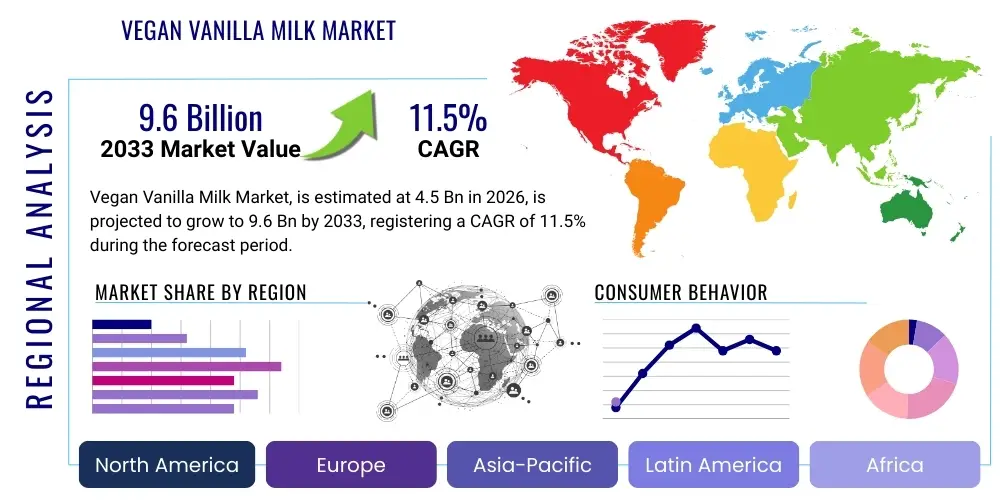

Vegan Vanilla Milk Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443375 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Vegan Vanilla Milk Market Size

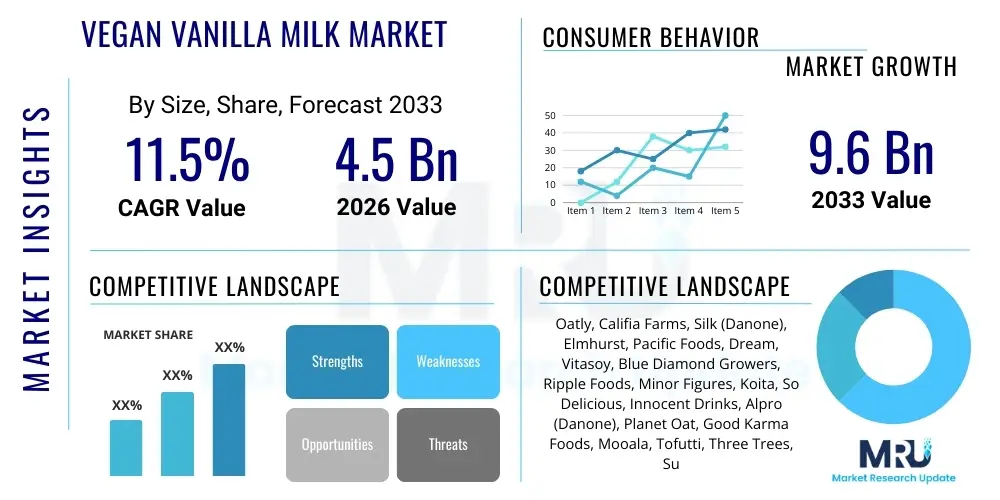

The Vegan Vanilla Milk Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at $4.5 Billion in 2026 and is projected to reach $9.6 Billion by the end of the forecast period in 2033.

The substantial growth trajectory of the Vegan Vanilla Milk Market is primarily fueled by shifting consumer dietary preferences, particularly the rise of plant-based diets and increasing awareness regarding lactose intolerance and dairy allergies. Vanilla, as a universally accepted and palatable flavor profile, significantly enhances the appeal of vegan milk alternatives, making them more accessible and attractive to consumers transitioning away from traditional dairy. This flavor customization allows manufacturers to mask the often characteristic tastes of base ingredients like soy or oat, positioning vanilla variants as premium, ready-to-drink beverages or versatile culinary ingredients.

Market expansion is also supported by continuous product innovation, focusing on enhanced nutritional profiles (e.g., fortification with calcium and Vitamin D) and superior textural characteristics. Retail availability has surged across all major geographies, driven by aggressive marketing campaigns and expansion into mainstream distribution channels, including large hypermarkets and online grocery platforms. Furthermore, the strong sustainability narrative associated with plant-based alternatives compared to conventional dairy production resonates deeply with environmentally conscious Millennial and Gen Z consumers, cementing the market’s sustained high growth rate through 2033.

Vegan Vanilla Milk Market introduction

The Vegan Vanilla Milk Market encompasses the commercial production and distribution of non-dairy beverages flavored predominantly with vanilla extracts, utilizing plant sources such as almond, oat, soy, coconut, rice, and hemp. These products serve as functional and flavor-rich substitutes for traditional cow's milk, catering to a burgeoning global population adopting vegan, vegetarian, flexitarian, or dairy-free lifestyles due to health concerns, ethical considerations, or environmental motivations. The defining feature of these products is the incorporation of vanilla, which significantly boosts palatability and versatility, driving high consumer acceptance across various demographic segments.

Major applications of vegan vanilla milk span direct consumption as a standalone beverage, usage in breakfast cereals, coffee and tea preparation (especially in the rapidly growing specialty coffee sector), and integration into culinary applications such as baking, smoothies, and dessert manufacturing. The primary benefits include cholesterol-free consumption, lower calorie counts compared to whole dairy milk, ease of digestion for lactose-intolerant individuals, and an enhanced environmental footprint. Key driving factors include increasing prevalence of lactose intolerance globally, expanding consumer education regarding animal welfare, rising disposable incomes in developing economies leading to greater expenditure on premium food items, and vigorous efforts by key market players to introduce innovative formulations and sustainable packaging solutions.

The market is characterized by high competition and constant introduction of new base ingredients, such as pea protein and specific blends, aimed at maximizing protein content while minimizing environmental impact. Manufacturers are focusing heavily on clean label ingredients, aiming for non-GMO, organic certifications, and reduced sugar content in their vanilla formulations to capture the health-conscious consumer base. This continuous refinement in product offerings ensures the market remains dynamic and responsive to evolving consumer demands for both nutrition and taste complexity.

Vegan Vanilla Milk Market Executive Summary

The Vegan Vanilla Milk Market is experiencing robust acceleration driven by powerful convergence of health and sustainability trends. Business trends highlight strategic collaborations between plant-based manufacturers and large food service chains, alongside increased investment in localized sourcing and processing infrastructure to improve supply chain resilience and reduce carbon emissions. The sector sees significant mergers and acquisitions activity, where established food and beverage conglomerates integrate specialized plant-milk startups to diversify their portfolios and gain immediate access to advanced formulation technology and brand recognition within the vegan community. Product differentiation is achieved through emphasis on specific health attributes, such as high protein in pea milk variants or low environmental impact in oat milk options, all while utilizing the universal appeal of the vanilla flavor to ensure mainstream acceptance.

Regionally, North America and Europe remain the dominant markets, characterized by high consumer awareness, developed retail infrastructure, and supportive regulatory environments for novel food products. However, the Asia Pacific (APAC) region is projected to register the highest growth rate, fueled by rapid urbanization, westernization of dietary habits, and growing acceptance of plant-based dairy alternatives in densely populated countries like China and India, where traditional dairy consumption patterns are beginning to shift. Latin America and the Middle East & Africa (MEA) present untapped potential, with market entry barriers related to cold chain logistics and local consumer education gradually being overcome through targeted marketing and product adaptations suitable for local culinary traditions.

Segment-wise, the Oat Milk segment, particularly when combined with the vanilla flavor profile, has emerged as the fastest-growing source due to its superior creamy texture and lower environmental water footprint compared to almond or rice bases. Distribution channels are shifting towards online retail, reflecting modern consumer preference for convenience and subscription models, though traditional supermarkets and hypermarkets still command the largest market share. The end-user segment is increasingly driven by the Food and Beverage industry, utilizing vanilla vegan milk as a bulk ingredient in ready-to-eat meals, confectionery, and specialized dietary products, ensuring stable, high-volume demand alongside direct consumer sales.

AI Impact Analysis on Vegan Vanilla Milk Market

Common user inquiries regarding AI's influence on the Vegan Vanilla Milk Market center on themes of supply chain optimization, personalized product formulation, and predictive consumer trend analysis. Users are keenly interested in how Artificial Intelligence can minimize production waste (especially in processing plant sources like oats or almonds), enhance flavor consistency across batches using machine learning algorithms, and develop highly customized, nutrient-optimized vanilla milk products tailored to individual health profiles (e.g., low sugar, high calcium specific formulas). Concerns often revolve around data privacy related to consumer personalization and the high initial investment required for adopting advanced automation and AI-driven quality control systems in manufacturing facilities. The consensus expectation is that AI will primarily drive efficiency, quality standardization, and rapid response to emerging ingredient sustainability concerns.

- AI-driven optimization of crop yield forecasting and sourcing of raw materials (e.g., vanilla beans, oat grains) to enhance supply chain predictability.

- Machine learning algorithms utilized for predictive quality control, ensuring consistent vanilla flavor profiles and optimal texture (mouthfeel) across varying base ingredients.

- Robotics and automated processing lines integrated via AI systems to reduce labor costs and minimize cross-contamination risks in allergen-sensitive vegan production environments.

- Personalized nutrition platforms leveraging AI to recommend specific vanilla vegan milk formulations based on user dietary needs and genetic data.

- Predictive modeling of consumer purchasing behavior and social media sentiment analysis to inform new product development (NPD) strategies, particularly concerning sugar reduction and fortification trends.

- Smart inventory management systems powered by AI to reduce perishable ingredient waste and optimize distribution routes for chilled products, enhancing shelf life.

DRO & Impact Forces Of Vegan Vanilla Milk Market

The dynamics of the Vegan Vanilla Milk Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities, collectively forming the Impact Forces that guide strategic decisions. The primary driver remains the global health and wellness movement, propelling consumers toward functional, clean-label, and dairy-free options, where the vanilla flavor acts as a crucial taste bridge. However, the market faces significant restraints, notably the relatively higher cost of production for specialized plant bases compared to conventional dairy, leading to premium pricing that can deter budget-conscious consumers. Opportunities lie in expanding into emerging markets, developing novel protein sources (like fava bean or algae), and integrating advanced sustainable packaging solutions. These forces mandate continuous innovation and strategic pricing by market players.

Key drivers include the dramatic rise in ethical consumerism, leading to boycotts or reduction in dairy consumption due to animal welfare concerns, which strongly favors the vegan segment. Furthermore, government initiatives and public health campaigns promoting healthier eating habits, often highlighting the benefits of reducing saturated fat intake found in dairy, reinforce the demand for fortified, flavored plant milks. The extensive presence of vanilla as a flavor that pairs well with coffee and tea has cemented its position in the booming café culture, providing a stable, high-volume application driver across the food service sector globally, especially in urban areas.

Restraints, besides pricing, include challenges related to ingredient stability and texture replication; achieving the rich, creamy mouthfeel of dairy milk using plant bases, particularly while maintaining a pleasant vanilla taste without excessive additives, remains a technical hurdle. Supply volatility of certain plant ingredients (e.g., almond sourcing impacted by drought) and the regulatory complexity across different regions regarding labeling standards for plant milks (e.g., use of the term 'milk') also pose significant challenges. However, manufacturers are mitigating these risks by diversifying raw material sourcing and investing heavily in advanced processing techniques such as high-pressure processing (HPP) to enhance stability and shelf life, transforming potential restraints into areas for technological advancement and competitive advantage.

Segmentation Analysis

The Vegan Vanilla Milk Market segmentation provides critical insights into consumer behavior, operational efficiency, and investment priorities, slicing the market based on Source, Packaging Type, Distribution Channel, and End-Use. Understanding these segments is vital for manufacturers to tailor their product offerings and marketing strategies effectively, addressing specific demographic needs, such as the preference for oat-based products among barista users or the reliance on cartons in retail settings. This detailed segmentation reflects the diversity of the plant-based category, where vanilla acts as the unifying, high-appeal flavoring agent across multiple base ingredients, ensuring versatility and maximizing market penetration across varied consumer groups globally.

- Source:

- Almond Milk

- Soy Milk

- Oat Milk

- Coconut Milk

- Rice Milk

- Hemp Milk

- Other Sources (e.g., Cashew, Pea, Flax)

- Packaging Type:

- Cartons (Tetra Pak)

- Bottles (PET, Glass)

- Pouches and Others

- Distribution Channel:

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail

- Specialty Stores

- Foodservice (HoReCa)

- End-Use:

- Direct Consumption

- Food & Beverage Industry (e.g., Bakeries, Confectionery)

Value Chain Analysis For Vegan Vanilla Milk Market

The Value Chain for the Vegan Vanilla Milk Market starts with the sourcing of specialized agricultural commodities, representing the upstream analysis phase. This involves the cultivation and harvesting of primary plant sources—oats, almonds, soy, etc.—along with the sourcing of high-quality, often natural, vanilla extracts. Efficiency and sustainability in this upstream segment are crucial, as raw material costs constitute a significant portion of the final product expense and environmental impact. Manufacturers often engage in long-term contracts or vertical integration to secure consistent, high-standard supplies, focusing on non-GMO and organic certifications to appeal to premium market segments. Processing involves complex steps like grinding, soaking, enzyme treatment (especially for oat), filtration, pasteurization, homogenization, and the crucial blending of the vanilla flavor component, often requiring advanced high-pressure processing (HPP) technology to ensure microbial safety and extend shelf life.

The middle stage focuses on production, packaging, and quality assurance. Given the perishable nature of the final product, aseptic packaging (primarily Tetra Pak cartons) is dominant, enabling extended ambient shelf stability, which is vital for global distribution. Downstream analysis covers the complex web of distribution channels, encompassing both direct and indirect routes. Indirect distribution, dominated by third-party logistics (3PL) providers specialized in cold chain management, moves products from production facilities to retail outlets like supermarkets and convenience stores. The rise of direct-to-consumer (D2C) and specialized online retail models, however, allows brands to bypass traditional intermediaries, offering enhanced margins and direct customer interaction.

The distinction between direct and indirect channels is critical; indirect channels provide mass market access and visibility, while direct channels, particularly online retail, offer opportunities for personalized bundles and specialized product launches (e.g., limited edition vanilla flavors). Effective channel management requires sophisticated inventory control and forecasting, especially given the fluctuating demand for different base types (e.g., seasonal spikes for oat milk in coffee shops). Final consumer engagement, including post-purchase feedback and loyalty programs, completes the value chain, ensuring continuous product improvement and brand reinforcement in a highly competitive market where brand loyalty often hinges on perceived health benefits and superior taste experience provided by the vanilla flavoring.

Vegan Vanilla Milk Market Potential Customers

The potential customer base for Vegan Vanilla Milk is broadly categorized into health-conscious consumers, individuals with specific dietary restrictions, and environmentally and ethically motivated buyers. The primary consumer segment consists of individuals diagnosed with lactose intolerance or milk protein allergies, for whom dairy consumption is medically restricted. Beyond this core group, the expanding segment of flexitarians—who consciously reduce, but do not eliminate, meat and dairy—represents a substantial, high-growth buyer pool, drawn to vanilla vegan milk for its versatility and flavor profile in everyday consumption. This group prioritizes taste and texture, making the vanilla variant a successful entry point into the plant-based category.

Secondary high-potential customers include specialty coffee shops (HoReCa sector) and industrial food processors (B2B segment). Coffee shops increasingly require barista-grade vegan vanilla milk (especially oat and soy bases) that froth and steam effectively without curdling, driven by consumer demand for non-dairy lattes and cappuccinos. The industrial sector utilizes vanilla vegan milk as a key ingredient in vegan ice cream, yogurts, baked goods, and ready-to-drink shakes, seeking consistent quality and bulk availability. Geographically, the Millennial and Gen Z demographics across North America and Western Europe exhibit the highest consumption frequency, valuing brand narratives around sustainability and natural ingredients alongside the appealing vanilla taste.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $4.5 Billion |

| Market Forecast in 2033 | $9.6 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Oatly, Califia Farms, Silk (Danone), Elmhurst, Pacific Foods, Dream, Vitasoy, Blue Diamond Growers, Ripple Foods, Minor Figures, Koita, So Delicious, Innocent Drinks, Alpro (Danone), Planet Oat, Good Karma Foods, Mooala, Tofutti, Three Trees, SunOpta |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Vegan Vanilla Milk Market Key Technology Landscape

The technology landscape governing the Vegan Vanilla Milk Market is characterized by innovations focused on extraction efficiency, sensory attributes, and extended shelf life, essential for maintaining the product's quality and market viability. High-Shear Homogenization remains fundamental, used to break down fats and suspended solids into minute particles, preventing separation and creating the smooth, creamy texture consumers expect, particularly in oat and cashew bases. This process is crucial because achieving a dairy-like mouthfeel while balancing the distinct flavor notes of vanilla requires precise particle size distribution. Additionally, Ultra-High Temperature (UHT) processing is widely adopted, enabling sterile packaging (often in aseptic cartons) and ambient shelf stability for several months, which is critical for economical global distribution, though maintaining flavor integrity through this harsh process is a continuous challenge for vanilla notes.

Enzyme Technology represents a significant area of research and application, especially within the rapidly growing oat milk segment. Enzymes are used to break down complex carbohydrates in oats into simpler sugars, naturally sweetening the product and enhancing its body and texture without the need for excessive added sugars. This enzymatic conversion is key to creating 'barista blend' versions that foam effectively. Furthermore, encapsulation and flavor masking technologies are increasingly utilized to ensure that the delicate vanilla flavor remains pronounced and consistent, while masking the inherent 'beany' or 'grassy' notes often associated with soy or pea protein bases. These formulation technologies are competitive differentiators, impacting consumer preference heavily.

Looking forward, Sustainable Processing Techniques, such as High-Pressure Processing (HPP) which minimizes heat exposure, are being explored to achieve pasteurization levels while better preserving the nutritional content and the natural, volatile flavor compounds of premium vanilla extracts. Traceability technology, utilizing blockchain and QR codes, is also becoming prevalent. This allows brands to offer 'farm-to-carton' transparency, verifying the ethical and sustainable sourcing of both the base ingredient and the vanilla, appealing directly to the highly informed consumer base that drives this market segment. Optimization of these processes directly contributes to reducing energy consumption and water usage, aligning with the core sustainability ethos of the plant-based industry.

Regional Highlights

Regional dynamics significantly influence the consumption patterns and strategic focus within the Vegan Vanilla Milk Market, dictated by varying dietary norms, regulatory frameworks, and economic development levels. North America stands as the largest market, characterized by mature consumer acceptance, high purchasing power, and intense competition among major manufacturers. The presence of a strong clean-label movement and a pervasive coffee culture demanding high-quality, flavored alternatives solidifies the region's dominance, with vanilla almond and vanilla oat milk being particularly popular choices for coffee preparation and standalone consumption. Marketing efforts here often center around superior nutrition, organic certification, and ethical sourcing, supported by extensive retail and online distribution networks.

Europe, particularly Western and Northern European countries (UK, Germany, Sweden), follows closely, driven by progressive governmental sustainability goals and deep-rooted vegan and vegetarian movements. The European market exhibits high penetration rates for flavored plant milks, benefiting from well-established plant-based brands like Alpro and Oatly. However, the Asia Pacific (APAC) region is projected to be the fastest-growing market globally. This expansion is fueled by rising disposable incomes, shifting dietary trends influenced by Western culture, and increasing recognition of health issues like lactose intolerance, especially in urban centers of China, Japan, and Southeast Asia. Local manufacturers in APAC are increasingly launching vanilla-flavored options utilizing locally available sources like rice and soy, adapting formulations to regional taste preferences, often opting for less sweet profiles than their Western counterparts.

Latin America (LATAM) and the Middle East & Africa (MEA) represent emerging frontiers. Growth in LATAM is concentrated in major economies like Brazil and Mexico, where urbanization and awareness campaigns are gradually increasing adoption, though price sensitivity remains a major market constraint. In MEA, market entry is challenged by logistical hurdles, including inconsistent cold chain infrastructure, but high demand in affluent urban centers (e.g., UAE, Saudi Arabia) for premium, imported, dairy-free, vanilla-flavored products offers lucrative niche opportunities. These emerging regions require focused investment in education and localized product sizes and distribution models to realize their full potential in the forecast period.

- North America: Dominant market share; driven by high consumer awareness, robust health trends, established specialty coffee culture, and significant presence of major plant-based brands (e.g., Califia Farms, Silk).

- Europe: High adoption rates; strong regulatory push for sustainability; leading markets include UK, Germany, and Benelux; preference for oat and almond bases with natural vanilla flavoring.

- Asia Pacific (APAC): Fastest-growing region; rapid urbanization and westernization of diets; emerging consumer base in China and India; adaptation of products to local preferences (e.g., soy-based vanilla milk).

- Latin America (LATAM): Growth concentrated in urban areas of Brazil and Mexico; increasing health consciousness; market penetration constrained by price sensitivity and limited retail density outside major cities.

- Middle East & Africa (MEA): High growth potential in premium segments (UAE, Saudi Arabia); reliance on imports; logistical challenges related to cold chain management; demand driven by health-conscious expatriates and affluent local populations seeking specialty goods.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Vegan Vanilla Milk Market.- Oatly

- Califia Farms

- Silk (Danone)

- Elmhurst

- Pacific Foods

- Dream

- Vitasoy

- Blue Diamond Growers

- Ripple Foods

- Minor Figures

- Koita

- So Delicious

- Innocent Drinks

- Alpro (Danone)

- Planet Oat

- Good Karma Foods

- Mooala

- Tofutti

- Three Trees

- SunOpta

- Danone North America

- Nestlé S.A. (via acquired brands)

- Hain Celestial Group

- Daiya Foods Inc.

- VFC (Vegan Fried Chicken)

- The Bridge Bio

- Happy Happy Soy Boy

- Living Harvest Foods

- Earth's Own Food Company

- Nutriops SL

Frequently Asked Questions

Analyze common user questions about the Vegan Vanilla Milk market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Vegan Vanilla Milk Market?

The Vegan Vanilla Milk Market is projected to exhibit a Compound Annual Growth Rate (CAGR) of 11.5% during the forecast period from 2026 to 2033, driven by expanding consumer interest in plant-based beverages and favorable taste profiles.

Which base ingredient segment is currently dominating the Vegan Vanilla Milk Market?

While Almond Milk traditionally holds a large market share, the Oat Milk segment is currently demonstrating the highest growth velocity, favored for its superior creamy texture, lower environmental impact, and effectiveness in coffee applications when flavored with vanilla.

What are the primary factors restraining the market growth of Vegan Vanilla Milk?

The main restraints include the high production costs associated with specialized plant sources and processing, leading to premium pricing compared to conventional dairy, and ongoing challenges in regulatory harmonization regarding product labeling.

Which geographical region is expected to show the fastest market growth?

The Asia Pacific (APAC) region is forecasted to experience the fastest market growth, propelled by rising disposable incomes, rapid urbanization, and increasing health consciousness driving the adoption of flavored dairy alternatives across major economies like China and India.

How is technology impacting the quality and production of vanilla vegan milk?

Key technologies such as High-Shear Homogenization are used to ensure smooth texture, while enzyme technology naturally sweetens products like oat milk. Ultra-High Temperature (UHT) processing and advanced aseptic packaging extend shelf life and maintain the integrity of the vanilla flavor profile for global distribution.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager