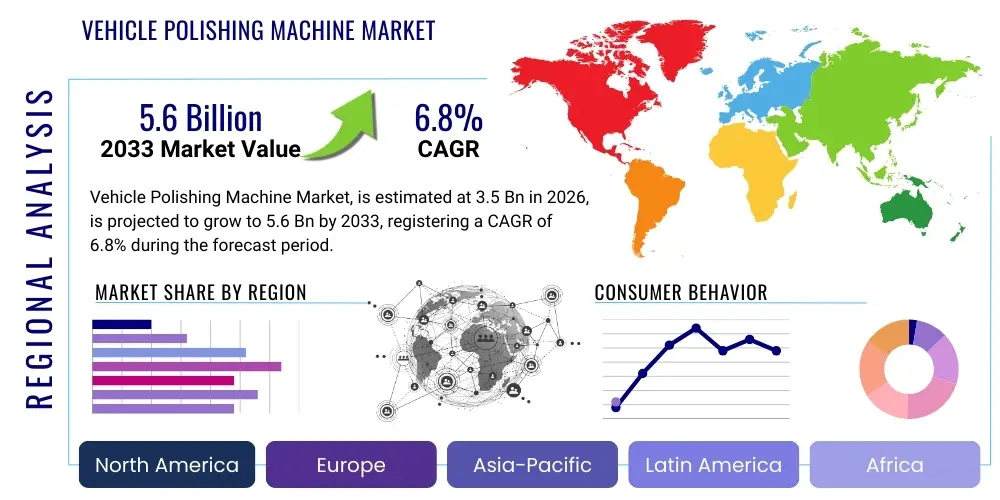

Vehicle Polishing Machine Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442854 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Vehicle Polishing Machine Market Size

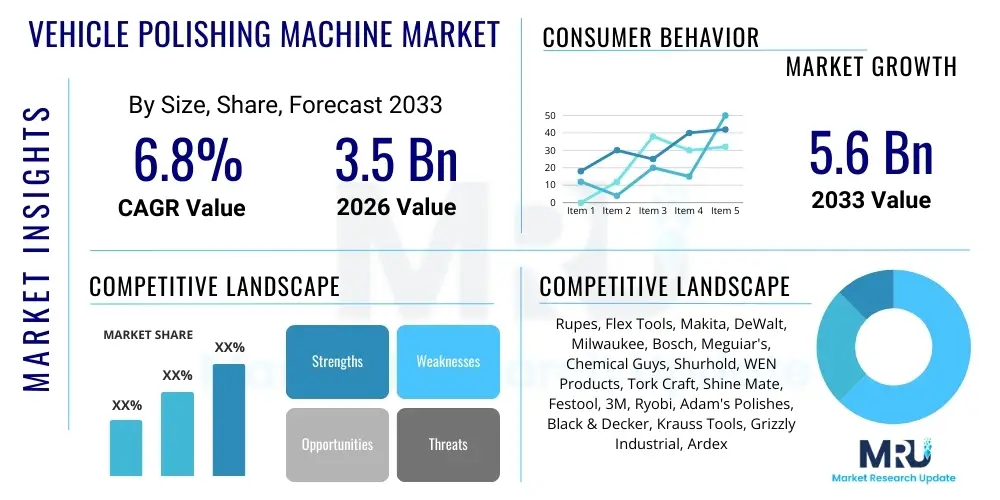

The Vehicle Polishing Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.6 Billion by the end of the forecast period in 2033.

Vehicle Polishing Machine Market introduction

The Vehicle Polishing Machine Market encompasses a wide range of electrical and pneumatic tools designed specifically for surface correction, paint finishing, and enhancing the aesthetic appeal of vehicles. These machines utilize rotational or orbital movements coupled with abrasive pads and compounds to remove swirl marks, oxidation, scratches, and other paint defects, restoring the vehicle's luster and protective clear coat integrity. The core product categories include rotary polishers, which offer aggressive cutting action, and dual-action (DA) polishers, known for their safer, more user-friendly orbital motion, making them popular among both professional detailers and amateur enthusiasts. The complexity and sophistication of these tools have increased significantly, driven by advancements in motor technology, ergonomic design, and electronic speed control systems that allow for precise manipulation of the polishing process, ensuring optimal results on modern automotive paint systems, which are often highly sensitive to heat buildup and excessive friction.

Major applications of vehicle polishing machines span the entire automotive aftermarket ecosystem, including dedicated professional detailing shops, collision repair centers (for blending and finishing repaired panels), high-end car washes offering premium paint correction services, and original equipment manufacturers (OEMs) for final quality control finishing lines. Furthermore, the burgeoning community of DIY automotive enthusiasts represents a significant application segment, fueled by the accessibility of high-quality, lightweight, and easy-to-handle DA polishers. The primary benefit derived from utilizing these machines is the dramatic improvement in vehicle aesthetics and the long-term protection of the paint surface, thereby maintaining or enhancing the vehicle's resale value. Effective paint correction not only removes visual defects but also prepares the surface optimally for the application of advanced protective coatings such as ceramic coatings and specialized waxes, which require a pristine foundation for maximum adhesion and durability.

The driving factors propelling the growth of the Vehicle Polishing Machine Market are multifaceted, primarily centered around the increasing consumer focus on vehicle aesthetics and maintenance, particularly in emerging economies where vehicle ownership is rapidly rising. The professional detailing segment is experiencing consistent growth, driven by consumer demand for premium services that exceed standard wash procedures. Technological innovation plays a crucial role, with manufacturers continuously introducing lighter, cordless, and more powerful tools utilizing lithium-ion battery technology, which enhances portability and operational flexibility, especially in mobile detailing operations. Additionally, the proliferation of specialized polishing compounds, pads, and support systems designed to work synergistically with specific machine types further stimulates market expansion. Regulatory pressures regarding vehicle cleanliness and safety standards also indirectly influence the market, promoting the consistent upkeep of vehicle surfaces.

Vehicle Polishing Machine Market Executive Summary

The Vehicle Polishing Machine Market is undergoing robust expansion, characterized by significant business trends favoring cordless technology and ergonomic designs tailored for efficiency and user comfort. Major manufacturers are prioritizing the integration of brushless motor technology, which extends tool life, increases power output, and improves battery efficiency, catering directly to the demands of professional detailers who require reliable, all-day performance. Another pivotal trend is the convergence of professional-grade features into consumer-friendly devices, driven by the expanding DIY segment that seeks near-professional results using accessible tools. Strategic partnerships between machine manufacturers and compound/pad suppliers are also becoming common, aiming to provide bundled solutions that optimize the entire polishing workflow, ensuring compatibility and maximizing performance across the system. Furthermore, sustainability is an emerging business focus, leading to research into more durable, reusable, and environmentally friendly polishing accessories.

Regional trends indicate that North America and Europe currently dominate the market share, primarily due to high vehicle ownership rates, strong consumer awareness regarding paint protection, and the presence of a mature professional detailing industry characterized by high service quality standards. However, the Asia Pacific (APAC) region is projected to exhibit the highest growth rate during the forecast period, fueled by rapid urbanization, increasing disposable incomes, and the corresponding surge in luxury and premium vehicle sales, particularly in countries like China and India, where detailing services are rapidly transitioning from niche offerings to mainstream automotive maintenance activities. Latin America and the Middle East & Africa (MEA) are also showing promising growth, primarily driven by expanding infrastructure for automotive repair and maintenance services and a growing local detailing culture that emphasizes vehicle presentation. Infrastructure development, particularly in collision repair and authorized service centers, dictates the speed of market penetration in these developing regions.

Segmentation trends highlight the increasing dominance of Dual Action (DA) polishers, which are becoming the go-to tool for both professionals (due to their versatility and finishing capability) and amateurs (due to their reduced risk of paint damage). Within the application segment, Professional Detailing Services remains the largest revenue contributor, consistently investing in high-end, heavy-duty machines to handle high-volume throughput and specialized paint correction tasks. However, the Individual/DIY Use segment is the fastest-growing category, stimulated by targeted marketing, online educational content (videos and tutorials), and the introduction of economically priced, compact DA polishers. The distribution landscape is also shifting, with online retail channels gaining traction due to their ability to offer a wider selection, comparative pricing, and direct-to-consumer accessibility, challenging traditional brick-and-mortar specialty stores, though professional supplies often remain tied to established distribution networks.

AI Impact Analysis on Vehicle Polishing Machine Market

User inquiries regarding AI's influence on the Vehicle Polishing Machine Market often revolve around automated detailing processes, machine guidance systems, and predictive maintenance for the tools themselves. Key themes users are concerned about include the potential for AI-powered robotics to automate high-precision paint correction, thereby reducing labor costs and skill requirements, and the development of intelligent polishers that can dynamically adjust speed, pressure, and oscillation patterns based on real-time surface feedback. Users also express interest in how machine learning could analyze paint defects (like orange peel or clear coat thickness) using integrated sensors, providing prescriptive instructions or automatically executing the optimal polishing strategy. The expectation is that AI integration will lead to unprecedented precision, minimizing human error and ensuring consistent, flawless finishes, particularly in high-volume settings like OEM finishing lines or large detailing franchises. However, concerns also exist regarding the initial investment cost of such advanced systems and the displacement of highly skilled manual labor.

- AI-Powered Robotic Polishing: Deployment of automated systems in OEM facilities and large service centers for consistent, high-speed finishing.

- Real-Time Surface Analysis: Integration of sensors (e.g., spectrophotometers, thickness gauges) coupled with ML algorithms to identify paint defects and optimize the polishing path.

- Adaptive Machine Control: Polishers dynamically adjusting motor speed, torque, and oscillation based on real-time surface resistance and temperature to prevent burn-through or hazing.

- Predictive Maintenance for Tools: AI analyzing usage patterns and motor performance to alert users of impending failures or necessary maintenance for minimizing downtime.

- Training and Simulation: Using AI models to simulate complex polishing techniques, aiding in the training of new detailing professionals.

- Inventory Optimization: Machine learning algorithms forecasting demand for specific pads, compounds, and replacement parts based on geographical detailing activity and season.

DRO & Impact Forces Of Vehicle Polishing Machine Market

The dynamics of the Vehicle Polishing Machine Market are significantly shaped by several critical factors encapsulated in the Drivers, Restraints, and Opportunities (DRO) framework, which collectively determine the market trajectory and competitive intensity. Primary market drivers include the pervasive consumer desire for enhanced vehicle aesthetics and preservation of resale value, alongside technological advancements that have rendered polishing tools more powerful, safer, and ergonomically superior. This is further amplified by the growth of specialized automotive aftercare services, where high-quality paint correction is a foundational offering. Conversely, the market faces restraints such as the relatively high initial cost associated with professional-grade, high-performance machinery, and the steep learning curve and significant manual skill required to achieve flawless results with rotary polishers, which poses a barrier to entry for casual users. Opportunities arise from the rapidly expanding use of cordless technology, enabling greater mobility for detailers, the introduction of more user-friendly DA polishers that democratize paint correction, and the integration of smart features and AI-guided tools that promise to standardize output quality and reduce training time.

A key driver is the transition towards cordless power tools, leveraging advanced lithium-ion battery packs that offer extended run times and consistent power delivery rivaling corded counterparts. This mobility is indispensable for mobile detailing services, which represent a rapidly growing segment, particularly in densely populated urban areas where fixed shop space is expensive. Furthermore, the rising adoption of specialized protective coatings, such as nanoceramic formulations, mandates a high level of paint preparation (polishing) to ensure proper chemical bonding and durability, thus inherently linking the growth of the coatings market to the demand for precision polishing machines. Manufacturers are continuously innovating around tool ergonomics, reducing vibration and weight to mitigate operator fatigue, directly increasing the efficiency and output potential of professional detailers, thereby improving the economic viability of paint correction services. The professional detailing industry’s expansion acts as a fundamental, non-cyclical driver, relying on regular vehicle usage irrespective of new car sales cycles.

However, market growth is often constrained by factors related to consumer perception and operational complexities. Many casual vehicle owners, or even smaller repair shops, perceive professional polishing machines as overly complex or unnecessary, opting instead for manual application or low-cost alternatives, limiting the market penetration outside the dedicated enthusiast or professional segment. Furthermore, the highly fragmented nature of the distribution channels, combined with the presence of low-quality, inexpensive imports from certain regions, creates pricing pressure and confuses end-users regarding true performance and longevity expectations. The reliance on highly skilled labor for complex defect removal, particularly when using aggressive rotary tools, represents another inherent restraint; if the talent pool does not keep pace with market demand, service quality can become inconsistent. Impact forces driving market momentum include the high competitive intensity among tool manufacturers, driving down prices and accelerating innovation cycles, and the rapid pace of battery technology improvements which continually resets performance benchmarks for cordless tools.

Segmentation Analysis

The Vehicle Polishing Machine Market is rigorously segmented based on product type, application, and distribution channel, providing a granular view of market dynamics and consumer preferences across different usage scenarios. Product segmentation highlights the performance spectrum required by users, ranging from the high-torque, aggressive action of rotary polishers necessary for heavy defect removal to the safer, more refined movement of dual-action polishers preferred for finishing and general maintenance. Application segmentation clearly delineates between high-volume professional environments, such as detailing shops and collision repair centers, and the expansive, rapidly growing individual consumer market. This classification is vital for manufacturers to tailor product specifications, pricing strategies, and marketing communications to resonate with the distinct needs and skill levels of each end-user group, recognizing that professional users prioritize durability and power, while DIY users emphasize ease of use and safety features.

- By Product Type:

- Rotary Polishers

- Dual Action (DA) Polishers

- Forced Rotation Polishers

- Orbital Sanders/Polishers (Hybrid)

- By Application:

- Professional Detailing Services

- Individual/DIY Use

- Automotive OEM & Repair Shops

- Used Car Dealerships & Auction Preparation

- By Distribution Channel:

- Online Retail (E-commerce platforms, Direct manufacturer sites)

- Offline Retail (Specialty Stores, Automotive Parts Stores, Hypermarkets)

- By Power Source:

- Corded

- Cordless (Battery-Powered)

Value Chain Analysis For Vehicle Polishing Machine Market

The value chain for the Vehicle Polishing Machine Market is complex, involving distinct stages from raw material procurement to final consumer application, characterized by significant specialization at the manufacturing and distribution levels. The upstream segment involves the sourcing of key components, primarily focusing on high-grade aluminum and specialized polymers for tool bodies, sophisticated magnetic materials for high-efficiency motors (especially brushless DC motors), and advanced lithium-ion cells for cordless tool batteries. Key activities here include design optimization for ergonomics and vibration dampening, precision engineering of gearing systems, and rigorous quality control for electrical components. Efficiency in the upstream supply chain directly impacts the final cost and performance characteristics of the polisher, driving manufacturers to establish robust relationships with specialized electronics and motor suppliers, particularly those providing brushless technology.

The manufacturing stage is central, where raw components are assembled into finished polishing machines. This stage often includes significant R&D investment focused on developing proprietary orbital or rotational mechanisms (e.g., specialized gear systems for forced rotation polishers), enhancing heat dissipation capabilities, and integrating electronic control modules for precise speed management. Downstream activities involve distribution and sales. The distribution channel is bifurcated into direct sales (often used for high-volume OEM contracts or large detailing franchise systems) and indirect sales, which utilize established networks of distributors, wholesalers, and retailers. Indirect channels, particularly specialty automotive detail supply stores, often provide essential technical support and hands-on demonstrations, critical for a tool that requires specific application knowledge.

The direct distribution channel, increasingly driven by manufacturers' own e-commerce platforms, allows for rapid market feedback and greater control over branding and pricing, particularly for premium or niche products. However, the indirect distribution channel, encompassing global retail giants and local automotive parts outlets, remains crucial for reaching the mass market and providing necessary immediate access to ancillary products like pads and compounds. The value creation at the final stage lies in the professional detailing service providers, who utilize the machines to deliver high-value surface correction services. Their demand dictates the specifications and quality requirements placed back onto the manufacturers, ensuring continuous innovation in power, ergonomics, and durability, cementing their role as critical nodes in the market's demand cycle.

Vehicle Polishing Machine Market Potential Customers

The primary end-users and buyers of vehicle polishing machines are broadly categorized into professional users who require industrial-grade durability and performance, and private consumers who prioritize ease of use and safety features for personal vehicle maintenance. Professional detailing service centers represent the largest and most sophisticated customer base, demanding high-end, often corded or high-capacity cordless rotary and forced rotation polishers capable of operating reliably for long periods under heavy loads. These businesses prioritize machines that offer exceptional torque, advanced electronic controls, and comprehensive manufacturer support, as tool performance is directly linked to their service revenue and client satisfaction. Their purchasing decisions are heavily influenced by the speed of paint correction and the finesse of the finishing capabilities, justifying investment in premium brands and specialized, segment-specific tools for tasks ranging from aggressive cutting to final jewel finishes.

Another significant segment of professional buyers includes automotive OEM assembly plants and high-volume collision repair facilities. OEMs use highly specialized, often automated or semi-automated polishing systems for final quality checks and defect removal on new vehicles before shipment. Collision repair shops, conversely, require robust, portable tools for blending repaired paint sections seamlessly with existing panels, focusing on versatility and compatibility with various abrasive systems. The DIY or individual consumer segment constitutes the fastest-growing customer base. These buyers are typically drawn to dual-action (DA) polishers due to their minimal risk of damaging the paint, lower price points, and generally lighter weight. Their purchasing decisions are often influenced by online reviews, social media tutorials, and brand reputation for user-friendliness, purchasing through online marketplaces and big-box retailers, highlighting the importance of accessibility and simplified operational instructions.

Furthermore, ancillary business customers, such as used car dealerships and large-scale fleet management companies, form another key customer demographic. Used car dealerships frequently invest in polishing machines to quickly enhance the aesthetic appeal of pre-owned inventory, maximizing the sale price through cost-effective refurbishment. Fleet operators, including rental car agencies and logistics companies, utilize these tools for routine maintenance of corporate vehicle appearances, ensuring branding consistency and longevity of paint finishes under harsh operational conditions. Specialized sectors, such as boat and aerospace maintenance, also frequently adapt high-powered vehicle polishing machines for large surface area maintenance, demonstrating cross-industry applicability based on the fundamental need for high-quality surface restoration and protection across different transportation assets requiring high surface integrity.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.6 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Rupes, Flex Tools, Makita, DeWalt, Milwaukee, Bosch, Meguiar's, Chemical Guys, Shurhold, WEN Products, Tork Craft, Shine Mate, Festool, 3M, Ryobi, Adam's Polishes, Black & Decker, Krauss Tools, Grizzly Industrial, Ardex |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Vehicle Polishing Machine Market Key Technology Landscape

The technology landscape of the Vehicle Polishing Machine Market is characterized by a strong push towards high-efficiency motor systems, superior battery technology, and advanced electronic controls designed to enhance both performance and user safety. The adoption of brushless DC (BLDC) motors stands out as the most significant technical shift. BLDC motors offer several advantages over traditional brushed motors, including higher efficiency, reduced heat generation, extended tool life due to the elimination of wearable carbon brushes, and the ability to maintain consistent torque even under heavy loads. This is particularly crucial for professional-grade cordless polishers, where power consistency throughout the battery life is essential for uniform paint correction results. Manufacturers are also heavily investing in advanced thermal management systems, incorporating specialized venting and cooling fins to prevent heat buildup in the tool’s housing and motor, which is a common concern during extended, high-intensity polishing sessions, ensuring reliability and maximizing operational uptime in demanding environments.

Another crucial technological development revolves around battery and power management systems, particularly within the cordless segment. Modern professional polishers utilize high-capacity, high-discharge lithium-ion battery platforms, often featuring specialized communication protocols between the battery pack and the tool. These intelligent systems monitor current draw, temperature, and remaining charge with high accuracy, optimizing power delivery and preventing over-discharge or overheating, thereby extending the overall service life of the expensive battery units. Furthermore, tool design emphasizes orbital mechanics optimization, especially in Dual Action (DA) polishers. Innovations focus on increasing the orbit throw (the distance the pad oscillates) to facilitate faster material removal and better defect correction without compromising the safety profile. Larger throw polishers (e.g., 15mm or 21mm) are rapidly becoming standard in the professional market due to their ability to cover larger areas more efficiently and reduce the overall time spent on correction stages.

The convergence of digital technology is also reshaping the user interface and functionality of premium polishers. Many high-end models now incorporate advanced electronic feedback circuits, often referred to as load sensing or intelligent speed control, which automatically adjust motor torque to maintain a constant revolutions per minute (RPM) or oscillations per minute (OPM) regardless of the pressure applied by the operator. This electronic precision is a game-changer for consistency, especially when polishing complex contoured surfaces. Moreover, the accessory ecosystem, including specialized polishing pads (foam, microfiber, wool) and backing plates, is constantly evolving, utilizing materials science to optimize heat dispersion, durability, and compound compatibility, ensuring the entire polishing system—machine, pad, and compound—works synergistically to achieve desired finishing quality efficiently. The synergy between these hardware and materials advancements defines the high-performance segment of the contemporary Vehicle Polishing Machine Market.

Regional Highlights

- North America (U.S., Canada): Represents a mature and highly competitive market, characterized by strong consumer spending on high-end vehicles and a sophisticated professional detailing industry. The region drives innovation in cordless technology and demands premium, durable tools. The presence of specialized detailing schools and a high density of automotive enthusiasts contribute significantly to market volume.

- Europe (Germany, U.K., France): A major market emphasizing ergonomic design, energy efficiency, and adherence to strict quality standards. Germany, in particular, showcases high demand due to its robust domestic automotive industry and high concentration of collision repair and restoration specialists. The shift towards smaller, highly portable machines is noticeable, driven by mobile detailing popularity.

- Asia Pacific (APAC) (China, India, Japan): The fastest-growing regional market, driven by skyrocketing vehicle sales, increasing disposable incomes, and the expansion of organized automotive service chains. China and India are experiencing a substantial uplift in demand for affordable, yet effective, dual-action polishers as detailing culture solidifies. Japanese consumers emphasize precision and brand quality, supporting premium tool sales.

- Latin America (Brazil, Mexico): Exhibits strong growth, primarily focused on the urbanization effect and the rising demand for vehicle refurbishment and maintenance services. The market often leans towards cost-effective, durable rotary tools in the commercial repair sector, though modern DA polishers are gaining traction among newer, higher-end service providers in metropolitan areas.

- Middle East and Africa (MEA): Growth is concentrated in the Gulf Cooperation Council (GCC) countries, fueled by the substantial presence of luxury and high-performance vehicles, which necessitates professional-grade, specialized polishing services. The hot climate often mandates robust tools capable of handling challenging paint conditions and high levels of atmospheric dust and contamination, driving demand for powerful machines.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Vehicle Polishing Machine Market.- Rupes

- Flex Tools

- Makita

- DeWalt

- Milwaukee

- Bosch

- Meguiar's

- Chemical Guys

- Shurhold

- WEN Products

- Tork Craft

- Shine Mate

- Festool

- 3M

- Ryobi

- Adam's Polishes

- Black & Decker

- Krauss Tools

- Grizzly Industrial

- Ardex

Frequently Asked Questions

Analyze common user questions about the Vehicle Polishing Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a Rotary Polisher and a Dual-Action (DA) Polisher?

A Rotary Polisher rotates solely on a central axis, providing intense, direct cutting power ideal for severe defect removal but requiring high skill to prevent paint damage (burn-through). A Dual-Action (DA) Polisher oscillates the pad while spinning eccentrically, making it much safer, highly user-friendly, and perfect for finishing stages and light to moderate paint correction, dominating the DIY and beginner professional segments.

Which factors are driving the shift toward Cordless Polishing Machines?

The shift towards cordless polishing is driven primarily by advancements in lithium-ion battery technology, offering extended runtime and consistent power output that rivals corded tools. This enhances mobility, operational flexibility for mobile detailers, eliminates tripping hazards associated with cords, and reduces setup time in professional environments, boosting overall efficiency.

How does the growth of ceramic coatings impact the demand for high-quality polishers?

The increasing popularity of ceramic and specialized protective coatings directly drives demand for high-quality polishers because these coatings require a near-perfect, contaminant-free paint surface for optimal adhesion and longevity. High-end DA and forced rotation polishers are essential for achieving the required level of paint correction (prep work) before coating application, making them indispensable tools in this growing market segment.

What is the projected fastest-growing end-user segment for vehicle polishing machines?

The Individual/DIY Use segment is projected to be the fastest-growing end-user segment. This growth is facilitated by the availability of affordable, safe, and user-friendly DA polishers, coupled with abundant online tutorials that lower the barrier to entry for consumers seeking to achieve professional-level results on their personal vehicles at home, focusing heavily on convenience and accessibility.

What role does Brushless Motor Technology play in the market?

Brushless motor technology is crucial as it significantly enhances the performance and lifespan of polishing machines. Brushless motors offer higher torque, greater energy efficiency (crucial for cordless models), reduced maintenance due to the absence of wearable brushes, and superior heat management, making the tools more durable and suitable for the continuous, heavy-duty demands of professional detailing operations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager