Video Conferencing Equipment Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442562 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Video Conferencing Equipment Market Size

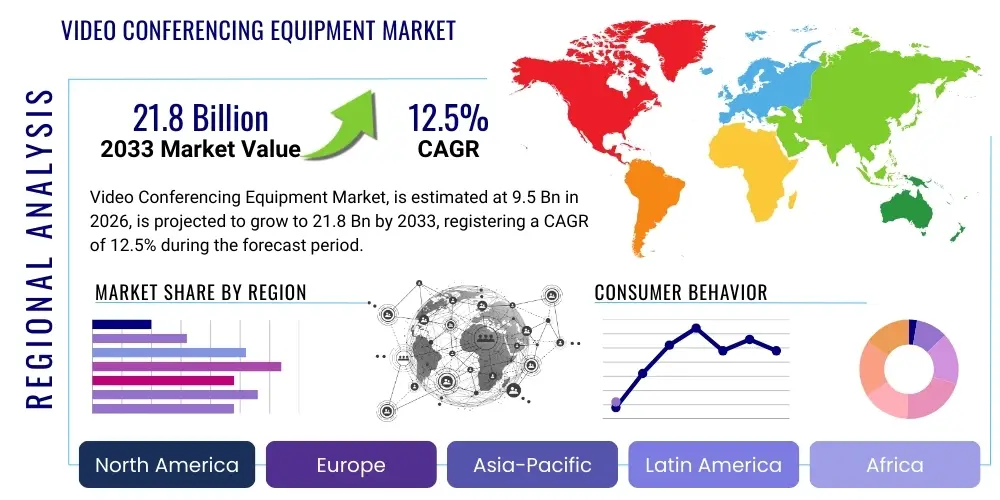

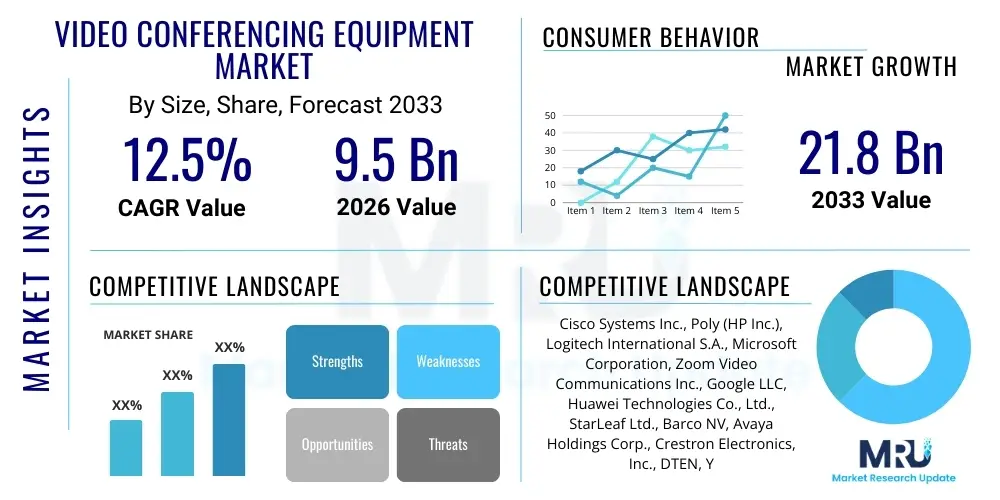

The Video Conferencing Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 9.5 Billion in 2026 and is projected to reach USD 21.8 Billion by the end of the forecast period in 2033.

Video Conferencing Equipment Market introduction

The Video Conferencing Equipment Market encompasses hardware, software, and dedicated services designed to facilitate real-time visual and audio communication between geographically dispersed participants. This market includes professional-grade devices such as dedicated room systems, immersive telepresence solutions, high-definition cameras, specialized microphones, and integrated codecs. The core drivers for market expansion stem from the global transition towards hybrid and remote work models, requiring reliable, high-quality collaboration tools that mimic in-person interactions effectively. Furthermore, the increasing adoption of video communication across non-corporate sectors, notably in telemedicine and virtual education, significantly contributes to the demand for advanced equipment.

Product sophistication is rapidly increasing, moving beyond basic camera and microphone setups to include smart features like automated framing, acoustic echo cancellation, and 4K resolution capabilities. These advancements address critical pain points related to meeting productivity, user experience, and seamless integration with unified communication platforms (UCC). Key applications span corporate boardrooms, huddle spaces, educational lecture halls, clinical settings for remote diagnostics, and government communications. The primary benefit derived from these technologies is the reduction of travel costs and time, coupled with enhanced organizational agility and improved global team collaboration, making video conferencing equipment a foundational element of modern enterprise infrastructure.

Driving factors are heavily influenced by the widespread availability of high-speed internet infrastructure, particularly the rollout of 5G networks, which guarantees low latency and high bandwidth necessary for superior video quality. Additionally, competitive pressure to maintain business continuity and accelerate digital transformation mandates the integration of sophisticated conferencing solutions. The shift from traditional proprietary systems toward standardized, software-defined solutions also lowers entry barriers and encourages broader adoption across Small and Medium-sized Enterprises (SMEs), further propelling market growth across diverse vertical markets.

Video Conferencing Equipment Market Executive Summary

The Video Conferencing Equipment Market is undergoing a rapid evolution, primarily fueled by enduring business trends centered on enterprise digitalization and the normalization of flexible work arrangements. Hybrid work models necessitate sophisticated, interoperable equipment that can seamlessly connect office environments with remote workers, driving demand for intelligent endpoints capable of managing mixed environments. Business trends indicate a strong move toward cloud-based video services and Hardware-as-a-Service (HaaS) models, offering scalability and reduced capital expenditure, making premium conferencing solutions accessible to a wider spectrum of businesses. Technological integration, particularly with AI for meeting automation and enhanced audio-visual quality, is becoming a decisive competitive differentiator among leading vendors, focusing on optimizing meeting efficiency and user comfort.

Regionally, North America maintains its dominance due to early adoption of advanced technologies, the presence of major technology hubs, and robust corporate spending on IT infrastructure upgrades. However, the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, propelled by massive digitalization initiatives in emerging economies like India and China, coupled with a booming SME sector increasingly relying on cost-effective video collaboration tools. European markets are characterized by stringent data privacy regulations (GDPR), leading to increased demand for secure, on-premise, or highly compliant cloud-hybrid solutions, especially within governmental and financial services sectors. The market dynamics across these geographies are often dictated by local connectivity infrastructure quality and regulatory frameworks governing data transmission.

Segment trends highlight the burgeoning importance of Huddle Room Systems, representing the fastest-growing equipment category, reflecting the shift away from large boardrooms toward smaller, impromptu collaboration spaces. The Software segment, particularly cloud-based licensing for platforms, is outpacing hardware growth, signifying the market's movement toward unified communication ecosystems rather than standalone physical devices. Furthermore, the application segment shows remarkable expansion in the Healthcare and Education verticals. Telemedicine requires reliable, high-resolution equipment for remote consultations, while educational institutions invest in synchronous learning tools, ensuring robust and interactive virtual classroom experiences, thus diversifying the market beyond traditional corporate use cases.

AI Impact Analysis on Video Conferencing Equipment Market

User queries regarding AI's influence on the Video Conferencing Equipment Market frequently center on themes of automation, user experience enhancement, and potential security vulnerabilities. Common questions include: "How does AI improve meeting productivity?", "Will AI eliminate the need for dedicated conference room staff?", "What are the privacy implications of AI-driven facial recognition in meeting rooms?", and "How is AI mitigating background noise and acoustic challenges?" The core user expectation is that AI should invisibly integrate to solve operational frictions, making the meeting experience smoother and more efficient without compromising data security or individual privacy. There is a strong interest in AI features like automated summarization and transcription, which promise tangible time savings post-meeting.

Based on this analysis, AI is transforming video conferencing from a passive communication tool into an intelligent collaboration engine. Key themes revolve around perceptual improvements—AI-powered features such as automated camera framing (speaker tracking), dynamic illumination adjustment, and superior noise suppression (acoustic fence technology) are standardizing the high-quality meeting experience regardless of the physical environment. Furthermore, AI algorithms are integral to backend operations, optimizing network bandwidth usage and predicting potential connectivity issues, thereby ensuring superior reliability and uptime for crucial business meetings. These capabilities significantly enhance the value proposition of modern conferencing equipment, justifying premium pricing for integrated smart systems.

However, the integration of AI also raises pertinent concerns regarding data governance and ethical use. Features that involve biometric analysis, such as attendee identification or emotion detection, prompt questions about consent and data retention policies. Users are keenly aware that meeting recordings and transcriptions represent sensitive corporate data, driving demand for solutions that offer edge processing—where AI computations occur locally on the device rather than in the cloud—to bolster privacy. The market is thus responding by developing robust, certified AI-enabled endpoints that balance advanced functionality with rigorous compliance standards, ensuring widespread enterprise trust and adoption.

- AI-driven Noise and Acoustic Suppression: Eliminating distractions and enhancing voice clarity.

- Automated Camera Framing and Speaker Tracking: Dynamically adjusting focus and zoom for optimal visual presentation.

- Real-time Transcription and Translation: Providing accessibility and facilitating international meetings.

- Meeting Summarization and Action Item Generation: Increasing post-meeting productivity and documentation efficiency.

- Predictive Maintenance and Diagnostics: AI monitoring system health and preempting hardware failures.

- Facial Recognition for Seamless Login and Personalized Settings: Expediting room setup and user authentication.

- Bandwidth Optimization and Quality of Service (QoS) Management: Intelligently adapting video streams to available network conditions.

DRO & Impact Forces Of Video Conferencing Equipment Market

The dynamics of the Video Conferencing Equipment Market are primarily shaped by a powerful confluence of external and internal forces, encapsulated by Drivers, Restraints, and Opportunities (DRO). Major drivers include the irreversible global shift toward hybrid working models, the necessity for geographically dispersed teams to collaborate seamlessly, and the inherent cost-saving benefits associated with reduced business travel. The continual miniaturization and performance improvement of hardware components, coupled with advancements in high-speed connectivity (5G/Fiber), further accelerate adoption. These driving forces create a sustained, foundational demand for reliable and feature-rich communication endpoints across all organizational sizes, moving video collaboration from a specialized tool to an essential utility.

Despite robust growth, the market faces significant restraints, notably the persistent security concerns surrounding data transmission and unauthorized access to proprietary corporate communications. The integration of complex hardware and software ecosystems often presents interoperability challenges between competing vendor platforms, complicating deployment and management for IT departments. Furthermore, the high initial capital investment required for deploying dedicated, high-end room systems, particularly for smaller organizations, can serve as a barrier to entry. While cloud-based solutions mitigate some initial costs, reliance on external network infrastructure introduces vulnerabilities and performance variability that must be continuously managed, restraining full-scale enterprise adoption in certain highly regulated sectors.

Opportunities for growth are concentrated in untapped verticals and emerging technologies. The rapid expansion of telemedicine and distance learning creates new, highly specialized application needs, requiring ruggedized and customized equipment. The integration of Extended Reality (XR) technologies, including augmented and virtual reality, promises to usher in the next generation of immersive meeting experiences, positioning collaboration equipment at the forefront of digital workplace innovation. Moreover, the massive underserved market represented by SMEs in developing economies, increasingly accessing video communication through affordable, standardized cloud subscriptions, offers a substantial runway for volume growth, supported by governmental initiatives focused on digital inclusion and infrastructure development. Successfully navigating the security-interoperability trade-off while capitalizing on specialized applications will define market leadership in the coming decade.

Segmentation Analysis

The Video Conferencing Equipment Market is analyzed across critical dimensions including component type, deployment model, organizational size, and application vertical, providing a granular view of market dynamics and adoption trends. The stratification by component reveals the ongoing strategic competition and synergy between specialized hardware, proprietary software, and essential integration/maintenance services. Analyzing deployment models highlights the accelerated trend towards flexibility, with cloud-based services gaining significant traction due to their scalability and operational simplicity, challenging the traditional dominance of on-premise systems.

Furthermore, segmentation by organizational size—Small and Medium-sized Enterprises (SMEs) versus Large Enterprises—demonstrates differing priorities: Large enterprises focus on robust, highly integrated telepresence systems, while SMEs prioritize cost-effectiveness and ease of use, often favoring software-only or huddle room solutions. The application vertical segmentation is vital, showcasing market penetration across Corporate, Education, Healthcare, and Government sectors, each demanding unique features relating to security, compliance, and specific end-user environments. This multi-faceted segmentation allows vendors to tailor product development and go-to-market strategies precisely, addressing the diverse needs inherent in the rapidly evolving collaborative landscape.

The most lucrative segment currently resides within the Software and Services categories, as enterprises increasingly seek managed services, customized integration, and continuous software updates that unlock the full potential of their physical hardware assets. The shift towards Subscription-based models (SaaS and HaaS) ensures recurring revenue streams for vendors and lowers the total cost of ownership (TCO) for end-users. The continuous refinement of software codecs and cloud infrastructure means that the performance gap between dedicated hardware and advanced software solutions is narrowing, leading to a converged ecosystem where interoperability and feature parity are key buying considerations.

- By Component:

- Hardware (e.g., dedicated systems, cameras, microphones, codecs)

- Software (e.g., proprietary licenses, cloud services, endpoints software)

- Services (e.g., managed services, integration, maintenance, consulting)

- By Deployment Type:

- On-premise

- Cloud-based

- Hybrid

- By Organization Size:

- Small and Medium Enterprises (SMEs)

- Large Enterprises

- By Application:

- Corporate (Huddle Rooms, Boardrooms)

- Education (Virtual Classrooms, Administration)

- Healthcare (Telemedicine, Remote Diagnostics)

- Government and Defense (Secure Communications)

- Others (Legal, Media, Finance)

Value Chain Analysis For Video Conferencing Equipment Market

The Value Chain for the Video Conferencing Equipment Market initiates with the upstream analysis, dominated by component manufacturers specializing in high-fidelity audio sensors, high-resolution optics (4K/8K cameras), dedicated processors (DSPs and GPUs), and advanced codec chips. These foundational technology suppliers, often located in Asia Pacific, dictate the quality and cost base of the final product. Research and Development (R&D) activities at this stage focus heavily on miniaturization, enhanced processing efficiency, and integrating machine learning capabilities directly onto the chips, optimizing performance for real-time video processing and AI features like noise cancellation and facial recognition. Patent portfolio and technological differentiation are critical competitive factors in this upstream segment.

The core manufacturing and assembly stage involves integrating these components into branded equipment—dedicated room systems, USB cameras, speakerphones, and software endpoints. Market leaders focus on industrial design, user interface optimization, and rigorous testing for interoperability across various Unified Communications (UC) platforms like Microsoft Teams, Zoom, and Cisco Webex. This stage is closely followed by the distribution channel, which utilizes both direct and indirect models. Direct sales are common for large enterprise contracts involving extensive customization and system integration, typically handled by the equipment manufacturer’s internal sales team. Indirect channels rely heavily on value-added resellers (VARs), system integrators, and specialized distributors who provide installation, training, and ongoing technical support to end-users, acting as crucial intermediaries that add significant value by bundling hardware with necessary managed services.

The downstream analysis focuses on the end-user deployment and continuous service provision. System integrators play a vital role in ensuring that video conferencing equipment is properly integrated into existing IT networks, meeting room acoustics, and security protocols. Post-sales services, including software updates, cloud platform subscriptions (for signaling and bridging), and maintenance contracts, represent a substantial and growing portion of the total market value. The proliferation of Hardware-as-a-Service (HaaS) models further solidifies the role of the downstream service provider, shifting the revenue structure from a one-time equipment sale to a subscription-based, long-term relationship, emphasizing ongoing customer support and infrastructure management.

Video Conferencing Equipment Market Potential Customers

Potential customers for Video Conferencing Equipment span a broad range of sectors, fundamentally driven by the need for enhanced connectivity and collaborative efficiency. The largest segment remains the corporate sector, including multinational corporations, large enterprises, and Small and Medium-sized Enterprises (SMEs), all seeking to optimize operational costs associated with travel and accelerate decision-making processes. Large enterprises typically invest in premium, immersive telepresence systems and extensive huddle room deployments across global offices, focusing on seamless interoperability and centralized management capabilities. SMEs, conversely, represent a high-volume market favoring cost-effective, easy-to-deploy solutions, often leveraging high-quality USB peripherals and cloud-based subscription services to meet their collaboration needs without significant upfront capital investment.

Beyond traditional corporate use, the Healthcare sector is a rapidly expanding customer base, utilizing high-definition video conferencing for telemedicine services, remote patient monitoring, surgical assistance, and continuing medical education. These customers prioritize equipment reliability, specialized HIPAA/GDPR compliance features, and exceptional video fidelity necessary for accurate remote diagnosis. Similarly, educational institutions—from K-12 schools to universities—are significant buyers, investing in equipment to support distance learning, hybrid classroom models, and administrative meetings. Their requirements often focus on integrating with Learning Management Systems (LMS) and ensuring ease of use for educators and students alike, driving demand for educational-specific collaboration tools.

Government and defense agencies also constitute a crucial segment, prioritizing highly secure, encrypted, and often certified on-premise or private cloud solutions due to the sensitive nature of their communications. This segment demands equipment built to strict specifications regarding data integrity and national security protocols. Emerging customer segments include legal services for virtual court appearances and client consultations, and media/entertainment companies requiring high-quality, low-latency collaboration for remote production and content review. The diversity of these end-user needs underscores the necessity for flexible, modular, and specialized video conferencing solutions tailored to specific vertical market compliance and functional requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 9.5 Billion |

| Market Forecast in 2033 | USD 21.8 Billion |

| Growth Rate | CAGR 12.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cisco Systems Inc., Poly (HP Inc.), Logitech International S.A., Microsoft Corporation, Zoom Video Communications Inc., Google LLC, Huawei Technologies Co., Ltd., StarLeaf Ltd., Barco NV, Avaya Holdings Corp., Crestron Electronics, Inc., DTEN, Yealink Network Technology Co. Ltd., NEC Corporation, Sony Corporation, Aver Information Inc., Lifesize, Inc., Pexip AS, Vaddio (Legrand AV), BlueJeans by Verizon |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Video Conferencing Equipment Market Key Technology Landscape

The technological landscape of the Video Conferencing Equipment Market is characterized by a relentless pursuit of greater immersion, improved reliability, and seamless integration with existing IT infrastructure. Central to this evolution is the standardization and adoption of advanced codecs and transmission protocols, such as H.265 (High-Efficiency Video Coding) for delivering high-resolution video (4K and beyond) with minimal bandwidth overhead, crucial for maintaining quality in constrained network environments. Furthermore, WebRTC (Web Real-Time Communication) technology has gained immense traction, enabling browser-based, plug-in-free video calls, significantly lowering barriers to entry and simplifying the user experience across diverse devices and operating systems, which is a key driver for the software segment's growth.

A critical technical focus area is the enhancement of acoustic performance through sophisticated digital signal processing (DSP) and AI integration. Technologies such as beamforming microphones, adaptive noise cancellation, and echo suppression arrays are now standard in professional equipment, ensuring crystal-clear audio even in acoustically challenging meeting spaces. Spatial audio technology is emerging, offering a more immersive and natural conversation experience by simulating the directionality of voices, making remote participants sound as if they are placed within the physical room. Simultaneously, interoperability standards, particularly SIP (Session Initiation Protocol) and H.323, remain foundational, although they are increasingly being superseded by vendor-agnostic cloud bridging services that allow disparate hardware and software platforms (e.g., Teams and Zoom room systems) to connect effortlessly, addressing one of the major historical restraints of the market.

The convergence of professional AV control and conferencing hardware is another significant trend, relying on protocols like Dante for audio networking and PoE (Power over Ethernet) for simplified installation and centralized management. The shift towards IoT in meeting rooms allows conferencing equipment to interact dynamically with room scheduling systems, lighting, and climate control, creating a truly intelligent, automated environment. The ongoing rollout of 5G infrastructure provides the necessary backbone for high-quality mobile and remote participation, ensuring that even participants connected via cellular networks can maintain enterprise-grade video quality. This technological interplay, focusing on automation, high fidelity, and universal access, defines the competitive edge in the modern video conferencing market.

Regional Highlights

- North America: Market Maturity and Innovation Hub

North America currently holds the largest share of the global Video Conferencing Equipment Market, driven by the presence of major technology corporations, a high density of early adopters, and robust corporate spending on digital transformation initiatives. The region's market is characterized by a strong demand for high-end, intelligent room systems and cloud-based subscription services. The United States, in particular, dictates global trends, showing high penetration rates in corporate, healthcare (telemedicine), and federal government sectors. The continuous focus on adopting hybrid work models post-2020 has ensured sustained investment in upgrading legacy equipment and deploying advanced AI-enabled hardware endpoints that prioritize security and seamless user experience, making it a highly competitive and innovation-led region. The market here is highly saturated but constantly refreshing due to rapid technological cycles.

Canada also contributes significantly, with businesses showing a keen interest in integrated Unified Communications as a Service (UCaaS) solutions that bundle video, voice, and messaging. The regulatory environment is supportive of cloud adoption, though data sovereignty requirements occasionally steer larger institutions toward hybrid deployment models. Vendors operating in North America must emphasize strong integration capabilities with popular platforms like Microsoft Teams and Zoom Rooms, as interoperability is a primary purchasing criterion for the region's large enterprise clients. Furthermore, the region is a leader in testing and deploying advanced features like holographic conferencing and AR/VR integration for collaboration.

- Europe: Focus on Compliance and Hybrid Flexibility

Europe represents a highly mature market demonstrating steady, substantial growth, heavily influenced by regional data privacy regulations, specifically the General Data Protection Regulation (GDPR). This regulatory environment means European buyers, particularly those in the financial services and government sectors, often prioritize secure, compliant solutions, favoring vendors who can demonstrate clear data processing boundaries and, in some cases, preferring hybrid or on-premise deployments over pure public cloud models. The adoption of video conferencing equipment across Europe is widely distributed, with significant markets in the UK, Germany, and France.

The post-pandemic shift to long-term flexible working arrangements has accelerated the demand for high-quality huddle room solutions across Central and Western Europe. Companies are focusing on standardizing equipment across home offices and centralized corporate locations to ensure meeting equity between in-office and remote participants. Eastern European countries are experiencing faster adoption rates as enterprises modernize their communication infrastructure. European buyers place a high value on sustainable manufacturing practices and energy efficiency in their technology procurement, increasingly favoring vendors who adhere to rigorous environmental and social governance (ESG) standards alongside technical performance.

- Asia Pacific (APAC): Exponential Growth and Digitalization Drive

The APAC region is projected to register the highest Compound Annual Growth Rate (CAGR) throughout the forecast period. This rapid expansion is fundamentally driven by accelerating digitalization, massive infrastructural investments (especially 5G rollout), and the sheer volume of Small and Medium-sized Enterprises (SMEs) entering the digital economy. Countries such as China, India, Japan, and Australia are key contributors, although their market characteristics differ widely. China and India are volume-driven markets, witnessing substantial government and education sector procurement alongside rapid corporate expansion.

Japan and Australia, being more technologically mature, show demand patterns similar to North America, focusing on premium, high-integration systems. However, a defining feature of the overall APAC market is the preference for mobile-first and low-latency solutions, accommodating vast geographical distances and often mobile-centric workforces. Local vendors hold significant competitive leverage due to lower pricing and quicker customization capabilities. The education sector in APAC, driven by massive population density, represents a crucial growth engine, demanding scalable, reliable equipment for remote learning initiatives. Vendors must address diverse language support and ensure compatibility with regionally dominant communication platforms to succeed in this dynamic and fast-growing market.

- Latin America (LATAM) and Middle East & Africa (MEA): Emerging Opportunities

Growth in LATAM and MEA is robust but nascent compared to other regions. LATAM market growth is driven by increasing foreign investment and the need for multinational corporations operating there to connect seamlessly with global headquarters. Brazil and Mexico are primary centers of demand, focusing on modernizing outdated communication infrastructure. High-quality infrastructure availability remains a variable constraint, leading to demand for equipment optimized for lower bandwidth scenarios.

In the MEA region, particularly the GCC countries (UAE, Saudi Arabia), substantial government-led smart city projects and digitalization mandates in sectors like finance and oil & gas fuel demand for advanced, highly secure video conferencing systems. Africa presents long-term growth potential, predominantly driven by mobile connectivity improvements and expanding educational and healthcare initiatives. Vendors must emphasize scalable, durable, and easily maintainable systems suitable for varying climate and infrastructure conditions across these developing markets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Video Conferencing Equipment Market.- Cisco Systems Inc.

- Poly (HP Inc.)

- Logitech International S.A.

- Microsoft Corporation

- Zoom Video Communications Inc.

- Google LLC

- Huawei Technologies Co., Ltd.

- StarLeaf Ltd.

- Barco NV

- Avaya Holdings Corp.

- Crestron Electronics, Inc.

- DTEN

- Yealink Network Technology Co. Ltd.

- NEC Corporation

- Sony Corporation

- Aver Information Inc.

- Lifesize, Inc.

- Pexip AS

- Vaddio (Legrand AV)

- BlueJeans by Verizon

Frequently Asked Questions

Analyze common user questions about the Video Conferencing Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the key differences between dedicated room systems and USB conferencing devices?

Dedicated room systems (e.g., codecs, telepresence units) are high-fidelity, highly secure, and optimized for large spaces, offering robust integration and network management features. USB conferencing devices (e.g., webcams, speakerphones) are portable, flexible, cost-effective, and primarily designed for huddle rooms or personal use, connecting via a host PC.

How is the rise of hybrid work models impacting demand for video conferencing equipment?

Hybrid work models are driving unprecedented demand for "meeting equity," necessitating intelligent hardware that ensures remote participants have an experience equivalent to in-room attendees. This drives investment in AI-enabled cameras, acoustic optimization tools, and interoperable cloud-based systems for seamless transitions between home and office environments.

Which technology segment—Hardware or Software—is showing faster market growth?

The Software and Services segment is generally exhibiting faster growth than standalone hardware. This is attributed to the widespread adoption of Unified Communications as a Service (UCaaS) platforms and the increasing reliance on recurring subscription models for advanced features, maintenance, and cloud-based bridging services, making the ecosystem software-centric.

What is the role of AI in improving the performance of video conferencing equipment?

AI significantly enhances performance through noise suppression (acoustic fencing), automated camera framing and tracking, real-time transcription, and network optimization. These features reduce user fatigue, improve meeting documentation, and ensure superior audio-visual quality regardless of the ambient conditions in the meeting space.

What are the primary security concerns associated with enterprise video conferencing systems?

Key security concerns include unauthorized interception of video and audio streams, data sovereignty issues related to cloud-based recordings, and vulnerabilities associated with endpoint devices being connected to the corporate network. Enterprises demand robust encryption (end-to-end), certified compliance, and strong access control protocols to mitigate these risks.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager