UV Objective Lenses Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443611 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

UV Objective Lenses Market Size

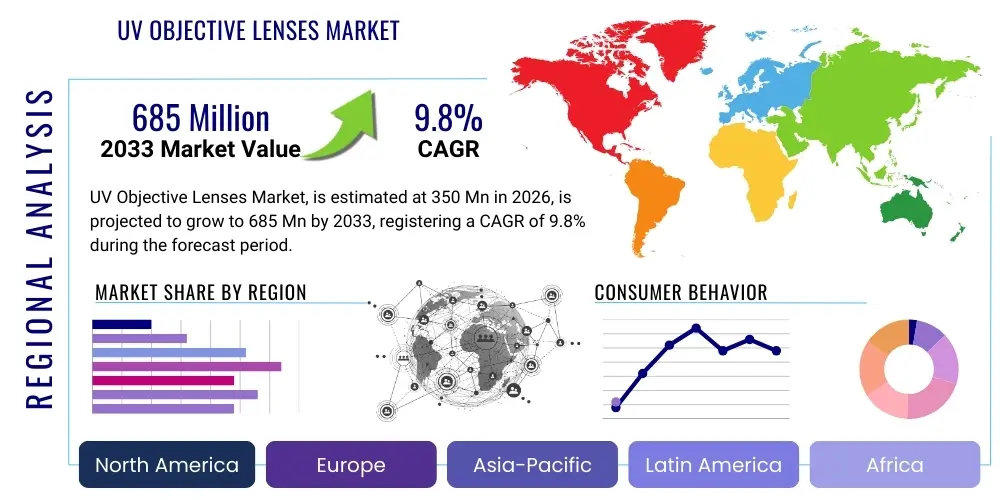

The UV Objective Lenses Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.8% between 2026 and 2033. The market is estimated at $350 Million in 2026 and is projected to reach $685 Million by the end of the forecast period in 2033.

UV Objective Lenses Market introduction

The UV Objective Lenses Market encompasses specialized optical components designed for imaging, inspection, and manipulation in the ultraviolet spectrum, typically ranging from approximately 400 nm down to the vacuum ultraviolet (VUV) region below 200 nm. These lenses are distinct from visible-light objectives due to the unique challenges associated with UV wavelengths, including high material absorption, stringent chromatic aberration control, and the scarcity of suitable high-transmittance optical materials, primarily fused silica and specialized crystal materials like CaF2. The fundamental product, the UV objective lens, is engineered to deliver high-resolution imaging and high numerical aperture (NA) performance critical for advanced technological applications where standard visible light objectives are insufficient or inappropriate due to performance limitations or sample interaction characteristics. The escalating demand for miniaturization in electronics and the necessity for precise non-destructive testing are central to the market's robust expansion. These lenses are instrumental in achieving diffraction-limited resolution necessary for emerging metrology standards.

Major applications of UV objective lenses span several high-technology sectors, most notably semiconductor manufacturing, where Deep Ultraviolet (DUV) lithography and photolithography inspection demand the highest precision optics for pattern generation and defect analysis on wafers. Furthermore, the biomedical field utilizes these lenses extensively in fluorescence microscopy and spectroscopy, particularly for analyzing organic molecules and cellular structures that exhibit strong UV absorption or fluorescence excitation characteristics. Other significant applications include industrial laser systems, material science research (such as Raman spectroscopy and surface analysis), and defense sectors involving specialized sensing and surveillance equipment. The core benefits derived from utilizing UV objectives include superior spatial resolution compared to visible light systems, enhanced contrast for specific materials, and the ability to interact with materials that require energy levels specific to the UV spectrum.

Key driving factors underpinning the market growth include the relentless push toward smaller feature sizes in integrated circuits (ICs), necessitating advanced DUV and extreme ultraviolet (EUV) optical systems for manufacturing and quality control. Secondly, the increasing sophistication of research in nanotechnology and biotechnology requires high-power UV light sources and corresponding high-NA optics to probe and manipulate samples at the nanoscale. Technological advancements in reflective and catadioptric designs, which mitigate chromatic aberration challenges inherent in purely refractive UV systems, are also broadening the applicability and performance envelope of these specialized lenses. Finally, rising investment in advanced medical diagnostics and pharmaceutical research, which relies heavily on high-resolution UV imaging techniques, further propels market expansion across developed and rapidly developing economies.

UV Objective Lenses Market Executive Summary

The UV Objective Lenses market is experiencing significant growth, predominantly driven by structural shifts in the semiconductor and advanced research sectors. Business trends indicate a pronounced investment in reflective and catadioptric lens designs, moving away from purely refractive systems, particularly for the critical 193 nm and lower wavelength applications. Major manufacturers are focusing on integrating advanced automation and computational optics to compensate for residual aberrations and manufacturing tolerances, thereby enhancing performance stability across diverse environmental conditions. Furthermore, strategic collaborations between optical component suppliers and advanced lithography equipment manufacturers (OEMs) are becoming a defining feature of the competitive landscape, aimed at creating highly customized, integrated solutions for next-generation manufacturing processes. The shift towards large-scale photonics integration and the proliferation of high-throughput UV spectroscopy equipment are also opening up lucrative niche segments for specialized lens providers, demanding ultra-low scatter and high laser damage threshold characteristics.

Regionally, the Asia Pacific (APAC) stands out as the primary engine of market expansion, primarily fueled by massive government and private sector investment in semiconductor fabrication facilities (fabs) across China, Taiwan, and South Korea. These regions are the global epicenters for advanced IC production, thus creating an unprecedented demand for sophisticated UV inspection and metrology tools. North America and Europe maintain significant market shares, largely driven by fundamental research institutions, defense applications, and specialized medical device manufacturing, focusing heavily on innovative R&D and intellectual property generation related to novel UV materials and coating technologies. Emerging economies in Latin America and the Middle East are showing nascent growth, primarily through academic research partnerships and initial investments in domestic pharmaceutical manufacturing capabilities, though their current market penetration remains relatively small but is anticipated to accelerate toward the latter half of the forecast period.

In terms of segment trends, the Catadioptric UV Objectives segment is projected to exhibit the highest CAGR due to its superior performance in aberration correction and capability to handle broad UV bandwidths without significant loss in fidelity, making them ideal for high-NA applications in deep UV. By application, the Semiconductor Inspection and Metrology segment dominates the market share, directly correlating with the scaling requirements of Moore's Law, demanding extreme precision for critical dimension (CD) measurement and defect detection. The shift towards multi-photon imaging and advanced confocal microscopy in the Biomedical Imaging segment is also pushing demand for specialized, high-numerical aperture lenses capable of high light collection efficiency and minimal autofluorescence. End-user trends show that Electronics Manufacturing remains the largest consuming sector, yet Research Institutions and university-affiliated cleanrooms are pivotal in driving the adoption of ultra-high-performance, custom-built objective lenses for exploratory materials research and quantum computing applications.

AI Impact Analysis on UV Objective Lenses Market

Analysis of common user questions related to the impact of Artificial Intelligence (AI) on the UV Objective Lenses market reveals a clear focus on three core areas: optical system optimization, real-time aberration correction, and automated defect classification (ADC). Users frequently inquire whether AI algorithms can predict material performance degradation under high UV flux, how machine learning (ML) can refine the manufacturing process of complex freeform optics, and the potential for AI-driven image processing to extract higher fidelity data from noise-heavy UV images. Key themes center around the expectation that AI will transition UV objective lens technology from static hardware components to dynamically managed intelligent systems. Concerns often revolve around the massive datasets required for training effective ML models for optics and the integration challenges between proprietary optical control systems and standardized AI frameworks, while expectations are high regarding enhanced throughput and minimized human intervention in critical inspection processes, leading to tighter quality control and reduced costs associated with calibration drift.

The practical application of AI is primarily concentrated on enhancing the utility and performance of the entire imaging chain, not just the physical lens element itself. For instance, AI algorithms are now being deployed to analyze real-time wavefront sensor data generated by complex lithography systems, allowing for instantaneous adjustment of active optics (e.g., deformable mirrors or piezoelectric lens positioning systems) to maintain peak performance despite environmental fluctuations or mechanical vibrations. This capability extends the practical lifespan and precision of highly sensitive UV objectives. Furthermore, in non-destructive testing and semiconductor metrology, deep learning models are drastically improving the speed and accuracy of Automated Defect Classification (ADC), rapidly distinguishing between nuisance defects and genuine critical flaws based on subtle patterns observed through high-resolution UV objectives, significantly reducing false positive rates and improving overall fabrication efficiency.

Looking forward, the integration of AI is expected to revolutionize the design phase of UV objective lenses. Generative design techniques, powered by AI, can explore vast parametric spaces faster than traditional human-led optimization, identifying novel optical configurations that utilize exotic materials or unconventional surface geometries to achieve diffraction limits that were previously computationally intractable. This iterative design process, informed by simulating real-world manufacturing constraints and operational conditions, will accelerate the development cycle of next-generation UV optics required for high-NA EUV lithography and sophisticated multi-spectral deep UV research. The shift means that the objective lens is increasingly viewed as an interconnected component within a larger, AI-optimized photonic system, where the physical hardware is complemented and dynamically optimized by intelligent software controls.

- AI optimizes optical design by utilizing generative algorithms to explore complex, high-NA, aberration-free lens configurations.

- Machine Learning (ML) enhances real-time aberration correction through dynamic feedback loops linked to wavefront sensors, stabilizing image quality in DUV systems.

- Deep Learning models significantly improve Automated Defect Classification (ADC) in semiconductor inspection, reducing false positives and accelerating metrology throughput.

- Predictive maintenance driven by AI monitors objective lens degradation (e.g., haze formation, coating damage) under high UV irradiation, optimizing replacement cycles.

- AI-driven image processing techniques enhance signal-to-noise ratio in UV spectroscopy and microscopy, allowing for clearer visualization of low-contrast features.

DRO & Impact Forces Of UV Objective Lenses Market

The UV Objective Lenses Market is fundamentally shaped by a confluence of powerful drivers related to technological advancement and restraints centered on material and manufacturing complexities, alongside significant opportunities derived from emerging fields. Key drivers include the unrelenting progress in semiconductor scaling, which mandates UV optics for photolithography and precise quality control, and the accelerating adoption of advanced UV imaging technologies in life sciences for non-invasive cellular analysis. These drivers exert a strong positive impact force, continually elevating performance standards (e.g., numerical aperture, working distance) and pushing demand for highly customized, specialized lenses. However, market growth is significantly restrained by the scarcity and high cost of suitable UV-transparent materials, such as specific grades of fused silica and CaF2 crystals, which possess the necessary refractive and low-absorption properties for these wavelengths. Furthermore, the extreme precision required in manufacturing, including complex polishing, coating deposition, and stringent contamination control in cleanroom environments, contributes significantly to high production costs and limits the scalability of manufacturing operations, thereby acting as a critical impact force constraining rapid volume expansion.

Opportunities for growth are abundant, particularly in the domain of developing novel catadioptric and purely reflective systems that circumvent the material limitations of refractive optics by utilizing mirror-based designs, which are inherently achromatic and suitable for wider spectral ranges. The rise of quantum computing research and the need for precision laser manipulation and imaging at deep UV wavelengths also represent a burgeoning application segment demanding bespoke UV objective solutions. Moreover, the increasing global focus on advanced medical diagnostics, including DNA analysis and pathogen detection utilizing UV fluorescence techniques, opens new avenues for specialized, high-throughput microscope systems integrated with optimized UV objectives. The primary impact force accelerating these opportunities is technological innovation in thin-film coating technology and advanced metrology instrumentation, which enable the design and verification of these complex reflective and catadioptric elements, promising to lower system complexity and potentially expand market accessibility over the long term as production techniques mature.

The interplay between these factors creates a highly technical and competitive landscape. The need for continuous innovation to overcome material limitations (Restraint) is directly addressed by increased R&D investment (Driver) focused on novel designs (Opportunity). The market equilibrium is maintained by the high barrier to entry for new manufacturers due to the requirement for stringent contamination control and proprietary coating technologies. Therefore, the dominant impact force is the technological imperative from the semiconductor industry, which sustains high prices for ultra-premium UV objectives while simultaneously funding the necessary technological breakthroughs. This pressure cooker environment ensures that UV objective lens performance continues its trajectory of improvement, essential for maintaining the current pace of technological advancement in electronics and advanced scientific research globally, creating a cyclical relationship between industrial demand and optical innovation that defines the market structure.

Segmentation Analysis

The UV Objective Lenses Market is comprehensively segmented based on the fundamental optical design type, the specific application areas where they are deployed, and the primary end-user sectors utilizing this technology. Segmentation by Type is crucial as it reflects the technical compromise between cost, complexity, and performance; refractive lenses are generally simpler but suffer from chromatic aberration, whereas catadioptric and reflective systems offer superior achromatic performance but are significantly more costly and mechanically complex to implement. Application segmentation highlights the highest-value markets, particularly the electronics and life science sectors, which drive volume and precision requirements. Finally, end-user segmentation helps identify the differential needs of industrial manufacturing versus purely academic or governmental research, providing clarity on procurement cycles and customization levels required across the market spectrum.

- By Type

- Refractive UV Objectives (Purely lens-based, typically fused silica/CaF2)

- Reflective UV Objectives (Purely mirror-based, inherently achromatic)

- Catadioptric UV Objectives (Combination of lenses and mirrors, optimized for DUV/EUV)

- By Application

- Semiconductor Inspection and Metrology

- Biomedical Imaging and Spectroscopy

- Material Science and Research

- Industrial Metrology and Quality Control

- Defense and Aerospace Sensing

- By End-User

- Electronics Manufacturing and Foundries

- Research Institutions and Universities

- Healthcare & Pharmaceutical Industry

- Government and Defense Organizations

Value Chain Analysis For UV Objective Lenses Market

The value chain for the UV Objective Lenses Market is complex and highly specialized, beginning with the upstream sourcing of high-purity optical materials, primarily UV-grade fused silica, calcium fluoride (CaF2), and specific metallic substrates for mirror coatings. Upstream activities are dominated by a select group of material suppliers who can ensure the homogeneity, low absorption coefficient, and stringent inclusion control necessary for deep UV transmission and high laser damage threshold. The next critical stage involves the precision manufacturing processes: grinding, polishing, and shaping the optical elements, followed by sophisticated thin-film coating deposition (anti-reflective, high-reflective, and protective coatings), which must be executed in ultra-clean environments to maintain optical integrity. Given the precision required (often sub-nanometer surface roughness), these manufacturing processes constitute a high-value, high-barrier-to-entry segment of the chain.

The midstream involves the integration and assembly of these highly polished and coated components into the final objective lens system. This requires expert optical engineering for alignment and tolerancing, particularly for complex catadioptric systems that involve precise positioning of multiple lenses and mirrors to maintain diffraction-limited performance across the field of view. Original Equipment Manufacturers (OEMs) specializing in advanced lithography tools, high-end microscopy systems, and industrial metrology machines are the primary purchasers of these assembled objectives. They integrate the lenses into their complete systems, adding sophisticated control electronics and software interfaces necessary for application-specific deployment. This integration phase is where significant added value is generated through system calibration and performance verification.

Downstream distribution channels are characterized by a dual approach: direct sales for high-volume, highly customized objectives sold directly to major semiconductor foundries or advanced scientific research institutes (such as national labs) for immediate integration into proprietary equipment; and indirect distribution through specialized optical component distributors for standard or off-the-shelf objectives aimed at universities, smaller R&D labs, and lower-volume industrial users. The direct channel ensures deep technical support and customization feedback loops, crucial for leading-edge applications. The indirect channel provides accessibility and shorter lead times for standard products. Post-sales support, recalibration services, and specialized cleaning—given the sensitivity of UV optics to contamination—also form a high-value component of the downstream activities, ensuring long-term product reliability and customer satisfaction in critical, high-cost environments.

UV Objective Lenses Market Potential Customers

The potential customers for the UV Objective Lenses Market are concentrated within highly specialized industrial and institutional sectors where the unique resolution and energy transmission properties of UV light are indispensable for operational or research objectives. The largest segment of end-users consists of Electronics Manufacturing and Semiconductor Foundries, including major integrated device manufacturers (IDMs) and pure-play foundries. These entities are buyers of ultra-high-NA objectives for DUV lithography alignment, critical dimension (CD) metrology, overlay measurements, and rapid defect inspection of advanced silicon wafers, representing the highest volume and highest cost applications in the market. The relentless pursuit of smaller feature sizes ensures sustained demand from this critical customer base, which views these objectives as strategic assets integral to their production yield.

Another major customer segment includes Research Institutions and Academic Laboratories globally, specifically those involved in advanced materials science, physical chemistry, nanotechnology, and fundamental physics research. These customers typically require smaller volumes but demand highly specialized, often custom-designed UV objectives for unique experimental setups, such as deep-UV laser manipulation, synchrotron light source interfacing, or high-resolution scanning probe microscopy techniques utilizing UV illumination. Their buying decisions are frequently driven by technical specifications, spectral range flexibility, and compatibility with complex vacuum or controlled atmospheric chambers, rather than pure volume efficiency. This segment often serves as the testing ground for next-generation optical designs before industrial scale-up.

Finally, the Healthcare and Pharmaceutical sector, alongside Government and Defense organizations, constitutes the remaining critical customer base. Healthcare customers utilize UV objectives in specialized microscopes for fluorescence lifetime imaging, DNA sequencing tools, and non-destructive inspection of sterile medical devices and pharmaceutical products, driven by stringent quality standards. Defense and aerospace customers acquire UV objectives for remote sensing, specialized surveillance systems, and high-energy laser targeting systems, where ruggedness, reliability, and specific environmental tolerances are paramount. These buyers require lenses with high durability, broad operational temperature ranges, and often secure supply chains, creating a distinct niche market focused on performance under extreme conditions and long-term supply assurance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $350 Million |

| Market Forecast in 2033 | $685 Million |

| Growth Rate | 9.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Thorlabs, Newport Corporation, Edmund Optics, Carl Zeiss AG, Nikon Corporation, Olympus Corporation, SCHOTT AG, Corning Incorporated, Resolve Optics Ltd., Kyocera Optics, Optosigma, MKS Instruments, Excelitas Technologies Corp., Jenoptik AG, Lambda Research Optics, Coastal Optical Systems, Syntec Optics, Qioptiq (Excelitas Technologies), Shanghai Optics, Piezosystem Jena GmbH |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

UV Objective Lenses Market Key Technology Landscape

The technology landscape of the UV Objective Lenses Market is defined by the ongoing struggle to achieve extremely high numerical aperture (NA) and near-perfect wavefront correction across the challenging short-wavelength spectrum. The cornerstone technology remains the use of crystalline materials like Calcium Fluoride (CaF2) and high-purity synthetic fused silica, which offer necessary deep UV (DUV) transmission capabilities below 250 nm, crucial for excimer laser systems operating at 248 nm (KrF) and 193 nm (ArF). Technological advancements are heavily concentrated on mitigating intrinsic material limitations, primarily birefringence and thermal expansion, which can significantly distort the wavefront under high-power laser irradiation. Manufacturers are increasingly employing computerized polishing techniques, such as Magnetorheological Finishing (MRF) and Ion Beam Figuring (IBF), to achieve the ultra-smooth surfaces (RMS roughness often less than 0.5 nm) required to minimize light scatter and maintain extremely low wavefront error in high-NA systems, directly impacting the resolution and contrast achieved in applications like semiconductor lithography.

A second pivotal technology area is the shift towards advanced achromatic designs, moving beyond purely refractive optics, which are inherently prone to chromatic aberration due to the high dispersion of UV-transparent materials. Catadioptric designs, which combine reflective mirrors and refractive lenses, are crucial for DUV and VUV applications where broad bandwidth imaging or highly corrected systems are necessary, such as advanced metrology and multi-spectral spectroscopy. These systems often utilize advanced freeform and aspheric surfaces, which are increasingly manufactured using deterministic micro-polishing technologies and verified using sophisticated interferometry (e.g., phase-shifting interferometry) to ensure conformance to nanometer-level tolerances. The challenge here lies in the mechanical alignment and stabilization of these hybrid systems, necessitating robust opto-mechanical mounts with thermal compensation features to maintain alignment precision under varying operating temperatures.

Furthermore, the performance of UV objective lenses is fundamentally reliant on thin-film coating technology. Advanced dielectric coatings are required not only to minimize reflection losses (Anti-Reflection, AR) but also to maximize the laser-induced damage threshold (LIDT) for use with high-power pulsed UV lasers common in inspection and material processing. Manufacturers employ proprietary deposition techniques, such as Ion Beam Sputtering (IBS), to produce highly dense, low-defect, multilayer coatings with precise thickness control, ensuring spectral performance exactly matches the application wavelength (e.g., 193 nm or 266 nm). Ongoing R&D focuses on developing durable protective coatings that resist environmental degradation (e.g., atmospheric contaminants, humidity) without compromising high transmission, thereby extending the operational life and reliability of these exceedingly delicate optical components in industrial cleanroom and demanding research environments.

Regional Highlights

- Asia Pacific (APAC): The APAC region, driven primarily by powerhouse economies like China, South Korea, and Taiwan, dominates the UV Objective Lenses market in terms of production demand and market volume. This dominance is intrinsically linked to its status as the global manufacturing hub for advanced semiconductors. Massive investments in foundry capacity (e.g., TSMC, Samsung, SMIC) necessitate continuous procurement of high-end DUV and EUV compatible objective lenses for photolithography, wafer inspection, and critical dimension metrology. The region's focus is on high-throughput industrial application, creating a robust demand for highly standardized, repeatable, and robust UV optics. Furthermore, increasing governmental support for domestic high-tech R&D and pharmaceutical manufacturing further fuels growth outside of pure semiconductor applications.

- North America: North America represents a mature, high-value market, characterized by cutting-edge research and specialized, low-volume, high-performance applications in defense, aerospace, and advanced academic research (e.g., quantum optics, fundamental materials science). The demand here is driven by premier research institutions and a strong presence of key optical component manufacturers and defense contractors. North American companies often lead innovation in bespoke reflective and catadioptric designs aimed at ultra-broadband or extreme-environment operations, focusing on intellectual property and technological superiority over mass production volume.

- Europe: Europe is a vital market, supported by strong academic research infrastructure and the presence of world-leading optical and metrology equipment manufacturers (e.g., Zeiss, ASML partner ecosystems). Key demand areas include advanced industrial metrology, automotive component inspection utilizing specialized UV illumination, and sophisticated life science research. The focus in Europe often leans toward precision engineering, highly calibrated systems, and strict adherence to industrial quality standards, driving demand for UV objectives with verifiable long-term stability and traceability.

- Latin America, Middle East, and Africa (MEA): These regions currently hold a smaller share but present emerging market opportunities. Growth in MEA is primarily supported by rising investment in localized scientific research centers and initial diversification efforts into domestic pharmaceutical production, requiring standard UV spectroscopy and basic microscopy objectives. Latin America shows gradual growth driven by university research and developing industrial quality control labs. Demand in these regions is typically focused on cost-effectiveness and versatile, off-the-shelf objectives rather than the ultra-high-end customization prevalent in APAC or North America.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the UV Objective Lenses Market.- Thorlabs

- Newport Corporation

- Edmund Optics

- Carl Zeiss AG

- Nikon Corporation

- Olympus Corporation

- SCHOTT AG

- Corning Incorporated

- Resolve Optics Ltd.

- Kyocera Optics

- Optosigma

- MKS Instruments

- Excelitas Technologies Corp.

- Jenoptik AG

- Lambda Research Optics

- Coastal Optical Systems

- Syntec Optics

- Qioptiq (Excelitas Technologies)

- Shanghai Optics

- Piezosystem Jena GmbH

Frequently Asked Questions

Analyze common user questions about the UV Objective Lenses market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary material challenges in manufacturing high-performance UV objective lenses?

The primary material challenge is sourcing and processing UV-transparent crystalline materials, such as Calcium Fluoride (CaF2) and high-purity Fused Silica, which must exhibit extremely low absorption coefficients and resistance to thermal distortion and radiation damage, particularly for high-power Deep UV (DUV) applications below 200 nm. Manufacturing requires complex, contamination-free polishing techniques.

How do catadioptric objective lenses improve performance compared to purely refractive UV objectives?

Catadioptric objectives, utilizing a combination of mirrors and lenses, significantly improve performance by achieving inherent achromaticity. This design minimizes chromatic aberration over a broader spectral range compared to purely refractive systems, which suffer from high dispersion in the UV spectrum, making them essential for high-Numerical Aperture (NA) metrology and inspection systems.

Which application segment drives the largest demand for UV objective lenses globally?

The Semiconductor Inspection and Metrology segment drives the largest global demand. The relentless requirement for smaller feature sizes in integrated circuits (ICs) necessitates the use of UV objective lenses for high-resolution photolithography alignment, critical dimension (CD) measurement, and defect detection on wafers.

How does AI technology specifically influence the next generation of UV objective lens systems?

AI primarily influences UV objective systems by enabling dynamic performance optimization. Machine learning algorithms analyze real-time wavefront data to facilitate instantaneous aberration correction via active optics and significantly enhance the speed and accuracy of Automated Defect Classification (ADC) in high-throughput inspection processes.

What is the projected growth rate (CAGR) for the UV Objective Lenses Market through 2033?

The UV Objective Lenses Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.8% between 2026 and 2033, driven by continuous technological advancements in DUV lithography and expanding applications in advanced biomedical research.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager