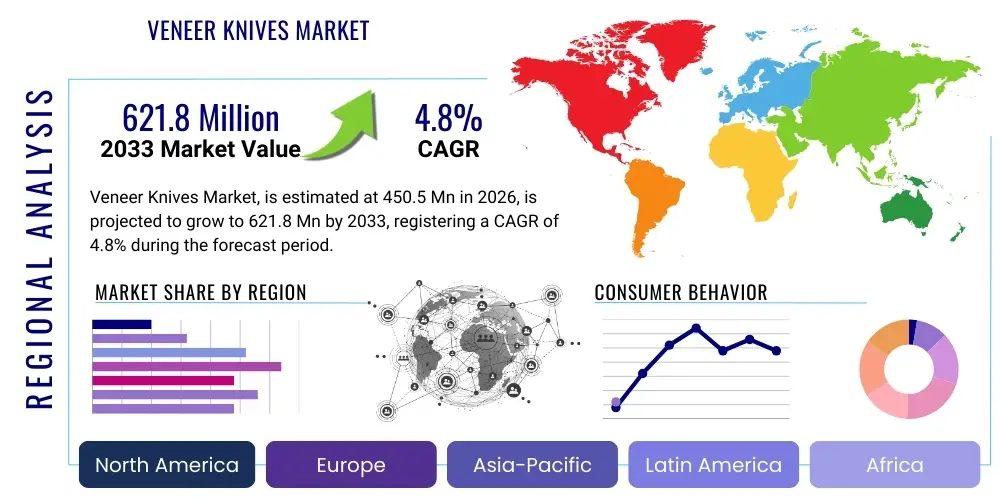

Veneer Knives Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442992 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Veneer Knives Market Size

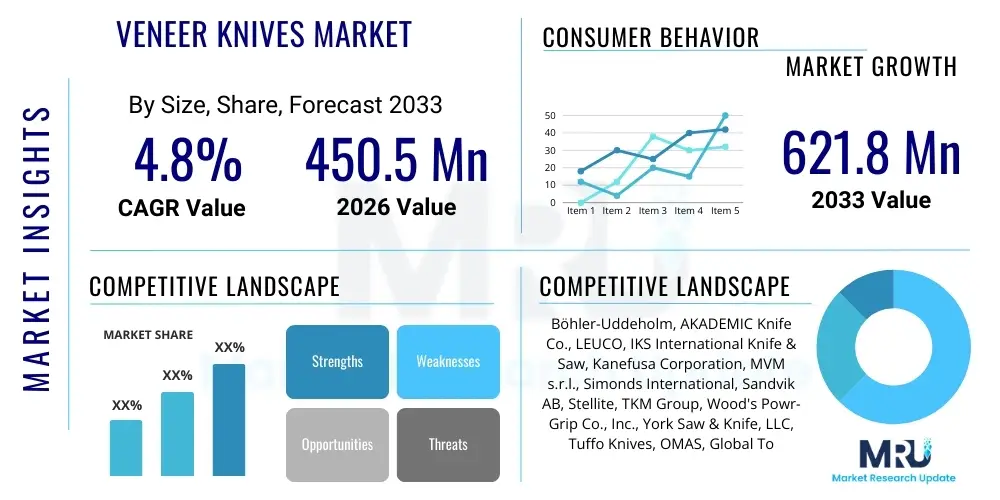

The Veneer Knives Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 621.8 Million by the end of the forecast period in 2033.

Veneer Knives Market introduction

The Veneer Knives Market encompasses the industrial tools essential for slicing logs into thin sheets of veneer, which are crucial components in the production of plywood, laminated wood products, and high-end furniture. These specialized knives are meticulously engineered instruments, designed primarily from high-grade alloy steels, often featuring enhanced surface treatments such as chrome plating or specialized coatings to maximize sharpness, durability, and resistance to wear and tear. The precision offered by high-quality veneer knives directly influences the final quality, thickness consistency, and yield efficiency of the veneer produced, making them a critical capital expenditure in the wood processing industry.

The primary applications of veneer knives span across rotary peeling, slicing, and half-round slicing processes used by veneer manufacturers and plywood mills globally. Major applications include the production of decorative veneers for architectural finishes, structural veneers for construction materials, and composite wood products like oriented strand board (OSB) and particleboard where veneer sheets form an essential layer. The benefits derived from employing advanced veneer knives include reduced downtime due to less frequent replacement, improved cutting accuracy minimizing wood waste, and the ability to process harder or specialized wood species effectively.

Market growth is predominantly driven by the robust expansion of the global construction sector, particularly in emerging economies, and the sustained demand for aesthetically pleasing and cost-effective wood-based materials in interior design and furniture manufacturing. Furthermore, technological advancements in blade material science, including the adoption of tungsten carbide and advanced ceramics for edge retention, are pushing the market forward by offering superior product lifecycles and enhanced cutting performance, thereby justifying premium pricing for specialized tools.

Veneer Knives Market Executive Summary

The global Veneer Knives Market is exhibiting steady expansion, underpinned by strong business trends focusing on material innovation and operational efficiency within the wood processing sector. Manufacturers are increasingly investing in sophisticated heat treatment protocols and specialized coatings, such as Physical Vapor Deposition (PVD) and Chemical Vapor Deposition (CVD), to enhance knife durability and reduce the frequency of re-sharpening, addressing a core concern of high operational costs for end-users. Consolidation among key players is observed as companies seek to expand their geographical footprint and diversify their product portfolios to cover straight knives, clipper knives, and pressure bar systems, offering comprehensive solutions to large industrial mills.

Regionally, the Asia Pacific (APAC) stands out as the primary growth engine, fueled by massive infrastructure projects, burgeoning domestic furniture markets in China and India, and the presence of high-volume plywood production hubs. North America and Europe, while mature, emphasize high-precision cutting and compliance with stringent environmental standards, driving demand for premium, long-lasting knives that minimize material waste. Latin America and the Middle East & Africa (MEA) represent emerging opportunities, stimulated by local forestry utilization and investments in modern wood processing capabilities, though growth rates here are more volatile due to economic instability.

Segment trends indicate a sustained dominance of the straight veneer knives segment due to their universal use in slicing machines, alongside increasing adoption of high-performance alloy steels (e.g., D2 and high-speed steel) over standard carbon steel blades, reflecting the industry's shift towards operational longevity. Furthermore, the burgeoning demand for thin, decorative veneers is specifically boosting the market for precision slicing knives. Manufacturers focusing on integrated service models, including professional re-sharpening and maintenance packages, are capturing significant market share by offering value-added services that extend the useful life of the cutting tools.

AI Impact Analysis on Veneer Knives Market

User queries regarding AI’s influence in the Veneer Knives Market primarily revolve around predictive maintenance, optimization of sharpening schedules, and quality control during the veneer peeling process. Users seek information on whether AI can analyze real-time sensor data from veneer lathes (such as vibration, temperature, and current draw) to predict knife failure or optimal replacement/sharpening cycles, thereby maximizing tool life and reducing unscheduled downtime. There is also significant interest in how machine learning algorithms could process images or scans of the veneer sheet immediately after cutting to detect microscopic defects caused by knife wear, ensuring instantaneous quality adjustments. The key themes include efficiency improvement, cost reduction through maximized tool lifespan, and integrating smart monitoring systems into traditional wood processing machinery.

While AI does not directly manufacture the physical knives, its influence is profound in optimizing the industrial processes surrounding knife usage. Predictive analytics powered by AI algorithms can significantly reduce operational expenditure by shifting maintenance from reactive to proactive strategies. By analyzing historical performance data combined with real-time sensor input (e.g., acoustic emissions or thermal imaging), systems can accurately forecast the remaining useful life (RUL) of a veneer knife, notifying operators precisely when sharpening is required, preventing damage to the knife edge and ensuring consistent veneer quality. This intelligent scheduling minimizes material waste and maximizes machine uptime.

Furthermore, AI-driven quality assurance systems are rapidly gaining traction. High-speed camera systems coupled with deep learning models can scrutinize the freshly cut veneer surface for imperfections such as chatter marks, thickness variations, or fiber tearing that signal immediate knife performance degradation. This instant feedback loop allows for automated adjustments to machine parameters (feed rate, pressure bar setting) or flags the need for tool change, ensuring that large batches of wood are not wasted due to a dull blade. This integration of AI elevates the overall precision and cost-effectiveness of veneer production, indirectly increasing the demand for high-specification knives compatible with these monitoring systems.

- AI enables predictive maintenance, optimizing knife sharpening and replacement schedules.

- Machine learning algorithms analyze real-time sensor data (vibration, temperature) to forecast remaining useful life (RUL) of the knives.

- AI-powered vision systems detect microscopic veneer defects instantly, ensuring superior quality control.

- Optimization of cutting parameters (speed, pressure) based on AI feedback minimizes wood wastage.

- Facilitates integration of smart monitoring features into advanced veneer lathe machinery.

DRO & Impact Forces Of Veneer Knives Market

The Veneer Knives Market growth is fundamentally driven by the expanding global construction industry and the consistent worldwide demand for wood panel products, offset by significant restraints such as high raw material price volatility and the intense competition from alternative building materials. Opportunities emerge through technological advancements in knife materials and coatings, specifically the adoption of ultra-hard materials that dramatically extend tool life, coupled with the increasing need for professional re-sharpening and maintenance services. The major impact forces governing the market dynamics are the economic vitality of key industrial sectors and the pace of technological adoption among wood processing mills.

Drivers: A primary driver is the rapid urbanization and infrastructure development, particularly across Asia Pacific and Latin America, which necessitate massive quantities of plywood and structural wood panels, directly increasing the operational hours of veneer cutting machinery and consequently the demand for replacement knives. Secondly, the increasing preference for engineered wood products (EWP) like structural plywood, which offer superior strength-to-weight ratios and design versatility compared to solid wood, sustains the high-volume production requirements for veneer sheets. Lastly, the industry’s push for efficiency and sustainability mandates the use of premium knives that reduce kerf loss and maximize veneer yield from expensive logs.

Restraints: The market faces substantial constraints, notably the fluctuating global prices of key raw materials, including high-grade alloy steels (e.g., chrome, molybdenum, and vanadium), which directly inflate manufacturing costs for veneer knife producers. Furthermore, the inherent operational challenge of tool wear and the associated high costs of frequent sharpening or replacement pose a financial burden on end-users, leading some smaller mills to prioritize lower-cost, standard-grade knives with shorter lifecycles. Environmental regulations impacting forestry and logging activities in key wood-producing regions also occasionally restrict the availability of raw logs, indirectly dampening the demand for cutting tools.

Opportunities: Significant growth opportunities lie in the development and commercialization of knives utilizing advanced metallurgical compositions, such as carbide-tipped edges or ceramic inserts, which promise unprecedented resistance to abrasive wear, particularly when processing exotic or high-resin wood species. Market expansion is also possible through focused penetration into maintenance and service contracts, providing high-precision CNC re-sharpening services that guarantee quality and extend the knives’ economic usefulness. Moreover, the integration of IoT sensors and smart systems into the knife manufacturing process to track usage and performance offers value-added services and differentiates premium market offerings.

Segmentation Analysis

The Veneer Knives Market is intricately segmented based on material type, knife type, and application, reflecting the diverse requirements and technological variations across the global wood processing industry. Segmentation provides clarity on consumer preferences and allows manufacturers to tailor their production lines, ranging from high-volume, standard alloy steel knives for structural plywood to high-precision, coated knives essential for decorative veneer slicing. The fundamental differences in operating speeds, log types (hardwood vs. softwood), and required veneer thickness drive the material and design choices across these segments.

The segmentation by knife type (Straight vs. Circular) captures the different processing methods: straight knives dominate slicing and rotary peeling processes, while circular knives are often employed in clipper systems for sizing the cut veneer sheets. Material segmentation (Alloy Steel, Tool Steel, Carbide Tipped) directly correlates with performance characteristics, price points, and target application, with advanced tool steels typically serving high-demand industrial operations requiring minimal downtime. Application segmentation clarifies the end-use, with Plywood Manufacturing consuming the largest volume due to the global scale of structural wood production, followed by the Decorative Veneer and Laminated Wood segments which demand higher precision tools.

Understanding these segments is crucial for market stakeholders, as growth rates vary significantly. For instance, the demand for carbide-tipped knives is expected to accelerate faster than that for traditional alloy steel knives, owing to the superior longevity offered by the former, despite a higher initial capital outlay. Geographically defined production needs also influence segmentation, with regions processing harder tropical woods exhibiting greater demand for specialized, highly durable knife materials resistant to high abrasion.

- By Knife Type:

- Straight Veneer Knives (Slicing Knives, Peeling Knives)

- Clipper Knives

- Circular Knives

- Pressure Bars

- By Material Type:

- High Carbon Steel

- High-Speed Steel (HSS)

- Alloy Tool Steel (e.g., D2, O1)

- Carbide Tipped Knives

- Specialty Coated Knives (PVD/CVD coatings)

- By Application:

- Plywood Manufacturing

- Laminated Veneer Lumber (LVL) Production

- Decorative Veneer Slicing

- Others (e.g., Wood Composites)

Value Chain Analysis For Veneer Knives Market

The value chain for the Veneer Knives Market begins with the highly specialized procurement of raw materials, primarily high-grade alloy metals such as chromium, tungsten, and molybdenum, sourced from global mining and specialty steel producers. Upstream analysis highlights the criticality of maintaining consistent quality and supply of these complex alloys, as variations directly impact the final tool performance and lifespan. Manufacturers of veneer knives, situated in the middle of the chain, focus heavily on precision metallurgy, heat treatment, and advanced grinding processes (often CNC-controlled) to achieve the required hardness and edge geometry. This manufacturing stage requires high capital investment in specialized machinery and metallurgical expertise, acting as a significant barrier to entry.

The distribution channel is crucial for delivering the product to the end-users. Direct distribution typically involves large knife manufacturers supplying directly to major, high-volume plywood or veneer mills through long-term contracts, enabling specialized service and technical support. Indirect distribution utilizes regional industrial equipment distributors, specialized tool suppliers, and local representatives who cater to smaller and medium-sized processing plants, often providing faster local inventory access and handling ancillary services like emergency re-sharpening. The robustness of the service segment (re-sharpening, maintenance) is increasingly integrated into the distribution model, adding significant value downstream.

Downstream analysis focuses on the end-users: plywood mills, LVL producers, and decorative veneer manufacturers. The quality of the veneer knife is immediately reflected in the efficiency of the veneer lathe operation, yield optimization, and the final aesthetic and structural quality of the wood product. Key downstream activities include inventory management (maintaining spare knives), regular sharpening cycles, and precise installation and calibration of the knives within the cutting machinery. The increasing complexity of modern machinery necessitates closer collaboration between knife manufacturers and machinery OEMs to optimize tool performance under various operating conditions.

Veneer Knives Market Potential Customers

The primary customers for veneer knives are industrial entities involved in large-scale primary wood processing, where logs are transformed into thin sheets of wood used for composite materials. These end-users are characterized by high operational intensity, requiring durable and precision-engineered cutting tools that minimize production bottlenecks and maximize raw material utilization. The capital expenditure for veneer knives is often substantial, prompting customers to seek long-term relationships with suppliers who can guarantee product consistency and reliable post-sale technical support, particularly regarding re-sharpening services.

Key buyer segments include international plywood corporations with integrated forestry and manufacturing operations, major producers of laminated veneer lumber (LVL) used predominantly in construction, and smaller, specialized decorative veneer slicing houses that prioritize impeccable surface quality. These customers are highly sensitive to knife lifespan and precision, as tool failure or poor cutting quality directly results in significant financial losses through wasted timber and production halts. Purchasing decisions are thus heavily influenced by total cost of ownership (TCO), including the initial cost, expected lifespan, and the cost and feasibility of re-sharpening.

Furthermore, Original Equipment Manufacturers (OEMs) of veneer lathes and slicing machinery constitute a secondary but important customer base, often purchasing knives for initial equipment installation or recommending specific knife suppliers to their clients. Other potential customers include third-party industrial tool re-sharpening facilities and specialized repair shops that service the wood industry, maintaining inventories of various knife types to meet rapid replacement demand from local mills.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 621.8 Million |

| Growth Rate | CAGR 4.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Böhler-Uddeholm, AKADEMIC Knife Co., LEUCO, IKS International Knife & Saw, Kanefusa Corporation, MVM s.r.l., Simonds International, Sandvik AB, Stellite, TKM Group, Wood's Powr-Grip Co., Inc., York Saw & Knife, LLC, Tuffo Knives, OMAS, Global Tooling Solutions (GTS), Forberg International, Schwaebische Werkzeugmaschinen GmbH (SW), B.R. Industrial Tools. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Veneer Knives Market Key Technology Landscape

The technological landscape of the Veneer Knives Market is defined by continuous innovation in metallurgy, heat treatment processes, and surface engineering, all aimed at enhancing the tool's wear resistance and edge retention capability. High-performance knives rely heavily on the precise composition of alloy tool steels, incorporating elements like vanadium and tungsten to increase hardness and toughness without sacrificing resilience. Advanced vacuum heat treatment (VHT) and cryogenics are essential technologies used by leading manufacturers to ensure uniform grain structure and maximize the steel's intended mechanical properties, which directly translates into a longer operational life between sharpening cycles.

Surface technology represents another critical area of innovation. Coatings applied using Physical Vapor Deposition (PVD) or Chemical Vapor Deposition (CVD) techniques, such as Titanium Nitride (TiN) or specialized ceramics, are utilized to reduce friction, protect the cutting edge from abrasive wear caused by wood resins and contaminants, and provide an extra layer of corrosion resistance. These coatings are particularly vital for knives used in processing abrasive woods, offering superior durability compared to uncoated steel. Furthermore, the development of carbide-tipped knives, where extremely hard tungsten carbide inserts are brazed onto a softer steel body, is a key technology addressing the demand for tools capable of surviving demanding, high-volume industrial environments.

The manufacturing process itself is heavily reliant on Computer Numerical Control (CNC) grinding technology. High-precision CNC grinding machines are required to achieve the extremely tight tolerances, mirror-like finish, and perfect angular geometry necessary for precise veneer peeling or slicing. This precision is essential for producing high-quality, uniform veneer sheets and minimizes vibration during the cutting process. The integration of advanced metrology and quality control systems ensures that every knife blade adheres to demanding specifications, guaranteeing optimal performance upon installation in the high-speed veneer lathes utilized by major wood processors globally.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to be the fastest-growing and largest regional market, primarily driven by massive plywood and wood panel production in China, India, and Southeast Asian countries. The region benefits from lower manufacturing costs and booming construction sectors, demanding high volumes of both structural and decorative veneers. The focus here is balanced between cost-effectiveness and volume output, leading to high consumption of both standard alloy and mid-range HSS knives. Regulatory support for domestic wood industries further fuels the demand for associated processing tools.

- North America: This region is characterized by high operational efficiency and a strong focus on quality and advanced technology adoption. North American mills often process large volumes of softwood and high-value hardwood, driving demand for premium, long-life, and carbide-tipped knives that minimize machine downtime and maximize lumber recovery. Environmental compliance and automation integration are key trends, favoring manufacturers that offer technologically advanced and sustainably produced cutting solutions.

- Europe: The European market maintains a steady demand, focusing heavily on precision, longevity, and adherence to strict quality standards, particularly for decorative veneer applications used in high-end furniture and architectural finishes. Countries like Germany, Italy, and Scandinavia lead in adopting advanced CNC sharpening technologies and specialized knife coatings. The market is mature, with growth driven primarily by replacement cycles and technological upgrades rather than sheer volume expansion.

- Latin America: This region presents significant growth potential, linked to increasing domestic construction activity and the exploitation of local timber resources, especially in Brazil and Chile. The market is developing, with a growing number of mills upgrading their equipment, shifting from older, less efficient knife types to modern alloy steel blades. Economic stability remains a key determinant of investment levels in new wood processing machinery and high-grade tooling.

- Middle East and Africa (MEA): The MEA market is currently the smallest but exhibits emerging potential, fueled by diversification efforts and infrastructure investment, particularly in the Gulf Cooperation Council (GCC) countries. Demand for veneer knives is closely tied to local furniture production and construction projects requiring imported wood panels, though local manufacturing capabilities are slowly expanding, creating gradual demand for industrial tooling.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Veneer Knives Market.- Böhler-Uddeholm

- AKADEMIC Knife Co.

- LEUCO

- IKS International Knife & Saw

- Kanefusa Corporation

- MVM s.r.l.

- Simonds International

- Sandvik AB

- Stellite (Kennametal Inc.)

- TKM Group

- Wood's Powr-Grip Co., Inc.

- York Saw & Knife, LLC

- Tuffo Knives

- OMAS

- Global Tooling Solutions (GTS)

- Forberg International

- Schwaebische Werkzeugmaschinen GmbH (SW)

- B.R. Industrial Tools.

Frequently Asked Questions

Analyze common user questions about the Veneer Knives market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Veneer Knives Market?

The primary drivers include the global expansion of the construction industry, particularly urbanization in emerging economies, and the sustained demand for cost-effective engineered wood products like plywood and laminated veneer lumber (LVL). Technological advancements in knife materials that offer extended operational life also contribute significantly to market growth.

Which material types are most commonly used for manufacturing high-performance veneer knives?

High-performance veneer knives are commonly manufactured using alloy tool steels such as D2 and specialized High-Speed Steel (HSS) for superior edge retention and toughness. There is a growing trend towards carbide-tipped knives and knives with advanced surface coatings (e.g., PVD) to enhance abrasion resistance and durability when processing difficult wood species.

How does the choice of veneer knife material impact wood processing efficiency?

The material choice directly determines the knife's lifespan and cutting precision. Superior materials minimize friction, reduce the frequency of necessary sharpening or replacement, lead to less machine downtime, and ensure uniform veneer thickness, thereby maximizing wood yield and overall operational efficiency.

What is the role of AI and digitalization in the modern Veneer Knives industry?

AI primarily supports operational efficiency through predictive maintenance systems. These systems use sensor data to accurately forecast the remaining useful life of the knife, optimizing sharpening schedules. Digitalization also enhances quality control by instantly identifying veneer defects caused by tool wear, ensuring superior product quality.

Which geographical region represents the largest demand segment for veneer knives?

The Asia Pacific (APAC) region currently holds the largest market share and is expected to exhibit the highest growth rate. This dominance is attributed to the presence of high-volume manufacturing hubs for plywood and wood panels, driven by immense infrastructure and construction activities in countries like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager