Upstream Petrotechnical Training Service Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441605 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Upstream Petrotechnical Training Service Market Size

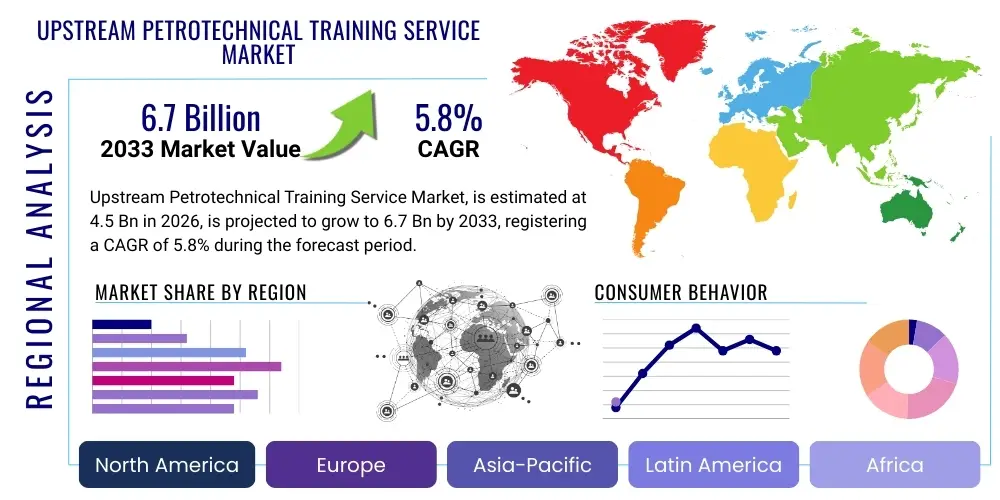

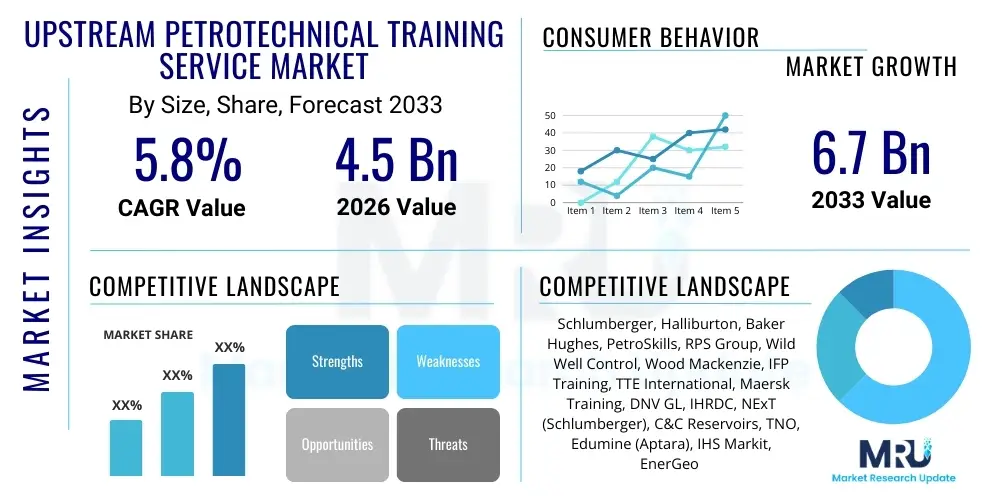

The Upstream Petrotechnical Training Service Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 6.7 Billion by the end of the forecast period in 2033.

Upstream Petrotechnical Training Service Market introduction

The Upstream Petrotechnical Training Service Market encompasses specialized educational and development programs designed to equip professionals within the Exploration and Production (E&P) sector with the essential skills required for discovering, evaluating, and extracting hydrocarbon resources. These services are critical for maintaining operational efficiency, ensuring safety compliance, and navigating the complexities of increasingly challenging geological environments, such as deepwater and unconventional reservoirs. The necessity for these services is amplified by the industry’s ongoing digital transformation, which requires a new generation of geoscientists, drilling engineers, and reservoir managers proficient in data analytics, subsurface modeling, and integrated operations technologies. Providers in this market offer a wide array of courses, ranging from foundational concepts in geology and petrophysics to advanced training in drilling optimization and production surveillance, often utilizing high-fidelity simulators and real-world case studies.

Major applications of petrotechnical training span the entire E&P lifecycle, including seismic interpretation, well log analysis, reservoir characterization, drilling program design, and production monitoring. The primary benefit derived by operators is the reduction of operational risks, improved decision-making quality, and optimization of asset performance, which directly impacts capital expenditure efficiency. Furthermore, specialized training in areas such as Carbon Capture and Storage (CCS) and geothermal energy is increasingly integrated into curricula, reflecting the industry's pivot toward energy transition objectives. The demand is intrinsically linked to global E&P spending and the complexity of new projects, which necessitates a highly skilled and continuously evolving workforce capable of adopting cutting-edge petrotechnical methodologies.

Driving factors for sustained market growth include the mandatory requirement for standardized safety and operational training in highly regulated environments, the critical need to transfer knowledge effectively as an aging workforce retires, and the proliferation of advanced digital tools like machine learning and AI in subsurface interpretation. These factors compel both International Oil Companies (IOCs) and National Oil Companies (NOCs) to invest heavily in robust, scalable training solutions. The transition towards unconventional resources and deepwater exploration requires specialized skills that traditional academic programs may not fully address, thereby fueling the reliance on specialized petrotechnical training providers who can deliver context-specific, practical knowledge tailored to immediate operational needs. The shift toward remote delivery methods further enhances accessibility and scalability across diverse geographical operational hubs.

- Market Intro: Provision of highly specialized technical training crucial for E&P professionals globally.

- Product Description: Curricula covering geology, geophysics, drilling engineering, reservoir management, and production optimization.

- Major Applications: Subsurface modeling, drilling operation planning, enhanced oil recovery (EOR) strategy development, and risk mitigation.

- Benefits: Reduced operational downtime, improved safety performance, optimized resource recovery, and enhanced professional skill development.

- Driving Factors: Workforce attrition, increasing technical complexity of reservoirs, stringent regulatory compliance, and digital integration adoption in E&P.

Upstream Petrotechnical Training Service Market Executive Summary

The Upstream Petrotechnical Training Service market is undergoing a profound transformation driven by digital integration, sustainability mandates, and demographic shifts within the energy sector. Business trends indicate a strong movement away from traditional classroom settings towards blended learning models that incorporate high-fidelity simulation, virtual reality (VR), and cloud-based Learning Management Systems (LMS). Training providers are rapidly adapting their offerings to focus on interdisciplinary skills, particularly the intersection of petrotechnical expertise and data science, ensuring graduates are equipped to handle big data generated by smart fields. Furthermore, consolidation among smaller specialized training firms by larger educational technology companies and established oilfield service providers is shaping the competitive landscape, focused on offering comprehensive, integrated human capital solutions rather than isolated training courses. This emphasis on customizable, on-demand training solutions is a key differentiating factor in attracting major corporate clients.

Regionally, the market dynamics vary significantly. The Middle East and Africa (MEA) and Asia Pacific (APAC) regions are experiencing robust growth, primarily fueled by massive long-term investment by NOCs in developing local technical talent to support national content goals and handle burgeoning complex mega-projects. North America and Europe, while possessing mature markets, are seeing demand shift intensely towards specialized skills related to energy transition technologies, such as CO2 sequestration, methane emissions reduction, and advanced geothermal system development. European markets, in particular, are prioritizing training that aligns with stringent environmental, social, and governance (ESG) standards. This regional diversification in demand profiles requires service providers to maintain flexible and localized training infrastructure, accommodating both rapidly developing operational hubs and sophisticated, mature markets focused on innovation.

In terms of segment trends, e-learning and remote delivery modalities are showing the highest Compound Annual Growth Rate (CAGR), reflecting the need for cost-effective, scalable, and readily accessible training for globally dispersed teams, especially post-pandemic. Simulation-based training remains highly valuable, particularly for critical activities like deepwater drilling and well control, where practical experience with zero risk is paramount. End-user segmentation highlights that National Oil Companies (NOCs) are the largest consumers, driven by large workforce size and government mandates for technical competency, while independent E&P companies often favor modular, just-in-time training focused on specific project requirements. The growing trend towards "integrated reservoir management" mandates training programs that break down traditional silos between geology, drilling, and production disciplines, driving demand for cross-functional curricula designed to enhance collaborative operational planning.

AI Impact Analysis on Upstream Petrotechnical Training Service Market

Common user questions regarding AI’s impact on the Upstream Petrotechnical Training Service Market frequently revolve around whether AI automation will render traditional petrotechnical skills obsolete, how AI can personalize the learning experience, and the necessary integration of data science modules into core engineering curricula. Users are keen to understand how AI-powered tools, such as predictive modeling and automated interpretation software, will change the job scope of a geoscientist or reservoir engineer. The key themes summarized from user concerns are the need for rapid curriculum updates to reflect AI-driven workflows, the expectation that AI should enhance training efficiency through personalized delivery and performance monitoring, and the underlying anxiety about the future relevance of conventional expertise versus data literacy. Organizations expect training providers to bridge the gap between theoretical petrotechnical knowledge and practical application of machine learning algorithms to real-world subsurface data challenges, fundamentally shifting the focus from manual data processing to validation and ethical data usage.

The direct impact of Artificial Intelligence is manifesting through advanced predictive learning analytics, where algorithms track trainee performance, identify knowledge gaps with high precision, and dynamically adjust course content for optimal retention. This shift from standardized curriculum delivery to highly personalized learning pathways ensures maximum efficiency in skill development, reducing the time required to onboard competent staff. Furthermore, AI is crucial in enhancing the fidelity and complexity of simulation training. AI algorithms can manage vast datasets in real-time within a drilling simulator, introducing realistic, unpredictable subsurface responses that force trainees to adapt quickly, mimicking high-stakes operational environments more accurately than previous generation simulators. This deep integration makes training more relevant to the dynamic nature of modern field operations.

AI is also driving a fundamental re-evaluation of the core subject matter taught in petrotechnical programs. The emphasis is moving from traditional calculations and manual interpretation towards teaching professionals how to effectively manage, structure, and derive insights from large-scale structured and unstructured data using specialized AI and machine learning platforms. This necessitates the introduction of modules focused on data governance, model validation, and ethical AI deployment within the E&P context. Consequently, training providers are collaborating with technology firms to co-develop courses that not only explain the petrotechnical application but also teach the underlying coding and statistical skills needed to interact with and optimize AI tools. This evolution ensures that the future workforce functions as "hybrid professionals," integrating domain expertise with advanced computational literacy, thereby securing the long-term strategic relevance of petrotechnical training services.

- AI enables personalized learning paths by identifying and targeting specific skill deficiencies in individual learners.

- Integration of machine learning and deep learning modules into core geosciences and engineering curricula becomes mandatory.

- AI improves simulation fidelity by introducing realistic, data-driven real-time operational feedback loops (Digital Twins for training).

- Automation of routine tasks shifts training focus towards high-level problem-solving, decision verification, and strategic data interpretation.

- AI tools assist training providers in market forecasting and course demand analysis, optimizing resource allocation.

DRO & Impact Forces Of Upstream Petrotechnical Training Service Market

The Upstream Petrotechnical Training Service Market is shaped by a confluence of powerful drivers and structural restraints, alongside significant market opportunities, all coalescing to form complex impact forces that dictate investment and strategy. A primary driver is the accelerating complexity of exploration and production environments; as easily accessible reservoirs deplete, operators must delve into technically challenging areas like ultra-deepwater, high-pressure/high-temperature (HPHT) environments, and highly heterogeneous unconventional plays. This complexity mandates continuous, advanced training in specialized techniques such as advanced well placement, hydraulic fracturing optimization, and complex geological modeling, making basic training insufficient. Furthermore, stringent global safety regulations, especially following major industrial incidents, enforce mandatory recurrent training, particularly in well control and drilling safety protocols, providing a stable, recurring revenue stream for service providers. This regulatory pressure ensures compliance remains a non-negotiable component of operational expenditure.

Conversely, the market faces significant restraints, most notably the high volatility and cyclical nature of global oil and gas prices. When commodity prices drop, E&P companies universally implement immediate, deep cuts in discretionary spending, with training budgets often being among the first to be reduced, impacting long-term skill development programs. Another substantial restraint is the substantial initial investment required for sophisticated training infrastructure, such as high-fidelity drilling simulators or specialized labs, which deters entry for smaller providers and necessitates large capital outlay for major firms. Furthermore, the perceived value of training is sometimes undermined by high employee turnover, especially in regions with competitive talent markets, leading companies to be hesitant about investing significant resources into staff who might move to a competitor shortly after achieving certification. Addressing this necessitates innovative contractual models and closer integration of training with talent retention strategies.

Opportunities within the market are predominantly driven by technological shifts and the energy transition. The necessity for remote, scalable delivery has spurred massive investment in e-learning platforms, virtual reality (VR), and augmented reality (AR) tools, offering lower costs per trainee and expanding geographical reach, particularly in remote operational areas. A burgeoning opportunity lies in specialized training related to low-carbon energy solutions; as IOCs and NOCs pivot towards diversification, expertise is urgently needed in areas like carbon storage reservoir identification, hydrogen production integration, and advanced geothermal system operation. These emerging areas represent entirely new skill domains that existing workforces must master quickly. The integration of training services with consultancy and workforce development strategies—offering holistic human capital solutions rather than just courses—provides a key mechanism for capturing greater market share and demonstrating tangible Return on Investment (ROI) on training expenditure, thus mitigating the impact of cyclical price volatility.

- Drivers: Increasing technical complexity of resource plays (deepwater, unconventional), regulatory mandate for safety and compliance, rapid integration of advanced digital technologies (IoT, data analytics).

- Restraints: Cyclical volatility in oil and gas prices leading to reduced training budgets, high capital expenditure required for advanced simulators and training infrastructure, and global shortage of qualified technical instructors.

- Opportunities: Expansion into energy transition training (CCS, geothermal), adoption of immersive technologies (VR/AR) for remote delivery, and customization of content for specific regional governmental requirements (local content mandates).

- Impact Forces: High bargaining power of major NOCs and IOCs (buyers) demanding tailored solutions; intensifying rivalry among providers pushing innovation in delivery methods; and substitution threat from in-house corporate universities, though external expertise remains critical for cutting-edge technology.

Segmentation Analysis

The Upstream Petrotechnical Training Service Market is comprehensively segmented based on the type of discipline covered, the mode of course delivery, and the end-user profile. Analyzing these segments is crucial for understanding specific areas of growth and investment priorities within the E&P sector. Discipline-based segmentation, which includes drilling, geosciences, reservoir engineering, and production optimization, reveals where immediate technical needs are most critical. For example, demand for advanced drilling courses remains perpetually high due to the catastrophic risks associated with well control failures, while demand for geosciences training is increasingly focused on integrating machine learning interpretation tools into traditional seismic and logging workflows. The complexity of unconventional resource extraction has particularly spurred demand for specialized reservoir engineering courses focused on maximizing sweep efficiency and optimizing fracture network geometry.

Segmentation by delivery mode distinguishes between traditional classroom instruction, which is vital for foundational knowledge and certification, simulation-based training, which provides high-stakes, risk-free practical experience, and e-learning/virtual instruction, which provides scalability and cost-efficiency. E-learning has witnessed the most rapid growth, driven by its flexibility and ability to reach geographically dispersed workforces, though simulation training, especially in areas of high mechanical risk like well intervention and managed pressure drilling, maintains the highest price point and perceived value. Providers are increasingly adopting a hybrid approach, using e-learning for theoretical groundwork and reserving high-cost simulators or hands-on fieldwork for critical competency assessment and practical application, optimizing both cost and learning effectiveness.

End-user segmentation differentiates market dynamics between National Oil Companies (NOCs), International Oil Companies (IOCs), Independent E&P Operators, and Oilfield Service (OFS) Companies. NOCs represent the largest segment due to their vast workforces and long-term nation-building strategies that prioritize standardized, large-scale competency development, often mandating local content requirements for training. IOCs typically focus on high-end, specialized training tailored to specific global projects, emphasizing leadership and digital integration skills. OFS companies require training focused on the safe operation and maintenance of specialized equipment and technology deployment, ensuring their field personnel are experts in vendor-specific tools and methodologies. Understanding these varying needs allows training providers to customize pricing models, curriculum depth, and delivery schedules to maximize their penetration across the diverse landscape of energy sector employers.

- By Discipline:

- Geosciences Training (Geology, Geophysics, Petrophysics)

- Drilling Engineering and Operations Training (Well Control, HPHT, MPD)

- Reservoir Engineering and Management Training (EOR, Simulation)

- Production and Facilities Engineering Training (Optimization, Integrity)

- Health, Safety, and Environment (HSE) Compliance Training

- By Delivery Mode:

- Classroom and Workshop Training (Traditional In-person)

- E-Learning and Virtual Training (Self-Paced, Instructor-Led Online)

- Simulation and Immersive Training (VR/AR, High-Fidelity Simulators)

- On-the-Job Mentorship and Field Training

- By End-User:

- National Oil Companies (NOCs)

- International Oil Companies (IOCs)

- Independent Exploration and Production (E&P) Companies

- Oilfield Service (OFS) Providers

- Governmental and Regulatory Bodies

Value Chain Analysis For Upstream Petrotechnical Training Service Market

The value chain for Upstream Petrotechnical Training Services starts with the upstream phase: Curriculum Development and Content Creation. This crucial step involves specialized subject matter experts (SMEs), often retired industry veterans or academic partners, who analyze current industry demands, regulatory changes, and emerging technological requirements (such as digitalization or energy transition). Providers invest heavily in R&D to create proprietary training content, high-fidelity case studies, and practical exercises that reflect real-world subsurface challenges. The quality and relevance of this content are the primary determinants of market differentiation and pricing power. Strategic partnerships with technology developers, such as software vendors for reservoir simulation, are vital at this stage to ensure the training incorporates the latest tools and methodologies used in operational settings.

The midstream phase focuses on Training Delivery and Infrastructure Management. This involves selecting the optimal distribution channel, whether through proprietary training centers, third-party academic institutions, or cutting-edge digital platforms. Direct delivery channels involve employing and managing highly skilled instructors, procuring and maintaining complex simulation equipment, and handling logistics for global deployments. Indirect distribution channels include licensing course material to corporate clients for internal use or partnering with localized training agencies to meet regional compliance requirements. The efficiency of the Learning Management System (LMS) and the capability of the digital infrastructure to support immersive, high-bandwidth content are critical components of value creation in the current digital landscape, emphasizing seamless access and global reach.

The downstream segment encompasses Certification, Competency Assessment, and Post-Training Support. This phase ensures the tangible outcome of the service: verifiable professional competency and improved operational performance. Certification programs, often aligned with international standards (e.g., IWCF for well control), add significant value. Post-training support, including access to online resources, refresher courses, and performance monitoring tools, helps companies track the long-term impact of their investment. Direct channels involve the training provider actively consulting with the client to integrate training outcomes into performance appraisals and career progression paths. Indirect channels might involve collaboration with industry bodies to standardize certification requirements, effectively linking the training service back to measurable corporate productivity improvements and risk reduction metrics, completing the value cycle.

Upstream Petrotechnical Training Service Market Potential Customers

The potential customer base for Upstream Petrotechnical Training Services is highly concentrated within organizations engaged in the exploration, development, and production of oil and gas resources, alongside the major firms that support these activities. National Oil Companies (NOCs) like Saudi Aramco, ADNOC, and Petrobras represent the largest pool of potential customers. These entities often operate under national mandates to develop a large, highly competent local workforce to support massive domestic and international E&P portfolios. Their demand is characterized by the need for bulk training, standardized curricula across all organizational levels, and often requires training providers to establish physical training centers within the host country to meet local content requirements and facilitate extensive technology transfer programs.

International Oil Companies (IOCs) such as ExxonMobil, Shell, and TotalEnergies, while generally having highly structured internal training academies, rely heavily on external providers for highly specialized, project-specific, or proprietary technology training. IOC demand focuses on niche skills required for complex frontier operations (e.g., arctic drilling, deepwater subsea completions) and advanced digital literacy, particularly in areas where they seek a competitive edge. Independent E&P companies, which often have leaner technical teams and focus on specific basins or unconventional plays, seek highly efficient, modular training solutions that minimize time away from the field and are immediately applicable to current project challenges, preferring on-demand e-learning or quick workshop formats tailored to their specific geological context.

A third significant customer group comprises major Oilfield Service (OFS) companies like Schlumberger, Halliburton, and Baker Hughes. These firms require continuous, rigorous training for their field engineers and technical sales teams to ensure they can safely and effectively deploy complex, highly specialized proprietary equipment and software solutions provided to E&P operators. Training for OFS companies is crucial for maintaining service quality, reducing liability, and demonstrating technical competence during contract negotiations. Furthermore, regulatory bodies and government agencies, responsible for enforcing safety standards (e.g., well control), also constitute a smaller but vital customer segment, often commissioning training providers to develop and certify curriculum standards that apply across the entire industry, establishing their own staff competence through external providers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Schlumberger, Halliburton, Baker Hughes, PetroSkills, RPS Group, Wild Well Control, Wood Mackenzie, IFP Training, TTE International, Maersk Training, DNV GL, IHRDC, NExT (Schlumberger), C&C Reservoirs, TNO, Edumine (Aptara), IHS Markit, EnerGeo Alliance, PetroMentor, KBC (Yokogawa). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Upstream Petrotechnical Training Service Market Key Technology Landscape

The technological evolution within the Upstream Petrotechnical Training Service market is centered on enhancing engagement, realism, and scalability, moving far beyond traditional PowerPoint presentations and textbooks. Immersive training technologies, specifically Virtual Reality (VR) and Augmented Reality (AR), are fundamentally transforming how complex and dangerous field operations are taught. VR simulators allow engineers to safely practice high-stakes procedures—such as blowout prevention, complex wireline interventions, or subsea manifold maintenance—in a risk-free, highly realistic digital environment. This not only accelerates competency development but also drastically reduces the operational costs associated with training on expensive, active rigs or platforms. AR technology, conversely, provides 'just-in-time' guidance to field technicians, overlaying digital instructions or sensor data onto real equipment, enhancing operational precision and troubleshooting capabilities in remote locations.

Another pivotal technological development is the implementation of high-fidelity, physics-based digital twins for training. These digital replicas of actual operating assets or subsurface reservoirs integrate real-time operational data, allowing trainees to experience genuine operational scenarios, including equipment failures, pressure fluctuations, and geological uncertainties, without any physical consequence. When integrated with advanced Learning Management Systems (LMS) hosted on cloud platforms, these simulations offer a truly global, standardized training experience. Cloud-based LMS platforms facilitate seamless access to comprehensive digital course catalogs, track granular performance metrics, and enable instant content updates, ensuring that training materials are always current with the latest technology and regulatory requirements, overcoming the logistical challenges of supporting a global workforce.

Furthermore, the utilization of Artificial Intelligence (AI) and Machine Learning (ML) is becoming integral to both the content and the delivery method. AI is leveraged to create adaptive learning experiences, tailoring content difficulty and pace based on individual learner proficiency, thereby optimizing knowledge retention and speeding up the skill acquisition process. ML algorithms are also used in curriculum development to analyze emerging operational risks and technological shifts within the E&P sector, allowing providers to proactively design courses addressing future skills gaps, such as managing autonomous drilling systems or interpreting vast volumes of sensor data from integrated field operations. The adoption of these digital tools ensures that petrotechnical training remains strategically relevant to the industry's drive toward fully automated and data-centric operational models, demanding hybrid skills that blend deep technical domain knowledge with computational expertise.

Regional Highlights

Regional dynamics heavily influence the demand for petrotechnical training services, driven by differing operational environments, regulatory landscapes, and stages of energy development. North America, encompassing the mature basins of the US and Canada, represents a highly sophisticated market characterized by rapid technological adoption, particularly in unconventional resource development (shale gas and oil). Demand here is focused heavily on digital skills, AI application in reservoir modeling, and efficiency optimization through continuous learning tailored to the fast-paced nature of independent operators. The need for standardized, safety-critical training, especially in well control, remains paramount, often delivered through high-end simulators and mobile training units serving geographically dispersed fracking sites. The ongoing investment in Carbon Capture Utilization and Storage (CCUS) also creates a niche but rapidly growing demand for specialized geologic training related to permanent CO2 storage reservoir characterization and monitoring.

The Middle East and Africa (MEA) region is arguably the largest and most stable growth engine for the training market. National Oil Companies (NOCs) in this region, particularly in the GCC states, drive demand through extensive nationalization programs aimed at building local technical capacity across large, multi-decade mega-projects. Training is often structured around long-term contract agreements, requiring providers to deliver large-scale programs, establish local training academies, and ensure culturally appropriate content delivery. The focus is comprehensive, covering foundational skills for new recruits as well as advanced training for deep drilling and sophisticated reservoir management techniques necessary for maximizing recovery from world-class assets. In Africa, demand is characterized by major project development in emerging deepwater basins (e.g., Mozambique, Nigeria), requiring specialized offshore safety and subsea engineering training, often tied directly to international financial agreements and capacity-building requirements.

Asia Pacific (APAC) exhibits strong potential driven by energy security concerns and increasing domestic E&P activities in countries like China, India, and Indonesia, alongside significant offshore activity in Southeast Asia. This region struggles with a persistent shortage of highly skilled petrotechnical professionals, making external training services essential for bridging the competency gap. Demand is diverse, ranging from basic competency training in foundational skills to advanced technical training required for complex deep-sea and challenging high-CO2 gas fields. Europe, conversely, is characterized by a mature energy sector and an intense focus on the energy transition agenda. Training demand here is strongly pivoting towards decommissioning, asset integrity management for aging North Sea infrastructure, and expertise related to renewable energy integration and energy storage solutions, requiring providers to rapidly diversify their course catalog away from pure hydrocarbon extraction techniques.

- North America: Focus on digital transformation, unconventional plays (shale), safety compliance (well control), and specialized CCUS training. High demand for flexible e-learning and VR simulations.

- Middle East & Africa (MEA): Highest volume demand driven by NOC nationalization and long-term mega-projects. Emphasis on foundational competency, advanced deep drilling, and large-scale customized programs.

- Asia Pacific (APAC): Strong growth due to skilled labor shortages and increasing offshore E&P investment. Need for foundational upskilling and specialization in complex offshore and mature field recovery techniques.

- Europe: Pivoting towards energy transition skills (geothermal, hydrogen, decommissioning), asset integrity, and strict adherence to environmental and governance (ESG) training standards.

- Latin America: Demand tied to large deepwater projects (Brazil, Guyana) and onshore unconventional development (Argentina). Focus on subsea engineering, reservoir characterization, and operational safety.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Upstream Petrotechnical Training Service Market.- Schlumberger (NExT)

- Halliburton (Landmark)

- Baker Hughes

- PetroSkills

- RPS Group

- Wild Well Control

- Wood Mackenzie

- IFP Training

- TTE International

- Maersk Training

- DNV GL

- IHRDC (International Human Resources Development Corporation)

- C&C Reservoirs

- TNO

- Edumine (Aptara)

- IHS Markit

- EnerGeo Alliance

- PetroMentor

- KBC (Yokogawa)

- Heriot-Watt University (Continuing Professional Development Units)

Frequently Asked Questions

Analyze common user questions about the Upstream Petrotechnical Training Service market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth in the Upstream Petrotechnical Training Market?

The primary driver is the accelerating complexity of E&P operations, particularly in deepwater and unconventional plays, alongside the necessity for integrating advanced digital technologies (AI, IoT) into existing workflows. This requires continuous professional development to maintain competency and operational efficiency, compounded by the retirement wave of experienced professionals.

How is digital technology reshaping the delivery of petrotechnical training?

Digital technology is driving a massive shift towards remote and scalable delivery models, utilizing cloud-based Learning Management Systems (LMS), Virtual Reality (VR) simulators for high-risk training, and AI-powered personalized learning paths, significantly improving accessibility and reducing logistical costs for global organizations.

Which geographical region exhibits the highest current demand for petrotechnical training services?

The Middle East and Africa (MEA) region currently exhibits the highest volume demand, primarily driven by substantial long-term investment by National Oil Companies (NOCs) focused on technical workforce nationalization and supporting large-scale, complex E&P projects over the coming decades.

Are traditional skills becoming obsolete due to the rise of AI in the E&P sector?

Traditional petrotechnical skills are not becoming obsolete but are being augmented. Training is shifting focus from manual interpretation to advanced data literacy, ethical AI model validation, and hybrid skills that combine deep domain expertise with the ability to leverage computational tools for faster, more accurate decision-making in the subsurface.

What are the key specialized training areas emerging due to the energy transition?

Emerging specialized training areas include Carbon Capture and Storage (CCS) reservoir characterization, advanced geothermal systems development, hydrogen production and storage techniques, methane emissions reduction strategies, and rigorous asset integrity management for transitioning infrastructure.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager