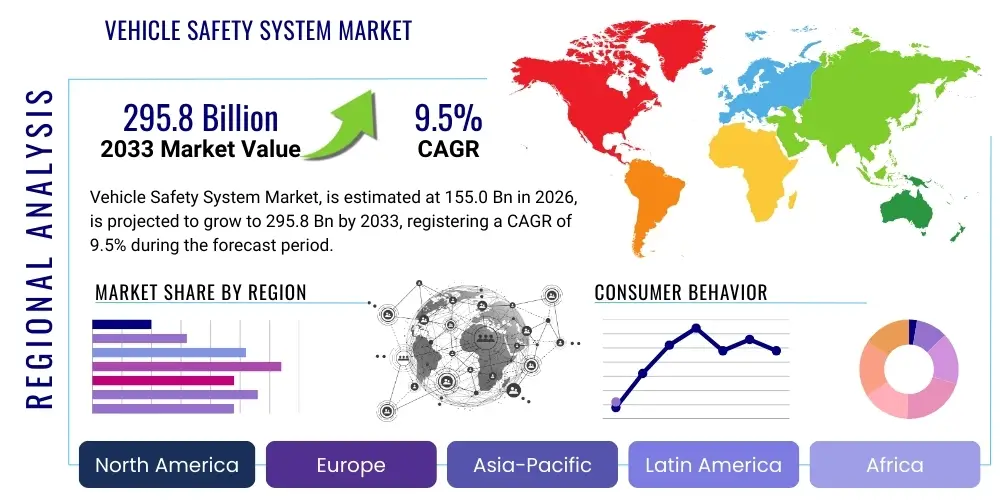

Vehicle Safety System Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441548 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Vehicle Safety System Market Size

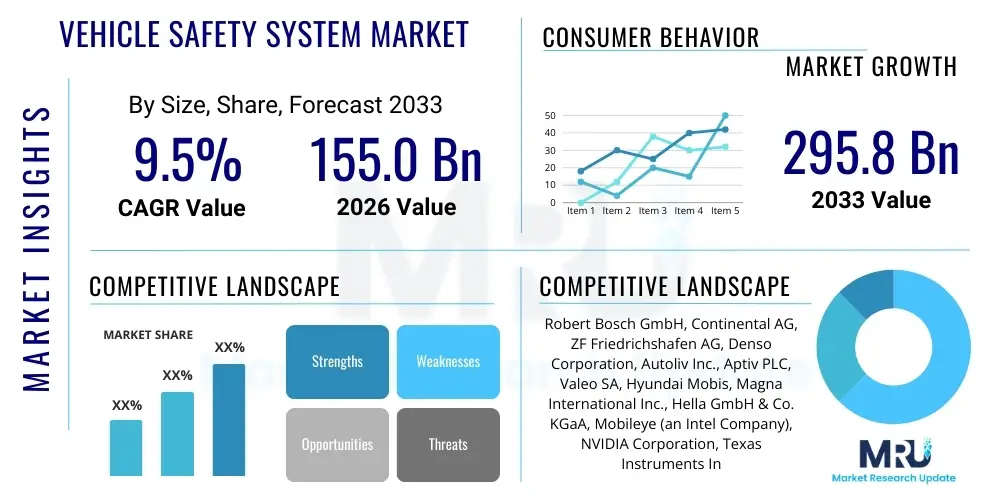

The Vehicle Safety System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 155.0 Billion in 2026 and is projected to reach USD 295.8 Billion by the end of the forecast period in 2033.

Vehicle Safety System Market introduction

The Vehicle Safety System Market encompasses a complex array of technologies, both active and passive, designed to prevent accidents, minimize injury severity, and safeguard occupants and pedestrians. This market includes sophisticated systems such as Advanced Driver Assistance Systems (ADAS), Electronic Stability Control (ESC), Anti-lock Braking Systems (ABS), airbags, and emerging technologies like Vehicle-to-Everything (V2X) communication. The fundamental product offering is integrated safety architecture, moving beyond isolated components toward holistic vehicle protection. Major applications span passenger vehicles, commercial trucks, and specialized fleet vehicles, driven primarily by government regulatory mandates focused on improving road safety statistics globally. The continuous advancement in sensor technology, processing power, and software reliability is central to this market’s evolution.

Key benefits derived from advanced vehicle safety systems include substantial reductions in accident rates, lower insurance premiums for consumers utilizing high-tech safety features, and enhanced driver comfort through automated assistance features. Active safety systems, particularly those categorized under ADAS, are crucial in addressing the leading causes of accidents, such as driver distraction and fatigue. Technologies like Autonomous Emergency Braking (AEB), Lane Keep Assist (LKA), and Adaptive Cruise Control (ACC) provide critical layers of protection, intervening when human error is likely. The integration of these systems necessitates robust connectivity and high-speed data processing capabilities within the vehicle's electronic control units (ECUs), fostering collaboration between automotive OEMs and technology providers.

The primary driving factor propelling the Vehicle Safety System Market is the stringent implementation of safety regulations across major automotive markets, including the mandate for features like ESC and increasingly, AEB, in new vehicles. Furthermore, consumer demand, particularly in mature markets like North America and Europe, is shifting preferences toward vehicles equipped with higher levels of safety autonomy (L2 and L3 systems), viewing these features as essential differentiators. The growing penetration of electric vehicles (EVs) and autonomous vehicles (AVs) also serves as a significant catalyst, as these platforms require redundancy and enhanced perception capabilities inherent in advanced safety systems. Continuous innovation in sensor fusion and AI-driven predictive algorithms is essential to sustaining this growth trajectory.

Vehicle Safety System Market Executive Summary

The Vehicle Safety System Market is characterized by intense technological competition and strategic partnerships focused on accelerating the development of Level 3 and Level 4 autonomous driving prerequisites. Current business trends indicate a strong move toward software-defined vehicles (SDVs), where over-the-air (OTA) updates and centralized computing architectures facilitate continuous improvement and activation of safety features post-purchase. Key industry players are consolidating their supply chains, seeking vertical integration of software and hardware to ensure reliability and minimize latency critical for safety functions. Furthermore, data monetization strategies surrounding real-time operational data collected by safety sensors are emerging as a critical secondary revenue stream, providing valuable insights for insurance providers and municipal planning agencies, thus defining new business models in automotive safety.

Regional trends highlight distinct growth patterns influenced by regulatory landscapes and technological adoption rates. North America and Europe remain the leaders in advanced safety system adoption, driven by Euro NCAP and NHTSA safety ratings which heavily prioritize ADAS features, leading to higher average vehicle content value. The Asia Pacific (APAC) region, particularly China, demonstrates the highest volume growth, fueled by rapid urbanization, increasing disposable incomes, and local governmental push for domestically developed smart mobility infrastructure. Latin America and the Middle East & Africa (MEA) are focused primarily on mandatory passive safety features (airbags, ABS) but are slowly transitioning towards basic active safety systems as regulatory frameworks mature, indicating significant potential for future market expansion.

Segment trends emphasize the dominance of active safety systems over traditional passive systems in terms of growth rate. Within active systems, sensor technologies—specifically radar and camera systems—constitute the largest and fastest-growing segment, propelled by their foundational role in nearly all ADAS functions. The integration of high-resolution LiDAR is experiencing rapid commercialization, particularly in high-end luxury and premium AV testing fleets, indicating its future criticality. Moreover, the demand for specialized safety features in commercial vehicles, such as blind spot detection systems tailored for heavy-duty trucks and last-mile delivery vans, is creating specialized segment opportunities distinct from the passenger vehicle market focus.

AI Impact Analysis on Vehicle Safety System Market

User inquiries regarding the impact of Artificial Intelligence on the Vehicle Safety System Market frequently revolve around four core themes: reliability and fault tolerance in autonomous decision-making; the efficacy of AI in handling edge cases and unpredictable scenarios; the timeline for mass market adoption of Level 3 and higher safety autonomy; and the ethical and legal implications of accident liability when an AI system is controlling the vehicle. Users are keenly interested in how AI, specifically deep learning and neural networks, can improve sensor fusion accuracy, thereby reducing false positives and enhancing predictive braking and collision avoidance capabilities compared to conventional rule-based algorithms. There is also significant concern regarding data privacy and the vast amount of environmental data required to train these robust safety models, generating questions about regulatory oversight and consumer data protection.

AI's primary transformative role lies in transitioning safety systems from reactive monitoring to proactive prediction. By employing sophisticated machine learning models, modern safety systems can analyze complex, multi-sensor data streams (radar, cameras, LiDAR) simultaneously to create a robust, high-fidelity environmental model surrounding the vehicle. This fusion capability allows the system to accurately differentiate between critical objects (pedestrians, other vehicles) and environmental noise, drastically improving the performance of critical functions like AEB and pedestrian detection, especially in adverse weather conditions or low light. The ability of AI to learn from vast datasets enables continuous refinement of driving policies and hazard assessment, ensuring the system adapts to diverse road conditions globally.

Furthermore, AI algorithms are fundamental to the operation of high-level ADAS features (L2+ and above), managing complex tasks such as lane centering, traffic jam assist, and highway pilot functions. These systems rely on AI to interpret context, predict the trajectory of surrounding agents, and execute smooth, human-like control inputs, enhancing not only safety but also occupant comfort. The integration of AI into vehicle safety systems is accelerating the trend towards centralized domain controllers, replacing distributed ECUs. This architecture allows for more efficient processing of AI models and facilitates over-the-air software updates, ensuring that the vehicle's safety capabilities improve throughout its lifespan, marking a paradigm shift in how vehicle safety is maintained and enhanced.

- Enhanced Sensor Fusion: AI algorithms combine data from multiple sensor modalities (LiDAR, Radar, Camera) to create a unified, reliable environmental perception map, significantly reducing uncertainty.

- Predictive Hazard Detection: Machine learning models predict potential collision scenarios faster than human reaction time, enabling earlier and more decisive intervention by systems like Autonomous Emergency Braking (AEB).

- Autonomous Decision Making: AI facilitates Level 3 and Level 4 autonomy by managing complex driving tasks, including navigating intersections and handling unexpected traffic events safely.

- Reduced False Positives: Deep learning networks minimize erroneous braking or steering interventions caused by sensor noise or non-critical objects, improving system trustworthiness and user experience.

- Over-the-Air (OTA) Updates: AI-driven software architecture allows safety features to be continuously improved and validated remotely, enhancing system longevity and performance reliability.

- Personalized Safety Profiles: AI enables safety systems to adapt intervention thresholds and warnings based on individualized driver behavior and preferences, optimizing engagement.

DRO & Impact Forces Of Vehicle Safety System Market

The Vehicle Safety System Market is shaped by a confluence of strong regulatory mandates (Drivers), significant technological complexity and cost barriers (Restraints), and burgeoning opportunities presented by vehicle connectivity (Opportunities). The primary driver is the global imperative to reduce road fatalities, leading governments in key regions (US, EU, China) to enforce minimum safety requirements for new vehicles, such as mandated AEB and specific pedestrian protection standards. These mandates compel OEMs to integrate sophisticated active safety features rapidly. Counterbalancing this growth are major restraints, notably the high initial cost of advanced sensor suites (particularly LiDAR) and the substantial investment required for validation and testing across diverse operational domains. Furthermore, the market benefits greatly from the development of Vehicle-to-Vehicle (V2V) and Vehicle-to-Infrastructure (V2I) communication, which offers unprecedented opportunities for collaborative safety measures and hazard warnings.

Drivers are strongly influenced by consumer awareness and the competitive landscape. Safety ratings agencies (e.g., Euro NCAP, IIHS) play a crucial role by continually raising the standard for what constitutes a safe vehicle, effectively pushing safety features that were once optional into the standard equipment category. This creates a virtuous cycle where consumer preference for five-star safety ratings drives OEM adoption, further stimulating innovation in areas like occupant monitoring and fatigue detection systems. The shift towards electrification also acts as a driver, as EV platforms often require a 'skateboard' design that facilitates easier sensor placement and centralized computational power, ideal for advanced safety integration.

Restraints include the challenge of ensuring cybersecurity for connected safety systems, as any compromise could severely impact vehicle control and passenger safety. There is also a distinct lack of standardized global protocols for V2X communications and sensor data formats, which fragments development efforts and increases system integration complexity. Opportunities are abundant, specifically in the aftermarket segment for upgrading older vehicles with basic ADAS functions, and the expansion into emerging markets where governments are initiating foundational safety system legislation. Moreover, the long-term opportunity lies in providing functional safety (ISO 26262 compliance) consulting and validation services, capitalizing on the increasing demand for certified system reliability in safety-critical applications.

Impact Forces:

- Regulatory Compliance (High Impact, Sustained Force): Global mandates for AEB, ESC, and crash testing standards necessitate universal adoption of core safety features.

- Technological Advancements (High Impact, Accelerating Force): Rapid improvements in AI processing power and sensor miniaturization enable higher levels of reliable autonomy.

- Cybersecurity Risks (Medium Impact, Increasing Force): Vulnerabilities in connected V2X and OTA systems pose significant threats, requiring rigorous security protocols and validation processes.

- System Integration Complexity (Medium Impact, Limiting Force): Combining diverse sensor types (fusion) and ensuring low latency communication across various ECUs increases development time and costs.

- Consumer Demand for Autonomy (High Impact, Growing Force): Public preference for vehicles offering advanced driving assistance and high safety ratings drives differentiation among OEMs.

Segmentation Analysis

The Vehicle Safety System Market is fundamentally segmented based on the type of safety system (Active vs. Passive), the specific technology deployed (Sensors, Software, etc.), the level of automation (L0 to L5), and the application vehicle type (Passenger vs. Commercial). The distinction between active and passive systems remains crucial, although the boundary is blurring with semi-active components. Active safety, encompassing ADAS features like LKA and ACC, dominates the current growth trajectory due to regulatory pushes and technological sophistication. Segmentation by vehicle type underscores the increasing focus on specialized safety requirements for commercial fleets, which demand robust systems optimized for heavy loads and prolonged duty cycles, often incorporating specialized driver monitoring and telematics for enhanced safety management.

- By System Type:

- Active Safety Systems (ADAS)

- Passive Safety Systems (Airbags, Seatbelts, Crash Sensors)

- By Technology:

- Sensor Systems (Radar, LiDAR, Camera, Ultrasonic)

- Software & Algorithm

- Hardware (ECUs, Actuators)

- V2X Communication Modules

- By Vehicle Type:

- Passenger Vehicles

- Commercial Vehicles (Light, Medium, Heavy-Duty)

- By Level of Autonomy:

- L0 (No Automation)

- L1 (Driver Assistance)

- L2 (Partial Automation)

- L3 (Conditional Automation)

- L4 (High Automation)

- L5 (Full Automation)

- By Channel:

- OEM (Original Equipment Manufacturer)

- Aftermarket

Value Chain Analysis For Vehicle Safety System Market

The value chain for the Vehicle Safety System Market is highly fragmented yet structurally critical, starting with upstream raw material suppliers and semiconductor manufacturers, moving through Tier 2 component specialists, and culminating at Tier 1 suppliers who serve as the primary integrator for OEMs. Upstream analysis reveals significant dependence on the semiconductor industry for highly specialized chips, particularly microcontrollers (MCUs) and System-on-Chips (SoCs) required for high-speed sensor data processing and AI acceleration. Tier 2 suppliers focus on specialized components such as lenses, radar antennae, and inertial measurement units (IMUs). Strategic control over semiconductor supply is paramount, as demonstrated by recent global supply chain disruptions, reinforcing the trend toward secure, long-term sourcing agreements.

Midstream activities are dominated by Tier 1 suppliers like Bosch, Continental, and ZF, who integrate diverse components into sophisticated modular safety systems (e.g., radar modules, camera systems, and unified ADAS domain controllers). These Tier 1 companies invest heavily in software development, calibration, and functional safety validation (ISO 26262) to deliver ready-to-install subsystems to OEMs. This stage is characterized by high intellectual property value, as the proprietary algorithms governing sensor fusion and decision-making reside primarily within the Tier 1 software stacks. The distribution channel from Tier 1 to OEMs is predominantly direct, ensuring strict quality control and just-in-time delivery for complex, safety-critical components.

Downstream analysis focuses on the final assembly by Original Equipment Manufacturers (OEMs) and subsequent distribution to the end consumer through both direct sales channels and franchised dealerships. Aftermarket distribution, while smaller, involves specialized retailers and installers providing add-on safety features, especially fleet management systems and basic rearview cameras. Direct distribution models are increasingly utilized by electric vehicle startups and premium brands to maintain control over the customer experience, including software activations and safety feature maintenance. Indirect distribution remains essential for global reach and servicing, relying on extensive dealership networks for diagnostics, maintenance, and potentially, safety system repairs or software upgrades.

Vehicle Safety System Market Potential Customers

The primary consumers of Vehicle Safety Systems are Original Equipment Manufacturers (OEMs) globally, spanning established automotive giants and emerging electric vehicle (EV) manufacturers. OEMs are the largest volume buyers, integrating these systems directly into their vehicle architectures during the design and production phase to meet regulatory compliance, achieve high safety ratings (e.g., five-star Euro NCAP), and differentiate their products based on technological superiority and driver assistance capabilities. The move towards autonomous driving necessitates long-term strategic partnerships between OEMs and Tier 1 technology suppliers to co-develop robust, certified safety platforms tailored for specific vehicle models and operational environments.

A rapidly growing segment of potential customers includes large commercial fleet operators, rental companies, and logistics providers. These entities prioritize safety systems, such as advanced telematics, driver fatigue monitoring, collision mitigation systems specifically designed for heavy-duty trucks, and external camera systems, primarily to reduce operational risk, minimize insurance liabilities, and adhere to strict occupational safety standards. For these customers, the return on investment (ROI) is tangible, derived from reduced downtime due to accidents and lower fuel consumption achieved through smoother, assisted driving, making safety technology a necessary operational investment rather than merely a regulatory compliance measure.

Furthermore, the aftermarket segment targets individual vehicle owners seeking to enhance the safety of older vehicles, often installing basic ADAS features like parking assist or high-quality dashcam systems with basic collision detection. Government and municipal bodies constitute another customer category, particularly for V2I infrastructure deployment, requiring smart road sensors, communication units, and traffic management safety systems that interact seamlessly with vehicle safety technology. These bodies are crucial for funding and implementing the foundational infrastructure necessary for advanced collaborative safety protocols to function effectively at scale.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 155.0 Billion |

| Market Forecast in 2033 | USD 295.8 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Robert Bosch GmbH, Continental AG, ZF Friedrichshafen AG, Denso Corporation, Autoliv Inc., Aptiv PLC, Valeo SA, Hyundai Mobis, Magna International Inc., Hella GmbH & Co. KGaA, Mobileye (an Intel Company), NVIDIA Corporation, Texas Instruments Incorporated, Renesas Electronics Corporation, Veoneer Inc., Innoviz Technologies, Luminar Technologies, Mando Corporation, Hitachi Astemo, Gentex Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Vehicle Safety System Market Key Technology Landscape

The technological landscape of the Vehicle Safety System Market is rapidly evolving, moving from discrete, passive components toward highly integrated, software-intensive active systems, anchored by sophisticated sensor modalities. Radar technology remains foundational due to its reliability in adverse weather, encompassing both short-range (parking, blind spot monitoring) and long-range (ACC, forward collision warning) applications. High-resolution camera systems, leveraging advanced image recognition and AI processing, provide crucial contextual information for pedestrian and lane detection. The convergence of these sensor outputs through highly optimized sensor fusion software, executed on powerful domain controllers, is the single most important technological shift, enabling the robustness required for higher levels of driving automation.

LiDAR (Light Detection and Ranging) is emerging as a critical, high-growth technology, particularly for Level 3 and Level 4 vehicle safety systems, due to its ability to generate highly accurate, three-dimensional point cloud maps of the vehicle's surroundings. While historically cost-prohibitive, advancements in solid-state LiDAR and micro-electromechanical systems (MEMS) technology are lowering unit costs and increasing reliability, accelerating its deployment in series production vehicles. Complementing the sensor stack are advanced connectivity technologies, specifically 5G and V2X (DSRC or C-V2X), which enable vehicles to communicate vital safety information, such as real-time accident warnings or traffic light timings, extending the vehicle's "vision" beyond the line of sight and facilitating collaborative safety maneuvers.

The architectural shift towards centralized computational platforms, often running on high-performance semiconductor chips from companies like NVIDIA and Mobileye, defines the modern safety system. These powerful computing units replace dozens of disparate ECUs, centralizing control, reducing complexity, and facilitating the deployment of complex AI models for functional safety applications. Furthermore, the mandatory adoption of Functional Safety standards (ISO 26262) and Safety of the Intended Functionality (SOTIF) is driving technological investment into rigorous validation tools and redundancy architectures (e.g., dual fail-safe systems) to ensure that the increased complexity of modern safety systems does not compromise reliability or responsiveness in critical scenarios.

Regional Highlights

Regional dynamics play a crucial role in shaping the global Vehicle Safety System Market, driven by differential regulatory requirements, consumer purchasing power, and infrastructural readiness for advanced technologies.

- North America: This region is characterized by high demand for L2+ ADAS features, driven by strong consumer interest in advanced driver convenience and aggressive safety standards set by bodies like the IIHS and NHTSA. The US is a pioneer in testing and deployment of autonomous safety features (L3 and L4), especially in commercial trucking and ride-sharing services. Regulatory pressure continues to focus on mandatory AEB for both passenger and commercial vehicles, sustaining high market value. The region benefits from strong presence of major technology providers and a mature semiconductor ecosystem.

- Europe: Europe is a global leader in enforcing stringent vehicle safety regulations, spearheaded by the European Commission and Euro NCAP. Mandatory inclusion of safety features such as AEB with pedestrian detection, Intelligent Speed Assistance (ISA), and LKA has rapidly accelerated market penetration. The region exhibits high market maturity and strong growth in advanced V2X communication (C-ITS initiatives) to improve overall road network safety and efficiency, positioning it at the forefront of collaborative safety system adoption.

- Asia Pacific (APAC): APAC is the fastest-growing region in terms of volume, driven primarily by the massive automotive markets of China, Japan, and India. China's government push for "smart cars" and localized autonomous driving standards is a massive catalyst for both production and technological development, leading to rapid integration of domestically sourced safety solutions. Japan and South Korea lead in technological sophistication, focusing heavily on pedestrian safety and highly advanced sensor systems suitable for densely populated urban environments. Increased disposable income across the region is shifting consumer preference towards higher-spec safety packages.

- Latin America (LATAM): The LATAM market is currently focused on consolidating foundational passive safety features, such as airbags and ABS, often driven by regional trade agreements and local mandates. However, there is a nascent but growing adoption of basic active safety systems (e.g., ESC) as safety awareness increases and manufacturing standards align more closely with global norms. Economic volatility and diverse regulatory frameworks pose integration challenges, leading to slower but steady growth concentrated initially in Brazil and Mexico.

- Middle East and Africa (MEA): This region exhibits varied adoption rates. The Gulf Cooperation Council (GCC) countries show high adoption rates for premium safety features due to high per capita income and luxury vehicle consumption. The broader African continent focuses predominantly on regulatory compliance for basic passive safety, presenting long-term growth opportunities as infrastructure improves and vehicle fleets modernize. Investment in intelligent transportation systems (ITS) in urban centers is beginning to drive demand for V2I components.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Vehicle Safety System Market.- Robert Bosch GmbH

- Continental AG

- ZF Friedrichshafen AG

- Denso Corporation

- Autoliv Inc.

- Aptiv PLC

- Valeo SA

- Hyundai Mobis

- Magna International Inc.

- Hella GmbH & Co. KGaA

- Mobileye (an Intel Company)

- NVIDIA Corporation

- Texas Instruments Incorporated

- Renesas Electronics Corporation

- Veoneer Inc.

- Innoviz Technologies

- Luminar Technologies

- Mando Corporation

- Hitachi Astemo

- Gentex Corporation

Frequently Asked Questions

Analyze common user questions about the Vehicle Safety System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between active and passive vehicle safety systems?

Active safety systems, such as Autonomous Emergency Braking (AEB) and Electronic Stability Control (ESC), proactively prevent accidents or mitigate their severity by intervening in the vehicle's operation. Passive safety systems, like airbags and seatbelts, activate during or after a collision to minimize injury to occupants.

Which technology is driving the highest growth in the Vehicle Safety System Market?

Advanced Driver Assistance Systems (ADAS) sensors, particularly the integration of high-resolution camera systems, Radar, and emerging LiDAR technology, are the primary growth drivers. These technologies enable higher levels of automation (L2+) and fulfill mandatory regulatory requirements globally, focusing on perception capabilities.

How do global safety regulations impact the adoption of vehicle safety systems?

Global safety regulations, particularly those established by Euro NCAP and NHTSA, directly mandate the inclusion of specific active safety features (e.g., AEB and ESC) in new vehicles. These mandates compel OEMs to adopt and standardize complex technologies, acting as the strongest non-market driver for market expansion.

What are the key cybersecurity concerns related to modern vehicle safety systems?

Modern vehicle safety systems rely heavily on connected features (V2X, OTA updates) and complex centralized ECUs. The key cybersecurity concern is the potential for unauthorized external access (hacking) to safety-critical functions, which necessitates robust software encryption, secure communication protocols, and rigorous system validation to maintain functional safety.

What is the role of Artificial Intelligence in next-generation vehicle safety?

AI is essential for next-generation safety by enabling advanced sensor fusion, interpreting complex driving scenarios, and making predictive, real-time control decisions required for Level 3 and Level 4 autonomous driving systems. AI enhances reliability and reduces human error by allowing systems to handle unpredictable "edge cases" effectively.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager