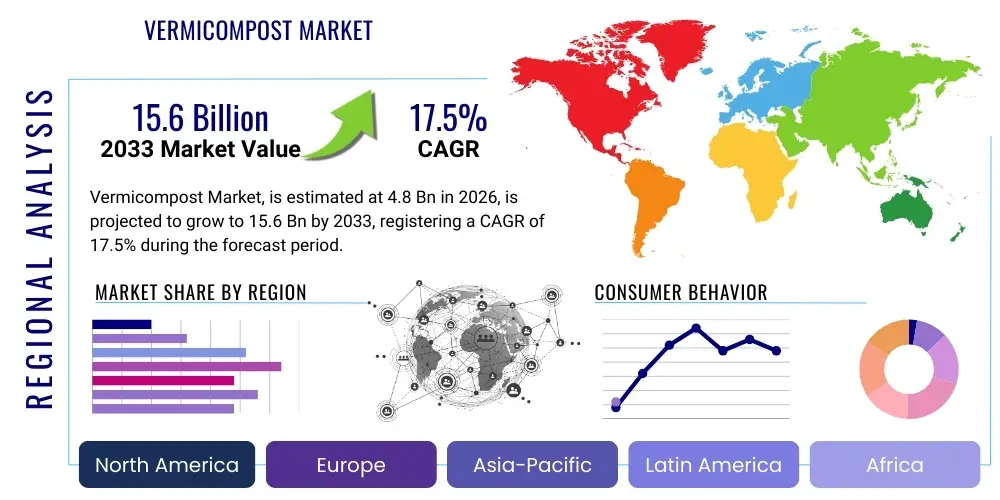

Vermicompost Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441130 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Vermicompost Market Size

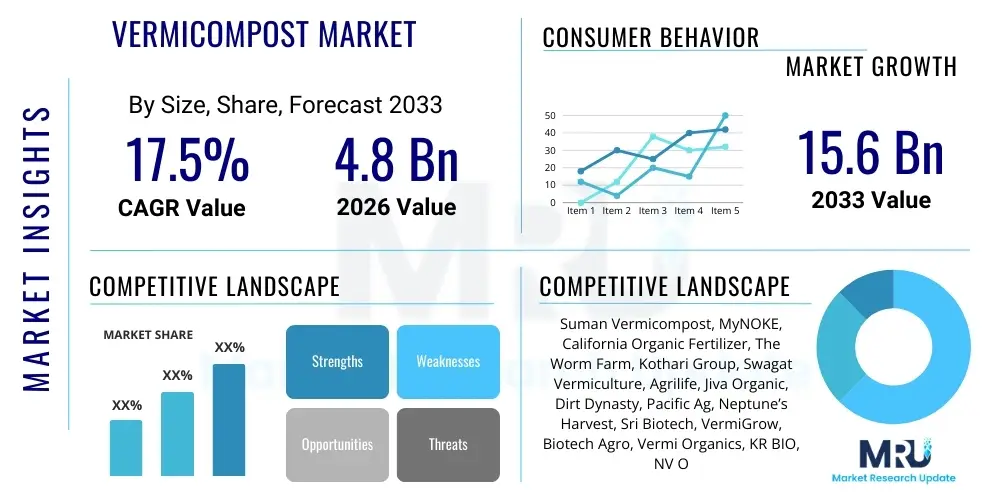

The Vermicompost Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 17.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 15.6 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating global demand for organic agricultural inputs, heightened environmental consciousness regarding chemical fertilizer usage, and robust governmental support promoting sustainable farming practices across key economies in North America, Europe, and the Asia Pacific region. The market size reflects the increasing commercial viability of vermicomposting operations, moving beyond small-scale initiatives to large industrial installations capable of processing significant volumes of organic waste and manure, thereby establishing vermicompost as a crucial component in circular economy models.

Vermicompost Market introduction

The Vermicompost Market encompasses the production, distribution, and utilization of nutrient-rich organic manure derived from the biodegradation of organic materials, such as agricultural waste, crop residues, and animal manure, using specific species of earthworms, primarily Eisenia fetida and Lumbricus rubellus. This product serves as a superior soil amendment and biofertilizer, significantly enhancing soil structure, water retention capacity, and overall fertility, while simultaneously reducing dependency on synthetic chemical inputs. Vermicompost, often recognized for its high concentration of humic acids, essential plant nutrients, and beneficial soil microbes, plays a pivotal role in regenerative agriculture systems, promoting healthy crop growth and bolstering plant immunity against pests and diseases. Its application spans diverse agricultural sectors, including commercial farming, landscaping, horticulture, and home gardening, positioning it as a cornerstone in the global transition toward sustainable food systems.

Major applications of vermicompost are predominantly found in high-value crop cultivation, such as organic fruits, vegetables, medicinal plants, and specialty flowers, where premium quality and chemical-free production are prioritized by consumers and regulators. Beyond traditional agriculture, vermicompost is increasingly adopted in soil reclamation projects, particularly in degraded or heavily contaminated lands, owing to its exceptional capacity to restore microbial biodiversity and sequester heavy metals. Key benefits driving its market adoption include improved crop yield and quality, enhanced nutrient cycling, effective organic waste management, reduced environmental pollution associated with conventional composting methods, and decreased operational costs for farmers seeking long-term soil sustainability. Furthermore, the rising awareness among regulatory bodies about the detrimental effects of synthetic fertilizers on ecological balance and human health is accelerating the institutionalization of vermicompost usage mandates.

The primary driving factors propelling the market forward include the accelerating growth of the global organic food industry, which mandates certified organic inputs like vermicompost to meet production standards. Secondly, global solid waste management crises necessitate efficient and eco-friendly disposal solutions for municipal and agricultural organic waste, wherein vermicomposting offers a high-value resource recovery pathway. Thirdly, continuous technological advancements in vermiculture practices, including mechanized harvesting and sorting systems, are improving production efficiency and scalability, making vermicompost more cost-competitive against traditional inputs. Finally, favorable government subsidies, research grants focused on sustainable agriculture, and educational outreach programs are significantly influencing farmer adoption rates, particularly in emerging economies where agricultural productivity gains are essential for food security and rural economic development.

Vermicompost Market Executive Summary

The Vermicompost Market is characterized by robust growth stemming from the dual pressures of sustainable waste management mandates and escalating consumer demand for organic food products. Business trends indicate a strong move toward industrial-scale vermicomposting facilities, often integrated with large livestock operations or municipal solid waste processing centers, enabling high-volume output and ensuring consistent product quality. Key commercial strategies involve vertical integration, where players manage both the waste sourcing and the final product distribution, and strategic partnerships with agricultural cooperatives and government bodies for subsidized distribution programs. Furthermore, significant investment is being channeled into product innovation, focusing on developing specialized vermicast formulations tailored for specific soil types and crop requirements, utilizing advanced screening and nutrient fortification techniques to maximize efficacy and shelf life, thereby distinguishing premium products in a fragmented market landscape.

Regionally, the Asia Pacific (APAC) stands out as the most dominant market, largely attributed to its immense agricultural land base, high volume of organic waste generation, and proactive governmental policies in countries like India and China promoting organic farming transition and soil health initiatives. North America and Europe, while possessing smaller agricultural sectors, represent the highest-value markets due to stringent organic labeling standards, high per capita income supporting premium organic produce consumption, and established distribution networks for specialty biofertilizers. The Latin American and Middle Eastern and African (MEA) regions are emerging swiftly, fueled by climate change mitigation efforts that favor soil carbon sequestration through organic amendments and the necessity to optimize water usage in drought-prone areas, a key benefit provided by vermicompost application, which enhances soil moisture retention capabilities.

Segment trends highlight the dominance of the African nightcrawler (Eudrilus eugeniae) segment in terms of processing efficiency in warmer climates, while the European nightcrawler (Eisenia fetida) remains crucial in temperate zones, dictating raw material processing technologies and regional production feasibility. In terms of application, the horticulture and landscaping segment shows the fastest growth rate, driven by urbanization and the demand for maintaining pristine public green spaces and high-quality nurseries. Crucially, the end-user segment is shifting, with large-scale commercial organic farms increasingly replacing smaller, subsistence-level operations as the primary revenue generators for industrial-grade vermicompost producers, demanding bulk orders and competitive pricing structures, which forces producers to prioritize operational scaling and process automation to maintain acceptable margins and fulfill supply consistency requirements throughout the peak agricultural seasons.

AI Impact Analysis on Vermicompost Market

User inquiries regarding the integration of Artificial Intelligence (AI) in the Vermicompost Market primarily revolve around optimizing operational efficiency, enhancing product quality control, and improving supply chain predictability. Common concerns focus on how machine learning algorithms can analyze complex biological and environmental variables—such as temperature, moisture content, pH levels, and feedstock composition—to precisely manage the vermiculture environment, minimizing risks like overheating or nutrient depletion, which are crucial for maintaining optimal earthworm health and maximizing conversion rates. Users are keenly interested in predictive analytics for demand forecasting based on seasonal agricultural cycles and climate patterns, allowing producers to align production volume accurately. Furthermore, there is significant interest in using Computer Vision and robotics for automating tedious tasks such as initial feedstock sorting, quality inspection of the finished product, and efficient, non-invasive harvesting of castings, reducing labor costs and ensuring homogeneity in the final product output.

- AI-driven optimization of climate control systems within large-scale vermiculture beds to maintain ideal moisture and temperature, maximizing earthworm productivity and waste conversion efficiency.

- Predictive modeling using machine learning to forecast nutrient profiles (N-P-K content) in the final vermicompost based on initial feedstock characteristics and processing duration, ensuring consistent product quality.

- Automation of feedstock sorting processes utilizing Computer Vision to detect and remove harmful contaminants (e.g., plastics, metals) before feeding, improving safety and purity.

- Demand forecasting and inventory management optimization using sophisticated algorithms that analyze agricultural planting schedules, regional weather patterns, and market pricing fluctuations.

- Implementation of AI in robotics for precision harvesting and automated packaging, reducing manual labor dependency and increasing throughput for industrial operations.

- Diagnostic support systems leveraging AI to identify early signs of earthworm stress, disease, or predatory infestations based on sensory data analysis, enabling proactive intervention and minimizing batch loss.

DRO & Impact Forces Of Vermicompost Market

The dynamics of the Vermicompost Market are heavily influenced by a confluence of driving factors rooted in global sustainability goals, restraints related to scalability and perception, and significant opportunities arising from innovative applications and regulatory shifts. Key drivers include the accelerated shift towards organic and sustainable farming methods globally, spurred by consumer demand for healthier food and stricter environmental regulations curtailing the use of synthetic fertilizers and pesticides. Simultaneously, major restraints center on the inherent challenges of large-scale standardized production, including the slow biological conversion process, the dependence on high-quality and consistent organic feedstock supply, and the lack of awareness among conventional farmers regarding the economic benefits and appropriate application techniques of vermicompost relative to cheaper, readily available chemical alternatives. Opportunities are vast, primarily in utilizing vermicompost for specialized high-value applications, such as hydroponics and vertical farming media, and expanding into global markets requiring certified organic inputs. These interacting forces create a complex market environment where strategic innovation in processing technology and distribution efficiency is paramount for overcoming biological limitations and capitalizing on macro-environmental tailwinds supporting bio-based inputs.

Impact forces acting upon the market are largely defined by external regulatory pressures and technological advancements. Regulatory forces, particularly the implementation of stricter environmental protection laws regarding waste disposal and soil quality maintenance in developed economies, significantly amplify the necessity and adoption of vermicompost as a viable, sustainable solution for waste valorization. Economic impact forces include the fluctuating prices of synthetic fertilizers, which, when high, make vermicompost a more cost-effective alternative for certain crops, boosting market penetration. Socially, the increasing consumer preference for ethically sourced and environmentally friendly products drives retail demand for organic produce, subsequently fueling the demand for organic inputs like vermicompost. Technological impact forces are crucial; innovations in reactor design, bio-processing techniques, and quality assurance methodologies are essential for reducing production cycles, ensuring nutrient consistency, and increasing the overall competitiveness and market acceptance of industrialized vermicompost products against highly standardized chemical inputs.

The overall market trajectory is strongly positive, driven by the structural imperative to transition global agriculture away from high-impact chemical reliance toward regenerative practices. However, operational bottlenecks, particularly related to the logistics of managing large volumes of heterogeneous organic waste and the temperature sensitivity of earthworm populations, present persistent challenges that require continuous investment in R&D and specialized infrastructure. Overcoming these restraints necessitates a concerted effort among producers, academic institutions, and policymakers to standardize production protocols, develop robust supply chain traceability systems, and subsidize adoption to bridge the initial cost difference compared to conventional fertilizers. The long-term opportunities inherent in carbon sequestration benefits and enhanced agricultural resilience position the vermicompost market for sustained, exponential growth, provided that scalability and standardization hurdles are effectively addressed through technology and regulatory harmonization.

Segmentation Analysis

The Vermicompost Market is strategically segmented based on factors such as type of earthworm used, feedstock source, application area, and geographical distribution, which allows for detailed market assessment and targeted strategy development. Understanding these segments is crucial for identifying areas of high growth potential and tailoring product offerings to meet specific end-user requirements, whether they pertain to large-scale commercial agriculture or specialty horticulture. The feedstock segment, particularly, provides insights into the integration opportunities with waste management industries, determining the long-term sustainability and cost structure of vermicompost production facilities. Regional segmentation highlights differential adoption rates driven by varying climate conditions, regulatory environments, and prevailing agricultural practices across continents, with key divergences observed between mature organic markets and rapidly developing agricultural economies focusing on yield enhancement.

- By Type

- African Nightcrawler (Eudrilus eugeniae)

- Red Wiggler (Eisenia fetida)

- European Nightcrawler (Lumbricus rubellus)

- Others (e.g., Perionyx excavatus)

- By Application

- Farming (Commercial Organic Farming, Conventional Farming)

- Horticulture (Nurseries, Greenhouses)

- Home Gardening and Lawn Care

- Landscaping and Sports Turf

- Others (e.g., Soil Remediation, Aquaculture Feed)

- By Feedstock

- Agricultural Waste (Crop Residues, Bagasse)

- Animal Manure (Cow Dung, Poultry Litter, Pig Manure)

- Organic Waste from Food Processing

- Bio-slurry and Sewage Sludge

- Others (e.g., Forest Litter)

- By Packaging and Form

- Bulk (Truckloads, Large Sacks)

- Packaged (Bags, Containers)

- Liquid Vermicompost (Vermiwash)

- By Region

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Vermicompost Market

The value chain of the Vermicompost Market begins with the Upstream activities, which involve the critical sourcing and pre-processing of organic feedstock. This stage requires efficient collection logistics for high-volume materials such as animal manure from dairies or agricultural residues from farms, followed by conditioning (e.g., partial composting, moisture adjustment) to make the substrate suitable for earthworm habitation. Key upstream suppliers include large commercial farming operations, municipal waste management bodies, and specialized suppliers providing earthworm stock of specific species. The efficiency of this initial stage directly impacts the cost of raw materials and the final nutrient profile of the product. Optimization efforts in the upstream segment are currently focused on reducing transportation costs and ensuring the consistent quality and absence of heavy metal contamination in the feedstock to meet stringent organic certification standards imposed in developed markets.

The core production stage involves the vermiculture process itself, encompassing bedding preparation, earthworm inoculation, feeding cycles, environmental monitoring (temperature, moisture, aeration), and the biological conversion phase. Downstream activities commence with harvesting the vermicast, followed by crucial post-processing steps such as screening to remove residual debris and earthworms, curing, and packaging, often involving specific technologies for granulation or conversion into liquid form (vermiwash). Quality control is essential downstream, requiring laboratory testing to verify nutrient content, microbial activity, and absence of pathogens before distribution. Effective downstream management ensures the final product meets commercial specifications and is shelf-stable, ready for deployment across diverse agricultural applications ranging from precision farming to bulk soil amendment projects.

Distribution channels for vermicompost are categorized into Direct and Indirect channels. Direct sales often target large commercial organic farms, government agricultural projects, and bulk buyers like landscaping companies, enabling producers to secure higher margins and maintain closer relationships with high-volume users. Indirect channels rely heavily on established networks, including agricultural input cooperatives, specialized distributors of biofertilizers, gardening retail stores, and e-commerce platforms, particularly for smaller, packaged consumer-focused products. The choice of channel depends on the product form and target customer, with bulk sales typically moving through specialized logistics providers, while packaged goods utilize general retail and digital fulfillment networks. The complexity of handling bulk organic material and maintaining quality during transit makes robust, cold-chain-like logistics essential, especially for liquid vermiwash products, influencing the competitive landscape and regional market penetration strategies employed by leading manufacturers.

Vermicompost Market Potential Customers

The primary End-Users or Buyers in the Vermicompost Market are categorized based on the scale and nature of their agricultural operations, exhibiting distinct purchasing behaviors and product requirements. Large-scale commercial organic farms constitute a critical segment, demanding bulk quantities of high-quality, standardized vermicompost, often requiring specific nutrient ratios tailored to their crop cycles and soil testing results. These commercial buyers prioritize consistency, supply reliability, and favorable pricing negotiated through long-term supply contracts, using vermicompost as a staple input to meet strict organic certification prerequisites and enhance overall yield without compromising soil health. Their purchasing decisions are highly influenced by verifiable field trial data and the demonstrated return on investment achieved through improved crop quality and resistance.

The horticulture and landscaping sector represents another significant customer base, encompassing commercial nurseries, greenhouse operators, and professional landscaping service providers responsible for maintaining public parks, golf courses, and residential properties. These buyers often seek packaged, high-purity vermicompost for specialized applications such as potting mixes, seed starting, and aesthetic plant maintenance, where superior soil structure and sustained nutrient release are crucial for premium plant appearance and health. This segment is less price-sensitive than bulk agriculture but demands exceptional product purity, fine texture, and readily available, localized supply through retail garden centers and specialized supply houses.

Additionally, small-scale farmers, home gardeners, and hobbyists form a substantial consumer segment, relying on packaged vermicompost for their immediate needs, driven primarily by personal preferences for sustainable practices and interest in chemical-free produce for household consumption. Government and institutional buyers, including agricultural research institutes, state farming corporations, and soil remediation project managers, are also major buyers, often procuring large volumes for national soil health initiatives, demonstration farms, or environmental restoration projects, where the proven ecological benefits of vermicompost align directly with public policy objectives related to sustainability and environmental quality improvement. The diversity across these end-user profiles necessitates a multi-faceted marketing and distribution strategy for market participants.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 15.6 Billion |

| Growth Rate | 17.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Suman Vermicompost, MyNOKE, California Organic Fertilizer, The Worm Farm, Kothari Group, Swagat Vermiculture, Agrilife, Jiva Organic, Dirt Dynasty, Pacific Ag, Neptune’s Harvest, Sri Biotech, VermiGrow, Biotech Agro, Vermi Organics, KR BIO, NV Organics, TerraVesco, Worm Power, Black Diamond Vermicompost |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Vermicompost Market Key Technology Landscape

The technological landscape of the Vermicompost Market is rapidly evolving, driven by the need to shift from labor-intensive, batch-oriented operations to mechanized, continuous flow systems that ensure scalability and product uniformity. A core technological advancement lies in the optimization of continuous flow vermireactors, which utilize gravity or mechanical systems to gradually introduce feedstock and systematically harvest vermicast, significantly reducing labor input and operational footprint compared to traditional windrow or bin methods. These modern reactor designs incorporate advanced monitoring systems based on IoT sensors to track essential parameters such as temperature, moisture, dissolved oxygen, and pH levels in real-time. This precise environmental control minimizes system upsets, ensures optimal earthworm health, and accelerates the composting process, thereby increasing overall facility throughput and output consistency, a key requirement for satisfying large commercial farm contracts.

Post-processing technology is equally vital for market competitiveness. This includes sophisticated screening and sieving equipment designed to separate the fine vermicast from larger unconverted organic matter and earthworms with minimal damage, ensuring a high-quality, uniform final product texture suitable for modern agricultural spreaders and application systems. Furthermore, technology related to the production of liquid vermicompost, or vermiwash, involves specialized extraction, aeration, and stabilization techniques to preserve the high concentration of beneficial microorganisms, plant hormones, and enzymes found in the liquid effluent. Packaging technologies are also improving, focusing on vacuum sealing, nitrogen flushing, and durable, UV-resistant materials to extend the product’s shelf life and maintain microbial viability during storage and extended transport across diverse climate zones, critical for serving international markets.

Finally, emerging technologies are focused on feedstock pretreatment and waste characterization to enhance the efficiency of the biological process. This includes mechanical shredding, microbial inoculation, and specialized partial thermophilic composting prior to vermiculture, which detoxifies the waste and ensures a homogeneous, easily digestible substrate for the earthworms, leading to faster conversion rates and superior nutrient content in the final product. Research into genetic selection and propagation of robust earthworm species that exhibit higher tolerance to environmental fluctuations and faster breeding cycles is also a key area of technological investment, aiming to improve the biological input side of the production chain. These technological integrations allow producers to position their product as a premium, technologically derived biofertilizer, moving beyond the perception of vermicompost merely as recycled waste material and solidifying its role as a high-performance agricultural input essential for the modern sustainable economy.

Regional Highlights

- Asia Pacific (APAC): APAC dominates the global vermicompost market due to the sheer size of its agricultural sector, high population density leading to significant organic waste generation, and strong government support for organic farming initiatives, particularly in countries like India, China, and Southeast Asian nations. Subsidies, large-scale rural development programs, and mandatory waste-to-wealth policies accelerate adoption rates, making this region a powerhouse for both production and consumption, characterized by a mix of small-scale traditional units and large industrial facilities integrated with agricultural cooperatives.

- North America: This region is characterized by high consumer awareness regarding organic food and premium pricing, driving demand for high-quality, certified organic inputs. The market here focuses heavily on specialty applications like turf management (golf courses, sports fields) and professional horticulture. Technological adoption in processing, including automation and advanced quality control, is highest here, positioning North America as a high-value, albeit smaller volume, market driven by stringent regulatory standards and robust R&D investment in biostimulant functionality.

- Europe: Europe exhibits steady growth, primarily driven by the European Union’s Farm to Fork Strategy and Green Deal, which mandate a significant reduction in chemical fertilizer use and encourage ecological farming practices. Key markets like Germany, France, and the UK prioritize quality and traceability. Vermicompost manufacturers in this region often focus on premium, packaged products and liquid formulations (vermiwash) marketed as biostimulants, benefiting from established logistics networks and mature consumer acceptance of environmentally friendly agricultural products.

- Latin America (LATAM): LATAM is rapidly emerging, fueled by its vast agricultural export base and the need to restore soil fertility in heavily farmed areas. Countries like Brazil and Mexico are witnessing increased large-scale production, driven by favorable climate conditions for vermiculture and growing demand for organic exports destined for North American and European markets. The region focuses on integrating vermicomposting with livestock operations to efficiently manage manure waste and generate secondary revenue streams.

- Middle East and Africa (MEA): Growth in MEA is primarily motivated by the need for improved water retention capabilities in arid and semi-arid agricultural lands, which vermicompost significantly aids, and food security initiatives. Governments are actively exploring sustainable soil amendments to maximize efficiency under water scarcity constraints. The market is concentrated in nations like South Africa, Egypt, and Saudi Arabia, often supported by government-backed pilot projects focusing on desert reclamation and high-value crop production under protected cultivation (greenhouses).

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Vermicompost Market.- Suman Vermicompost

- MyNOKE

- California Organic Fertilizer

- The Worm Farm

- Kothari Group

- Swagat Vermiculture

- Agrilife

- Jiva Organic

- Dirt Dynasty

- Pacific Ag

- Neptune’s Harvest

- Sri Biotech

- VermiGrow

- Biotech Agro

- Vermi Organics

- KR BIO

- NV Organics

- TerraVesco

- Worm Power

- Black Diamond Vermicompost

Frequently Asked Questions

Analyze common user questions about the Vermicompost market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver for the current high growth rate of the Vermicompost Market?

The primary driver is the accelerating global shift towards organic farming and sustainable agricultural practices, fueled by stringent government regulations against chemical fertilizers and increasing consumer demand for organic, chemical-free food products. This structural demand requires inputs like vermicompost to maintain soil health and obtain necessary organic certifications.

How does vermicompost production contribute to waste management and the circular economy?

Vermicompost production is a highly efficient bio-conversion process that transforms diverse organic wastes, such as animal manure and agricultural residues, into valuable soil amendments. This process significantly reduces landfill waste volume and methane emissions, effectively closing the nutrient loop and contributing fundamentally to circular economic models in waste valorization.

What is the main challenge facing large-scale commercial vermicompost producers?

The main challenge is achieving standardization and consistency in product nutrient profile and quality across large production batches. This is due to the inherent variability of organic feedstock and the biological nature of the process, requiring significant investment in advanced monitoring, climate control technologies, and rigorous post-processing quality assurance protocols.

Which geographical region holds the largest market share for vermicompost and why?

The Asia Pacific (APAC) region holds the largest market share. This dominance is attributed to its massive agricultural base, supportive government policies promoting soil health and organic transition, and high volumes of accessible agricultural and animal waste suitable for feedstock, particularly in key agricultural economies like India and China.

Beyond soil amendment, what are the emerging applications for vermicompost?

Emerging applications include the use of vermicompost derivatives, such as liquid vermiwash, as potent biostimulants and bio-pesticides in specialized agriculture, including hydroponics and vertical farming systems. Additionally, it is increasingly utilized in large-scale environmental soil remediation projects to restore microbial diversity and aid in heavy metal sequestration.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager