used both for studying viral particle assembly and for industrial-scale harvesting and purification of viral antigens. Recent global health crises have emphasized the need for rapid, efficient, and scalable methods for producing high-purity vaccines, pushing pharmaceutical manufacturers to invest heavily in robust ultracentrifugation capacity, capable of handling large volumes with exceptional reliability. This health-related impetus validates the critical, non-substitutable role of ultracentrifuge technology in global public health preparedness and therapeutic innovation.

In-Depth Analysis of Market Restraints

The primary restraint hindering market expansion is the prohibitive cost structure associated with ultracentrifuges. The capital investment required for a single high-end preparative unit or an analytical ultracentrifuge system, along with associated components like specialized rotors and vacuum systems, often ranges in the hundreds of thousands of dollars. This financial barrier is compounded by the high operational costs. The rotors, especially those made of advanced materials like titanium or carbon fiber, have finite lifespans and require meticulous log-keeping and mandatory replacement, representing substantial recurring costs. Furthermore, the specialized environment needed, including robust electrical and cooling infrastructure, adds to the complexity and total cost of ownership, making budget allocation extremely challenging for institutions operating under tight fiscal constraints, thereby limiting broader market penetration into smaller or less-funded research facilities globally.

Another significant constraint is the necessity for highly specialized technical expertise for both operation and maintenance of these complex instruments. Ultracentrifugation protocols—particularly those involving density gradients for virus or lipoprotein separation—require precise calculations and meticulous execution. Mismanagement of rotor loading, imbalance, or protocol parameters can lead to costly sample loss or, critically, dangerous rotor failure. Consequently, personnel must undergo extensive, costly training, and the availability of qualified service engineers is often regionally limited. This reliance on highly specialized human capital creates operational bottlenecks in laboratories, especially in emerging markets, slowing down the rate at which new units can be brought online and utilized efficiently for advanced research or manufacturing purposes.

Finally, the long product lifecycles of ultracentrifuges, often exceeding 10 to 15 years, slightly dampen the immediate demand for new equipment purchases. While beneficial for end-users seeking long-term asset value, this longevity means replacement cycles are slow. Unlike consumables or reagents, which are purchased frequently, a well-maintained ultracentrifuge represents a decade-plus investment. Market growth must therefore rely heavily on either expansion in new laboratory construction, or the adoption of new, technologically superior models driven by critical applications like gene therapy that necessitate the absolute latest in speed, capacity, and safety features. Absent these critical, high-growth application drivers, the market refresh rate would be significantly slower, placing a natural constraint on consistent year-over-year volume growth.

Elaboration on Growth Opportunities

A major opportunity for market growth lies in the increasing miniaturization and automation of ultracentrifuge systems. While preparative units often need large capacity, there is a burgeoning demand for compact, high-speed benchtop models that offer easier installation, reduced footprint, and simplified operation, making them suitable for personalized medicine research, small-scale validation studies, and diagnostic labs. Miniaturized analytical ultracentrifugation (AUC) systems, often integrated with microfluidics, allow for the characterization of precious, low-volume samples, opening up new research pathways in clinical diagnostics and early drug discovery where sample material is scarce. Manufacturers focusing on these compact, user-friendly solutions can tap into previously underserved markets, lowering the operational complexity barrier and increasing accessibility across academic and clinical settings.

The explosive growth of Contract Research Organizations (CROs) and Contract Manufacturing Organizations (CMOs) presents a lucrative channel for high-volume sales. Biopharmaceutical companies are increasingly outsourcing complex analytical characterization and large-scale biopurification to these specialized service providers to manage costs and expedite timelines. CROs and CMOs require state-of-the-art, high-throughput ultracentrifuge fleets that guarantee regulatory compliance and scalable production capacity. Manufacturers can strategically target these organizations with bundled service and equipment packages, offering integrated installation, calibration, and long-term maintenance contracts, securing substantial, recurring revenue streams based on the high volume and stringent quality demands inherent in outsourced bioproduction services.

Furthermore, the untapped potential in emerging markets, particularly within the Middle East and Africa (MEA) and specific Southeast Asian nations, offers significant growth avenues. As these regions experience infrastructural development and government focus shifts towards establishing sophisticated biotech research hubs, the need for foundational high-end laboratory equipment like ultracentrifuges increases. Manufacturers must tailor their sales strategies to address regional challenges, such as logistical difficulties and capital investment constraints, potentially through leasing models or partnerships with local distributors who can provide reliable on-the-ground technical support and training necessary to encourage the adoption of high-precision analytical and preparative technology in these developing scientific ecosystems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager