Vaccine Storage Medical Refrigerators Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441407 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Vaccine Storage Medical Refrigerators Market Size

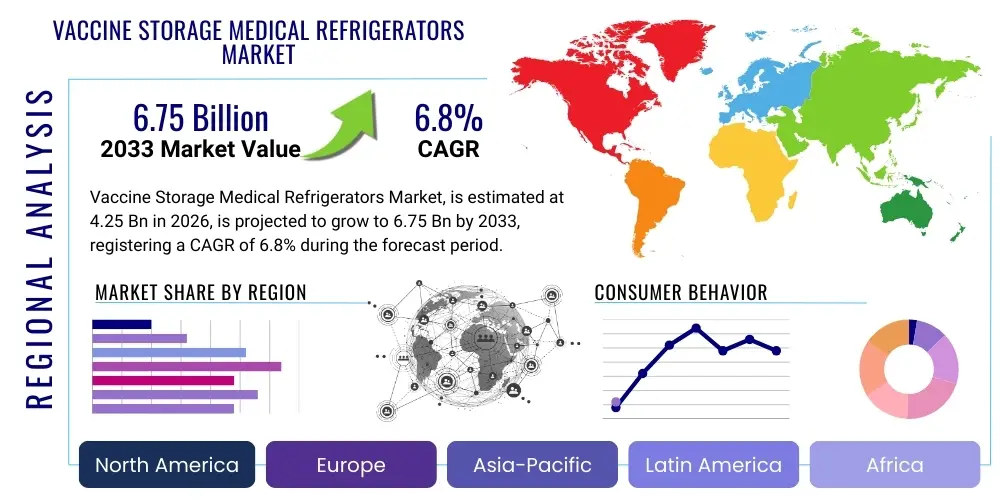

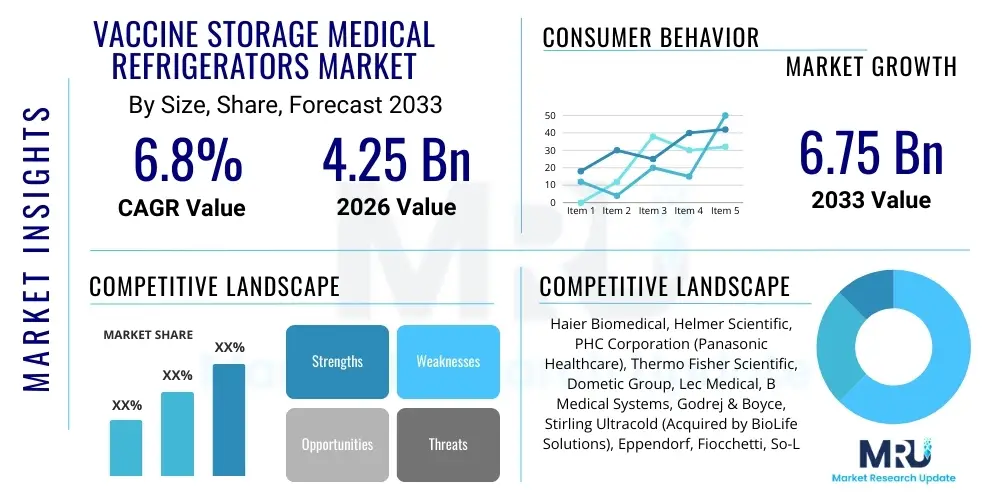

The Vaccine Storage Medical Refrigerators Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.25 Billion in 2026 and is projected to reach USD 6.75 Billion by the end of the forecast period in 2033. This substantial growth trajectory is underpinned by increasing global immunization programs, stringent regulatory guidelines mandating precise temperature control for biological products, and significant investments in healthcare infrastructure across developing nations. The necessity of maintaining the integrity and efficacy of increasingly temperature-sensitive vaccine formulations, including mRNA vaccines, elevates the criticality of high-precision cold storage solutions.

The market expansion is heavily influenced by the transition from conventional domestic refrigerators to certified medical-grade units which offer superior temperature stability, reliable alarm systems, and precise monitoring capabilities. Demand drivers include global efforts to eradicate infectious diseases, necessitating mass vaccination campaigns, and the rising prevalence of chronic illnesses requiring specialized biologics storage. Furthermore, the expansion of pharmaceutical supply chains into remote and underserved areas requires robust, often solar-powered, cold chain equipment, creating new opportunities for specialized refrigerator manufacturers. Regulatory bodies, such as the World Health Organization (WHO) and regional health agencies, consistently update performance standards, compelling healthcare providers to upgrade existing outdated equipment, thereby stimulating continuous market turnover.

Vaccine Storage Medical Refrigerators Market introduction

The Vaccine Storage Medical Refrigerators Market encompasses specialized refrigeration units designed specifically for the safe and compliant storage of vaccines and other temperature-sensitive medical supplies. These devices are critical components of the pharmaceutical cold chain, maintaining temperatures typically ranging from +2°C to +8°C, or ultra-low temperatures down to -86°C for specialized vaccines. The product differentiation lies in features such as forced-air cooling, microprocessor-based temperature controls, robust alarm systems, and validated temperature mapping capabilities, distinguishing them significantly from standard commercial refrigeration units. These refrigerators ensure biological product efficacy, preventing potential financial losses and public health risks associated with temperature excursions.

Major applications of these medical refrigerators span across public health immunization centers, hospitals, clinics, pharmacies, blood banks, and research laboratories. In public health, they are indispensable for large-scale national immunization programs (NIPs), ensuring that vaccines reach the final point of administration without degradation. In hospital settings, they are used both in central pharmacies and specialized wards for managing inventory of high-value, sensitive medications. The primary benefits driving adoption include enhanced patient safety through guaranteed vaccine potency, compliance with global health regulations (like WHO PQS certification), reduced operational risk associated with product spoilage, and improved inventory management facilitated by integrated monitoring systems.

Key driving factors accelerating market growth include increasing worldwide attention to pandemic preparedness, symbolized by recent global health crises that highlighted cold chain vulnerabilities. Furthermore, government initiatives in various countries to strengthen primary healthcare infrastructure, particularly in emerging economies, are fueling bulk purchases of reliable cold chain equipment. Technological advancements, such as the integration of IoT for remote monitoring and predictive maintenance, are making these units more reliable and efficient. The continuous development of new, highly potent, but extremely temperature-sensitive vaccine types necessitates the constant renewal and upgrading of existing storage fleets, sustaining market demand.

Vaccine Storage Medical Refrigerators Market Executive Summary

The Vaccine Storage Medical Refrigerators Market exhibits robust growth driven by stringent regulatory environments and expanding global immunization efforts. Business trends indicate a strong shift toward digitalization, with manufacturers integrating cloud connectivity, real-time data logging, and advanced alarm mechanisms into their units to meet compliance requirements and enhance operational efficiency. Consolidation activities, including strategic partnerships and mergers, are common among established players seeking to broaden geographical reach, particularly in high-growth Asia Pacific regions, and to acquire specialized ultra-low temperature technology capabilities. Furthermore, there is a growing emphasis on energy efficiency, leading to the adoption of hydrocarbon refrigerants and advanced insulation materials to reduce operating costs and align with sustainability goals, which is a key purchasing criterion for large organizational buyers and NGOs.

Regionally, North America and Europe maintain leading positions due to established advanced healthcare systems, high levels of regulatory compliance, and significant pharmaceutical R&D activities demanding state-of-the-art storage for clinical trials and commercial supply. However, the Asia Pacific region is forecast to demonstrate the highest Compound Annual Growth Rate, spurred by large population bases, government-led universal healthcare expansion, increasing investments in cold chain logistics (especially in countries like India and China), and the local production of various vaccine types. Latin America and the Middle East and Africa (MEA) are also experiencing accelerated growth, largely attributed to international funding for infectious disease prevention and the critical need for reliable cold chain infrastructure to support mass immunization campaigns targeted at underserved populations.

Segment trends highlight the dominance of the conventional refrigerator segment (2°C to 8°C) due to its pervasive use for routine childhood immunizations, though the ultra-low temperature (ULT) freezer segment is witnessing explosive growth, driven by specialized needs for COVID-19 mRNA vaccines and other advanced biological therapies. Segmentation by product type also reveals increased adoption of portable units and solar-powered refrigerators, crucial for last-mile delivery and deployment in regions with unreliable electricity access. End-user segmentation shows that hospitals and pharmacies remain major revenue generators, but the institutional buyer segment, encompassing government agencies and large non-governmental organizations (NGOs) involved in global health, represents a consistently expanding procurement avenue due to large-volume purchasing cycles focused on meeting public health mandates.

AI Impact Analysis on Vaccine Storage Medical Refrigerators Market

User inquiries regarding Artificial Intelligence (AI) in the medical refrigeration sector center heavily on enhancing proactive temperature monitoring, optimizing maintenance schedules, and improving cold chain logistics visibility. Key concerns frequently raised include how AI algorithms can predict equipment failure before it compromises vaccine integrity, the capabilities of machine learning in analyzing vast streams of temperature and operational data, and the role of AI in optimizing power consumption in remote or solar-powered units. Users anticipate that AI integration will shift storage management from reactive troubleshooting to predictive, automated control, drastically reducing instances of temperature excursions and minimizing costly vaccine waste, thereby improving overall system reliability and regulatory compliance across diverse operational settings globally.

- AI-driven Predictive Maintenance: Analyzing sensor data (compressor cycles, temperature fluctuations, ambient conditions) to forecast component failure, enabling preemptive servicing and zero downtime, crucial for high-value vaccines.

- Optimized Inventory Management: Using machine learning to predict consumption rates and optimize storage layouts, ensuring FIFO (First-In, First-Out) compliance and reducing expired stock within the limited shelf life constraints.

- Enhanced Temperature Stability Control: AI algorithms fine-tune compressor and fan operations in real-time, adapting to door openings and external environmental changes faster and more precisely than traditional controllers, maintaining ultra-stable temperatures (e.g., within +/- 0.5°C).

- Automated Compliance and Reporting: Generating automated, tamper-proof audit trails and compliance reports required by regulatory bodies (e.g., CDC, WHO), minimizing manual labor and errors.

- Cold Chain Route Optimization: Integrating refrigeration data with logistics platforms to optimize transport routes and storage points, minimizing time spent outside certified temperature ranges during distribution.

- Energy Efficiency Optimization: Learning usage patterns and external ambient temperatures to intelligently adjust cooling cycles, particularly impactful for solar direct drive (SDD) systems in off-grid locations, maximizing battery life and minimizing power consumption.

DRO & Impact Forces Of Vaccine Storage Medical Refrigerators Market

The dynamics of the Vaccine Storage Medical Refrigerators Market are governed by a complex interplay of stringent regulations (Drivers), the substantial initial investment required (Restraints), and the emerging needs for last-mile cold chain solutions (Opportunities). The primary driving force is the global commitment to universal immunization, requiring reliable storage capacity, compounded by the increasing sophistication and sensitivity of modern biological products, which demand tighter temperature controls. Restraints primarily involve the high procurement cost of certified medical-grade units compared to commercial alternatives, especially in resource-constrained environments, alongside the continuous challenge of ensuring consistent electricity supply in remote areas. Opportunities arise from technological innovations such as IoT integration, solar power adoption, and the increasing demand for ultra-low temperature freezers following the successful deployment of mRNA vaccine technologies worldwide. These forces collectively shape investment decisions, market penetration rates, and technological innovation cycles within the industry, influencing long-term strategic planning for both manufacturers and end-users.

The impact forces influencing this market include shifts in global health funding priorities and technological advancements in refrigeration science. Global health crises, such as pandemics, exert a massive positive force, necessitating rapid scaling of cold chain capacity and significant government investment in resilient infrastructure. Conversely, the stringent certification requirements, particularly the WHO Performance, Quality and Safety (PQS) standards, act as both a driver (by ensuring quality) and a restraint (by creating market entry barriers for non-compliant manufacturers). The long-term impact of sustainable development goals encourages manufacturers to innovate toward greener, energy-efficient solutions using natural refrigerants like R600a and R290, ensuring the market evolves to meet both efficacy and environmental responsibility mandates.

Segmentation Analysis

The Vaccine Storage Medical Refrigerators Market is segmented based on product type, temperature range, storage capacity, and end-user, providing a granular view of demand patterns across various healthcare settings. Segmentation by product type differentiates between standard refrigerators, freezers, and combination units, catering to distinct inventory needs and facility sizes. The temperature range segmentation is perhaps the most critical, separating conventional cold chain (+2°C to +8°C) units, which dominate standard immunization storage, from ultra-low temperature (ULT) freezers (-40°C to -86°C), which have become essential for advanced biologics and specific sensitive vaccines. Analyzing these segments helps stakeholders understand shifting investment priorities driven by global immunization strategies and emerging vaccine technologies.

Capacity segmentation allows manufacturers to target needs ranging from small clinics requiring countertop units to regional distribution hubs needing large walk-in cold rooms. Capacity types often dictate technology choice; smaller units prioritize portability and sometimes solar capability, while large units focus on redundancy and energy management systems. End-user segmentation confirms that institutional buyers (governments, NGOs) represent bulk purchasing power, demanding consistency and compliance, whereas hospitals and pharmacies prioritize user interface, reliable monitoring, and integration with existing inventory systems. The complexity of vaccine distribution mandates diverse product offerings to ensure the cold chain is maintained consistently from the manufacturing site down to the last-mile point of use, making segmentation analysis vital for effective market strategy.

- By Product Type:

- Laboratory Refrigerators

- Pharmacy Refrigerators

- Blood Bank Refrigerators

- Portable Refrigerators and Coolers

- Freezers (Standard and Ultra-Low Temperature)

- By Temperature Range:

- 2°C to 8°C (Conventional Cold Chain)

- -20°C to -40°C (Standard Freezing)

- -40°C to -86°C (Ultra-Low Temperature, ULT)

- By Storage Capacity:

- Below 100 Liters (Countertop/Portable)

- 100 to 500 Liters (Medium Capacity)

- Above 500 Liters (High Capacity/Walk-in Cold Rooms)

- By End User:

- Hospitals and Clinics

- Pharmaceutical Companies and Biopharmaceutical Manufacturers

- Research and Academic Institutions

- Pharmacies

- Blood Centers

- Governmental Agencies and Public Health Organizations (e.g., WHO, UNICEF)

Value Chain Analysis For Vaccine Storage Medical Refrigerators Market

The value chain for the Vaccine Storage Medical Refrigerators Market begins with the upstream suppliers responsible for core components, including high-performance compressors, advanced insulation materials (like vacuum insulation panels), specialized sensors, and microprocessor controllers. Quality assurance and consistent sourcing of these highly specialized parts are critical, as component failure directly jeopardizes the cold chain integrity. Manufacturers then assemble and certify these units, often requiring compliance with multiple international standards (ISO, CE, WHO PQS). Technological expertise in refrigeration cycles, temperature mapping validation, and software integration (for monitoring) represents a significant value addition at this stage. Intense competition requires manufacturers to maintain optimized production lines and robust quality control procedures to minimize defects and maximize energy efficiency, appealing directly to cost-conscious institutional buyers.

The downstream activities involve distribution channels, which are highly specialized given the medical nature of the product. Distribution often occurs through a mix of direct sales (especially for large governmental or institutional tenders) and indirect channels utilizing specialized medical equipment distributors and logistics providers who possess expertise in handling and installing validated cold chain equipment. The indirect channel often provides local maintenance and calibration services, a non-negotiable requirement for regulatory compliance. Furthermore, the role of international NGOs, such as UNICEF and Gavi, acting as major procurement agents, significantly influences distribution strategies, particularly in emerging markets where delivery and installation services require logistical sophistication and specific expertise in often challenging operational environments.

Post-sales service, including routine maintenance, calibration, validation (IQ/OQ/PQ), and the provision of spare parts, constitutes a critical part of the value chain, ensuring the long operational lifespan and continuous regulatory compliance of the refrigeration units. Direct channels allow for immediate feedback and tailored service agreements, whereas indirect channels rely heavily on distributor training and certification to maintain high service quality standards. Potential customers value comprehensive support packages that guarantee minimal downtime, recognizing that the cost of vaccine spoilage far outweighs the maintenance expense. This focus on reliability and validated performance ensures that the value chain extends beyond the initial sale, fostering long-term relationships centered on trust and continuous operational support.

Vaccine Storage Medical Refrigerators Market Potential Customers

Potential customers for Vaccine Storage Medical Refrigerators are primarily entities within the public health sector and advanced biomedical research and clinical domains who require validated temperature control for biological assets. End-users include governmental bodies responsible for national immunization programs (NIPs), which represent the largest volume buyers, often procuring equipment through multi-year contracts and large international tenders coordinated by organizations like the Pan American Health Organization (PAHO) and UNICEF. These institutional buyers prioritize units certified by the WHO Performance, Quality, and Safety (PQS) system, focusing on extreme durability, high energy efficiency (especially solar-powered variants), and robust remote monitoring capabilities to manage vast, decentralized cold chains across diverse climates.

Secondary high-value customers include private healthcare systems, large hospital networks, and retail pharmacy chains that manage consumer prescriptions for vaccines (like flu shots) and specialized therapeutics. These buyers often seek integrated solutions that interface smoothly with facility management systems and electronic health records (EHRs), emphasizing sleek design, quiet operation, and automated documentation features. Furthermore, the pharmaceutical and biotechnology industry, including Contract Research Organizations (CROs), forms a crucial customer segment, demanding ultra-low temperature freezers for storing clinical trial materials, active pharmaceutical ingredients (APIs), and proprietary cell lines, where temperature stability is non-negotiable for product development and regulatory approval.

Academic research institutions and specialized reference laboratories also represent significant potential customers, often requiring small to medium-capacity units for sample banking and experimentation. Their procurement decisions are heavily influenced by precision temperature control and advanced data logging features to comply with rigorous research protocols. The growing global focus on preparedness for future pandemics ensures that government stockpiling facilities and emergency medical service providers will continue to be expanding customer bases, prioritizing highly reliable, rapidly deployable, and validated storage solutions capable of handling surge capacity demands for newly developed vaccines.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.25 Billion |

| Market Forecast in 2033 | USD 6.75 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Haier Biomedical, Helmer Scientific, PHC Corporation (Panasonic Healthcare), Thermo Fisher Scientific, Dometic Group, Lec Medical, B Medical Systems, Godrej & Boyce, Stirling Ultracold (Acquired by BioLife Solutions), Eppendorf, Fiocchetti, So-Low Environmental Equipment, Follett LLC, Vestfrost Solutions, Marvel Scientific, Migali Scientific, Kirsch Medical GmbH, Cool Chain Technologies, Biobase Group, A&S Refrigeration. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Vaccine Storage Medical Refrigerators Market Key Technology Landscape

The technological landscape of the Vaccine Storage Medical Refrigerators Market is characterized by a drive towards enhanced temperature precision, improved energy efficiency, and advanced connectivity features necessary for regulatory compliance and operational security. Core technological advancements focus heavily on optimizing the refrigeration system itself, moving away from older HFC refrigerants toward natural, environmentally friendly hydrocarbon refrigerants (R290, R600a), which offer superior thermodynamic performance and significantly reduce the unit's carbon footprint. Furthermore, advanced insulation techniques, notably the integration of Vacuum Insulation Panels (VIPs), are becoming standard in high-end and portable units, allowing for thinner walls, maximizing internal storage capacity, and significantly extending holdover times during power outages, a crucial feature for maintaining the integrity of sensitive vaccines in challenging environments.

Digitalization represents another crucial technological pillar. Modern medical refrigerators are increasingly equipped with integrated microprocessors capable of precise temperature control and continuous monitoring, often to within ±0.5°C tolerance. These systems utilize multiple temperature probes (internal and simulated load probes) to provide highly accurate data. The advent of IoT technology facilitates secure, cloud-based data logging and real-time remote monitoring, enabling users to receive instant alerts via SMS or email regarding door openings, power failures, or temperature excursions. This capability not only ensures compliance with GxP standards but also provides invaluable audit trails and operational oversight, particularly for complex, multi-site cold chain networks managed by large governmental or pharmaceutical entities. This shift to interconnected systems minimizes manual checks and drastically reduces the risk of human error.

A critical emerging technology, especially relevant for global health outreach, is Solar Direct Drive (SDD) technology. These refrigerators utilize solar power directly to run the cooling compressor, storing energy in the cold mass (ice banks or phase change material) rather than relying on conventional batteries, which have limited lifespans and complex maintenance requirements. SDD units have been rigorously tested and certified by the WHO for deployment in areas lacking reliable electricity infrastructure, fundamentally solving the "last mile" cold chain challenge. Similarly, the specialized Ultra-Low Temperature (ULT) freezer segment is seeing technological breakthroughs, including the use of high-efficiency single-stage or cascade refrigeration systems that eliminate the need for costly liquid nitrogen, making ultra-low storage more accessible, cost-effective, and easier to maintain in standard laboratory and hospital settings.

Regional Highlights

Regional dynamics within the Vaccine Storage Medical Refrigerators Market reflect disparities in healthcare spending, regulatory enforcement, and infrastructure maturity, significantly influencing demand and product specialization. North America holds a dominant market share, driven by advanced healthcare infrastructure, significant R&D investment in new biologics requiring specialized cold storage, and stringent regulatory requirements imposed by the CDC and FDA, necessitating constant equipment upgrades and validated storage solutions. The region's focus is heavily on high-end, IoT-enabled ULT freezers and sophisticated centralized monitoring systems that integrate seamlessly across large hospital networks and pharmaceutical supply chains, demanding premium pricing for enhanced reliability and data security.

Europe represents another key established market, characterized by strict EU regulatory frameworks (e.g., Good Distribution Practice, GDP) and well-funded national healthcare systems. Market growth is sustained by the ongoing modernization of cold chain facilities and a strong inclination towards adopting energy-efficient and sustainable refrigeration solutions, aligning with European Green Deal objectives. Germany, the UK, and France are major contributors, exhibiting high demand for certified pharmacy refrigerators and specialized laboratory units. Manufacturers in this region often lead in adopting natural refrigerants and superior insulation technologies to meet the high standards for environmental responsibility while maintaining efficacy.

The Asia Pacific (APAC) region is projected to be the fastest-growing market globally. This exponential growth is fueled by massive government initiatives to expand immunization coverage across large populations (especially in India, China, and Southeast Asia), coupled with substantial public and private investments in healthcare infrastructure development. The primary demand driver here is the need for reliable, cost-effective, and often solar-powered conventional cold chain equipment (2°C to 8°C) to manage routine immunization programs in rural and remote areas. Furthermore, the region is rapidly becoming a global manufacturing hub for vaccines, increasing the localized demand for high-capacity, highly regulated storage systems at manufacturing and distribution centers.

Latin America (LATAM) and the Middle East and Africa (MEA) are also experiencing robust market expansion, largely supported by international aid programs (Gavi, WHO) focused on strengthening cold chain capacity to combat infectious diseases. Demand in these regions is heavily focused on rugged, reliable, and WHO PQS-certified equipment, particularly Solar Direct Drive refrigerators, which are crucial for ensuring the last-mile integrity of heat-sensitive vaccines despite unreliable electrical grids. The MEA region, particularly the Gulf Cooperation Council (GCC) countries, also shows a burgeoning demand for advanced ULT freezers driven by growing biomedical research activities and specialized healthcare tourism.

- North America: Leading market share, driven by stringent regulatory compliance (FDA/CDC), high demand for ULT freezers for specialized biologics, and rapid adoption of IoT monitoring systems in hospital and research settings.

- Europe: Mature market focusing on energy efficiency, GDP compliance, and modernization of existing cold chain infrastructure; strong adoption of natural refrigerants (R290, R600a).

- Asia Pacific (APAC): Highest CAGR, fueled by massive government immunization programs, rapid healthcare infrastructure development in emerging economies (China, India), and significant demand for conventional and solar-powered cold chain equipment.

- Latin America (LATAM): Growth driven by regional health organization initiatives and increasing investment in establishing decentralized cold chain networks; high adoption of WHO PQS-certified units.

- Middle East and Africa (MEA): Critical demand for rugged, off-grid solutions (Solar Direct Drive); market expansion supported by international humanitarian aid and increased localized biomedical investment in GCC nations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Vaccine Storage Medical Refrigerators Market.- Haier Biomedical

- Helmer Scientific

- PHC Corporation (Panasonic Healthcare)

- Thermo Fisher Scientific

- Dometic Group

- Lec Medical

- B Medical Systems

- Godrej & Boyce

- Stirling Ultracold (Acquired by BioLife Solutions)

- Eppendorf

- Fiocchetti

- So-Low Environmental Equipment

- Follett LLC

- Vestfrost Solutions

- Marvel Scientific

- Migali Scientific

- Kirsch Medical GmbH

- Cool Chain Technologies

- Biobase Group

- A&S Refrigeration

Frequently Asked Questions

Analyze common user questions about the Vaccine Storage Medical Refrigerators market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the key difference between a medical refrigerator and a standard commercial refrigerator for vaccine storage?

Medical refrigerators are engineered specifically for precise temperature control (typically +2°C to +8°C or ULT), featuring forced-air circulation, microprocessor controllers, multiple internal sensors, and advanced alarm systems designed to prevent temperature excursions. Standard commercial units lack the necessary precision and stability required to maintain vaccine efficacy and meet regulatory compliance standards.

What role does WHO PQS certification play in purchasing decisions for vaccine cold chain equipment?

WHO PQS (Performance, Quality, and Safety) certification is a crucial assurance standard, particularly for institutional and governmental buyers globally. It validates that the equipment has been independently tested and proven to meet rigorous quality, temperature stability, and reliability criteria, guaranteeing the unit is fit for purpose in complex immunization programs, especially in developing regions.

How is the market addressing the need for cold storage in areas with unreliable electricity?

The market is increasingly adopting Solar Direct Drive (SDD) refrigeration technology and phase change material (PCM) liners. SDD units use solar power directly to maintain temperature by storing energy as cold mass, eliminating the need for complex, failure-prone batteries, ensuring temperature stability for critical vaccines in off-grid or power-unstable locations.

What is driving the growth of the Ultra-Low Temperature (ULT) freezer segment?

The rapid expansion of the ULT segment (storing between -40°C and -86°C) is primarily driven by the success and widespread deployment of advanced mRNA vaccines, along with increasing global R&D activities in cell and gene therapies and other sensitive biologicals that require exceptionally deep freezing for long-term viability and stability.

What are the primary regulatory requirements governing vaccine storage medical refrigerators?

Primary requirements include maintaining a consistent temperature range (typically +2°C to +8°C) without excursions, mandatory continuous temperature monitoring and data logging (often for 24/7 traceability), validation protocols (IQ/OQ/PQ), and alarm mechanisms to instantly alert personnel to deviations, ensuring compliance with global standards like GDP and local health agency guidelines (e.g., CDC Vaccine Storage guidelines).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager