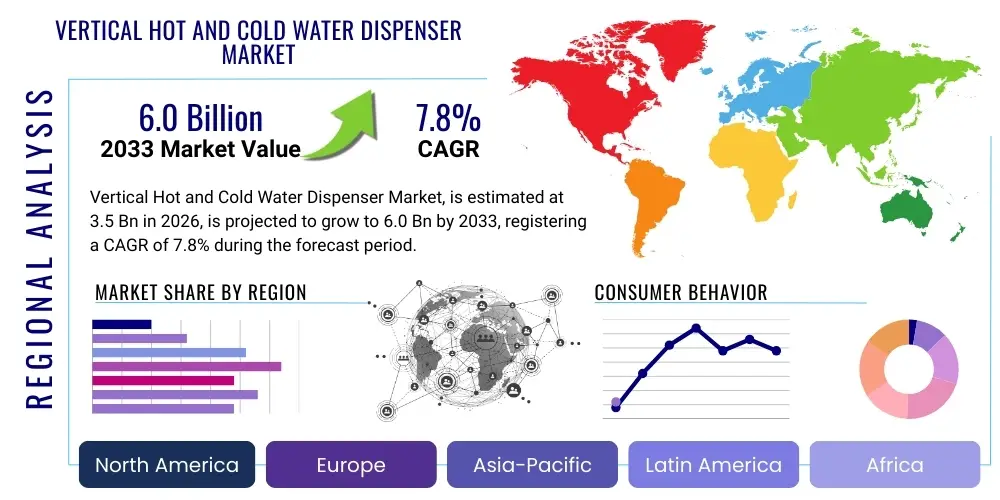

Vertical Hot and Cold Water Dispenser Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442853 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Vertical Hot and Cold Water Dispenser Market Size

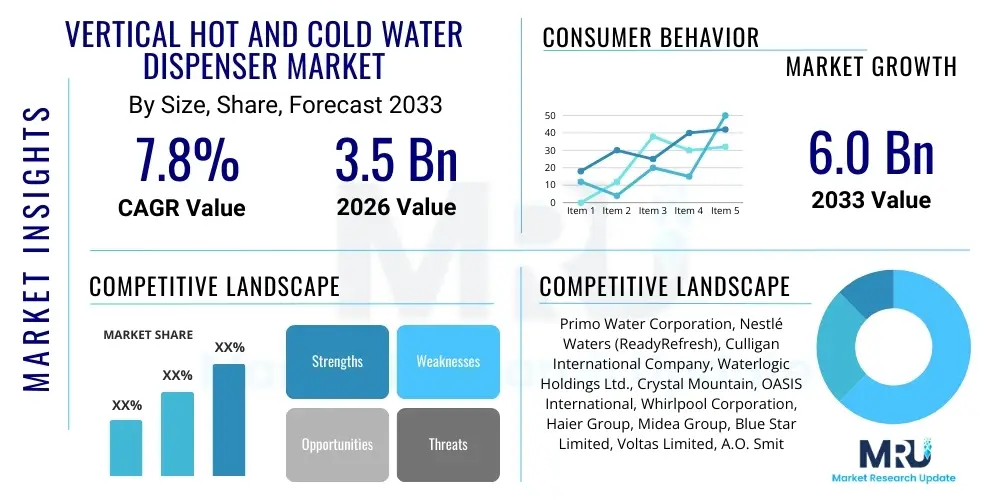

The Vertical Hot and Cold Water Dispenser Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 6.0 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by increasing consumer awareness regarding water quality, coupled with the rising demand for convenient, instant access to temperature-controlled drinking water in both residential and commercial settings. The rapid urbanization across emerging economies and the enhanced focus on office hydration and employee wellness initiatives are significant contributing factors underpinning this robust market valuation and growth trajectory over the next decade.

The market valuation reflects a fundamental shift in consumer behavior away from traditional water consumption methods, emphasizing instant gratification and hygiene. The integration of advanced filtration technologies, such as UV sterilization and reverse osmosis (RO), within vertical dispenser units is enhancing product value and justifying higher price points, thus boosting the overall market size in monetary terms. Furthermore, regulatory support in developed regions promoting clean drinking water standards, coupled with technological advancements in energy-efficient cooling and heating mechanisms, contribute significantly to the positive market outlook, ensuring sustainable growth throughout the forecast period and solidifying the market's trajectory towards the projected valuation.

Geographic expansion, particularly into the Asia Pacific region, which exhibits high population density and increasing disposable incomes, plays a critical role in scaling the market size. Manufacturers are consistently innovating designs to cater to aesthetic preferences and space constraints inherent in modern living and working environments. This dedication to product diversification, including smart features and compact vertical designs, ensures broader market penetration across various socioeconomic groups, reinforcing the market’s calculated growth rate and validating the aggressive forecast reaching USD 6.0 Billion by 2033.

Vertical Hot and Cold Water Dispenser Market introduction

The Vertical Hot and Cold Water Dispenser Market encompasses the manufacturing, distribution, and sales of freestanding or floor-mounted appliances designed to dispense purified drinking water at dual temperature settings: instant hot water and chilled cold water. These sophisticated appliances offer superior convenience, eliminating the need for separate kettles or refrigeration units for drinking water. Product designs prioritize space efficiency, fitting seamlessly into modern kitchens, corporate breakrooms, healthcare facilities, and public spaces where aesthetics and utility are equally important. The core functionality centers on high-efficiency cooling compressors and rapid heating elements, often combined with multi-stage filtration systems, including carbon filters, sediment filters, and optional advanced purification technologies like UV light, ensuring both safety and palatability of the dispensed water.

Major applications for vertical hot and cold water dispensers span residential usage, institutional settings such as schools and universities, and commercial environments including offices, retail stores, and hospitality venues. The primary benefit derived by end-users is unparalleled convenience and hydration promotion; these devices deliver instant hot water for beverages like tea and coffee, and refreshingly cold water, encouraging consistent water intake. Key driving factors propelling market expansion include rising health consciousness regarding tap water contaminants, the global push towards sustainable practices (reducing plastic bottle consumption), and the growing preference for automated home and office solutions that simplify daily tasks. Furthermore, the aesthetic appeal of sleek, modern vertical designs is increasing their adoption as essential kitchen and workplace fixtures.

Market introduction involves rigorous product testing to meet international safety and energy efficiency standards, such as those set by regulatory bodies like the FDA or CE. Successful market entry relies heavily on establishing robust distribution networks, often leveraging partnerships with appliance retailers, e-commerce platforms, and specialized water supply services. The continuous technological evolution, focusing on features like touchless operation, self-cleaning capabilities, and IoT integration for monitoring filter life and water quality, ensures sustained market relevance. This dedication to integrating convenience, safety, and smart technology positions vertical dispensers as critical components of contemporary living and working infrastructure, driving sustained demand across various international markets and socioeconomic strata.

Vertical Hot and Cold Water Dispenser Market Executive Summary

The Vertical Hot and Cold Water Dispenser Market is experiencing strong growth, primarily fueled by global urbanization and increased health-consciousness. Key business trends include the shift towards Bottleless (Point-of-Use or POU) systems, offering enhanced environmental sustainability and lower operational costs compared to traditional bottled dispensers. Technological innovation is focused on integrating smart connectivity (IoT) for real-time diagnostics, maintenance scheduling, and usage tracking, appealing strongly to corporate and high-end residential segments. The competitive landscape is characterized by moderate consolidation, with major appliance manufacturers competing intensely through product differentiation, extended warranty schemes, and efficient after-sales service networks. Furthermore, the expansion of e-commerce channels has significantly broadened the geographic reach of smaller, specialized manufacturers, intensifying market competition and accelerating product obsolescence cycles, demanding continuous innovation from market leaders.

Regional trends indicate that the Asia Pacific (APAC) region, led by China and India, is poised to exhibit the highest growth rate, driven by rapid infrastructural development, increasing middle-class disposable income, and inadequate public water infrastructure quality necessitating in-home filtration solutions. North America and Europe, representing mature markets, show steady growth focused on premium features such as advanced purification (e.g., alkaline water, mineralization) and aesthetic integration into office and home designs, emphasizing energy efficiency and ergonomic design. Conversely, the Middle East and Africa (MEA) market is seeing accelerated adoption due to climate conditions necessitating readily available cold water and concerns over localized water scarcity and quality. These divergent regional needs necessitate tailored marketing and product strategies, focusing either on volume and affordability (APAC) or premium features and sustainability (North America/Europe).

Segmentation trends highlight the dominance of the POU segment due to its long-term cost-effectiveness and eco-friendly attributes compared to the traditional bottled segment. Application-wise, the commercial and institutional sectors remain the largest revenue generators, driven by stringent workplace safety and health regulations, encouraging employers to invest in high-quality hydration solutions. Moreover, within the residential segment, there is a growing demand for compact, highly efficient models with advanced safety features (e.g., child locks for hot water), reflecting heightened consumer expectations for convenience and safety. The ongoing material science improvements are also paving the way for dispensers made from antimicrobial or recycled materials, responding to both hygiene concerns and sustainability mandates, profoundly influencing purchasing decisions across all end-user segments.

AI Impact Analysis on Vertical Hot and Cold Water Dispenser Market

User queries regarding the impact of Artificial Intelligence (AI) on the Vertical Hot and Cold Water Dispenser Market frequently center on predictive maintenance capabilities, enhanced user experience through personalization, and the integration of smart home ecosystems. Users are primarily concerned with whether AI can reduce operational downtime by predicting component failures (like compressors or filters) before they occur, thus lowering long-term ownership costs. There is significant interest in how AI algorithms can optimize energy consumption based on historical usage patterns, responding to peak and off-peak demand cycles, which addresses the sustainability goals of corporate buyers. Furthermore, consumers anticipate AI integration to personalize dispensed water parameters, such as controlling temperature variations or dispensing measured volumes automatically based on learned user preferences or external health metrics. The synthesis of these common questions reveals an expectation that AI will transform the dispenser from a simple utility appliance into a proactive, efficient, and personalized hydration hub, moving beyond basic automation into genuine predictive intelligence and adaptive functionality.

AI's influence is transforming the maintenance and operational efficiency paradigm for vertical water dispensers. By leveraging embedded sensors that monitor parameters like flow rates, cooling cycles, heating element efficiency, and water quality metrics, AI algorithms can analyze this vast data stream to identify subtle anomalies indicative of impending failure. This predictive diagnostic capability allows service providers to dispatch technicians with the correct parts only when necessary, drastically reducing unnecessary visits and maximizing the lifespan of the unit while minimizing disruption for the end-user. This optimization of service logistics represents a substantial competitive advantage, ensuring higher uptime and enhanced customer satisfaction, especially critical in high-traffic commercial environments where continuous operation is paramount.

Beyond maintenance, AI is crucial for optimizing the user interaction and promoting healthier hydration habits. Smart dispensers powered by AI can learn the daily routines of users in a shared environment (like an office) or a residential setting, pre-heating or pre-cooling water reservoirs just before anticipated peak usage times, thereby reducing standby energy consumption and ensuring instant availability. Future iterations are expected to integrate with wearable health technology, potentially adjusting mineral levels or suggesting optimal intake schedules based on an individual’s physiological needs, moving the device toward becoming an active health management tool. This convergence of IoT, AI, and personalization is redefining the value proposition of modern water dispensing technology, justifying premium pricing and driving advanced adoption rates among tech-savvy consumers and sustainability-focused organizations globally.

- Predictive maintenance alerts based on real-time component performance monitoring.

- Optimized energy consumption through AI learning of daily usage patterns and demand forecasting.

- Personalized dispensing settings, including preferred temperature, volume, and optional mineral infusion based on user profiles.

- Automated diagnostics for self-cleaning cycles and filter replacement scheduling.

- Integration with smart home and commercial building management systems (BMS) for centralized control.

- Enhanced security features such as anomaly detection for potential tampering or leaks.

DRO & Impact Forces Of Vertical Hot and Cold Water Dispenser Market

The Vertical Hot and Cold Water Dispenser Market is shaped by a confluence of robust drivers, persistent restraints, and significant emerging opportunities, collectively defining the impact forces influencing its growth trajectory. The primary driver is the pervasive global health and hygiene awareness, particularly post-pandemic, which has intensified demand for touchless operation and multi-stage filtration capabilities, assuring users of contaminant-free water access. Coupled with this is the escalating rate of urbanization across developing nations, which often correlates with compromised municipal water supplies, prompting households and businesses to seek reliable in-premise purification and dispensing solutions. These core drivers, emphasizing safety, convenience, and health, provide the foundational momentum for market expansion. However, the market faces headwinds primarily from the relatively high initial capital outlay required for high-end POU dispensers and the recurring maintenance costs associated with filter replacements and periodic servicing, which can deter budget-conscious consumers in certain regions.

A key opportunity presenting itself to market participants lies in the rapid advancement and consumer acceptance of smart home and office technologies. Integrating vertical dispensers with IoT platforms allows manufacturers to offer value-added services such as remote monitoring, automated supply chain replenishment for consumables (filters, CO2 canisters), and data analytics on water consumption patterns for corporate clients seeking sustainability reporting metrics. Furthermore, focusing on product line diversification, specifically developing compact, highly aesthetic models tailored for small apartments or niche markets like recreational vehicles (RVs) and small clinics, offers substantial untapped revenue potential. The successful realization of these opportunities requires significant investment in research and development, particularly in improving energy efficiency and reducing the acoustic footprint of the dispensing units, making them more appealing for residential adoption where noise is a critical factor.

The inherent impact forces dictate intense competition and a constant requirement for innovation. Consumer demand for sustainable products necessitates that manufacturers prioritize the use of recyclable materials and develop energy-efficient cooling technologies (e.g., heat pump technology). The regulatory environment, particularly concerning certifications for water safety (NSF, WQA), acts as a necessary barrier to entry, ensuring product quality but demanding substantial compliance investment from new players. Ultimately, the market trajectory is determined by the balance between the convenience offered by instantaneous temperature control and purification (Driver) versus the perceived high Total Cost of Ownership (TCO) and the infrastructural challenges in regions with unreliable electricity supply (Restraints). Navigating this complex interplay of forces requires strategic pricing, robust service delivery, and continuous technological advancement to convert opportunities into sustainable market share gains, ensuring the projected CAGR is met consistently through the forecast period.

Segmentation Analysis

The Vertical Hot and Cold Water Dispenser Market is comprehensively segmented based on three critical parameters: product type, application, and distribution channel, providing a granular view of market dynamics and targeted consumer groups. Product Type segmentation distinguishes between Bottled Dispensers, which rely on external water jugs (typically 3- or 5-gallon bottles), and Point-of-Use (POU) Dispensers, which connect directly to the municipal water line and utilize internal filtration systems. This delineation is crucial as POU systems are rapidly gaining market share due to their convenience, lower long-term operating costs, and reduced environmental footprint associated with plastic bottle waste and transportation. Manufacturers are strategically focusing their R&D efforts on enhancing the filtration efficiency and purification stages within POU models, catering to the increasing consumer demand for high-quality, continuous water access without the hassle of bottle management.

Application analysis segments the market into Residential, Commercial, and Institutional end-users, reflecting highly diverse requirements for volume capacity, operational durability, and aesthetic integration. Commercial environments, encompassing offices, retail spaces, and manufacturing facilities, demand high-capacity, robust units capable of handling continuous use and often prioritizing touchless operation for hygiene compliance. Institutional settings, such as schools, hospitals, and government offices, typically require specialized units adhering to strict health and safety standards, including features like anti-scald protection and specialized filters for sensitive populations. The residential segment, while requiring lower volume capacity, drives innovation in compact design, noise reduction, and smart features, reflecting the consumer desire for integration with modern home technology and sophisticated aesthetics, making segment-specific marketing essential.

The Distribution Channel segmentation analyzes how products reach the end consumer, primarily categorized into offline channels (traditional retail stores, specialized appliance dealers, and direct sales/contract distribution) and online channels (e-commerce platforms and company websites). The rapid expansion of e-commerce has democratized market access, allowing smaller brands to compete effectively and offering consumers a wide variety of models and competitive pricing. However, for the high-volume commercial sector, direct sales and contract distribution remain vital due to the necessity of professional installation, ongoing maintenance contracts, and bulk purchasing agreements. Understanding the regional variation in preferred distribution channels—for instance, heavy reliance on specialized dealers in Europe versus widespread e-commerce adoption in North America and parts of Asia—is paramount for optimizing logistical efficiency and achieving comprehensive market coverage, ensuring products are available where the target customer prefers to purchase and receive support.

- Product Type:

- Bottled Dispensers (Top-loading, Bottom-loading)

- Point-of-Use (POU) / Bottleless Dispensers

- Application:

- Residential

- Commercial (Offices, Retail, Manufacturing)

- Institutional (Hospitals, Schools, Government)

- Distribution Channel:

- Offline (Retail Stores, Dealer Networks)

- Online (E-commerce, Company Websites)

- Technology:

- Standard Filtration (Carbon/Sediment)

- Advanced Purification (RO, UV, Alkaline)

- Operation:

- Touchless/Sensor-Operated

- Manual Faucet/Push-Button

Value Chain Analysis For Vertical Hot and Cold Water Dispenser Market

The value chain for the Vertical Hot and Cold Water Dispenser Market begins with upstream activities focused on raw material sourcing and component manufacturing. This stage involves securing high-grade plastics for the housing and reservoirs, stainless steel for internal tanks and piping, and essential electronic components such as compressors, heating elements, thermostats, and advanced filtration media (e.g., specialized membranes and activated carbon). Efficiency in the upstream segment relies heavily on establishing stable supply contracts and adhering to stringent quality control standards for core components, particularly the energy-intensive cooling systems, which significantly impact the final product’s reliability and operational cost. Strategic partnerships with specialized component suppliers, especially those providing IoT modules and UV sterilization technology, are crucial for maintaining a technological edge and optimizing the cost structure during the manufacturing phase.

The midstream phase encompasses assembly and manufacturing, where components are integrated into the final vertical dispenser unit. This phase is characterized by sophisticated assembly line processes, rigorous safety testing (electrical and pressure resistance), and quality assurance checks to ensure compliance with regional health and appliance standards (e.g., ISO, CE, UL). Manufacturers must manage complex logistics, including inventory control for diverse models tailored to different market specifications (e.g., voltage requirements, plug types, specialized filtration needs). Optimization in this stage focuses on lean manufacturing techniques to reduce waste, maximize throughput, and ensure the consistent quality necessary for durable, long-life appliances, which is a key purchase criterion for commercial clients. Effective in-house R&D capabilities drive innovation in energy recovery systems and noise reduction, improving overall product competitiveness.

Downstream activities involve the distribution channel, which bridges the gap between the manufacturer and the end-user. Distribution is segmented into direct sales (for large institutional or corporate contracts), indirect sales through appliance retailers, specialized water service dealers, and rapidly growing e-commerce platforms. Specialized distributors often provide value-added services such as professional installation, filter replacement subscriptions, and ongoing maintenance support, particularly for POU systems. Direct and indirect channels each serve distinct customer needs: direct channels prioritize customized solutions and long-term service agreements, while indirect channels emphasize broad availability and consumer convenience. Successful downstream operation hinges on maintaining strong inventory control across global networks and providing swift, reliable after-sales support, significantly influencing brand reputation and customer loyalty, especially in the highly competitive residential market segment.

Vertical Hot and Cold Water Dispenser Market Potential Customers

The primary end-users and buyers of vertical hot and cold water dispensers are broadly categorized into three distinct segments: Residential, Commercial, and Institutional, each possessing unique purchasing motivations and product requirements. Residential customers seek convenience, aesthetics, and child safety features, prioritizing compact, energy-efficient models that seamlessly integrate into kitchen designs. Their purchase decisions are heavily influenced by ease of use, brand trust, and the perceived health benefits of advanced filtration technologies such as RO and UV sterilization, often purchased through retail or e-commerce channels. For these buyers, the dispenser acts as a premium lifestyle appliance, justifying investment based on long-term health and convenience gains, aiming to reduce reliance on single-use plastic bottles.

Commercial potential customers, including corporate offices, retail stores, manufacturing plants, and hospitality venues (hotels, restaurants), represent the largest volume buyers. Their requirements center on durability, high dispensing capacity, reliability, and stringent hygiene standards, often favoring POU systems for efficiency and low operational expenditure. Purchasing decisions are typically driven by facility managers or HR departments, focused on improving employee wellness, meeting occupational safety standards, and ensuring a professional, clean environment for clients and staff. These customers frequently enter into long-term contracts with direct distributors for installation, scheduled maintenance, and bulk filter replenishment, valuing uninterrupted service and immediate technical support above initial unit cost.

Institutional buyers, such as schools, universities, hospitals, and government facilities, prioritize highly robust, tamper-resistant, and high-flow dispensers that comply with specific public health regulations. In healthcare environments, advanced purification is mandatory, often requiring specialized anti-microbial surfaces and touchless operation to minimize cross-contamination risks. Educational institutions prioritize sturdy construction and prominent safety features, particularly child-lock mechanisms for hot water taps, while governmental organizations seek transparency in procurement and adherence to sustainability mandates. These customers generally require dispensers that offer superior longevity and ease of cleaning, procured via structured public tenders and long-term service level agreements (SLAs), making the Total Cost of Ownership (TCO) and adherence to safety certifications crucial factors in the procurement process.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 6.0 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Primo Water Corporation, Nestlé Waters (ReadyRefresh), Culligan International Company, Waterlogic Holdings Ltd., Crystal Mountain, OASIS International, Whirlpool Corporation, Haier Group, Midea Group, Blue Star Limited, Voltas Limited, A.O. Smith Corporation, Coway Co., Ltd., Xiaomi Corporation, Avalon Water Coolers, Honeywell International Inc., Electrolux AB, Aqua Clara International, Kenmore Appliances, LG Electronics. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Vertical Hot and Cold Water Dispenser Market Key Technology Landscape

The technological landscape of the Vertical Hot and Cold Water Dispenser Market is defined by continuous advancements focusing primarily on purification efficiency, energy conservation, and user interaction. Modern dispensers increasingly integrate multi-stage filtration technologies, moving beyond basic carbon and sediment filters to incorporate advanced purification methods such as Reverse Osmosis (RO) membranes for removing microscopic contaminants and UV-C light sterilization to eliminate bacteria and viruses without chemical additives. This combination of mechanical and disinfection technologies ensures the highest standard of water purity, addressing escalating public concerns about municipal water quality. Furthermore, the shift towards filterless self-sanitization methods, often using integrated ozone or chemical-free UV systems that routinely clean the internal water paths and reservoirs, is a critical innovation driving product differentiation and consumer confidence in hygiene.

Energy efficiency represents another crucial technological battlefield. Traditional compressor-based cooling systems are being refined for greater efficiency, while innovative alternatives such as thermoelectric cooling (Peltier effect) and highly efficient heat pump technologies are being explored, especially for smaller, residential units. Manufacturers are also implementing advanced insulation materials and smart thermostats that adjust cooling and heating cycles based on predicted demand or user input, significantly reducing electricity consumption during periods of standby or low usage. The adoption of certified components and adherence to strict energy performance standards (like Energy Star) is becoming a prerequisite for market viability, particularly in highly regulated Western markets where operational costs are scrutinized by corporate buyers seeking long-term savings and adherence to environmental, social, and governance (ESG) metrics.

The rise of the Internet of Things (IoT) and smart functionality is fundamentally transforming how dispensers are used and maintained. New generations of vertical dispensers feature Wi-Fi connectivity, allowing for remote monitoring of water quality, filter life status, and real-time consumption data, which is invaluable for commercial management. Sensor technologies are becoming increasingly sophisticated, enabling touchless operation via proximity sensors, which addresses growing hygiene concerns and improves accessibility. Moreover, the integration of AI capabilities, as previously discussed, facilitates predictive maintenance and usage optimization. These digital enhancements not only elevate the user experience through automation but also create new revenue streams for manufacturers via subscription services for monitoring, automatic filter delivery, and advanced technical support, firmly positioning the dispenser within the broader ecosystem of connected appliances and smart infrastructure.

Regional Highlights

The market dynamics for Vertical Hot and Cold Water Dispensers vary significantly across major global regions, influenced by economic development, climate, water infrastructure quality, and consumer preferences. North America, characterized by high disposable income and a strong corporate culture prioritizing employee benefits, represents a mature market segment. Adoption here is driven by the preference for premium POU systems with sophisticated filtration (e.g., alkaline or mineralized water options) and seamless, aesthetically pleasing designs suitable for modern office spaces and upscale residential areas. The focus remains on sustainable practices, compelling manufacturers to emphasize energy efficiency and waste reduction, supported by robust regulatory frameworks and well-established distribution and service networks.

The Asia Pacific (APAC) region is projected to be the engine of global growth, experiencing the highest CAGR over the forecast period. This exponential growth is underpinned by rapid urbanization, substantial population density, and significant infrastructural deficits in municipal water treatment, leading to high consumer demand for in-home and in-office purification solutions. Countries like China and India are characterized by a massive middle-class population eager to invest in consumer appliances that enhance health and convenience. While price sensitivity remains a factor, the shift towards POU systems is accelerating, driven by government initiatives to reduce plastic pollution and improvements in domestic manufacturing capabilities, allowing for competitive pricing of feature-rich models.

Europe presents a highly fragmented but substantial market, where demand is segmented geographically. Western Europe exhibits saturation but focuses heavily on high-specification, low-noise, and ultra-sustainable POU models, driven by strict EU energy and environmental directives. Eastern Europe, conversely, is experiencing rapid growth, mirroring APAC's dynamic, as businesses and affluent consumers upgrade from older, less efficient bottled systems. Latin America and the Middle East & Africa (MEA) are emerging markets showing vigorous expansion, primarily influenced by climatic conditions that necessitate readily available chilled water (MEA) and intermittent water quality issues (LATAM). Infrastructure stability and currency fluctuation remain key operational challenges in these regions, demanding that successful market penetration strategies focus on durable, cost-effective, and locally serviceable models that can withstand varying operational environments.

- Asia Pacific (APAC): Highest growth potential, fueled by urbanization, water quality concerns, and rising middle-class income; dominated by POU system adoption in corporate and institutional settings.

- North America: Mature market focusing on premiumization, IoT integration, energy efficiency, and advanced purification features (RO, alkaline).

- Europe: Growth driven by sustainability mandates and regulatory compliance; strong demand for ultra-low noise and aesthetically integrated POU models.

- Middle East & Africa (MEA): Rapid expansion driven by hot climate necessitating instant cold water access; market sensitive to price and robust product performance in challenging conditions.

- Latin America (LATAM): Growing adoption due to health awareness and regional variations in municipal water quality; focused on establishing stronger after-sales service infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Vertical Hot and Cold Water Dispenser Market.- Primo Water Corporation

- Nestlé Waters (ReadyRefresh)

- Culligan International Company

- Waterlogic Holdings Ltd.

- Crystal Mountain

- OASIS International

- Whirlpool Corporation

- Haier Group

- Midea Group

- Blue Star Limited

- Voltas Limited

- A.O. Smith Corporation

- Coway Co., Ltd.

- Xiaomi Corporation

- Avalon Water Coolers

- Honeywell International Inc.

- Electrolux AB

- Aqua Clara International

- Kenmore Appliances

- LG Electronics

Frequently Asked Questions

Analyze common user questions about the Vertical Hot and Cold Water Dispenser market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Bottled and Point-of-Use (POU) water dispensers?

Bottled dispensers utilize pre-filled 3 or 5-gallon jugs of water, requiring manual replacement, while Point-of-Use (POU) vertical dispensers connect directly to the existing water line, filtering and purifying municipal water on demand, eliminating the need for recurring bottle deliveries and storage. POU systems generally offer lower long-term operating costs and a reduced carbon footprint, making them the preferred choice for commercial installations seeking sustainability.

Are vertical hot and cold water dispensers energy efficient?

Modern vertical hot and cold water dispensers are increasingly energy efficient, particularly those with Energy Star certification. Manufacturers employ advanced insulation, smart thermostats, and optimized cooling cycles that use AI to learn usage patterns and reduce energy consumption during off-peak hours. While the instant hot water function is energy-intensive, overall energy usage is minimized compared to older models and separate appliances like kettles and refrigerators.

What advanced filtration technologies are most common in modern vertical dispensers?

The most common advanced filtration technologies include Reverse Osmosis (RO), which removes dissolved solids and contaminants, and UV-C Light Sterilization, which inactivates bacteria, viruses, and other pathogens without using chemicals. Many high-end POU models combine these technologies with activated carbon filters to improve taste and remove chlorine, ensuring comprehensive purification and the highest level of water quality for the end-user.

How is AI impacting the maintenance and functionality of water dispensers?

AI is primarily used for predictive maintenance by monitoring internal components and anticipating failures (like compressor wear or flow rate drops), alerting service providers before downtime occurs. Functionally, AI enables usage optimization, adjusting cooling/heating cycles based on learned demand patterns, and facilitating personalized temperature and volume settings, thereby enhancing reliability and user experience while simultaneously reducing operational energy consumption.

Which geographical region is expected to drive the highest growth in the Vertical Dispenser Market?

The Asia Pacific (APAC) region, specifically encompassing emerging economies like China and India, is forecast to exhibit the highest Compound Annual Growth Rate (CAGR). This growth is primarily fueled by rapid urbanization, increasing disposable income among the burgeoning middle class, and rising public awareness regarding the necessity of private, high-quality water purification solutions due to inconsistent municipal water infrastructure and stringent new corporate wellness mandates.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager