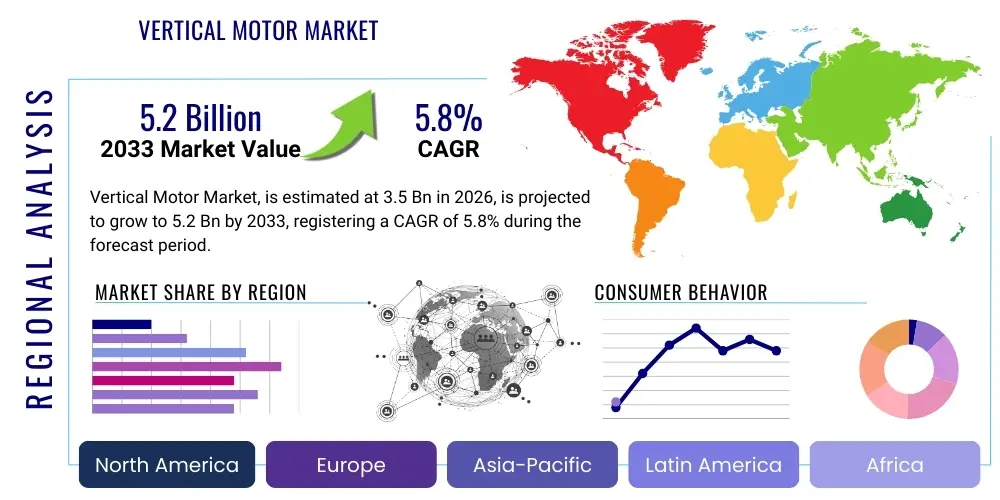

Vertical Motor Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441468 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Vertical Motor Market Size

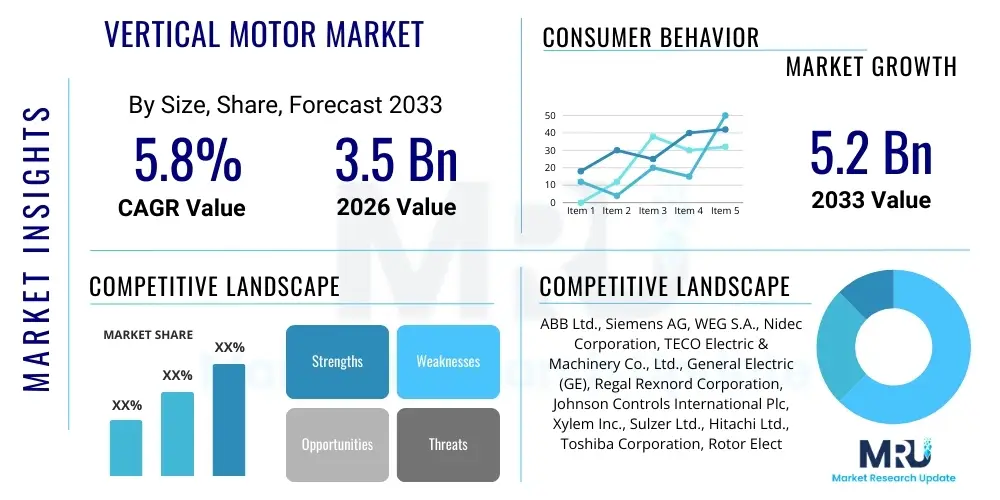

The Vertical Motor Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.2 Billion by the end of the forecast period in 2033.

Vertical Motor Market introduction

The Vertical Motor Market encompasses electric motors specifically designed for vertical mounting, characterized by features such as non-reverse ratchets, anti-friction bearings, and robust thrust bearing systems capable of managing significant downward thrust loads generated by coupled equipment, predominantly pumps. These motors are essential components in numerous critical infrastructure applications, including deep well pumping for agriculture and municipal water supply, as well as circulating pumps in HVAC systems and power generation cooling towers. Their unique mechanical configuration ensures reliable operation where the driven equipment is situated below the motor or requires vertical integration, optimizing footprint and fluid dynamics. The design complexity, particularly concerning bearing systems and lubrication, differentiates them significantly from standard horizontal motors, ensuring longevity and efficiency under challenging conditions.

Key product characteristics defining this market include variations in enclosure types (e.g., Totally Enclosed Fan Cooled - TEFC, Weather Protected Type I/II - WPI/WPII), horsepower ratings ranging from fractional to several thousand, and voltage requirements spanning low to medium voltage classes. Major applications are concentrated in the water and wastewater treatment sector, oil and gas processing (especially pipeline booster stations), and the increasingly important industrial cooling sector. The inherent ability of vertical motors to handle high axial thrust loads and their space-saving orientation are primary benefits driving their adoption across industries prioritizing operational stability and minimized installation footprint. Furthermore, modern vertical motor designs integrate advanced insulation and vibration monitoring capabilities to enhance predictive maintenance schedules and reduce overall lifecycle costs, making them indispensable in environments demanding high reliability.

Driving factors for sustained market growth include rapid urbanization, which necessitates expanded water infrastructure globally, and the continuous need for high-efficiency irrigation systems in arid and semi-arid regions. Regulatory mandates emphasizing energy efficiency, particularly in medium-voltage applications, are pushing manufacturers toward Premium Efficiency (IE3/NEMA Premium) and Super Premium Efficiency (IE4) vertical motors. Additionally, the proliferation of large-scale renewable energy projects, such as concentrated solar power, often relies on vertical pumping systems for thermal fluid circulation, further bolstering demand. The durability and specialized nature of these motors ensure sustained market relevance despite advancements in competing technologies, as the fundamental requirement for managing deep-set loads vertically remains constant.

Vertical Motor Market Executive Summary

The Vertical Motor Market is currently undergoing significant transformation, driven by robust industrial output and critical infrastructure investments worldwide, particularly within the Asia Pacific region which is witnessing unprecedented expansion in water resource management and chemical processing facilities. Current business trends indicate a strong shift towards intelligent vertical motors equipped with integrated sensors for real-time diagnostics and condition monitoring, facilitating the transition from reactive maintenance to advanced predictive maintenance strategies. This move is supported by industrial initiatives focused on maximizing uptime and reducing operational expenditures, with manufacturers focusing on modular designs that simplify field servicing and allow for quicker replacement of critical components like thrust bearings and seals. Furthermore, consolidation among key industry players, coupled with strategic partnerships targeting advanced material science for enhanced winding insulation and corrosion resistance, are defining the competitive landscape.

Regional dynamics illustrate that while North America and Europe maintain dominance in terms of high-value, specialized motor deployments (such as those for nuclear power cooling or specialized petrochemical pumping), the highest growth trajectory is centered in developing economies. The Asia Pacific region, fueled by large-scale infrastructure projects in India, China, and Southeast Asian nations related to wastewater recycling and large agricultural schemes, represents the most lucrative segment for standard and medium-voltage vertical motors. In contrast, the Middle East and Africa (MEA) market shows demand concentrated in the oil and gas sector for boosting pipeline throughput and in desalination plants, requiring motors specifically engineered for extreme environmental conditions and corrosive resistance. These regional variations in end-use requirements necessitate localized product customization and targeted distribution strategies from global market leaders.

Segment trends highlight the increasing prominence of the medium voltage (1 kV to 6 kV) segment due to its efficiency benefits in high-horsepower applications typical in municipal pumping stations and power generation. By product type, the demand for AC Induction Vertical Motors remains dominant due to their ruggedness and cost-effectiveness, although Synchronous and Permanent Magnet Vertical Motors are gaining traction, particularly in applications where precise speed control and ultra-high efficiency (IE4/IE5) are mandated by stringent energy regulations. The end-user analysis confirms that the Water and Wastewater segment continues to hold the largest market share, driven by global mandates for sanitation and potable water access, followed closely by the Oil & Gas industry requiring high-reliability vertical motors for down-hole and surface pumping operations critical for hydrocarbon extraction and transportation infrastructure stability.

AI Impact Analysis on Vertical Motor Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Vertical Motor Market primarily focus on themes of predictive failure analysis, optimization of pumping system energy consumption, and the automation of motor design processes. Users frequently ask about the practical application of machine learning algorithms to interpret complex vibration and temperature data generated by vertical motor sensors, aiming to predict catastrophic bearing failures or cavitation events before they occur. Key concerns revolve around data standardization, the cost-effectiveness of implementing advanced AI algorithms on legacy systems, and the security protocols required for transmitting sensitive operational data to cloud-based or edge computing platforms for analysis. Expectations are high concerning AI's potential to dramatically extend the mean time between failures (MTBF) for high-thrust vertical systems and to provide dynamic operational adjustments that maintain optimal efficiency under varying load conditions, thereby reducing overall energy expenditure, which is a significant operating cost for municipal and industrial pump stations.

- AI-Powered Predictive Maintenance: Machine learning models analyze real-time sensor data (vibration, temperature, current signatures) to predict bearing degradation, shaft misalignment, or insulation failure in high-thrust vertical motors, significantly extending equipment lifespan and minimizing unplanned downtime.

- Energy Optimization and Efficiency: AI algorithms dynamically adjust motor speed and load parameters based on instantaneous system demand (e.g., fluctuating water levels or flow rates), ensuring the vertical motor operates at its peak efficiency point (IE4/IE5 compliance) and minimizing wasted energy.

- Smart Design and Prototyping: Generative AI assists engineers in optimizing complex vertical motor component geometries, such as impellers and thrust bearing configurations, to enhance hydraulic performance and reduce mechanical stress under extreme axial loads.

- Automated Diagnostics and Troubleshooting: AI systems provide immediate root cause analysis for performance anomalies detected in vertical pump systems, guiding maintenance personnel toward precise fixes, reducing reliance on specialized engineering expertise, and accelerating resolution times.

- Enhanced Data Security and Integrity: AI models are deployed at the edge (motor control unit) to filter and prioritize data, ensuring only critical, pre-processed alerts are transmitted, enhancing both data integrity and cybersecurity posture for interconnected industrial control systems (ICS).

- Supply Chain and Inventory Management: AI predicts motor component failure rates across a fleet of installed vertical motors, optimizing the inventory levels for high-cost replacement parts (e.g., mechanical seals, large thrust bearings) within service centers, improving responsiveness and reducing carrying costs.

DRO & Impact Forces Of Vertical Motor Market

The dynamics of the Vertical Motor Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities, which collectively determine the market trajectory and influence investment decisions across the industrial ecosystem. Primary drivers stem from the global necessity to upgrade and expand water and wastewater infrastructure, particularly in emerging economies struggling with water scarcity and sanitation issues, creating a sustained demand for reliable, high-head vertical turbine pumps and their corresponding motor drives. Furthermore, stringent global environmental regulations mandating highly efficient industrial equipment necessitate the adoption of premium efficiency (IE3/IE4) vertical motors, effectively phasing out less efficient legacy systems. The robust demand from the oil and gas sector, particularly for vertical motors used in enhanced oil recovery (EOR) and complex offshore drilling applications, also provides significant foundational market support, despite intermittent volatility in crude oil prices. These drivers establish a foundation for consistent, albeit structurally complex, market expansion.

However, the market faces several restraining factors that temper growth rates and introduce operational challenges. The significantly higher initial capital expenditure (CapEx) associated with specialized vertical motors, particularly those designed for high-thrust or medium-voltage operation, compared to standard horizontal alternatives, often delays procurement decisions in cost-sensitive applications. Furthermore, the technical complexity involved in the installation, alignment, and specialized maintenance procedures required for vertical motors—particularly concerning thrust bearing inspection and replacement—demands a highly skilled workforce, which is often scarce in remote or developing operational areas. Economic instability and prolonged supply chain disruptions, especially concerning highly specialized electrical steel and large-scale copper components, also present short-term restraints on production capacity and delivery timelines, impacting profitability for manufacturers.

In terms of opportunities, the market is poised for significant gains through technological innovation focusing on material science and digitalization. The development of advanced composite materials for motor enclosures offers the potential for enhanced corrosion resistance and reduced motor weight, simplifying installation and expanding application scope in harsh chemical environments. Moreover, the integration of advanced IoT and edge computing capabilities within vertical motor control systems provides a crucial opportunity for manufacturers to transition from selling hardware to offering comprehensive, data-driven service contracts focused on operational performance and predictive uptime guarantees. Additionally, the nascent but rapidly growing market for high-efficiency submersible vertical motors tailored for geothermal energy extraction and advanced aquaculture facilities presents new avenues for product diversification and revenue generation beyond traditional municipal and industrial pumping applications. These opportunities focus on maximizing motor lifespan and minimizing the total cost of ownership (TCO) for end-users.

Segmentation Analysis

The Vertical Motor Market is systematically segmented based on Product Type, Motor Efficiency, Voltage Class, Speed, and End-User Industry, providing a clear map of market dynamics and targeted deployment strategies. This granular segmentation allows manufacturers and strategists to focus R&D efforts on specific high-growth areas, such as the medium voltage class driven by large-scale infrastructure projects, or the IE4/IE5 efficiency segments mandated by increasingly stringent global energy standards. The analysis across these dimensions reveals that while the AC Induction Motor segment dominates in volume due to its reliability and widespread adoption, the future growth is highly concentrated in specialized synchronous and permanent magnet variants where ultra-high efficiency and precise speed control are paramount. Understanding these segment behaviors is crucial for accurate forecasting and successful market penetration in specific industrial verticals.

- Product Type:

- AC Vertical Induction Motors

- Synchronous Vertical Motors

- Permanent Magnet Vertical Motors

- Vertical Direct Current (DC) Motors

- Motor Efficiency:

- Standard Efficiency (IE1)

- High Efficiency (IE2)

- Premium Efficiency (IE3/NEMA Premium)

- Super Premium Efficiency (IE4)

- Voltage Class:

- Low Voltage Vertical Motors (Up to 1 kV)

- Medium Voltage Vertical Motors (1 kV to 6 kV)

- High Voltage Vertical Motors (Above 6 kV)

- Speed (RPM):

- High Speed (3000-3600 RPM)

- Medium Speed (1500-1800 RPM)

- Low Speed (Up to 1200 RPM)

- End-User Industry:

- Water and Wastewater Treatment

- Oil and Gas (Upstream, Midstream, Downstream)

- Power Generation (Thermal, Nuclear, Renewables)

- Chemical and Petrochemical Processing

- Mining and Metals

- Pulp and Paper

- HVAC and Commercial Infrastructure

Value Chain Analysis For Vertical Motor Market

The Vertical Motor Market value chain begins with the highly specialized upstream procurement of raw materials, dominated by the sourcing of high-grade copper wire, specialized electrical steel laminations (e.g., cold-rolled grain-oriented steel), and high-performance bearing components capable of withstanding extreme axial thrust, particularly large spherical roller thrust bearings. The manufacturing phase is highly capital-intensive, involving specialized casting, high-precision machining of motor frames and shafts, and complex winding processes tailored for vertical orientation and necessary insulation class. Research and development activities, which focus heavily on optimizing electromagnetic design for efficiency (IE4/IE5) and designing robust lubrication and cooling systems for thermal management, represent a critical value-addition stage. Quality control throughout this phase is rigorous, ensuring adherence to standards like NEMA, IEC, and API, particularly for motors destined for explosive or critical infrastructure environments.

The midstream and distribution channels are characterized by a mix of direct sales channels for very large, customized vertical motors (especially high-voltage or hazardous environment units) and indirect channels utilizing authorized distributors, system integrators, and value-added resellers for standard industrial applications. System integrators play a vital role, coupling the motor with the appropriate vertical pump (such as vertical turbine pumps, or mixed flow pumps) and providing the complete packaged solution required by end-users in water utilities or petrochemical plants. Effective distribution relies heavily on local stockholding and technical support capabilities, given the weight, size, and need for specialized rigging during installation. The high degree of customization required for vertical motors often mandates close collaboration between the manufacturer and the engineering procurement construction (EPC) firms involved in major industrial projects, thereby streamlining the path to market for large orders.

Downstream activities center on installation, commissioning, and long-term maintenance services, which often represent a significant portion of the total lifecycle revenue for manufacturers. Direct channels are predominantly used for post-sales support and specialized service contracts, particularly for advanced condition monitoring and predictive maintenance utilizing IoT platforms. Given the difficulty and expense associated with servicing installed vertical motors—often requiring major rig-up and hoist operations—reliability and efficient post-sales support are paramount differentiators. Manufacturers who successfully integrate smart sensing technologies and offer proactive maintenance agreements gain a significant competitive edge, transitioning the customer relationship from a transactional product sale to a long-term partnership focused on maximized operational uptime and reduced maintenance expenditure.

Vertical Motor Market Potential Customers

The primary customers for vertical motors are large entities operating critical, non-negotiable infrastructure where continuous fluid movement is essential, or where operational space constraints necessitate a vertical footprint. The Water and Wastewater sector represents the largest consumer demographic, comprising municipal water utilities, regional irrigation authorities, and industrial entities requiring large-scale water intake and effluent treatment facilities. These customers typically procure vertical motors designed to drive deep well turbine pumps or large circulating pumps, requiring motors with high starting torque and specialized thrust bearing arrangements to handle the extreme weight and hydraulic forces generated by the impellers deep below the surface. Their purchasing decisions are heavily influenced by regulatory compliance concerning energy efficiency (IE3/IE4) and motor longevity to minimize disruption to public services.

Another major customer segment is the Oil and Gas industry, encompassing upstream drilling companies, midstream pipeline operators (for booster pumps), and downstream refineries. In this sector, vertical motors are utilized in highly specialized applications, including pump-jacks, submersible pumping systems in boreholes, and complex fluid transfer operations within chemical processing units. These customers require motors that meet stringent safety certifications (e.g., ATEX, IECEx) for hazardous locations and are built with materials resistant to corrosive hydrocarbons and extreme temperature fluctuations. Reliability in remote and hostile environments is the key purchasing criterion, driving demand for heavy-duty, customized vertical motors with robust sealing and specialized cooling mechanisms to ensure uninterrupted operation in remote locations.

Furthermore, Power Generation facilities, including both conventional thermal power plants (for cooling water circulation) and nuclear facilities (for critical safety-related pumping systems), constitute a significant customer base. The demands here are for high-horsepower, medium-to-high voltage vertical motors requiring exceptional stability and adherence to strict quality assurance protocols, often including nuclear-grade certifications. Other burgeoning customer groups include large-scale chemical processing plants, which use vertical motors for agitated mixing and transferring volatile liquids, and the Mining sector, which utilizes robust vertical pump motors for dewatering operations in deep pits and underground shafts, demanding ruggedized designs capable of handling abrasive slurries and fluctuating load profiles.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.2 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB Ltd., Siemens AG, WEG S.A., Nidec Corporation, TECO Electric & Machinery Co., Ltd., General Electric (GE), Regal Rexnord Corporation, Johnson Controls International Plc, Xylem Inc., Sulzer Ltd., Hitachi Ltd., Toshiba Corporation, Rotor Electrical Machines, Inc., KSB SE & Co. KGaA, US Motors (Nidec), Marathon Electric, VEM Group, TMEIC Corporation, Rockwell Automation, Hyosung Heavy Industries. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Vertical Motor Market Key Technology Landscape

The technological landscape of the Vertical Motor Market is currently defined by a strong emphasis on achieving superior energy efficiency, enhancing operational resilience, and facilitating remote diagnostics. A core technological advancement involves the rapid adoption of specialized Super Premium Efficiency (IE4) and approaching Ultra Premium Efficiency (IE5) designs, often achieved through the incorporation of Permanent Magnet Synchronous Motor (PMSM) technology, particularly in variable speed drive (VSD) applications. PMSM vertical motors offer significantly reduced rotor losses compared to traditional induction motors, making them highly attractive for continuous-duty pump applications where power consumption is a major operating expenditure. Furthermore, advanced insulation systems, such as Vacuum Pressure Impregnation (VPI) using specialized resins, are crucial for high-voltage and medium-voltage vertical motors to ensure resistance against partial discharge and thermal stress, dramatically improving reliability and lifespan in challenging industrial environments.

Bearing system technology represents another critical area of innovation, particularly the development of high-performance thrust bearings designed to handle the massive downward loads inherent in vertical turbine pumps. Manufacturers are increasingly utilizing advanced bearing materials, optimized lubrication systems (including oil bath and forced lubrication), and non-reverse ratchet mechanisms that are critical for preventing backspin in pumped media applications. Furthermore, the integration of Condition Monitoring Systems (CMS) utilizing micro-electromechanical systems (MEMS) sensors is becoming standard. These sensors are embedded to collect high-fidelity data on vibration, temperature, and magnetic flux, allowing for sophisticated analysis of bearing health, shaft alignment, and winding condition, transforming maintenance practices from time-based to predictive.

Digitalization technologies, underpinned by the Industrial Internet of Things (IIoT), are fundamentally changing how vertical motors are operated and managed. Modern vertical motor systems are equipped with smart Motor Control Centers (MCCs) and integrated communication protocols (e.g., Modbus, Ethernet/IP) that allow seamless integration into plant Distributed Control Systems (DCS). This connectivity enables remote monitoring, detailed performance profiling, and, crucially, allows for the deployment of advanced software algorithms for fault detection and operational optimization. Edge computing capabilities are being implemented to process large data volumes locally, enabling faster response times for critical shutdowns and reducing the bandwidth requirements for cloud connectivity, thereby ensuring that the specialized demands of high-reliability vertical applications are met with real-time actionable intelligence.

Regional Highlights

The global Vertical Motor Market exhibits distinct regional consumption patterns and growth drivers, shaped primarily by infrastructure maturity, energy policy, and reliance on water resources. The Asia Pacific (APAC) region stands out as the highest-growth market, driven predominantly by massive governmental investment in water supply, sewerage infrastructure, and rapid industrialization in countries like China, India, and Indonesia. The need for large-scale vertical turbine pumps for agricultural irrigation and burgeoning urban water treatment plants in this region is unprecedented, stimulating strong demand across low and medium voltage motor segments. Furthermore, the expansion of chemical and pharmaceutical manufacturing sectors in APAC also contributes significantly, requiring specialized, explosion-proof vertical motors for mixers and circulation systems, positioning the region as the epicenter of future volume growth.

North America maintains its leadership in terms of technology adoption and the market value of specialized, high-horsepower vertical motors. The demand here is largely replacement-driven, focused on upgrading aging infrastructure—particularly municipal waterworks and cooling tower systems—with Premium Efficiency (IE3/NEMA Premium) and IE4 motors to comply with strict federal and state energy conservation standards. The robust Oil & Gas sector, especially in the US and Canada, requires highly reliable vertical motors for extraction and pipeline operations, driving innovation in ruggedized and explosion-proof designs. The market is characterized by mature infrastructure, leading to purchasing decisions that prioritize total cost of ownership (TCO) and advanced diagnostic capabilities over initial capital outlay.

Europe presents a mature but stable market, marked by stringent environmental and energy efficiency legislation which strongly mandates the adoption of IE4-level vertical motors across nearly all industrial applications. The growth is moderate, centered on precision engineering applications in the petrochemical and power generation sectors, including specialized units for nuclear facilities and high-purity water systems. The Middle East and Africa (MEA) market growth is volatile but strong, heavily influenced by large-scale desalination projects in the Gulf Cooperation Council (GCC) countries and investments in water distribution networks. These projects require large, custom-engineered vertical motors designed to withstand high salinity, extreme ambient temperatures, and continuous operation, creating significant niche opportunities for specialized global manufacturers.

- Asia Pacific (APAC): Dominant growth region fueled by urbanization, massive water infrastructure projects, and industrial expansion; high demand for medium-voltage vertical motors in irrigation and wastewater.

- North America: Focus on infrastructure modernization, replacement of legacy systems, and compliance with NEMA Premium standards; strong demand from the specialized Oil & Gas vertical and high-thrust applications.

- Europe: Stable market driven by strict IE4 efficiency mandates and technological refinement; emphasis on motors for highly regulated industries like petrochemicals and nuclear power.

- Middle East & Africa (MEA): High investment potential driven by large-scale desalination plants and oil pipeline booster stations; demand for motors engineered for harsh, corrosive, and high-temperature environments.

- Latin America (LATAM): Growth concentrated in mining dewatering operations and agricultural pumping modernization, though growth rates are subject to regional economic stability and commodity price fluctuations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Vertical Motor Market.- ABB Ltd.

- Siemens AG

- WEG S.A.

- Nidec Corporation

- TECO Electric & Machinery Co., Ltd.

- General Electric (GE)

- Regal Rexnord Corporation

- Johnson Controls International Plc

- Xylem Inc.

- Sulzer Ltd.

- Hitachi Ltd.

- Toshiba Corporation

- Rotor Electrical Machines, Inc.

- KSB SE & Co. KGaA

- US Motors (Nidec)

- Marathon Electric

- VEM Group

- TMEIC Corporation

- Rockwell Automation

- Hyosung Heavy Industries

Frequently Asked Questions

Analyze common user questions about the Vertical Motor market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical advantage of a vertical motor over a standard horizontal motor?

The primary advantage of a vertical motor lies in its specialized thrust bearing system, which is engineered to manage high axial (downward) thrust loads imposed by vertical pump impellers, such as those found in deep well turbine pumps. This orientation saves significant floor space and optimizes the hydraulic efficiency of the coupled pump system, making it essential for water utilities and industrial fluid transport.

Which end-user industry accounts for the largest share of the Vertical Motor Market?

The Water and Wastewater Treatment industry holds the largest market share. Vertical motors are indispensable for driving critical equipment like vertical turbine pumps in municipal water intake stations, sewage pumping facilities, and large-scale agricultural irrigation systems globally, due to their reliability and ability to handle high fluid heads.

What are the key drivers for adopting Super Premium Efficiency (IE4) vertical motors?

The key drivers for adopting IE4 vertical motors are stringent energy efficiency regulations mandated by governments (like European Ecodesign directives and NEMA standards) and the necessity for industrial operators to reduce substantial electricity costs associated with continuous-duty pumping. IE4 motors offer minimal energy losses and reduced total cost of ownership (TCO) over their operational lifespan.

How is predictive maintenance influencing the Vertical Motor Market?

Predictive maintenance, driven by integrated IoT sensors and AI analytics, is critically influencing the vertical motor market by shifting service models. It allows operators to monitor thrust bearing health and winding insulation in real-time, accurately predicting component failures, maximizing motor uptime, and optimizing maintenance schedules, thereby drastically reducing the risk of catastrophic pump station failure.

What is the significance of the Medium Voltage segment in vertical motor sales?

The Medium Voltage (1 kV to 6 kV) segment is highly significant as it caters to the majority of high-horsepower applications (typically above 200 HP) required by large municipal pumping stations, power generation facilities, and major oil and gas pipeline booster pumps. These applications require higher voltage for efficiency and are fundamental to large-scale infrastructure projects.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager