Urea Control Valve Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442288 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Urea Control Valve Market Size

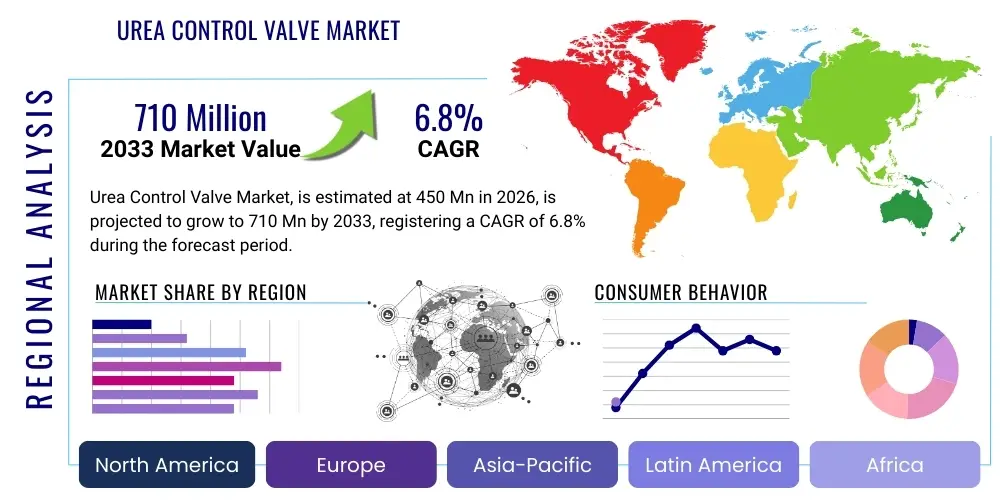

The Urea Control Valve Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $450 Million USD in 2026 and is projected to reach $710 Million USD by the end of the forecast period in 2033.

Urea Control Valve Market introduction

The Urea Control Valve Market plays a crucial role within the automotive and industrial sectors, particularly in pollution control systems mandated globally. These specialized valves are integral components of Selective Catalytic Reduction (SCR) systems, which are essential for reducing harmful nitrogen oxide (NOx) emissions from diesel engines. The primary function of the urea control valve is to precisely meter and inject Diesel Exhaust Fluid (DEF), an aqueous urea solution, into the exhaust gas stream upstream of the catalyst. This precise dosage control is paramount for achieving optimal NOx conversion efficiency while minimizing ammonia slip and ensuring regulatory compliance, making the technology indispensable in modern, high-efficiency internal combustion engines across heavy-duty commercial vehicles, passenger cars, and off-road machinery.

The core product description revolves around highly durable, electronically actuated valves designed to withstand harsh operating conditions, including high temperatures, chemical corrosivity from the urea solution, and vibrational stresses inherent in vehicle operation. Key characteristics include high accuracy in fluid dispensing, rapid response times for dynamic engine load changes, and resistance to crystallization and clogging, which are common challenges when dealing with urea solutions. Major applications span across on-road transportation, including Class 8 trucks and buses, as well as marine vessels, construction equipment, agricultural machinery, and stationary power generation units that employ diesel engines and are subject to stringent environmental regulations such as EPA Tier 4 Final, Euro VI, and equivalent standards in emerging markets. The continuous enforcement and tightening of emission standards globally are the fundamental drivers bolstering market demand for sophisticated and reliable urea control valve solutions.

Key benefits derived from advanced urea control valves include enhanced fuel economy achieved through optimized SCR performance, extended operational life of the SCR catalyst system, and guaranteed compliance with increasingly strict global emission limits, thereby avoiding significant regulatory penalties for fleet operators and manufacturers. Furthermore, innovations in solenoid design, material science, and integrated electronic control units (ECUs) are driving improvements in system reliability and diagnostic capabilities. These advancements ensure accurate operation even under extreme climatic variability, crucial for maintaining long-term performance and reducing maintenance overheads. The robust demand is structurally linked to the global production volume of diesel-powered vehicles and industrial equipment requiring advanced emission control.

Urea Control Valve Market Executive Summary

The Urea Control Valve market is experiencing robust growth fueled by stringent global regulatory frameworks, particularly in North America and Europe, mandating lower nitrogen oxide (NOx) emissions from diesel engines, which directly necessitates the integration of Selective Catalytic Reduction (SCR) technology. Business trends indicate a strong focus on miniaturization, enhanced durability against DEF crystallization, and the development of intelligent valves integrated with sophisticated Engine Control Units (ECUs) for real-time dosage adjustments. The market sees intense competition centered on achieving cost-effective mass production while maintaining high precision and reliability, prompting manufacturers to invest heavily in advanced material research, particularly ceramics and specialized polymers, to counteract the corrosive nature of Diesel Exhaust Fluid (DEF). The rising adoption of Euro VI and equivalent standards in developing economies, coupled with significant fleet renewal cycles in developed regions, acts as a primary economic catalyst driving sustained sales volume and technological evolution.

Regionally, Asia Pacific is emerging as the fastest-growing market, primarily due to the rapid implementation of stringent emission norms (such as China VI and India's Bharat Stage VI) in large vehicle manufacturing hubs, particularly in China and India, where high-volume commercial vehicle production drives substantial demand for control valve components. North America and Europe remain mature, high-value markets, characterized by high technological penetration and continuous demand for aftermarket replacements and high-specification valves for heavy-duty applications. Regional trends also reflect localized manufacturing strategies, with key players establishing production facilities closer to major automotive assembly plants in target regions to optimize supply chain logistics and reduce tariff impacts. Furthermore, government subsidies and incentives promoting cleaner vehicle technologies are accelerating the transition across various geographical clusters.

Segment trends highlight the dominance of the Solenoid Valve type due to its cost-effectiveness and proven reliability, although Piezoelectric valves are gaining traction in premium and highly demanding applications where ultra-fast response times are critical for transient engine operation compliance. By application, the On-Highway segment, encompassing heavy-duty trucks and buses, constitutes the largest market share owing to high vehicle density and continuous operation cycles. However, the Off-Highway segment, including agricultural, construction, and mining equipment, is projected to exhibit above-average growth rates as regulatory scrutiny expands to cover these previously less-regulated sectors. Original Equipment Manufacturers (OEMs) represent the dominant sales channel, although the aftermarket segment is steadily growing, driven by replacement needs for aging SCR systems and routine maintenance across large commercial fleets.

AI Impact Analysis on Urea Control Valve Market

User queries regarding the impact of Artificial Intelligence (AI) on the Urea Control Valve Market primarily focus on themes of predictive maintenance, optimization of DEF dosing algorithms, and the integration of machine learning into real-time exhaust system diagnostics. Common concerns revolve around how AI can enhance the precision of urea injection under highly variable operating conditions (e.g., altitude changes, rapid acceleration), thereby maximizing NOx reduction efficiency while minimizing DEF consumption and preventing system failure due to crystallization or clogging. Users are also keenly interested in the potential for AI-driven anomaly detection, allowing fleet managers and OEMs to predict valve failure before it occurs, significantly reducing unplanned downtime and warranty claims. The consensus expectation is that AI will transform the control loop from a reactive, map-based system to a highly predictive and self-learning dosing mechanism.

The implementation of AI/Machine Learning (ML) techniques allows SCR systems to move beyond static calibration maps. By processing vast streams of telemetry data—including engine load, ambient temperature, exhaust gas temperature, NOx sensor readings, and vehicle speed—AI algorithms can instantaneously calculate the precise stoichiometry required for optimal urea injection. This high-fidelity, adaptive control eliminates the inefficiency associated with conventional control strategies, leading to measurable reductions in DEF usage and better overall emissions compliance margin. Furthermore, AI facilitates complex sensor fusion, correlating data from various system components (e.g., pressure, temperature, level sensors) to ensure the valve performs optimally throughout its life cycle, adapting to component wear or minor operational deviations.

Ultimately, the influence of AI will manifest in two major areas: manufacturing process optimization and enhanced product performance in the field. In manufacturing, AI can optimize quality control and calibration procedures for control valves, ensuring zero-defect deployment. In operational vehicles, AI-enabled control units will allow for over-the-air updates to dosing software, adapting to new fuel formulations or shifting environmental regulatory priorities without physical hardware modification. This paradigm shift towards software-defined control components enhances the longevity and efficiency of the entire SCR system, positioning the control valve as a critical endpoint in an intelligent emission management architecture.

- Enhanced Predictive Maintenance: AI algorithms analyze vibration, temperature, and current draw data from the valve to forecast potential mechanical failures or electrical issues weeks in advance.

- Optimized Dosing Algorithms: Machine learning models utilize real-time environmental and engine data to achieve ultra-precise DEF injection, minimizing waste and maximizing NOx conversion efficiency.

- Real-Time Anomaly Detection: AI monitors system performance against baseline parameters, flagging crystallization risks, injector nozzle blockages, or electrical degradation immediately.

- Manufacturing Quality Control: Integration of computer vision and ML for automated inspection and calibration of valve components, ensuring high fidelity during assembly.

- Adaptive Emission Compliance: AI-driven software updates allow valves to adapt their operational profile based on evolving regional or seasonal emission requirements (AEO/GEO focus).

DRO & Impact Forces Of Urea Control Valve Market

The dynamics of the Urea Control Valve Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO). The paramount driver remains the continuous and expanding global mandate for lower exhaust emissions, exemplified by legislative benchmarks such as Euro VII proposals and further tightening of EPA standards. These regulations compel virtually all manufacturers of diesel engines—from heavy-duty trucks to small utility engines—to implement or upgrade SCR technology, directly translating to non-discretionary demand for control valves. Secondly, the increasing average age of commercial vehicle fleets in many regions necessitates a growing aftermarket for reliable replacement valves, especially as initial SCR systems installed over a decade ago begin to reach their end-of-life cycle. This persistent regulatory pressure combined with natural replacement cycles creates a resilient market foundation, irrespective of short-term economic fluctuations in new vehicle sales.

However, significant restraints temper the market's explosive growth potential. The primary technical challenge is the inherent corrosive and crystallization nature of Diesel Exhaust Fluid (DEF)/urea solution. DEF crystallization at low temperatures or during system shutdown cycles can lead to valve clogging, necessitating frequent maintenance or premature replacement, which increases operational costs and reduces consumer acceptance. Furthermore, the global semiconductor shortage and intermittent supply chain disruptions, especially for specialized electronic control components integrated into smart valves, pose a temporary, yet significant, constraint on production volumes and lead times for high-demand valves. The long-term threat comes from the accelerating transition towards electric and hydrogen fuel cell vehicles in transportation, which, while gradual, will eventually erode the core demand base for components linked to internal combustion engines.

Opportunities for growth are concentrated around technological advancements and emerging market penetration. Manufacturers have a strong opportunity to innovate with self-cleaning or heated valve designs that mitigate crystallization risks, thereby enhancing product differentiation and reliability. Moreover, the increasing adoption of SCR systems in the high-growth marine and power generation sectors offers diversification away from the purely automotive base. Strategic partnerships with major engine OEMs in rapidly developing industrializing nations, particularly those implementing new emissions standards (e.g., Latin America and Southeast Asia), represent significant untapped potential. The overarching impact forces dictate that reliable, precise, and durable valve performance is the central determinant of market success, ensuring regulatory compliance and minimizing end-user total cost of ownership.

Segmentation Analysis

The Urea Control Valve Market is meticulously segmented based on several key operational and structural parameters, providing granular insights into demand patterns across various industry verticals. Segmentation by Valve Type differentiates between Solenoid Valves, which utilize an electromagnetic coil for actuation and are prevalent due to their low cost and robustness, and the more advanced Piezoelectric Valves, which offer superior precision and faster response times, targeting premium and performance-critical applications. Segmentation by Application is critical, distinguishing between the dominant On-Highway segment (commercial vehicles, passenger diesel cars) and the rapidly expanding Off-Highway segment (construction, agriculture, mining, marine), each with distinct operational requirements regarding durability and chemical resistance.

Furthermore, segmentation by Component helps analyze the complexity of the integrated system, covering the nozzle assembly, dosing unit, and the electronic control module, highlighting the technological sophistication embedded within the complete valve system. Sales channel segmentation—Original Equipment Manufacturer (OEM) vs. Aftermarket—is vital for understanding strategic supply dynamics, where OEM dominates initial sales while the aftermarket ensures sustained revenue streams through replacement and maintenance cycles. The detailed breakdown of the market allows stakeholders to tailor their product development and marketing strategies to meet specific end-user demands, ranging from cost-sensitive fleet operators to performance-focused engine manufacturers. The geographical segmentation further refines market strategy by acknowledging the variance in regulatory enforcement and diesel engine penetration across continents.

- By Valve Type:

- Solenoid Valves

- Piezoelectric Valves

- By Application:

- On-Highway Vehicles (Heavy-Duty Trucks, Light Commercial Vehicles, Passenger Cars)

- Off-Highway Vehicles (Construction Equipment, Agricultural Machinery, Mining Equipment)

- Marine Vessels

- Industrial/Power Generation (Stationary Engines)

- By Component:

- Dosing Unit/Body

- Nozzle Assembly

- Electronic Control Unit (ECU Interface)

- By Sales Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket

Value Chain Analysis For Urea Control Valve Market

The Value Chain for the Urea Control Valve Market begins with upstream activities involving the sourcing of highly specialized raw materials, including high-grade stainless steel for structural components, advanced polymers and ceramics for sealing and contact surfaces (due to DEF's corrosive nature), and specialized electromagnetic coils and semiconductor chips for actuation and control. Key upstream suppliers include global metallurgy firms, precision plastics manufacturers, and electronic component providers. The quality and purity of these raw materials are critical, as they directly influence the valve's reliability, especially its resistance to corrosion, high heat, and crystallization. Disruptions in the supply of microcontrollers or specialized metallic alloys can significantly impact manufacturing output and cost structures for valve producers.

Midstream processes involve the sophisticated manufacturing, assembly, and testing of the control valves. This stage includes precision machining of the valve body, assembly of the delicate nozzle and solenoid/piezoelectric mechanism, and rigorous calibration testing to ensure dosing accuracy and response time meet stringent OEM specifications. Manufacturers often integrate lean manufacturing techniques and automated quality control to handle high volumes while maintaining the necessary precision. Downstream activities focus on distribution, sales, and service. The dominant distribution channel is direct sales to Original Equipment Manufacturers (OEMs), where valves are supplied just-in-time for integration into new engine assembly lines (Tier 1 supply relationship). Indirect channels cater primarily to the Aftermarket, involving distributors, independent workshops, and authorized service centers that handle replacement and repair parts.

The distribution network is bifurcated: Direct channels maximize control over quality and pricing for large OEM contracts, fostering long-term strategic relationships. Indirect channels, essential for serving the global installed base, require a robust logistics infrastructure to ensure timely availability of replacement parts across diverse geographical markets. Efficiency in the downstream logistics chain, particularly in managing global inventory and fulfilling aftermarket orders quickly, provides a competitive advantage. Furthermore, effective technical support and training for aftermarket service technicians regarding installation and diagnostic procedures for complex electronic valves are integral parts of maintaining product reputation and customer satisfaction across the entire value chain.

Urea Control Valve Market Potential Customers

Potential customers for Urea Control Valves are primarily entities involved in the production, operation, and maintenance of diesel engines that must comply with modern global emission regulations (such as Euro VI/VII, EPA 2010, and BS VI). The largest segment of buyers comprises Original Equipment Manufacturers (OEMs) of heavy-duty commercial vehicles, including global giants producing Class 8 trucks, buses, and vocational vehicles. These OEMs integrate the control valves directly into their proprietary SCR systems during the assembly process, making them Tier 1 customers whose purchasing decisions are based on performance metrics, long-term supply reliability, and overall system cost effectiveness. Furthermore, manufacturers of diesel engines utilized in lighter commercial vehicles and premium diesel passenger vehicles also represent a significant and continuously demanding customer base, driven by high production volumes and strict noise, vibration, and harshness (NVH) requirements.

The second major customer group includes manufacturers and assemblers of Off-Highway equipment. This diverse sector encompasses construction equipment (excavators, loaders), agricultural machinery (tractors, combines), mining vehicles, and specialized forestry equipment. As emission regulations expand to cover these non-road mobile machinery sectors, the integration of high-durability SCR systems becomes mandatory, requiring rugged, reliable control valves capable of operating under extreme environmental conditions (dust, shock, wide temperature variations). The procurement focus here is often on robust construction and extended maintenance intervals, valuing longevity over potential marginal cost savings, differentiating their needs from those of on-highway vehicle manufacturers.

Finally, the Aftermarket segment represents a crucial customer base, primarily consisting of fleet operators, independent repair shops, and authorized dealer service centers globally. These buyers purchase replacement urea control valves required for routine maintenance, repair, and failure remediation in vehicles already in operation. For fleet operators, minimizing vehicle downtime is paramount, meaning quick access to reliable, cost-effective aftermarket parts is essential. The demand in this segment is less sensitive to new vehicle production cycles and more sensitive to the existing population of diesel vehicles equipped with SCR technology, providing a stable, long-term revenue stream for manufacturers able to effectively manage global distribution and inventory.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $450 Million USD |

| Market Forecast in 2033 | $710 Million USD |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bosch, Continental AG, Delphi Technologies (BorgWarner), Cummins Emission Solutions, Weifu Group, Tenneco Inc., Denso Corporation, Faurecia (FORVIA), Vitesco Technologies, Stanadyne LLC, Hitachi Astemo, MAHLE GmbH, Schaeffler Group, Kolbenschmidt Pierburg (Rheinmetall Automotive), Magneti Marelli (Marelli), S&S Diesel Motorsport, Woodward, Inc., Parker Hannifin, Hilite International, PurePower Technologies |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Urea Control Valve Market Key Technology Landscape

The technology landscape for Urea Control Valves is characterized by continuous innovation aimed at solving the primary operational challenges posed by Diesel Exhaust Fluid (DEF) and meeting increasingly tighter dosing precision requirements. A central technological focus revolves around materials science, specifically developing advanced ceramic and polymer coatings for internal components and sealing elements. These materials enhance chemical compatibility with the urea solution, crucial for preventing degradation and extending service life. Furthermore, integrated heating elements and sophisticated thermal management systems are critical innovations, preventing DEF crystallization, which typically occurs at low ambient temperatures, thereby ensuring reliable system startup and operation in cold climates. The move towards highly modular dosing units that combine the valve, pump, and filter into a single, compact assembly is also a notable trend, simplifying installation and maintenance for OEMs.

Actuation technology represents a significant differentiator within the market. Solenoid valves, while mature, are continually being optimized with faster switching times and lower energy consumption through improved electromagnetic design and materials. The emerging high-performance alternative is Piezoelectric technology. Piezoelectric valves offer unparalleled precision and response speeds, critical for meeting the demanding transient response requirements of modern engine cycles, especially under complex driving conditions or sudden load changes. Although more expensive, their enhanced control capability supports optimized fuel efficiency and reduced total DEF consumption, making them increasingly attractive for premium, high-output diesel applications where performance margins are narrow.

Connectivity and intelligence form the third major technological pillar. Modern control valves are increasingly integrated with sophisticated Electronic Control Units (ECUs) and utilize advanced diagnostic capabilities. This includes onboard microprocessors that monitor dosing feedback, ambient conditions, and sensor inputs to perform self-correction and fault reporting. Furthermore, the integration of sensor technology, such as ultrasonic sensors for detecting crystallization or monitoring nozzle integrity, ensures proactive maintenance alerts. Future developments are heavily focused on leveraging Machine Learning (ML) and AI within the ECU to refine dosing maps in real-time, optimizing the SCR system's performance adaptively over the vehicle's lifespan, thereby making the entire emission control system smarter and more compliant with evolving AEO standards.

Regional Highlights

- North America (USA, Canada, Mexico): North America remains a highly mature and lucrative market, driven primarily by the strict EPA 2010 and subsequent regulations targeting heavy-duty trucks and off-highway equipment. The region is characterized by high demand for rugged, high-performance valves capable of withstanding extreme temperature variations. Replacement demand in the aftermarket, supported by large commercial truck fleets, contributes significantly to market volume. Technological adoption is high, favoring sophisticated dosing systems and durable components to minimize downtime.

- Europe (Germany, France, UK, Italy, Spain): Europe is a technology leader, largely governed by Euro VI and the upcoming Euro VII standards, which necessitate exceptionally precise dosing mechanisms to meet stringent NOx and particle number limits. The region shows strong demand for Piezoelectric valves in premium passenger cars and heavy-duty Euro VI trucks. Government initiatives promoting cleaner transportation and strict enforcement mechanisms ensure continuous, high-value demand, focusing on efficiency and system integration within compact vehicle architectures.

- Asia Pacific (China, India, Japan, South Korea): APAC is the fastest-growing market, primarily catalyzed by the rapid implementation of stringent norms like China VI and India's Bharat Stage VI (BS VI) across massive commercial and passenger vehicle segments. China's shift towards cleaner diesel technology, coupled with its huge manufacturing capacity, dominates the regional market volume. India's burgeoning automotive sector also presents significant opportunities. The demand here is often bifurcated, seeking cost-effective, high-volume solutions while also driving localized manufacturing and supply chain development.

- Latin America (Brazil, Argentina): This region is characterized by phased regulatory adoption, with countries like Brazil moving towards stricter equivalents of Euro V/VI standards (e.g., PROCONVE P-8). The market growth is accelerating but remains constrained by economic volatility and slower fleet renewal rates compared to developed regions. Demand is focused on robust, proven valve designs suitable for sometimes challenging fuel quality and varied operational terrains.

- Middle East and Africa (MEA): The MEA region is currently driven by specific industrial and mining projects, and localized implementation of emission standards, particularly in large commercial centers or countries with significant oil and gas activity. The market is smaller but expanding, with demand concentrated on highly durable valves that can withstand extremely high ambient temperatures and dusty conditions. Aftermarket demand linked to imported vehicles and construction machinery is a primary sales driver.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Urea Control Valve Market.- Bosch

- Continental AG

- Delphi Technologies (BorgWarner)

- Cummins Emission Solutions

- Weifu Group

- Tenneco Inc.

- Denso Corporation

- Faurecia (FORVIA)

- Vitesco Technologies

- Stanadyne LLC

- Hitachi Astemo

- MAHLE GmbH

- Schaeffler Group

- Kolbenschmidt Pierburg (Rheinmetall Automotive)

- Magneti Marelli (Marelli)

- S&S Diesel Motorsport

- Woodward, Inc.

- Parker Hannifin

- Hilite International

- PurePower Technologies

Frequently Asked Questions

What is the primary function of a Urea Control Valve in modern diesel engines?

The primary function is the precise metering and injection of Diesel Exhaust Fluid (DEF), which is an aqueous urea solution, into the exhaust stream. This injection is a critical step in the Selective Catalytic Reduction (SCR) process, ensuring efficient conversion of harmful Nitrogen Oxides (NOx) into harmless nitrogen and water vapor, thereby ensuring compliance with global emission standards like Euro VI and EPA Tier 4 Final.

How do regulatory standards like Euro VII influence the demand for these valves?

Increasingly stringent regulatory standards, such as the proposed Euro VII, necessitate control valves with higher precision and faster response times. These regulations drive demand for advanced technologies, particularly Piezoelectric valves and highly integrated smart dosing units, capable of maintaining low NOx emissions even under highly dynamic engine operating conditions, thus accelerating technological innovation and adoption.

What technological advancements are mitigating the risk of DEF crystallization?

Key technological advancements include the integration of sophisticated electrical heating elements within the valve body and nozzle assembly, coupled with advanced thermal management protocols controlled by the ECU. These systems are designed to rapidly heat the DEF during cold startups and prevent residual urea from solidifying within the valve or nozzle when the engine is shut down, enhancing system reliability and reducing maintenance requirements.

Which regional market is exhibiting the fastest growth in the Urea Control Valve sector?

The Asia Pacific (APAC) region, specifically China and India, is experiencing the fastest market growth. This rapid expansion is driven by the swift and widespread implementation of stringent localized emission norms, such as China VI and BS VI, across vast fleets of commercial vehicles, creating massive demand for new SCR systems and associated control valve components.

What are the main advantages of Piezoelectric control valves over traditional Solenoid valves?

Piezoelectric control valves offer significantly faster switching times and higher dosing precision compared to traditional Solenoid valves. This superior performance allows for more accurate adjustments to DEF injection in response to rapid changes in engine load and temperature, leading to optimized NOx reduction efficiency and reduced DEF consumption, particularly beneficial for compliance in high-performance applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager