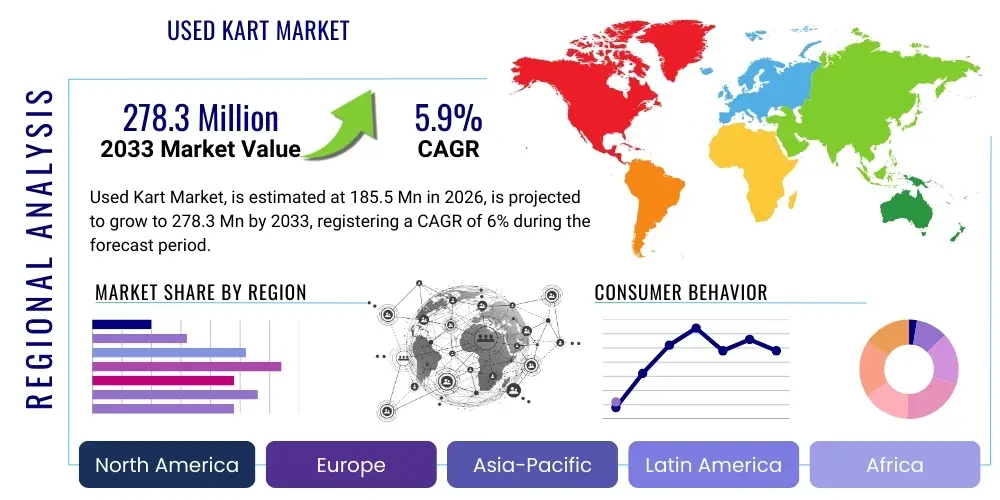

Used Kart Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441608 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Used Kart Market Size

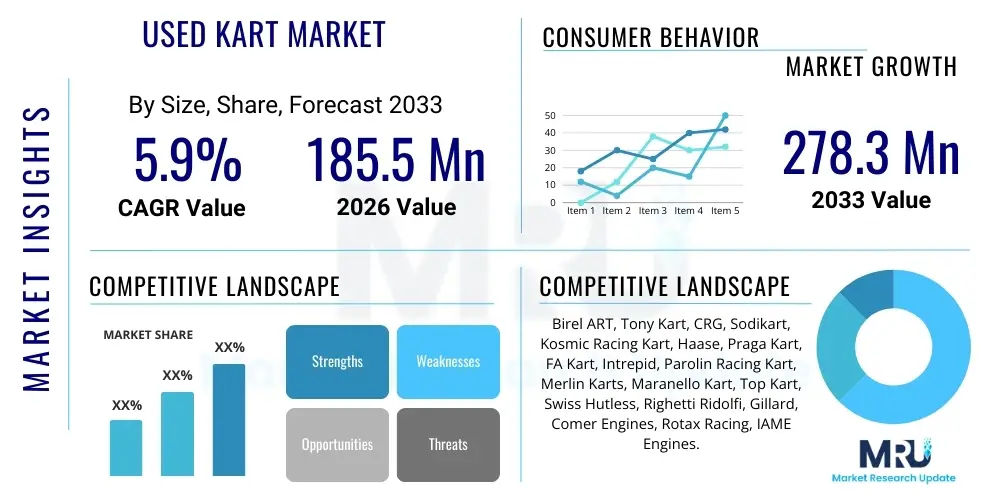

The Used Kart Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.95% between 2026 and 2033. The market is estimated at $185.5 Million USD in 2026 and is projected to reach $278.3 Million USD by the end of the forecast period in 2033. This consistent expansion is driven primarily by the rising global interest in grassroots motorsports, coupled with the inherent cost-efficiency that used equipment provides to both amateur enthusiasts and established racing leagues operating under budget constraints. The cyclical nature of competitive karting, where racers frequently upgrade their chassis and engine packages, ensures a steady supply of high-quality used karts, stabilizing the market.

Used Kart Market introduction

The Used Kart Market encompasses the sale, distribution, and refurbishment of previously owned go-karts, serving a diverse clientele ranging from recreational hobbyists and rental track operators to serious professional racers. This market segment thrives on providing an accessible entry point into motorsport activities, significantly reducing the initial investment barrier associated with acquiring new, factory-fresh racing equipment. Used karts offer performance characteristics often comparable to new models, particularly in competitive classes where chassis design evolution is incremental, allowing participants to maximize their racing budget.

Products within this market are segmented primarily by kart type (rental vs. racing), engine specification (two-stroke, four-stroke, or electric), and chassis manufacturer. Major applications include localized competitive racing events, driver training academies, and commercial amusement and rental facilities seeking durable, low-cost operational assets. The foundational benefits of participating in the used market include superior value retention, immediate availability of seasoned equipment, and lower depreciation costs compared to purchasing new assets, making it an economically prudent choice for participants globally.

Key driving factors accelerating the expansion of the used kart sector involve the increasing professionalization of karting as a pathway to Formula racing, which necessitates frequent equipment upgrades among elite competitors, thereby feeding the used supply chain. Furthermore, the proliferation of digital marketplaces dedicated to motorsports equipment has significantly enhanced transparency and liquidity, allowing buyers and sellers across different geographies to connect easily. The emphasis on standardized inspection protocols and certified pre-owned programs by major distributors is also boosting consumer confidence in the quality and safety of second-hand racing machinery.

Used Kart Market Executive Summary

The Used Kart Market is witnessing robust growth, underpinned by critical business and consumer trends focusing on accessibility and sustainable racing economics. A significant business trend involves the formalized trade-in and refurbishment programs being initiated by premium chassis manufacturers and large regional distributors. These programs ensure quality control and inject renewed consumer trust into high-value used racing equipment. Furthermore, the burgeoning popularity of electric karting is slowly introducing a new sub-segment of used electric karts, although the market remains predominantly geared toward traditional combustion engines for high-performance applications. Pricing mechanisms are becoming increasingly dynamic, utilizing data analytics to assess the residual value based on racing pedigree, maintenance history, and component life cycles.

Regionally, Europe maintains its position as the dominant market for high-performance used racing karts due to its extensive history and established infrastructure for competitive motorsport, hosting key CIK-FIA affiliated events that drive quick turnover of elite equipment. However, the Asia Pacific region, particularly countries like China and India, is registering the highest growth rate, fueled by rising disposable incomes and government initiatives promoting grassroots sports development. North America showcases a strong demand profile focused equally on both recreational karts for large private tracks and entry-level racing karts for local club events, often characterized by a preference for four-stroke engines due to ease of maintenance.

Segment trends reveal a continued strong preference for two-stroke racing karts in the professional and semi-professional tiers due to their high power-to-weight ratio, ensuring liquidity in this segment. Concurrently, the four-stroke used kart segment is expanding rapidly among rental operations and introductory racing series, valued for their reliability and reduced operating costs. The recreational segment is stabilizing as consumers increasingly rely on online platforms to secure customized used packages. Overall, the market's resilience is tied directly to its ability to offer cost-effective alternatives across all levels of karting participation, positioning the used sector as an essential component of the global motorsports ecosystem.

AI Impact Analysis on Used Kart Market

Common user inquiries regarding the impact of Artificial Intelligence (AI) on the Used Kart Market center primarily on optimizing inventory pricing, verifying provenance and authenticity, and predicting the lifespan and maintenance needs of complex components like engines and chassis. Users frequently question how AI algorithms can ensure fair market value for a used racing kart with a documented history versus one with incomplete records, highlighting a strong desire for enhanced transparency and standardized valuation models. There is also significant interest in AI-powered tools that can analyze high-resolution images of equipment to detect subtle signs of damage or wear that might be overlooked by a human inspector, thereby mitigating fraud risks in high-value transactions. Additionally, prospective buyers are keen on utilizing predictive maintenance schedules derived from telemetry data, processed by AI, to understand the true operational cost of a used kart before purchase.

The deployment of AI and machine learning models in the Used Kart Market promises a transformative shift away from subjective, manual appraisals toward data-driven, objective valuation systems. AI can ingest vast datasets comprising historical sales records, component specifications, known maintenance issues specific to chassis models (e.g., crack propagation areas), and even localized demand fluctuations to generate dynamic, real-time pricing recommendations. This capability is crucial for large distributors who manage expansive inventories and require rapid turnover, ensuring optimal profit margins while maintaining competitive pricing for consumers. Furthermore, AI-driven chatbots and recommendation engines are improving the customer journey by matching buyers with suitable karts based on their budget, skill level, and intended application (e.g., novice track days vs. regional championship series), significantly streamlining the search process and reducing cognitive load for buyers.

Beyond commerce, AI is extending its utility into operational and technical domains. Specialized computer vision algorithms, trained on thousands of hours of used kart diagnostics, are being implemented for remote inspection purposes, allowing sellers to upload media that the AI analyzes for structural integrity, component fatigue, and adherence to regulatory standards. This remote verification minimizes the need for physical inspection for initial vetting, expediting cross-border sales. The integration of AI with existing digital marketplaces also enhances fraud detection by flagging suspicious listings, inconsistencies in maintenance logs, or sellers attempting to quickly liquidate assets without providing transparent history. This analytical layer fundamentally de-risks the transaction process for used kart buyers and sellers alike.

- AI-driven dynamic pricing models improve valuation accuracy based on equipment history, racing pedigree, and component usage metrics.

- Machine learning algorithms enhance fraud detection by analyzing discrepancies in digital maintenance logs and ownership records.

- Predictive maintenance analytics, leveraging prior telemetry data, offer buyers estimated lifespan remaining on critical engine components, reducing ownership uncertainty.

- Computer vision and remote inspection tools utilize AI to verify structural integrity and wear indicators from uploaded imagery, standardizing quality assurance.

- Optimized inventory management systems use AI to forecast demand by region and segment, ensuring efficient stocking and reducing holding costs for dealers.

DRO & Impact Forces Of Used Kart Market

The dynamics of the Used Kart Market are heavily influenced by a delicate balance of inherent advantages (Drivers) and systemic challenges (Restraints), creating significant windows for growth (Opportunities) that collectively shape the Impact Forces acting upon market evolution. A primary driver is the perpetual demand for affordable entry points into professional motorsport, positioning used karts as indispensable training tools. Simultaneously, the chief restraint revolves around the lack of universal standardization in maintenance reporting and equipment certification, leading to information asymmetry between sellers and buyers. The key opportunity lies in leveraging digitalization and third-party verification services to build trust and formalize the secondary market structure. These forces combine to create an impact environment where market growth is contingent upon increasing transactional security and the perceived value retention of pre-owned racing assets.

The principal drivers sustaining market vitality include the rapid turnover cycle mandated by competitive racing—where top-tier racers upgrade chassis annually to gain marginal performance advantages—and the overall global expansion of professional karting infrastructure, leading to more regional events and a larger pool of participants. The lower capital expenditure required for used equipment allows for greater experimentation by novice teams and individual drivers, fueling adoption. Conversely, the market faces strong restraints, notably the technical complexity associated with verifying the operational history of high-performance engines, which are often rebuilt multiple times. Concerns over non-genuine parts being utilized in refurbishment and the general lack of manufacturer-backed warranties on used racing equipment pose significant hurdles to premium segment growth. Furthermore, the transportation and logistics costs involved in cross-border used equipment sales can be prohibitive, especially for larger rental fleets.

Opportunities for disruptive growth are concentrated in two key areas: the formalization of the used market through OEM or certified distributor networks offering robust guarantees and the technological shift toward electric used karts. As the original equipment market for electric karts matures, the secondary market for used electric karts will present a novel, low-maintenance alternative, appealing to recreational and rental segments focused on sustainability and minimal noise pollution. The impact forces are thus pushing the market toward greater stratification: a high-trust, premium segment supported by verifiable history and certification, and a broad, accessible entry-level segment driven by digital, peer-to-peer marketplaces. The overall market trajectory indicates that addressing the standardization restraint through technological verification methods will be the critical determinant of long-term value creation.

Segmentation Analysis

Segmentation analysis of the Used Kart Market reveals a highly differentiated landscape shaped by intended application, technical specification, and engine type, reflecting the varied needs of recreational users versus serious competitors. The market is primarily stratified based on the level of performance and the associated maintenance requirements of the equipment. Understanding these segments is crucial for distributors and refurbishers, as pricing, inventory management, and marketing efforts must be tailored to the specific demands of each sub-group. For instance, the racing kart segment prioritizes component lifespan and historical race documentation, whereas the rental kart segment focuses on chassis durability, standardization, and ease of maintenance, leading to divergent market strategies and value chains across the board.

The Type segmentation, dividing the market into Rental Karts and Racing Karts, is fundamental. Rental Karts often feature protective bodywork, governors for speed regulation, and heavier-duty chassis designed for continuous, multi-user operation with minimal maintenance downtime. The used market for rental fleets often sees bulk purchases by new facility operators. In contrast, Racing Karts are lightweight, highly specialized machines (often two-stroke) requiring intensive technical knowledge; their value is closely linked to their competitive history and the reputation of the chassis and engine builder. The Engine segmentation (Two-Stroke, Four-Stroke, Electric) reflects performance tiers and running costs, with Two-Stroke dominating competitive used sales and Four-Stroke dominating recreational and entry-level racing due to longevity and lower fuel expenses. Electric karts, while a niche segment currently, are beginning to gain traction in used markets that focus on environmentally conscious urban tracks.

The Application segmentation (Amateur Racing, Professional Racing, Recreation/Rental) dictates the average transaction value and the buyer's criteria for quality inspection. Amateur racers and hobbyists represent the largest volume segment, seeking reliable, affordable karts, often purchasing directly from private sellers through digital classifieds. Professional Racing teams and academies, though smaller in volume, drive the demand for the highest-value, recently upgraded used karts (often less than one season old) and require stringent provenance documentation. The Recreation/Rental segment remains vital for large-scale B2B transactions, where operational efficiency and uniform fleet condition outweigh marginal performance gains. This granular segmentation allows market stakeholders to precisely target their supply and refurbishment efforts, optimizing capital deployment.

- By Type:

- Rental Karts

- Racing Karts

- By Engine:

- Two-Stroke

- Four-Stroke

- Electric

- By Application:

- Amateur Racing (Hobbyists, Club Racing)

- Professional Racing (Driver Academies, Senior Leagues)

- Recreation/Rental (Commercial Track Operations)

Value Chain Analysis For Used Kart Market

The Used Kart Market value chain begins with the Upstream analysis, focusing on the original equipment manufacturers (OEMs) of chassis (e.g., Tony Kart, Birel ART) and engine suppliers (e.g., Rotax, IAME, Honda). While these entities do not primarily deal in used goods, their production quality, release cycles, and parts availability directly influence the residual value and repairability of karts in the secondary market. High-quality original manufacturing ensures that used karts retain substantial value, justifying refurbishment costs. The immediate upstream phase involves primary owners (race teams or individual racers) who initiate the supply by selling or trading in their equipment, often driven by yearly model upgrades or competitive regulations mandating new components.

The Midstream component is critical, comprising independent dealers, certified refurbishers, and specialized maintenance shops. These entities acquire the used karts, assess their condition, perform necessary repairs, replace time-sensitive components (like seats, tires, or specific engine parts), and then certify or categorize the equipment based on condition. The distribution channel is bifurcated into direct sales (peer-to-peer via online forums or direct dealer sales) and indirect channels (e.g., auctions, motorsports classified websites, and certified pre-owned programs managed by large distributors). The reliability of the refurbishment process and the transparency provided by the dealer determine consumer trust and the achieved selling price. Certified refurbishment programs, often backed by a limited warranty, significantly elevate the perceived value compared to purely peer-to-peer transactions.

The Downstream phase focuses on the final consumption by the end-users: entry-level racers, commercial rental operators, and established teams looking for testing equipment. Direct channels are commonly favored by recreational buyers seeking the lowest price, but they assume the highest risk regarding maintenance history. Indirect channels, involving formalized dealerships or established online platforms with escrow and verification services, attract institutional buyers (like large rental fleets or racing academies) willing to pay a premium for verified quality and standardized paperwork. The efficiency of the distribution network, particularly the ability to handle large, bulky items like chassis across international borders, is a key determinant of market liquidity and downstream pricing stability.

Used Kart Market Potential Customers

The potential customer base for the Used Kart Market is highly segmented, driven primarily by budgetary constraints, frequency of use, and competitive ambition. The largest cohort consists of entry-level racing enthusiasts and amateur club racers who require reliable yet cost-effective equipment to participate in local sanctioned events. These buyers are typically sensitive to initial purchase price and are motivated by the opportunity to acquire competitive-grade chassis and engines that would be prohibitively expensive when purchased new. They rely heavily on the availability of parts and the general reputation of the chassis manufacturer for ease of repair and support, often favoring models that have strong aftermarket support and widespread use within their local racing community.

A second crucial customer segment involves commercial entities, specifically rental track operators and amusement park facilities. These institutional buyers focus on durability, standardization across their fleet, and minimizing total cost of ownership (TCO). For this segment, used rental karts, often sold in bulk packages, represent a massive cost saving compared to capital expenditure on new fleet equipment. Their purchasing decisions are guided by engine type (favoring durable four-stroke or heavy-duty electric models), chassis life expectancy, and the ease of sourcing standardized replacement components for fleet maintenance. Reliability and continuous operational uptime are paramount for this B2B segment, making verifiable maintenance records a key purchasing requirement.

Finally, professional racing teams, established driver academies, and high-tier competitive drivers represent the third, high-value customer group. These buyers seek the most recently retired equipment, typically karts used for only one competitive season or those utilized as training/testing mules. Their motivation is not purely cost savings, but the ability to acquire elite technology (chassis and engine packages) that is still highly competitive, often at a significant discount from new MSRP. These customers demand meticulous service records, documented component hours, and confirmation of regulatory compliance (homologation papers), often purchasing directly from factory-supported race teams or authorized distributors running certified pre-owned programs to ensure absolute authenticity and performance standards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $185.5 Million USD |

| Market Forecast in 2033 | $278.3 Million USD |

| Growth Rate | 5.95% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Birel ART, Tony Kart, CRG, Sodikart, Kosmic Racing Kart, Haase, Praga Kart, FA Kart, Intrepid, Parolin Racing Kart, Merlin Karts, Maranello Kart, Top Kart, Swiss Hutless, Righetti Ridolfi, Gillard, Comer Engines, Rotax Racing, IAME Engines. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Used Kart Market Key Technology Landscape

The technology landscape within the Used Kart Market is increasingly influenced by digital tools designed to enhance transparency, improve component longevity assessment, and streamline cross-border transactions. A critical technological development is the implementation of advanced diagnostic tools and telemetry systems, originally used in high-level racing, that track and log engine hours, heat cycles, and performance metrics. When this data is made available to prospective used kart buyers, it provides an objective measure of the equipment's history, moving beyond reliance on paper logs. Furthermore, non-destructive testing (NDT) techniques, such as ultrasound and dye penetrant testing, are being adopted by professional refurbishers to certify the structural integrity of chassis frames, mitigating the risk of purchasing fatigued or previously damaged high-performance karts.

Digitalization platforms form the core infrastructure of the modern used kart trade. Specialized online marketplaces are deploying sophisticated filtering and search functionalities, enabling buyers to quickly locate karts based on specific technical criteria, such as engine homologation status, chassis model year, and verifiable racing history. Crucially, the emerging application of blockchain technology is being explored to create immutable, decentralized records of ownership and maintenance history for high-value racing karts. This distributed ledger system could drastically reduce fraud, enhance consumer confidence in authenticity, and streamline the transfer of provenance when a kart changes ownership multiple times across different jurisdictions.

In terms of physical technology, advancements in engine sealing and tamper-proof electronic control units (ECUs) are beginning to improve trust in the used engine segment, particularly for "spec" classes where engine parity is essential. These technologies ensure that competitive used engines have not been illegally modified beyond class rules, retaining their certified value. Moreover, refurbished karts benefit from modern material science used in replacement parts, focusing on lighter, more durable composites for seats and bodywork, extending the useful life of the used asset. Overall, the technological evolution is centered on transforming the used kart buying experience into a high-trust, data-verified transaction, thereby increasing market liquidity and reducing informational asymmetry inherent in secondary equipment markets.

Regional Highlights

Europe: Dominance in High-Performance Used Racing Karts

Europe stands as the epicenter of the global Used Kart Market, primarily due to its deeply entrenched competitive racing culture, hosting premier championships like the CIK-FIA European and World Championships. This mature ecosystem ensures a high volume of elite, high-performance racing karts entering the secondary market annually, as top teams and drivers continuously upgrade to the latest homologation cycles. The supply is characterized by a strong presence of premium European chassis manufacturers (e.g., Tony Kart, CRG) and established engine manufacturers (Rotax, IAME). The demand in Europe is sophisticated, emphasizing specific component wear tolerances, documented engine hours, and official racing pedigree. Germany, Italy, and the UK are key markets, benefiting from specialized distributors who offer professional refurbishment and certification services, sustaining higher residual values for high-end used equipment compared to other regions. This regional strength is further supported by streamlined logistics for internal European trade, facilitating the movement of used assets across borders for competitive sales.

North America: Balancing Recreation and Accessibility

The North American market (US and Canada) exhibits robust demand driven by a strong grassroots recreational karting culture and the increasing popularity of four-stroke sprint racing series, which prioritize reliability and lower running costs. Unlike Europe's focus on two-stroke competitive turnover, North America shows a greater appetite for used four-stroke and durable rental karts, catering to the numerous private track owners and expanding commercial rental facilities. The market is highly influenced by online classifieds and localized club sales, often lacking the formalized certification systems prevalent in Europe. However, large regional distributors are increasingly implementing standardized inspection criteria to capture the growing mid-tier amateur racing segment. The sheer geographical size of the region means that logistics and specialized freight services play a crucial role in enabling interstate and cross-border transactions, influencing the final acquisition cost for bulk buyers.

Asia Pacific (APAC): Emerging Growth and Rental Expansion

The APAC region represents the fastest-growing segment in the Used Kart Market, propelled by rapid urbanization, rising middle-class disposable incomes, and significant investment in motorsport infrastructure development, particularly in nations like China, Japan, Australia, and India. While the competitive segment is growing, the primary driver for used kart demand is the massive proliferation of commercial rental tracks and entertainment centers. These operators seek bulk quantities of reliable, affordable rental-spec karts. Due to the nascent nature of the local high-end competitive market in many APAC countries, much of the high-performance used equipment is imported from Europe or North America, necessitating complex customs and import processes. This reliance on international sourcing creates opportunities for specialized import/export dealers who can manage verification and logistics, offering robust profit margins but requiring careful mitigation of import duties and taxes.

Latin America (LATAM) and Middle East & Africa (MEA): Niche Markets and Import Reliance

The LATAM and MEA regions constitute niche but expanding markets, where demand is heavily reliant on the import of used equipment due to limited local manufacturing capabilities. In LATAM, competitive karting is popular in Brazil and Argentina, creating a steady, localized used market primarily fed by national racing series. In MEA, the emergence of motorsport hubs, particularly in the UAE and Saudi Arabia, fuels demand for high-quality used racing karts for new academies and local championships. Both regions are highly sensitive to exchange rate fluctuations and political stability, which directly impact the cost of importing high-value used assets. Used karts provide a crucial cost advantage, making competitive motorsports accessible in economies where purchasing new European or US equipment would be prohibitively expensive. The key challenge remains establishing verified parts supply chains and consistent maintenance standards for the imported used fleets.

- Europe: Dominant market for high-performance used two-stroke racing karts, characterized by high turnover and formalized certification.

- North America: Strong demand for four-stroke and recreational used karts, driven by accessibility and club racing prevalence.

- Asia Pacific: Fastest-growing region, primarily fueled by B2B demand from new commercial rental track operations and increasing grassroots motorsport participation.

- Latin America: Cost-sensitive, import-reliant market focusing on affordable competitive entry points and local racing series turnover.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Used Kart Market.- Birel ART

- Tony Kart (OTK Group)

- CRG S.p.A.

- Sodikart

- Kosmic Racing Kart (OTK Group)

- Haase Kart

- Praga Kart

- FA Kart (OTK Group)

- Intrepid Kart Technology

- Parolin Racing Kart

- Merlin Karts

- Maranello Kart

- Top Kart

- Swiss Hutless

- Righetti Ridolfi

- Rotax Racing (Engine Supplier & Used Market Influence)

- IAME (Engine Supplier & Used Market Influence)

- Tillotson (Component Supplier & Used Market Influence)

- Honda Racing (Four-Stroke Engine Influence)

- Kart Republic

Frequently Asked Questions

Analyze common user questions about the Used Kart market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the current growth rate projection for the Used Kart Market?

The Used Kart Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.95% through 2033, driven by increasing participation in amateur motorsports and the need for affordable racing equipment.

Which geographical region dominates the sales of high-performance used racing karts?

Europe holds market dominance in the high-performance segment, characterized by frequent equipment turnover among professional race teams and established manufacturer-backed certification programs.

How is AI impacting the valuation and authenticity of used karts?

AI is being utilized to implement dynamic pricing models based on verified history and component wear, and computer vision tools are being deployed to detect damage and verify authenticity, increasing transaction transparency.

What is the primary difference between the demand for used karts in North America versus Europe?

North America's demand is balanced between recreational use and robust four-stroke club racing, prioritizing reliability; whereas Europe focuses overwhelmingly on high-end, competitive two-stroke racing karts with documented pedigree.

What are the main drivers of growth in the Used Kart Market?

Key drivers include the high cost of new competitive equipment, the necessity for frequent upgrades in professional racing which feeds the supply chain, and the expansion of accessible digital marketplaces facilitating sales.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager