Van and Minivan Conversions Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442739 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Van and Minivan Conversions Market Size

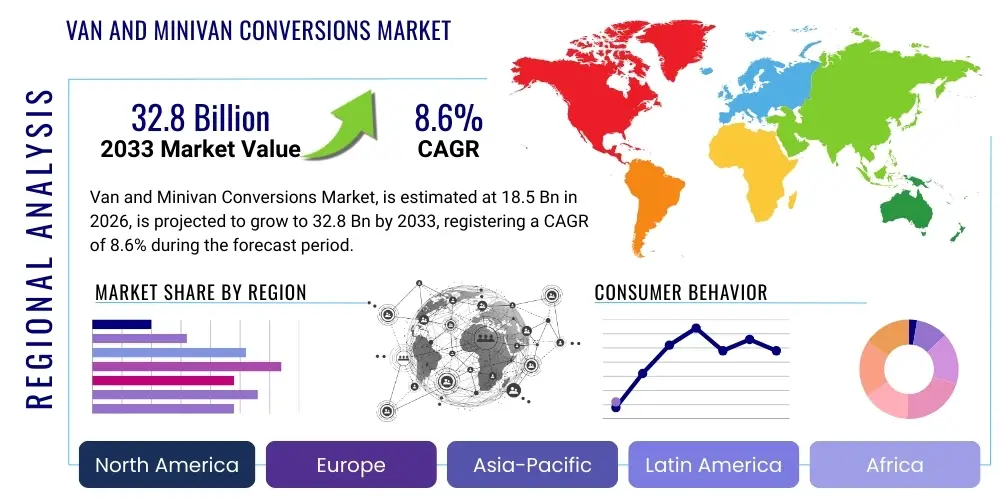

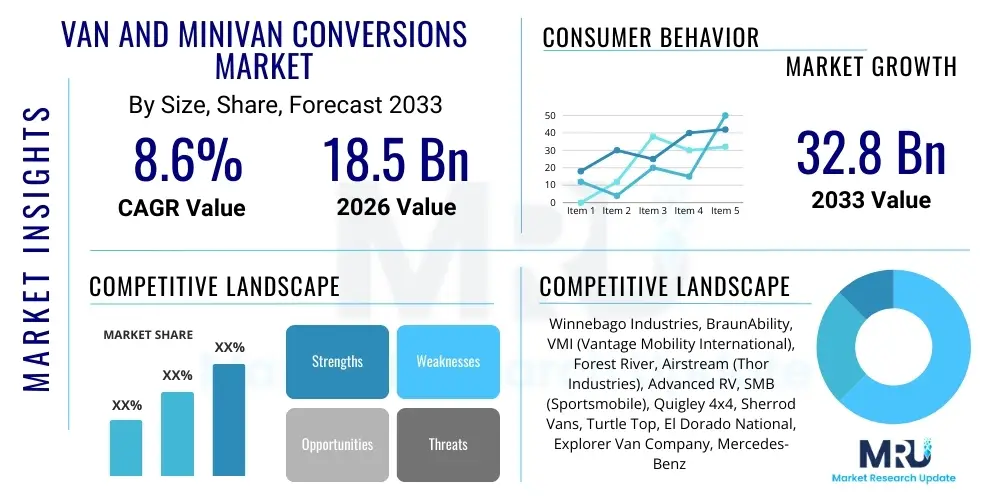

The Van and Minivan Conversions Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.6% between 2026 and 2033. The market is estimated at USD 18.5 Billion in 2026 and is projected to reach USD 32.8 Billion by the end of the forecast period in 2033. This significant expansion is primarily fueled by rising consumer demand for customized and multifunctional vehicles, spanning sectors from recreational travel (RVs and campers) to essential mobility solutions for disabled individuals and specialized commercial fleet applications. The post-pandemic surge in outdoor recreation and the increasing adoption of nomadic lifestyles are crucial catalysts bolstering demand for high-end, comfortable van conversions globally, particularly in North America and Europe. Regulatory shifts promoting accessibility also drive growth in the medically-adapted minivan segment, ensuring sustained market buoyancy throughout the forecast horizon.

Market valuation reflects the cumulative investment across modification services, specialized component manufacturing, and the integration of advanced technologies such as solar power systems, smart home features, and enhanced insulation materials. Key determinants influencing the total addressable market size include the cost of base vehicles, the complexity of the conversion (e.g., pop-top roofs, wet baths, high-capacity electrical systems), and regional disposable income levels. While luxury conversions targeting the high-net-worth demographic contribute substantially to the overall revenue figures, the volume remains dominated by accessible mobility modifications and standard commercial upfitting. The competitive landscape is intensely focused on innovation, efficiency, and meeting stringent safety standards set forth by transportation authorities, further validating the high value proposition within this niche but expanding automotive aftermarket sector.

Van and Minivan Conversions Market introduction

The Van and Minivan Conversions Market encompasses the modification, customization, and upfitting of standard base vans and minivans into specialized vehicles tailored for unique end-uses. These conversions range from highly technical mobility adaptations, featuring wheelchair ramps and securement systems, to luxurious Recreational Vehicles (RVs) and campers optimized for extended travel, alongside commercial customizations such as delivery fleets, mobile offices, and emergency service vehicles. The product description involves integrating specialized interiors, mechanical components, electrical systems, plumbing, insulation, and structural alterations to transform the utilitarian base vehicle into a functional, comfortable, and purpose-built solution. Major applications span personal mobility, recreational touring, commercial logistics, healthcare transport, and professional service provision, making this market deeply diversified and resilient to single-sector economic fluctuations.

The primary benefits driving market adoption include enhanced vehicle utility, personalization capabilities that standard factory models cannot offer, and significant cost savings compared to purchasing purpose-built, highly specialized vehicles from OEMs. Conversion services offer flexibility in design, allowing end-users to optimize space and features precisely for their needs, whether that involves a minimalist off-grid camper or a fully automated, accessible transport vehicle. Driving factors sustaining market growth include the rising preference for experiential travel and the "van life" movement, favorable government regulations mandating accessible transport infrastructure, and technological advancements in lightweight, durable conversion materials. Furthermore, the economic advantage of repurposing existing vehicle platforms into specialized tools continues to attract both individual consumers and large commercial fleet operators globally.

This industry functions at the intersection of automotive engineering, bespoke craftsmanship, and specialized component manufacturing, relying heavily on skilled technicians and compliance with rigorous safety certifications. The complexity of modern electronic integration, especially in high-end RV conversions utilizing smart systems and renewable energy sources, necessitates specialized expertise, contributing to the premium pricing structure of these converted vehicles. As urbanization increases and vehicle ownership models evolve, the demand for versatile, multi-functional transport platforms ensures that the Van and Minivan Conversions Market remains a dynamic and expanding segment within the broader automotive aftermarket ecosystem.

Van and Minivan Conversions Market Executive Summary

The Van and Minivan Conversions Market is experiencing robust growth driven by converging business trends, technological innovations, and shifting consumer behavior towards personalized and experiential mobility solutions. Key business trends include the consolidation of specialized conversion companies to achieve scale, increased investment in digitalization for custom design and virtual reality pre-visualization services, and strategic partnerships between base vehicle OEMs and conversion specialists to streamline production and warranty coverage. Regionally, North America maintains its dominance due to high disposable income, established RV culture, and stringent accessibility regulations, while the Asia Pacific region is emerging rapidly, particularly for commercial delivery vans and entry-level camper conversions, fueled by e-commerce expansion and rising middle-class tourism. European markets show stable growth, focusing intensely on sustainable conversion practices, lightweight materials, and maximizing space efficiency in smaller chassis vehicles prevalent across the continent.

Segment trends highlight the exceptional performance of the Recreational (RV/Camper) conversion segment, which continues to capitalize on the post-pandemic lifestyle shift prioritizing domestic and outdoor travel, demanding highly specified, self-sufficient vehicles equipped with advanced power systems and connectivity. Simultaneously, the Mobility Conversion segment remains vital, benefiting from demographic shifts, an aging population, and legislative mandates supporting inclusive transport solutions, leading to advancements in automated ramps, docking systems, and customized seating. In terms of base vehicle type, full-size vans (e.g., Ford Transit, Mercedes Sprinter, Ram ProMaster) are preferred for comprehensive RV and commercial upfitting due to their generous volume and payload capacity, whereas minivans retain market share primarily within the accessibility modification sector due to their lower floor height and maneuverability, ensuring market diversification across varied vehicle platforms.

Overall, the market trajectory is highly positive, underpinned by continuous product innovation centered on energy independence (solar, high-capacity lithium batteries) and smart integration (IoT, remote diagnostics). The regulatory environment, particularly concerning vehicle safety and emissions standards, acts as both a challenge and an impetus for innovation, compelling converters to adopt best practices and high-quality materials. Stakeholders across the value chain, from component suppliers to final integrators, are focusing on optimizing supply chain resilience to mitigate material shortages and expedite delivery times, crucial factors in maintaining customer satisfaction in this highly customized manufacturing sector. The projected CAGR of 8.6% reflects sustained demand across all major application categories through 2033.

AI Impact Analysis on Van and Minivan Conversions Market

Common user questions regarding AI’s impact on the Van and Minivan Conversions Market frequently revolve around personalization capabilities, safety enhancements, and the efficiency of the conversion process itself. Users seek to understand how AI can automate complex interior layout design based on usage profiles, leading to optimized space and material utilization. Key concerns include the cost of integrating smart AI-driven systems into older conversion models, the longevity and maintenance of complex electronic components, and the ethical implications of using AI for enhanced driver assistance and predictive maintenance in specialized vehicles. The market expects AI to significantly reduce design iteration time, improve quality control through automated inspection, and revolutionize the user experience via intelligent cabin controls, predictive diagnostics, and advanced autonomous parking features, especially critical for larger converted RVs and commercial fleets.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally transforming the design, manufacturing, and operation phases of converted vans and minivans. In the design phase, generative AI is utilized to rapidly produce thousands of optimized layouts based on specific customer inputs regarding activities, storage needs, and accessibility requirements, significantly shortening the lead time for bespoke projects. Furthermore, AI-powered predictive maintenance systems are being embedded into converted vehicles, monitoring critical components like high-capacity batteries, solar charging efficiency, and specialized mobility equipment (lifts, ramps). These systems alert owners and fleet managers to potential failures before they occur, drastically improving reliability and reducing downtime, which is particularly valuable in commercial and medical transport applications. This technological evolution increases the complexity but elevates the overall sophistication and value proposition of high-end conversions.

Operationally, AI contributes to enhanced safety and driver comfort. Advanced driver-assistance systems (ADAS) are increasingly prevalent, customized to account for the altered weight distribution and dimensions of converted vehicles, offering features such as enhanced blind-spot monitoring, customized stability control calibration, and semi-autonomous driving capabilities tailored for highway travel in large RVs. For the mobility segment, AI algorithms are optimizing navigation for accessible routes and managing the operation sequence of complex hydraulic or electronic lifts, ensuring maximum safety and ease of use for individuals with disabilities. This technological push transforms the converted vehicle from a static modification into a dynamic, intelligent platform capable of adapting to real-time operating conditions and user needs, securing its competitive edge against standard factory models.

- AI-driven generative design optimizing interior layouts and material efficiency.

- Predictive maintenance systems monitoring specialized conversion components (electrical, plumbing, lifts).

- Customized Advanced Driver-Assistance Systems (ADAS) calibrated for altered vehicle weight and dimensions.

- Intelligent cabin management for energy efficiency, climate control, and smart appliance operation.

- Automated quality control and inspection during the manufacturing and upfitting process.

- Optimization of supply chain logistics for faster turnaround times on custom orders using ML forecasting.

- Enhanced user interface and personalized experience through voice and gesture control integration.

DRO & Impact Forces Of Van and Minivan Conversions Market

The Van and Minivan Conversions Market is shaped by a powerful set of Drivers, Restraints, and Opportunities (DRO), collectively forming the Impact Forces that dictate its growth trajectory. The primary Drivers include the widespread appeal of the 'van life' culture and experiential tourism, the expanding aging population requiring specialized mobility solutions, and the booming demand for last-mile delivery vehicles requiring light commercial upfitting. These drivers create sustained volume and value growth, pushing converters toward innovative and scalable manufacturing processes. Restraints predominantly center on the high initial cost of a comprehensive conversion, often rivaling or exceeding the cost of the base vehicle itself, coupled with persistent supply chain volatility for key components (e.g., electronic chips, high-capacity batteries, specialty materials). Furthermore, stringent and varied regulatory standards across different jurisdictions for vehicle modifications pose compliance challenges, slowing market entry for smaller players and increasing operational overhead.

Opportunities are abundant and largely driven by technological advancement and untapped geographical markets. The market can significantly capitalize on the transition towards electric vehicle (EV) platforms, as EV chassis offer unique layout possibilities (flat floors, no internal combustion engine constraints) and high power reserves ideal for complex conversions. Expansion into emerging economies, particularly in Southeast Asia and Latin America, presents vast potential for standardized, cost-effective commercial and rental fleet conversions. The emphasis on sustainable conversions, utilizing recycled materials, highly efficient appliances, and advanced solar power setups, aligns with global environmental trends and attracts environmentally conscious consumers, offering a premium market segment for differentiated products. Strategic investment in automation and modular design represents a critical force for increasing production capacity and reducing the economic impact of skilled labor shortages, a chronic constraint in specialized craftsmanship sectors.

The combined impact forces ensure market resilience. While high costs and supply chain risks present headwinds (Restraints), the fundamental shifts in lifestyle and demographics (Drivers) provide a strong underlying demand. The greatest long-term impact force lies in the convergence of electrification (EV base vehicles) and smart technology integration (AI/IoT), offering Opportunities to redefine what a converted van or minivan can deliver in terms of functionality, sustainability, and user experience. Successful market players are those who can effectively navigate the regulatory landscape while leveraging modular construction techniques to accelerate customization and reduce total ownership costs for the end-user, thereby maximizing the favorable growth conditions projected through the forecast period to 2033.

Segmentation Analysis

The Van and Minivan Conversions Market is broadly segmented based on Conversion Type, Vehicle Type, and End-Use, reflecting the diverse applications and specialized requirements of the industry. This detailed segmentation allows market participants to precisely target niche demands, optimize their product offerings, and allocate resources efficiently. The Conversion Type segment distinguishes between modifications primarily focused on accessibility, recreational use, and professional/commercial functions, each requiring distinct engineering approaches and component sets. Understanding these segments is critical for manufacturers who must comply with specific safety standards—such as ADA compliance for mobility conversions or NFPA standards for RV systems—to operate successfully within their chosen specialization.

The Vehicle Type segmentation separates the market based on the base platform used, recognizing the inherent differences in capabilities, costs, and conversion potential between full-size Vans (e.g., high-roof cargo vans), Minivans (lower profile, family-oriented vehicles), and increasingly, medium-duty commercial platforms. Full-size vans dominate the high-value RV and heavy commercial segments due to superior space and payload, whereas minivans remain the preferred platform for basic, cost-effective personal mobility adaptations where lower entry height is paramount. Analyzing the interplay between Conversion Type and Vehicle Type reveals optimal market strategies; for example, luxury RV conversions are almost exclusively performed on high-roof, long-wheelbase vans, while mobility conversions are popular across both van and minivan chassis, dependent on the required level of adaptation.

End-Use segmentation, dividing the market into Personal, Commercial, and Rental applications, highlights where the bulk of investment and volume is concentrated. Personal use (including both mobility and RV owners) drives demand for highly customized, premium features, whereas commercial use (e.g., delivery, mobile workshops, medical outreach) focuses heavily on durability, standardization, and fleet management integration. The growing rental segment, particularly for 'experience rental' RVs and accessible transport services, demands robust, easily maintained conversions that can withstand high turnover and varied user handling. These segmented analyses provide a crucial framework for strategic planning, revealing which consumer or business behaviors are currently providing the strongest impetus for market growth and technological development across the van and minivan conversion ecosystem.

- By Conversion Type:

- Mobility Conversions (Wheelchair Lifts, Ramps, Seating Securement Systems)

- Recreational Conversions (RV/Campervans, Class B Motorhomes, Overlanding)

- Commercial Conversions (Service Vehicles, Mobile Workshops, Delivery/Logistics)

- By Vehicle Type:

- Full-size Vans (High-Roof, Cargo, Passenger)

- Minivans (Standard, Accessible)

- By End-Use:

- Personal Use (Individual Owners)

- Commercial Use (Fleets, Service Companies, Government Agencies)

- Rental Services (RV Rental Agencies, Mobility Service Providers)

Value Chain Analysis For Van and Minivan Conversions Market

The Value Chain for the Van and Minivan Conversions Market is complex and multi-layered, beginning with upstream raw material and component suppliers and extending through highly specialized conversion processes to the final distribution and after-sales service. Upstream analysis focuses on the sourcing of critical inputs, including the base vehicle chassis (supplied by OEMs like Ford, Stellantis, Daimler), specialty metals for structural reinforcement, high-performance insulation materials (e.g., polyiso, wool), advanced electrical components (lithium-ion batteries, solar panels, inverters), and interior fittings (cabinetry, seating, appliances). Volatility in raw material prices and component scarcity, particularly for automotive-grade semiconductors, directly impacts conversion costs and lead times, making strategic supplier relationships and multi-sourcing critical for operational resilience within the upstream segment.

The core conversion process, situated midstream, involves highly skilled craftsmanship, engineering, and compliance management. This stage sees the transformation of the base vehicle through structural modification (e.g., cutting holes for windows, vents, and pop-top roofs), installation of mechanical systems (HVAC, plumbing), electrical systems, and finishing the interior customization. Conversion companies often act as specialized manufacturers, requiring certifications and adherence to governmental safety standards (e.g., NHTSA, DOT). Direct distribution involves established conversion firms selling vehicles directly to the end-user or specialized dealers, particularly common in the high-end RV and mobility segments. Indirect distribution often utilizes a network of authorized regional dealers, who facilitate sales, financing, and localized service, thereby extending the market reach of the primary conversion manufacturer.

Downstream analysis centers on market access and customer service, including specialized financing options tailored to converted vehicles, insurance provision, and an extensive network of specialized service and repair centers capable of maintaining proprietary conversion systems. The after-sales service, including warranty support for the conversion modifications separate from the OEM chassis warranty, is crucial for customer satisfaction and brand loyalty. The shift towards electrification necessitates continuous training for downstream technicians to handle high-voltage EV platforms and complex battery management systems. Optimizing the flow of information and products across the direct and indirect channels is vital, ensuring that highly detailed custom specifications from the end-user are accurately translated and executed during the manufacturing phase, securing the integrity of the overall value proposition and maximizing market efficiency.

Van and Minivan Conversions Market Potential Customers

Potential customers for the Van and Minivan Conversions Market are highly diverse, spanning individual consumers seeking personalized lifestyle solutions and large corporate entities requiring specialized fleet operations. The primary end-users or buyers include individuals with mobility challenges who necessitate adaptive vehicle technology (lifts, hand controls, specialized seating), and the rapidly expanding segment of leisure travelers and digital nomads prioritizing self-contained, comfortable recreational vehicles (campervans, Class B motorhomes) for extended domestic and international travel. These personal buyers demand high levels of customization, focusing on aesthetic design, off-grid capabilities, and maximizing space efficiency, making them key drivers for the premium segment of the market and pushing innovation in sustainable and compact technology integration.

On the commercial front, potential customers include package delivery and logistics companies requiring specialized shelving, bulkhead installation, and temperature control for last-mile delivery fleets, especially driven by the continuous boom in e-commerce. Furthermore, utility companies, construction firms, and various service providers (plumbers, electricians) utilize commercial conversions to create highly efficient mobile workshops, demanding durability, optimized tool storage, and integrated technology for job tracking and connectivity. Healthcare providers represent another critical customer base, purchasing conversions for non-emergency medical transport (NEMT), mobile clinics, and specialized outreach services, where compliance with hygiene and medical equipment standards is paramount, necessitating stringent material and design specifications.

The rental and institutional sectors form the third major customer group. Vehicle rental companies, specializing in RVs or mobility vehicles, require robust, standardized conversions that offer high reliability and low maintenance costs due to frequent use by varied operators. Government agencies, including municipal services, police, fire departments, and military branches, often procure customized vans for specific operational needs, ranging from mobile command centers to specialized transport units. The decision-making process for these institutional buyers is often complex, focused on adherence to bid specifications, proven reliability records, and the ability of the converter to provide scalable, standardized fleet solutions and long-term maintenance contracts, securing volume business for manufacturers capable of handling industrial-scale production.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 32.8 Billion |

| Growth Rate | 8.6% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Winnebago Industries, BraunAbility, VMI (Vantage Mobility International), Forest River, Airstream (Thor Industries), Advanced RV, SMB (Sportsmobile), Quigley 4x4, Sherrod Vans, Turtle Top, El Dorado National, Explorer Van Company, Mercedes-Benz Vans (Upfitting Division), Lear Corporation, and REV Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Van and Minivan Conversions Market Key Technology Landscape

The technological landscape of the Van and Minivan Conversions Market is undergoing rapid modernization, driven by the need for increased energy independence, superior connectivity, and enhanced safety within the confined spaces of a converted vehicle. A critical technology is the adoption of advanced lithium-ion battery systems (LiFePO4) paired with high-efficiency solar power integration. This allows recreational and commercial conversions to achieve significant off-grid capability and power complex residential-grade appliances without relying on noisy generators, meeting the growing consumer demand for sustainable and self-sufficient travel. Furthermore, the use of lightweight and high-strength materials, such as composite panels, carbon fiber reinforcements, and advanced thermal insulation foams, is essential for maximizing payload capacity while improving fuel efficiency, a key factor for profitability in commercial fleets and ensuring compliance with stringent weight regulations in the mobility sector.

Another dominant technological trend is the pervasive integration of the Internet of Things (IoT) and smart vehicle systems. These technologies enable centralized digital control panels (multiplex wiring systems) that manage everything from lighting, water tanks, and climate control to monitoring battery health and fuel levels, often accessible remotely via smartphone applications. This 'smart conversion' capability enhances the user experience and offers crucial remote diagnostics for fleet managers, reducing operational complexity and facilitating predictive maintenance. In the mobility segment, technological advancements are focused on precision automation, utilizing sophisticated sensor arrays and electric servo motors for the smooth, reliable, and swift deployment of wheelchair ramps, lifts, and securement devices, ensuring maximum safety and operational efficiency for users with limited mobility.

Furthermore, the manufacturing process itself is being revolutionized by technology, including the use of 3D scanning and computer-aided design (CAD) to precisely map the interior dimensions of base vehicles, ensuring bespoke furniture and component integration fit perfectly and efficiently. This level of precision minimizes material waste and speeds up production lead times, moving away from traditional, labor-intensive customization methods toward modular, scalable production. As the industry shifts towards EV platforms, technology development is intensively focused on optimizing the conversion to leverage the base vehicle's electrical architecture and thermal management systems without compromising range, presenting both a challenge and a significant technological opportunity for specialized conversion engineers who must become experts in high-voltage vehicle modification.

Regional Highlights

- North America: The dominant market for van and minivan conversions, particularly for large, high-end recreational vehicles (Class B motorhomes built on platforms like the Mercedes Sprinter and Ford Transit). This region benefits from a well-established RV culture, high disposable incomes, and the presence of major conversion manufacturers and component suppliers. Stringent accessibility regulations (ADA requirements) ensure consistent demand for sophisticated mobility conversions, while the robust growth of e-commerce fuels demand for light commercial delivery vehicle upfitting. The focus here is on luxury, advanced technology integration, and off-grid capabilities, driving the highest average selling prices globally for premium conversions.

- Europe: Characterized by a strong emphasis on compact, highly efficient conversions, reflecting the region's diverse geography and stricter road regulations concerning vehicle size. The market is mature for campervans (often built on smaller chassis like the VW Transporter or Fiat Ducato) and has a strong focus on sustainable materials and eco-friendly conversions. Germany, France, and the UK are key markets, showing robust demand for both leisure travel and essential mobility solutions. The rapid adoption of electric vans across Europe is poised to accelerate the EV conversion segment, benefiting converters capable of optimizing battery placement and interior space.

- Asia Pacific (APAC): The fastest-growing regional market, driven by expanding middle-class tourism, improving road infrastructure, and the massive expansion of commercial logistics networks in countries like China, Japan, and Australia. While the recreational segment is developing, the primary volume driver is commercial conversions (delivery, service, and public transport adaptations). Australia exhibits a strong market for rugged 4x4 van conversions and overlanding vehicles due to its unique geographical requirements. The emphasis in APAC is often on standardization, reliability, and cost-efficiency to meet the high-volume demands of growing commercial fleets.

- Latin America: An emerging market primarily focused on essential commercial transport and entry-level passenger conversions. Economic volatility and regulatory complexity present challenges, but urbanization and infrastructure investments are creating opportunities for logistics-focused van conversions. The market demands robust, easily serviceable modifications tailored to challenging road conditions, with lower uptake of highly luxurious or technologically complex recreational modifications compared to North America or Europe.

- Middle East and Africa (MEA): A highly fragmented market where demand is concentrated in specific areas, such as the Gulf Cooperation Council (GCC) countries for luxury executive shuttles and specialized commercial vehicles (e.g., ambulances, mobile service units). Africa’s market is dominated by basic commercial conversions and specialized transport for mining and infrastructure projects. The region requires high-durability conversions that can withstand extreme climate conditions and often utilizes heavy-duty mechanical components rather than complex electronics.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Van and Minivan Conversions Market.- Winnebago Industries

- BraunAbility

- VMI (Vantage Mobility International)

- Forest River

- Airstream (Thor Industries)

- Advanced RV

- SMB (Sportsmobile)

- Quigley 4x4

- Sherrod Vans

- Turtle Top

- El Dorado National

- Explorer Van Company

- Mercedes-Benz Vans (Upfitting Division)

- Lear Corporation

- REV Group

- Colorado Camper Van

- Roadtrek Inc.

- Tecnoform S.p.A. (Component Supplier)

- Fiat Professional (Base Vehicle OEM and Partner)

- Stellantis (Conversion Partner)

Frequently Asked Questions

Analyze common user questions about the Van and Minivan Conversions market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Van and Minivan Conversions Market?

The primary factor driving market growth is the global surge in demand for personalized experiential travel, commonly known as the 'van life' movement, alongside critical demographic shifts necessitating specialized mobility solutions for an aging population and individuals with disabilities. This dual demand for leisure customization and essential accessibility ensures robust market expansion.

How are electric vehicle (EV) platforms impacting van conversions?

EV platforms are positively impacting conversions by offering larger, flat floor spaces and high-capacity electrical systems ideal for powering sophisticated amenities (A/C, appliances). This technological shift enables more efficient and sustainable conversions, though it requires specialized engineering expertise to manage battery weight and thermal integration.

Which geographic region holds the largest market share for van and minivan conversions?

North America currently holds the largest market share due to its established infrastructure for recreational vehicles (RVs), high consumer spending on luxury customizations, and comprehensive regulatory mandates supporting the accessibility segment, driving both high volume and high average transaction values.

What are the main conversion types within the market segmentation?

The main conversion types are Mobility Conversions (focused on accessibility like wheelchair lifts), Recreational Conversions (Campervans/RVs for leisure travel), and Commercial Conversions (upfitting for logistics, mobile workshops, and service vehicles).

What is the typical lifespan and maintenance consideration for a professional van conversion?

A professional van conversion typically has a long operational lifespan, often exceeding 10-15 years, provided regular maintenance is performed. Key maintenance considerations include the specialized electrical systems (batteries, solar), water and plumbing systems in RVs, and routine inspection of mobility equipment like lifts and ramps to ensure safety and functionality, requiring specialized aftermarket service.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager