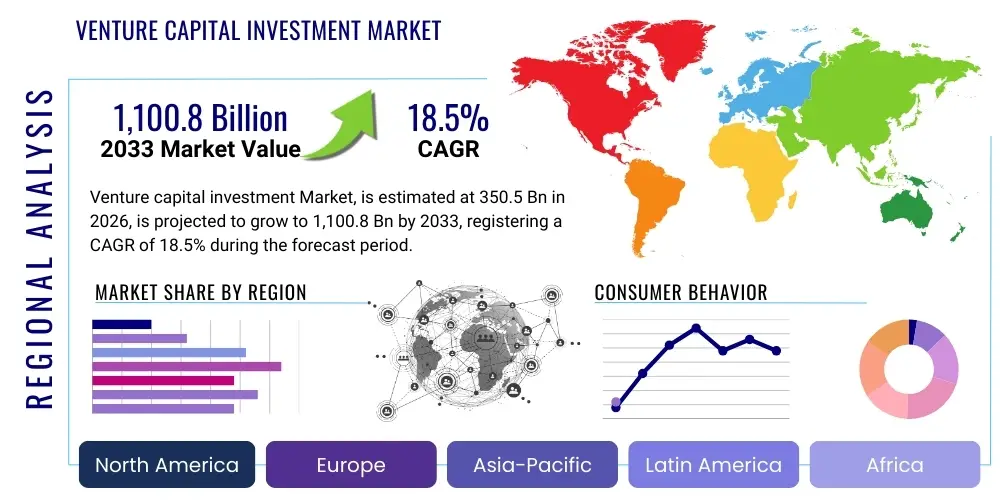

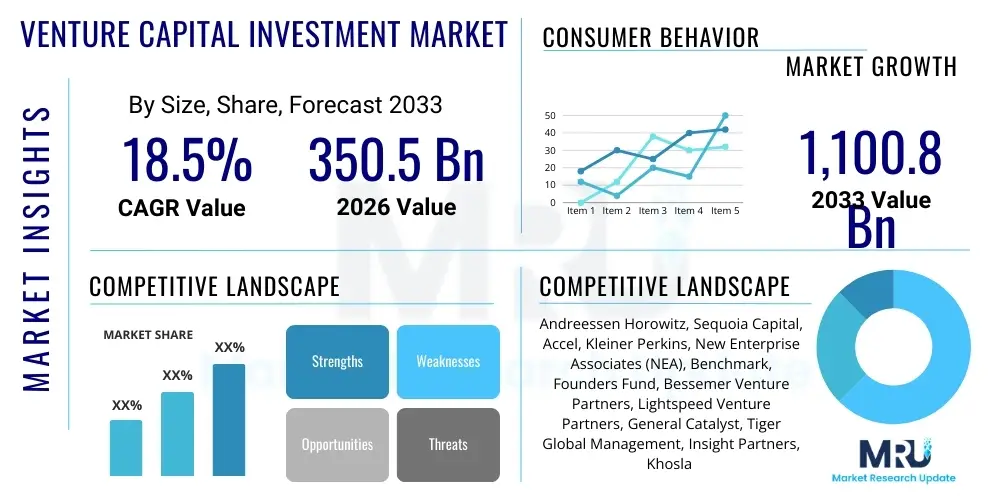

Venture capital investment Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441304 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Venture capital investment Market Size

The Venture capital investment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at $350.5 Billion in 2026 and is projected to reach $1,100.8 Billion by the end of the forecast period in 2033.

Venture capital investment Market introduction

The Venture Capital (VC) investment market is fundamentally characterized by the deployment of financial capital to startups and small businesses demonstrating exceptional growth potential. This capital injection is typically provided in exchange for equity ownership, facilitating the transformation of nascent ideas into established commercial entities. VC funding differs significantly from traditional private equity by focusing on early-stage, high-risk, high-reward opportunities, often concentrated in rapidly evolving technological sectors such as software, biotechnology, and financial technology. The primary function of venture capital extends beyond mere financial support; it includes providing strategic guidance, operational expertise, and access to critical industry networks, which are crucial for the accelerated scaling of portfolio companies.

Major applications of venture capital span across the entire spectrum of the startup ecosystem, funding product development, market penetration, scaling infrastructure, and talent acquisition. The benefits derived from robust VC activity are multilateral, fueling innovation, creating high-value jobs, and driving technological disruption across established industries. For investors (Limited Partners or LPs), venture capital offers access to non-correlated, potentially outsized returns, provided the underlying fund successfully navigates the inherent risks of early-stage investing. The structural mechanism ensures that capital flows efficiently towards groundbreaking ideas that might otherwise struggle to secure conventional financing.

Key driving factors accelerating the expansion of the Venture capital investment Market include rapid global digital transformation, the decreasing cost of technology development (e.g., cloud computing infrastructure), and widespread entrepreneurial adoption globally. Furthermore, the increasing availability of sophisticated data analytics tools enables VCs to better assess market potential and mitigate risks associated with new ventures. Government policies supporting innovation, coupled with the rising prominence of highly specialized Deep Tech sectors like AI, quantum computing, and climate technology, are creating persistent demand for specialized venture capital funds capable of understanding and nurturing complex, long-duration projects. This dynamic environment sustains a high growth trajectory for the market.

Venture capital investment Market Executive Summary

The Venture capital investment market is experiencing profound shifts driven by cyclical economic factors and fundamental technological advancements. Current business trends indicate a bifurcation in deployment strategies: while early-stage valuations have stabilized or slightly compressed due to rising interest rates and cautious Limited Partner (LP) commitments, mega-rounds for proven growth-stage companies specializing in generative AI, large language models, and sustainable technology remain highly competitive. There is a discernible trend towards sector specialization among General Partners (GPs), moving away from generalist strategies to focus on highly nuanced areas like specialized healthcare devices, vertical SaaS platforms, and advanced manufacturing technologies (Industry 4.0). Moreover, exit strategies are becoming more complex, with the IPO window remaining volatile, pushing VCs towards strategic acquisitions (M&A) as the primary liquidity event.

Regionally, the market dynamics demonstrate persistent dominance by North America, particularly the US, owing to its deep capital pools, robust entrepreneurial infrastructure, and institutionalized VC ecosystem. However, Asia Pacific (APAC), led by rapidly maturing markets in India and Southeast Asia, is rapidly closing the gap, propelled by massive digital consumer bases and increasing governmental support for tech ecosystems. Europe is consolidating its position, with notable activity in FinTech and Climate Tech, particularly in the UK, Germany, and France. These regions are actively competing by enhancing regulatory frameworks to attract and retain high-growth startups and the corresponding VC capital required for scaling.

Segment trends reveal that the Information Technology (IT) sector, especially software and AI infrastructure, continues to absorb the largest share of capital, reflecting the pervasive digitalization across all global economies. Within funding stages, Growth Stage (Series C+) investments, although decreasing in volume, still account for the majority of the deployed dollar value, demonstrating investor confidence in later-stage de-risked assets. Conversely, Seed Stage funding remains robust, driven by the emergence of new micro-funds and angel networks, ensuring a healthy pipeline of future portfolio companies. Institutional Investors, specifically pension funds and endowments, remain the foundational capital providers (LPs), exhibiting a long-term commitment despite short-term fluctuations in market performance metrics.

AI Impact Analysis on Venture capital investment Market

Analysis of common user questions reveals significant interest and concern regarding how Artificial Intelligence (AI), particularly generative AI and machine learning (ML), is fundamentally restructuring the Venture Capital investment landscape. Users frequently inquire about the optimal sectors for AI investment (e.g., AI infrastructure vs. applications), the potential displacement of human VC analysts by AI-driven due diligence tools, and the inflationary impact of AI on startup valuations. A recurring theme is the expectation that AI will dramatically increase the speed and accuracy of deal sourcing and portfolio management, while simultaneously acknowledging the high regulatory risk and capital intensity associated with developing foundational AI models. The consensus anticipates that VCs who successfully integrate proprietary AI tools for market mapping and predictive failure analysis will gain a crucial competitive edge in the next investment cycle.

The integration of AI is transforming venture capital operational models. On the due diligence side, AI algorithms are being deployed to screen thousands of potential investment targets based on publicly available data, proprietary funding history, and social network analysis, identifying promising startups that human analysts might overlook. This enables a more systematic and less geographically constrained deal sourcing process. Furthermore, AI tools are used for pattern recognition in term sheets and legal documents, accelerating the negotiation phase and reducing administrative overhead. This shift allows VCs to dedicate more human bandwidth to strategic advising and deep sector expertise rather than preliminary filtering.

From a portfolio management perspective, AI tools provide real-time insights into the operational health and trajectory of portfolio companies, utilizing metrics derived from sales data, product usage statistics, and competitive analysis. This predictive monitoring capability enables VCs to intervene strategically before critical issues escalate, optimizing capital deployment decisions for subsequent funding rounds (follow-on investments). Crucially, AI-focused VCs are now prioritizing investments in enabling technologies—the foundational layer of computing power, data infrastructure, and specialized chips required to train and run large AI models—recognizing that the infrastructure layer offers more stable, long-term returns compared to transient consumer applications built on top of these models.

- AI accelerates deal sourcing and market mapping using predictive algorithms.

- Generative AI models are driving unprecedented high valuations for foundational AI startups.

- AI tools enhance due diligence by automating risk assessment and identifying market gaps.

- Increased focus on investments in AI infrastructure (chips, data platforms) rather than just applications.

- Portfolio monitoring is optimized through real-time predictive analytics powered by machine learning.

- The barrier to entry for building and launching software startups is reduced by AI coding assistants, potentially increasing the deal flow volume.

DRO & Impact Forces Of Venture capital investment Market

The Venture capital investment Market is influenced by a powerful confluence of Drivers, Restraints, and Opportunities, which collectively form the Impact Forces shaping its future trajectory. Key drivers include the exponential growth in global technological innovation, particularly in areas like biotechnology and digital health, which require specialized, long-term capital. Furthermore, the massive shift towards digitalization across industries, coupled with increased corporate interest in external innovation (often facilitated by Corporate Venture Capital or CVC), sustains high demand for VC funding. Offsetting these drivers are significant restraints, notably global macroeconomic volatility, characterized by high inflation and fluctuating interest rates, which directly impact Limited Partners' (LPs') liquidity and risk appetite, leading to capital scarcity and valuation corrections in certain segments. Regulatory uncertainty, particularly regarding data privacy and cross-border technology transfers, also complicates investment decisions.

Opportunities in the VC market are predominantly focused on addressing global systemic challenges. The imperative for sustainable development and energy transition presents a massive opportunity for Climate Tech and clean energy investments, attracting significant governmental and institutional funding commitments. Similarly, the aging global population and the need for more personalized medicine are driving opportunities in HealthTech and advanced therapeutics. The increasing sophistication of specialized investment vehicles, such as venture debt and secondaries, provides VCs with more flexible tools for capital management and liquidity provision, diversifying exit pathways beyond traditional IPOs. These opportunities incentivize the formation of highly specialized funds capable of navigating complex scientific and regulatory environments.

The collective Impact Forces suggest a market undergoing maturation, moving from a period of excessive generalized growth to one characterized by discipline and specialization. The primary impact force is the convergence of technology and global crises: startups addressing climate change or healthcare access are now seen not just as social good, but as essential economic infrastructure, thus attracting premium valuations and steady capital flow. Conversely, the impact of increased capital efficiency—the ability of startups to scale faster with less funding, partly due to AI tools—means VCs need to deploy capital strategically, focusing on defensible intellectual property and strong unit economics, rather than sheer market expansion at all costs. This environment necessitates rigorous due diligence and proactive portfolio management to maximize returns while mitigating the heightened systemic risk posed by geopolitical instability and shifting monetary policies.

Segmentation Analysis

The Venture capital investment market is rigorously segmented based on the stages of funding (Type), the industry in which the startup operates (Industry Vertical), and the source of the capital (Investor Type). This granular segmentation is essential for understanding capital flow dynamics, risk profiles, and return expectations within the market. Different segments exhibit distinct capital requirements, time horizons, and susceptibility to macroeconomic shifts. Analyzing these segments allows both General Partners and Limited Partners to construct diversified portfolios tailored to specific risk tolerances and mandated returns, thereby optimizing overall capital efficiency and strategic positioning in the highly competitive investment ecosystem.

- Type: Seed Stage, Early Stage (Series A/B), Growth Stage (Series C+), Late Stage (Pre-IPO)

- Industry Vertical: Information Technology (IT), Healthcare & Biotech, FinTech, E-commerce & Retail, Energy & Cleantech, Manufacturing & Industrials

- Investor Type: Institutional Investors, Corporate Venture Capital (CVC), Angel Investors, Family Offices

Value Chain Analysis For Venture capital investment Market

The Venture Capital value chain begins with the upstream activities centered on capital aggregation and fund formation. This stage involves General Partners (GPs) raising commitments from Limited Partners (LPs), such as pension funds, endowments, and sovereign wealth funds. Upstream analysis focuses on LP relationships, fund size optimization, and adherence to investment mandates, ensuring a steady and reliable flow of capital. The quality of the fund's proprietary deal flow, often generated through extensive industry networks and sector specialization, is a crucial differentiator at this stage. Success in the upstream phase is determined by the fund's track record and the perceived market expertise of the GP team, influencing the attractiveness of the fund to institutional investors.

The core midstream activity involves deal sourcing, due diligence, investment execution, and intensive portfolio management. Due diligence requires exhaustive analysis of technological viability, market opportunity, team strength, and competitive landscape. Post-investment, the VC firm actively participates in the strategic development of the portfolio company, often taking board seats, facilitating talent recruitment, and advising on follow-on funding strategies. Distribution channels in this market are primarily indirect, relying on the reputation of the GP team, established referral networks from founders and previous LPs, and increasingly, specialized data platforms and events for deal sourcing and syndication.

The downstream component of the value chain is focused on achieving liquidity and maximizing return on investment, primarily through exit strategies. These exits typically occur via Initial Public Offerings (IPOs) or Strategic Acquisitions (M&A). The timing and execution of these exits are highly sensitive to market conditions, and successful downstream execution requires strong relationships with investment banks and corporate acquirers. The indirect distribution of returns—where profits flow back to LPs after the GP's carried interest is taken—completes the cycle, reinforcing the fund's reputation and paving the way for the next fund generation. Direct distribution within the VC ecosystem is rare, generally limited to direct co-investments by LPs alongside the core fund, which remains an indirect investment mechanism.

Venture capital investment Market Potential Customers

The primary direct customers or beneficiaries of the Venture capital investment Market are high-growth startups and innovative private companies seeking external capital to scale operations. These entities span various growth stages, from pre-revenue companies requiring Seed funding to mature technology firms seeking Late Stage capital to bridge the gap to an IPO or M&A event. Potential customers are fundamentally defined by their need for capital coupled with a disruptive business model, strong intellectual property, and a defensible market position. These companies look for more than just money; they seek strategic partners who can provide operational expertise, mentorship, and access to crucial follow-on financing networks necessary for achieving hyper-growth.

The demand characteristics of these customers vary significantly by sector. For instance, biotech startups require exceptionally large, long-duration capital commitments to navigate extensive clinical trials and regulatory hurdles, whereas software-as-a-service (SaaS) companies prioritize funding that accelerates sales, marketing, and global expansion, often demonstrating faster revenue scaling. Geographically, customers are increasingly global, with significant opportunities emerging outside traditional tech hubs, driving VCs to establish international presence and specialized regional funds to cater to diverse entrepreneurial ecosystems in markets like Southeast Asia, Latin America, and emerging Africa, where local market knowledge is paramount for successful investment.

The ultimate buyers or consumers of the products and services developed by these portfolio companies are diverse—ranging from enterprise businesses adopting new SaaS solutions, consumers utilizing FinTech platforms, patients benefiting from novel medical treatments, and entire industries transitioning to sustainable energy solutions. While these end-users do not directly transact with the VC fund, their demand dictates the viability and ultimate success of the VC investment. Therefore, the long-term potential customers for the VC ecosystem are defined by segments of the global economy where technological disruption is poised to create significant efficiency gains or entirely new markets, validating the high-risk investment thesis undertaken by the venture capital firm.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $350.5 Billion |

| Market Forecast in 2033 | $1,100.8 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Andreessen Horowitz, Sequoia Capital, Accel, Kleiner Perkins, New Enterprise Associates (NEA), Benchmark, Founders Fund, Bessemer Venture Partners, Lightspeed Venture Partners, General Catalyst, Tiger Global Management, Insight Partners, Khosla Ventures, Greylock Partners, Index Ventures, Y Combinator, 500 Global, DST Global, Norwest Venture Partners, Mithril Capital Management |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Venture capital investment Market Key Technology Landscape

The technology landscape underpinning the Venture capital investment market is shifting rapidly, moving beyond basic operational tools toward sophisticated analytical and infrastructure solutions. The most critical technological development is the pervasive adoption of Artificial Intelligence (AI) and Machine Learning (ML) platforms specifically tailored for financial services, utilized for enhanced predictive modeling, deal flow management, and competitive analysis. These AI-driven tools facilitate proprietary signal detection within massive datasets, allowing VCs to identify emerging market trends and evaluate the technological defensibility of potential investments with far greater speed and precision than traditional methods. This technology enables a systematic approach to deal execution, replacing reliance on informal networks alone.

Beyond AI, the market relies heavily on robust data infrastructure, including specialized Customer Relationship Management (CRM) systems designed to track interactions with founders and manage complex portfolio relationships, often integrated with API-driven data sources providing real-time market metrics. Furthermore, the rise of Decentralized Autonomous Organizations (DAOs) and blockchain technology is impacting the funding mechanisms themselves, particularly within the Web3 and cryptocurrency sectors, necessitating specialized expertise and technological literacy among VC firms. Firms are increasingly investing in internal data science teams to build custom analytical platforms that provide a competitive advantage by synthesizing unstructured and proprietary data sets into actionable investment insights, thereby minimizing reliance on off-the-shelf software solutions.

The key technological imperative for modern VC firms is achieving operational efficiency and scaling expertise. This includes leveraging cloud infrastructure for seamless global collaboration and using security protocols to protect sensitive deal information. Crucially, the technology used by VCs mirrors the technology they invest in. As the focus shifts towards Deep Tech, including advanced computing, quantum physics applications, and synthetic biology, the necessary due diligence tools become scientifically rigorous, requiring computational power and access to highly specialized datasets. This technological convergence ensures that VC operations remain agile, scalable, and capable of effectively evaluating the complex technologies driving future market growth and attracting significant investment.

Regional Highlights

Regional dynamics play a vital role in shaping global venture capital flows, reflecting differences in entrepreneurial culture, regulatory environments, technological specialization, and access to Limited Partner (LP) capital. The market is increasingly interconnected, yet distinct regional strengths and weaknesses dictate localized investment strategies and capital deployment trends, leading to the emergence of specialized regional funds focusing on local market nuances.

- North America (NA): Dominates the global VC market, primarily driven by the United States. Characterized by unparalleled depth of LP capital, high risk tolerance, and strong concentration in major innovation hubs like Silicon Valley, Boston, and New York. Strong focus on software, foundational AI, and cutting-edge biotech. Regulatory frameworks generally favor innovation and capital formation, sustaining premium valuations and large-scale fund deployment.

- Europe: Exhibits robust growth, specializing significantly in FinTech, Climate Tech, and Deep Tech. Key hubs include London, Berlin, and Paris. Market activity is supported by significant institutional capital and increasing government initiatives aimed at fostering national technology champions (e.g., French Tech). Investment size often lags behind NA, but European startups demonstrate strong capital efficiency, particularly in enterprise software.

- Asia Pacific (APAC): Represents the fastest-growing region, fueled by massive consumer digital adoption in China, India, and Southeast Asia. India, in particular, is witnessing exponential growth in digital payments, SaaS, and EdTech. Dynamics are highly varied, with China focusing heavily on domestic AI and advanced manufacturing, while Southeast Asia emphasizes internet economies and cross-border logistics. Investment activity is susceptible to regional geopolitical tensions and varying regulatory landscapes.

- Latin America (LATAM): Emerging as a major destination for VC, driven by strong growth in FinTech (addressing large underbanked populations) and e-commerce across countries like Brazil, Mexico, and Colombia. The region attracts significant international capital seeking diversification and exposure to large, rapidly digitalizing economies. Challenges include localized regulatory complexity and macroeconomic instability, requiring VCs to adopt specialized local knowledge.

- Middle East and Africa (MEA): VC activity is intensifying, particularly in the UAE, Saudi Arabia (backed by large sovereign wealth funds), and Israel (a global leader in cybersecurity and military technology). Africa, led by Nigeria and South Africa, shows significant potential in mobile tech and FinTech solutions tailored for unique local infrastructure challenges. Capital deployment often focuses on domestic market needs and is increasingly influenced by large regional government mandates for economic diversification away from oil dependence.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Venture capital investment Market.- Andreessen Horowitz

- Sequoia Capital

- Accel

- Kleiner Perkins

- New Enterprise Associates (NEA)

- Benchmark

- Founders Fund

- Bessemer Venture Partners

- Lightspeed Venture Partners

- General Catalyst

- Tiger Global Management

- Insight Partners

- Khosla Ventures

- Greylock Partners

- Index Ventures

- Y Combinator

- 500 Global

- DST Global

- Norwest Venture Partners

- Mithril Capital Management

Frequently Asked Questions

Analyze common user questions about the Venture capital investment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Venture capital investment market?

The Venture capital investment market is projected to grow at a strong CAGR of 18.5% between the forecast years of 2026 and 2033, driven primarily by technological disruption and increased institutional appetite for high-growth assets.

Which industry vertical is currently receiving the largest share of VC funding?

The Information Technology (IT) sector, particularly focusing on B2B Software-as-a-Service (SaaS), cloud infrastructure, and foundational Artificial Intelligence (AI) technologies, continues to attract the largest portion of global venture capital deployment.

How is the current macroeconomic environment affecting startup valuations in the VC market?

High inflation and rising interest rates have introduced significant capital constraints, leading to a general stabilization and selective correction of startup valuations, particularly in growth and late stages, as investors prioritize profitability over sheer growth metrics.

What role does Corporate Venture Capital (CVC) play in the current market dynamics?

CVC is playing an increasingly crucial role by providing strategic capital and access to corporate resources, driving investments that align with the parent corporation's innovation needs, especially in industry verticals such as FinTech, Energy, and specialized manufacturing.

Which geographical region is showing the fastest growth potential in venture capital investment?

The Asia Pacific (APAC) region, particularly India and Southeast Asia, exhibits the fastest growth potential, supported by rapid digitalization, massive consumer markets, and increasing local and international fund mobilization.

What are the primary exit strategies for venture capital investors?

The primary exit strategies are Strategic Acquisitions (M&A) by large corporate entities and Initial Public Offerings (IPOs). Due to recent IPO market volatility, M&A has become the more frequent and reliable exit pathway for many portfolio companies.

How is AI impacting the operational structure of venture capital firms themselves?

AI tools are being integrated into VC operations to automate deal sourcing, enhance due diligence efficiency through predictive analytics, and improve real-time portfolio health monitoring, allowing human VCs to focus on strategic mentorship and complex negotiations.

What defines a Growth Stage (Series C+) investment compared to an Early Stage investment?

Growth Stage investments are typically larger capital infusions provided to companies with proven market fit, established revenue streams, and a clear path to profitability or market dominance, focusing on scaling infrastructure and global expansion rather than initial product development.

What is the main restraint impacting capital commitment from Limited Partners (LPs)?

The main restraint is the "denominator effect," where volatile public market valuations reduce the value of LPs’ public equity holdings, making their committed allocation to private assets (VC funds) proportionally larger, thus constraining new commitments.

Beyond funding, what key support do VCs typically provide to portfolio companies?

Venture capitalists provide essential non-monetary support, including strategic guidance, board governance, access to critical talent acquisition networks, and facilitating introductions to potential customers or follow-on investors.

Why are Deep Tech investments becoming a major focus area for venture capital?

Deep Tech (e.g., quantum computing, advanced biotech) is gaining focus because it offers strong technological defensibility through complex intellectual property and addresses large, long-term societal or industrial challenges, potentially yielding massive, non-correlated returns despite higher initial risk profiles.

How does the concept of 'Impact Forces' relate to the VC market?

Impact Forces represent the compounded effect of drivers, restraints, and opportunities, illustrating how external macro factors like global crises (e.g., pandemics, climate change) and technological convergence dictate the direction and speed of capital flow within the investment ecosystem.

What distinguishes Angel Investors from Institutional Investors in VC funding?

Angel Investors are high-net-worth individuals who typically provide smaller, initial Seed-stage capital using personal funds, often focusing on advisory roles; Institutional Investors are large organizations (like pension funds) providing massive capital to funds (LPs) with strict fiduciary duties.

How is regulatory uncertainty affecting cross-border VC deals?

Regulatory uncertainty, particularly concerning data localization, intellectual property protection, and foreign investment screening (CFIUS-like structures globally), adds complexity, costs, and risk to cross-border deals, leading VCs to favor regionally specialized funds.

What are the implications of the shift towards specialization among General Partners (GPs)?

The shift towards specialization allows GPs to achieve deeper domain expertise, leading to better deal selection, more effective due diligence, and higher strategic value for portfolio companies, crucial for maintaining competitive advantage in sectors like Climate Tech and HealthTech.

Why is the valuation of foundational AI startups soaring currently?

Foundational AI startups, particularly those developing Large Language Models (LLMs) and specialized chip technology, are valued highly due to their critical infrastructure role, perceived network effects, and the vast potential market size across all downstream application layers.

What is the significance of the "Base Year" 2025 in this market analysis?

The Base Year 2025 serves as the reference point for assessing current market conditions, establishing the foundational metrics from which the projected Compound Annual Growth Rate (CAGR) and market forecasts through 2033 are calculated, reflecting the most recent closed fiscal data and market adjustments.

How does the value chain analysis apply to direct versus indirect distribution in VC?

VC distribution is overwhelmingly indirect; capital flows from LPs to GPs (the fund), who then invest in startups. Direct distribution is minor, primarily involving LPs co-investing directly alongside the fund, but still filtered through the fund’s originating deal flow and management.

What is the primary factor driving VC investment in the Energy & Cleantech sector?

The primary factor is the global mandate for decarbonization and energy transition, backed by substantial regulatory support and massive public and private capital commitments seeking sustainable, long-term infrastructure and technology solutions.

What defines a high-growth startup as a potential customer for VC funding?

A high-growth startup is defined by its disruptive technology, demonstrable product-market fit, scalable business model capable of exponential growth, strong management team, and ability to generate defensible intellectual property or a significant network effect.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager