Vacuum Pump Filters Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442112 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Vacuum Pump Filters Market Size

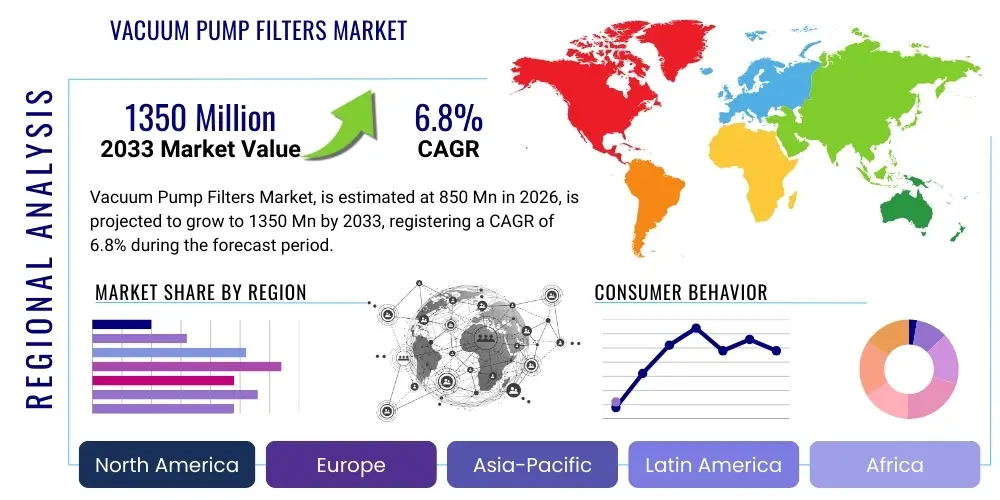

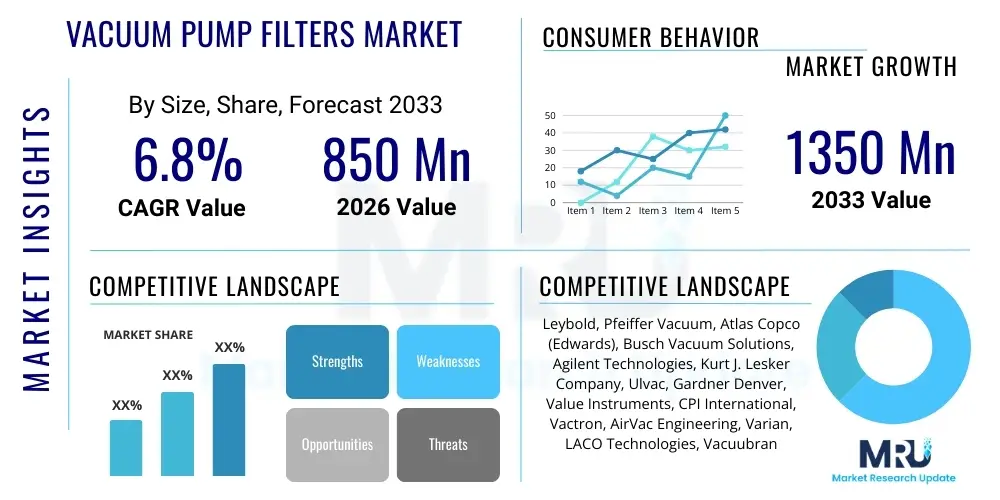

The Vacuum Pump Filters Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $850 Million in 2026 and is projected to reach $1350 Million by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the escalating demand for ultra-clean vacuum environments across critical high-technology sectors, notably semiconductor manufacturing and advanced pharmaceutical production. The indispensable role of vacuum pump filters in ensuring process purity, preventing equipment failure, and complying with increasingly stringent environmental discharge regulations solidifies their continuous market expansion and value appreciation globally.

Vacuum Pump Filters Market introduction

The Vacuum Pump Filters Market encompasses a diverse range of filtration solutions designed to protect vacuum pumps from contaminants, including particulate matter, corrosive gases, and condensed vapors, while simultaneously ensuring the purity of exhausted air or gases into the surrounding environment. These essential components are specialized to handle the unique operating conditions prevalent in high-vacuum and ultra-high-vacuum systems, where even minute levels of impurities can compromise sensitive processes. Products range from simple particulate filters and dust traps to complex oil mist eliminators and activated carbon adsorption cartridges, tailored for specific pump types such as rotary vane, dry scroll, and turbo pumps, ensuring optimal pump performance and extended operational lifespan across varied industrial applications.

Major applications of vacuum pump filters span mission-critical industries where precision and contamination control are paramount. The semiconductor industry relies heavily on these filters to prevent byproduct deposition during etching and deposition processes, which could otherwise lead to wafer defects and equipment downtime. Similarly, in pharmaceutical and biotechnology manufacturing, particularly during lyophilization (freeze-drying) and solvent recovery, filters are vital for safeguarding both the product integrity and the health of the operating machinery. The inherent benefits derived from high-quality filtration include reduced maintenance frequency, diminished consumption of expensive vacuum oils, and critical protection against abrasive wear, significantly lowering the total cost of ownership for complex vacuum systems.

Driving factors influencing robust market growth include the global expansion of semiconductor fabrication facilities (Fabs), particularly in Asia Pacific, spurred by the proliferation of 5G, IoT, and AI technologies requiring advanced memory and logic chips. Furthermore, tightening governmental regulations concerning industrial air quality and emissions necessitate the installation of highly efficient exhaust filters, pushing manufacturers toward superior filtration media and smart monitoring solutions. The continuous technological shift towards dry pump systems, which often require specialized filtering to handle harsh process chemistries, also acts as a key market accelerator, ensuring sustained demand for advanced filtration components optimized for these non-lubricated environments.

Vacuum Pump Filters Market Executive Summary

The Vacuum Pump Filters Market is experiencing transformative business trends characterized by a dual focus on enhanced efficiency and environmental compliance. Manufacturers are increasingly integrating smart filtration technologies, leveraging IoT sensors to monitor differential pressure, saturation levels, and operational temperatures in real-time. This pivot towards condition-based monitoring rather than fixed interval replacement schedules is driving innovation in filter media lifespan and predictive maintenance service models. Furthermore, supply chain resilience, particularly post-global disruptions, is leading key industry players to diversify material sourcing and establish regional manufacturing hubs closer to high-demand end-user clusters, especially in rapidly industrializing economies.

Regionally, Asia Pacific maintains its dominance in market share, primarily driven by massive investments in semiconductor fabrication plants (Fabs) in countries such as China, Taiwan, and South Korea, which serve as global manufacturing hubs for electronics. North America and Europe, while possessing slower volume growth, exhibit higher demand for premium, specialized, and environmentally compliant filtration solutions, reflecting stringent regulatory frameworks and intensive R&D activities in sectors like aerospace and advanced materials research. Latin America and the Middle East & Africa (MEA) are emerging regions, where infrastructure development in petrochemicals and general industrial manufacturing is beginning to necessitate standardized vacuum pump maintenance and filtration protocols, promising accelerated growth in the latter half of the forecast period.

Segment trends reveal a significant shift towards high-efficiency oil mist eliminators and specialized dry pump filters. As industrial processes increasingly demand cleaner vacuum, the requirement for removing fine particulates and managing corrosive vapor streams becomes critical, driving the adoption of filters utilizing advanced materials like PTFE and glass microfiber media. The aftermarket segment, comprising replacement filters and service contracts, remains the largest revenue generator, emphasizing the cyclical nature of consumable products. However, the OEM segment is growing steadily, boosted by pump manufacturers integrating high-performance filtration as a standard component of new system designs to improve warranty periods and initial system performance metrics, thus capturing value early in the equipment lifecycle.

AI Impact Analysis on Vacuum Pump Filters Market

User queries regarding the impact of Artificial Intelligence (AI) on the Vacuum Pump Filters Market predominantly focus on how predictive analytics can optimize filter replacement schedules, minimize unexpected pump downtime, and enhance manufacturing process efficiency. Common questions revolve around the integration of AI-driven sensor data (e.g., pressure drop curves, vibration analysis) to predict the 'end-of-life' of a filter with greater accuracy than traditional time-based methods. Users are keen to understand if AI can facilitate the development of 'smart filters' that self-report degradation or contamination type, leading to tailored maintenance interventions. Key concerns include the cost implication of retrofitting existing vacuum systems with AI-compatible sensors and the standardization of data exchange protocols between different pump and filter manufacturers.

The integration of AI technologies is poised to revolutionize the maintenance and design of vacuum pump filtration systems by moving beyond reactive or scheduled maintenance toward truly predictive operational models. AI algorithms, trained on vast datasets encompassing operational history, ambient conditions, processed materials, and filter performance characteristics, can accurately forecast the remaining useful life (RUL) of filtration media. This enhanced predictability minimizes unnecessary filter changes—a significant operational expenditure—while drastically reducing the risk of catastrophic pump failure or process contamination resulting from filter saturation. Consequently, AI enhances overall equipment effectiveness (OEE) and operational efficiency, particularly in highly automated and capital-intensive environments like semiconductor fabrication plants (Fabs).

Furthermore, AI is instrumental in optimizing the manufacturing process for the filters themselves. Generative design techniques informed by machine learning can simulate fluid dynamics and particulate capture efficiency, leading to the rapid development of novel filter geometries and media composites that offer superior capture rates with reduced pressure drop across the filter element. In the near future, AI-driven automation in filter production lines, including quality control and precision assembly, will ensure higher consistency and reliability of complex filtration units, especially those handling corrosive or pyrophoric materials. This technological advancement supports the market trend toward highly specialized, application-specific filtration solutions required by emerging technologies like Extreme Ultraviolet (EUV) lithography.

- AI-driven predictive maintenance optimizes filter replacement timing, reducing unplanned downtime by up to 30%.

- Machine learning enhances filter design processes, leading to media with superior efficiency and lower pressure drop characteristics.

- IoT sensor integration, enabled by AI analytics, allows for real-time monitoring of filter saturation and operational health.

- Automated quality control systems powered by computer vision improve the consistency and reliability of complex filter manufacturing.

- AI facilitates customized filtration protocols based on process gas composition and flow dynamics, optimizing performance for specific chemical applications.

DRO & Impact Forces Of Vacuum Pump Filters Market

The market dynamics for vacuum pump filters are defined by a complex interplay of drivers, restraints, and opportunities, culminating in significant impact forces that shape investment and strategic decisions. Primary drivers include the robust, non-negotiable requirements for process cleanliness in critical high-tech manufacturing sectors, particularly the rapid scaling of advanced semiconductor nodes where contamination tolerance is measured in parts per billion. This demand is coupled with increasing global regulatory scrutiny, particularly in Europe and North America, regarding industrial exhaust air quality, mandating high-efficiency oil mist and particulate elimination to protect the environment and maintain occupational health standards. These factors collectively create a persistent, structural demand for high-performance filtration components.

However, the market faces notable restraints that can temper growth rates. The high cost associated with specialized, high-purity filtration media (e.g., those resistant to highly corrosive process gases) represents a significant hurdle, especially for smaller industrial users or those in cost-sensitive general manufacturing sectors. Furthermore, the inherent nature of vacuum pump filters as consumables requiring frequent replacement generates significant operational expenditure (OpEx) for end-users, prompting intense price pressure and driving some customers toward less efficient, lower-cost alternatives or riskier filter reprocessing attempts. Managing the disposal of contaminated filters, which often contain hazardous waste, presents complex logistical and environmental challenges, adding to the total operational burden.

Opportunities for market growth lie predominantly in geographical expansion into emerging manufacturing hubs and technological innovation. The proliferation of renewable energy technologies, such as solar photovoltaic (PV) and battery manufacturing, both of which rely on large-scale vacuum processes, presents substantial new application areas for specialized filters. Moreover, the development of 'smart' filtration systems incorporating sensor technology and IoT connectivity allows manufacturers to transition from selling mere components to providing value-added predictive maintenance services, creating new, high-margin revenue streams. The continuous drive toward miniaturization and complexity in microelectronics demands next-generation filtration solutions capable of handling exotic process chemistries, creating opportunities for suppliers who invest heavily in materials science research.

- Drivers: Accelerated expansion of semiconductor and flat panel display manufacturing globally; Stringent environmental regulations limiting volatile organic compound (VOC) and oil mist emissions; Increasing adoption of sensitive dry vacuum pump technologies.

- Restraints: High recurring operational expenditure due to the consumable nature of filters; Logistical complexities and regulatory requirements associated with handling and disposing of hazardous, contaminated filter waste; Intense price competition in the standardized aftermarket segment.

- Opportunities: Technological shift towards IoT-enabled smart filters providing real-time condition monitoring and predictive replacement; Expanding application scope in high-growth sectors like electric vehicle battery production and thin-film solar manufacturing; Market penetration in underserved industrial manufacturing regions in Southeast Asia and Latin America.

- Impact Forces: High capital intensity in end-user industries mandates reliable filtration to protect expensive vacuum systems; Environmental sustainability pressures drive innovation toward reusable or recyclable filter designs; Globalization of supply chains necessitates localized inventory and faster delivery mechanisms for critical consumables.

Segmentation Analysis

The Vacuum Pump Filters Market segmentation provides a granular view of the diverse product landscape and application dependencies driving market growth. The market is primarily segmented based on Filter Type, Application, Pump Type, and End-User. Analyzing these segments reveals shifting preferences influenced by technological advancements in vacuum systems and evolving requirements for process purity. For instance, the transition from traditional oil-sealed pumps to modern dry vacuum technologies has dramatically altered the demand profile, favoring specialized dry pump filters designed to handle chemical condensation and abrasive dust without the presence of lubricating oil.

The segmentation by Application is particularly critical as it correlates directly with required filtration efficiency and material specifications. The Semiconductor and Electronics segment mandates the highest levels of purity, driving demand for Ultra-Low Penetration Air (ULPA) equivalent filters and corrosion-resistant activated carbon media. Conversely, the General Industrial segment, encompassing packaging and material handling, typically utilizes more cost-effective particulate filters and standard oil mist eliminators. This disparity in performance demands allows manufacturers to tailor product lines, catering to the specific regulatory and process sensitivity needs of each vertical.

Furthermore, the segmentation between OEM (Original Equipment Manufacturer) and Aftermarket sales is essential for strategic planning. While OEM sales are linked to new capital expenditures and the replacement cycle of the vacuum pumps themselves, the aftermarket segment dominates revenue generation due to the ongoing need for periodic replacement of consumable filters. Strategies often involve securing long-term service agreements (LSAs) with end-users through the aftermarket channel, ensuring recurring revenue and providing opportunities to introduce premium, high-efficiency replacement products designed for longer life cycles or enhanced monitoring capabilities.

- By Type:

- Oil Mist Eliminators (Coalescing Filters)

- Particulate Filters (Inlet Filters/Dust Traps)

- Activated Carbon Filters (Adsorption Filters)

- Chemical Filters (Neutralizing/Scrubbing Media)

- By Application:

- Semiconductor and Electronics Manufacturing (Highest Purity Demand)

- Pharmaceutical and Biotechnology (Freeze-Drying, Solvent Recovery)

- Chemical Processing and Petrochemicals (Handling Corrosive Gases)

- Research and Development (Laboratory and Scientific Applications)

- General Industrial (Vacuum Packaging, Metallurgical Processes)

- By Pump Type:

- Rotary Vane Pump Filters (Oil-Sealed)

- Dry Pump Filters (Scroll, Claw, Screw, Turbomolecular)

- Diffusion Pump Filters

- By End-User:

- Original Equipment Manufacturers (OEM)

- Aftermarket/Maintenance, Repair, and Operations (MRO)

Value Chain Analysis For Vacuum Pump Filters Market

The value chain for the Vacuum Pump Filters Market begins with the upstream sourcing of specialized raw materials, primarily including high-performance fiber media (such as borosilicate glass microfiber, synthetic PTFE, and various polymer composites), specialized chemical adsorbents (like high-purity activated carbon or molecular sieves), and critical housing materials (aluminum, stainless steel, or durable plastics). Success in the upstream segment relies heavily on maintaining rigorous quality control over these input materials, as filter performance is fundamentally dependent on media pore size uniformity, chemical resistance, and thermal stability. Suppliers must adhere to stringent cleanliness standards, especially for media destined for semiconductor fabrication environments, where contamination during the material phase is unacceptable.

The midstream stage involves the complex manufacturing and precision assembly of the filter elements and complete housing units. This includes pleating the filter media to maximize surface area, accurately sealing the media within the frame to prevent bypass leakage (a common failure point), and integrating features like pressure gauges or sensor ports for smart monitoring. Manufacturing processes often require specialized cleanroom environments (ISO Class 7 or better) to ensure the finished product meets the contamination control standards required by the end-users. The intellectual property often resides in the proprietary media formulations and the structural design of the filter cartridge, which is optimized for minimal pressure drop while maximizing capture efficiency and lifespan.

Downstream analysis focuses on the distribution and end-user maintenance protocols. Distribution channels are segmented into direct sales (typically for large OEM contracts and major pharmaceutical or semiconductor accounts) and indirect sales through specialized industrial distributors, maintenance service providers, and regional stocking dealers. The aftermarket is heavily reliant on an efficient indirect distribution network that can rapidly supply replacement cartridges to minimize system downtime. The final stage involves the installation, operation, and eventual disposal or recycling of the spent filter element, where manufacturers increasingly offer technical support and consultancy on optimal filter selection and sustainable disposal practices, integrating closely with the customer's maintenance, repair, and operations (MRO) workflow.

Vacuum Pump Filters Market Potential Customers

Potential customers for vacuum pump filters are defined by their reliance on vacuum technology for their core processes, demanding high reliability and strict environmental control. The primary consumers are sophisticated manufacturing entities in the high-technology sectors. This includes semiconductor manufacturers (Fabs) that utilize vacuum systems extensively for processes like sputtering, etching, and chemical vapor deposition (CVD). These end-users demand the most technologically advanced and chemically resistant filters due to the presence of highly corrosive and often toxic process gases. Their purchasing decisions are driven by total cost of ownership (TCO) assessments, including filter lifespan and the catastrophic cost associated with pump failure or process contamination.

Another significant segment comprises the pharmaceutical and biotechnology industries. Customers in this sector utilize vacuum pumps in critical operations such as solvent removal, concentration, and lyophilization (freeze-drying) of sensitive biological materials. Here, the priority is preventing cross-contamination, protecting the active pharmaceutical ingredients (APIs), and ensuring the exhausted air is free of biological or chemical hazards. This drives demand for specialized sterilizing-grade filters and high-purity oil mist eliminators. Furthermore, the stringent validation requirements in this industry necessitate filters accompanied by extensive documentation and traceability, ensuring compliance with global regulatory bodies such as the FDA and EMA.

The third major customer group encompasses specialized industrial manufacturers, including those involved in metallurgy (vacuum furnaces), thin-film coating (e.g., optical components and solar panels), and advanced materials research (universities and government laboratories). These customers often require robust, high-volume particulate filters to handle heavy dust loads or specialized chemical traps to manage specific, unusual process chemistries. Purchasing trends here are often driven by operational robustness, ease of maintenance, and the ability of the supplier to provide application-specific consulting, distinguishing these customers from the high-volume standardization often seen in general industrial vacuum packaging applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $850 Million |

| Market Forecast in 2033 | $1350 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Leybold, Pfeiffer Vacuum, Atlas Copco (Edwards), Busch Vacuum Solutions, Agilent Technologies, Kurt J. Lesker Company, Ulvac, Gardner Denver, Value Instruments, CPI International, Vactron, AirVac Engineering, Varian, LACO Technologies, Vacuubrand, Welch Vacuum, Donaldson Company, Swagelok Company, Parker Hannifin Corporation, Fastech Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Vacuum Pump Filters Market Key Technology Landscape

The technology landscape in the Vacuum Pump Filters Market is rapidly evolving, driven primarily by the need for higher purity environments and increased operational lifespan under extreme conditions. One critical technological advancement involves the use of advanced composite filter media, specifically PTFE (Polytetrafluoroethylene) membranes and specialized ceramic fibers, which offer superior chemical inertness and thermal stability compared to traditional fiberglass or cellulose media. These materials are essential for dry pump applications handling aggressive halogenated gases and corrosive compounds generated during semiconductor etching processes. Innovations also focus on optimized pleating techniques and structural designs that minimize pressure drop across the filter element, thereby reducing energy consumption and maintaining vacuum efficiency without compromising particulate capture rates, aligning filtration technology with broader industrial energy efficiency goals.

A second major technological thrust is the integration of digital capabilities, effectively transitioning passive filters into active, monitored components of the vacuum system ecosystem. This involves embedding IoT-enabled sensors (e.g., differential pressure transducers, temperature sensors, and chemical vapor detectors) directly into the filter housing or cartridge. These sensors transmit real-time data on filter status to a centralized control system or cloud platform. This connectivity facilitates predictive maintenance regimes, allowing operators to precisely gauge filter saturation and contaminant loading, thereby scheduling replacements optimally. Furthermore, some high-end filters incorporate RFID or NFC tags for automated inventory management and ensuring the installation of the correct, validated replacement part, critical for maintaining compliance in regulated industries like pharmaceuticals.

Future technology development is concentrated on sustainable and modular filtration solutions. Efforts are underway to develop filter media that are either fully recyclable or offer significantly extended service intervals, addressing the environmental and logistical burdens associated with frequent disposal of hazardous materials. Modular filter systems, where different stages of filtration (e.g., particulate, mist, and chemical adsorption) can be swapped out independently, are gaining traction. This modularity allows end-users to tailor filtration capabilities exactly to the process chemistry requirements, offering a flexible and cost-effective approach to vacuum protection. Additionally, manufacturers are investing in specialized surface treatments and coatings for filter media to enhance oleophobicity and hydrophobicity, effectively preventing the blinding of the filter surface and extending performance lifetime in high-vapor load applications.

Regional Highlights

The global Vacuum Pump Filters Market exhibits distinct regional consumption and growth patterns, heavily influenced by the presence of high-tech manufacturing, regulatory frameworks, and overall industrial development. Asia Pacific (APAC) dominates the market both in volume and revenue, primarily driven by massive capital expenditures in semiconductor fabrication, advanced electronics assembly, and flat panel display production across Taiwan, South Korea, China, and Japan. The region's status as the world's manufacturing center necessitates a constant, high-volume supply of vacuum pump consumables. Growth in APAC is further fueled by the rapid expansion of domestic chemical and pharmaceutical production, particularly in emerging economies like India and Southeast Asia, demanding increasingly sophisticated and reliable filtration systems to meet rising quality standards.

North America and Europe represent mature markets characterized by stringent environmental regulations and a focus on high-value, specialized R&D applications. In North America, the market is driven by demanding sectors such as aerospace, defense, and advanced materials research, alongside a resurgence in domestic semiconductor manufacturing initiatives fueled by government incentives (e.g., the CHIPS Act). These regions exhibit a strong preference for premium, high-efficiency, and 'smart' filtration solutions, where operational reliability and compliance outweigh initial cost considerations. European demand is highly influenced by strict environmental directives like REACH, pushing manufacturers toward certified, low-emission oil mist eliminators and sustainable product life cycles.

Latin America and the Middle East & Africa (MEA) currently hold smaller market shares but offer significant long-term growth potential. Growth in MEA is primarily linked to the expansion of petrochemical processing, desalination plants, and general industrial infrastructure development, driving demand for standard particulate and oil mist filters for heavy-duty applications. Latin America's market growth is tied to the expansion of pharmaceutical packaging, food processing, and automotive sectors. These emerging regions offer opportunities for global filter manufacturers to establish localized distribution and service networks, focusing on product durability and simplified maintenance protocols suitable for rapidly developing industrial maintenance environments.

- Asia Pacific (APAC): Leading market share due to unparalleled investments in semiconductor fabrication (Fabs) and consumer electronics manufacturing; High demand for dry pump filters and ultra-high purity media.

- North America: Focus on high-value applications in R&D, aerospace, and advanced materials; Strong regulatory push for smart, monitoring-enabled filtration solutions.

- Europe: Driven by strict environmental compliance (REACH, RoHS) and sophisticated manufacturing in pharmaceuticals and precision engineering; Demand for energy-efficient filtration with validated performance data.

- Latin America and MEA: Emerging markets driven by growth in petrochemicals, infrastructure projects, and localized manufacturing; Increasing adoption of basic filtration systems with a focus on durability and cost efficiency.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Vacuum Pump Filters Market.- Leybold

- Pfeiffer Vacuum

- Atlas Copco (Edwards)

- Busch Vacuum Solutions

- Agilent Technologies

- Kurt J. Lesker Company

- Ulvac

- Gardner Denver

- Value Instruments

- CPI International

- Vactron

- AirVac Engineering

- Varian

- LACO Technologies

- Vacuubrand

- Welch Vacuum

- Donaldson Company

- Swagelok Company

- Parker Hannifin Corporation

- Fastech Inc.

Frequently Asked Questions

Analyze common user questions about the Vacuum Pump Filters market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the key drivers for the current growth in the Vacuum Pump Filters Market?

The primary drivers are the exponential growth and technological advancement in the semiconductor industry, which mandates ultra-clean vacuum environments, coupled with increasingly stringent global environmental regulations governing industrial air emissions and occupational health safety standards.

How does the shift toward dry vacuum pump technology influence filter demand?

The adoption of dry pumps increases demand for specialized, chemically resistant filters, such as activated carbon cartridges and PTFE-based media, which are necessary to manage the abrasive and corrosive byproducts generated without the cushioning effect of traditional vacuum pump oil.

What role does AI or IoT technology play in modern vacuum filtration?

AI and IoT enable 'smart filtration' through integrated sensors that monitor differential pressure and contamination levels in real-time. This supports predictive maintenance, optimizing filter replacement cycles to prevent unexpected downtime and maximize filter lifespan efficiency.

Which application segment holds the largest market share for vacuum pump filters?

The Semiconductor and Electronics manufacturing segment holds the largest market share due to its high volume usage of specialized, high-purity vacuum processes (etching, deposition) and the extreme financial and operational costs associated with contamination-related yield losses.

What are the primary challenges related to vacuum pump filter utilization?

Major challenges include the high recurring operational costs associated with frequent replacement of consumables, the complex logistics of safely disposing of hazardous, chemically contaminated filters, and the need for filters to consistently operate under aggressive process conditions without failure.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager