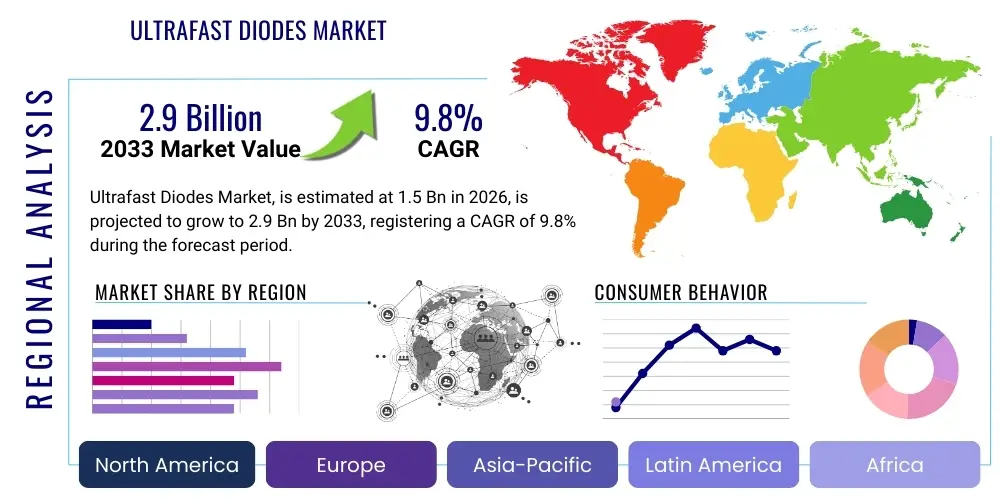

Ultrafast Diodes Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441671 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Ultrafast Diodes Market Size

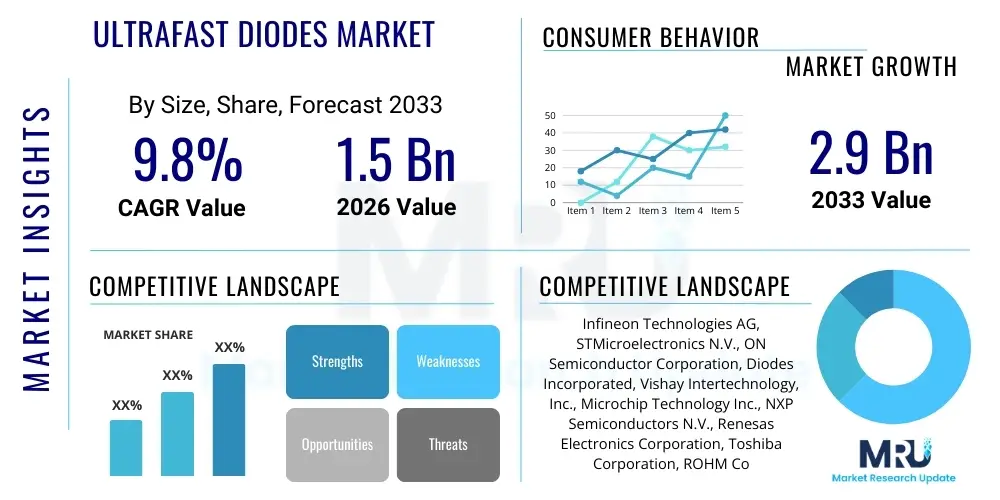

The Ultrafast Diodes Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.9 Billion by the end of the forecast period in 2033.

Ultrafast Diodes Market introduction

The Ultrafast Diodes Market encompasses specialized semiconductor devices designed to achieve extremely short reverse recovery times (trr), significantly reducing power losses and enabling high-frequency operation in modern electronic circuits. These diodes are crucial components in systems requiring efficient power management and fast switching capabilities, distinguishing them from standard recovery diodes which exhibit slower transitions, leading to energy dissipation at higher frequencies. The increasing demand for miniaturization, higher energy efficiency, and reliable performance across various end-use sectors positions ultrafast diodes as indispensable elements in contemporary power electronics architecture.

Ultrafast diodes, typically fabricated using planar processes and incorporating heavy metal doping (like gold or platinum) or sophisticated lifetime control techniques, are defined by their recovery characteristics, which often range from less than 5 nanoseconds (ns) for hyperfast types up to several hundred nanoseconds for standard ultrafast varieties. The primary benefit derived from these components is enhanced system efficiency, particularly in switch-mode power supplies (SMPS), power factor correction (PFC) circuits, and high-frequency inverters where high switching speeds minimize commutation losses. Furthermore, the robust nature and stable performance of these devices contribute to improved reliability and longevity of the final electronic products.

The primary driving factors fueling market expansion include the global surge in demand for energy-efficient consumer electronics, the pervasive adoption of electric vehicles (EVs) and hybrid electric vehicles (HEVs) requiring high-power conversion stages, and the continuous expansion of telecommunication and data center infrastructure which mandate stable, high-density power solutions. Technological advancements, such as the increasing integration of Silicon Carbide (SiC) based ultrafast diodes, offer superior thermal management and even faster switching speeds compared to traditional silicon counterparts, further accelerating their market penetration across high-voltage and high-current applications, especially in industrial automation and renewable energy systems.

Ultrafast Diodes Market Executive Summary

The global Ultrafast Diodes Market is undergoing a rapid transformation driven by technological shifts toward higher power density and increased operational frequencies, necessitated by stringent global energy efficiency standards and the proliferation of compact electronic devices. Business trends indicate a strong focus on research and development, particularly in wide-bandgap materials like Silicon Carbide (SiC), which allows manufacturers to overcome the physical limits of traditional silicon diodes regarding speed and thermal tolerance. Strategic alliances, mergers, and acquisitions are common as key players seek to expand their product portfolios, secure critical supply chains, and gain expertise in specialized high-power applications, particularly in the burgeoning electric vehicle charging and industrial motor drive sectors.

Regionally, the Asia Pacific (APAC) market dominates the consumption and manufacturing landscape, primarily fueled by the presence of major electronics manufacturing hubs in China, South Korea, and Taiwan, coupled with significant governmental investment in renewable energy infrastructure and electric mobility programs. North America and Europe demonstrate strong growth, albeit driven primarily by high-end industrial and automotive applications where performance and reliability are prioritized over cost. The regulatory push for higher efficiency in power supplies (e.g., 80 PLUS standards) in these developed regions ensures sustained demand for premium ultrafast diode solutions, prompting localized innovation and customization to meet specific industrial requirements.

Segment trends reveal that the Hyperfast Diodes segment (with trr less than 30 ns) is exhibiting the fastest growth due to their essential role in high-frequency applications like resonant converters and sophisticated PFC circuits used in data center power modules and advanced telecom equipment. Furthermore, the application segmentation highlights the increasing dominance of the Automotive Electronics segment, particularly driven by the transition from 400V to 800V architectures in electric vehicles, requiring diodes with extremely low reverse recovery losses and high-temperature operation capabilities. Silicon-based diodes still hold the majority share by volume due to their cost-effectiveness, but SiC-based variants are rapidly gaining market share in revenue due to their higher average selling prices and superior performance in critical, high-power density applications.

AI Impact Analysis on Ultrafast Diodes Market

Common user questions regarding AI's influence on the Ultrafast Diodes Market often revolve around how AI hardware requirements affect diode specifications, the role of AI in optimizing power management within data centers, and the potential for AI-driven design tools to accelerate diode development. Users frequently inquire if AI accelerators, which require highly stable and high-speed power delivery networks, will mandate stricter specifications for ultrafast diodes, particularly concerning transient response and reliability under extreme loads. There is significant interest in understanding how the immense computational power required for AI processing, especially in large language models and neural networks, translates into increased power density demands, thereby pushing the boundaries for thermal management and switching performance of these essential components. Furthermore, consumers and industry professionals are keen to know if AI could be leveraged in predictive maintenance for power systems utilizing ultrafast diodes, improving system uptime and operational efficiency by detecting potential failure points before they manifest.

- AI data center expansion drives exponential demand for high-efficiency power supplies (SMPS and VRMs) using ultrafast diodes.

- AI hardware accelerators require extremely low inductance and high transient response characteristics from power delivery components, favoring hyperfast diode variants.

- Increased heat density in AI servers necessitates diodes with superior thermal performance and high junction temperatures, boosting demand for SiC-based ultrafast solutions.

- AI algorithms are increasingly used in optimizing power system designs, potentially leading to customized and highly specific requirements for ultrafast diode specifications.

- Predictive maintenance platforms powered by AI monitor diode performance parameters in real-time, enhancing system reliability in critical infrastructure like cloud computing facilities.

- The development of AI-driven semiconductor process control optimizes manufacturing yield and consistency for high-performance ultrafast diodes.

DRO & Impact Forces Of Ultrafast Diodes Market

The dynamics of the Ultrafast Diodes Market are fundamentally shaped by a complex interplay of Drivers, Restraints, and Opportunities, collectively influenced by significant external Impact Forces originating from regulatory frameworks, technological discontinuities, and global economic shifts. The primary drivers include the mandatory shift towards energy-efficient power conversion necessitated by international standards (e.g., European Union ErP Directive, U.S. Energy Star), the electrification of the automotive sector demanding robust high-voltage components, and the relentless growth of infrastructure supporting 5G technology and massive data centers. These factors collectively push manufacturers towards higher frequency switching solutions, making ultrafast diodes an essential component for achieving system efficiency and compactness.

Conversely, the market faces significant restraints, notably the relatively high manufacturing cost associated with wide-bandgap materials like Silicon Carbide (SiC), which limits their adoption in cost-sensitive, high-volume consumer applications despite superior performance metrics. Furthermore, achieving extremely low reverse recovery times in high-voltage diodes often involves complex fabrication processes and specialized doping techniques, posing technological challenges related to yield and reliability standardization. The cyclical nature of the semiconductor industry and potential supply chain vulnerabilities, as evidenced by recent global shortages, also introduce market volatility and hinder consistent production scaling, impacting the global availability and pricing of these crucial components.

Opportunities for expansion are abundant, particularly in emerging applications such as advanced medical imaging equipment (requiring precise high-voltage switching), renewable energy systems (solar inverters and wind turbine converters), and smart grid infrastructure development, all of which benefit immensely from improved power quality and efficiency offered by ultrafast diodes. The continuous innovation in packaging technologies, such as surface mount device (SMD) packages capable of handling higher power levels while maintaining compact footprints, further broadens the applicability of these diodes across various demanding environments. The convergence of these drivers and opportunities, coupled with the constraint mitigation strategies focusing on cost reduction and process optimization, define the future trajectory of the ultrafast diodes industry, positioning it for robust, sustained growth.

Segmentation Analysis

The Ultrafast Diodes Market is segmented primarily based on Type, Application, and Region, reflecting the diverse technical requirements and end-use sectors driving demand for these specialized components. Segmentation by Type categorizes diodes based on their reverse recovery time characteristics—ranging from standard ultrafast to hyperfast—which is critical for matching the diode's capabilities to the operating frequency of the power circuit. The Application segmentation provides insight into major end-user industries, such as automotive, industrial automation, and consumer electronics, allowing market players to tailor product development and strategic marketing efforts toward high-growth sectors. This detailed segmentation analysis is crucial for understanding market dynamics and identifying niche opportunities where specific performance attributes of ultrafast diodes deliver maximum value proposition.

Furthermore, the segmentation analysis helps in clarifying the competitive landscape, as different technologies (Silicon vs. SiC) tend to dominate specific segments; for instance, SiC ultrafast diodes are highly prevalent in high-voltage industrial and electric vehicle applications due to their high thermal stability and superior efficiency at extreme switching speeds. Meanwhile, conventional silicon ultrafast diodes maintain dominance in mainstream consumer and low-to-medium power SMPS due to their advantageous cost-to-performance ratio. Analyzing these segment trends allows manufacturers to allocate resources effectively, focusing on developing proprietary solutions that meet the stringent performance criteria of demanding segments like automotive power converters and high-power density telecommunication equipment, ensuring market relevance and sustained revenue growth.

- By Type:

- Standard Ultrafast Diodes (100-500 ns)

- Superfast Diodes (30-100 ns)

- Hyperfast Diodes (5-30 ns)

- High-Frequency Ultrafast Diodes (Less than 5 ns)

- By Material:

- Silicon (Si) Ultrafast Diodes

- Silicon Carbide (SiC) Ultrafast Diodes

- Gallium Nitride (GaN) Based Diodes

- By Application:

- Switch Mode Power Supplies (SMPS)

- Power Factor Correction (PFC) Circuits

- Motor Drives and Control

- Automotive Electronics (OBC, DC-DC Converters)

- Industrial Inverters and Welding Equipment

- Telecommunications Infrastructure

- Consumer Electronics (Adapters and Chargers)

- Renewable Energy Systems (Solar Inverters)

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, U.K., France, Italy)

- Asia Pacific (China, Japan, India, South Korea)

- Latin America (Brazil, Argentina)

- Middle East and Africa (MEA)

Value Chain Analysis For Ultrafast Diodes Market

The value chain for the Ultrafast Diodes Market begins with upstream activities dominated by raw material procurement, encompassing high-purity silicon wafers and specialized wide-bandgap substrates like Silicon Carbide. This stage involves complex chemical processing, crystal growth, and initial wafer preparation, which are critical determinants of the final diode performance and manufacturing cost. Key players in this phase are typically large chemical and material science companies specializing in semiconductor-grade substrate production. Success in the upstream segment relies heavily on maintaining rigorous quality control and achieving economies of scale in wafer fabrication, particularly for advanced SiC materials which require extremely high temperatures and complex epitaxy processes to achieve the desired material purity and layer thickness.

The midstream phase involves the core manufacturing processes, including photolithography, diffusion, ion implantation, metallization, and final dicing and packaging. This is where proprietary diode designs, lifetime control techniques (such as electron irradiation or gold doping), and packaging innovations (like high thermal conductivity encapsulation) are implemented. Direct distribution channels are commonly used for large-volume industrial customers and specialized automotive manufacturers who require customized specifications and guaranteed supply chain integrity. These direct relationships facilitate quicker feedback loops for quality control and technical support, essential for mission-critical applications where failure is not an option.

Downstream activities center on the final assembly and integration of ultrafast diodes into various end-user products, utilizing both direct and indirect distribution channels. Indirect channels, involving electronics distributors, specialized resellers, and catalog houses, are essential for reaching a vast network of smaller manufacturers, design engineers, and maintenance, repair, and overhaul (MRO) operations globally. These distributors provide inventory management, technical documentation, and localized support, bridging the gap between semiconductor manufacturers and dispersed end-users across consumer, telecom, and general industrial sectors. The efficiency of the downstream distribution network directly impacts the time-to-market for new electronic products relying on ultrafast switching capabilities.

Ultrafast Diodes Market Potential Customers

The primary potential customers and end-users of ultrafast diodes span a broad spectrum of industries where high efficiency, fast switching, and reliable power management are paramount requirements for operational success. Major buyers include Original Equipment Manufacturers (OEMs) specializing in Switch Mode Power Supplies (SMPS), ranging from high-power server and telecom supplies to compact consumer device chargers. These customers seek diodes that minimize reverse recovery losses (Qrr) to maximize system energy efficiency and comply with increasingly strict international power consumption standards. The purchasing decisions of SMPS manufacturers are heavily influenced by the diode’s thermal characteristics and its ability to operate reliably at high junction temperatures, reducing the need for extensive external cooling solutions.

Another crucial customer segment is the Automotive Electronics sector, specifically manufacturers of On-Board Chargers (OBCs), DC-DC converters, and traction inverters for electric and hybrid vehicles. These applications demand extremely robust and high-voltage ultrafast diodes, increasingly favoring SiC-based solutions due to their superior performance in harsh, high-temperature, and high-vibration environments typical of automotive use. Automotive buyers prioritize components with proven qualification standards (like AEC-Q101) and long-term supply agreements to ensure component availability throughout the vehicle's long lifecycle. The ongoing transition to 800V battery architectures in performance EVs further elevates the demand for advanced ultrafast diode technology capable of handling higher voltage transients with minimal switching losses.

Industrial customers, encompassing manufacturers of welding equipment, professional motor drives, uninterruptible power supplies (UPS), and high-power industrial lasers, represent a segment that demands high reliability and durability over pure cost optimization. These buyers often require diodes rated for higher currents and voltages (up to 1200V or more), where efficiency directly translates into reduced operating costs and enhanced system robustness against industrial transients. Furthermore, emerging customer groups include developers of advanced medical imaging systems (MRI, CT scanners) and operators of large-scale renewable energy farms (solar and wind inverters), all requiring precise, high-speed power electronics to ensure optimal energy harvesting and distribution, cementing their position as significant future consumers of high-performance ultrafast diodes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.9 Billion |

| Growth Rate | 9.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Infineon Technologies AG, STMicroelectronics N.V., ON Semiconductor Corporation, Diodes Incorporated, Vishay Intertechnology, Inc., Microchip Technology Inc., NXP Semiconductors N.V., Renesas Electronics Corporation, Toshiba Corporation, ROHM Co., Ltd., GeneSiC Semiconductor Inc. (now part of Littelfuse), StarPower Semiconductor Ltd., Fuji Electric Co., Ltd., WeEn Semiconductors Co., Ltd., Sanken Electric Co., Ltd., Yangzhou Yangjie Electronic Co., Ltd., Semikron Danfoss, KEC Corporation, Mersen Corporate Services SAS, and Littelfuse, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ultrafast Diodes Market Key Technology Landscape

The technological landscape of the Ultrafast Diodes Market is primarily defined by continuous advancements in semiconductor material science and process optimization, aiming to drastically reduce the reverse recovery charge (Qrr) and forward voltage drop (VF) simultaneously. Traditional silicon-based ultrafast diodes utilize specialized fabrication techniques, such as platinum or gold doping, to control carrier lifetime and achieve sub-100 ns recovery times. However, the inherent physical limitations of silicon regarding bandgap energy restrict their operational frequency and thermal performance, particularly above 600V. Research focuses on optimizing junction termination techniques to enhance voltage blocking capabilities and reliability under high-temperature cycling, ensuring stable performance across automotive and industrial grades. Packaging innovations, including low-inductance surface-mount packages and advanced thermal dissipation materials, are crucial for managing the heat generated at high switching speeds and facilitating miniaturization.

The most disruptive technological shift involves the increasing prominence of Wide-Bandgap (WBG) materials, specifically Silicon Carbide (SiC) and, to a lesser extent, Gallium Nitride (GaN). SiC Schottky barrier diodes (SBDs) offer negligible reverse recovery charge (Qrr approaches zero), enabling virtually loss-less switching and operation at significantly higher frequencies (MHz range) compared to silicon. SiC SBDs are rapidly becoming the component of choice for high-power, high-voltage applications such as solar inverters, electric vehicle charging infrastructure, and industrial power supplies where efficiency gains outweigh the higher initial component cost. The continuous reduction in SiC substrate defect density and improvement in epitaxy growth processes are pivotal technological challenges that, once mastered, will further reduce manufacturing costs and accelerate mass-market adoption across various segments.

Furthermore, Hybrid diodes, which combine the benefits of different technologies, represent a significant area of current development. For instance, combining a SiC Schottky diode with a low-speed silicon PN diode can provide avalanche capability while maintaining excellent switching performance, offering a compromise between ruggedness and speed. Advanced modeling and simulation tools are also integral to the technological landscape, allowing engineers to predict diode behavior under extreme operating conditions (e.g., severe overcurrent or high-temperature transients) and optimize chip design before costly physical prototyping. The integration of these advanced materials and computational design techniques ensures that ultrafast diodes remain at the forefront of power electronics efficiency and density improvements globally, supporting the industry's push toward smaller, cooler, and more reliable power conversion solutions across all voltage levels.

Regional Highlights

The Ultrafast Diodes Market exhibits distinct growth patterns and maturity levels across key geographical regions, driven by localized industrial policies, technology adoption rates, and regional infrastructure investment in electrification and high-speed communications.

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market due to its dominant position in global electronics manufacturing, especially in China, South Korea, and Taiwan. Robust demand stems from massive production of consumer electronics, significant deployment of 5G infrastructure, and aggressive government initiatives promoting electric vehicle adoption and renewable energy projects. China, in particular, drives high-volume demand for ultrafast diodes used in power adapters, LED lighting, and industrial motor control, while Japan leads in precision manufacturing and adoption of high-performance SiC diodes for sophisticated industrial automation and automotive applications.

- North America: This region is characterized by early adoption of advanced technologies and high investment in data center expansion and high-reliability industrial power systems. Demand is concentrated in high-power, high-performance ultrafast diodes, often SiC-based, driven by stringent regulatory requirements for power efficiency in enterprise hardware and major defense and aerospace sector procurements. The U.S. remains a key market for innovation and deployment of advanced power conversion solutions in EV charging and specialized telecom equipment.

- Europe: Europe maintains a strong focus on sustainability and green technology, which translates into high demand for highly efficient ultrafast diodes in renewable energy inverters (solar and wind) and industrial automation equipment. Countries like Germany and the UK exhibit high penetration rates for advanced power factor correction (PFC) circuits and electric vehicle components. European regulations, such as RoHS and various energy efficiency directives, mandate the use of high-performance components, fostering a steady market for hyperfast and SiC diodes, particularly in the premium segment.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions represent emerging markets with increasing potential. Growth is driven by developing infrastructure projects, urbanization, and increasing access to consumer electronics. While generally more cost-sensitive, adoption rates are rising, particularly in utility-scale solar projects in MEA and expanding automotive production bases in LATAM, requiring reliable, medium-power ultrafast solutions. Future growth depends heavily on the pace of localized industrialization and regulatory implementation of energy efficiency mandates.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ultrafast Diodes Market.- Infineon Technologies AG

- STMicroelectronics N.V.

- ON Semiconductor Corporation

- Diodes Incorporated

- Vishay Intertechnology, Inc.

- Microchip Technology Inc.

- NXP Semiconductors N.V.

- Renesas Electronics Corporation

- Toshiba Corporation

- ROHM Co., Ltd.

- GeneSiC Semiconductor Inc. (now part of Littelfuse)

- StarPower Semiconductor Ltd.

- Fuji Electric Co., Ltd.

- WeEn Semiconductors Co., Ltd.

- Sanken Electric Co., Ltd.

- Yangzhou Yangjie Electronic Co., Ltd.

- Semikron Danfoss

- KEC Corporation

- Mersen Corporate Services SAS

- Littelfuse, Inc.

Frequently Asked Questions

Analyze common user questions about the Ultrafast Diodes market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical advantage of ultrafast diodes over standard recovery diodes?

The primary advantage of ultrafast diodes lies in their significantly reduced reverse recovery time (trr), which minimizes switching losses and heating during high-frequency operation, thereby dramatically improving the overall efficiency and power density of power conversion circuits like SMPS and inverters.

How is the demand for ultrafast diodes influenced by the growth of the electric vehicle (EV) sector?

The EV sector is a major driver, demanding robust, high-voltage ultrafast diodes, especially SiC variants, for essential components like On-Board Chargers (OBCs) and DC-DC converters, where high efficiency and reliability under extreme temperature conditions are critical for maximizing battery life and charging speed.

Which material segment is projected to experience the fastest growth in the ultrafast diodes market?

The Silicon Carbide (SiC) material segment is projected to show the fastest revenue growth due to its superior performance characteristics, including negligible reverse recovery charge (Qrr) and high thermal stability, making it ideal for high-power industrial and automotive applications exceeding 600V requirements.

What are the main application areas driving the volume demand for standard silicon ultrafast diodes?

Volume demand for standard silicon ultrafast diodes is predominantly driven by Switch Mode Power Supplies (SMPS) used in consumer electronics, adapters, LED lighting ballast circuits, and cost-sensitive medium-power industrial applications, where their favorable cost-to-performance ratio is highly valued.

How do global energy efficiency standards affect the market for high-frequency ultrafast diodes?

Stringent global energy efficiency standards, such as 80 PLUS for power supplies, directly increase the necessity for high-frequency ultrafast diodes, compelling designers to use components with minimal switching losses to meet elevated efficiency thresholds required by regulatory bodies globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager