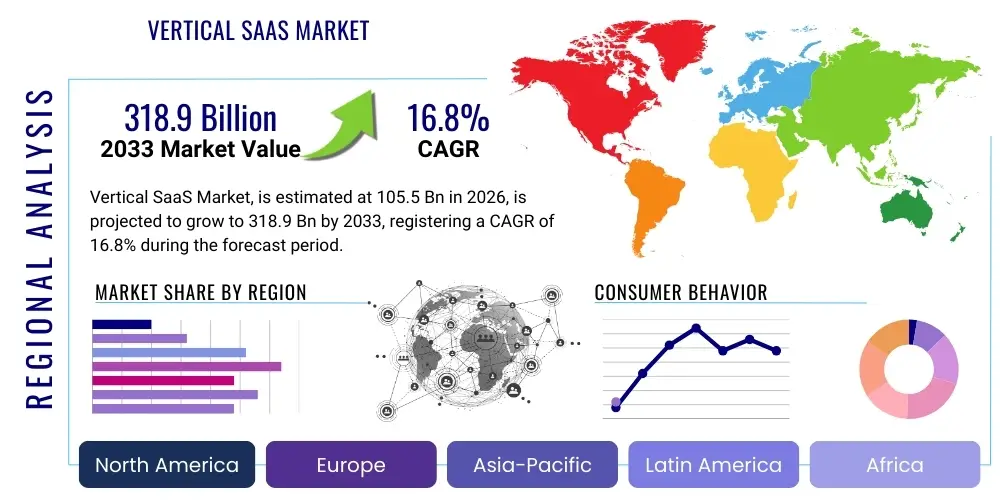

Vertical SaaS Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442974 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Vertical SaaS Market Size

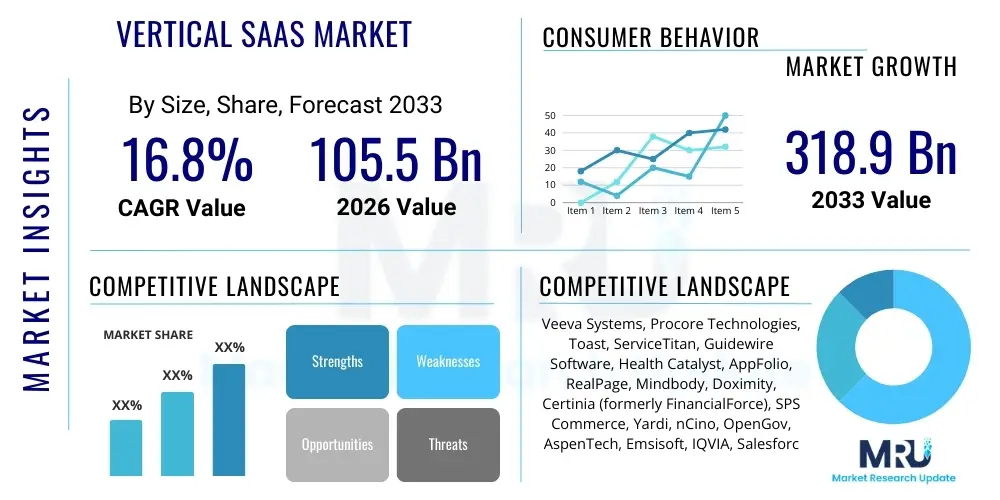

The Vertical SaaS Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 16.8% (CAGR) between 2026 and 2033. The market is estimated at $105.5 Billion in 2026 and is projected to reach $318.9 Billion by the end of the forecast period in 2033.

This robust expansion is fundamentally driven by the accelerating demand for highly specialized, industry-specific software solutions that offer deep integration, regulatory compliance, and tailored workflow optimization, which horizontal SaaS solutions often fail to deliver. Vertical SaaS companies benefit from higher customer retention rates and stronger pricing power due to the mission-critical nature of their software within niche markets. Furthermore, increased venture capital investment focused on vertical specificity and platform consolidation across fragmented industries is fueling significant product innovation and geographical market penetration, particularly in North America and Asia Pacific regions.

Vertical SaaS Market introduction

The Vertical Software as a Service (SaaS) Market encompasses cloud-delivered software solutions designed explicitly for the unique operational needs of a specific industry vertical, such as healthcare, construction, or financial services. Unlike horizontal SaaS, which targets broad business functions (e.g., CRM or HR) across multiple industries, Vertical SaaS offers deep functionality tailored to industry-specific workflows, compliance requirements, and terminology. These platforms often serve as the core operating system for businesses within their niche, managing everything from patient scheduling in medical practices to regulatory reporting in FinTech, thereby providing a definitive competitive edge through specialization and domain expertise.

The product description for Vertical SaaS emphasizes modules focused on highly specialized applications. For instance, in the construction industry, a Vertical SaaS platform manages bid tracking, materials procurement logistics, and project scheduling integration, features irrelevant to a retail Vertical SaaS platform, which focuses heavily on inventory optimization, point-of-sale integration, and multi-channel fulfillment specific to e-commerce regulations. Major applications span core operational processes, including regulatory compliance management, industry-specific financial modeling, specialized supply chain management, and customized data analytics that derive insights pertinent only to that vertical’s challenges and data structures. The shift toward these specialized tools is a direct response to the inadequacy of generalized software in meeting complex, niche demands.

The primary benefits of adopting Vertical SaaS include enhanced operational efficiency, reduced implementation complexity due to pre-configured industry best practices, and guaranteed adherence to strict sector-specific regulatory frameworks (e.g., HIPAA in healthcare or PCI compliance in financial services). Driving factors include the increasing digitization of traditional industries, the necessity for sophisticated data management tools that interpret proprietary industry data, and the strong return on investment (ROI) derived from systems that directly improve revenue-generating or cost-saving activities specific to the vertical. Furthermore, regulatory pressures often mandate the use of specialized, auditable software, pushing organizations away from generic solutions toward integrated vertical platforms.

Vertical SaaS Market Executive Summary

The Vertical SaaS market is witnessing a strong transition driven by consolidation and deep integration capabilities, marking a significant evolution from fragmented niche providers to comprehensive, mission-critical operating systems for entire industries. Business trends highlight a pronounced shift towards embedded finance (FinTech capabilities integrated directly into the SaaS offering, like payment processing for construction or healthcare platforms) and the strategic acquisition of complementary technology stacks to expand the total addressable market (TAM) within a vertical. Companies are prioritizing platformization, moving beyond single-function applications to offering suites that manage complex workflows from end-to-end, leading to increased customer lock-in and higher lifetime value (LTV). This move toward bundled, highly specialized services is redefining competitive dynamics, favoring providers that can deliver seamless, compliance-aware, and highly configurable solutions.

Regionally, North America maintains market leadership, largely due to its mature technology adoption curve, substantial venture capital ecosystem, and a highly complex regulatory environment demanding specialized software, particularly in healthcare and financial services. However, the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, spurred by rapid digital transformation initiatives across emerging economies in manufacturing, retail, and logistics sectors, coupled with government support for cloud adoption in countries like India, China, and Southeast Asia. Europe is characterized by stringent data sovereignty regulations (GDPR), which encourages localized Vertical SaaS solutions tailored to specific national legal frameworks, particularly in public sector and education verticals. Investment in Latin America and MEA is rising, often targeting resource management and localized consumer services.

Segmentation trends reveal that the Healthcare and Financial Services verticals currently dominate market share due to their high regulatory burdens and complex data processing needs. Healthcare SaaS focuses intensely on electronic health records (EHR), practice management, and telehealth solutions, while FinTech SaaS targets specific banking, lending, and insurance processes (e.g., nCino for lending). The fastest-growing segments, however, are emerging in less-digitized sectors like Construction and Agriculture (AgriTech). Construction Vertical SaaS platforms, such as Procore, are revolutionizing site management and project collaboration, while AgriTech solutions are leveraging IoT and data analytics for precision farming. Deployment trends favor cloud-native architectures overwhelmingly, though hybrid models persist in highly regulated or legacy-heavy enterprise environments.

AI Impact Analysis on Vertical SaaS Market

User inquiries regarding AI's influence on the Vertical SaaS Market primarily center on three areas: how AI can automate industry-specific compliance and regulatory workflows; whether AI will lead to the consolidation or further specialization of niche platforms; and the extent to which deep learning can extract actionable, proprietary insights from massive, unstructured vertical datasets (e.g., medical imaging or construction site data). Users are concerned about data privacy and the ethical deployment of AI in sensitive areas like patient care or financial modeling. Expectations are high regarding AI’s potential to shift Vertical SaaS from mere systems of record to proactive, predictive systems of intelligence that fundamentally alter industry operations and enhance decision-making speed.

The integration of Artificial Intelligence (AI) is transforming Vertical SaaS from passive data repositories into intelligent, predictive platforms, significantly elevating their value proposition. Since Vertical SaaS solutions control high-fidelity, proprietary datasets specific to a single industry, they are uniquely positioned to train and deploy highly accurate machine learning models. For example, AI can automate complex claims processing in InsurTech, predict equipment failure in specialized manufacturing, or optimize supply chain routes based on real-time climate data in AgriTech. This transition allows Vertical SaaS providers to offer "intelligence as a service," moving beyond basic automation to true prescriptive guidance, leading to unparalleled operational efficiency and risk mitigation for their clientele.

Furthermore, AI is crucial for maintaining regulatory compliance in dynamic environments. In finance, AI algorithms automatically flag suspicious transactions based on sector-specific norms and update compliance checks as regulations change. In healthcare, natural language processing (NLP) simplifies complex medical charting and billing processes, ensuring accurate coding and reducing human error. This deep, functional embedding of AI elevates the barriers to entry for horizontal competitors and reinforces the competitive moat of specialized Vertical SaaS providers. The future of Vertical SaaS is fundamentally tied to its ability to leverage its unique data advantage to solve the hardest, most specialized problems within its industry through sophisticated AI and machine learning capabilities.

- AI-driven automation of industry-specific compliance checks (e.g., HIPAA, GDPR, banking regulations).

- Predictive maintenance and failure analysis based on proprietary industrial IoT data.

- Natural Language Processing (NLP) for complex document interpretation (e.g., legal contracts, medical charts).

- Enhanced data specialization, allowing deep learning models trained exclusively on vertical datasets (e.g., medical imaging diagnostics).

- Creation of proactive, prescriptive analytics dashboards guiding critical operational decisions.

- Intelligent workflow optimization tailored to niche industrial processes (e.g., construction progress monitoring via computer vision).

- Embedded FinTech functionalities utilizing AI for personalized pricing and risk assessment.

DRO & Impact Forces Of Vertical SaaS Market

The Vertical SaaS market expansion is fundamentally driven by the inherent need for deep operational specialization and enhanced regulatory adherence that generic software cannot satisfy, acting as the principal driver. Restraints primarily involve the high initial cost of transitioning from legacy systems (often highly customized on-premise solutions) and the challenges associated with convincing highly conservative, traditionally non-digital industries (like heavy manufacturing or utilities) of the immediate ROI. Significant opportunities exist in the penetration of emerging markets and the strategic integration of embedded FinTech and AI services, transforming core platforms into complete operational ecosystems. These forces collectively shape the market's trajectory, leading to higher valuations for niche leaders and intensifying competition for sector dominance.

Drivers: The increasing complexity of industry-specific regulations mandates software solutions that are intrinsically compliance-aware, a necessity that Horizontal SaaS often fails to meet. Furthermore, organizations recognize that competitive advantage is derived from optimizing core, industry-specific workflows, necessitating specialized tools that offer deep functional expertise, leading to higher user adoption and less friction. The high switching costs associated with moving off a mission-critical Vertical SaaS platform—where all proprietary data and unique operational logic reside—ensures high customer retention and provides vendors with powerful pricing leverage, fostering long-term stability and growth. Vertical platforms also offer accelerated time-to-value as they require minimal customization upon deployment within their target industry.

Restraints: One significant barrier is the fragmented nature of many traditional industries, which results in smaller TAMs for highly specialized solutions, potentially limiting the scalability compared to broad Horizontal SaaS markets. Furthermore, integration with antiquated, often proprietary legacy systems prevalent in sectors like manufacturing or government presents substantial technical and operational challenges. Concerns over data security and vendor lock-in are persistent, especially among Small and Medium Enterprises (SMEs) hesitant to entrust their entire operational backbone to a single cloud provider. The requirement for specialized domain expertise within the development teams limits the talent pool, increasing development and maintenance costs.

Opportunities: The greatest opportunities lie in the underdeveloped digitization landscape of critical, yet traditionally manual, industries such as construction, agriculture, and government (GovTech). Introducing embedded banking and payment processing directly into vertical platforms creates new, high-margin revenue streams (Embedded FinTech), solidifying the platform's utility as the industry standard transactional backbone. Geographical expansion into rapidly digitizing APAC and Latin American markets represents a key growth vector. Moreover, the leveraging of AI and IoT data specific to the vertical allows providers to offer predictive and prescriptive services, moving up the value chain from transactional support to strategic partnership.

Impact Forces: The core impact force is the undeniable trend toward specialization. As industries become more technologically sophisticated and regulated, the necessity for tailored tools supersedes the convenience of generalized software. This specialization acts as a powerful gravitational pull, driving enterprises toward Vertical SaaS solutions. The second major impact force is market consolidation. Successful Vertical SaaS platforms tend to acquire smaller, complementary niche tools, creating dominant, integrated systems. This consolidation increases market efficiency and strengthens the leader's position, setting industry standards and accelerating the retirement of older, non-integrated software stacks.

Segmentation Analysis

The Vertical SaaS market is primarily segmented based on the specific Industry Vertical served, which dictates the functional complexity and regulatory requirements of the software. Further segmentation is categorized by Enterprise Size, reflecting the distinct needs of large enterprises versus Small and Medium Enterprises (SMEs), particularly concerning implementation costs and module complexity. Finally, the Deployment Model differentiates between pure cloud-native solutions and hybrid or on-premise implementations, though the market is rapidly converging toward cloud-first architectures to maximize scalability and reduce maintenance overhead.

- By Industry Vertical:

- Healthcare (HealthTech)

- Financial Services (FinTech)

- Retail and E-commerce

- Real Estate and Property Management (PropTech)

- Construction and Engineering (ConTech)

- Manufacturing and Industrial

- Government and Public Sector (GovTech)

- Agriculture (AgriTech)

- Legal and Compliance

- Education (EdTech)

- By Enterprise Size:

- Small and Medium Enterprises (SMEs)

- Large Enterprises

- By Deployment Model:

- Cloud-based

- On-premise/Hybrid

Value Chain Analysis For Vertical SaaS Market

The Value Chain for Vertical SaaS is highly specialized, beginning upstream with infrastructure providers and specialized data suppliers, moving through core software development and platform optimization, and culminating downstream at the distribution and customer support stages. Upstream analysis focuses heavily on the technology foundations, including hyperscale cloud providers (AWS, Azure, GCP) that offer the underlying computing power and scalability necessary for large-scale vertical data handling. Crucially, access to proprietary or specialized data feeds (e.g., industry-specific regulatory libraries, real-time market data, or medical device integration data) is paramount, as this data forms the basis for the deep functional utility offered by the Vertical SaaS product.

Midstream activities involve intensive product development focused on deep domain expertise and regulatory compliance engineering. Unlike horizontal SaaS, development involves continuous partnership with industry experts and regulatory bodies to ensure the software remains current and compliant. Downstream analysis emphasizes distribution and customer engagement. Direct distribution is the dominant model, utilizing specialized sales teams that possess significant domain knowledge to effectively communicate the platform's value proposition to niche buyers. Indirect distribution often includes industry-specific consulting firms, systems integrators that specialize in a particular vertical (e.g., healthcare IT consulting), and implementation partners who help clients migrate from legacy systems and customize modules for specific workflows within the sector.

The primary value created across the chain is the reduction of operational risk and the assurance of compliance, leading to higher efficiency. The proximity to the end customer (a characteristic of Vertical SaaS) enables rapid feedback loops, which fuel continuous product improvement and feature development specifically targeted at solving the vertical's most pressing pain points. The integration of embedded payment gateways or financial services further strengthens the downstream link, converting the software platform into an indispensable financial and operational hub for the end-user, thereby maximizing customer retention and increasing the lifetime value derived from the distribution channel.

Vertical SaaS Market Potential Customers

Potential customers for Vertical SaaS solutions are highly defined organizations operating within specific, identifiable industry niches that require specialized, workflow-driven software to manage core operational, compliance, and financial processes. These buyers span the spectrum from small, independent dental practices needing patient management software to large, multinational construction firms demanding integrated project management and compliance tools across complex, multi-site projects. The common characteristic among these customers is the recognition that generic software leads to significant inefficiencies, regulatory risk, and a failure to capitalize on specialized data insights unique to their industry.

The primary End-User/Buyers can be categorized based on their complexity and size. Large enterprises in heavily regulated sectors, such as major banks or hospital systems, purchase Vertical SaaS to ensure mandatory compliance and achieve technological integration across disparate business units (e.g., a hospital system utilizing an integrated Electronic Health Record and billing platform). For these large entities, the software must be highly scalable, customizable, and capable of integrating with existing legacy infrastructure. Procurement decisions are typically centralized and involve extensive due diligence regarding data security and regulatory certifications.

Conversely, Small and Medium Enterprises (SMEs) often purchase Vertical SaaS for its out-of-the-box specialization and ease of deployment. An independent veterinary clinic, for instance, needs a simple, integrated platform for scheduling, inventory, and regulatory reporting specific to animal care, without the overhead of heavy IT infrastructure. For SMEs, the critical buying factors are affordability, mobile accessibility, and immediate productivity gains. Regardless of size, the ultimate buyer criteria for Vertical SaaS remain domain relevance, compliance capabilities, and the ability to enhance specific, mission-critical operational outcomes that directly impact revenue or liability reduction within their niche.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $105.5 Billion |

| Market Forecast in 2033 | $318.9 Billion |

| Growth Rate | 16.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Veeva Systems, Procore Technologies, Toast, ServiceTitan, Guidewire Software, Health Catalyst, AppFolio, RealPage, Mindbody, Doximity, Certinia (formerly FinancialForce), SPS Commerce, Yardi, nCino, OpenGov, AspenTech, Emsisoft, IQVIA, Salesforce (Industry Clouds), Blackbaud |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Vertical SaaS Market Key Technology Landscape

The technological underpinnings of the Vertical SaaS market are defined by architecture focused on specialization, scalability, and deep integration. The shift towards microservices architecture is paramount, allowing Vertical SaaS platforms to rapidly deploy and update discrete, industry-specific functions without disrupting the entire system—crucial for maintaining uptime and compliance within mission-critical sectors. Robust Application Programming Interfaces (APIs) are essential, enabling seamless integration with specialized third-party tools (e.g., industry hardware, proprietary data feeds, or legacy software systems) that are commonplace within specific verticals. Furthermore, the reliance on secure, multi-tenant cloud infrastructure (leveraging services like AWS or Azure GovCloud) is fundamental to meeting the stringent data sovereignty and regulatory requirements demanded by industries like government and healthcare.

Specialized AI and Machine Learning (ML) capabilities represent the highest growth area in the technology landscape. Since Vertical SaaS platforms host unique, homogenous datasets (e.g., all data relates to lending, or all data relates to clinical trials), these providers are uniquely positioned to build highly accurate predictive models that are infeasible for generic horizontal providers. This includes leveraging computer vision for construction monitoring, utilizing NLP for automated claims assessment in insurance, and deploying predictive risk modeling in FinTech. The technology focus is moving beyond simple data storage and workflow execution to providing embedded intelligence that fundamentally drives operational and financial results specific to the vertical.

Moreover, the adoption of low-code/no-code (LCNC) development tools within the Vertical SaaS framework is empowering implementation partners and large enterprise clients to customize the platform for their unique organizational sub-niche without extensive coding. This configurability significantly enhances the platform’s adaptability and accelerates deployment time. Finally, the embedding of financial technologies—such as payment processing, lending features, and expense management—directly into the operational software stack necessitates highly secure and compliant FinTech integration technologies, often requiring partnerships with specialized banking infrastructure providers, further cementing the platform's role as the central operational hub for its industry.

Regional Highlights

- North America: This region dominates the global Vertical SaaS market, characterized by mature cloud adoption, highly sophisticated enterprise infrastructure, and intensive capital investment, particularly in sectors such as HealthTech and specialized FinTech. The stringent and often complex regulatory environment in the U.S. and Canada necessitates specialized compliance solutions, driving demand for Vertical SaaS platforms like Veeva Systems (Life Sciences) and nCino (Banking). The U.S. remains the epicenter of innovation and venture funding for vertical specialization.

- Europe: The European market is fragmented but rapidly growing, driven by national-level digital transformation initiatives and the imperative to comply with pan-European regulations such as GDPR. Growth is pronounced in GovTech and specific industrial manufacturing segments, particularly in Germany and the Nordics. The focus here is often on modular solutions that can be easily adapted to varying languages and national legal frameworks within the continent.

- Asia Pacific (APAC): APAC is projected to exhibit the fastest CAGR, fueled by rapid industrialization, government-led mandates for cloud adoption, and the massive scale of industries like e-commerce (e.g., specialized retail platforms) and manufacturing across markets like China, India, and Southeast Asia. The adoption of AgriTech and specialized financial inclusion platforms is particularly accelerating in emerging APAC economies.

- Latin America (LATAM): Growth in LATAM is driven by the modernization of resource management, utilities, and foundational financial services. The market is increasingly attracting global Vertical SaaS vendors seeking expansion, particularly those focused on regional compliance standards and mobile-first deployments suitable for local infrastructure constraints.

- Middle East and Africa (MEA): The MEA region shows strong potential, particularly within government services (Smart City initiatives) and energy/resource management sectors, largely driven by large-scale government investments in diversification and digital transformation agendas, especially in the Gulf Cooperation Council (GCC) countries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Vertical SaaS Market.- Veeva Systems

- Procore Technologies

- Toast

- ServiceTitan

- Guidewire Software

- Health Catalyst

- AppFolio

- RealPage

- Mindbody

- Doximity

- Certinia (formerly FinancialForce)

- SPS Commerce

- Yardi Systems

- nCino

- OpenGov

- AspenTech

- Emsisoft

- IQVIA

- Salesforce (Industry Clouds)

- Blackbaud

Frequently Asked Questions

Analyze common user questions about the Vertical SaaS market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the fundamental difference between Vertical SaaS and Horizontal SaaS?

Vertical SaaS focuses on deep functionality tailored to a single industry's unique workflows and regulatory requirements (e.g., software only for dentistry or construction), providing specialized solutions. Horizontal SaaS offers broad functionality (e.g., CRM, HR) applicable across many different industries, prioritizing breadth over domain depth. Vertical solutions generally yield higher customer retention and pricing power.

Which industry vertical is showing the strongest growth potential in the near future?

While Healthcare and Financial Services hold the largest current market share, the Construction (ConTech) and Agriculture (AgriTech) verticals are demonstrating the highest near-term growth rates. These sectors are undergoing rapid digitization and are adopting specialized software to manage complex supply chains, regulatory adherence, and data from IoT devices, moving away from fragmented, manual processes.

How is Embedded FinTech impacting the competitive landscape of Vertical SaaS providers?

Embedded FinTech, which integrates financial services like payments, lending, or insurance directly into the core vertical platform, is transforming providers into essential financial hubs. This strategy increases revenue streams, significantly raises customer switching costs, and solidifies the platform’s position as the mission-critical operating system for the entire vertical ecosystem.

What are the primary challenges limiting the adoption of Vertical SaaS among Small and Medium Enterprises (SMEs)?

The main challenges for SMEs include the perceived high initial investment and integration costs, concerns about vendor lock-in preventing future flexibility, and the integration complexities required when transitioning away from deeply entrenched, often customized, legacy operational systems, even if those systems are inefficient.

How do Vertical SaaS companies leverage AI differently compared to generic software vendors?

Vertical SaaS companies possess exclusive, high-fidelity datasets unique to their niche (e.g., specialized medical records or construction data). This allows them to train and deploy highly accurate, proprietary AI models focused on solving complex, domain-specific problems like predictive regulatory compliance, specialized diagnostics, or industrial failure prediction, offering intelligence that horizontal AI cannot match.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager