Vehicle Water Based Fire Extinguisher Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443297 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Vehicle Water Based Fire Extinguisher Market Size

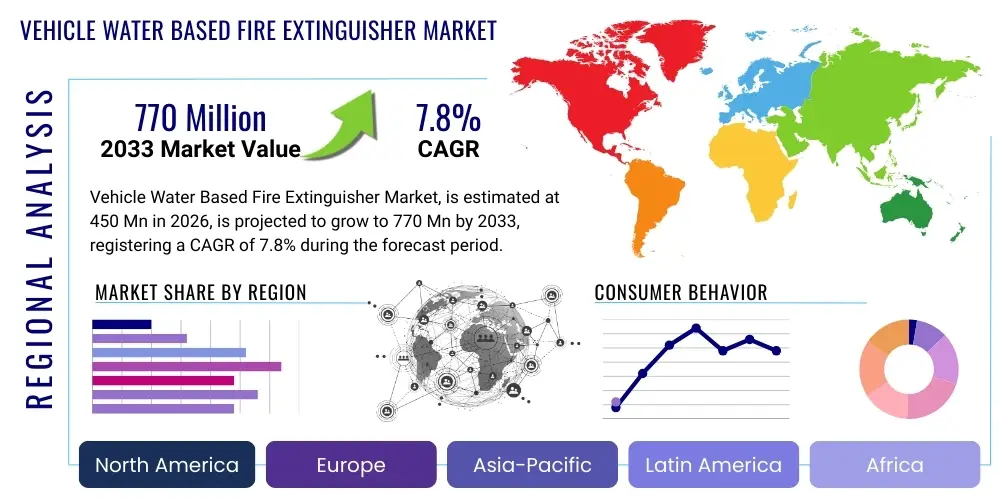

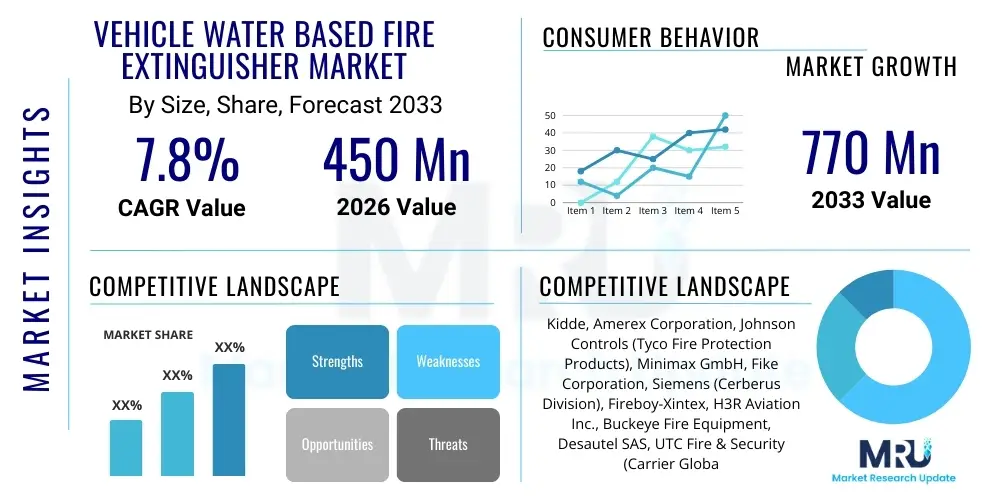

The Vehicle Water Based Fire Extinguisher Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 770 Million by the end of the forecast period in 2033.

Vehicle Water Based Fire Extinguisher Market introduction

The Vehicle Water Based Fire Extinguisher Market encompasses the manufacturing, distribution, and utilization of fire suppression devices specifically engineered for automotive, commercial, and heavy-duty vehicles, relying primarily on water or water-based solutions often augmented with specialized additives. These extinguishers are gaining significant traction as regulatory bodies worldwide pivot towards safer, cleaner, and more environmentally responsible fire suppression agents, moving away from halogenated hydrocarbons or certain traditional dry chemical powders that pose environmental or health risks. The core product description involves pressurized containers delivering a focused stream or mist of water-based extinguishing agent, effective predominantly against Class A fires (ordinary combustibles like wood, paper, and textiles) common in vehicle cabins, and increasingly adapted with additives to handle Class B (flammable liquids) and even emerging Class F (cooking oils, though less common in primary vehicle use) hazards, while specialized variants are being developed for the unique thermal runaway challenges presented by electric vehicle (EV) battery fires.

Major applications of these vehicle-specific water-based systems span a wide array of mobility sectors, including commercial trucking and logistics fleets, passenger buses, public transportation networks, rail operations, and increasingly, within personal passenger vehicles, particularly high-end or mandated commercial cars. The primary driving factors fueling this market expansion are stringent governmental safety mandates requiring fire suppression equipment in commercial vehicles, particularly in densely populated urban transport systems where the risk to passengers is paramount. Furthermore, the rapid global adoption of electric vehicles, which necessitates highly effective and rapid cooling agents to mitigate lithium-ion battery thermal runaway incidents, is creating a specialized and lucrative sub-segment for advanced water-mist and specialized wetting agent formulations.

The inherent benefits of water-based fire extinguishers over traditional chemical options include their superior cooling capabilities, minimal toxic residue, and reduced environmental footprint, aligning perfectly with global sustainability goals. Water-based solutions generally offer quicker cooling of burning materials, significantly reducing the chance of re-ignition, which is critical in confined vehicle environments. Moreover, they are typically easier and less costly to clean up post-discharge compared to powders, minimizing vehicle downtime and repair costs. This combination of strong performance, environmental compliance, and regulatory push ensures that the Vehicle Water Based Fire Extinguisher Market remains on a robust growth trajectory, driven by both necessary compliance and technological advancements in additive chemistry.

Vehicle Water Based Fire Extinguisher Market Executive Summary

The Vehicle Water Based Fire Extinguisher Market is currently undergoing significant transformation, primarily driven by evolving regulatory landscapes emphasizing cleaner agents and the exponential growth of the global Electric Vehicle (EV) sector. Business trends indicate a shift away from standard dry powder solutions toward high-performance, compact water-mist and advanced additive-based systems designed for specialized vehicle fire risks, particularly battery fires which require intensive cooling and suppression capabilities. Key manufacturers are focusing their investment on research and development (R&D) to enhance the effectiveness of these agents, integrating features like optimized nozzle designs for deeper penetration and smart monitoring systems that utilize IoT technologies to track extinguisher readiness and location within large fleets. Strategic partnerships between fire safety equipment producers and major automotive original equipment manufacturers (OEMs) are becoming a defining trend, aiming to integrate these safety solutions directly into vehicle design, thereby capturing market share earlier in the value chain.

Regional trends reveal that Europe, specifically driven by stringent UNECE regulations concerning fire safety in buses and coaches, holds a leading position in terms of adoption and technology maturity, followed closely by North America, which sees high demand primarily from the large commercial trucking and transit sectors. The Asia Pacific (APAC) region is projected to exhibit the fastest growth rate, fueled by massive infrastructure investments, rapid urbanization, and China’s dominant position in EV manufacturing and deployment, necessitating new, large-scale safety protocols. In emerging economies within APAC and Latin America, market growth is often tied directly to government mandates standardizing safety equipment in public transport vehicles, creating large, predictable demand curves for basic and mid-range water-based units.

Segment trends highlight the dominance of the commercial vehicle segment (heavy trucks, buses) due to mandatory requirements and high utilization rates, though the light commercial vehicle and passenger car segments are rapidly increasing their market presence, especially in premium and luxury vehicles where enhanced safety features are a selling point. The technology segment based on additives—specifically wetting agents and foaming agents designed to enhance water's performance against hydrocarbon and electrical fires—is seeing the most vigorous innovation and market uptake. Water-mist technologies are particularly favored for sensitive electronic environments and battery compartments, minimizing collateral damage while maximizing cooling efficiency, setting a clear path for future segment growth and differentiation among major market competitors.

AI Impact Analysis on Vehicle Water Based Fire Extinguisher Market

User inquiries regarding AI's impact on the Vehicle Water Based Fire Extinguisher Market frequently center on the potential for autonomous fire detection and response mechanisms, predictive maintenance of extinguisher systems, and optimization of emergency logistics. Users are keen to understand how AI-powered sensors and embedded systems can move beyond simple smoke detection to identify specific types of fire (e.g., electrical vs. fuel) and automatically activate targeted suppression systems using water-based agents precisely when and where needed. Key themes include concerns about system reliability in harsh vehicle environments, the integration costs for advanced AI-driven sensors into existing fleets, and the regulatory acceptance of fully autonomous fire intervention systems. Expectations are high regarding AI’s ability to minimize false alarms, significantly reduce reaction time, and provide real-time reporting on incident severity and suppression effectiveness, thereby maximizing passenger and asset safety and fundamentally transforming reactive fire safety into a predictive discipline.

- AI-driven sensor fusion enhances early fire detection, differentiating between ambient heat, smoke composition, and thermal runaway signatures characteristic of EV batteries.

- Predictive maintenance algorithms analyze usage patterns, environmental data, and pressure readings to schedule maintenance or replacement of water-based systems before failure occurs.

- Autonomous activation systems use AI to confirm fire conditions and initiate targeted discharge of water-based agents without human intervention, improving response speed.

- Optimization of supply chain and inventory management for extinguisher refills and spare parts is achieved using AI forecasting models based on fleet size and regulatory compliance cycles.

- AI integration supports the development of "smart extinguishers" that report readiness status, location, and discharge history via telematics systems, crucial for fleet management auditing.

DRO & Impact Forces Of Vehicle Water Based Fire Extinguisher Market

The market is predominantly influenced by robust regulatory drivers mandating fire safety in commercial transport, coupled with the critical need for effective fire mitigation solutions in the rapidly expanding Electric Vehicle (EV) sector, which drives demand for specialized water-based cooling agents. Restraints primarily involve the inherent limitations of water-based systems against certain specialized fires (Class C, Class D without specific additives) and the perception that they might cause electrical damage, though modern mist systems are minimizing this concern. Opportunities lie in the technological advancement of biodegradable additives that expand the extinguishing capability of water beyond Class A, and the integration of these systems into telematics platforms for remote monitoring and predictive maintenance. These factors collectively exert significant impact forces, accelerating the shift toward cleaner, high-performance vehicle fire suppression solutions globally.

Segmentation Analysis

The Vehicle Water Based Fire Extinguisher Market is comprehensively segmented based on the type of extinguishing agent used, the specific vehicle type requiring protection, and the channel through which these products are distributed. Agent type segmentation is critical as it reflects the technological maturity and specific fire hazard being addressed, ranging from basic pure water units to advanced systems incorporating AFFF or specialized wetting agents. Vehicle type determines both the necessary size/capacity and the required certification standards (e.g., passenger car versus heavy-duty bus standards). Distribution channels differentiate between products supplied directly to manufacturers for integration (OEM) and those sold for retrofit or routine maintenance (Aftermarket), each presenting distinct market dynamics regarding pricing, volume, and customer relationship management. Understanding these segments is paramount for manufacturers to tailor product specifications and marketing strategies effectively to disparate end-user needs and regulatory environments.

- By Agent Type:

- Pure Water/De-ionized Water

- Water with Wetting Agents (Class A and some Class B capability)

- Water Mist Systems

- Water-Film Forming Foam (AFFF)

- By Vehicle Type:

- Passenger Cars (Light Vehicles)

- Commercial Vehicles (LCVs, HCVs)

- Buses and Coaches (Public Transport)

- Off-Road Vehicles (Mining, Construction)

- Electric Vehicles (EVs) and Hybrid Vehicles

- By Capacity/Size:

- Under 2 Liters

- 2 Liters to 6 Liters

- Above 6 Liters (Typically for fixed systems or large commercial vehicles)

- By Distribution Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket (Retail, Safety Suppliers, Fleet Maintenance)

Value Chain Analysis For Vehicle Water Based Fire Extinguisher Market

The value chain for Vehicle Water Based Fire Extinguishers begins with the upstream procurement of specialized raw materials, primarily high-grade stainless steel or corrosion-resistant aluminum for cylinders, durable plastics for nozzles and valves, and sophisticated chemical concentrates for the water additives (wetting agents, foams). Upstream analysis highlights that the market is sensitive to fluctuations in global metal commodity prices and the supply of specialized chemicals, necessitating robust supplier management and long-term contracts to ensure cost stability and material quality compliance. The manufacturing phase involves precision welding, pressure testing, and chemical formulation, where adherence to international safety standards (e.g., ISO, CE, UL) is non-negotiable, driving capital expenditure in quality control and automated assembly lines. Efficiency in this stage directly impacts the final unit cost and reliability of the life-saving equipment, which is a primary concern for end-users.

The distribution channel is dichotomous, splitting significantly between Direct and Indirect routes. Direct distribution involves supplying large volumes of specialized units directly to automotive OEMs for factory installation, a relationship characterized by long sales cycles, high customization, and substantial volume commitments. Indirect distribution leverages a network of specialized safety equipment distributors, automotive parts wholesalers, and large retail chains (e.g., for personal vehicle or small fleet purchases in the aftermarket). This indirect route requires extensive partnership management and localized inventory stocking to meet immediate replacement and compliance needs across different geographic regions, often involving safety certifications specific to each country or regional bloc.

Downstream analysis focuses on the end-user interaction and post-sale servicing. For fleet operators and public transport bodies, reliable maintenance and periodic hydrostatic testing are crucial, creating a substantial market for service providers specializing in fire safety equipment maintenance and refilling. The success of the downstream phase relies heavily on the ease of maintenance and the longevity of the extinguisher unit under extreme vehicle operating conditions (vibration, temperature fluctuations). Continuous feedback from fleet managers and maintenance personnel regarding unit durability and operational performance is vital for manufacturers to iteratively improve product design and maintain a competitive edge, emphasizing total cost of ownership (TCO) rather than just initial purchase price.

Vehicle Water Based Fire Extinguisher Market Potential Customers

The primary end-users and buyers in the Vehicle Water Based Fire Extinguisher Market are segregated based on volume requirements and regulatory drivers. Automotive Original Equipment Manufacturers (OEMs) constitute a significant customer base, especially those manufacturing commercial vehicles (buses, large trucks) and, increasingly, manufacturers of electric vehicles, where integrating specialized fire suppression systems is becoming a design requirement rather than an aftermarket addition. These customers demand high volume, guaranteed quality compliance (e.g., specific ECE/FMVSS standards), and integration assistance from the extinguisher supplier to ensure seamless factory fitting and system longevity within the vehicle structure, necessitating customized product lines and stringent supply chain management.

A second, massive segment of potential customers includes Fleet Operators and Transportation Authorities. This group encompasses commercial logistics companies managing thousands of heavy goods vehicles (HGVs), public transportation departments operating bus and train networks, and rental car agencies. These buyers are primarily driven by continuous regulatory compliance, minimizing vehicle downtime, and mitigating insurance risk. Their purchasing decisions are often based on the TCO, reliability, ease of inspection, and the effectiveness of the suppression agent against common vehicle fires, requiring robust, easy-to-service units purchased through aftermarket channels or dedicated safety distributors on cyclical replacement schedules.

Finally, smaller but growing customer groups include private passenger vehicle owners, specialized industrial vehicle operators (mining, construction), and insurance providers who may mandate superior fire protection for high-value assets. For private owners, the decision is often voluntary and influenced by perceived safety benefits, while industrial operators require ruggedized, large-capacity units capable of operating in extreme temperatures and environments. The emerging EV market particularly targets these customer groups with specialized, highly technical water-mist solutions capable of handling lithium-ion battery risks, creating new growth avenues focusing on specialized end-user needs rather than generalized safety compliance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 770 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Kidde, Amerex Corporation, Johnson Controls (Tyco Fire Protection Products), Minimax GmbH, Fike Corporation, Siemens (Cerberus Division), Fireboy-Xintex, H3R Aviation Inc., Buckeye Fire Equipment, Desautel SAS, UTC Fire & Security (Carrier Global), Gielle Group, Britannia Fire, Safex Fire, Ceasefire Industries Pvt. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Vehicle Water Based Fire Extinguisher Market Key Technology Landscape

The technology landscape within the Vehicle Water Based Fire Extinguisher Market is defined by continuous innovation focused on optimizing the efficiency and collateral damage profile of the extinguishing medium, particularly addressing the unique challenges posed by modern vehicle construction and power sources, such as high voltage systems and lithium-ion batteries. A critical area of technological development is the refinement of water mist systems. These systems utilize high pressure to atomize water into ultra-fine droplets, significantly increasing the surface area for heat absorption and oxygen displacement. This not only offers superior cooling (essential for managing thermal runaway in EV batteries) but also minimizes the amount of water used, substantially reducing the risk of electrical short circuits or water damage to sensitive vehicle electronics, thereby balancing effectiveness with asset protection, a key requirement for modern fleet managers and OEMs.

Further innovation is centered around chemical additives. While pure water is effective against Class A fires, manufacturers are heavily investing in the development of environmentally benign wetting agents and bio-degradable surfactants. These additives lower the surface tension of the water, allowing it to penetrate deeper into burning materials (like upholstery, rubber, or composites) and effectively coat Class B fuel sources, significantly expanding the utility of water-based extinguishers. The search for PFAS-free (Per- and Polyfluoroalkyl Substances) solutions is a major technological driver, responding to global legislative pressure to eliminate these persistent chemicals from firefighting foams, leading to the creation of advanced, fluorine-free foam (FFF) concentrates specifically tailored for vehicle application where space and weight are critical considerations.

The integration of smart technology represents the frontier of the key technology landscape. This involves incorporating advanced sensors (thermal, optical, chemical) directly into the vehicle fire suppression system, often linked via the vehicle's telematics system. These smart systems can perform real-time diagnostic checks on the extinguisher’s operational readiness (pressure, agent volume, nozzle integrity), provide immediate alerts to the driver or fleet manager upon detection, and potentially initiate autonomous discharge in milliseconds. Furthermore, data collected by these systems provides valuable operational insights into fire incident frequency and suppression effectiveness, guiding manufacturers in future design iterations and ensuring compliance with increasingly sophisticated safety standards across diverse global transportation networks.

Regional Highlights

- North America: This region exhibits a mature market characterized by stringent safety regulations from bodies like the NHTSA and FMCSA, driving mandatory installation in commercial trucking and school bus fleets. The high adoption rate of large logistics vehicles and the growing infrastructure for electric commercial vehicles create continuous demand for high-capacity, certified water-based systems. Manufacturers focus heavily on UL/FM approved products and integration with advanced fleet management telematics.

- Europe: Europe is a leader in adopting advanced water-mist and clean-agent technologies, largely driven by the UNECE R107 regulation concerning fire suppression in buses and coaches, mandating automatic fire detection and suppression in engine compartments and, increasingly, in battery compartments of electric buses. Germany, the UK, and Scandinavia show high demand for high-tech, eco-friendly systems due to strong environmental consciousness and dense urban public transport networks.

- Asia Pacific (APAC): The fastest-growing region, APAC is spurred by rapid urbanization, massive public transport expansion projects (especially in China, India, and Southeast Asia), and the region's dominance in global EV production and sales. Regulatory compliance is rapidly tightening, moving from basic manual extinguishers to mandatory fixed suppression systems in new commercial and public vehicles, creating enormous volume demand for cost-effective and performance-validated water-based solutions.

- Latin America (LATAM): Market growth in LATAM is primarily focused on mandatory requirements for public transport and heavy industrial fleets (mining, construction). The region often imports certified equipment, though domestic manufacturing is rising. Price sensitivity is higher, making standard water-based systems and entry-level wetting agent solutions more prevalent, while investment in advanced mist technologies is concentrated in specialized sectors or international fleets.

- Middle East and Africa (MEA): This region is characterized by extreme operating environments (high temperatures), necessitating robust, durable equipment. Demand is heavily concentrated in the logistics, oil & gas transportation, and public transit sectors in countries like the UAE and Saudi Arabia. Adoption is driven by international safety standards for cross-border transport and large government fleet investments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Vehicle Water Based Fire Extinguisher Market.- Kidde (Carrier Global Corporation)

- Amerex Corporation

- Johnson Controls (Tyco Fire Protection Products)

- Minimax GmbH & Co. KG

- Fike Corporation

- NAFFCO (National Fire Fighting Manufacturing FZCO)

- Siemens AG (Cerberus Division)

- Fireboy-Xintex LLC

- H3R Aviation Inc.

- Buckeye Fire Equipment Company

- Desautel SAS

- Gielle Group

- Britannia Fire Ltd

- Safex Fire Services Ltd.

- Ceasefire Industries Pvt. Ltd.

- Halma plc (through subsidiaries)

- Cold Fire Suppression, Inc.

- Chubb Fire & Security (APi Group)

- Hochiki Corporation

- Nobel Fire Systems

Frequently Asked Questions

Analyze common user questions about the Vehicle Water Based Fire Extinguisher market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary benefit of water-based fire extinguishers over traditional dry chemicals for vehicles?

Water-based extinguishers, especially mist systems, offer superior cooling capabilities, significantly reducing the risk of re-ignition, minimizing toxic residue, and lowering environmental impact compared to many traditional dry chemical or halogenated agents, which is vital for confined vehicle spaces.

Are water-based extinguishers safe to use on electrical vehicle (EV) battery fires?

Standard water extinguishers pose risks near high-voltage components. However, specialized high-pressure water mist systems and dedicated EV water-based agents are engineered to address thermal runaway in lithium-ion batteries by providing rapid, localized cooling with minimal electrical conductivity risks.

Which regulatory standards govern the use of fire extinguishers in commercial transport vehicles?

Key international standards include UNECE R107 (for buses/coaches, especially in Europe), specific regulations by the US Federal Motor Carrier Safety Administration (FMCSA), and national fire codes (e.g., NFPA in the US), which dictate mandatory types, sizes, and installation locations for vehicle fire suppression equipment.

How does the integration of AI or IoT affect the vehicle fire extinguisher market?

AI and IoT enable the shift from manual checking to predictive maintenance and autonomous response. Smart systems monitor extinguisher pressure and agent levels remotely, detect fire conditions earlier through sensor fusion, and automatically activate targeted suppression faster than human intervention, improving fleet safety management.

What are the key differences between Water Mist and Wetting Agent extinguishers?

Water mist systems atomize pure or treated water under high pressure for cooling and oxygen displacement, minimizing collateral damage. Wetting agent extinguishers use chemical additives to lower water's surface tension, improving penetration into porous Class A materials and enhancing effectiveness against certain Class B flammable liquid fires.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager