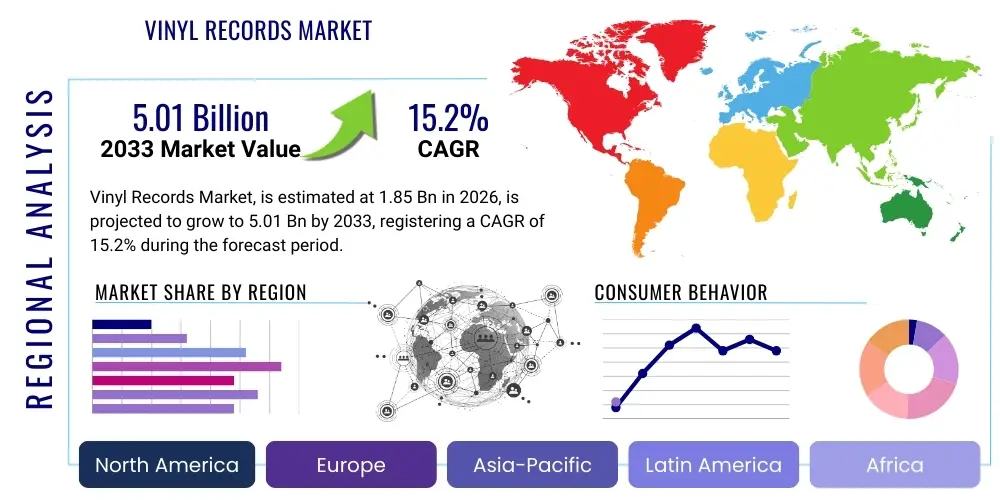

Vinyl Records Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442222 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Vinyl Records Market Size

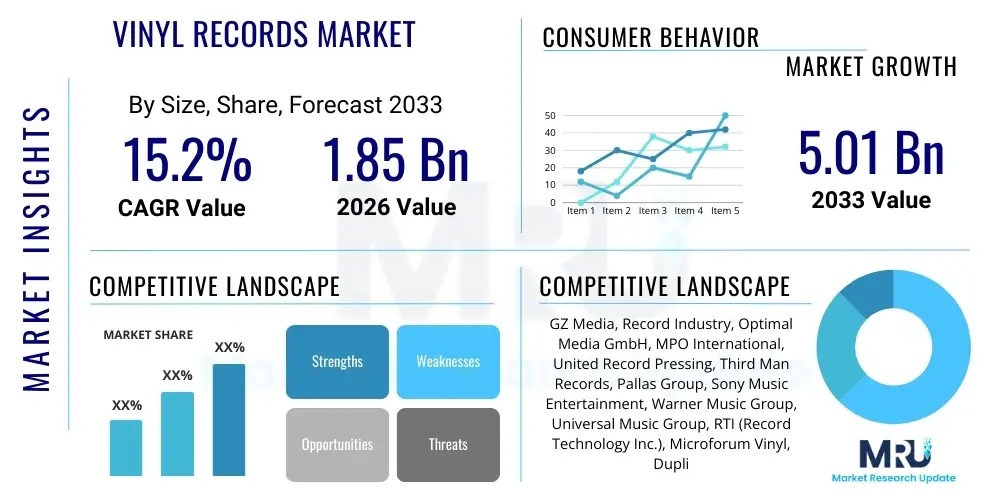

The Vinyl Records Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.2% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 5.01 Billion by the end of the forecast period in 2033.

Vinyl Records Market introduction

The Vinyl Records Market, characterized by the enduring popularity of analog sound carriers, represents a significant niche within the broader music and entertainment industry, experiencing a remarkable resurgence driven by nostalgia, superior audio quality perception, and the tangible collecting experience. This market encompasses the manufacturing, distribution, and retail of phonograph records, typically made of polyvinyl chloride (PVC), which are played on turntables. Unlike their digital counterparts, vinyl records offer a physical artifact deeply valued by enthusiasts, providing album artwork, liner notes, and the unique warmth of analog sound reproduction. The industry is witnessing continuous technological improvements in pressing quality and material science, balancing traditional manufacturing methods with modern precision engineering to meet soaring consumer demand globally.

The primary applications of vinyl records span serious audiophile listening, casual enjoyment, DJ mixing, and high-value collecting. For audiophiles, the perceived richness and depth of analog sound, free from the compression artifacts often associated with digital formats, constitute a major benefit. For general consumers, owning a physical record connects them more intimately with the artists and the music culture. Key benefits driving market expansion include the premium sound experience, the aesthetic and collectible nature of the product, and its positioning as a high-end gift item. Furthermore, artists increasingly utilize vinyl releases as a primary merchandising tool, offering limited editions and colored variants to maximize engagement and revenue streams, capitalizing on the format’s experiential value that digital platforms cannot replicate.

Driving factors for the sustained growth of the Vinyl Records Market are multifaceted, rooted primarily in demographic shifts and cultural trends. The revival is powered both by older generations rediscovering their cherished format and, more critically, by younger consumers (Millennials and Gen Z) embracing vinyl as a fashionable and authentic media format. These younger buyers often purchase vinyl as a complement to digital streaming, desiring a physical connection to their favorite music. The expansion of independent record stores, the prominence of dedicated events like Record Store Day (RSD), and significant investment by major record labels in upgrading pressing plant infrastructure to reduce lead times are further solidifying market momentum. The commitment of high-fidelity equipment manufacturers to producing sophisticated turntables and associated gear also ensures the playback ecosystem remains robust and accessible to new entrants.

Vinyl Records Market Executive Summary

The Vinyl Records Market is currently navigating a pivotal phase characterized by unprecedented demand overwhelming existing manufacturing capacity, driving significant business trends centered around vertical integration and infrastructural expansion. Major business players, including both independent record labels and global music conglomerates, are actively investing hundreds of millions of dollars into new pressing plants and automated machinery to alleviate supply bottlenecks, often leading to consolidation within the manufacturing sector. The business landscape is increasingly segmented between high-volume standard releases requiring efficient mass production and niche, audiophile-grade pressings demanding meticulous quality control and specialized material input. Pricing strategies are also adapting, with limited edition collector items commanding premium prices, while standard reissues maintain competitive retail positioning to appeal to the broader consumer base. This dual approach maximizes market penetration across different consumer willingness-to-pay segments.

Regionally, the market demonstrates robust performance, particularly in established Western economies, though emerging markets are rapidly accelerating their adoption. North America and Europe remain the dominant regions, benefiting from deeply entrenched collecting cultures, high disposable incomes, and the presence of numerous legacy and independent labels fueling continuous new releases and reissues. In North America, the focus is heavily on direct-to-consumer sales and maximizing the impact of Record Store Day, while Europe often leads in manufacturing innovation and sustainability initiatives related to PVC alternatives. The Asia Pacific region, particularly countries like Japan and South Korea, exhibits high-value consumption patterns, emphasizing pristine quality and limited edition imports, signaling strong future growth potential as local manufacturing capacity begins to scale up in key centers like Australia and India.

Segmentation trends reveal dynamic shifts in consumer preferences and purchasing behaviors across various product types and distribution channels. The 12-inch LP remains the primary revenue generator due to its optimal format for full album releases and superior sound fidelity, appealing most strongly to audiophiles and serious collectors. However, the market is observing increasing interest in 7-inch singles, especially for exclusive limited-run releases tied to specific artists or events, catering to impulse buyers and niche collectors. The most profound segment trend is the sustained shift toward online distribution channels, including dedicated label websites and major e-commerce platforms, offering unparalleled reach and efficiency, although brick-and-mortar retail remains crucial for the browsing and discovery experience vital to vinyl enthusiasts. Distribution channels are becoming hybrid, integrating physical retail presence with sophisticated online inventory management to serve a geographically diverse customer base effectively.

AI Impact Analysis on Vinyl Records Market

User inquiries regarding the influence of Artificial Intelligence (AI) on the Vinyl Records Market predominantly focus on optimizing production logistics, enhancing archival quality, and improving consumer discovery. Key themes revolve around whether AI can help solve the persistent manufacturing bottlenecks plaguing the industry, specifically through predictive maintenance in pressing plants and highly optimized scheduling of lacquer cutting and plating processes. Consumers are also curious about how AI-powered tools might enhance the digital side of vinyl engagement, such as personalized recommendations for specific pressings or utilizing machine learning to analyze the sonic characteristics of different masters, helping audiophiles identify the highest quality editions. Concerns often center on maintaining the artisanal and human element of record production, ensuring AI acts as a supporting tool rather than a replacement for the craftsmanship inherent in vinyl manufacturing.

The practical application of AI is anticipated to revolutionize the upstream supply chain management, particularly in forecasting demand for specific titles and managing raw material inventory, notably PVC pellets, which are subject to global supply fluctuations. By analyzing historical sales data, streaming metrics, and social media sentiment, AI algorithms can provide highly accurate production forecasts, allowing pressing plants to allocate limited machine time more efficiently, drastically reducing the lengthy lead times currently faced by labels. This optimization not only improves the profitability of manufacturers but also enhances customer satisfaction by ensuring popular releases are available closer to their announcement dates, thereby stabilizing retail pricing and reducing speculative secondary market inflation.

Furthermore, AI is poised to enhance the customer experience on the retail and archival side. AI-driven systems can create advanced recommendation engines that move beyond genre matching, suggesting specific vinyl pressings based on parameters like mastering engineer, pressing plant reputation, and even minor audible variations identified through machine listening analysis. For large archives and libraries, AI image recognition and natural language processing (NLP) can rapidly categorize, catalogue, and cross-reference extensive collections of album art, liner notes, and discographical details, significantly improving data accuracy for online marketplaces and ensuring better metadata for collectors globally. While the physical act of pressing remains traditional, the surrounding logistics and informational ecosystem will become heavily augmented by intelligent systems.

- AI optimizes pressing plant scheduling, reducing production bottlenecks and lead times.

- Predictive maintenance algorithms minimize machine downtime and ensure consistent pressing quality.

- AI-driven demand forecasting stabilizes PVC supply chain and inventory management.

- Machine learning enhances retail recommendation engines, suggesting specific high-quality pressings to audiophiles.

- NLP and image recognition expedite the cataloging and archiving of vinyl artwork and metadata.

- AI supports quality control by analyzing minor sonic imperfections during manufacturing post-production checks.

DRO & Impact Forces Of Vinyl Records Market

The Vinyl Records Market is shaped by a unique blend of cultural drivers, physical limitations, and shifting consumer expectations, collectively summarized by its Dynamics, Restraints, and Opportunities (DRO). Key drivers include the overwhelming consumer demand for the tangible and authentic musical experience, the perceived superior audio fidelity of analog playback, and the strong cultural push from music influencers and media emphasizing the collecting hobby. These positive forces are currently countered by significant operational restraints, primarily centered around the acute capacity constraints within the manufacturing sector, including limited availability of functional, high-precision pressing machines and the scarcity of specialized skilled labor, such as lacquer cutting engineers. The primary opportunities lie in technological investments aimed at scaling production and the development of sustainable PVC alternatives, offering a strategic pathway for future expansion and mitigating environmental concerns associated with plastic usage. These forces result in a market characterized by high growth potential but significant logistical fragility, where operational efficiency dictates short-term success.

Drivers are intrinsically linked to cultural consumption patterns, making them resilient to purely economic downturns. The 'experience economy' strongly favors vinyl, as consumers value the ritual of playing a record, appreciating the artwork, and engaging with the physical medium in a non-disposable manner, contrasting sharply with transient digital consumption. The role of artists and record labels in consistently promoting vinyl as the premium format also serves as a perpetual marketing engine. However, the restraining forces present immediate challenges to profitability and market stability. The decades-long dormancy of the vinyl industry led to the dismantling of most manufacturing infrastructure, meaning current production relies on machines often dating back to the 1970s, requiring extensive, specialized, and often custom maintenance. This aging infrastructure, combined with long lead times (often 6-12 months for standard orders), restricts the ability of labels, especially independent ones, to quickly capitalize on emerging trends or surprise hits, leading to frustration across the supply chain.

Opportunities for market expansion are concentrated on infrastructural innovation and geographical diversification. Significant opportunity exists in optimizing the current manufacturing process through automation and digital integration, reducing reliance on outdated manual techniques while retaining quality. Furthermore, expanding manufacturing capacity into underserved regions, particularly Asia Pacific and Latin America, allows for localized production, reducing complex international shipping logistics and costs associated with tariffs and customs delays. The development and commercialization of bio-based or recycled PVC substitutes present a crucial environmental opportunity, appealing to sustainability-conscious consumers and proactively addressing future regulatory pressures regarding plastic use. The overarching impact force on the market is the delicate balance between maintaining the perceived high-fidelity quality—the format’s core selling point—while aggressively scaling production to meet mass-market demand without compromising the artisanal appeal that drives consumer loyalty.

Segmentation Analysis

The Vinyl Records Market is strategically segmented based on product type, size, distribution channel, and end-user, providing a granular view of consumer preferences and market dynamics. This segmentation is crucial for stakeholders to tailor production volumes, marketing strategies, and channel partnerships effectively. The market structure reflects the coexistence of high-volume, standard retail products alongside highly specialized, low-volume collector items. Understanding these distinct segments allows manufacturers to prioritize investments in specific pressing capacities (e.g., maximizing 12-inch LP output) while enabling retailers to optimize inventory management between online platforms and physical stores, ultimately leading to higher revenue capture across all consumer touchpoints.

- By Product Type:

- Standard LP (Long Play)

- EP (Extended Play)

- Singles (45 RPM)

- By Size:

- 7-inch

- 10-inch

- 12-inch

- By Distribution Channel:

- Retail Stores (Independent Record Shops, Major Chain Stores)

- Online Sales (E-commerce Platforms, Label Websites)

- Direct-to-Consumer (D2C)

- By End-User:

- Collectors/Audiophiles

- Casual Listeners

- DJs/Professional Users

Value Chain Analysis For Vinyl Records Market

The Vinyl Records market value chain is extensive and begins with upstream processes dominated by critical raw material suppliers and highly specialized technical services. The core upstream input is polyvinyl chloride (PVC) resin, alongside other materials such as lacquers, stampers, and specialized chemical plating solutions necessary for the creation of masters and molds. Key upstream activities include the initial mastering and lacquer cutting, which is a highly technical bottleneck requiring expert engineers and specialized cutting lathes. This phase profoundly influences the final sound quality, positioning these technical services as high-value, high-leverage points in the entire chain. Reliability in the supply of high-grade, virgin PVC is paramount, although increasing regulatory and environmental pressures are driving research into sustainable alternatives, which will necessitate adjustments in upstream sourcing strategies.

The midstream process is concentrated on manufacturing—specifically, pressing the records. This stage involves converting the metal stampers into finished vinyl discs using hydraulic presses, followed by quality control, labeling, and sleeving. Given the limited number of major, operational pressing plants globally, manufacturers hold significant bargaining power in this segment, leading to the long lead times observed across the industry. Downstream activities focus heavily on distribution and retail. Major record labels (e.g., Universal, Sony, Warner) often handle their own distribution through established networks, while independent labels rely on specialized distributors who manage logistics between manufacturers and various retail outlets. Packaging and fulfillment, particularly for fragile products like records, requires specialized logistics providers capable of ensuring product integrity during transit.

Distribution channels for vinyl records are bifurcated into direct and indirect routes, each serving distinct customer needs. Direct channels, primarily encompassing label-owned websites and artist stores (D2C), allow for maximum margin capture and direct customer relationship management, essential for limited editions and highly anticipated releases. Indirect channels form the bulk of market volume, relying on brick-and-mortar independent record stores, which serve as crucial hubs for community, browsing, and product discovery, and major online retailers (like Amazon and specialty music stores), which provide vast inventories and global reach. The success of the downstream operation hinges on maintaining inventory visibility across these disparate channels, ensuring that high-demand, low-supply items are allocated strategically to maximize brand exposure and retail penetration while maintaining fair pricing.

Vinyl Records Market Potential Customers

The potential customer base for the Vinyl Records Market is diverse, extending beyond the traditionally recognized audiophile segment to include several high-growth demographics, fundamentally shifting the end-user landscape. The primary segment comprises serious collectors and dedicated audiophiles who prioritize sound quality, rarity, and the tangible nature of the media. These buyers are typically affluent, possess high-end playback equipment, and are willing to pay a substantial premium for specific pressings, limited editions, and imported vinyl that promises superior fidelity, viewing their purchases as long-term cultural investments rather than simple consumption. Targeting this group requires deep technical metadata (mastering details, pressing plant origin) and specialized marketing through audiophile publications and forums.

A rapidly expanding segment consists of casual listeners and lifestyle consumers, predominantly younger demographics (Millennials and Gen Z) who have grown up with digital streaming but are seeking a physical connection to their music. These consumers view vinyl as a fashionable, aesthetic, and authentic format that complements their streaming habits. They often buy records of popular contemporary artists or classic albums for home decor and social currency. Their purchasing decisions are heavily influenced by visual appeal (colored vinyl, special packaging) and mainstream accessibility. Retail strategy for this segment focuses on availability in major chain stores and appealing online merchandising, emphasizing the experiential and collectible nature rather than purely technical audio details.

The third significant group includes professional users, specifically DJs and musicians who require vinyl for performance purposes, particularly within specific electronic music genres like house and techno, where the tactile control offered by records remains essential. Although this segment often utilizes specialized digital vinyl systems, the demand for traditional 12-inch singles, especially for limited-run releases and highly desirable tracks, remains consistent. Furthermore, there is a growing institutional market consisting of archives, academic libraries, and music historical societies that purchase records for preservation and educational purposes, demanding pristine condition and comprehensive cataloging. These diverse end-user segments necessitate varied production runs, from extremely limited pressings for collectors to high-volume standard black vinyl for casual mass-market appeal.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 5.01 Billion |

| Growth Rate | 15.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | GZ Media, Record Industry, Optimal Media GmbH, MPO International, United Record Pressing, Third Man Records, Pallas Group, Sony Music Entertainment, Warner Music Group, Universal Music Group, RTI (Record Technology Inc.), Microforum Vinyl, Duplication.ca, Furnace Record Pressing, Independent Record Pressing, Pirate Press, Vinyl Factory, New On Vinyl. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Vinyl Records Market Key Technology Landscape

Despite its analog foundation, the Vinyl Records Market relies heavily on a complex and specialized technological landscape that spans both traditional machinery and modern digital integration necessary for mastering and manufacturing. The core technology involves the mastering process, where music is transferred to a master disc (lacquer or direct metal mastering) using a cutting lathe, a highly precise, electromechanical device that requires expert calibration and atmospheric control. The quality of the stylus, the heat regulation during cutting, and the quality of the lacquer blank significantly determine the audio fidelity of the final product. Recent technological advancements in this area focus on improving consistency and precision, often integrating digital controllers and highly accurate temperature monitoring systems into legacy lathes to achieve tighter tolerances and reduce cutting errors, a necessity given the premium price point of audiophile vinyl.

In the manufacturing phase, the dominant technology revolves around specialized hydraulic vinyl presses. While the fundamental operation remains largely unchanged since the mid-20th century, the industry is seeing major investments in automation and modernization. New pressing machines being installed by leading manufacturers are fully automated, integrating computerized monitoring of steam, cooling water, and pressure cycles to ensure uniform disc thickness and groove formation, eliminating human inconsistency and speeding up cycle times. This automated technology addresses the need for high-volume output while maintaining the rigorous quality standards expected by consumers. Furthermore, innovations in electroplating—the process used to create the metal stampers from the lacquer—are focusing on materials science to increase stamper durability, thereby allowing for longer, more efficient production runs before replacement is necessary.

Beyond the physical pressing, the technological landscape includes crucial quality control and material innovation. Non-contact measurement systems, often leveraging laser or optical scanning technology, are being developed and deployed to quickly verify groove geometry and identify defects that would be impossible to catch manually, ensuring a high yield of flawless records. Simultaneously, the industry is actively researching sustainable materials technology to replace virgin PVC. Efforts include utilizing recycled PVC (though this can introduce sonic imperfections) and exploring bio-plastics or alternative polymers that offer comparable acoustic damping and rigidity to standard vinyl. Success in material innovation will not only satisfy environmental mandates but also provide a technological advantage to manufacturers who can offer high-quality, eco-friendly pressing options, positioning technology as a direct enabler of market opportunity.

Regional Highlights

- North America (NA): Represents the largest revenue share, driven by a robust culture of collecting, high consumer awareness, and the significant presence of major record labels and independent distribution networks. The US market dominates, characterized by high adoption rates among younger consumers and the immense success of annual events like Record Store Day, which injects substantial capital into the physical retail sector.

- Europe: A major production hub, home to several of the world's largest independent pressing plants (e.g., GZ Media, Record Industry). Germany and the UK are primary consumption markets, emphasizing both audiophile quality reissues and thriving independent music scenes. Europe is also a leader in exploring sustainable manufacturing practices and is highly sensitive to distribution logistics due to cross-border shipping complexities.

- Asia Pacific (APAC): The fastest-growing regional market, exhibiting high potential particularly in Japan, South Korea, and Australia. Japan maintains a highly discerning collector base known for demanding ultra-high-quality pressings and imported music. Market growth is accelerating due to rising disposable incomes, cultural globalization, and increased localized investment in modern pressing infrastructure to reduce reliance on expensive imports.

- Latin America (LATAM): An emerging region where vinyl interest is rapidly accelerating, driven by the resurgence of local musical heritage and growing access to online retail channels. Brazil and Mexico are key markets, where economic growth allows consumers to invest in premium physical media. However, distribution logistics and manufacturing consistency remain nascent challenges.

- Middle East and Africa (MEA): Currently a smaller, niche market primarily centered around expatriate communities and specialized collectors in affluent urban centers like the UAE. Growth is dependent on increasing cultural acceptance, establishing robust local distribution networks, and making high-fidelity playback equipment more accessible to the middle class.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Vinyl Records Market.- GZ Media

- Record Industry

- Optimal Media GmbH

- MPO International

- United Record Pressing

- Third Man Records

- Pallas Group

- Sony Music Entertainment

- Warner Music Group

- Universal Music Group

- RTI (Record Technology Inc.)

- Microforum Vinyl

- Duplication.ca

- Furnace Record Pressing

- Independent Record Pressing

- Pirate Press

- Vinyl Factory

- New On Vinyl

Frequently Asked Questions

Analyze common user questions about the Vinyl Records market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the current resurgence in the Vinyl Records Market?

The resurgence is driven primarily by consumer demand for a superior, tangible audio experience, the collectible nature of the format, and its aesthetic appeal among younger generations. Artists also increasingly utilize vinyl as a critical high-margin merchandising tool alongside digital streaming revenues, reinforcing its status as a premium physical media format.

Are manufacturing bottlenecks affecting the availability and price of new vinyl releases?

Yes, significant manufacturing bottlenecks, stemming from limited operational pressing plant capacity and reliance on aging machinery, result in long production lead times (often 6–12 months). This scarcity often leads to delayed releases and contributes to higher retail prices, particularly for highly anticipated or limited edition albums globally.

How is the industry addressing sustainability and the use of PVC?

The industry is actively investing in research and development for sustainable alternatives to traditional PVC, including bio-based plastics and recycled vinyl compounds. Major manufacturers are prioritizing energy-efficient operations and waste reduction to address environmental concerns and meet rising consumer demand for eco-friendly media options.

Which geographic region currently leads the Vinyl Records Market in terms of consumption?

North America currently holds the largest share of vinyl record consumption, characterized by a massive installed base of collectors, high disposable income levels, and mature distribution channels across the United States and Canada. Europe also maintains a very strong consumption base and remains the primary production hub.

Is vinyl quality consistent across different manufacturers and pressings?

Vinyl quality can vary significantly based on the mastering engineer, the quality of the lacquer cut, the PVC material used, and the precision of the pressing plant machinery. Audiophiles often seek out pressings from specific, reputable plants known for meticulous quality control, as consistency is a highly valued differentiator in the collector market.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager