Uroflowmetry System Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443146 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Uroflowmetry System Market Size

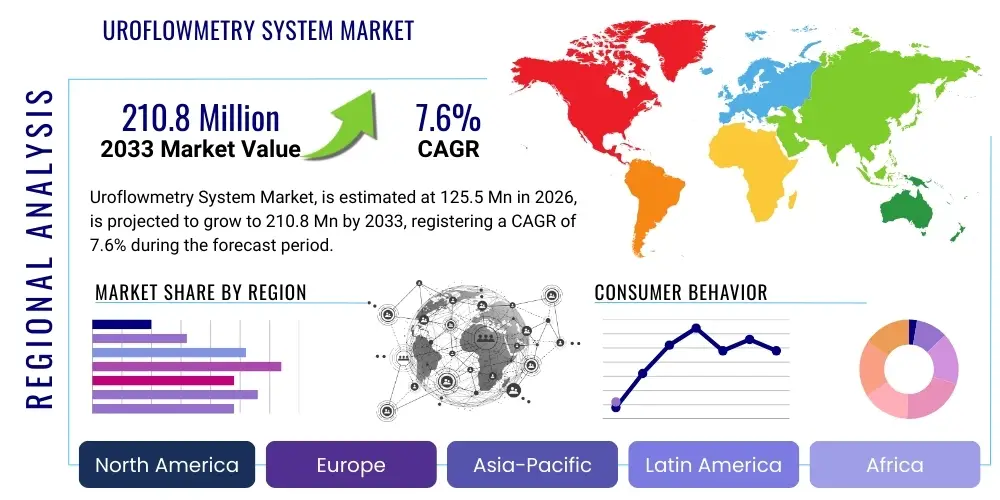

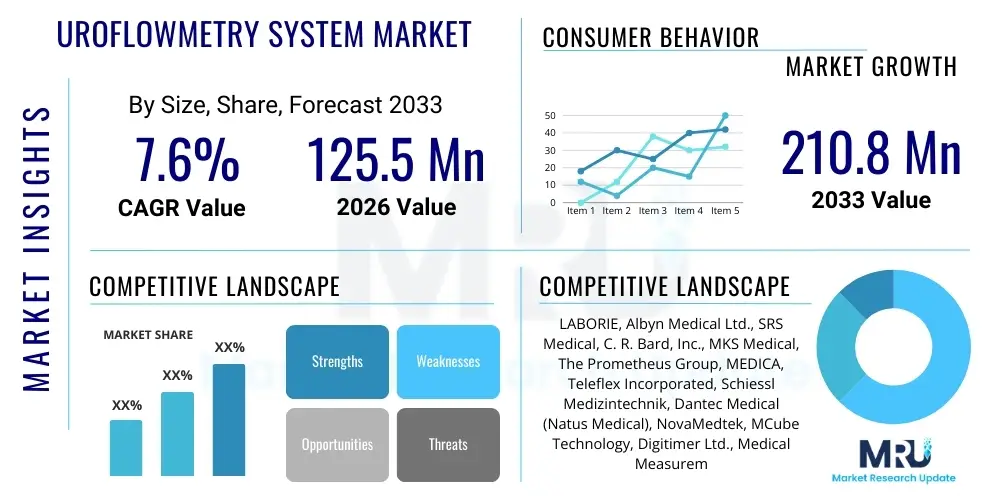

The Uroflowmetry System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.6% CAGR between 2026 and 2033. The market is estimated at $125.5 Million USD in 2026 and is projected to reach $210.8 Million USD by the end of the forecast period in 2033. This substantial expansion is primarily driven by the increasing global prevalence of urological disorders, particularly among the aging demographic, coupled with advancements in non-invasive diagnostic technologies that enhance patient comfort and data accuracy. The transition towards portable and wireless uroflowmetry solutions is a key accelerating factor, making the technology more accessible across diverse clinical settings, including smaller clinics and home-care environments.

Market expansion is also supported by improving healthcare infrastructure in emerging economies and heightened awareness regarding the importance of early and accurate diagnosis of Lower Urinary Tract Dysfunction (LUTD). Governments and private entities are increasingly investing in sophisticated diagnostic tools, recognizing their role in preventing complications associated with conditions like Benign Prostatic Hyperplasia (BPH) and neurogenic bladder. Furthermore, the standardization of clinical guidelines recommending uroflowmetry as a first-line diagnostic tool contributes significantly to its rising adoption rate across major geographic regions, solidifying the market's robust trajectory.

Uroflowmetry System Market introduction

The Uroflowmetry System Market encompasses devices and software utilized to measure the volume of urine voided per unit of time, providing crucial objective data for the diagnosis and management of various lower urinary tract symptoms (LUTS). These systems are non-invasive diagnostic tools essential for evaluating bladder function, assessing the severity of urinary obstruction, and monitoring the efficacy of pharmacological or surgical treatments. Typical products include gravimetric transducers, electronic flow meters, and integrated software platforms designed for data storage, analysis, and generation of detailed reports, crucial for clinical decision-making across urology practices worldwide.

Major applications of uroflowmetry systems span a wide range of urological conditions, including the diagnosis and monitoring of Benign Prostatic Hyperplasia (BPH), evaluating bladder outflow obstruction, assessing voiding difficulties related to neurological disorders, and managing urinary incontinence. The primary benefits of these systems are their objectivity, non-invasiveness, and ability to provide reproducible results quickly in an outpatient setting. This ease of use minimizes patient discomfort and maximizes clinical efficiency, allowing urologists to gather essential functional data without recourse to more invasive procedures unless strictly necessary. The fundamental principle involves measuring flow rate, maximum flow rate (Qmax), and voided volume, translating raw data into interpretable clinical graphs.

Key driving factors propelling the growth of this market include the global increase in the geriatric population, which is inherently more susceptible to LUTS and BPH; continuous technological innovations leading to the development of highly accurate, portable, and wireless devices; and the rising incidence of chronic diseases such as diabetes and neurological disorders that frequently result in secondary bladder dysfunction. Furthermore, the trend toward early diagnosis and preventative healthcare measures, supported by favorable reimbursement policies in developed markets, is sustaining the demand for sophisticated and reliable uroflowmetry solutions, ensuring robust market performance throughout the forecast period.

Uroflowmetry System Market Executive Summary

The Uroflowmetry System Market is characterized by vigorous growth, underpinned by substantial technological shifts towards digitization and mobility. Business trends indicate a strong competitive landscape focused on integrating data analytics and connectivity features, allowing systems to interface seamlessly with Electronic Medical Records (EMR) and telehealth platforms. Manufacturers are prioritizing the development of wireless and portable systems that facilitate use in primary care settings and remote monitoring scenarios, thereby broadening the accessibility of diagnostic capabilities beyond traditional specialized hospital units. Strategic mergers, acquisitions, and collaborations between technology developers and established medical device companies are frequently observed, aimed at consolidating market share and accelerating the penetration of advanced features such as automated reporting and AI-supported data interpretation, positioning technology and integration as primary competitive differentiators.

Regionally, North America and Europe currently dominate the market due to established, high-capacity healthcare infrastructures, high public awareness of urological health, and strong regulatory frameworks that favor investment in advanced medical diagnostics. However, the Asia Pacific (APAC) region is poised for the highest growth rate, fueled by rapidly expanding healthcare spending, increasing urbanization, and a large, aging population seeking improved diagnostic standards. Investments in infrastructure development, particularly in nations like China and India, are opening lucrative avenues for market penetration. Conversely, Latin America and the Middle East & Africa (MEA) present growth opportunities through untapped clinical needs, though market expansion in these regions is often contingent upon overcoming economic constraints and improving basic healthcare accessibility and specialized training.

Segment-wise, the market is demonstrating a clear preference for wireless uroflowmetry systems, which offer enhanced flexibility and reduced setup complexity compared to traditional wired devices. Among end-users, hospitals continue to be the largest consumers due to the volume of diagnostic procedures performed, but the ambulatory surgical centers and specialty clinics segment is expected to exhibit faster growth. This accelerated adoption is a reflection of the global shift towards providing specialized care in more cost-effective outpatient settings. Furthermore, the software segment, including advanced analytical and reporting modules, is expanding rapidly as clinicians increasingly rely on sophisticated tools for longitudinal patient management and research purposes, driving demand for solutions that enhance diagnostic efficiency and precision.

AI Impact Analysis on Uroflowmetry System Market

User queries regarding the integration of Artificial Intelligence (AI) in uroflowmetry systems predominantly revolve around accuracy improvement, the potential for automated diagnosis, and the workflow efficiency gains. Users frequently inquire if AI can reduce inter-operator variability in interpreting complex flow patterns, particularly in pediatric or challenging cases. Key concerns often center on data privacy, validation of AI algorithms against established clinical benchmarks, and the cost-effectiveness of integrating sophisticated AI software into existing hardware platforms. There is significant expectation that AI tools should not only interpret the raw flow trace but also correlate the findings with patient-reported symptoms and history, thereby providing a more holistic and predictive diagnostic output, fundamentally transforming the role of the technician and refining the urologist's diagnostic process.

The core theme summarizing user expectations is the shift from diagnostic support to predictive modeling. Clinicians anticipate that AI will enhance the precision of identifying subtle abnormalities in flow patterns that might be overlooked by human analysis, thereby improving the early detection of conditions such as incipient bladder outlet obstruction or detrusor hypocontractility. Furthermore, integrating machine learning algorithms promises significant operational efficiencies by automating the charting, reporting, and flagging of urgent cases, thereby optimizing the clinical workflow. This technological augmentation is expected to address the critical needs for rapid and standardized assessment in high-volume clinic environments, justifying the initial investment in advanced software licenses and necessary computing infrastructure.

In essence, the market anticipates AI moving beyond simple data processing to become an integral, intelligent layer within the uroflowmetry ecosystem. This includes automated quality control of the test procedure, ensuring validity before analysis, and offering personalized treatment recommendations based on recognized patterns in large datasets of voiding dysfunction cases. The successful implementation of AI will require transparent validation studies and robust data security protocols to build clinical trust and facilitate widespread adoption, transforming uroflowmetry from a basic measurement tool into a sophisticated, interconnected diagnostic hub capable of complex pattern recognition and risk stratification, further optimizing resource utilization.

- AI provides automated analysis of complex flow curves, reducing manual interpretation variability.

- Machine learning algorithms enhance diagnostic accuracy for conditions like BPH and detrusor dysfunction.

- Predictive analytics enables risk stratification and prognosis assessment for LUTS patients.

- Integration with EMR systems is streamlined through intelligent data structuring and automated reporting.

- AI supports remote monitoring by quickly processing at-home uroflow data and flagging anomalies.

DRO & Impact Forces Of Uroflowmetry System Market

The Uroflowmetry System Market growth is robustly influenced by significant Drivers (D), managed by constraining Restraints (R), and propelled forward by considerable Opportunities (O), all interacting through potent Impact Forces. The primary driver is the accelerating global prevalence of age-related urological conditions such as BPH and overactive bladder (OAB), necessitating objective diagnostic tools. Restraints largely center on the relatively high capital cost of advanced wireless systems and associated software licenses, coupled with inconsistent or complicated reimbursement structures in developing regions, which can hinder smaller clinic adoption. The key opportunity lies in leveraging telemedicine and remote patient monitoring, expanding system utilization into home-based diagnostic settings, thereby meeting the growing demand for convenient and accessible healthcare services, especially post-pandemic.

Impact forces acting on this market include intense technological competition focused on miniaturization and integration capabilities. The shift towards non-invasive diagnostics exerts a strong positive pull, as uroflowmetry offers valuable clinical insights without requiring patient catheterization or exposure to radiation, aligning with modern preferences for minimally invasive care pathways. Furthermore, regulatory scrutiny, while ensuring safety and efficacy, acts as a constraining force, requiring substantial investment in clinical trials and certification processes, particularly for novel AI-integrated devices. The confluence of demographic pressure (aging population) and technological innovation (wireless systems) creates a sustained positive impact trajectory, significantly overriding the existing restraints.

The dynamic interplay between increasing clinical need and technological feasibility defines the market trajectory. While the financial burden of initial investment poses a restraint, the long-term cost-effectiveness resulting from accurate, early diagnosis and improved patient management—preventing more costly late-stage interventions—presents a strong counter-leveraging driver. The substantial opportunity to penetrate high-growth emerging economies, coupled with continuous upgrades in software analytics and connectivity, ensures that the market will maintain its upward momentum. The overall impact of these forces is overwhelmingly positive, driving continuous product development and market expansion across both established and nascent healthcare systems worldwide.

Segmentation Analysis

The Uroflowmetry System Market is comprehensively segmented based on technology type, product component, clinical application, and primary end-user. This layered segmentation provides a granular view of market dynamics, revealing where investment is concentrated and identifying areas of rapid growth. The technology segment differentiates between wired systems, which are traditionally accurate but less flexible, and wireless systems, which are experiencing accelerated adoption due to their portability and ease of integration into mobile healthcare environments. Analysis of product components helps delineate the value generated by the physical hardware (flowmeters and transducers) versus the increasingly critical software segment (data management, analysis, and reporting tools), which drives long-term revenue streams through subscriptions and upgrades. Understanding these divisions is crucial for strategic planning and resource allocation within the competitive landscape.

Application-based segmentation highlights the primary clinical domains driving demand. While Benign Prostatic Hyperplasia (BPH) represents the dominant application due to its high global prevalence, the use of uroflowmetry in diagnosing and managing neurogenic bladder and general voiding disorders is expanding rapidly, reflecting its broad clinical utility. The end-user analysis clearly indicates the distribution of demand, with large volume purchasers like hospitals and specialized urology clinics leading the market, alongside the rapidly growing segment of ambulatory surgical centers (ASCs) and home care settings, driven by the demand for decentralized care. This structure allows market participants to tailor their marketing and distribution strategies specifically to the operational needs and purchasing power of each customer group, maximizing penetration and adoption rates globally, particularly focusing on systems optimized for high throughput or high portability.

- By Type:

- Wired Uroflowmetry Systems

- Wireless Uroflowmetry Systems

- By Product:

- Uroflowmetry Devices (Flowmeters, Transducers)

- Uroflowmetry Software and Accessories

- By Application:

- Benign Prostatic Hyperplasia (BPH) Diagnosis

- Urinary Tract Infections (UTIs) & Voiding Dysfunction

- Neurogenic Bladder Management

- Pediatric Urology

- Research Applications

- By End-User:

- Hospitals and Clinics

- Ambulatory Surgical Centers (ASCs)

- Diagnostic Laboratories

- Research Institutions

Value Chain Analysis For Uroflowmetry System Market

The value chain for the Uroflowmetry System Market begins with the upstream activities of raw material procurement and component manufacturing, focusing primarily on high-precision electronic components, sensors (such as gravimetric load cells or pressure transducers), and medical-grade plastics. Suppliers of specialized sensors and electronic boards play a critical role, as the accuracy and reliability of the final device are directly dependent on the quality of these core elements. Manufacturers invest heavily in R&D to integrate these components into user-friendly, reliable devices, ensuring compliance with strict international medical device regulations (e.g., FDA, CE marking). This initial phase is characterized by stringent quality control and high barriers to entry due to necessary technological expertise and regulatory clearances.

Midstream activities involve the assembly, testing, and crucial integration of proprietary software, which handles data acquisition, analysis, and EMR connectivity. Distribution channels are bifurcated: direct sales channels are typically employed for large institutional clients (major hospital networks) requiring complex installation, specialized training, and ongoing technical support, often managed by the manufacturer’s internal sales team. Indirect distribution relies on specialized medical device distributors and regional resellers who possess established relationships with smaller clinics and ambulatory centers, offering localized support and faster market reach, particularly in geographically dispersed markets. These intermediaries are vital for navigating diverse regional regulatory and reimbursement landscapes efficiently.

Downstream activities focus on the end-users—hospitals, clinics, and research centers—where the devices are deployed and utilized for patient diagnostics. Post-sale services, including maintenance, calibration, and software updates (often SaaS models for the analytical software), form a continuous revenue stream and are crucial for maintaining customer loyalty and ensuring the longevity of the device. The increasing adoption of cloud-based platforms for data management and remote diagnostics further enhances the downstream value, facilitating better clinical collaboration and patient follow-up. Effective management of the distribution and service network is paramount to ensuring high device uptime and maximizing clinical utility across the entire customer base.

Uroflowmetry System Market Potential Customers

The primary end-users and potential customers of Uroflowmetry Systems are highly specialized medical facilities and healthcare providers dedicated to urology and related disciplines. Hospitals, particularly those with dedicated urology departments and teaching facilities, represent the largest segment of potential customers due to the high volume of inpatients and outpatients presenting with complex voiding dysfunctions. These institutions typically require high-throughput, integrated systems capable of networking across various departments and interfacing seamlessly with established hospital information systems. They prioritize robust devices that offer extensive analytical capabilities and scalability, often opting for premium, fixed-installation models for routine diagnostics.

Ambulatory Surgical Centers (ASCs) and specialized urology clinics constitute a rapidly expanding customer base. These entities focus heavily on outpatient care and specialized procedures, making them ideal targets for portable and wireless uroflowmetry systems. Their purchasing decisions are often driven by space efficiency, ease of operation, and cost-effectiveness. The increasing trend of shifting minor diagnostic and surgical procedures away from expensive hospital settings directly boosts the demand for highly versatile and mobile systems suitable for a clinical office environment, emphasizing the need for quick setup and minimal maintenance requirements.

A third significant customer segment includes academic and clinical research institutions that utilize uroflowmetry systems for clinical trials, drug efficacy testing, and physiological studies related to lower urinary tract function. These customers require highly accurate, specialized systems often equipped with advanced data logging and analytical software tailored for research protocols, including systems designed for pediatric or highly specialized neuro-urology investigations. Furthermore, the burgeoning segment of telehealth and remote monitoring services is rapidly adopting portable uroflowmetry devices, positioning primary care providers and independent diagnostic laboratories as emerging key customers focused on decentralized, community-based diagnostics.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $125.5 Million USD |

| Market Forecast in 2033 | $210.8 Million USD |

| Growth Rate | 7.6% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | LABORIE, Albyn Medical Ltd., SRS Medical, C. R. Bard, Inc., MKS Medical, The Prometheus Group, MEDICA, Teleflex Incorporated, Schiessl Medizintechnik, Dantec Medical (Natus Medical), NovaMedtek, MCube Technology, Digitimer Ltd., Medical Measurement Systems (MMS), Boston Scientific Corporation, Bioseb, Aymed, Mianyang Huahui Medical Equipment Co., Ltd., Datalink, Gynex Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Uroflowmetry System Market Key Technology Landscape

The Uroflowmetry System market is defined by a continuous evolution in sensor technology and data handling capabilities, moving away from simple mechanical measurement towards sophisticated digital integration. The core technology relies on two main types of sensors: gravimetric sensors (load cell technology) and rotating disc flow meters. Gravimetric systems, which measure the weight of the collected urine over time, are increasingly favored for their exceptional accuracy and high linearity, providing highly reliable flow rate data crucial for clinical precision. Modern devices integrate high-resolution analog-to-digital converters to ensure that minute variations in flow are captured and translated accurately, minimizing measurement errors associated with environmental disturbances or inconsistent voiding patterns.

The most significant recent technological advancement is the widespread adoption of wireless connectivity, predominantly using Bluetooth or Wi-Fi protocols, enabling data transmission directly to a computer, tablet, or cloud server without physical cabling constraints. This shift enhances the mobility of the device, allowing for non-intrusive patient setup and easier use in various clinical settings, including the patient’s home. Furthermore, system integration is key; modern uroflowmetry systems are designed with proprietary interfaces or open APIs (Application Programming Interfaces) to ensure seamless compatibility with major Electronic Medical Records (EMR) systems, such as Epic and Cerner, automating data entry, reducing administrative burden, and minimizing the potential for transcription errors, thereby greatly improving clinical workflow efficiency.

In addition to hardware improvements, the accompanying software landscape has become critically important. Advanced analytical software includes features such as automated artifact detection, sophisticated algorithms for calculating standardized parameters (e.g., Qmax, average flow), and comprehensive report generation conforming to international standardization committee recommendations. Future technological landscapes are heavily focused on machine learning and Artificial Intelligence (AI) integration, utilizing large datasets to provide automatic classification of flow patterns (e.g., obstructed vs. unobstructed curves) and offering predictive insights into treatment response, making the software component the most dynamic area of current technological investment and differentiation among key market players.

Regional Highlights

- North America: This region holds the largest market share, driven by robust healthcare spending, high adoption rates of advanced diagnostic technologies, and favorable reimbursement policies for urological procedures. The presence of major market players and well-established clinical guidelines recommending uroflowmetry as a standard diagnostic for LUTS ensures sustained high demand. Early adoption of wireless and AI-integrated systems further solidifies its leading position.

- Europe: Europe represents a mature market with consistent growth, strongly supported by sophisticated public healthcare systems (like the NHS in the UK and centralized systems in Germany and France) and high levels of patient awareness. Regulatory harmonization through CE marking facilitates market entry, and the strong academic research environment frequently leads to clinical validation and rapid uptake of new uroflowmetry technologies, particularly in areas of neuro-urology and geriatric care.

- Asia Pacific (APAC): APAC is anticipated to exhibit the highest Compound Annual Growth Rate (CAGR). This accelerating growth is attributed to massive improvements in healthcare infrastructure, rising disposable incomes leading to greater access to specialized care, and a substantial, aging population in countries such as China, Japan, and India. Governments are increasingly prioritizing the modernization of medical diagnostics, making this region a prime target for market expansion and direct investment by global manufacturers, focusing on low-cost, high-reliability systems.

- Latin America (LATAM): Growth in LATAM is steady, driven by the expansion of private healthcare facilities and increasing foreign investment in medical technology. While constrained by economic volatility and slower regulatory processes in some nations, the demand for non-invasive diagnostics in major economies like Brazil and Mexico is rising, creating niche opportunities for portable and affordable uroflowmetry solutions in rapidly urbanizing areas.

- Middle East and Africa (MEA): The MEA market is developing, characterized by significant investment in state-of-the-art medical facilities in the Gulf Cooperation Council (GCC) countries. Market expansion is concentrated in specialized hospitals that serve medical tourism and wealthy domestic populations, demanding high-end diagnostic tools. Adoption in less developed parts of Africa remains challenging but is offset by targeted aid and public health initiatives focused on basic diagnostic capabilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Uroflowmetry System Market.- LABORIE

- Albyn Medical Ltd.

- SRS Medical

- C. R. Bard, Inc.

- MKS Medical

- The Prometheus Group

- MEDICA

- Teleflex Incorporated

- Schiessl Medizintechnik

- Dantec Medical (Natus Medical)

- NovaMedtek

- MCube Technology

- Digitimer Ltd.

- Medical Measurement Systems (MMS)

- Boston Scientific Corporation

- Bioseb

- Aymed

- Mianyang Huahui Medical Equipment Co., Ltd.

- Datalink

- Gynex Corporation

Frequently Asked Questions

Analyze common user questions about the Uroflowmetry System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary clinical advantage of wireless uroflowmetry systems?

Wireless uroflowmetry systems offer significantly enhanced patient convenience and mobility, allowing for standardized testing in a comfortable, private setting, which often yields more accurate and natural voiding results than tests conducted in a clinical environment. They also simplify setup and reduce the risk of environmental interference associated with wired connections, promoting flexibility in clinical workflow.

How is AI transforming the interpretation of uroflowmetry results?

AI is transforming interpretation by enabling automated pattern recognition, allowing the system to quickly analyze complex flow curves and identify subtle anomalies indicative of specific urological conditions. This capability minimizes human error, standardizes diagnostic reporting across different clinicians, and supports faster, more objective clinical decision-making, especially in high-volume settings.

What is the typical lifespan and required maintenance for a modern uroflowmetry device?

The typical operational lifespan of modern uroflowmetry hardware (the flow sensor) is generally 5 to 8 years, though the accompanying software platform is updated continually. Required maintenance involves annual calibration checks to ensure measurement accuracy, routine cleaning of the sensor components, and mandatory software updates to maintain EMR compatibility and access the latest analytical algorithms.

Which application segment drives the highest demand in the Uroflowmetry Market?

The diagnosis and monitoring of Benign Prostatic Hyperplasia (BPH) consistently drives the highest demand in the uroflowmetry market. BPH is highly prevalent among aging males globally, necessitating reliable, non-invasive diagnostic tools like uroflowmetry to assess the severity of bladder outlet obstruction and track treatment efficacy over time.

Are portable uroflowmetry systems suitable for research applications and clinical trials?

Yes, portable and highly accurate wireless uroflowmetry systems are increasingly suitable for research applications and clinical trials. Their ease of use and ability to capture standardized, objective data in diverse or remote environments make them ideal for multi-site studies or monitoring drug effectiveness, provided they meet necessary research-grade accuracy and data output standards.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager