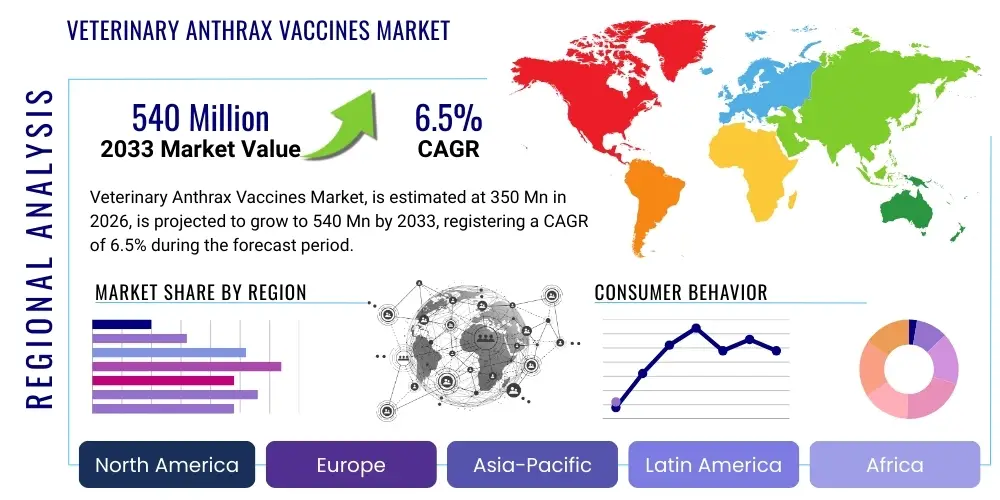

Veterinary Anthrax Vaccines Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441887 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Veterinary Anthrax Vaccines Market Size

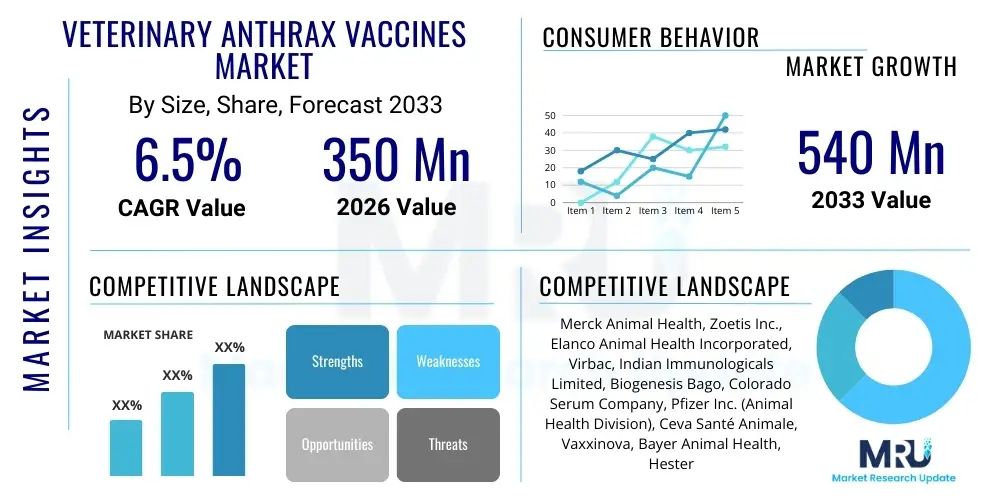

The Veterinary Anthrax Vaccines Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 350 Million in 2026 and is projected to reach USD 540 Million by the end of the forecast period in 2033.

Veterinary Anthrax Vaccines Market introduction

The Veterinary Anthrax Vaccines Market encompasses the production, distribution, and sale of biological products designed to immunize livestock and other susceptible animals against Bacillus anthracis, the causative agent of Anthrax. Anthrax is a critical zoonotic disease, severely impacting agricultural economies, particularly in endemic regions of Africa, Asia, and parts of the Americas. The primary product currently dominating the market is the live attenuated spore vaccine (Sterne strain), valued for its high efficacy and relatively low production cost, though regulatory hurdles and cold chain requirements remain significant challenges. These vaccines are essential for prophylactic measures, preventing large-scale outbreaks, reducing animal mortality, and ultimately mitigating the risk of zoonotic transmission to human populations through contaminated animal products or environmental exposure. Major applications involve routine prophylactic vaccination programs administered by governmental veterinary services or private agricultural entities in areas where the disease is known to be enzootic, focusing primarily on cattle, sheep, goats, and horses.

The core benefit of widespread veterinary vaccination is the establishment of herd immunity, which stabilizes livestock populations and ensures food safety and security within vulnerable agricultural communities. Market growth is fundamentally driven by the rising global awareness of zoonotic disease threats, increasing livestock populations to meet expanding global protein demand, and enhanced governmental funding for animal health surveillance and control programs. Additionally, international organizations like the World Organisation for Animal Health (OIE) actively promote vaccination protocols, bolstering market demand, especially in developing economies struggling with sporadic or endemic anthrax cases. The vaccines are typically administered seasonally or during pre-outbreak periods, creating cyclical demand tied closely to regional climate patterns and livestock migration cycles.

Veterinary Anthrax Vaccines Market Executive Summary

The global Veterinary Anthrax Vaccines Market is characterized by stable demand driven predominantly by mandatory state-level vaccination programs in endemic zones and increasingly stringent international regulations concerning animal health and trade. Business trends show a strategic shift toward developing thermostable and recombinant subunit vaccines to overcome the logistic limitations associated with the current reliance on live attenuated vaccines, which require stringent cold chain management. Key players are focusing on securing government contracts and expanding distribution networks within high-risk regions such as sub-Saharan Africa and Central Asia, which represent substantial untapped market potential. Furthermore, mergers and acquisitions are observed as large multinational animal health companies seek to acquire niche expertise in biodefense and specific regional production capabilities, aiming to diversify their portfolios beyond traditional companion animal and feed additive products.

Regional trends indicate that Asia Pacific and Africa currently represent the largest consumption centers due to high livestock density and widespread endemicity, often fueled by large public sector procurement volumes. North America and Europe, while having lower endemic prevalence, maintain critical vaccine reserves for preparedness and biosecurity purposes, driven by high biosecurity standards and preparedness against potential agroterrorism. Segment trends highlight that the animal type segment is overwhelmingly dominated by cattle and sheep vaccines, which constitute the majority of administered doses globally. Within the product type segment, while the conventional live attenuated vaccine currently holds the maximum share, the market is poised for gradual transformation as advancements in vaccine technology introduce safer, next-generation alternatives with improved shelf life and reduced side effects, potentially increasing adoption in regulatory-sensitive markets.

AI Impact Analysis on Veterinary Anthrax Vaccines Market

Common user questions regarding AI's influence in the Veterinary Anthrax Vaccines Market revolve primarily around its potential to accelerate novel antigen discovery, optimize manufacturing and quality control processes, and enhance real-time disease surveillance. Users frequently inquire about how AI can predict outbreaks, thereby optimizing vaccine distribution and deployment, and whether machine learning algorithms can design more efficacious or thermostable vaccine candidates, moving beyond the decades-old Sterne strain. Concerns also center on the validation and regulatory acceptance of AI-derived insights in veterinary medicine, particularly regarding the safety profile and immunogenicity prediction of new vaccines. The consensus expectation is that AI will transform the market by shifting practices from reactive outbreak control to proactive, predictive preventive health management, leading to improved resource allocation and reduced economic losses associated with anthrax.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is anticipated to profoundly influence the entire value chain of veterinary vaccine development and deployment. In the R&D phase, AI algorithms can analyze vast genomic and proteomic datasets of Bacillus anthracis strains, identifying novel protective antigens that elicit stronger immune responses or offer broader protection against genetic variants. This capability drastically reduces the time and cost associated with traditional antigen screening. Furthermore, predictive modeling utilizing AI can correlate environmental data (rainfall, temperature, soil pH) with historical outbreak patterns, generating highly specific risk maps that allow veterinary authorities to preemptively focus vaccination efforts on impending hotspots, ensuring vaccine efficacy is maximized and waste is minimized. This targeted approach enhances preparedness, particularly crucial for diseases like anthrax where environmental factors play a large role in spore activation.

In manufacturing and logistics, AI optimizes production yields by analyzing fermentation data and adjusting parameters in real-time, ensuring batch consistency and scalability, which is vital for meeting large-volume public tenders. Supply chain management benefits significantly through ML-driven forecasting models that predict regional demand fluctuations based on epidemic cycles and government purchasing timelines, thereby minimizing stockouts or overstocking of temperature-sensitive products. The ultimate impact of AI implementation is the development of a more resilient, responsive, and technologically advanced veterinary health infrastructure, capable of delivering superior vaccine products precisely when and where they are needed most.

- AI accelerates novel protective antigen identification through genomic analysis.

- Machine Learning optimizes vaccine manufacturing processes, enhancing yield and consistency.

- Predictive analytics enables real-time outbreak forecasting and targeted vaccine distribution strategies.

- AI assists in developing thermostable vaccine formulations by simulating protein stability under various conditions.

- Enhanced surveillance systems, powered by AI, correlate environmental factors with infection risks for preemptive intervention.

DRO & Impact Forces Of Veterinary Anthrax Vaccines Market

The market trajectory is shaped by a complex interplay of Drivers, Restraints, and Opportunities, collectively forming the Impact Forces. A primary driver is the recurring incidence of anthrax in key livestock-producing regions, necessitating mandated, continuous vaccination schedules by government bodies to protect both animal and human health. This institutional demand provides a stable foundation for the market. However, significant restraints include the challenges associated with vaccine efficacy variation, complex storage requirements (strict cold chain maintenance required for current live vaccines), and resistance to vaccination programs stemming from misinformation or high costs in resource-limited settings. Opportunities primarily reside in technological innovation, specifically the development of safer, subunit, or recombinant vaccines that eliminate biosafety risks and overcome cold chain dependency, opening new distribution possibilities in remote, high-risk areas. These factors determine the pace of market expansion and product adoption globally.

Drivers: Growing global livestock population, fueled by increasing per capita meat and dairy consumption, directly correlates with the need for preventative veterinary medicines. Furthermore, heightened biosecurity concerns globally, particularly after historical instances of anthrax being weaponized, push governments to maintain strategic vaccine reserves and rigorous surveillance programs, thereby ensuring sustained procurement. The financial impetus provided by international animal health organizations, promoting disease control in developing nations, facilitates large-scale public sector purchasing. Moreover, rising awareness among farmers regarding the substantial economic losses incurred due to animal mortality, reduced productivity, and trade restrictions following an anthrax outbreak, encourages voluntary adoption of prophylactic measures, particularly in commercial farming setups that prioritize herd health management and certification for international trade compliance. These macroeconomic and biosecurity pressures are fundamental to market growth.

Restraints: The most prominent constraint is the reliance on the live attenuated Sterne strain, which, despite its efficacy, possesses inherent drawbacks, including potential residual virulence and stringent requirements for refrigeration, making distribution in rural and tropical areas logistically demanding and costly. Regulatory complexities and the lengthy approval processes for new veterinary biologicals also slow down market access for innovative products. Another critical restraint is the issue of public perception and resistance, where concerns about potential vaccine side effects or inadequate understanding of the disease risk lead to poor compliance with mandated vaccination schedules, thus inhibiting herd immunity effectiveness. Furthermore, the intermittent nature of outbreaks means that market demand can fluctuate significantly year-to-year in non-endemic or sporadic regions, posing inventory management challenges for manufacturers.

Opportunities: The market offers significant opportunities through innovation in vaccine formulation. Development of non-replicating or subunit vaccines that are thermostable would revolutionize distribution logistics, drastically reducing costs and expanding market reach into remote areas currently underserved by the cold chain infrastructure. Genetic engineering techniques present a pathway for producing vaccines with enhanced immunogenicity and reduced potential side effects, appealing to markets with stringent regulatory requirements. Additionally, diversification of target animal species, beyond traditional cattle and sheep, to include wildlife reservoir monitoring and vaccination programs, represents a growing, albeit specialized, market segment driven by ecological preservation and zoonotic control efforts. Establishing public-private partnerships focused on capacity building and local manufacturing in endemic regions could also unlock substantial growth potential.

- Drivers: Mandatory vaccination programs in endemic regions; Increasing global livestock population; Heightened biosecurity and zoonotic disease control focus; Government funding for animal health.

- Restraints: Cold chain dependency and logistical complexity; Perceived risk of residual virulence in live vaccines; High cost barrier for small farmers; Regulatory hurdles for novel biological products.

- Opportunity: Development of thermostable, non-live subunit and recombinant vaccines; Expansion into underserved remote markets; Adoption of advanced diagnostic tools integrated with vaccination strategies.

- Impact Forces: High regulatory dependence (Government procurement); Technological constraints (Cold Chain); Economic impact of disease outbreaks (High driver for demand).

Segmentation Analysis

The Veterinary Anthrax Vaccines Market is comprehensively segmented based on product type, animal type, and end-user, providing a granular view of demand patterns and strategic market focuses. Segmentation by product type helps differentiate between established conventional vaccines and emerging, technologically advanced alternatives, reflecting ongoing efforts to improve safety and handling. The animal type classification, predominantly focusing on large ruminants, highlights the areas of highest economic vulnerability to anthrax. End-user segmentation distinguishes between public sector procurement, which dominates volume, and private sector utilization, which often prioritizes specialized, premium products and services. Understanding these segments is crucial for manufacturers in tailoring production capacity, distribution channels, and marketing strategies to meet diverse regional and economic needs efficiently.

The market dominance currently resides within the conventional live attenuated vaccine segment (Sterne strain), primarily due to its proven historical efficacy and significantly lower cost compared to modern developments, making it the preferred choice for mass vaccination campaigns in resource-constrained endemic nations. However, the subunit and recombinant vaccines segment is projected to experience the fastest growth rate, driven by demand from developed markets and private commercial farms prioritizing minimal risk and high safety standards. Geographically, segmentation analysis confirms that market volume is heavily skewed toward regions with extensive livestock populations and historical exposure to anthrax, dictating the strategic priorities for large-scale vaccine distribution and storage infrastructure.

- By Product Type:

- Live Attenuated Vaccines (Sterne Strain)

- Subunit Vaccines

- Recombinant Vaccines

- By Animal Type:

- Cattle

- Sheep and Goats

- Horses and other Equines

- Other Animals (Wildlife and specialized livestock)

- By End-User:

- Government Agencies and Veterinary Public Health (State-led vaccination programs)

- Commercial Livestock Farms

- Research and Academic Institutions

Value Chain Analysis For Veterinary Anthrax Vaccines Market

The value chain for Veterinary Anthrax Vaccines begins with upstream activities focused on strain acquisition, high-containment R&D, and bulk active ingredient manufacturing, particularly the cultivation and purification of the Bacillus anthracis spore culture required for the Sterne strain. Key challenges in this phase include maintaining high biosafety level (BSL-3 equivalent) manufacturing environments and ensuring regulatory compliance regarding strain purity and potency, which necessitate specialized infrastructure and skilled personnel. The midstream involves formulation, filling, and packaging, where strict temperature controls are vital for preserving product viability. Due to the public health significance and biodefense implications of anthrax vaccines, the procurement and distribution processes are heavily centralized and regulated, differing significantly from standard commercial veterinary pharmaceuticals.

Downstream activities center around the complex distribution channel, which is often bifurcated. Direct distribution typically involves large governmental tenders where vaccines are procured in massive quantities by national veterinary departments (e.g., USDA, European Union agencies, or national Ministries of Agriculture) and subsequently distributed via centralized government cold chain systems to regional veterinary offices or designated vaccination centers. Indirect distribution involves private distributors or specialized veterinary wholesalers handling sales to large commercial farms or private veterinary practitioners. The predominance of public sector purchasing means that pricing and contract negotiation are crucial determinants of profitability, making strong governmental relations and robust supply chain resilience paramount for manufacturers. The efficient management of the cold chain, spanning from the manufacturing facility to the final administration point, is the single most critical factor in preserving vaccine integrity throughout the entire value chain.

Veterinary Anthrax Vaccines Market Potential Customers

The primary and largest potential customers (end-users/buyers) for Veterinary Anthrax Vaccines are governmental and quasi-governmental veterinary public health agencies. These entities are responsible for national disease control, maintaining strategic reserves, and executing widespread, often mandatory, prophylactic vaccination campaigns to protect national livestock wealth and minimize zoonotic risks. The decision-making unit here is typically centralized, focusing on cost-per-dose, logistical compatibility with national cold chain infrastructure, and proven historical efficacy, favoring large-volume, tender-based procurement contracts. The consistent demand generated by these institutional buyers forms the bedrock of the market, particularly in endemic regions of Africa and Asia.

A secondary, yet rapidly growing customer segment, comprises commercial livestock farmers and large-scale agricultural enterprises in both endemic and non-endemic regions. These buyers prioritize premium vaccines with superior safety profiles, reduced administration frequency, and minimal risk of post-vaccination complications, viewing vaccination as a critical input for maintaining herd health certification necessary for high-value export markets. While their procurement volume is smaller than that of government bodies, their willingness to adopt advanced, potentially higher-priced subunit vaccines indicates a shift toward quality-driven purchasing decisions. Furthermore, specialized end-users include research laboratories and academic institutions involved in infectious disease studies and biodefense preparedness, requiring small volumes of highly specialized or reference-strain vaccines.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350 Million |

| Market Forecast in 2033 | USD 540 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Merck Animal Health, Zoetis Inc., Elanco Animal Health Incorporated, Virbac, Indian Immunologicals Limited, Biogenesis Bago, Colorado Serum Company, Pfizer Inc. (Animal Health Division), Ceva Santé Animale, Vaxxinova, Bayer Animal Health, Hester Biosciences, China Animal Husbandry Industry Co., Ltd., Sanofi (Animal Health), Inovio Pharmaceuticals, Intervet (MSD Animal Health), BioVeta, Laboratorios Hipra. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Veterinary Anthrax Vaccines Market Key Technology Landscape

The technological landscape of the Veterinary Anthrax Vaccines Market is primarily defined by two generations of products: the traditional live spore vaccines and the emerging non-live alternatives. The foundational technology remains the live, non-encapsulated spore vaccine, epitomized by the Sterne 34F2 strain, developed in the 1930s. This method relies on manufacturing the attenuated bacterium, which, when injected, multiplies briefly and induces a robust cell-mediated and humoral immune response. While highly effective and cost-efficient for mass campaigns, this technology is constrained by the necessity for refrigerated storage and the slight, but persistent, risk of reversion or residual pathogenicity, demanding high biosafety standards throughout production and handling.

The current innovation focus is centered on next-generation vaccines aimed at mitigating the risks and logistical hurdles of the Sterne strain. Subunit vaccines, which utilize purified protective antigens (like Protective Antigen - PA) synthesized either chemically or through recombinant technology, represent a significant technological advancement. These vaccines are inherently safer as they contain no live organisms and can be formulated for enhanced thermostability, significantly easing cold chain requirements and improving shelf life, making them ideal for challenging climates. Recombinant DNA technology allows for the expression of optimal protective antigens in non-pathogenic host systems (like yeast or bacteria), enabling large-scale, consistent manufacturing and offering the potential for multivalent vaccines that target multiple infectious agents simultaneously, enhancing farmer convenience and cost-effectiveness. This shift reflects a move towards precision vaccinology in veterinary health.

Furthermore, novel delivery systems, such as mucosal or edible vaccines for livestock, are being explored, aiming to simplify administration, particularly in large herds where individual injection is labor-intensive. These advanced technologies, while currently more expensive to develop and produce, promise to increase compliance, improve safety profiles, and ultimately enhance the overall effectiveness of global anthrax control strategies by ensuring reliable vaccination coverage even in the most remote or logistically constrained regions. The technology landscape is moving from basic attenuation to highly sophisticated molecular design, aligning veterinary preparedness with modern biopharmaceutical standards.

Regional Highlights

- Asia Pacific (APAC): APAC is a dominant market region driven by the presence of vast livestock populations (India, China) and numerous anthrax endemic zones, particularly in South Asia and Southeast Asia. The region exhibits high volume consumption, largely fueled by government-sponsored, mandatory annual vaccination programs. Market growth is further stimulated by increased government spending on modernizing veterinary public health infrastructure and controlling zoonotic disease outbreaks to support burgeoning national economies heavily reliant on agriculture. However, logistics challenges related to vast geographical distances and inadequate cold chain facilities in rural areas remain a significant constraint, pushing demand towards the development of more stable vaccine formulations.

- Africa and Middle East (MEA): MEA is critically important due to the pervasive endemicity of anthrax across large parts of sub-Saharan Africa and sporadic outbreaks in the Middle East. This region relies almost exclusively on the cost-effective live attenuated vaccines, often procured through international aid organizations or centralized government purchasing agencies. Market stability is ensured by the frequent, sometimes mandatory, vaccination cycles necessary to mitigate devastating economic losses in nomadic and pastoralist communities. Future growth hinges on improved political stability, enhanced regulatory harmonization, and localized manufacturing capacity development, reducing dependency on costly imports and complex international supply chains for cold logistics.

- North America: North America represents a mature market characterized by high regulatory standards and a strategic focus on biosecurity and preparedness. While natural outbreaks are rare, demand is primarily driven by maintaining strategic national vaccine reserves for potential biodefense scenarios and protecting high-value commercial livestock against accidental exposure. Customers in this region (government and large commercial farms) demand vaccines with impeccable safety records, consistent potency, and comprehensive quality assurance documentation, often favoring advanced, purified, or recombinant options when available, despite higher costs.

- Europe: Similar to North America, Europe maintains rigorous biosecurity measures. Demand is stable, centered on managing occasional localized outbreaks in previously dormant areas (e.g., Eastern Europe) and complying with stringent EU animal health directives. The European market emphasizes high-quality manufacturing standards (GMP compliance) and favors vaccines with zero risk of residual virulence. Regulatory bodies strictly control the use of live attenuated strains, encouraging the adoption of non-live alternatives. The market is supported by sophisticated veterinary monitoring systems that facilitate rapid response to any confirmed case.

- Latin America (LATAM): LATAM presents a heterogeneous market, with endemic areas in countries like Brazil and Argentina supporting substantial beef and sheep industries. Demand is robust, driven by the economic imperative to prevent livestock losses and maintain export integrity. Market growth is tied to the expansion of commercial agriculture and improved enforcement of veterinary health regulations. Procurement is a mix of large-scale government tenders (especially for mass immunization programs) and private purchasing by large ranching operations focused on optimizing productivity and accessing lucrative international markets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Veterinary Anthrax Vaccines Market.- Merck Animal Health

- Zoetis Inc.

- Elanco Animal Health Incorporated

- Virbac

- Indian Immunologicals Limited

- Biogenesis Bago

- Colorado Serum Company

- Pfizer Inc. (Animal Health Division)

- Ceva Santé Animale

- Vaxxinova

- Bayer Animal Health

- Hester Biosciences

- China Animal Husbandry Industry Co., Ltd.

- Sanofi (Animal Health)

- Inovio Pharmaceuticals

- Intervet (MSD Animal Health)

- BioVeta

- Laboratorios Hipra

- AgriLabs

- Bimeda

Frequently Asked Questions

Analyze common user questions about the Veterinary Anthrax Vaccines market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand for Veterinary Anthrax Vaccines in endemic regions?

The primary factor is the necessity for government-mandated, prophylactic mass vaccination programs targeting susceptible livestock (cattle, sheep) to prevent massive economic losses, control zoonotic transmission to humans, and comply with international animal health regulations in high-risk zones, providing stable, volume-driven market demand.

How do technological advancements influence the logistics of anthrax vaccine distribution?

Technological advancements, specifically the development of subunit and recombinant vaccines, aim to eliminate the dependency on the stringent cold chain required for traditional live attenuated vaccines. Creating thermostable formulations simplifies storage, significantly reduces distribution costs, and allows for effective deployment in remote areas lacking reliable refrigeration infrastructure.

Which animal type segment holds the largest market share for anthrax vaccines globally?

The cattle segment, followed closely by sheep and goats, holds the largest market share. This dominance is due to their high susceptibility to anthrax, large global population sizes, significant economic value as food sources, and their heavy involvement in mass vaccination programs implemented by national veterinary services worldwide.

What regulatory challenges face new manufacturers entering the Veterinary Anthrax Vaccines Market?

New entrants face significant regulatory hurdles, including the need for high-level biosafety manufacturing facilities (BSL-3 equivalent), lengthy processes for demonstrating vaccine efficacy and safety (potency and stability studies), and obtaining specialized governmental approvals for marketing biological products critical for public health and biosecurity across diverse international jurisdictions.

How does the threat of agroterrorism impact the vaccine market in developed economies?

The threat of agroterrorism ensures sustained, strategic demand in developed economies (like North America and Europe), even where natural endemicity is low. Governments maintain large, sophisticated national vaccine stockpiles and invest in advanced surveillance technology as a critical biodefense measure, ensuring preparedness against deliberate pathogen introduction, thus stabilizing a niche, high-value segment of the market.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager