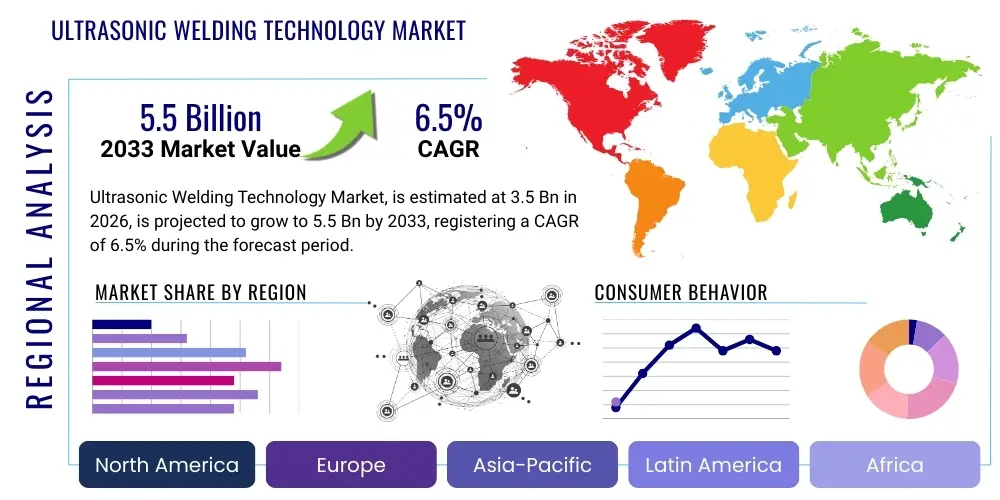

Ultrasonic Welding Technology Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443402 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Ultrasonic Welding Technology Market Size

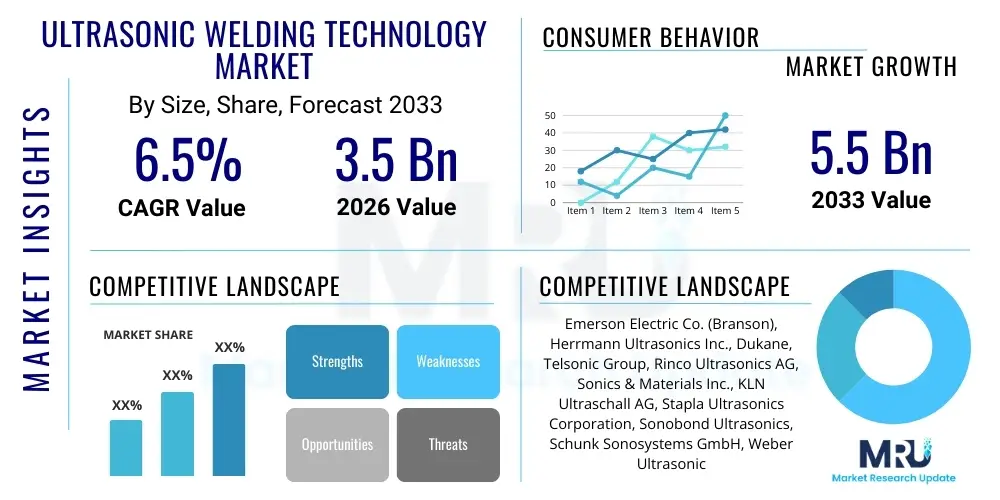

The Ultrasonic Welding Technology Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.5 Billion by the end of the forecast period in 2033.

Ultrasonic Welding Technology Market introduction

Ultrasonic welding technology is a crucial industrial joining technique that utilizes high-frequency acoustic vibrations (typically 15 kHz to 70 kHz) to create a solid-state weld. This process involves converting high-frequency electrical energy into mechanical vibration, which is then applied to the workpieces under pressure. The resulting friction and localized heating at the joint interface cause the material surfaces to soften and molecularly intermix, forming a strong, permanent bond. This technology is highly favored across numerous industries due to its speed, energy efficiency, and ability to join dissimilar materials and delicate components without the need for traditional adhesives, solvents, or external heat sources.

The core product offerings in this market include ultrasonic welding systems composed of generators (power supply), converters (transducers), boosters (amplitude transformers), and tooling (horns/sonotrodes). Major applications span the automotive sector, where it is used for instrument panels and interior components; the medical industry, essential for assembling sensitive devices like catheters and filters; packaging for sealing films and containers; and consumer electronics for joining plastic casings and miniaturized components. The primary benefit lies in achieving high-quality, clean welds rapidly, making it indispensable for mass production environments requiring stringent quality control and high throughput rates.

Key driving factors accelerating market adoption include the increasing global demand for lightweight materials, particularly in automotive and aerospace industries seeking improved fuel efficiency and reduced emissions. Furthermore, the proliferation of complex and miniature electronic devices necessitates precision joining techniques that ultrasonic welding uniquely provides. Regulatory pressures for sustainable manufacturing and reduced solvent use also favor this clean joining process, positioning ultrasonic welding as a critical enabling technology for Industry 4.0 automation systems globally.

Ultrasonic Welding Technology Market Executive Summary

The Ultrasonic Welding Technology Market is exhibiting strong business trends driven by significant investment in automation and the integration of advanced monitoring systems for process control. Manufacturers are increasingly prioritizing modular and adaptable welding solutions that can handle a diverse range of engineering plastics and non-ferrous metals. A critical trend is the shift towards higher frequency systems (above 40 kHz) to accommodate the growing trend of miniaturization in electronics and medical device manufacturing, demanding unparalleled precision and reduced heat stress on sensitive components. Supply chain resilience, following recent global disruptions, is also leading companies to adopt automated welding processes to reduce reliance on manual labor and ensure consistent production quality, propelling the demand for fully integrated robotic welding cells.

Regionally, Asia Pacific (APAC) stands out as the primary growth engine, fueled by massive foreign and domestic investment in manufacturing hubs across China, India, and Southeast Asian nations, particularly in the automotive and consumer electronics sectors. North America and Europe maintain strong market shares, focusing heavily on adopting sophisticated, high-end ultrasonic systems for specialized applications in medical devices, aerospace, and advanced battery pack assembly. The European market, in particular, is witnessing rapid integration of ultrasonic welding in sustainable packaging solutions, aligning with strict EU environmental directives aimed at reducing plastic waste and improving recyclability, necessitating clean and robust sealing methods.

Segment trends indicate that the application segment is dominated by automotive components, reflecting the ongoing global transition towards electric vehicles (EVs) which utilize ultrasonic technology for battery module assembly and interior plastic joining. Furthermore, the thermoplastic segment remains the largest material category, although significant growth is observed in the adoption of ultrasonic metal welding for wire splicing, terminal connections, and foil welding in EV battery production. Technology-wise, digitally controlled generators with advanced diagnostics are becoming the industry standard, offering enhanced repeatability and real-time process verification, essential for regulatory compliance in high-stakes sectors like healthcare and aerospace manufacturing.

AI Impact Analysis on Ultrasonic Welding Technology Market

Common user questions regarding the impact of AI on ultrasonic welding technology primarily revolve around predictive maintenance capabilities, automated quality assurance, and optimizing complex process parameters. Users frequently ask if AI can eliminate human error in setting up welding parameters, how machine learning algorithms can detect nascent faults in tooling (horns/sonotrodes) before they lead to part failure, and the extent to which AI-driven vision systems can ensure weld integrity on the micro-scale. The key concerns center on the cost of implementing AI infrastructure and the need for specialized data scientists to interpret complex machine learning models, balanced against the expectation of significant improvements in overall equipment effectiveness (OEE) and a reduction in scrap rates. The collective user expectation is that AI will transform ultrasonic welding from a highly skilled operator-dependent process into a fully autonomous, self-optimizing manufacturing station.

- AI-driven Predictive Maintenance: Monitoring transducer health, detecting generator anomalies, and forecasting tooling wear to minimize unscheduled downtime.

- Automated Process Optimization: Machine learning algorithms analyze acoustic signatures and power consumption data to dynamically adjust welding amplitude, pressure, and time for optimal weld strength and consistency.

- Enhanced Quality Control (Zero-Defect Manufacturing): Integration of AI vision systems and deep learning models to perform real-time, non-destructive evaluation of weld seams, identifying microscopic defects beyond human inspection capabilities.

- Digital Twinning: Creating virtual models of the welding process to simulate parameter changes and predict outcomes, accelerating R&D and setup times for new applications.

- Self-Adjusting Systems: Enabling ultrasonic welders to automatically compensate for minor material inconsistencies or environmental changes (e.g., temperature shifts) to maintain constant output quality.

DRO & Impact Forces Of Ultrasonic Welding Technology Market

The Ultrasonic Welding Technology Market is propelled by robust drivers, constrained by specific technological and cost barriers, and presents substantial opportunities rooted in emerging applications, all contributing to significant market impact forces. Key drivers include the overwhelming global mandate for lightweight and miniaturized products across electronics, automotive, and medical sectors, which necessitate a fast, clean, and reliable joining method for complex plastic geometries and thin films. The inherent efficiency and environmental cleanliness of ultrasonic welding, avoiding adhesives and solvents, further solidify its appeal as industries globally commit to more sustainable and cost-effective manufacturing processes. Coupled with the rising integration of IoT and Industry 4.0 principles, the demand for networked, high-precision welding systems is accelerating market expansion.

Conversely, the market faces restraints, primarily concerning the high initial capital expenditure required for advanced ultrasonic welding equipment, which can deter small and medium-sized enterprises (SMEs) from adoption. Furthermore, the technology exhibits inherent limitations regarding material compatibility; it is most effective on thermoplastics with specific molecular structures and thin non-ferrous metals, making it unsuitable for thermosets or high-strength steel alloys. The critical dependence on highly application-specific tooling (sonotrodes and fixtures) means that any product design change often requires significant investment in new custom tooling, adding complexity and cost to scaling production lines.

Despite these restraints, substantial opportunities exist, particularly in the rapidly evolving electric vehicle (EV) battery manufacturing space, where ultrasonic metal welding is essential for connecting copper and aluminum foils and terminal tabs with high electrical conductivity. Opportunities also arise from the development of advanced composite materials and specialized engineered polymers, requiring next-generation ultrasonic systems with broader material processing windows. The convergence of robotics and ultrasonic technology, leading to fully autonomous welding cells, further opens doors for high-mix, low-volume production environments. The primary impact force is technological substitution; the precision, speed, and clean nature of ultrasonic welding are increasingly displacing traditional joining methods (like screws, adhesives, or resistance welding) in critical, high-volume applications where quality and efficiency are paramount.

Segmentation Analysis

The Ultrasonic Welding Technology Market is extensively segmented based on material compatibility, product type, power output, and end-use application, providing a granular view of market dynamics and adoption trends. Segmentation by Material Type (e.g., Thermoplastics, Non-ferrous Metals) highlights the growing importance of metal welding driven by EV battery production, although thermoplastics still constitute the largest revenue segment due to their widespread use in consumer goods and packaging. By Product Type, the market is primarily divided into ultrasonic plastic welders and ultrasonic metal welders, with the former holding historical dominance but the latter exhibiting the fastest growth trajectory.

Further analysis by power output (e.g., Low Power < 1kW, Medium Power 1kW–3kW, High Power > 3kW) reveals that medium to high-power systems are increasingly deployed in demanding industrial applications such as large automotive component assembly and heavy-duty packaging sealing. The detailed application segmentation (Automotive, Medical, Electrical & Electronics, Packaging, Aerospace) clearly identifies the major demand centers, with Automotive consistently leading due to the high volume of plastic components and the transition to EV battery assembly requiring precision metal welding capabilities.

This structured segmentation is crucial for stakeholders to tailor their product development and market penetration strategies, focusing on high-growth niches such as micro-welding for wearable medical sensors or high-power solutions for large-format plastic joining, ensuring alignment with the specific technical demands of each end-user vertical. The continuous refinement of tooling and generator technology to improve flexibility across various material thicknesses is a key competitive differentiator within these segments.

- By Material Type: Thermoplastics, Non-ferrous Metals, Composites.

- By Product Type: Ultrasonic Plastic Welders, Ultrasonic Metal Welders.

- By Power Output: Low (Below 1 kW), Medium (1 kW – 3 kW), High (Above 3 kW).

- By Application: Automotive, Medical & Healthcare (Disposables, Filters, Catheters), Electrical & Electronics (Casings, Sensors, Wire Harnesses), Packaging (Sealing, Blister Packs), Aerospace & Defense, Others (Textiles, Toys).

Value Chain Analysis For Ultrasonic Welding Technology Market

The value chain for the Ultrasonic Welding Technology Market is complex, beginning with the highly specialized upstream analysis centered on the sourcing and processing of critical raw materials. Upstream activities primarily involve suppliers of electronic components necessary for generators (e.g., microprocessors, power transistors), and highly specialized materials like piezoelectric ceramics (PZT) essential for the converter/transducer, which defines the system's efficiency and reliability. The quality and cost of these specialized components significantly impact the final system price and performance. System integrators also source high-grade materials (titanium, aluminum, or specialized tool steel) for manufacturing custom tooling, including horns and fixtures, which are often the most application-specific and frequently replaced components in the entire system.

Midstream activities encompass the core manufacturing and integration process, where specialized OEMs design, assemble, and rigorously test the entire welding system, including the generator, actuator, and custom tooling. This stage involves deep expertise in acoustic engineering and industrial automation. Downstream analysis focuses on the distribution channels and end-user engagement. Distribution is typically managed through a combination of direct sales for large, customized industrial projects (especially in automotive Tier 1 suppliers and major medical manufacturers) and indirect sales utilizing specialized regional distributors who provide local technical support, training, and rapid replacement services for tooling and consumables. The success of the system relies heavily on the distributor's ability to provide localized application development and maintenance.

The final stage involves extensive aftermarket services, crucial for long-term customer relationships. Given the precision nature of ultrasonic welding, ongoing calibration, repair, and frequent replacement of horns and fixtures represent a significant revenue stream. Direct channels ensure maximum control over highly specialized installations and customized application development, offering system optimization consulting. Indirect channels are vital for penetrating geographically dispersed small-to-midsize manufacturers and providing standardized system sales, ensuring rapid market access and localized troubleshooting expertise across various global regions, ultimately driving the total cost of ownership for end-users.

Ultrasonic Welding Technology Market Potential Customers

The potential customers and end-users of ultrasonic welding technology are diverse, spanning virtually every sector involved in mass production requiring high-precision, rapid assembly of plastic or non-ferrous metal components. The primary buyer groups are Tier 1 automotive suppliers who utilize the technology extensively for interior components (door panels, dashboards), under-the-hood sensors, and increasingly, critical battery cell and module assembly for Electric Vehicles (EVs). These customers require high-speed, verifiable welding processes to meet strict safety and quality standards (e.g., ISO/TS 16949), making ultrasonic technology indispensable due to its repeatability and immediate weld verification capabilities.

Another major segment comprises manufacturers of medical devices and healthcare consumables. These buyers purchase ultrasonic welders for assembling sensitive and sterile products such as catheters, blood filters, non-woven fabrics (e.g., masks, gowns), and intricate plastic housings, where cleanliness, hermetic sealing, and avoiding contaminants (like adhesives) are absolute necessities. The precision capabilities allow for the assembly of micro-sized components increasingly used in wearable technology and minimally invasive surgical tools. High-volume electronics manufacturers, including those producing smartphones, laptops, and various consumer durables, form the third core customer base, relying on ultrasonic welders for joining plastic casings, embedding internal components, and assembling wire harnesses with speed and minimal thermal impact.

Furthermore, the packaging industry represents a perpetually growing customer base, specifically those dealing with flexible packaging, films, tubes, and blister packs. These customers seek fast and efficient sealing solutions that ensure product freshness and tamper-evidence, where ultrasonic sealing offers significantly faster cycle times and reduced energy consumption compared to heat sealing. Overall, any manufacturing entity focused on achieving lightweight construction, material diversity, precision joining, and stringent quality metrics for high-volume production lines constitutes a prime potential customer for advanced ultrasonic welding systems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.5 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Emerson Electric Co. (Branson), Herrmann Ultrasonics Inc., Dukane, Telsonic Group, Rinco Ultrasonics AG, Sonics & Materials Inc., KLN Ultraschall AG, Stapla Ultrasonics Corporation, Sonobond Ultrasonics, Schunk Sonosystems GmbH, Weber Ultrasonics GmbH, Forward Technology (Crest Group), Persheng Ultrasonic, Mastersonic Co., Ltd., Sonotronic Nagel GmbH, Mecasonic, Beijing Kailan Ultrasonic Equipment Co., Ltd., Dongguan Lingke Ultrasonic Machinery Co. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ultrasonic Welding Technology Market Key Technology Landscape

The technology landscape of the Ultrasonic Welding Technology Market is characterized by continuous refinement of core components aimed at maximizing efficiency, reliability, and precision, essential for modern manufacturing challenges. At the heart of any system is the ultrasonic generator, which has evolved significantly from analog power supplies to highly advanced digital generators utilizing microprocessors. These digital systems offer precise frequency control, immediate impedance matching, and sophisticated process monitoring capabilities, enabling real-time adjustments and comprehensive data logging for quality assurance and compliance in regulated industries. The shift to digital generators is fundamental to enabling Industry 4.0 integration, allowing welders to communicate seamlessly within factory automation networks and adopt self-optimizing functionalities.

Further technological advancements focus heavily on the tooling assembly, specifically the transducer (converter) and the sonotrode (horn). Transducers are becoming more efficient in converting electrical energy into high-frequency mechanical vibrations, minimizing heat loss and maximizing power output stability. The design and material science surrounding sonotrodes are critical, as they transmit the energy to the workpiece. Innovations include advanced finite element analysis (FEA) used to design complex sonotrode geometries that ensure uniform amplitude distribution, reducing stress points and extending tooling life, particularly when welding high-strength or geometrically complex parts. Furthermore, specialized coatings and materials are being developed for tooling to enhance durability when processing abrasive or highly engineered polymers.

Crucially, the integration of automation and ancillary technologies is defining the modern market. High-precision actuators (either pneumatic or servo-driven) offer highly repeatable downward pressure and speed control, which is vital for achieving consistent weld quality. The proliferation of specialized fixturing, often customized using 3D printing techniques for rapid prototyping and precise part location, further enhances system repeatability and throughput. Finally, advanced process monitoring—including acoustic signature analysis and graphical display of power, frequency, and collapse distance—is standard, allowing operators and automated quality systems to verify the integrity of every weld cycle against predetermined standards, ensuring compliance and minimizing scrap rates.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to dominate the global market share and witness the highest CAGR throughout the forecast period, primarily driven by massive investments in the region's expansive manufacturing base, particularly in China, South Korea, Japan, and India. The burgeoning electric vehicle market and the high-volume production of consumer electronics, requiring rapid assembly of plastic components and delicate metal wire bonding, are the principal demand drivers. Government initiatives supporting industrial automation and rapid urbanization further bolster the adoption of high-speed ultrasonic welding systems across diverse manufacturing verticals.

- North America: North America holds a significant market share, characterized by high adoption rates of advanced, automated ultrasonic systems, particularly within the medical device and aerospace sectors where stringent quality control and complex material joining are mandated. The region is a pioneer in implementing Industry 4.0 technologies and utilizing ultrasonic welding for highly specialized applications, including automotive battery assembly and military-grade equipment manufacturing, often focusing on high-precision, customized solutions rather than sheer volume.

- Europe: Europe represents a mature but consistently growing market, distinguished by its strong focus on environmental sustainability and high-quality packaging innovations. European manufacturers, particularly in Germany and Italy, lead in implementing ultrasonic sealing for sustainable and recyclable packaging films. The region’s robust automotive sector and stringent medical device regulations necessitate the use of highly reliable, digitally controlled ultrasonic welding equipment, maintaining strong demand for mid-to-high-power systems.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions show steady growth, primarily driven by increasing foreign direct investment in localized automotive assembly and packaging plants. While currently smaller in market size compared to the mature regions, the gradual shift from traditional, lower-cost joining methods to automated ultrasonic technology, supported by industrialization efforts, promises significant future growth opportunities, particularly in consumer goods and infrastructure-related manufacturing sectors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ultrasonic Welding Technology Market.- Emerson Electric Co. (Branson)

- Herrmann Ultrasonics Inc.

- Dukane

- Telsonic Group

- Rinco Ultrasonics AG

- Sonics & Materials Inc.

- KLN Ultraschall AG

- Stapla Ultrasonics Corporation

- Sonobond Ultrasonics

- Schunk Sonosystems GmbH

- Weber Ultrasonics GmbH

- Forward Technology (Crest Group)

- Persheng Ultrasonic

- Mastersonic Co., Ltd.

- Sonotronic Nagel GmbH

- Mecasonic

- Beijing Kailan Ultrasonic Equipment Co., Ltd.

- Dongguan Lingke Ultrasonic Machinery Co. Ltd.

Frequently Asked Questions

Analyze common user questions about the Ultrasonic Welding Technology market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for ultrasonic metal welding?

The surging growth of the Electric Vehicle (EV) industry is the primary driver, as ultrasonic metal welding is essential for connecting copper and aluminum foils and terminal tabs within battery cells and modules, offering superior electrical conductivity and mechanical integrity compared to other methods.

In which end-use application does ultrasonic welding offer the most significant advantage over traditional joining methods?

The Medical and Healthcare sector benefits immensely, as ultrasonic welding enables the clean, fast, and hermetic sealing of sensitive disposable devices (like filters and catheters) without introducing heat, adhesives, or solvents, thereby ensuring material integrity and sterility compliance.

How does Industry 4.0 influence the future development of ultrasonic welding technology?

Industry 4.0 mandates the integration of digital capabilities; future ultrasonic systems are being developed with advanced IoT connectivity, AI-driven predictive maintenance, and real-time process control (digital generators) to enable self-optimizing, fully automated manufacturing cells.

What materials can be effectively joined using ultrasonic welding technology?

Ultrasonic welding is highly effective for joining most thermoplastics (e.g., ABS, Polypropylene, Polycarbonate), as well as thin non-ferrous metals like copper, aluminum, brass, and nickel, but is generally unsuitable for thermoset plastics or high-strength ferrous alloys.

What are the typical lifespan and maintenance requirements for ultrasonic tooling (sonotrodes/horns)?

The lifespan of ultrasonic tooling varies significantly based on material (e.g., titanium, aluminum) and application intensity, but maintenance involves regular cleaning and replacement due to wear, with modern digital systems offering predictive diagnostics to forecast optimal replacement times, minimizing unscheduled production stops.

Detailed Market Dynamics and Future Outlook

The trajectory of the Ultrasonic Welding Technology Market is inextricably linked to the global push for manufacturing excellence, characterized by precision, speed, and sustainability. A crucial dynamic is the increasing sophistication required in material science integration. As manufacturers move toward advanced composites and multi-layered materials for demanding applications (e.g., aerospace interiors and medical implants), the development of flexible frequency generators and specialized sonotrodes capable of accommodating varying material thicknesses and acoustic properties becomes paramount. This complexity in materials necessitates greater computational power within the welding unit itself, driving investment into advanced sensor packages and real-time acoustic analysis to ensure consistent energy delivery and weld formation, regardless of minute variations in raw material batches.

Furthermore, the market is undergoing a geographical expansion beyond traditional industrial centers. While APAC remains the manufacturing powerhouse, the localization of production capabilities, particularly in emerging economies in LATAM and MEA, is creating new localized demand clusters. This requires key players to develop more robust, user-friendly, and cost-effective entry-level ultrasonic solutions, coupled with comprehensive local service support and training infrastructure. This decentralization of manufacturing necessitates standardized, modular welding head designs that can be easily integrated into various custom automation platforms globally, thereby addressing the diverse industrialization stages across different regional markets. The competitive landscape is shifting towards solution providers who offer not just hardware, but complete application engineering expertise, crucial for high-value segments like medical device assembly.

Looking ahead, the future outlook is defined by enhanced connectivity and data monetization. The vast amounts of operational data generated by digital ultrasonic generators—covering power graphs, frequency drifts, and collapse distances—are becoming valuable assets. Manufacturers are developing secure cloud platforms to host this data, offering clients advanced analytics for process validation, regulatory reporting, and benchmarking OEE across multiple factory locations. This transition from selling hardware to providing manufacturing intelligence solidifies the role of ultrasonic welding as a critical component in the smart factory ecosystem, where every weld cycle contributes to continuous process improvement and quality traceability, a prerequisite for advanced sectors like aerospace and pharmaceuticals.

Deep Dive: Ultrasonic Metal Welding Segment

The ultrasonic metal welding segment is witnessing explosive growth, positioning itself as the most dynamic sub-market within the broader ultrasonic technology landscape. This surge is predominantly attributable to the global electrification trend, specifically the proliferation of hybrid and battery electric vehicles (BEVs). Ultrasonic metal welding is the preferred technique for joining delicate but conductive materials such as copper and aluminum foils (down to micrometer thickness) in battery cell manufacturing, terminal welding, and busbar connections. Its advantage lies in its solid-state joining mechanism, which avoids melting the metals, thereby preserving their electrical conductivity and minimizing the formation of brittle intermetallic compounds that often plague fusion welding methods.

Technological refinement in this segment focuses on high-power, low-frequency systems (typically 20 kHz) coupled with robust, durable tooling designed to handle highly abrasive and repetitive metal joining tasks. The complexity arises from joining dissimilar metals (e.g., copper to aluminum) and maintaining extremely low electrical resistance in the welded joint, which is critical for battery performance and longevity. OEMs are competing intensely on weld quality verification, integrating complex force sensors and advanced energy monitoring algorithms specifically calibrated for metal dynamics, ensuring that every joint meets rigorous electrical and mechanical specifications, often verified by ultrasonic non-destructive testing (NDT) methodologies integrated inline.

Beyond automotive, ultrasonic metal welding is crucial in the production of solar panels and heat exchangers. In solar panel manufacturing, it is used for precise wire bonding and tab connections, significantly increasing production throughput and reducing heat damage to sensitive photovoltaic cells. The application demands high reliability over long operational periods. Consequently, suppliers are focusing their R&D efforts on developing modular systems that can be rapidly reconfigured to handle changes in battery cell formats (e.g., prismatic, pouch, or cylindrical) and foil thicknesses, offering flexibility to Tier 1 battery manufacturers who are constantly adapting their production lines to meet evolving global EV mandates and battery energy density requirements.

- Key Applications: EV Battery Foils, Terminal Welding, Wire Splicing, Solar Panel Connections, Busbar Assembly.

- Technological Focus: High-power digital generators, Specialized titanium sonotrodes with advanced coatings, Real-time electrical resistance monitoring.

- Growth Driver: Unprecedented global investment in battery manufacturing Gigafactories across North America, Europe, and APAC.

Analysis of Medical & Healthcare Applications

The Medical & Healthcare application segment demands the highest levels of precision and quality control, making ultrasonic welding a cornerstone technology. The technology is utilized for manufacturing a wide range of critical products, including fluid filters, blood processing devices, multi-lumen tubing, disposable surgical instruments, and complex plastic housings for monitoring equipment. The inherent benefit of ultrasonic welding—the ability to create clean, hermetic, particle-free seals without introducing adhesives or excessive heat—is crucial, as medical devices must comply with rigorous regulatory standards such as FDA guidelines and ISO 13485.

Miniaturization is a significant driver within this sector, pushing the market toward higher-frequency welding systems (40 kHz and higher). These higher frequencies allow for reduced amplitude and extremely fine control over energy delivery, which is essential for assembling micro-components used in wearable sensors, lab-on-a-chip devices, and microfluidics. Welding cycles often need to be extremely fast to maintain high throughput for high-volume disposables, while simultaneously requiring ultra-low amplitude to protect fragile components like internal electronics or membranes from vibrational stress.

The trend towards customized and bio-compatible materials, including highly specialized engineering plastics and thin films, requires advanced process validation. Consequently, medical device manufacturers are demanding ultrasonic systems with superior data acquisition capabilities. Full documentation of every welding parameter (energy, distance, time, peak power) is mandatory for audit trails and regulatory submissions. This emphasis on traceability and data integrity drives the market toward suppliers offering sophisticated software platforms integrated with the welding machine, facilitating rapid process validation (IQ/OQ/PQ) and long-term data archiving, ensuring compliance and significantly reducing product liability risks.

- Compliance Needs: FDA, ISO 13485 (Traceability and Validation).

- Key Products: Catheters, Filters, Non-woven Textiles (Gowns, Masks), Fluidic Devices, Disposable IV Components.

- Technology Requirement: High-frequency systems (40 kHz+), Servo-actuators for highly precise collapse control, Full data logging capabilities.

Competitive Landscape and Strategic Positioning

The competitive landscape of the Ultrasonic Welding Technology Market is dominated by a few global established players who possess deep application expertise and proprietary digital generator technology, alongside numerous specialized regional manufacturers focusing on niche applications or cost-effective solutions. Global market leaders like Emerson (Branson), Herrmann Ultrasonics, and Dukane leverage their extensive patent portfolios, global service networks, and established relationships with major Tier 1 automotive and medical device manufacturers to maintain market dominance. Their strategies often center on vertical integration, controlling the entire process from digital generator design to custom tooling manufacturing, providing complete, optimized welding solutions.

A major competitive strategy involves accelerating R&D in automation readiness. Companies are heavily investing in seamlessly integrating their welding heads with industrial robots and automated handling systems. This allows them to sell comprehensive robotic welding cells rather than standalone equipment, catering to the increasing industry demand for fully autonomous production lines. Furthermore, customization remains a critical differentiator; since ultrasonic welding is application-specific, the ability to rapidly design and deliver highly precise, acoustically tuned sonotrodes and complex fixtures provides a significant competitive edge, particularly in high-mix, low-volume scenarios.

Regional players, especially those in APAC, often compete on aggressive pricing and fast delivery cycles for standard plastic welding systems utilized in consumer goods and commodity packaging. However, the future competitive advantage will increasingly depend on technological specialization, particularly in high-growth segments like metal welding for e-mobility. Companies that can demonstrate superior capabilities in joining dissimilar metals with verifiable, low-resistance bonds, backed by sophisticated AI-driven quality assurance systems, are best positioned for long-term growth and market leadership in the advanced manufacturing era.

- Dominant Strategies: Automation integration (Robotic Cells), Digitalization (AI & IoT), Application-Specific Customization, Global Service Network Expansion.

- Key Differentiators: Proprietary digital generator technology, Advanced acoustic modeling (FEA) for tooling, Expertise in dissimilar material joining (Copper-Aluminum).

- Emerging Trend: Focus on total cost of ownership (TCO) reduction through predictive maintenance and tool longevity optimization.

Sustainability and Environmental Drivers

Sustainability mandates are increasingly acting as a powerful external driver for the adoption of ultrasonic welding technology across various industries. Ultrasonic welding is fundamentally a cleaner joining method compared to traditional alternatives. It eliminates the need for chemical solvents and adhesives, which reduces VOC (Volatile Organic Compound) emissions and simplifies the end-of-life recycling process of plastic components, aligning perfectly with circular economy principles and increasingly strict environmental regulations, particularly in Europe and North America.

In the packaging sector, ultrasonic sealing is replacing traditional heat sealing for certain films and containers, offering significant energy efficiency gains due to faster cycle times and highly localized heat input. This efficiency reduction contributes directly to lower operational carbon footprints for packaging manufacturers. Moreover, the ability of ultrasonic welding to join bio-based and recyclable plastic materials is opening new avenues for product innovation in sustainable packaging, which is a major focus area for consumer goods giants seeking to meet publicly declared sustainability targets.

Furthermore, the technology plays a vital role in reducing overall product weight. In the automotive industry, the use of ultrasonic welding for plastic and composite components facilitates lightweighting initiatives, directly leading to improved vehicle fuel economy and reduced emissions, or extended range in the case of EVs. This contribution to resource efficiency, both in terms of manufacturing energy use and the reduction of material waste (adhesives), positions ultrasonic welding technology as an environmentally superior option compared to traditional mechanical fastening or chemical bonding methods.

- Environmental Benefit: Eliminates adhesives and solvents (reducing VOCs).

- Energy Efficiency: Faster cycle times and localized energy input compared to heat sealing.

- Recyclability: Facilitates easier separation and recycling of joined plastic components.

- Key Application: Sustainable packaging films and lightweight automotive components.

Key Market Challenges and Mitigation Strategies

Despite its technological advantages, the Ultrasonic Welding Technology Market faces several persistent challenges. The primary obstacle remains the high initial capital investment required for advanced digital systems and associated automation integration. For SMEs, this significant upfront cost can be prohibitive, creating a barrier to entry. This is compounded by the high cost of custom tooling (horns/sonotrodes), which must be precisely tuned for each specific application and material, leading to significant tooling changeover costs when product designs evolve.

Material compatibility also poses a restraint. Ultrasonic welding is optimized for certain thermoplastic polymers and thin non-ferrous metals. Joining materials outside these parameters, such as highly filled or reinforced composites and specific types of polymers with low acoustic transmissibility, presents technical difficulties that limit the technology’s application scope in certain advanced sectors. Achieving high-quality welds on dissimilar plastics or materials with different melting temperatures requires specialized techniques and highly accurate process control, increasing complexity.

Mitigation strategies involve strategic technological and business model innovations. To address the cost barrier, manufacturers are increasingly offering flexible leasing and financing options, or providing modular systems where customers can upgrade components (e.g., from analog to digital generators) over time. Regarding material limitations, intense R&D is focused on developing multi-frequency welding systems that offer flexibility in energy delivery, expanding the range of compatible materials, particularly difficult-to-weld high-performance polymers. Furthermore, leveraging AI and machine learning for predictive tooling design reduces the costly trial-and-error often associated with developing new sonotrodes, thus decreasing time-to-market for complex applications and improving system adaptability.

- Challenge 1: High initial capital expenditure and tooling costs.

- Mitigation: Flexible financing models, modular system design, leveraging 3D printing for cost-effective fixture prototyping.

- Challenge 2: Limitations in material compatibility (thermosets, high-density composites).

- Mitigation: R&D in multi-frequency welding, specialized tooling materials, and advanced process monitoring for difficult materials.

Future Technology Trends in Ultrasonic Welding

The future of ultrasonic welding technology is trending toward increased autonomy, integration, and precision, reflecting the broader movement toward intelligent manufacturing systems. A key forthcoming trend is the widespread commercialization of advanced sensing technologies integrated directly into the welding head. This includes acoustic emission monitoring and thermal imaging during the weld cycle, providing micro-level feedback that allows the generator to adjust parameters instantly, moving beyond simple power and time controls to truly self-correcting systems that guarantee weld quality in real time.

Another major development involves the shift towards smaller, highly portable, and decentralized ultrasonic systems. As manufacturing moves away from centralized assembly lines to distributed, flexible production environments, there is growing demand for lightweight, handheld, or robot-mounted ultrasonic welding units that maintain industrial-grade power and precision. This facilitates complex 3D assembly operations and increases the utilization of collaborative robots (cobots) in manufacturing, where human operators work alongside automated welding tools.

Finally, the standardization of communication protocols (like OPC UA) for industrial data exchange will be critical. This allows ultrasonic welding machines, regardless of the manufacturer, to easily interface with enterprise resource planning (ERP) systems and manufacturing execution systems (MES). This integration enhances supply chain visibility, simplifies regulatory reporting, and enables large multinational corporations to manage and optimize their welding operations globally from a centralized digital platform, maximizing efficiency and minimizing regional quality variances.

- Trend 1: Fully Autonomous and Self-Correcting Welding Systems (AI-driven parameter control).

- Trend 2: Increased portability and robot-mounted systems (Cobot integration).

- Trend 3: Standardization of Data Protocols (OPC UA) for seamless ERP/MES integration.

- Trend 4: Continued development of specialized sonotrodes using Additive Manufacturing for geometric complexity.

Economic Outlook and Investment Opportunities

The economic outlook for the Ultrasonic Welding Technology Market remains robust, underpinned by resilient demand from high-growth industrial sectors globally. The market exhibits significant immunity to cyclical downturns in specific segments due to its critical role in non-discretionary sectors like healthcare and essential vehicle production (EVs). Investment opportunities are particularly concentrated in companies specializing in digital generator technology and those focused on the development of application-specific metal welding solutions for battery gigafactories. These areas promise the highest returns due to their high technological barriers to entry and massive scale demand.

Furthermore, strategic mergers and acquisitions (M&A) are likely to continue as larger industrial automation conglomerates seek to integrate advanced ultrasonic capabilities into their broader product offerings. Smaller, innovative firms specializing in high-frequency transducers or proprietary acoustic modeling software represent attractive targets for established market players looking to acquire cutting-edge R&D expertise and expand their material processing window. Investment should also be directed toward firms developing comprehensive service contracts and localized technical support networks, especially within the high-growth APAC region, where rapid deployment and reliable maintenance are key competitive factors.

Overall, the steady transition away from mechanical fastening and chemical bonding in favor of energy-efficient, rapid, and verifiable joining processes ensures long-term economic stability for the market. Capitalizing on the convergence of automation, electrification, and precision medical manufacturing will be key to generating substantial stakeholder value throughout the forecast period. The market's stability and growth are a direct reflection of continuous innovation enabling manufacturers worldwide to meet increasingly rigorous performance and sustainability demands.

The report provides a comprehensive overview and strategic analysis, positioning stakeholders to navigate the evolving technological and competitive landscapes effectively. The anticipated growth highlights the essential role of ultrasonic welding in modern, high-precision manufacturing.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager