Vibratory Bowl Feeder Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441358 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Vibratory Bowl Feeder Market Size

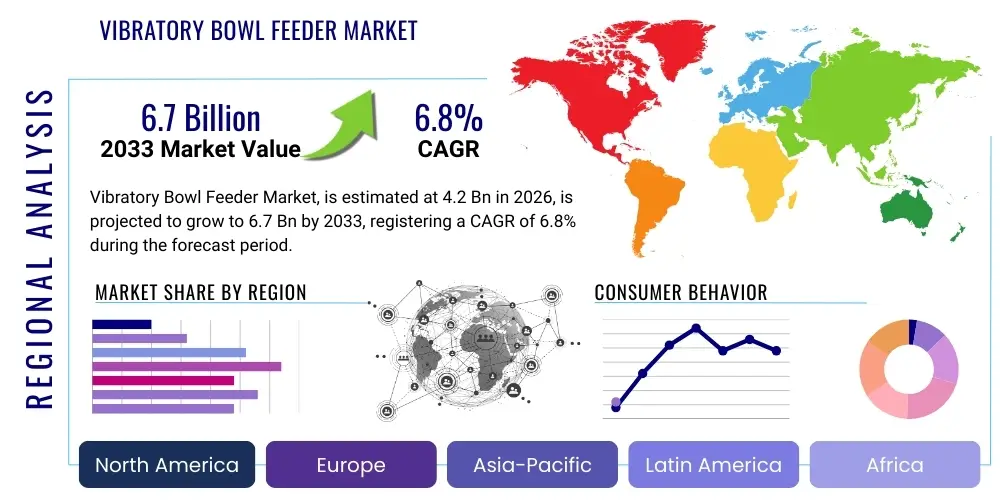

The Vibratory Bowl Feeder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.2 Billion in 2026 and is projected to reach USD 6.7 Billion by the end of the forecast period in 2033. This robust expansion is primarily driven by the escalating demand for automated assembly processes across critical manufacturing sectors, particularly in fast-growing economies in Asia Pacific. Manufacturers globally are seeking efficient, high-speed parts handling solutions to reduce labor dependency and enhance overall production line repeatability and accuracy.

The valuation reflects the increasing investment in advanced manufacturing infrastructure, especially within the electronics, automotive components, and medical device industries where micron-level precision in component orientation and delivery is non-negotiable. Furthermore, the rising adoption of Industry 4.0 paradigms, which necessitate seamless integration of feeding systems with robotics and vision inspection systems, contributes significantly to market value growth. The shift from manual kitting and sorting operations to fully automated assembly lines underscores the foundational necessity of reliable parts presentation equipment like vibratory bowl feeders.

Market growth projections consider the dynamic interplay between the maturation of traditional vibratory technology and the emergence of flexible feeding systems. While traditional bowls remain cost-effective for high-volume, single-part applications, ongoing innovations in dampening materials, digital controls, and quick-change tooling mechanisms are sustaining demand. The pharmaceutical and food processing sectors are particularly increasing their uptake, necessitated by stringent regulatory requirements regarding cleanliness, material compatibility (e.g., stainless steel usage), and the need for sterile, non-contact part handling environments.

Vibratory Bowl Feeder Market introduction

Vibratory bowl feeders are essential automated devices utilized in manufacturing and assembly processes to orient and feed individual components (parts) into a production machine or process line at a controlled rate and specific orientation. These systems operate on the principle of directed vibration, which causes parts placed randomly in a bowl to move spirally upward along an internal track. This movement, combined with tooling features integrated into the bowl walls, gradually separates, orients, and presents the parts correctly for robotic pickup or direct machine loading. The core objective of these feeders is to ensure consistent, reliable, and high-speed delivery of components, significantly enhancing throughput and minimizing manual intervention on assembly lines.

The primary applications of vibratory bowl feeders span high-volume manufacturing environments, including the assembly of intricate electronic components, micro-mechanical parts for medical devices, fasteners in the automotive industry, and caps/closures in the packaging sector. Their major benefit lies in their capacity to handle parts of complex geometries and tiny sizes with high precision, ensuring that the components are always presented in the correct orientation, which is crucial for subsequent automated operations like welding, gluing, or insertion. This reliability is foundational to automated production efficiency, directly impacting product quality and operational costs.

Key factors driving the expansion of the vibratory bowl feeder market include the global push toward industrial automation to counteract rising labor costs and shortages, the necessity for greater precision and repeatability in modern manufacturing, and the accelerating complexity and miniaturization of manufactured products. As assembly tolerances become tighter, the demand for sophisticated feeding equipment capable of handling delicate or dimensionally challenging parts accurately increases. Furthermore, the integration capabilities of modern feeders with advanced machine vision and robotic systems position them centrally in the ongoing global shift toward smart factory environments and mass customization production models.

Vibratory Bowl Feeder Market Executive Summary

The Vibratory Bowl Feeder Market is characterized by steady technological evolution emphasizing integration, speed, and noise reduction, driven primarily by the global surge in automated manufacturing investment. Business trends indicate a strong move toward highly customized feeding solutions capable of handling diverse materials—from delicate plastics to heavy metal fasteners—with minimized part damage. Major manufacturers are focusing on developing digital feeder controls (HMI/PLC integration) that allow for real-time monitoring, remote diagnostics, and quick parameter adjustments, aligning with Industry 4.0 protocols. Mergers and acquisitions are frequent among regional niche providers and global automation solution conglomerates seeking to consolidate expertise and expand geographic reach, particularly into high-growth manufacturing hubs in Southeast Asia.

Regionally, Asia Pacific (APAC) stands as the dominant market driver, fueled by massive capacity expansion in electronics assembly, automotive manufacturing, and consumer goods production in countries like China, India, and Vietnam. North America and Europe maintain strong market positions due to high-value manufacturing segments such as medical devices and aerospace, where high precision and strict regulatory compliance necessitate premium, specialized feeding solutions. While APAC dominates volume, Western markets focus on sophisticated, highly integrated, and proprietary system designs. Emerging markets in Latin America and MEA are showing increased growth potential as they modernize their industrial bases, albeit starting from a smaller installed base.

Segmentation analysis highlights the continued dominance of stainless steel feeders due to their durability and compliance suitability for food and pharmaceutical applications. However, the fastest growth is observed in customized feeders, which address the increasing complexity of modern product designs that standard feeders cannot accommodate efficiently. The electronics industry remains the largest end-user segment globally, demanding miniature part feeders with high throughput. Concurrently, the rise of modular and flexible feeding technology (such as robotic hoppers and linear track systems) represents a significant segmentation trend, posing competitive pressure on traditional vibratory bowls, though both systems often coexist within complex automation cells, optimizing different stages of the assembly process.

AI Impact Analysis on Vibratory Bowl Feeder Market

Common user questions regarding AI's influence center on whether smart systems can improve operational efficiency beyond standard mechanical adjustments, specifically focusing on predictive maintenance capabilities, enhanced part discrimination, and optimizing feed rates autonomously. Users frequently inquire about the feasibility of AI algorithms recognizing subtle defects or variations in parts that conventional machine vision might miss, and how self-learning systems can adapt to changes in component batches or wear-and-tear within the bowl tooling. The primary expectation is a reduction in downtime through anticipating mechanical failures and minimizing misfeeds by dynamically adjusting vibration parameters based on real-time feedback, moving the feeder from a static mechanical device to a self-optimizing mechatronic unit.

The integration of Artificial Intelligence and Machine Learning (ML) into vibratory bowl feeder systems is transforming them from simple mechanical devices into smart, responsive elements of the assembly line. AI algorithms leverage data gathered from embedded sensors—such as acceleration, acoustic signatures, and vision system feedback—to predict component jamming or part quality issues before they halt the production line. This predictive capability drastically reduces unscheduled downtime and improves Overall Equipment Effectiveness (OEE). Furthermore, ML allows the feeder to "learn" the optimal vibration frequency and amplitude required for presenting a specific batch of components, automatically compensating for environmental factors like humidity or slight variations in component dimensions that occur during the supplier's molding or stamping processes.

The next generation of vibratory feeders will utilize AI for advanced sorting and quality control. By coupling AI with high-speed cameras, the system can rapidly analyze component orientation and geometry, making micro-adjustments to the feed track tooling or diverting defective parts instantly. This capability transcends simple pass/fail checks; it enables real-time process optimization upstream, providing immediate feedback on component quality drift. This level of smart automation ensures higher downstream process reliability, validating the feeder's role not just as a parts presenter, but as an integrated quality assurance checkpoint within the fully automated factory ecosystem.

- Implementation of predictive maintenance scheduling based on vibration anomaly detection.

- AI-enhanced vision systems for instant, nuanced defect recognition and sorting of complex parts.

- Autonomous optimization of feed rates and vibration parameters to prevent jamming and maximize throughput.

- Self-learning algorithms to rapidly adapt feeding strategies for new or slightly varying component batches.

- Integration of feeder control into centralized factory AI platforms for global process synchronization.

DRO & Impact Forces Of Vibratory Bowl Feeder Market

The market dynamics are governed by a complex set of factors: Drivers include the urgent necessity for high-speed industrial automation and the resultant demand for reliable component presentation systems across mass-production sectors. Restraints primarily revolve around the high initial capital expenditure associated with custom-engineered solutions, the long lead times for complex tooling, and the operational inflexibility when switching between vastly different component types. Opportunities lie in the proliferation of small-batch, high-mix manufacturing, which necessitates flexible tooling and quick-change mechanisms, alongside the ongoing push for Industry 4.0 compliant, data-enabled equipment. These forces collectively shape the competitive landscape and technological roadmap for manufacturers in the sector.

Key drivers sustaining market expansion involve the continuous automation investment by the automotive industry for producing complex sub-assemblies and the burgeoning requirement for micro-component handling in the consumer electronics and MedTech markets. Regulatory pressures in sectors like pharmaceuticals, demanding high sanitary standards and audit trails for assembly processes, further boost the adoption of precision stainless steel feeders. However, the market faces significant restraints. The complexity involved in designing custom tooling for uniquely shaped parts is substantial, often requiring iterative physical prototyping which increases cost and delay. Furthermore, the specialized nature of traditional vibratory feeding limits their application, pushing some users towards general-purpose robotic handling cells that offer greater flexibility, albeit potentially lower throughput for specific high-volume parts.

The most significant impact forces acting on the market stem from technological substitution and macroeconomic stability. The rise of alternative feeding methods, such as flexible feeders utilizing robotics and vision systems (often called 'Any-Part' feeding systems), provides strong competitive pressure, particularly for low-volume, high-mix production. Simultaneously, global economic cycles and capital expenditure constraints in key manufacturing regions directly influence the rate of automation adoption and, consequently, the demand for new bowl feeder installations. Successful market players are those who can mitigate the technological threat by integrating smart features into traditional feeders while offering compelling ROI justifications through enhanced speed, reliability, and reduced maintenance costs.

Segmentation Analysis

The Vibratory Bowl Feeder Market is segmented based on the fundamental characteristics defining the equipment’s operation and its end application. Segmentation primarily categorizes the market by Type (Standard vs. Customized, based on design complexity and application specificity), Material (Stainless Steel, Aluminum, Polyurethane, driven by industry standards and part requirements), and crucially, by End-User Industry (which dictates volume, precision, and regulatory needs). This structure allows for a detailed assessment of market trends, identifying high-growth niches such as the specialized medical device feeder segment and tracking material preferences necessary for hygienic processing environments.

- By Type:

- Standard (Off-the-shelf, common fastener sizes)

- Customized (Engineered for unique, complex, or fragile parts)

- High-Speed (Optimized for very high throughput applications)

- By Material:

- Stainless Steel (Mandatory for food, pharmaceutical, and cleanroom environments)

- Aluminum (Common for general industrial applications)

- Other Materials (Polyurethane coatings, specialized plastics for noise reduction and part protection)

- By End-User Industry:

- Automotive (Fasteners, sensors, small components)

- Electronics and Semiconductors (Micro-components, surface mount devices)

- Pharmaceutical and Medical Devices (Syringe components, blister pack items)

- Packaging (Caps, closures, labels)

- Food & Beverage (Bottle caps, sealing rings)

- Consumer Goods

Value Chain Analysis For Vibratory Bowl Feeder Market

The value chain for the vibratory bowl feeder market begins with the upstream sourcing of high-quality raw materials, predominantly precision-machined stainless steel and aluminum, along with specialized magnetic coils, elastomers, and sophisticated electronic components (PLCs, sensors, drives). The effectiveness of the feeder is highly dependent on the quality and consistency of these inputs. Manufacturers must maintain robust relationships with metal suppliers who can guarantee tight tolerances and material certifications, especially for stainless steel used in regulated industries. Coil winding and electronics sourcing represent critical stages, influencing the operational lifespan and control capabilities of the final feeder unit.

The central phase involves design, engineering, and precision manufacturing. This stage encompasses highly specialized activities such as acoustic dampening optimization, track welding, and, most critically, tooling design—which requires deep application knowledge to ensure correct part orientation and flow dynamics. Many companies specialize in custom tooling design, often serving as critical subcontractors. Downstream activities involve distribution channels. These are typically bifurcated into direct sales for large, complex, and integrated automation projects, and indirect channels relying on distributors, system integrators, and value-added resellers (VARs) who incorporate the feeders into larger turnkey assembly systems. System integrators play a vital role, bridging the gap between component supply and final line installation.

The end-user phase focuses on installation, integration, and aftermarket support, including maintenance, spare parts, and tooling changes required by evolving production needs. The profitability and competitive edge often stem from the quality of integration services, ensuring the feeder operates optimally within the customer's existing robotic or machine-tool infrastructure. Direct channels enable closer customer feedback loops, facilitating continuous product improvement and adaptation. The trend toward digital feeders and remote diagnostics is enhancing the service component of the value chain, shifting focus towards subscription-based maintenance and software updates rather than just physical component replacement.

Vibratory Bowl Feeder Market Potential Customers

The primary consumers of vibratory bowl feeders are businesses operating high-volume manufacturing assembly lines that require precise and consistent feeding of small to medium-sized components. These end-users are concentrated in sectors where speed, repeatability, and minimal component damage are paramount. Key buyer criteria include maximum achievable throughput (parts per minute), reliability (MTBF/uptime), ease of changeover, and compliance with industry-specific standards, such as validated processes in pharmaceuticals or IATF 16949 certification in automotive manufacturing. The purchasing decision often involves collaboration between production engineers, automation specialists, and procurement teams, prioritizing the total cost of ownership (TCO) over the initial purchase price.

Within the automotive industry, customers include Tier 1 and Tier 2 suppliers responsible for producing intricate sub-assemblies like braking systems, engine sensors, and interior components, all requiring precise delivery of fasteners, springs, and small molded parts. In the electronics sector, manufacturers of consumer devices, telecommunications equipment, and computer hardware rely heavily on these feeders for handling micro-screws, pins, and contacts critical for printed circuit board (PCB) assembly and enclosure construction. The critical mass of production volume in these sectors makes manual handling prohibitive, solidifying the continuous demand for reliable automation infrastructure.

Furthermore, the pharmaceutical and medical device industries represent highly strategic customer segments, characterized by stringent demands for sanitation, non-contact handling, and specialized materials (stainless steel 316L). These customers utilize feeders for presenting components like syringe plungers, needle hubs, and capsule halves, where validation of the feeding process is mandatory for regulatory approval. Their purchasing calculus places extremely high value on system validation documents, material traceability, and ease of cleaning, often preferring suppliers who specialize in hygienic design principles over general industrial automation providers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.2 Billion |

| Market Forecast in 2033 | USD 6.7 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Aylesbury Automation, Afag Automation, RNA Automation, Fortville Feeders, Vibrant Technologies, Moorfeed Corp, DEPRAG SCHULZ GMBH & CO., K.G., Feedall Automation, Automation Devices, Inc. (ADI), SMC Corporation, WEBER Schraubautomaten GmbH, TDS Automation, AST Automation, Shinwa Co., Ltd., Reo-Pack A/S, Bosch Rexroth AG, FlexFactory GmbH, Automation Engineering Inc., ARBURG GmbH + Co KG, SANKI SEIKO. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Vibratory Bowl Feeder Market Key Technology Landscape

The technological landscape of the vibratory bowl feeder market is undergoing a significant transformation, moving beyond simple electromechanical vibration toward sophisticated mechatronic systems. A critical technological focus is on precision control. Modern feeders utilize digital control systems, often incorporating advanced Programmable Logic Controllers (PLCs) and Human-Machine Interfaces (HMIs), allowing operators to precisely adjust vibration frequency, amplitude, and sequencing digitally, rather than through manual tuning of mechanical counterweights or springs. This digital control is essential for managing delicate parts and achieving higher synchronization with high-speed downstream robotics, ensuring seamless pick-and-place operations with minimal cycle time variation.

Another major area of innovation is noise reduction and acoustic dampening. As industrial health and safety standards become stricter, manufacturers are integrating advanced polymer coatings, specialized mounting techniques, and enclosures to significantly reduce the operational noise levels generated by the vibrating metal components. Furthermore, rapid tooling change technology is becoming crucial for supporting flexible manufacturing models (high-mix, low-volume). Quick-change bowls, standardized mounting interfaces, and modular feeder designs allow production lines to rapidly switch between different components, reducing non-productive changeover time from hours to minutes, thus maximizing utilization in environments requiring frequent product variants.

Finally, the proliferation of sensor technology and machine vision integration defines the high-end segment. Advanced sensors monitor part accumulation, track orientation success rates, and provide real-time feedback to the PLC. Vision systems are increasingly used not just for verifying correct part orientation post-feeding, but also for actively guiding the feeder's parameters or triggering component rejection systems early in the process. This convergence of feeding mechanics, digital intelligence, and optical inspection enhances overall system reliability and forms the foundation for future AI-driven optimization, ensuring the continued relevance of vibratory feeding systems in highly automated smart factories.

Regional Highlights

Asia Pacific (APAC) stands as the undisputed engine of growth for the vibratory bowl feeder market, primarily due to the region's dominance in global electronics manufacturing, large-scale automotive production, and consumer goods assembly, particularly in China, South Korea, Japan, and India. The immense production volumes necessitate continuous investment in high-throughput automation equipment to maintain cost competitiveness. Local manufacturers in APAC are rapidly adopting advanced feeding technologies, often driven by government initiatives pushing for industrial modernization (e.g., "Made in China 2025"). The demand here is characterized by high volume, cost efficiency, and systems capable of handling extremely small, fragile components common in the mobile device and semiconductor industries.

North America and Europe represent mature markets characterized by replacement demand, stringent quality standards, and a focus on highly specialized, high-margin applications. In North America, growth is robust in the medical device, aerospace, and defense sectors, where feeders must often handle exotic materials and adhere to strict validation protocols (FDA compliance). European markets, particularly Germany and Italy, exhibit strong demand driven by the high-end automotive sector and sophisticated machinery manufacturing. These regions prioritize precision, reliability, system longevity, and the seamless integration of feeders into complex, proprietary automation architectures, often featuring advanced safety and acoustic dampening measures.

Latin America (LATAM) and the Middle East & Africa (MEA) are emerging regions showing gradual but accelerating adoption, driven by foreign direct investment in manufacturing and localized industrialization efforts. In LATAM, growth is tied to the expansion of automotive assembly plants (Mexico, Brazil) and packaging industries. In MEA, industrial diversification, especially in the Gulf Cooperation Council (GCC) states focusing on non-oil economic sectors, is generating demand for manufacturing automation, including parts feeding systems. While these regions currently hold smaller market shares, the rapid pace of infrastructure development and the increasing cost of labor signal significant future potential for automated solutions like vibratory bowl feeders.

- Asia Pacific (APAC): Dominant market, driven by electronics assembly and high-volume automotive production, leading in new installations and capacity expansion.

- North America: Focus on high-precision segments like medical devices, aerospace, and specialized industrial machinery, valuing technology integration and compliance.

- Europe: Strong demand from the automotive components sector and machinery manufacturing, emphasizing quality, noise reduction, and adherence to strict EU standards.

- Latin America (LATAM): Emerging market growth linked to localized automotive and packaging manufacturing modernization in key economies.

- Middle East & Africa (MEA): Growth potential derived from industrial diversification strategies and investment in regional manufacturing hubs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Vibratory Bowl Feeder Market.- Aylesbury Automation Ltd.

- Afag Automation AG

- RNA Automation Ltd.

- Fortville Feeders, Inc.

- Vibrant Technologies Co., Ltd.

- Moorfeed Corp.

- DEPRAG SCHULZ GMBH & CO., K.G.

- Feedall Automation, Inc.

- Automation Devices, Inc. (ADI)

- SMC Corporation

- WEBER Schraubautomaten GmbH

- TDS Automation

- AST Automation Systems Technologies

- Shinwa Co., Ltd.

- Reo-Pack A/S

- Bosch Rexroth AG

- FlexFactory GmbH

- Automation Engineering Inc.

- ARBURG GmbH + Co KG

- SANKI SEIKO CO., LTD.

Frequently Asked Questions

Analyze common user questions about the Vibratory Bowl Feeder market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of customized vibratory bowl feeders?

The primary driver is the increasing complexity and miniaturization of components, particularly in the electronics and medical device sectors. Customized feeders are essential to handle unique geometries, delicate materials, and specialized orientations that standard off-the-shelf units cannot reliably achieve at high speeds, thus maintaining production efficiency.

How are Industry 4.0 principles being applied to enhance vibratory feeder performance?

Industry 4.0 integration involves utilizing digital controls, embedded sensors, and network connectivity (IoT) to enable real-time performance monitoring, remote diagnostics, and data-driven predictive maintenance. This shift allows feeders to communicate directly with MES/ERP systems, optimizing component supply chain logistics and overall line synchronization.

What are the main drawbacks of traditional vibratory bowl feeders compared to flexible feeding systems?

Traditional vibratory feeders lack flexibility; they are typically single-part, single-purpose machines. They require significant time and cost investment for tooling changeovers and are impractical for high-mix, low-volume production runs, unlike vision-guided flexible feeders which can handle a wide range of parts without major mechanical retooling.

Which end-user industry accounts for the highest market share in the vibratory bowl feeder market?

The electronics and semiconductor industry consistently holds the largest market share due to the immense volume of small, complex components (e.g., micro-screws, connectors, pins) requiring extremely high throughput and precision feeding for automated assembly processes like PCB population and device enclosure construction globally.

What materials are mandatory for vibratory feeders used in the pharmaceutical and food processing industries?

In pharmaceutical and food processing sectors, compliance with strict sanitary and hygiene regulations mandates the use of materials such as Stainless Steel grades (e.g., 304 or 316L). These materials are chosen for their corrosion resistance, non-reactivity, and ease of cleaning, ensuring non-contamination and process validation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager