Urethral Stricture Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440935 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Urethral Stricture Market Size

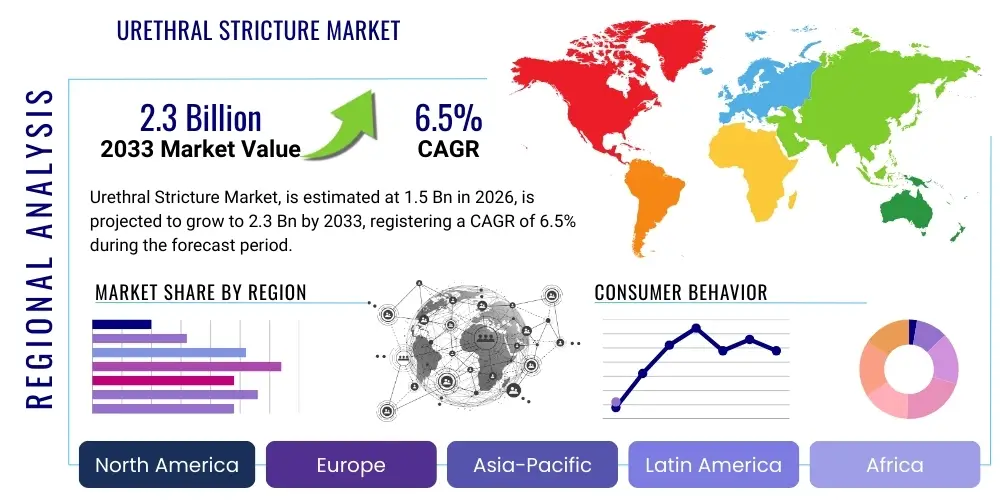

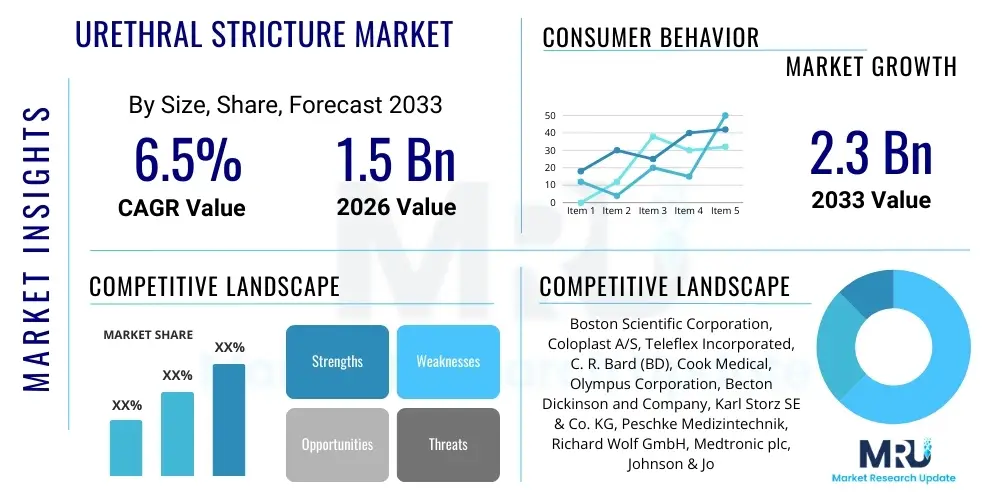

The Urethral Stricture Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.3 Billion by the end of the forecast period in 2033.

Urethral Stricture Market introduction

The Urethral Stricture Market encompasses diagnostic tools, treatment devices, and surgical procedures aimed at resolving the narrowing of the urethra, a condition predominantly caused by inflammation, injury, or infection. This narrowing obstructs the flow of urine, leading to significant morbidity, including urinary tract infections, chronic pain, and potentially kidney damage. The necessity for effective, durable, and minimally invasive treatment options is the core driver defining this market landscape. Key products range from temporary solutions like urethral dilation balloons and catheters to permanent implants such as stents, and complex surgical interventions like urethroplasty, which remains the gold standard for long-term correction.

The primary applications of market technologies revolve around diagnosis (using cystoscopy or urethrography) and subsequent therapeutic intervention. The rising global prevalence of chronic diseases such as diabetes, which increases susceptibility to urinary tract infections (a common precursor to strictures), coupled with an aging global population more prone to benign prostatic hyperplasia (BPH) and associated iatrogenic injuries during procedures, significantly boosts market demand. Furthermore, growing patient awareness regarding the complications associated with untreated strictures encourages earlier diagnosis and intervention, thereby contributing positively to market expansion across all major geographic regions, especially in developed healthcare systems emphasizing specialized urological care.

Key benefits derived from effective urethral stricture treatment include improved quality of life for patients by restoring normal voiding function, reducing the risk of life-threatening infections, and minimizing the need for repetitive, palliative interventions. Driving factors for market growth are heavily influenced by continuous technological advancements, particularly in bioabsorbable materials for stents and improved surgical visualization tools, which aim to reduce recurrence rates and post-operative complications. The shift toward specialized ambulatory surgical centers (ASCs) for routine procedures also enhances accessibility and potentially reduces overall healthcare costs associated with the management of this chronic urological condition.

Urethral Stricture Market Executive Summary

The Urethral Stricture Market is characterized by robust growth fueled primarily by demographic shifts, specifically the aging population, and continuous innovation in treatment modalities. Business trends indicate a strong preference among urologists for techniques promising lower recurrence rates, leading to increased adoption of complex procedures like urethroplasty and the development of drug-eluting biodegradable stents. Strategic mergers, acquisitions, and partnerships focusing on integrating surgical tools with advanced imaging and navigation systems are defining the competitive landscape. Companies are heavily investing in clinical trials to validate the long-term efficacy of novel minimally invasive approaches, positioning innovation as the primary competitive differentiator in the therapeutic space.

Regionally, North America maintains market dominance due to high healthcare expenditure, sophisticated infrastructure, and rapid adoption of advanced surgical techniques. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth trajectory, driven by improving healthcare access, increasing disposable income in emerging economies, and the large patient pool demanding better medical solutions. Regulatory harmonization and favorable reimbursement policies in key European nations also contribute significantly to steady growth. The trend across all regions is a movement away from traditional, less effective methods like simple dilation toward more definitive treatments, responding to clinical data that highlights the economic and patient burden of stricture recurrence.

Segment trends reveal that the Product segment is dominated by the Catheters and Dilators categories, mainly due to their necessity in initial diagnosis and temporary management, although the Stent segment is growing rapidly, propelled by advancements in materials science offering improved biocompatibility and longevity. Procedure-wise, urethroplasty holds significant value share due to its high success rates, yet endoscopic procedures like direct visual internal urethrotomy (DVIU) remain commonly performed due to their minimally invasive nature and suitability for primary or short strictures. End-user analysis highlights Hospitals as the largest revenue generators, yet Ambulatory Surgical Centers (ASCs) are quickly gaining traction as preferred sites for elective and less complicated procedures, necessitating changes in distribution and service provision strategies among market players.

AI Impact Analysis on Urethral Stricture Market

User queries regarding the intersection of Artificial Intelligence (AI) and the Urethral Stricture Market overwhelmingly focus on diagnostic accuracy, personalized surgical planning, and post-operative monitoring effectiveness. Users seek to understand how AI algorithms can enhance the interpretation of complex imaging data, such as retrograde urethrograms and MRIs, to precisely localize stricture length and density, which is critical for successful surgical outcomes. Furthermore, there is strong interest in predictive models that can assess the risk of stricture recurrence based on patient comorbidities and treatment history, allowing urologists to tailor procedures (e.g., choosing between endoscopic repair and open urethroplasty) with greater certainty. The overall expectation is that AI will streamline clinical workflows, reduce diagnostic subjectivity, and improve the durability of therapeutic interventions, transforming the patient care pathway from initial assessment to long-term follow-up.

The integration of AI extends significantly into procedural aspects, particularly in robotic and navigated surgery platforms increasingly used for complex urethral reconstructions. AI-driven systems are expected to provide real-time guidance, optimize microsurgical movements, and enhance the dexterity of surgeons, potentially expanding the pool of surgeons capable of performing specialized urethroplasty procedures reliably. For example, machine learning models could analyze historical surgical video data to provide intraoperative feedback on tissue handling and suture placement, thereby standardizing surgical quality. This level of precision is paramount in urology, where minute anatomical details dictate success, and the deployment of AI serves as a powerful tool for surgical education and quality assurance across global health systems facing varying levels of expertise.

Beyond the operating room, AI plays a crucial role in operational efficiency and patient management. Users are concerned with how AI can manage large datasets generated during follow-up, tracking symptoms, flow rates, and quality-of-life metrics to detect early signs of restenosis, allowing for timely, less invasive secondary intervention. Additionally, the administrative burden associated with managing chronic conditions like urethral stricture could be alleviated through AI-powered predictive analytics for resource allocation, appointment scheduling, and inventory management for specialized medical devices, ensuring that high-demand products like complex catheters and stents are readily available across hospital networks. This holistic impact positions AI not just as a clinical tool, but as an infrastructure enhancement within the market ecosystem.

- Enhanced Diagnostic Precision: AI algorithms improve the interpretation of urethrograms and ultrasound images for accurate stricture length and location assessment.

- Personalized Treatment Planning: Machine learning models predict recurrence risk, aiding urologists in selecting the optimal procedure (e.g., DVIU vs. Urethroplasty).

- Surgical Robotics Integration: AI provides real-time navigational assistance during complex urethral reconstruction, improving surgical accuracy and reducing operative time.

- Predictive Monitoring Systems: Utilizing patient-reported outcomes and flowmetry data to proactively identify early signs of stricture recurrence post-surgery.

- Optimized Resource Management: AI assists healthcare providers in managing inventory for specialized devices and optimizing scheduling for operating rooms dedicated to urological procedures.

DRO & Impact Forces Of Urethral Stricture Market

The Urethral Stricture Market's dynamics are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), all subject to significant Impact Forces stemming from public health trends, regulatory environments, and technological evolution. Key Drivers include the substantial increase in the aging demographic globally, as older populations have higher incidences of conditions necessitating catheterization and subsequent risk of stricture development, alongside the rising prevalence of diabetes and sexually transmitted infections (STIs) contributing to chronic inflammation and scarring of the urethra. Furthermore, continuous product innovation, particularly the introduction of drug-eluting balloons and stents designed to inhibit scar tissue formation, significantly enhances treatment appeal, pushing clinicians and patients toward adopting newer, often premium-priced, technologies, thereby expanding market value and procedure volume globally.

Conversely, significant Restraints challenge rapid market expansion. High procedural costs, especially associated with complex urethroplasty and premium specialized devices, often limit access in low- and middle-income countries, where healthcare infrastructure and reimbursement policies are inadequate. The pervasive issue of stricture recurrence—even after definitive treatment—deters patient compliance and increases the lifetime economic burden of the condition, prompting continuous clinical skepticism regarding the long-term effectiveness of certain minimally invasive devices like plain stents or repeat internal urethrotomies. Moreover, the need for specialized surgical expertise and extensive training required for complex reconstructive surgeries, such as buccal mucosa graft urethroplasty, creates a bottleneck in healthcare delivery, particularly in rural or underserviced regions globally.

Opportunities for growth are abundant, primarily centered on technological disruption and geographic expansion. The development of next-generation bioabsorbable and drug-eluting materials represents a major opportunity, aiming to overcome the high recurrence rates associated with current devices by providing therapeutic delivery and temporary scaffolding before naturally dissolving, reducing the need for device retrieval. Geographic Opportunities exist in penetrating lucrative, high-growth markets across APAC and Latin America, driven by increasing healthcare awareness, improving access, and expanding private insurance coverage. Furthermore, optimizing diagnostic pathways through non-invasive imaging techniques could lead to earlier intervention, shifting the treatment paradigm toward less complex, and thus more accessible, procedures. Impact forces such as changing regulatory standards, reimbursement reforms favoring high-value, durable treatments, and increasing scrutiny of patient outcomes significantly influence manufacturer behavior and clinical adoption rates, dictating which technologies gain traction.

Segmentation Analysis

The Urethral Stricture Market is segmented primarily based on Product Type, Procedure, and End-User, reflecting the diverse approaches utilized in managing this complex condition. This segmentation provides a granular view of market dynamics, revealing where investment is concentrated and where clinical preferences are shifting. The core product categories—catheters, stents, and dilators—serve distinct roles, from immediate urinary drainage and temporary intervention to long-term reconstruction. Procedures range from highly invasive surgical reconstruction to simple, quick endoscopic treatments. Understanding these distinct segments is crucial for stakeholders to tailor their product development, marketing, and distribution strategies to meet the specific needs of urologists and healthcare institutions worldwide, ensuring optimal market penetration and strategic resource allocation across different global healthcare settings.

Analyzing the segmentation by Procedure is essential, as the choice of intervention is heavily dependent on the stricture’s length, location, etiology, and patient comorbidities. While endoscopic treatments (like Dilation and Internal Urethrotomy) dominate in volume due to their speed and minimally invasive nature, Urethroplasty holds the highest revenue per procedure, representing the high-value, definitive treatment segment. The continuous clinical debate regarding the long-term success rates of various procedures drives innovation and shapes market share. For instance, growing evidence favoring urethroplasty success pushes device manufacturers to develop better surgical instruments and grafts, while high rates of repeat procedures for less invasive methods sustain the demand for disposable dilation kits and specialized catheters, ensuring market stability across all segments.

The End-User segment delineation between Hospitals and Ambulatory Surgical Centers (ASCs) highlights the trend toward decentralized and cost-effective care delivery. Hospitals, particularly large university or specialized urology centers, remain crucial for complex, inpatient procedures like multi-stage urethroplasty, demanding specialized capital equipment and extensive medical consumables. However, ASCs are becoming increasingly relevant for routine outpatient procedures such as dilation or DVIU, capitalizing on lower operational costs and enhanced patient convenience. This shift necessitates that device manufacturers adapt their sales strategies to serve both high-volume hospital purchasing groups and smaller, rapidly growing ASC networks, focusing on disposable, high-turnover products suitable for streamlined outpatient settings. The segmentation structure reflects the market's response to both clinical necessity and economic pressures within global healthcare systems.

- Product Type

- Urethral Catheters

- Urethral Stents (Metal, Polymer, Biodegradable, Drug-Eluting)

- Urethral Dilators and Balloon Systems

- Guidewires and Accessories

- Procedure

- Endoscopic Procedures (Dilation, Direct Visual Internal Urethrotomy - DVIU)

- Open Reconstructive Surgery (Urethroplasty - Excision and Primary Anastomosis, Substitution Urethroplasty using Grafts)

- End-User

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Specialty Clinics

- Stricture Location

- Anterior Urethra (Bulbar, Penile)

- Posterior Urethra (Membranous, Prostatic)

Value Chain Analysis For Urethral Stricture Market

The Value Chain for the Urethral Stricture Market begins with sophisticated upstream activities involving raw material procurement, focusing heavily on specialized, medical-grade materials such as biocompatible polymers, specialized metals (e.g., Nitinol for stents), and advanced bioabsorbable compounds. Research and Development (R&D) activities constitute a crucial upstream component, driving innovation in device design, particularly in enhancing device flexibility, reducing tissue reaction, and improving drug-eluting capabilities to prevent restenosis. Strategic partnerships with specialized material science companies and universities are essential at this stage to maintain a technological edge and ensure compliance with stringent biocompatibility and regulatory standards across international markets. Effective control over this initial phase directly influences the cost structure and the final quality profile of the therapeutic devices introduced downstream.

The midstream and downstream components focus on manufacturing, assembly, distribution, and end-user deployment. Manufacturing involves precise processes for sterilization, packaging, and quality control, typically adhering to ISO 13485 standards. Distribution channels are highly critical due to the specialized nature of the products, often requiring direct sales teams or highly specialized third-party medical distributors. These channels ensure products reach major hospitals and specialized urology centers promptly. The distribution model typically includes both direct and indirect sales approaches; large multinational corporations often use a direct approach in core markets (North America, Western Europe) to maintain margin and control product messaging, while relying on indirect distributors for market penetration in geographically diverse or highly regulated emerging economies. Training and technical support for end-users (urologists and operating room staff) are integrated into the downstream segment, driving optimal usage and promoting device longevity.

Upstream analysis reveals that supply chain vulnerabilities, particularly those related to scarce medical-grade polymers or specialized graft materials (like buccal mucosa acquisition protocol training), can impact manufacturing capacity and cost, making secure sourcing a priority for major players. Downstream analysis highlights the critical role of surgical training centers and clinical workshops in driving product adoption. Effective distribution channels are characterized by deep relationships with key opinion leaders and hospital purchasing networks. The market utilizes both direct sales for capital equipment and highly specialized devices (like complex urethroplasty sets) and indirect sales through large medical supply distributors for high-volume consumables (like standard catheters and dilation kits), optimizing outreach while managing logistical complexity efficiently across global regions with varying regulatory approval timelines and distribution requirements.

Urethral Stricture Market Potential Customers

The primary customers and end-users of products and services within the Urethral Stricture Market are specialized healthcare providers and medical institutions that manage and treat urological disorders. These entities include general hospitals, specialized urology clinics, and increasingly, ambulatory surgical centers (ASCs). Hospitals serve as the largest volume purchasers, particularly those with dedicated urology departments, residency programs, and facilities for complex reconstructive surgery. These institutions require a full spectrum of products, from diagnostic imaging supplies and basic consumables (catheters) to high-cost, single-use surgical kits and advanced capital equipment for robotic or laparoscopic-assisted urethroplasty, making them comprehensive targets for manufacturers.

Ambulatory Surgical Centers (ASCs) represent a high-growth customer segment, focusing primarily on less complex, outpatient procedures such as urethral dilation or direct visual internal urethrotomy (DVIU). ASCs prioritize cost-efficiency, reliability, and ease of use, making them ideal targets for manufacturers specializing in disposable endoscopic devices, high-efficiency dilation systems, and standardized procedural trays. Their purchasing decisions are often driven by value analysis committees focused on optimizing patient throughput and minimizing procedure-related costs, demanding a different sales strategy compared to large academic medical centers focused primarily on clinical outcomes and research integration.

Furthermore, independent urologists and group practices that perform office-based procedures constitute another important customer base, particularly for diagnostic tools, small-scale dilation kits, and intermittent catheter supplies required for long-term patient management. Government healthcare systems and national procurement agencies (especially in countries with centralized health services like the UK’s NHS or specific European systems) also function as massive, price-sensitive customers, demanding tenders for high-volume consumables. The potential customer base is highly diverse, ranging from large-scale public health infrastructure requiring cost-effective, high-volume products to elite private specialty clinics demanding the absolute latest, premium-priced technological innovations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.3 Billion |

| Growth Rate | CAGR 6.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Boston Scientific Corporation, Coloplast A/S, Teleflex Incorporated, C. R. Bard (BD), Cook Medical, Olympus Corporation, Becton Dickinson and Company, Karl Storz SE & Co. KG, Peschke Medizintechnik, Richard Wolf GmbH, Medtronic plc, Johnson & Johnson (Ethicon), ConMed Corporation, UroGPO, ROCAMED, NeoTract (Acquired by Teleflex) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Urethral Stricture Market Key Technology Landscape

The technology landscape of the Urethral Stricture Market is rapidly evolving, driven by the imperative to minimize recurrence rates, reduce invasiveness, and improve patient recovery times. A cornerstone of modern treatment is the development of advanced biomaterials, particularly in the stent segment. Current technological advancements focus on creating fully biodegradable or bioabsorbable stents made from specialized polymers that provide temporary mechanical support and drug delivery before safely dissolving, eliminating the long-term complication risks associated with permanent implants, such as chronic pain or encrustation. Furthermore, the integration of drug-eluting technology, specifically applying anti-proliferative agents like Paclitaxel onto balloons or stents, is a significant technical advancement aimed at actively inhibiting the fibrotic healing response that causes stricture recurrence, moving treatment beyond purely mechanical solutions toward therapeutic intervention.

In the surgical domain, visualization and navigation technologies are critical to enhancing the efficacy of both endoscopic and open procedures. High-definition flexible and rigid cystoscopes, featuring narrow-band imaging or confocal microscopy, provide urologists with superior intraoperative visualization, allowing for precise identification of stricture margins and surrounding healthy tissue, which is crucial for optimal surgical planning and excision. Additionally, the increasing adoption of robotic surgical platforms for complex posterior urethral strictures enables high-precision microsurgery, offering benefits such as enhanced dexterity, stable magnification, and reduced surgeon fatigue during lengthy reconstructive procedures. These robotic systems are increasingly coupled with advanced imaging software to create detailed 3D maps of the urethra, further personalizing the surgical approach based on individual anatomy.

The technological shift also includes non-invasive or minimally invasive diagnostic aids. While traditional retrograde urethrograms remain standard, high-frequency urethral ultrasound is gaining traction for its ability to provide real-time, cross-sectional views of the stricture, helping determine the degree of surrounding spongiofibrosis—a key predictor of treatment success. This technological refinement in diagnostics ensures that patients are stratified correctly for the most appropriate intervention, preventing unnecessary or suboptimal procedures. The focus across all technology streams—from materials science in devices to complex surgical robotics—is convergence: blending precision hardware with predictive software and therapeutic chemistry to create integrated, highly effective, and patient-centric treatment solutions that maximize the probability of a permanent cure, thus redefining the standard of care globally within this specialized segment of urology.

Regional Highlights

- North America: North America, comprising the United States and Canada, currently holds the largest share of the Urethral Stricture Market revenue. This dominance is attributed to several critical factors, including high healthcare spending, highly developed medical infrastructure, and widespread adoption of advanced surgical techniques, particularly complex urethroplasty and robotic assistance. Favorable reimbursement scenarios for specialized urological procedures and the presence of major device manufacturers drive substantial market growth. The region benefits from high patient awareness and a greater propensity for early diagnosis and treatment of urological conditions. Furthermore, the prevalence of associated risk factors, such as high rates of diabetes and cardiovascular interventions leading to increased catheter use, contributes significantly to the persistent demand for stricture management devices and procedures, solidifying its leading position. The emphasis on high-quality, durable outcomes favors premium-priced technologies, creating a lucrative environment for innovation.

- Europe: Europe represents a mature market characterized by robust public healthcare systems and strong regulatory frameworks (e.g., MDR compliance). Western European countries like Germany, the UK, and France are significant contributors due to established medical device markets and high levels of specialized urological expertise. Market growth in Europe is driven by standardization of surgical protocols and continuous investment in endoscopic and minimally invasive technologies. However, variations in reimbursement policies across different national health systems can influence procedure choice, often favoring cost-effective endoscopic management over high-cost urethroplasty, particularly in publicly funded settings. Eastern European countries present growing potential as healthcare infrastructure improves and adoption of advanced Western technologies increases, creating pockets of expansion opportunity focused on establishing clinical training programs for specialized procedures.

- Asia Pacific (APAC): The APAC region is forecast to be the fastest-growing market during the forecast period. This rapid expansion is primarily fueled by the region's massive and aging population, increasing disposable income, and continuous improvement in healthcare access, particularly in densely populated economies such as China, India, and South Korea. While the prevalence of strictures is high due to untreated infections and trauma, historical access to advanced care has been limited. The ongoing construction of specialized hospitals, increasing health insurance coverage, and government initiatives aimed at improving chronic disease management are rapidly accelerating the adoption of Western-standard treatment devices and procedures, creating substantial unmet demand. Manufacturers are focusing strategic efforts on localized product development and establishing strong distribution networks in this highly fragmented yet rapidly unifying market.

- Latin America (LATAM): The LATAM market is growing steadily, primarily concentrated in major economies such as Brazil, Mexico, and Argentina. Growth drivers include increasing awareness of urological health and gradual improvements in healthcare funding. However, the market faces challenges related to economic volatility, fragmented healthcare systems, and reliance on imported medical devices, which are often subject to high tariffs and complex import regulations. Market penetration strategies in LATAM often focus on value-based offerings and educational outreach to urologists to standardize treatment protocols, focusing initially on essential product categories like catheters and standard dilation kits before introducing high-end surgical robotics or complex stent technologies.

- Middle East and Africa (MEA): The MEA region exhibits heterogeneous market growth. The Gulf Cooperation Council (GCC) countries (UAE, Saudi Arabia, Qatar) show strong growth driven by high per capita healthcare spending, significant investment in medical tourism, and a preference for highly advanced medical technologies, often adopting Western standards rapidly. Conversely, countries in Africa face significant infrastructural and economic barriers. Stricture treatment in this segment is often focused on managing infectious etiologies with essential medical devices. The regional growth is heavily dependent on government-led healthcare reforms and international aid aimed at improving essential urological care infrastructure and establishing basic surgical capacity across underserved demographics, making it a highly opportunity-driven market contingent on policy changes.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Urethral Stricture Market.- Boston Scientific Corporation

- Coloplast A/S

- Teleflex Incorporated

- C. R. Bard (Acquired by Becton Dickinson)

- Cook Medical

- Olympus Corporation

- Becton Dickinson and Company (BD)

- Karl Storz SE & Co. KG

- Peschke Medizintechnik GmbH

- Richard Wolf GmbH

- Medtronic plc

- Johnson & Johnson (Ethicon)

- ConMed Corporation

- UroGPO

- ROCAMED

- NeoTract (Acquired by Teleflex)

- Stryker Corporation

- Angiomed GmbH & Co. Medizintechnik KG

- EDAP TMS SA

- Lumenis Ltd.

Frequently Asked Questions

Analyze common user questions about the Urethral Stricture market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the most effective long-term treatment for urethral strictures?

The most effective long-term treatment for complex or recurrent urethral strictures is generally considered to be Open Reconstructive Surgery, specifically urethroplasty. Urethroplasty procedures, which often involve excision and primary anastomosis or substitution using tissue grafts (like buccal mucosa), offer the highest success rates (typically 85-95%) and the lowest recurrence rates, positioning it as the gold standard for durable correction, superior to repeated endoscopic interventions.

How are new drug-eluting technologies impacting urethral stricture treatment?

Drug-eluting technologies, such as Paclitaxel-coated balloons or stents, are significantly impacting treatment by actively preventing restenosis. These devices locally deliver anti-proliferative medications to the urethral tissue following dilation or urethrotomy, inhibiting the formation of scar tissue (spongiofibrosis), thereby improving long-term patency and reducing the high recurrence rates traditionally associated with purely mechanical dilation methods.

Which product segment holds the highest growth potential in the Urethral Stricture Market?

The Urethral Stent segment, particularly the sub-segment focused on biodegradable and drug-eluting stents, is projected to hold the highest growth potential. This growth is driven by intense R&D aimed at developing temporary implants that provide therapeutic benefits without requiring subsequent removal procedures, aligning with the market's demand for minimally invasive solutions with improved efficacy and reduced patient burden.

What are the key drivers for market growth in the Asia Pacific region?

Key growth drivers in the Asia Pacific (APAC) region include the large and aging patient population, increasing prevalence of diabetes and urological infections, rapidly improving healthcare infrastructure and accessibility in key economies (China, India), and expanding medical insurance coverage, all of which contribute to rising diagnosis rates and demand for advanced Western-standard treatment devices.

What role does Artificial Intelligence (AI) play in diagnosing urethral strictures?

AI primarily enhances the accuracy of diagnostic imaging by utilizing machine learning algorithms to analyze complex radiologic studies, such as urethrograms and ultrasounds. This integration allows for more precise measurement of stricture length, caliber, and associated spongiofibrosis, providing surgeons with critical pre-operative data necessary for tailored surgical planning and improved prediction of treatment outcomes.

The Urethral Stricture Market is projected to exhibit sustained growth throughout the forecast period, driven by persistent demographic pressures and continuous technological innovation focusing on minimizing recurrence and enhancing procedural efficacy. Manufacturers are increasingly prioritizing the development of sophisticated biomaterials and integrating advanced visualization technologies to support definitive surgical treatments. The competitive landscape is characterized by strategic acquisitions aimed at consolidating market share and achieving scale, especially in the high-value stent and surgical reconstruction segments, while simultaneously focusing on cost-effective solutions for the expansive emerging markets. Regulatory approval pathways, particularly in developed regions like North America and Europe, remain a crucial determinant of market access for novel devices. The convergence of AI for precision diagnostics and advanced surgical robotics for reconstruction is set to redefine clinical standards, emphasizing personalized medicine and durable patient outcomes as central tenets of future market development. This specialized market requires deep clinical understanding, robust R&D pipelines, and sophisticated distribution networks to successfully navigate the complexities of global urological care provision.

Future market expansion will be significantly influenced by efforts to address the substantial clinical challenge of stricture recurrence. This includes intensified research into biological treatments, such as cell therapy or targeted drug delivery systems that modulate scar tissue formation at a molecular level, potentially complementing or even replacing current mechanical and surgical methods. Furthermore, the role of Ambulatory Surgical Centers (ASCs) is expected to grow, requiring manufacturers to adapt their product portfolios to high-volume, cost-sensitive settings without compromising quality. Success in this evolving market hinges on balancing the introduction of premium, high-efficacy technologies for complex cases with the provision of reliable, affordable consumables essential for routine management across diverse global economic settings. Stakeholders must maintain agility in their strategic planning to capitalize on both established procedure types and disruptive innovations.

The segmentation analysis confirms that while less invasive procedures account for a high volume of treatments globally, the highest revenue concentration resides in the definitive treatment segment, reflecting the high economic value placed on curing the stricture rather than managing recurrence. Regional growth dynamics necessitate distinct strategies; market leaders must leverage their established relationships and robust clinical evidence in North America and Europe while simultaneously building localized manufacturing and clinical training capacity in high-growth regions like APAC. Overall, the market remains robust, supported by inescapable epidemiological trends and a strong clinical mandate for treatments that offer long-term relief and significantly improve the quality of life for patients suffering from this challenging chronic condition, sustaining a positive outlook for investments in both diagnostic and therapeutic platforms.

Continuous monitoring of competitive maneuvers, including patent filings for novel stent designs and regulatory clearances for advanced robotic systems, will be essential for identifying future market leaders. The interplay between regulatory bodies and technology developers is becoming increasingly collaborative, aiming to accelerate the introduction of breakthrough devices that demonstrably reduce the burden of urethral stricture disease. Ultimately, the market trajectory is firmly focused on moving beyond traditional palliative care toward reconstructive and preventative therapeutic strategies, offering fertile ground for both established industry giants and specialized clinical technology startups seeking to address critical unmet needs in urology.

The increasing emphasis on value-based care models, particularly in the United States and parts of Europe, further strengthens the position of procedures like urethroplasty, which, despite higher initial costs, demonstrate superior long-term cost-effectiveness compared to repeated endoscopic failures. This economic pressure favors companies that can provide integrated solutions—combining diagnostic tools, surgical consumables, and post-operative monitoring platforms—thus optimizing the entire care continuum for the patient. Therefore, companies investing in end-to-end management solutions will secure a competitive advantage over those focused solely on singular product offerings within the urethral stricture management sphere, underscoring the shift toward holistic patient pathway optimization.

Furthermore, advancements in personalized medicine are beginning to influence the urethral stricture market. Researchers are investigating genetic factors and biomarkers that could predict an individual's propensity for stricture formation or recurrence, opening avenues for targeted pharmacological interventions administered locally through specialized drug-eluting delivery systems. This personalized approach promises to refine treatment selection, moving away from a one-size-fits-all model toward interventions tailored to the specific pathophysiology of the individual patient's scar tissue response. This technological frontier represents a significant long-term opportunity, demanding substantial collaboration between pharmaceutical researchers, device manufacturers, and urological specialists to translate genomic and proteomic insights into clinically relevant and commercially viable products. The next decade is anticipated to witness the commercialization of these highly targeted therapeutic devices, profoundly altering the competitive dynamics based on clinical efficacy.

The impact of global healthcare digitalization, extending beyond AI, is also relevant. Telemedicine and remote monitoring systems facilitate better long-term follow-up for stricture patients, allowing urologists to track urinary flow rates and symptom scores remotely. This capability is vital for the early detection of restenosis, often before symptoms become severe, enabling timely, less invasive intervention and potentially avoiding complicated surgical failure. The adoption of connected devices and digital health platforms improves patient engagement and data collection reliability, creating valuable datasets for ongoing research and product improvement. Regulatory bodies are increasingly supportive of these digital health tools, recognizing their potential to improve post-operative care efficiency and patient outcomes, thereby driving investment in the technological infrastructure supporting remote stricture management.

In summary, the Urethral Stricture Market is driven by a complex mix of epidemiology, technological push, and economic incentives. Key players must continuously innovate in biomaterials and surgical robotics while simultaneously optimizing distribution and clinical training to penetrate high-growth emerging economies. The overarching goal remains the development of a definitive, minimally invasive treatment that eliminates the high recurrence rate that currently plagues this condition, driving market competition towards solutions that prioritize superior clinical durability and long-term patient satisfaction.

The influence of patient advocacy groups and increasing patient literacy regarding treatment options also acts as a subtle yet powerful market force. Patients are increasingly seeking information on the long-term success rates of different procedures, shifting demand away from quick-fix endoscopic procedures toward more durable, often surgical, solutions. This patient-driven preference reinforces the market strength of specialized surgical instruments and advanced reconstructive training programs. For market players, communicating transparently about clinical outcomes and establishing robust patient education materials are becoming integral components of their marketing and commercialization strategies, distinguishing brands based on clinical trustworthiness and demonstrated long-term success, especially when competing against lower-cost, high-recurrence alternatives. The demand for evidence-based practice is higher than ever, compelling manufacturers to invest heavily in multi-year, multi-center clinical trials to validate their claims against the established high standards of urethroplasty.

Finally, global healthcare crises, such as pandemics, have highlighted the need for resilient and flexible supply chains. The manufacturing and distribution of specialized medical devices, including urethral stents and surgical materials, rely heavily on globalized logistics. Future market resilience depends on diversifying manufacturing footprints and securing reliable sources for specialized raw materials (like bioresorbable polymers), minimizing potential disruption risks. Companies that successfully implement robust, localized supply chain strategies will be better positioned to serve regional market demands consistently, mitigating risks associated with international trade barriers and ensuring uninterrupted access to critical urological care devices, thereby maintaining market share stability even during periods of global economic or health volatility. This focus on operational resilience is becoming a non-negotiable factor for institutional procurement decisions globally.

The Urethral Stricture Market is thus moving towards a future defined by surgical precision, material science excellence, and digital integration. These technological pillars are expected to dramatically improve patient outcomes, reduce healthcare system burdens associated with repeat procedures, and sustain the market's trajectory towards the forecasted value of USD 2.3 Billion by 2033. Strategic positioning requires expertise in both high-end surgical device technology and high-volume consumable manufacturing, ensuring comprehensive coverage of the entire care spectrum, from initial diagnosis to complex reconstruction and long-term follow-up monitoring.

The evolving regulatory environment also introduces complexities and opportunities. The transition in Europe from the Medical Device Directive (MDD) to the Medical Device Regulation (MDR) has increased the stringency of clinical evidence required for market approval, particularly impacting novel and high-risk devices like certain bioabsorbable stents. This regulatory shift encourages greater investment in rigorous clinical trials, potentially weeding out less effective technologies and favoring manufacturers with established quality management systems and extensive clinical data. Companies that successfully navigate these heightened regulatory hurdles gain a significant competitive advantage, leveraging regulatory compliance as a mark of quality and clinical confidence, particularly when selling to risk-averse institutional buyers and public health systems that demand validated safety and efficacy profiles before making significant capital investment decisions.

Furthermore, the competitive dynamic is heavily influenced by intellectual property (IP) protection surrounding proprietary stent designs and drug-eluting coatings. Companies that hold strong patent portfolios in these high-value segments can command premium pricing and secure dominant market positions until patents expire, often engaging in fierce litigation to protect their technological lead. Continuous reinvestment in IP generation and defense is thus a core component of the business strategy for leading players, especially those focused on disruptive technologies intended to offer a permanent solution to the stricture recurrence problem. The battle for technological superiority, backed by robust IP, is central to shaping the market's future structure and profitability, making M&A activity focused on acquiring specialized IP and clinical expertise a persistent trend throughout the forecast period and beyond.

The market also faces inherent ethical considerations, particularly regarding the cost-effectiveness and accessibility of high-end reconstructive surgery versus simpler, less effective treatments. Ensuring that advanced technologies are not exclusive to developed economies or affluent patient segments is a critical societal challenge that influences public health policy and procurement decisions globally. Device manufacturers are increasingly under pressure to demonstrate the economic value proposition of their products—proving that higher initial costs translate into substantial long-term savings by preventing repeated hospital visits and secondary procedures. This necessity to articulate clear value beyond clinical efficacy ensures that sustainability and global accessibility remain significant, if sometimes conflicting, forces shaping long-term market strategy and product affordability across different socioeconomic landscapes.

In conclusion, the Urethral Stricture Market demands a nuanced understanding of clinical needs, technological potential, and global economic realities. The drive towards durable, definitive solutions continues to accelerate, propelled by an aging population and advancements in personalized medicine and surgical technology. The successful market participant will be one that skillfully integrates innovation (e.g., drug-eluting biomaterials, AI-assisted robotics) with effective commercial strategies tailored to both high-reimbursement regions and rapidly expanding emerging markets, ultimately delivering enhanced clinical outcomes and operational efficiency across the entirety of the urological healthcare spectrum.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager