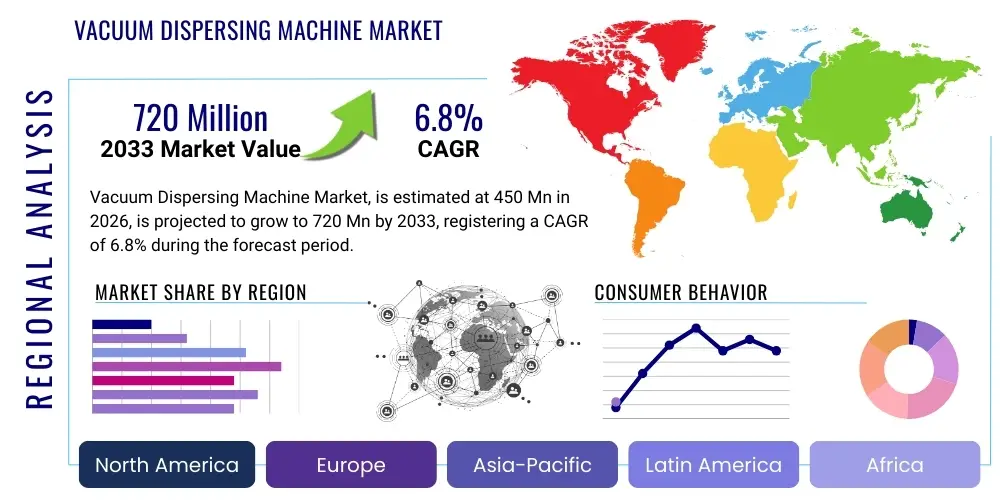

Vacuum Dispersing Machine Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441993 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Vacuum Dispersing Machine Market Size

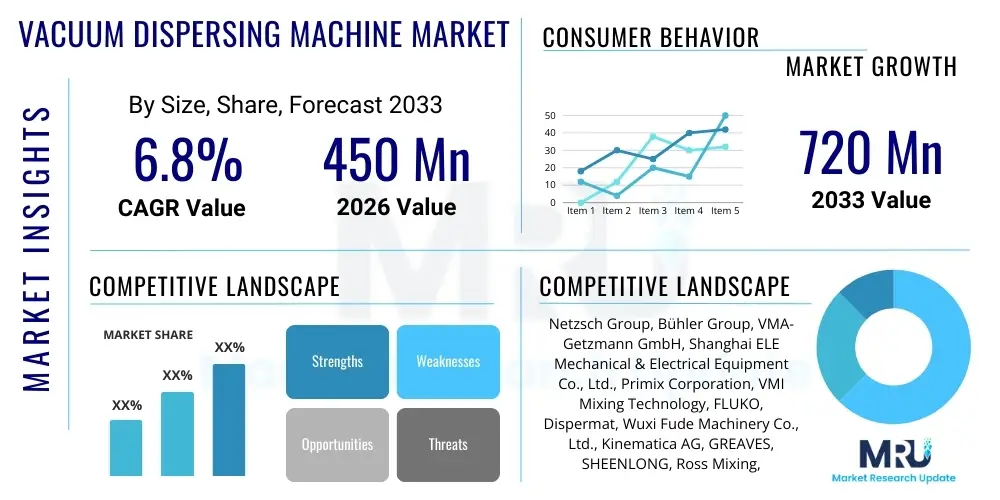

The Vacuum Dispersing Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 720 Million by the end of the forecast period in 2033.

This robust growth trajectory is primarily driven by the expanding applications in high-performance materials manufacturing, particularly within the paints, coatings, and advanced chemicals industries where precise particle size distribution and air exclusion are critical quality parameters. Vacuum dispersing technology inherently addresses issues related to foaming, sedimentation, and oxidation during the mixing process, thus becoming indispensable for producing superior quality pastes and slurries utilized in demanding industrial environments. The increasing global focus on quality control and standardization across regulated industries further solidifies the market’s expansion, mandating the use of enclosed and controlled processing environments.

Vacuum Dispersing Machine Market introduction

The Vacuum Dispersing Machine Market encompasses equipment designed to mix, homogenize, and disperse high-viscosity materials under controlled atmospheric conditions, specifically vacuum pressure. These machines utilize high-shear forces generated by impellers or dispersion discs while simultaneously drawing a vacuum to eliminate air entrapment, which significantly improves product density, stability, and aesthetic quality, especially in formulations prone to aeration like high-solid coatings or printing inks. Key components include the dispersion head, robust vacuum sealing systems, temperature control units, and advanced lifting mechanisms that allow for precise operation and material handling.

Major applications of these sophisticated dispersing systems span across the production of industrial coatings, automotive finishes, specialized adhesives, pharmaceutical suspensions, cosmetic emulsions, and various high-end chemical intermediate products. The primary benefit derived from employing vacuum dispersion technology is the prevention of pinholes, bubbles, and micro-foaming, leading to uniform particle wetting, superior dispersion stability, and reduced processing time compared to traditional open-tank mixers. Furthermore, operating under vacuum allows for lower boiling point solvents to be used safely and efficiently, often minimizing heat generation during the shear process.

Driving factors for the market include stringent regulatory standards demanding higher product purity and consistency, rapid industrialization in emerging economies fueling demand for specialized coatings and paints, and continuous innovation in material science requiring finer, more stable dispersions. The shift towards solvent-free or high-solid content formulations, which are inherently more viscous and prone to air entrapment, also necessitates the adoption of vacuum technology to ensure optimal manufacturing efficiency and final product performance.

Vacuum Dispersing Machine Market Executive Summary

The Vacuum Dispersing Machine Market demonstrates strong forward momentum, supported by critical business trends focused on automation, energy efficiency, and modular design to accommodate diverse batch sizes. Geographically, the market is highly concentrated in the Asia Pacific region, driven by massive investments in infrastructure development, rapid expansion of the automotive and electronics manufacturing sectors in countries like China and India, and increasing localized production capabilities for chemicals and coatings. North America and Europe remain key markets characterized by high adoption rates of technologically advanced, automated systems prioritizing data integrity and compliance with rigorous environmental standards, particularly concerning solvent emissions and process safety.

In terms of segmentation, the industrial-scale segment dominates the market revenue, reflecting the high-volume production needs of major chemical and coatings manufacturers. However, the laboratory-scale segment is exhibiting the highest growth rate, fueled by intensive R&D activities in new material development, nanotechnology applications, and specialized chemical synthesis requiring highly controlled dispersion environments. Trends within end-user industries indicate a strong demand for multi-functional units capable of incorporating high-shear dispersion alongside mixing and kneading capabilities within a single vacuum-sealed vessel, optimizing process flow and minimizing cross-contamination risks inherent in multi-stage processing.

Overall, the competitive landscape is defined by the strategic collaboration between equipment manufacturers and specialized chemical producers to develop customized dispersing solutions tailored to niche applications, such as high-purity battery slurries or ceramic suspensions. The market structure suggests increasing consolidation, with leading players acquiring smaller specialized technology providers to expand their intellectual property portfolio related to advanced impeller designs, real-time viscosity monitoring, and sophisticated vacuum control systems crucial for maintaining tight process tolerances and ensuring consistent output quality across various viscosity levels and material compositions.

AI Impact Analysis on Vacuum Dispersing Machine Market

Common user questions regarding AI's impact on Vacuum Dispersing Machines often center on enhancing process control, predicting equipment failure, and optimizing complex formulation parameters. Users frequently inquire about how AI can automate the determination of optimal dispersion duration and speed based on real-time particle size data, moving beyond empirical trial-and-error methods. Concerns also exist regarding the integration complexity of AI algorithms with existing legacy machinery and the standardization of data collection protocols across different vacuum dispersion units. The consensus expectation is that AI will transform these machines from simple mechanical dispersers into intelligent processing units, capable of self-optimization, reducing material waste, and vastly improving batch-to-batch consistency by correlating input raw material variations with necessary process adjustments.

The implementation of Artificial Intelligence and Machine Learning (ML) algorithms is poised to revolutionize the operational efficiency and output quality of vacuum dispersing equipment. AI models can analyze vast datasets gathered from sensors monitoring parameters such as torque, temperature, vacuum level, and real-time viscosity, enabling predictive maintenance schedules that dramatically reduce unplanned downtime and maintenance costs. By forecasting component wear, particularly on impellers and sealing mechanisms, operators can schedule interventions precisely, maximizing operational uptime.

Furthermore, AI-driven process optimization facilitates the rapid development of new product formulations. Instead of relying on lengthy and resource-intensive physical experimentation, ML algorithms can simulate the dispersion kinetics under varying vacuum and shear conditions, identifying the ideal processing window for novel or challenging material combinations. This capability shortens the time-to-market for new coatings, inks, and adhesives, offering a significant competitive advantage to manufacturers adopting these smart systems.

- AI integration enables Predictive Maintenance (PdM) based on real-time sensor data analysis, minimizing unexpected failures.

- Machine Learning optimizes dispersion parameters (speed, time, vacuum level) for complex, non-Newtonian fluids, improving consistency.

- Automated quality control using vision systems and AI to analyze particle size distribution in situ, ensuring AEO standards are met.

- AI algorithms assist in formulating new recipes by simulating optimal shear profiles and vacuum requirements, accelerating R&D cycles.

- Energy efficiency optimization through dynamic control of motor speed and cooling systems based on predicted load and temperature trends.

DRO & Impact Forces Of Vacuum Dispersing Machine Market

The Vacuum Dispersing Machine Market is fundamentally influenced by a complex interplay of Drivers, Restraints, and Opportunities (DRO). A primary driver is the escalating demand for high-quality, high-solid content formulations across the automotive, aerospace, and electronics sectors, which inherently require air-free processing to ensure structural integrity and flawless surface finishes. This is compounded by increasing regulatory pressures, particularly in Europe and North America, mandating closed, controlled processing environments to minimize solvent exposure and emissions, thereby favoring vacuum technology. Conversely, the high initial capital investment required for these advanced vacuum systems, coupled with the specialized maintenance expertise needed, acts as a significant restraint, particularly impacting small and medium-sized enterprises (SMEs) in developing regions. Impact forces stemming from technological shifts, such as the advancement of nanotechnology requiring ultra-fine dispersion, continuously shape the market.

The market benefits significantly from robust opportunities driven by the shift towards green chemistry and sustainable manufacturing. The ability of vacuum dispersers to handle high-viscosity, solvent-free systems efficiently and their suitability for processing sensitive bio-based materials opens new avenues in pharmaceutical and food applications. Furthermore, market expansion into customized and modular systems allows manufacturers to address the specific throughput and regulatory requirements of diverse end-users, moving away from generalized equipment offerings. The globalization of supply chains also introduces opportunities for key players to establish localized manufacturing hubs in high-growth regions like APAC, reducing logistical costs and improving service response times.

However, the restraints are amplified by the volatility in raw material prices, particularly specialized stainless steel components and advanced sealing materials, which can affect the final price of the dispersing equipment. Additionally, the challenge of standardizing integration interfaces between vacuum dispersers and upstream/downstream equipment (such as filling lines or storage tanks) poses technical barriers. Successful navigation of these impact forces—which include intensifying competition from Chinese manufacturers offering cost-effective alternatives and the rapid obsolescence risk associated with accelerating automation technologies—will determine market leadership over the forecast period.

- Drivers: Demand for high-solid and air-free coatings, stringent quality control standards in end-user industries, shift towards high-performance materials (e.g., battery slurries), and necessity for controlled processing environments.

- Restraints: High initial investment cost, complexity of integrating vacuum systems into existing infrastructure, need for specialized technical expertise for maintenance, and stringent regulatory approval processes for new designs.

- Opportunities: Expansion into pharmaceutical and cosmetic production, development of highly automated and remotely operable systems (Industry 4.0 integration), growth in emerging markets, and increasing focus on sustainable, low-solvent formulations.

- Impact Forces: Technological innovation focused on superior energy efficiency, competitive pricing pressures, and increasing cross-industry collaboration for customized process solutions.

Segmentation Analysis

The Vacuum Dispersing Machine Market is systematically segmented primarily by type, operational capacity, and end-use application, providing a granular view of demand dynamics across various industrial landscapes. Segmentation by type typically differentiates between high-speed dispersers (HSD) with vacuum capability, multi-shaft mixers, and customized dispersion systems designed for ultra-high viscosity paste. Operational capacity is a critical determinant, dividing the market into laboratory/bench-top models (typically below 50 liters), pilot-scale systems (50–500 liters), and industrial-scale production units (over 500 liters), reflecting the varied needs from R&D labs to continuous manufacturing facilities. The increasing complexity of materials, particularly those containing nanoparticles or requiring specialized shear rates, drives the demand for highly customizable and precise industrial models.

Segmentation by end-use application provides the most insightful analysis regarding market revenue, with the Paints and Coatings sector historically commanding the largest market share due to the universal requirement for defect-free, consistent dispersions across industrial, architectural, and automotive finishing product lines. However, the rapidly expanding Electronics and Energy sectors, specifically driven by the manufacturing of battery electrode slurries (anode and cathode materials) and specialized conductive inks, are projected to exhibit the highest Compound Annual Growth Rate over the forecast period. These applications necessitate exceptionally strict control over particle size, homogeneity, and complete air exclusion to prevent performance degradation, making high-end vacuum dispersers mandatory equipment.

The strategic differentiation in segmentation is moving towards technology and automation levels. Modern systems are increasingly segmented based on their ability to integrate with Industry 4.0 paradigms, featuring IoT connectivity, advanced sensor arrays, and compatibility with centralized Manufacturing Execution Systems (MES). This sophistication allows end-users to maximize throughput while minimizing batch variation, ensuring compliance with global manufacturing standards and significantly enhancing overall resource utilization and traceability throughout the dispersion process.

- By Type: High-Speed Vacuum Dispersers, Multi-Shaft Vacuum Mixers, Dual Planetary Vacuum Mixers.

- By Capacity: Laboratory Scale (< 50 Liters), Pilot Scale (50–500 Liters), Industrial Scale (> 500 Liters).

- By Application: Paints and Coatings, Inks and Pigments, Adhesives and Sealants, Chemical Processing, Cosmetics and Pharmaceuticals, Battery Slurries/Energy Materials.

- By Configuration: Fixed Tank Systems, Interchangeable Container Systems, Bottom Entry Systems.

Value Chain Analysis For Vacuum Dispersing Machine Market

The value chain for the Vacuum Dispersing Machine Market begins with upstream analysis, which involves the sourcing of critical raw materials and components necessary for manufacturing robust, reliable equipment. Key inputs include high-grade stainless steel (304 and 316L) for vessels and wetted parts, advanced mechanical seals capable of maintaining high vacuum integrity under high-shear stress, specialized motors, variable frequency drives (VFDs), and precision control components like PLC units and sensors. Relationships with specialized suppliers for these high-performance materials are crucial, as quality directly impacts the machine's longevity, operational safety, and its ability to maintain ultra-clean processing standards essential for industries like pharmaceuticals and electronics.

The midstream segment involves the core manufacturing, assembly, and testing of the vacuum dispersing machines. This stage demands specialized engineering expertise in fluid dynamics, vacuum technology, and mechanical design to ensure optimal shear efficiency and reliable sealing under industrial conditions. Manufacturers often differentiate themselves through proprietary impeller designs (e.g., sawtooth, rotor-stator configurations), optimized cooling systems, and compliance with international standards (e.g., ASME, CE, ATEX). The introduction of modular and customizable designs at this stage, focusing on flexibility to handle varying viscosities and batch sizes, adds significant value and supports downstream customer requirements.

The distribution channel facilitates the connection between manufacturers and end-users, utilizing both direct and indirect sales models. Direct distribution is favored for large, complex industrial systems where installation, commissioning, specialized training, and ongoing service contracts are essential components of the sale. Indirect channels, typically involving local agents, specialized distributors, and system integrators, are more common for smaller, standard units or laboratory equipment, particularly in geographically dispersed markets. Downstream analysis focuses on the end-users—the coatings, inks, adhesives, and specialty chemical manufacturers—who purchase the machines, utilize them in their production lines, and require extensive after-sales support, including spare parts supply and process optimization consultation, completing the cycle and driving future equipment demand.

Vacuum Dispersing Machine Market Potential Customers

The potential customer base for Vacuum Dispersing Machines is highly diversified but centers primarily on industries requiring precise control over fluid properties and exclusion of atmospheric gases during material processing. The dominant consumer segment includes large-scale manufacturers in the Paints and Coatings industry (e.g., architectural coatings, protective industrial coatings, automotive refinishes), who rely on vacuum dispersal to produce high-gloss, defect-free finishes and high-solids formulations efficiently. These buyers prioritize capacity, reliability, and ease of cleaning (CIP systems).

A rapidly growing customer segment is the Energy Storage market, specifically companies involved in the production of lithium-ion batteries and fuel cells. The manufacturing of anode and cathode slurries requires incredibly tight tolerances regarding homogeneity and particle dispersion under high vacuum to prevent electrolyte degradation and ensure optimal battery performance and cycle life. These customers are highly sensitive to contamination risks and demand machines with ultra-high precision control systems and specialized materials compatibility.

Furthermore, specialty chemical producers, pharmaceutical companies, and cosmetic manufacturers represent consistent customer segments. Pharmaceutical applications, such as the preparation of stable suspensions or high-viscosity gels, mandate aseptic or highly controlled environments, making vacuum systems indispensable for maintaining product purity and compliance with Good Manufacturing Practices (GMP). Customers in these highly regulated fields seek vendors who can provide extensive validation documentation and robust safety features alongside high performance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 720 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Netzsch Group, Bühler Group, VMA-Getzmann GmbH, Shanghai ELE Mechanical & Electrical Equipment Co., Ltd., Primix Corporation, VMI Mixing Technology, FLUKO, Dispermat, Wuxi Fude Machinery Co., Ltd., Kinematica AG, GREAVES, SHEENLONG, Ross Mixing, Inc., Shanghai Jwell Machinery Co., Ltd., Hockmeyer Equipment Corporation, Wuxi YK Automation Technology Co., Ltd., Fristam Pumps, INOUE MFG., INC., Morehouse Cowles, Sower. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Vacuum Dispersing Machine Market Key Technology Landscape

The technological landscape of the Vacuum Dispersing Machine Market is constantly evolving, driven by the need for higher efficiency, finer dispersion, and improved control systems. A cornerstone technology is the implementation of advanced High-Shear Dispersion (HSD) mechanisms, including proprietary sawtooth blade designs and rotor-stator configurations optimized for specific viscosity ranges and material compositions. Modern machines incorporate specialized impeller geometries designed through Computational Fluid Dynamics (CFD) modeling to maximize shear input and turbulence, ensuring complete wetting and de-agglomeration while minimizing localized overheating, even under deep vacuum conditions.

Crucially, the effectiveness of these machines relies heavily on sophisticated Vacuum Control Systems. Current technology features precision digital vacuum gauges, automated vacuum pumps (often rotary vane or liquid ring), and advanced sealing solutions (e.g., double mechanical seals with barrier fluid systems) that maintain stable, specified vacuum levels (often below 50 mbar absolute) throughout the entire batch processing cycle. Integration of these vacuum systems with inert gas blanketing capabilities (such as nitrogen purging) is becoming standard practice, especially when handling oxygen-sensitive materials or highly volatile solvents, ensuring safety and product integrity simultaneously.

Furthermore, Industry 4.0 integration profoundly impacts the technology landscape. New dispersers feature comprehensive sensor arrays (monitoring torque, temperature, pressure, vibration), integrated PLC control systems, and network connectivity (IoT) enabling remote monitoring, data logging, and integration with MES/ERP systems. This level of digitalization allows for real-time process verification, automated compliance reporting, and the foundation for implementing AI-driven process optimization and predictive maintenance strategies, representing a significant technological leap forward from manually operated equipment.

Regional Highlights

- Asia Pacific (APAC): The APAC region stands as the undisputed leader in both consumption and production of vacuum dispersing machines, driven by large-scale infrastructure projects, burgeoning automotive manufacturing sectors, and rapid expansion in electronics and renewable energy material production, particularly in China, India, and South Korea. Government initiatives supporting local chemical production and the presence of numerous large coatings and ink manufacturers accelerate market adoption. The regional market is characterized by a strong demand for high-capacity industrial units tailored for continuous, high-volume manufacturing environments.

- North America: Characterized by a high demand for advanced, fully automated, and compliant equipment. The market growth here is strongly linked to innovation in specialized applications such as aerospace coatings, high-end pharmaceutical ingredients, and advanced material research. North American manufacturers prioritize precision, data integrity, and compliance with strict safety and environmental regulations (EPA, OSHA), leading to higher adoption rates of smart, digitally integrated vacuum dispersion systems, often focusing on flexibility for smaller, highly technical batches.

- Europe: This region is defined by rigorous quality standards (e.g., REACH regulations) and a strong emphasis on sustainability and energy efficiency. European demand focuses on specialized dispersers for niche high-value products like water-borne coatings, complex cosmetic formulations, and environmentally friendly adhesives. Key markets, including Germany and Italy, drive innovation in machine design, favoring modularity, quick changeover capabilities, and sophisticated Clean-in-Place (CIP) systems to minimize waste and maximize operational cleanliness.

- Latin America (LATAM): The LATAM market, while smaller, shows steady growth driven by the expansion of the domestic construction and basic chemical manufacturing industries, particularly in Brazil and Mexico. Demand is generally focused on robust, cost-effective industrial equipment, often prioritizing basic reliability and ease of maintenance over the highly advanced automation features sought in North America or Europe. Infrastructure development and foreign direct investment are key indicators of future market expansion in this region.

- Middle East and Africa (MEA): Growth in the MEA region is closely tied to investment in oil and gas infrastructure, construction chemicals, and local production capabilities for paints and coatings. Countries like Saudi Arabia and the UAE are investing heavily in diversifying their industrial base, creating opportunities for suppliers of medium-to-large capacity vacuum dispersers. The market requires machines capable of operating reliably in challenging climates, often demanding robust cooling systems and explosion-proof (ATEX-compliant) components due to the processing environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Vacuum Dispersing Machine Market.- Netzsch Group

- Bühler Group

- VMA-Getzmann GmbH

- Shanghai ELE Mechanical & Electrical Equipment Co., Ltd.

- Primix Corporation

- VMI Mixing Technology

- FLUKO

- Dispermat

- Wuxi Fude Machinery Co., Ltd.

- Kinematica AG

- GREAVES

- SHEENLONG

- Ross Mixing, Inc.

- Shanghai Jwell Machinery Co., Ltd.

- Hockmeyer Equipment Corporation

- Wuxi YK Automation Technology Co., Ltd.

- Fristam Pumps

- INOUE MFG., INC.

- Morehouse Cowles

- Sower.

Frequently Asked Questions

Analyze common user questions about the Vacuum Dispersing Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of using a vacuum dispersing machine over a standard disperser?

The primary advantage is the elimination of air and volatile compounds during the high-shear process, which prevents foaming, micro-bubble entrapment, and oxidation. This results in superior product quality, enhanced stability, higher density, and improved physical performance for coatings, inks, and adhesives.

Which industries are the major consumers of industrial-scale vacuum dispersing machines?

The major consumers are the Paints and Coatings sector (architectural, automotive, industrial), the Adhesives and Sealants industry, and increasingly, the Energy sector for the production of high-performance battery electrode slurries (anode and cathode materials) requiring strictly controlled, air-free environments.

How does vacuum technology contribute to product quality in specialized chemical manufacturing?

Vacuum technology ensures particle homogeneity and prevents solvent evaporation or oxidation of sensitive ingredients. In pharmaceutical and fine chemical manufacturing, it guarantees purity by preventing contamination from ambient air and helps maintain precise temperature control during exothermic reactions.

What are the key technological advancements driving market growth?

Key advancements include the integration of Industry 4.0 features (IoT, advanced sensors, remote monitoring), sophisticated Computational Fluid Dynamics (CFD) optimized impeller designs for maximum shear efficiency, and the development of specialized systems tailored for handling ultra-high viscosity, non-Newtonian fluids like battery pastes.

Is the initial investment in vacuum dispersing equipment justifiable for small manufacturers?

While the initial cost is higher than standard mixers, the investment is justified for small manufacturers dealing with high-value, quality-critical formulations where product defects due to air entrapment are costly. Modern pilot-scale and lab-scale vacuum units offer cost-effective entry points for R&D and small-batch specialty production.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager