Varicella Attenuated Live Vaccine Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441983 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Varicella Attenuated Live Vaccine Market Size

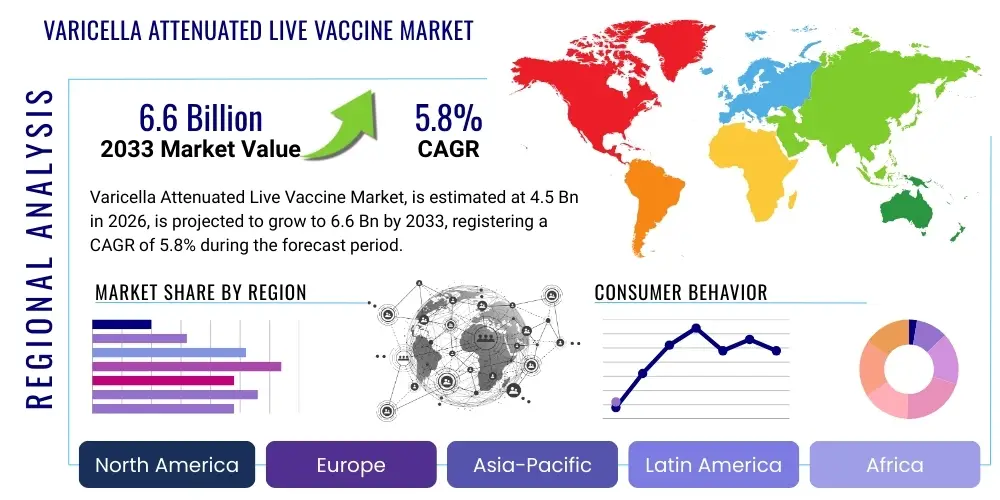

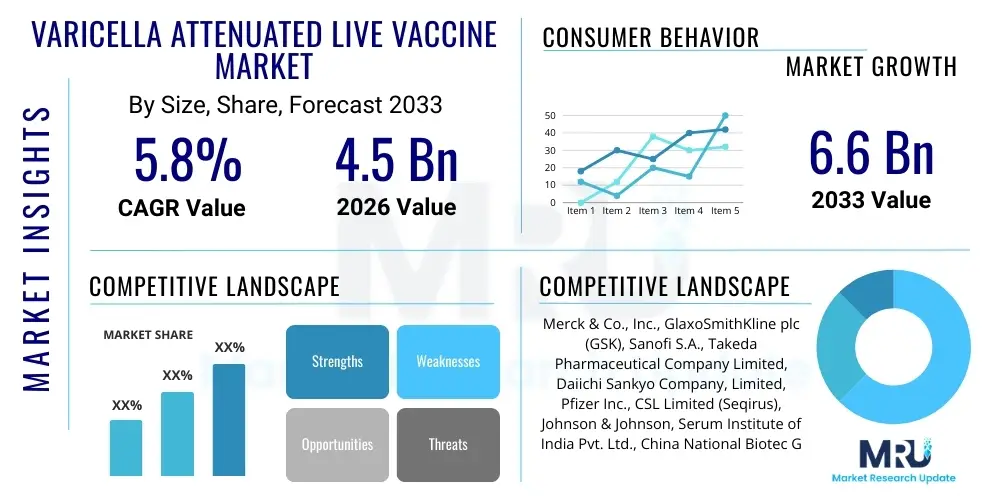

The Varicella Attenuated Live Vaccine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. This robust growth trajectory is underpinned by mandatory childhood vaccination programs across developed economies and increasing awareness regarding the long-term sequelae of varicella infection in vulnerable populations. The market expansion is also significantly influenced by continuous government funding for public health initiatives aimed at disease eradication and the transition towards combination vaccines that enhance patient compliance and simplify vaccination schedules globally. Pharmaceutical companies are heavily investing in improving storage stability and optimizing delivery mechanisms, contributing substantially to market valuation increases over the forecast period.

The market is estimated at $4.5 Billion in 2026 and is projected to reach $6.6 Billion by the end of the forecast period in 2033. This valuation projection reflects the anticipated success of global immunization drives, particularly in emerging economies where penetration rates are currently lower but are expected to rapidly accelerate due to improved cold chain logistics and the expansion of healthcare infrastructure. Furthermore, the persistent demand for booster doses among adolescents and adults who did not receive the full primary series, or whose immunity has waned, provides a crucial stabilizing factor for sustained revenue generation. The market size calculation incorporates the revenue derived from both single-antigen varicella vaccines and combination measles, mumps, rubella, and varicella (MMRV) vaccines, emphasizing the strategic shift towards bundled preventative solutions.

Varicella Attenuated Live Vaccine Market introduction

The Varicella Attenuated Live Vaccine Market encompasses the production, distribution, and administration of pharmaceutical products designed to prevent chickenpox, caused by the Varicella-Zoster Virus (VZV). The vaccine utilizes a weakened, or attenuated, strain of the VZV, typically the Oka strain, which stimulates a robust immune response without causing severe disease, providing long-lasting active immunity. Major applications center around routine childhood immunization programs, starting generally around 12 to 18 months of age, with subsequent booster doses administered later in childhood to ensure high seroconversion rates and herd immunity. Benefits derived from widespread adoption include a dramatic reduction in varicella incidence, minimization of associated complications such as secondary bacterial infections and pneumonia, and prevention of severe outcomes like congenital varicella syndrome and adult shingles later in life, resulting in significant healthcare cost savings. Key driving factors include stringent government mandates for pediatric vaccination, high safety profiles demonstrated over decades of use, and the critical need to eliminate highly contagious infectious diseases through comprehensive public health strategies globally.

Varicella Attenuated Live Vaccine Market Executive Summary

The Varicella Attenuated Live Vaccine Market is currently characterized by significant business trends focusing on merger and acquisition activities among key pharmaceutical players aiming to consolidate manufacturing capabilities and expand geographic reach, especially into high-growth Asian markets. Furthermore, a crucial operational trend involves optimizing cold chain logistics to manage the temperature-sensitive nature of live attenuated vaccines, which is paramount for maintaining product efficacy during distribution across diverse climatic zones. Regional trends indicate North America and Europe maintaining dominance due to established universal immunization programs and robust public funding structures, while the Asia Pacific region is demonstrating the highest growth trajectory, fueled by increasing disposable income, expanding access to private healthcare, and rising governmental commitment to preventative medicine initiatives. Segment trends show a sustained preference for the pediatric application segment as the primary revenue generator, although the adult travel and occupational health segments are exhibiting modest growth due to specific risk exposure profiles. Product type analysis highlights the increasing market share captured by combination vaccines (MMRV) due to their logistical efficiency and compliance benefits over monovalent formulations, reflecting a strategic shift among vaccine manufacturers towards multi-disease prevention platforms.

AI Impact Analysis on Varicella Attenuated Live Vaccine Market

Common user inquiries regarding the impact of Artificial Intelligence (AI) in the Varicella Attenuated Live Vaccine market typically revolve around optimizing vaccine development timelines, enhancing manufacturing efficiency through predictive quality control, and improving large-scale deployment strategies. Users are keenly interested in how AI can accelerate the identification of more stable and immunogenic vaccine strains, potentially replacing or refining the current Oka strain, and how machine learning algorithms can predict the efficacy and safety profiles of novel formulations pre-clinical trials. Furthermore, there is significant focus on AI's role in optimizing vaccination schedules based on real-time epidemiological data, thus maximizing herd immunity effectiveness in specific geographical areas. Key concerns often address data privacy in using patient health records for predictive modeling and the regulatory hurdles associated with adopting AI-validated manufacturing processes, alongside the cost implications of implementing sophisticated AI infrastructure within existing production facilities.

AI is poised to revolutionize the operational landscape of the Varicella Attenuated Live Vaccine market by enhancing virtually every stage from research and development to post-marketing surveillance. In R&D, AI algorithms can analyze complex genomic and proteomic data from the VZV, identifying optimal target antigens for vaccine refinement and predicting potential escape mutations, thereby ensuring long-term vaccine effectiveness. Within the manufacturing phase, predictive maintenance models utilizing AI minimize equipment downtime and ensure stringent quality control by analyzing production parameters in real-time, reducing batch failures inherent in biological product manufacturing. This level of optimization translates directly into higher yield and lower production costs per dose, mitigating supply chain vulnerabilities often associated with biologics.

Moreover, AI systems are crucial for optimizing global distribution and targeted deployment. By integrating diverse datasets, including climate variables, demographic shifts, and regional disease prevalence patterns, AI tools can forecast vaccine demand with high accuracy. This precise forecasting helps public health organizations allocate resources effectively, preventing stockouts in high-demand areas and minimizing wastage in lower-priority regions, which is especially important given the stringent cold chain requirements of the live attenuated vaccine. The implementation of AI-driven tools in pharmacovigilance also allows for rapid detection of rare adverse events post-launch, ensuring continuous monitoring and public trust in the established vaccine programs.

- Accelerated VZV strain optimization and antigen identification using machine learning (ML).

- Enhanced predictive modeling for clinical trial outcomes and vaccine immunogenicity assessment.

- Optimization of complex biologics manufacturing processes through real-time quality control and predictive maintenance.

- Improved cold chain monitoring and logistics planning using AI to minimize temperature excursions and maximize shelf life.

- AI-driven epidemiological modeling to refine vaccination schedules and achieve optimal herd immunity thresholds.

DRO & Impact Forces Of Varicella Attenuated Live Vaccine Market

The Varicella Attenuated Live Vaccine Market is profoundly shaped by a combination of driving forces related to mandatory public health policies and restraining factors inherent to the technical and logistical challenges of biological products, while constantly seeking opportunities through new market penetration and technological advancements. Key drivers include the proven efficacy and longevity of protection offered by the current vaccine formulations, which has led to widespread acceptance and inclusion in national immunization schedules globally, establishing a foundational demand base. Conversely, the market is restrained by the complexities of maintaining the cold chain necessary for transporting live attenuated vaccines, particularly in resource-limited settings, alongside the public apprehension and misinformation surrounding vaccine safety which can periodically suppress uptake rates. Opportunities primarily lie in the development of thermostable formulations that alleviate logistical burdens and expanding market access into populous developing nations that are currently transitioning towards universal varicella vaccination mandates.

Drivers

One of the principal drivers fueling the growth of the Varicella Attenuated Live Vaccine Market is the mandatory inclusion of the vaccine in national pediatric immunization schedules across major economies, including the United States, Canada, Australia, and many European nations. This legislative backing ensures a consistent and non-cyclical demand for millions of doses annually, providing market stability and predictability for manufacturers. The success of these mandatory programs is evident in the near-elimination of endemic varicella circulation in these regions, shifting the focus towards maintaining high vaccination coverage to prevent outbreaks. This high-level governmental commitment not only drives volume but also encourages investment in robust supply chain mechanisms and public awareness campaigns, reinforcing long-term market sustainability. Furthermore, the demonstrated public health benefit of preventing severe complications, especially in immunocompromised individuals and pregnant women, further solidifies the governmental and clinical justification for widespread vaccination efforts.

Another significant driver is the growing clinical acceptance and preference for combination vaccines, such as the Measles, Mumps, Rubella, and Varicella (MMRV) formulation. Combination vaccines reduce the number of necessary injections, thereby improving patient compliance, especially in pediatric settings where needle fatigue can be a deterrent to completing the full immunization course. This convenience for both healthcare providers and patients acts as a powerful market accelerator. Manufacturers are strategically emphasizing MMRV formulations as they offer logistical advantages, requiring less storage space and fewer administrative steps compared to delivering four separate monovalent vaccines. This integration into a single shot streamlines healthcare delivery, particularly important in large-scale public health vaccination campaigns where speed and efficiency are critical determinants of success.

Finally, the recognized benefit of preventing Herpes Zoster (Shingles) later in life, stemming from primary varicella vaccination in childhood, provides a secondary, long-term market driver. While the primary goal is chickenpox prevention, effective childhood vaccination limits the dormant VZV load, potentially influencing the incidence or severity of shingles in the aging population. This long-term health dividend reinforces the economic justification for universal childhood vaccination. Continuous research demonstrating the cost-effectiveness of these vaccines in reducing long-term healthcare expenditure related to varicella complications and shingle management further strengthens the market proposition and encourages broader insurance coverage globally.

Restraints

The primary restraint facing the Varicella Attenuated Live Vaccine Market is the inherent requirement for stringent cold chain management due to the nature of the live attenuated virus. The efficacy of the vaccine is highly dependent on maintaining storage temperatures typically between 2°C and 8°C throughout the entire supply chain, from manufacturing facility to the point of administration. Any breach in the cold chain can lead to rapid loss of viral viability, rendering the vaccine ineffective. This logistical constraint significantly limits market penetration in remote, rural, or developing regions where reliable electricity supply, specialized refrigeration equipment, and sophisticated tracking systems are often inadequate or non-existent, creating substantial barriers to distribution and ensuring quality control.

A secondary, yet potent, restraint is the persistent challenge posed by vaccine hesitancy and anti-vaccination sentiments globally. Although the varicella vaccine has a long history of safety and proven efficacy, organized misinformation campaigns and generalized public fear regarding alleged links between vaccines and chronic conditions (despite overwhelming scientific refutation) continue to depress immunization rates in certain demographics. This hesitancy forces manufacturers and public health agencies to expend considerable resources on countering false narratives and rebuilding public trust, diverting funds that could otherwise be used for improving access or R&D. Furthermore, regulatory agencies impose increasingly rigorous post-marketing surveillance requirements in response to public scrutiny, escalating the compliance costs for vaccine producers.

Finally, the existing market concentration, characterized by a few major pharmaceutical companies holding patents and possessing the highly specialized manufacturing expertise required for live attenuated vaccines, acts as a restraint on competitive pricing and innovation from smaller entrants. The high capital expenditure required to establish a compliant vaccine manufacturing facility, coupled with the lengthy and complex regulatory approval processes, creates significant barriers to entry. This oligopolistic structure can sometimes lead to localized supply shortages or dependence on specific vendors, challenging public health systems reliant on stable, predictable, and competitively priced supplies of essential vaccines.

Opportunities

A major opportunity for growth lies in geographic expansion into emerging and developing economies, particularly in Asia Pacific, Latin America, and Africa, where varicella vaccination is not yet universally mandated or widely implemented. Many countries in these regions are now updating their public health guidelines, moving varicella vaccination from an optional, private-market product to an essential component of the national immunization schedule. As these nations improve their cold chain infrastructure and increase healthcare spending, demand for the vaccine is expected to surge dramatically, offering high-volume sales potential for established market players. Strategic partnerships with local governments and non-governmental organizations to subsidize and facilitate vaccine introduction programs represent a critical avenue for capitalizing on this expanding demographic base.

Another significant opportunity revolves around technological advancements aimed at improving vaccine stability and delivery methods. Research into developing thermostable formulations of the live attenuated vaccine could revolutionize distribution by minimizing reliance on complex cold chain logistics, making the vaccine accessible to the most remote populations. Successful development of a vaccine that can withstand higher ambient temperatures for extended periods would drastically reduce logistical costs and wastage, solving the primary restraint faced by the market. Furthermore, advancements in alternative delivery technologies, such as micro-needle patches or inhalable formulations, could enhance patient acceptance and compliance, particularly for sensitive populations.

The expansion of the adult market segment presents a specialized opportunity, focusing on specific demographics requiring catch-up vaccination or re-vaccination. This includes healthcare workers, teachers, military personnel, and international travelers who may lack verifiable immunity and face high exposure risks. Targeted vaccination programs in occupational health settings, coupled with increasing travel health awareness, drive steady demand in this non-pediatric cohort. Moreover, the increasing emphasis on combination vaccines tailored for different age groups, such as booster shots that combine varicella protection with other relevant adult vaccines, offers premium pricing potential and product differentiation strategies for market leaders.

Impact Forces

The impact forces influencing the Varicella Attenuated Live Vaccine market are predominantly driven by epidemiological imperatives and regulatory stringency. Epidemics or outbreaks in previously well-vaccinated populations, often triggered by waning immunity or localized vaccine refusal, instantly amplify market demand and regulatory scrutiny regarding vaccine coverage targets. Furthermore, the global drive towards eliminating vaccine-preventable diseases means that governmental funding and international donor support remain highly influential, acting as a crucial non-commercial force that dictates purchasing volumes and market access in lower-income nations. Technological breakthroughs in viral attenuation techniques or stabilization methodologies (e.g., lyophilization enhancements) also act as a powerful force, potentially shifting market dominance by reducing manufacturing costs or simplifying distribution.

In the context of the varicella market, regulatory harmonization across jurisdictions is a pivotal impact force. When major regulatory bodies, such as the FDA, EMA, and WHO, align on recommended dosing schedules, safety requirements, and manufacturing standards, it simplifies the global launch and marketing process for manufacturers. Conversely, divergence in regulatory requirements—for example, variations in the minimum age for MMRV vs. monovalent varicella vaccine administration—can fragment the market and increase compliance complexity. Consumer perception, amplified rapidly through digital media, is an increasingly volatile impact force; positive clinical trial results or public health success stories boost confidence, while high-profile adverse event reports, even if statistically rare, can severely damage short-term market uptake and require immediate, coordinated industry response.

Segmentation Analysis

The Varicella Attenuated Live Vaccine Market segmentation provides a granular view of revenue streams, categorizing the market based on Product Type, Application, End-User, and Distribution Channel. Product type primarily differentiates between monovalent vaccines, containing only the VZV antigen, and combination vaccines, predominantly the MMRV formulations, which are witnessing accelerated adoption due to logistical efficiencies. The Application segment is largely dominated by routine childhood immunization, which provides the bulk of the market volume, although the adult catch-up and high-risk group segments offer niche, high-value opportunities. End-users typically include public health systems, private healthcare providers, and hospitals, with governmental procurement dominating volumes. Understanding these segment dynamics is critical for manufacturers to tailor their production capacity, pricing strategies, and regional marketing efforts effectively.

Detailed analysis of the Application segment reveals that pediatric immunization remains the core engine of market revenue, driven by established birth cohorts and universal vaccination mandates. However, there is an observable trend where high-income countries are expanding surveillance and actively recommending booster doses for children transitioning into adolescence, maintaining market vitality even after peak initial immunization is achieved. Concurrently, the Distribution Channel analysis underscores the vital importance of government procurement and central stockpiling mechanisms, especially in high-volume public health initiatives, while private pharmacies and clinics cater primarily to individual patient choice and supplementary vaccination needs, often at a higher price point per dose. This nuanced segmentation assists stakeholders in accurately forecasting demand across varied institutional purchasing dynamics and consumer behavior patterns.

- By Product Type:

- Monovalent Varicella Vaccine (Single Antigen)

- Combination Vaccines (e.g., MMRV)

- By Application:

- Pediatric Vaccination (Routine Childhood Immunization)

- Adult Vaccination (Catch-up and High-Risk Groups)

- By End-User:

- Hospitals and Clinics

- Public Health Agencies and Governmental Programs

- Private Practices and Pediatric Centers

- By Distribution Channel:

- Government Procurement

- Pharmaceutical Distributors

- Retail Pharmacies

Value Chain Analysis For Varicella Attenuated Live Vaccine Market

The value chain for the Varicella Attenuated Live Vaccine market is exceptionally complex and capital-intensive, starting with meticulous upstream activities involving specialized cell culture media preparation and maintenance of the proprietary Oka VZV seed strain. The core manufacturing process—attenuation, large-scale cell propagation, harvest, purification, and lyophilization—requires highly specialized bio-manufacturing facilities compliant with Good Manufacturing Practices (GMP) and substantial Quality Control (QC) infrastructure to ensure sterility and viral load integrity. Upstream efficiency, particularly the yield optimization of the viral culture, directly dictates the final cost of goods and the overall production capacity available to meet global demand, making intellectual property surrounding strain maintenance a significant value driver.

Downstream activities are dominated by packaging, stringent cold chain logistics, and distribution. Given that the vaccine is temperature-sensitive, the costs associated with specialized packaging, temperature monitoring devices, and refrigerated transport vehicles significantly inflate the total distribution expense compared to standard pharmaceuticals. The primary distribution channel involves large-scale procurement and bulk shipping to governmental central warehouses or specialized pharmaceutical distributors who manage regional cold chain hubs. Direct channels, where manufacturers supply large hospital networks or national procurement agencies, often involve established contractual agreements, while indirect channels leverage third-party distributors and logistics partners to reach smaller private clinics and retail pharmacies. The complexity of regulatory approvals across different nations adds another layer of cost and time to the downstream segment, requiring region-specific dossier submissions and labeling adherence.

Profit margins in the value chain vary significantly; manufacturing holds a high-risk, high-reward profile due to batch failure potential, whereas distribution margins are tightly linked to the efficiency of the cold chain network. The ultimate value delivery occurs at the point of administration through healthcare providers, who ensure proper handling and record-keeping, completing the chain and maximizing the public health impact. The high barrier to entry at the manufacturing stage ensures that a concentrated group of multinational pharmaceutical companies captures the majority of the inherent value derived from the initial intellectual property and high-throughput production capacity.

Varicella Attenuated Live Vaccine Market Potential Customers

The potential customer base for the Varicella Attenuated Live Vaccine Market is highly stratified, encompassing both large institutional buyers and individual consumers driven by specific health directives. The primary buyers are national and regional Public Health Agencies and Governmental Procurement Bodies, particularly those running Universal Immunization Programs (UIPs), as these entities purchase massive volumes of doses via tenders to achieve high coverage targets among newborns and young children. These governmental contracts prioritize factors like price stability, guaranteed supply volume, and compliance with national public health strategies, making them the most crucial end-user segment for market volume.

The secondary customer segment includes large Hospital Systems, Pediatric Clinics, and Private Healthcare Networks, particularly in regions where vaccination is not fully covered or mandated by the government, or where patients prefer private medical services. These customers typically procure smaller, more consistent volumes and often favor combination vaccines (MMRV) for convenience and superior patient experience. Additionally, Occupational Health Services and Travel Medicine Clinics constitute niche but important buyers, catering to adults who require catch-up vaccination due to risk exposure, international travel requirements, or employment in high-risk environments such as hospitals and schools. The ultimate recipient, the patient or parent, influences the final selection when purchasing outside of public programs, often guided by brand reputation and physician recommendation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $4.5 Billion |

| Market Forecast in 2033 | $6.6 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Merck & Co., Inc., GlaxoSmithKline plc (GSK), Sanofi S.A., Takeda Pharmaceutical Company Limited, Daiichi Sankyo Company, Limited, Pfizer Inc., CSL Limited (Seqirus), Johnson & Johnson, Serum Institute of India Pvt. Ltd., China National Biotec Group (CNBG), AstraZeneca plc, Bio Farma, Bharat Biotech International Limited, Mitsubishi Tanabe Pharma Corporation, Novavax, Inc., Emergent BioSolutions, Inc., Bavarian Nordic, SK Bioscience, Sinovac Biotech Ltd., and Walvax Biotechnology Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Varicella Attenuated Live Vaccine Market Key Technology Landscape

The technology landscape of the Varicella Attenuated Live Vaccine market is primarily centered around optimizing established cell culture techniques and enhancing the stability of the final product. The core technology relies on propagating the attenuated Oka strain of VZV in specialized human or animal cell cultures (e.g., human diploid cell culture or chick embryo fibroblasts). Critical technological innovation focuses on media optimization and bioreactor scale-up to ensure high viral yield while maintaining strict compliance with safety regulations and sterility standards. Lyophilization, or freeze-drying technology, is paramount in this sector, transforming the liquid viral suspension into a stable powder form that significantly extends shelf life, though still necessitating refrigeration. The efficiency and precision of the lyophilization process directly impact the residual moisture content, which is a key determinant of the vaccine's long-term stability and efficacy, thereby acting as a critical point of competitive technological differentiation among manufacturers.

Recent technological advancements are pushing beyond traditional lyophilization to address the core logistical constraint of the cold chain. This includes research into novel stabilizing excipients and buffer systems designed to protect the live viral structure under thermal stress, aiming to create truly thermostable vaccine variants capable of surviving prolonged periods outside of strict refrigeration. Furthermore, formulation technology is critical for the combination vaccines (MMRV), where precise antigenic compatibility and stability must be ensured when mixing multiple live attenuated viral components. This requires advanced analytical techniques and formulation chemistry to prevent interference between the antigens, ensuring that the vaccine retains maximal immunogenicity for all four components simultaneously, a major technological hurdle that only leading manufacturers have successfully overcome at commercial scale.

Additionally, the technology landscape incorporates sophisticated Quality Assurance (QA) and Quality Control (QC) systems utilizing rapid molecular diagnostic techniques, such as Quantitative Polymerase Chain Reaction (qPCR), to accurately measure viral titer and purity in manufactured batches. Automation and robotics are increasingly being integrated into the fill-and-finish processes to minimize human error and contamination risk, standardizing the final product presentation. The application of bio-informatics tools is also gaining prominence, aiding in genetic sequencing of the VZV strain to monitor stability and prevent drift, ensuring that the circulating vaccine strain remains homologous to the wild-type virus circulating in the population, a continuous technological challenge for all live attenuated vaccine producers.

Regional Highlights

The global varicella attenuated live vaccine market exhibits distinct regional dynamics driven by differing regulatory environments, socioeconomic factors, and the maturity of national immunization programs. North America and Europe currently represent the most substantial market value, largely due to early adoption of universal vaccination policies and well-established public healthcare procurement systems that guarantee high penetration rates. Conversely, the Asia Pacific region is projected to be the fastest-growing market segment, fueled by rapid economic development, increasing public health expenditure, and the governmental shift in populous countries like China and India towards mandatory inclusion of the varicella vaccine in their expanded immunization schedules. Latin America and the Middle East and Africa (MEA) are emerging markets, constrained by inconsistent cold chain infrastructure but poised for growth through international aid and focused initiatives aimed at improving maternal and child health outcomes, thereby increasing vaccine uptake over the forecast period.

- North America: This region, led by the United States and Canada, holds market dominance due to early universal recommendation of the varicella vaccine (Varivax initially, followed by MMRV) and highly efficient supply chains. High compliance rates, stringent pediatric healthcare standards, and robust government funding for both public and private sector immunization programs ensure consistent, high-volume demand. The emphasis here is shifting towards booster dose uptake and managing the adult catch-up market.

- Europe: The European market demonstrates high heterogeneity, with mandatory vaccination in certain countries (e.g., Germany) and recommended, non-mandatory schemes in others (e.g., UK, France). This region maintains strong revenue generation, driven by high per capita healthcare spending and a focus on combination vaccines. Challenges involve overcoming varied national policies and localized vaccine hesitancy in some Western European nations.

- Asia Pacific (APAC): APAC is the key growth engine, characterized by a large population base and accelerating government investment in preventative healthcare. Countries like Japan, South Korea, and Australia have established immunization programs, while China and India represent massive untapped potential as vaccination mandates expand, driving demand for localized manufacturing and cold chain infrastructure development.

- Latin America: This region is marked by governmental efforts to standardize immunization across diverse socioeconomic landscapes. Market growth is dependent on successful implementation of Pan-American Health Organization (PAHO) initiatives and securing reliable funding for bulk vaccine purchases. Brazil and Mexico are primary revenue contributors, focusing heavily on expanding access to routine pediatric care.

- Middle East and Africa (MEA): MEA presents the greatest logistical challenges due to underdeveloped cold chain infrastructure and political instability, yet also offers substantial long-term growth potential. Demand is largely project-driven, supported by international organizations (e.g., Gavi, WHO). Market development relies heavily on improving public health education, strengthening supply chain resilience, and achieving basic coverage targets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Varicella Attenuated Live Vaccine Market.- Merck & Co., Inc. (Dominant player globally, original developer of the Oka strain vaccine)

- GlaxoSmithKline plc (GSK)

- Sanofi S.A.

- Takeda Pharmaceutical Company Limited

- Daiichi Sankyo Company, Limited

- Pfizer Inc.

- CSL Limited (Seqirus)

- Johnson & Johnson

- Serum Institute of India Pvt. Ltd. (Major supplier to developing nations)

- China National Biotec Group (CNBG)

- AstraZeneca plc

- Bio Farma

- Bharat Biotech International Limited

- Mitsubishi Tanabe Pharma Corporation

- Novavax, Inc.

- Emergent BioSolutions, Inc.

- Bavarian Nordic

- SK Bioscience

- Sinovac Biotech Ltd.

- Walvax Biotechnology Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Varicella Attenuated Live Vaccine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Varicella Attenuated Live Vaccine Market between 2026 and 2033?

The Varicella Attenuated Live Vaccine Market is projected to exhibit a Compound Annual Growth Rate (CAGR) of 5.8% during the forecast period, driven primarily by expanding universal immunization mandates and increasing global health expenditure on preventative pediatric care.

Which product segment, monovalent or combination vaccines (MMRV), is experiencing faster market adoption?

Combination vaccines, particularly the Measles, Mumps, Rubella, and Varicella (MMRV) formulations, are experiencing accelerated market adoption due to their logistical advantages, simplification of immunization schedules, and improved patient compliance compared to monovalent varicella vaccine administrations.

What are the primary logistical challenges restraining the growth of the Varicella Attenuated Live Vaccine Market?

The most significant restraint is the stringent requirement for maintaining an unbroken cold chain (2°C to 8°C) throughout the distribution process, which is essential for preserving the viability of the live attenuated virus but poses major difficulties in remote or resource-limited emerging markets.

Which geographical region is expected to demonstrate the highest market growth rate during the forecast period?

The Asia Pacific (APAC) region is forecasted to exhibit the highest market growth rate, propelled by massive population size, increasing government investment in national immunization programs, and the formal inclusion of varicella vaccination mandates in several key regional economies.

How is Artificial Intelligence (AI) impacting the manufacturing and distribution of varicella vaccines?

AI is being utilized to optimize manufacturing yields, ensure predictive quality control, and enhance the efficiency of cold chain logistics planning. AI-driven models also improve the accuracy of demand forecasting for public health procurement, minimizing wastage and preventing supply chain shortages.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager