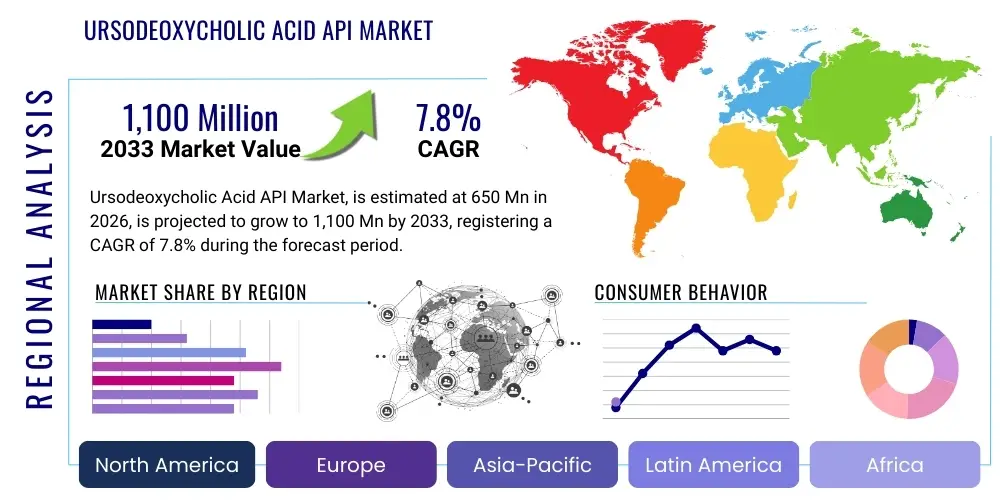

Ursodeoxycholic Acid API Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443114 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Ursodeoxycholic Acid API Market Size

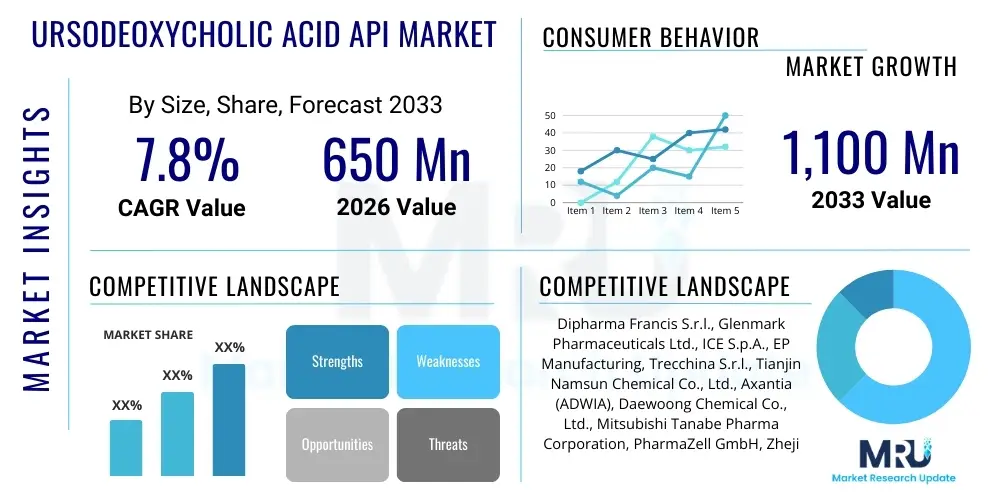

The Ursodeoxycholic Acid (UDCA) API Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 650 Million in 2026 and is projected to reach USD 1,100 Million by the end of the forecast period in 2033.

Ursodeoxycholic Acid API Market introduction

The Ursodeoxycholic Acid (UDCA) API market encompasses the global production and supply of the active pharmaceutical ingredient used primarily in the treatment of various hepatobiliary diseases. UDCA, a naturally occurring bile acid, functions by reducing the cholesterol saturation of bile, facilitating the dissolution of gallstones, and protecting hepatocytes from toxic bile acids. Its primary therapeutic application revolves around treating primary biliary cholangitis (PBC) and dissolving cholesterol gallstones. Given the chronic nature of these conditions and the increasing geriatric population prone to such disorders, the demand for high-purity UDCA API remains robust across established and emerging pharmaceutical markets worldwide. The stringent regulatory requirements governing API quality, especially in the context of injectable and oral formulations, necessitate sophisticated manufacturing processes and certified facilities, driving market consolidation among key players.

The product description of UDCA API involves a white or almost white crystalline powder, highly purified to meet pharmacopeial standards (USP, EP, JP). Purity levels are critical, as impurities in bile acid APIs, particularly related substances from precursor compounds, can affect patient safety and formulation stability. Major applications center on gastroenterology and hepatology, extending beyond its traditional use to investigate potential treatments for cystic fibrosis-related liver disease and non-alcoholic steatohepatitis (NASH), thereby broadening its therapeutic scope. The molecule’s mechanism of action involves modifying the bile acid pool composition, promoting hepatoprotection, and exerting anti-apoptotic effects, making it indispensable in modern liver disease management protocols.

Key benefits driving the market include UDCA’s established efficacy and long safety profile, positioning it as the first-line therapy for PBC. Furthermore, increasing awareness and improved diagnostic capabilities for chronic liver diseases, particularly in developing economies, contribute significantly to market expansion. The driving factors primarily include the rising prevalence of chronic liver disorders globally, coupled with a steady increase in generic drug manufacturing due to patent expirations of branded UDCA formulations. Technological advancements aimed at optimizing synthesis pathways, particularly transitioning from complex semi-synthetic processes to more controlled chemical syntheses or biotechnological routes, are also pivotal in enhancing cost-effectiveness and scalability, thereby supporting market growth.

Ursodeoxycholic Acid API Market Executive Summary

The Ursodeoxycholic Acid (UDCA) API market is characterized by moderate growth, primarily fueled by the sustained requirement for liver disease treatments and increasing geriatric demographics globally. Business trends indicate a strong focus on backward integration among major manufacturers to secure raw material supply chains, often involving sourcing high-purity animal bile or synthesizing key intermediates chemically. Competition remains fierce, particularly in the low-purity, commodity segment, leading to price volatility, while the demand for high-purity, pharmaceutical-grade UDCA API suitable for regulatory-intensive markets (North America, Europe) commands premium pricing and necessitates robust quality control systems. Strategic mergers and acquisitions aimed at consolidating manufacturing capacity and expanding geographic footprint are notable corporate strategies being implemented by market leaders to enhance competitive positioning and improve supply reliability for global pharmaceutical clients.

Regional trends reveal Asia Pacific (APAC), particularly China and India, as the central hubs for both production and consumption. These nations benefit from lower operational costs and a large patient base suffering from liver disorders. However, North America and Europe continue to represent the highest revenue markets due to stringent quality standards and high per-patient treatment costs, driving demand for compliant, high-end API. Furthermore, regulatory tightening by agencies like the FDA and EMA regarding impurity profiles and manufacturing practices is reshaping supply chains, favoring suppliers who can demonstrate adherence to current Good Manufacturing Practices (cGMP) consistently. Emerging markets in Latin America and the Middle East are exhibiting accelerated growth rates driven by improving healthcare infrastructure and expanding access to essential medicines, contributing significantly to volume growth forecasts.

Segment trends underscore the dominance of the high-purity segment (greater than 98.5%) driven by its use in complex formulations and regulated end-markets. In terms of application, Primary Biliary Cholangitis (PBC) treatment remains the leading revenue generator, though off-label use and clinical trials investigating UDCA’s role in other cholestatic and metabolic liver diseases are steadily expanding the application base. Source segmentation highlights a gradual shift towards synthetic or semi-synthetic methods over purely extracted animal bile, primarily due to ethical concerns, inconsistent supply, and difficulties in achieving ultra-high purity required by modern drug standards. The market structure emphasizes the pivotal role of third-party API manufacturers who supply finished dosage form (FDF) producers, making efficient, scalable, and compliant production capabilities the primary competitive differentiators across all major market segments.

AI Impact Analysis on Ursodeoxycholic Acid API Market

Common user questions regarding AI's influence on the UDCA API market frequently center on how machine learning can accelerate new synthesis routes, improve manufacturing yields, and optimize global supply chain logistics to prevent shortages of this critical API. Users are keen to understand if AI can reduce the cost burden associated with complex chemical purification processes, particularly those involving chromatographic separation needed to achieve high-purity UDCA, or if predictive maintenance algorithms could increase asset utilization in API manufacturing plants. Furthermore, there is significant inquiry into AI's role in drug repurposing, specifically identifying novel therapeutic applications or targets for UDCA, thereby expanding its clinical relevance beyond established indications like Primary Biliary Cholangitis.

The integration of artificial intelligence and machine learning (ML) platforms is beginning to streamline various operational aspects of the Ursodeoxycholic Acid API supply chain. In research and development, AI is utilized to model complex bile acid metabolism pathways, potentially identifying biomarkers that predict patient response to UDCA therapy, which would refine clinical targeting. Within synthesis optimization, ML algorithms are being deployed to analyze vast datasets of reaction conditions, catalyst performance, and impurity formation, leading to the rapid identification of optimal parameters that maximize yield and minimize energy consumption in batch or continuous manufacturing processes, ultimately reducing the cost of goods sold for high-grade API producers.

From a commercial and supply chain perspective, AI plays a crucial role in enhancing forecast accuracy and managing inventory risk. Given that raw materials for UDCA often face supply volatility (whether derived from natural sources or complex synthetic intermediates), predictive analytics driven by external factors such as global livestock market trends, geopolitical stability, and regulatory changes allows manufacturers to preemptively adjust production schedules and inventory levels. This improvement in supply chain resilience ensures consistent API availability for pharmaceutical partners, minimizing stock-outs and supporting stable pricing dynamics across the highly competitive global market landscape.

- AI-driven optimization of chemical synthesis pathways for enhanced yield and purity.

- Predictive maintenance analytics improving operational uptime and efficiency in manufacturing facilities.

- Machine learning models accelerating quality control and impurity detection during purification processes.

- AI-enabled demand forecasting and supply chain risk mitigation to ensure stable API availability.

- Data mining techniques supporting the repurposing and identification of novel clinical applications for UDCA.

DRO & Impact Forces Of Ursodeoxycholic Acid API Market

The Ursodeoxycholic Acid API market is significantly influenced by a dynamic interplay of stimulating drivers, restrictive challenges, and promising opportunities. A primary driver is the accelerating global incidence and prevalence of chronic liver diseases, notably Primary Biliary Cholangitis (PBC) and Non-Alcoholic Steatohepatitis (NASH), where UDCA is either a standard treatment or under intense investigation. This rising disease burden, coupled with increasing healthcare access in emerging economies, provides a persistent upward force on API demand. However, this growth trajectory is restrained by the high complexity and cost associated with achieving pharmaceutical-grade purity, especially eliminating trace toxic impurities which requires sophisticated purification technologies and strict adherence to cGMP. The reliance on fluctuating raw material availability, particularly for traditionally sourced bile acids, further acts as a supply constraint, imposing volatility on manufacturing costs and market stability.

Opportunities for market players primarily lie in diversifying the therapeutic applications of UDCA beyond its conventional uses. Research exploring its neuroprotective, anti-inflammatory, and anti-fibrotic properties is opening pathways for its use in conditions like cystic fibrosis-related liver disease and potentially neurodegenerative disorders. Furthermore, developing novel, cost-effective, and environmentally sustainable synthetic routes—such as fermentation-based production—presents a significant opportunity to overcome the supply volatility and ethical concerns associated with animal-derived raw materials, enabling manufacturers to scale production more efficiently and capture a larger market share. Strategic geographical expansion into underpenetrated regions with high liver disease prevalence also remains a viable avenue for growth, provided compliance with diverse local regulatory frameworks can be effectively managed.

The resulting impact forces delineate a market that is fundamentally stable due to the necessity of the drug in chronic disease management but sensitive to technological innovation and regulatory changes. Regulatory stringency, acting as an impactful restraint, necessitates continuous investment in quality control and process validation, which favors large, established manufacturers. Conversely, the demographic driver (aging population) ensures continuous demand. The net impact suggests sustained growth, albeit at a moderate rate, with competitive advantage increasingly shifting towards companies that successfully implement vertical integration, achieve superior purification yields, and possess robust intellectual property surrounding non-traditional synthesis methods. The market is thus propelled forward by disease prevalence while being shaped and limited by complex manufacturing requirements and quality mandates.

Segmentation Analysis

The Ursodeoxycholic Acid (UDCA) API market is systematically segmented based on various critical parameters, including the Source of Production, Purity Level, and Primary Application. This stratification allows for precise market analysis, identifying high-value niches and commodity segments. Segmentation by Source (Natural, Semi-Synthetic, Synthetic) is crucial, as it dictates the complexity of the manufacturing process, the potential impurity profile, and adherence to specific regulatory requirements or ethical considerations related to animal derivatives. The transition toward synthetic and semi-synthetic methods reflects industry efforts to secure consistent supply and mitigate risks associated with sourcing biological raw materials, while maintaining required high-quality standards for pharmaceutical use in regulated markets.

Purity Level segmentation (e.g., <98%, 98%-99%, >99%) is perhaps the most defining characteristic of competition within the UDCA API landscape. High-purity UDCA (typically >99% purity, with stringent limits on related bile acids and heavy metals) commands a premium price and is essential for products destined for highly regulated markets like the US, Europe, and Japan, especially for critical applications such as intravenous administration or long-term chronic treatments. The lower purity grades often find application in less regulated markets, veterinary pharmaceuticals, or as intermediates, defining a clear tiered pricing structure based on quality assurance and analytical precision.

Application-based segmentation divides the market primarily into treatments for Primary Biliary Cholangitis (PBC), Gallstone Dissolution Therapy, and emerging applications such as Non-Alcoholic Steatohepatitis (NASH) research or Cystic Fibrosis-related Liver Disease (CFLD). While PBC remains the cornerstone of UDCA demand, the growing volume of clinical trials and off-label usage in metabolic and inflammatory liver conditions signals a future shift in revenue contribution. Understanding these segment dynamics is essential for manufacturers to align their production capacity, quality control protocols, and commercial strategies with the specific needs of pharmaceutical end-users targeting these diverse therapeutic areas.

- By Source:

- Natural (Animal Bile Extraction)

- Semi-Synthetic

- Synthetic

- By Purity Level:

- Low Purity (Less than 98%)

- Medium Purity (98% to 99%)

- High Purity (Greater than 99%)

- By Application:

- Primary Biliary Cholangitis (PBC)

- Gallstone Dissolution

- Primary Sclerosing Cholangitis (PSC)

- Other Liver Diseases (e.g., NASH, CFLD)

- By End-User:

- Pharmaceutical Companies

- Contract Manufacturing Organizations (CMOs/CDMOs)

- Academic and Research Institutions

- By Route of Synthesis:

- Chemical Synthesis

- Fermentation/Bioconversion

Value Chain Analysis For Ursodeoxycholic Acid API Market

The value chain for the Ursodeoxycholic Acid API market is characterized by complex chemical transformations and rigorous quality control steps, starting from the procurement of highly specialized raw materials. Upstream analysis highlights the critical role of sourcing key precursors. For natural and semi-synthetic routes, this involves obtaining animal bile (typically from pigs or oxen) and processing it into intermediates like chenodeoxycholic acid (CDCA) or other bile acid derivatives. For purely synthetic routes, the upstream focus shifts to securing high-purity chemical starting materials (e.g., sterols) and managing complex, multi-step synthetic chemistry. Challenges at this stage involve raw material price volatility, ensuring ethical and consistent sourcing, and mitigating environmental impact from large-scale chemical processing. Success in the upstream segment dictates production stability and cost management across the entire chain.

The core manufacturing stage involves the conversion of these precursors into pharmaceutical-grade UDCA through advanced chemical synthesis, purification, and crystallization. This stage is capital-intensive and requires specialized cGMP facilities. Purification is paramount; it typically involves multiple crystallization and chromatographic separation steps to remove closely related bile acid impurities, achieving the ultra-high purity required for regulatory approval. Regulatory oversight heavily impacts this core manufacturing segment, compelling producers to invest continually in process validation, stability testing, and documentation compliant with international standards (ICH guidelines). Efficiency in this conversion step, measured by yield and throughput, is the primary source of competitive advantage.

Downstream analysis focuses on the distribution channels and the ultimate consumption by pharmaceutical end-users. Distribution channels are generally categorized as direct (manufacturer selling directly to large, integrated pharmaceutical companies or major CMOs) and indirect (utilizing specialized API distributors, particularly for smaller clients or fragmented regional markets). Direct channels emphasize long-term supply agreements and stringent quality audits, while indirect channels provide wider market reach and logistical flexibility. The end-users—primarily finished dosage form manufacturers—are highly sensitive to factors such as regulatory dossiers (DMF/ASMF filing status), consistent quality, and long-term supply stability. The efficiency of the distribution network, particularly cold chain logistics for certain formulations, plays a role in minimizing lead times and maintaining product integrity until formulation.

Ursodeoxycholic Acid API Market Potential Customers

The primary customers in the Ursodeoxycholic Acid API market are finished dosage form (FDF) pharmaceutical manufacturers who require the high-purity API for formulating tablets, capsules, or specialty liquid preparations used in treating hepatobiliary disorders. These customers range from multinational Big Pharma companies that market branded UDCA products globally to large generic drug manufacturers focusing on high-volume, cost-effective generic versions of established UDCA therapies. These firms prioritize suppliers with impeccable regulatory track records, including comprehensive Drug Master Files (DMFs) or Active Substance Master Files (ASMFs) filed with major global regulatory bodies (FDA, EMA, PMDA), ensuring the seamless integration of the API into their own regulated drug production processes. Their buying decisions are heavily influenced by the ability of the API supplier to guarantee consistent batch-to-batch quality and volume capacity.

A second significant customer segment comprises Contract Manufacturing Organizations (CMOs) and Contract Development and Manufacturing Organizations (CDMOs). These organizations act as intermediaries, often purchasing UDCA API on behalf of smaller pharmaceutical clients or biotech firms that outsource their FDF production. CMOs require flexible supply volumes and quick turnaround times, coupled with strict adherence to the specific quality parameters requested by their diverse clientele. As outsourcing trends accelerate within the pharmaceutical industry, the purchasing power and volume demand generated by leading global CDMOs have become increasingly influential, making them key targets for API market participants seeking reliable, high-volume contracts across various therapeutic categories utilizing UDCA.

Finally, academic institutions, specialized research laboratories, and smaller biotechnology firms constitute a crucial niche segment. These entities utilize UDCA API primarily for R&D purposes, including preclinical studies, early-phase clinical trials investigating new indications (e.g., anti-aging, neurological disorders), or developing novel drug delivery systems incorporating UDCA. Although the volume demand from this segment is significantly lower than that of FDF producers, it represents a high-value opportunity, often requiring ultra-high-purity, custom-batch sizes, and detailed analytical documentation. Suppliers who can offer comprehensive analytical support and flexibility in batch scale are best positioned to serve the specialized needs of the research community, potentially securing partnerships for future commercialization opportunities should clinical trials prove successful.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 650 Million |

| Market Forecast in 2033 | USD 1,100 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dipharma Francis S.r.l., Glenmark Pharmaceuticals Ltd., ICE S.p.A., EP Manufacturing, Trecchina S.r.l., Tianjin Namsun Chemical Co., Ltd., Axantia (ADWIA), Daewoong Chemical Co., Ltd., Mitsubishi Tanabe Pharma Corporation, PharmaZell GmbH, Zhejiang Chiral Medicine Chemicals Co., Ltd., Suzhou Tianyuan Pharmaceutical Co., Ltd., Span Chemicals Pvt. Ltd., Dishman Carbogen Amcis Ltd., Dr. Reddy's Laboratories Ltd., Solvay S.A., Shandong Audisi Biomedical Technology Co., Hubei Sanonda Co., Ltd., Centaur Pharmaceuticals Pvt. Ltd., and Shanghai Menad Pharmaceutical Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ursodeoxycholic Acid API Market Key Technology Landscape

The technology landscape for the Ursodeoxycholic Acid (UDCA) API market is heavily focused on chemical synthesis optimization and advanced purification methodologies designed to meet rigorous regulatory purity standards. Historically, UDCA was primarily derived from the extraction and modification of bear or pig bile acids (natural source), but modern manufacturing relies heavily on sophisticated semi-synthetic and fully synthetic chemical processes. Key technological advancements include the development of highly selective enzymatic or microbial conversion processes, often utilizing engineered microorganisms, to transform readily available starting materials (like cheaper bile acids or specific sterols) into UDCA with greater efficiency and fewer side products. This shift minimizes the dependency on animal sourcing, enhances batch consistency, and significantly improves the environmental profile of the manufacturing process compared to traditional multi-step chemical reactions which often involve harsh reagents and complex separation steps.

In terms of manufacturing execution, continuous flow chemistry is emerging as a disruptive technology in the production of complex APIs like UDCA. While traditional manufacturing relies on large batch reactors, continuous flow systems offer superior control over reaction kinetics, temperature, and mixing, which is critical for minimizing the formation of specific bile acid impurities (e.g., lithocholic acid, which is toxic). Implementing continuous manufacturing enables faster scale-up, reduces equipment size, and facilitates real-time quality assurance through integrated Process Analytical Technology (PAT) tools. Manufacturers adopting these highly digitized and automated processes are gaining a considerable competitive edge in terms of both cost efficiency and guaranteed purity levels, essential for supplying the highest tiers of regulated pharmaceutical markets.

Furthermore, advanced separation and purification techniques represent a vital segment of the technological landscape, essential for achieving the necessary API purity, often exceeding 99%. Technologies such as preparative High-Performance Liquid Chromatography (HPLC) and specialized crystallization techniques, including chiral resolution and polymorphic control, are indispensable for isolating UDCA from closely related isomers and structurally similar bile acid impurities. The development of robust, scalable, and cost-effective crystallization methods remains paramount, as crystallization is the final and most critical step in determining the physical form, flowability, and ultimate purity of the API powder. Investment in green chemistry principles, focusing on solvent recycling and reduction of toxic reagents, is also a growing technological trend driven by environmental sustainability mandates and stricter regulatory scrutiny over pharmaceutical waste.

Regional Highlights

Regional dynamics play a significant role in shaping the demand, supply, and regulatory environment of the Ursodeoxycholic Acid API market. North America, driven primarily by the United States, represents a high-value market characterized by stringent quality requirements imposed by the FDA and a highly developed healthcare system supporting long-term treatment for chronic liver conditions like PBC. The region mandates the highest standards for API purity, necessitating comprehensive DMF documentation and cGMP compliance from all suppliers. Although API manufacturing capacity in North America is relatively limited compared to Asia, the high cost of generic and branded UDCA formulations in this region ensures strong revenue generation. Demand is further supported by ongoing clinical research into UDCA's expanded applications, maintaining its status as a critical API.

Europe mirrors the high regulatory environment of North America, with the European Medicines Agency (EMA) enforcing rigorous standards for API quality and manufacturing processes across member states. Countries such as Germany, France, and Italy exhibit substantial market consumption due to a high prevalence of cholestatic liver diseases and a large geriatric population. European market demand is particularly sensitive to ethical sourcing requirements, which further drives the adoption of synthetic and semi-synthetic UDCA production routes over traditional natural extraction methods. The presence of major pharmaceutical innovators and specialized API manufacturers in countries like Italy and Switzerland ensures continuous investment in advanced synthesis technology and regulatory compliance, solidifying Europe's position as a premium market segment.

Asia Pacific (APAC) is the undisputed powerhouse of the UDCA API market, excelling in both production capacity and consumption volume. China and India are the world's leading suppliers, benefiting from lower labor costs, established chemical synthesis infrastructure, and large-scale manufacturing capabilities. This region caters extensively to generic pharmaceutical markets globally, contributing significantly to volume sales but often operating under highly competitive pricing pressure. Simultaneously, APAC countries like Japan and South Korea are major consumers, characterized by high per capita spending on healthcare and complex regulatory systems comparable to Western markets. The escalating burden of liver diseases due to lifestyle changes (e.g., rising rates of NASH) across the broader APAC region ensures that local consumption will continue to drive market expansion significantly throughout the forecast period.

- North America: High regulatory environment; demand driven by chronic disease management and R&D activities; premium pricing structure; focus on cGMP compliance.

- Europe: Strong focus on quality and ethical sourcing; high consumption in Western European nations; presence of key specialized API manufacturers; stringent regulatory oversight (EMA).

- Asia Pacific (APAC): Global manufacturing hub (China, India); high volume generic production; rapid growth in consumption driven by increasing liver disease prevalence and expanding healthcare access; varied regulatory landscape.

- Latin America (LATAM): Emerging market characterized by improving healthcare infrastructure; increasing reliance on generic imports; moderate but accelerating demand growth.

- Middle East and Africa (MEA): Small but growing market; demand influenced by regional conflicts and economic stability; increased focus on local pharmaceutical production and procurement of essential APIs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ursodeoxycholic Acid API Market.- Dipharma Francis S.r.l.

- ICE S.p.A.

- Glenmark Pharmaceuticals Ltd.

- Mitsubishi Tanabe Pharma Corporation

- Trecchina S.r.l.

- Tianjin Namsun Chemical Co., Ltd.

- Axantia (ADWIA)

- Daewoong Chemical Co., Ltd.

- PharmaZell GmbH

- Zhejiang Chiral Medicine Chemicals Co., Ltd.

- Suzhou Tianyuan Pharmaceutical Co., Ltd.

- Span Chemicals Pvt. Ltd.

- Dishman Carbogen Amcis Ltd.

- Dr. Reddy's Laboratories Ltd.

- Solvay S.A.

- Shandong Audisi Biomedical Technology Co.

- Hubei Sanonda Co., Ltd.

- Centaur Pharmaceuticals Pvt. Ltd.

- Shanghai Menad Pharmaceutical Co., Ltd.

- Fuji Chemical Industries Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Ursodeoxycholic Acid API market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Ursodeoxycholic Acid (UDCA) API primarily used for?

UDCA API is primarily used in pharmaceutical formulations for the treatment of hepatobiliary disorders, most notably as the first-line therapy for Primary Biliary Cholangitis (PBC) and for dissolving specific types of cholesterol gallstones.

Which synthesis method is becoming dominant in the UDCA API market?

While semi-synthetic routes historically dominated, there is a substantial shift towards fully synthetic chemical processes and emerging bio-conversion technologies to ensure stable supply, achieve ultra-high purity, and mitigate ethical and logistical issues associated with animal-derived raw materials.

What are the key growth drivers for the UDCA API market forecast period?

The primary growth drivers include the rising global incidence of chronic liver diseases, the continued use of UDCA as a standard of care for PBC, and increasing investigative research into its potential therapeutic benefits for metabolic disorders like NASH.

How does API purity level affect market segmentation and pricing?

API purity is a critical segment determinant; high-purity UDCA (>99%) commands premium pricing and is mandated for regulated markets (US, Europe) and sensitive applications, whereas lower purity tiers are typically confined to generic or less regulated regional markets.

Which geographical region dominates the manufacturing of UDCA API?

The Asia Pacific region, specifically China and India, dominates the global manufacturing and supply of Ursodeoxycholic Acid API, benefiting from established chemical manufacturing infrastructure and high-volume production capabilities.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager