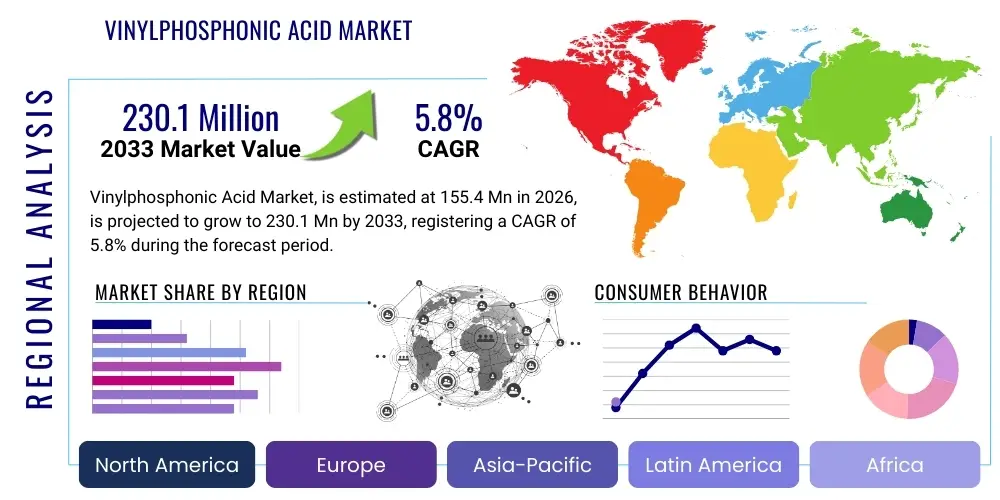

Vinylphosphonic Acid Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442036 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Vinylphosphonic Acid Market Size

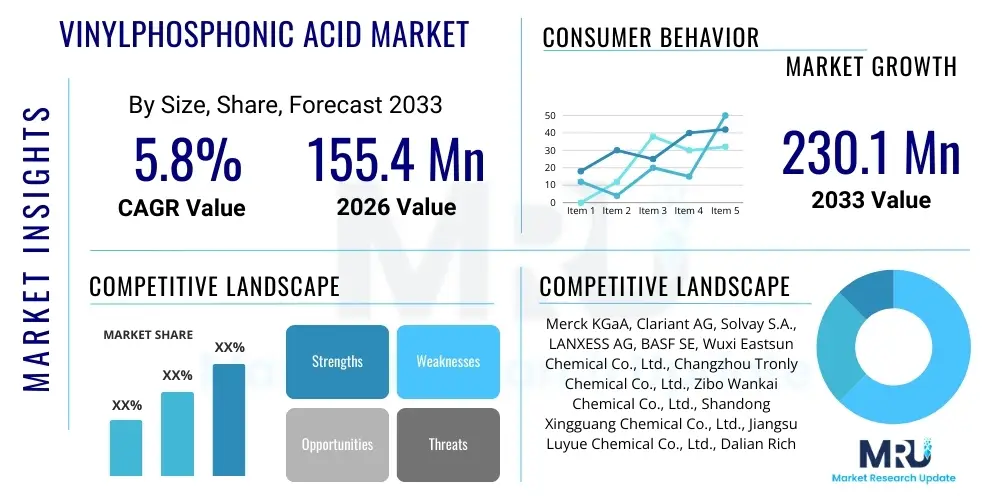

The Vinylphosphonic Acid Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 155.4 Million in 2026 and is projected to reach USD 230.1 Million by the end of the forecast period in 2033. This consistent growth trajectory is primarily fueled by the increasing demand for high-performance specialty chemicals, particularly in the fields of polymer modification, dental materials, and effective corrosion inhibitors for demanding industrial environments. The unique chemical structure of Vinylphosphonic Acid (VPA), featuring both a vinyl group and a phosphonic acid moiety, allows for versatile polymerization and superior adhesion properties, making it an indispensable component in advanced material formulations globally.

Vinylphosphonic Acid Market introduction

Vinylphosphonic Acid (VPA) is a crucial organophosphorus monomer characterized by the presence of an unsaturated vinyl group and a highly acidic phosphonic acid functionality. This bifunctional nature enables VPA to undergo polymerization reactions readily while simultaneously imparting strong polar characteristics, excellent adhesion, and robust chelating capabilities to resulting copolymers and homopolymers. Industrially, VPA serves as a fundamental building block in the synthesis of polymers used in applications such as dental adhesives, sophisticated water treatment chemicals, specialized coatings and paints, and as a critical component in fuel cell membranes, specifically Proton Exchange Membranes (PEMs), where its high proton conductivity is paramount. The increasing global focus on infrastructure durability and the development of high-efficiency energy storage and conversion technologies are significantly driving the utilization of VPA-derived materials.

The product’s primary benefits include exceptional thermal stability, strong affinity for metallic surfaces—providing superior corrosion and scale inhibition—and its ability to enhance the mechanical strength and durability of composite materials. VPA is particularly valued in the coatings sector for improving adhesion to substrates like metal and concrete, thereby extending the lifespan of protective layers in harsh environments. Driving factors for market expansion include the rapid growth of the construction and automotive industries in emerging economies, necessitating durable coating solutions, coupled with stringent environmental regulations promoting the use of phosphonate-based water treatment chemicals that are often more effective and stable than traditional alternatives. Furthermore, advancements in polymer science continually uncover new applications for VPA in high-tech fields like microelectronics and biomedical engineering, cementing its role as a vital specialty chemical monomer.

Vinylphosphonic Acid Market Executive Summary

The Vinylphosphonic Acid Market is experiencing dynamic shifts, driven by robust business trends focusing on sustainability and high-performance material development. Key business drivers include the necessity for superior corrosion inhibitors in oil and gas pipelines and industrial cooling systems, and the expanding adoption of VPA polymers in advanced dental and medical adhesives due to their biocompatibility and strong bonding capabilities. Regional trends indicate that Asia Pacific (APAC) remains the dominant region in terms of both manufacturing capacity and consumption, fueled by rapid industrialization, particularly in chemical processing and construction sectors in China and India. Conversely, North America and Europe emphasize research and development, focusing on high-purity VPA for specialized applications such such as next-generation fuel cell technology and advanced lithography processes, driving premium pricing in these geographies. Segment trends show that the application segment focused on Water Treatment Chemicals is the largest consumer, valuing VPA’s effectiveness in scaling control, while the Polymers and Resins segment exhibits the fastest growth due to innovation in fire-retardant materials and high-temperature stable plastics.

AI Impact Analysis on Vinylphosphonic Acid Market

User inquiries regarding AI's influence on the Vinylphosphonic Acid market primarily center on optimizing complex synthesis pathways, predicting material performance under various stress conditions, and ensuring stringent quality control across large-scale manufacturing batches. Users are keen to understand how machine learning can accelerate the discovery of novel VPA derivatives with enhanced properties for niche applications, such as high-temperature PEMs or biocompatible orthopedic adhesives. Concerns often revolve around the high data requirements necessary to train accurate predictive models for chemical processes and the necessity for integrating legacy manufacturing systems with modern AI infrastructure. Overall expectations highlight AI as a transformative tool for improving efficiency, reducing production waste, and drastically cutting R&D time for new VPA-based polymer formulations.

- AI algorithms are employed for optimizing the complex catalytic synthesis routes of VPA, reducing reaction time and increasing yield purity by predictive modeling of temperature, pressure, and catalyst concentration parameters.

- Machine learning facilitates advanced quality control by analyzing spectroscopic and chromatographic data in real-time, instantly identifying impurities and ensuring batch-to-batch consistency required for high-purity applications like microelectronics and fuel cells.

- AI-driven simulation tools accelerate the development of VPA copolymers by predicting the physical and chemical properties (e.g., thermal stability, proton conductivity, adhesion strength) of untested formulations, drastically minimizing costly and time-consuming laboratory experimentation.

- Predictive maintenance analytics, powered by AI, are crucial for minimizing downtime in VPA manufacturing plants, especially regarding highly corrosive process equipment involved in phosphonation reactions.

DRO & Impact Forces Of Vinylphosphonic Acid Market

The Vinylphosphonic Acid market is shaped by a confluence of accelerating drivers, structural restraints, and emerging opportunities, forming a complex landscape of impact forces. A primary driver is the escalating global demand for efficient water treatment solutions, where VPA derivatives excel as superior antiscalants and corrosion inhibitors, especially in industrial cooling towers and reverse osmosis systems. The robust growth in the dental restorative materials sector, requiring strong, durable, and biocompatible adhesives utilizing VPA monomers, further catalyzes market expansion. However, significant restraints include the relatively high cost of VPA production, often involving complex and energy-intensive chemical processes such as the Arbuzov reaction or specialized phosphonation techniques, which increases the barrier to entry for new manufacturers and impacts competitive pricing strategies across various end-user industries. Regulatory scrutiny concerning organophosphorus compounds, particularly regarding environmental discharge and biodegradability in certain regions like the European Union, also imposes operational constraints on market players.

Opportunities for market stakeholders primarily reside in the burgeoning field of sustainable energy, specifically in optimizing VPA-based polymers for high-performance Proton Exchange Membranes (PEMs) utilized in hydrogen fuel cells and redox flow batteries, which requires ultra-high purity VPA. Furthermore, the development of novel VPA derivatives with tailored functional groups can open up lucrative applications in advanced lithography chemicals and flame-retardant textiles, sectors demanding materials with exceptional chemical stability and performance. The impact forces are generally positive, yet heavily skewed by regulatory compliance needs; the shift towards environmentally benign synthesis methods, such as utilizing biocatalysis or continuous flow chemistry, represents a critical strategic imperative for maintaining long-term market competitiveness and capitalizing on the growing demand for green chemistry solutions, particularly among environmentally conscious industrial consumers and consumer goods manufacturers seeking sustainable supply chains. These forces necessitate significant capital investment in R&D and process improvement.

The market also faces inherent challenges related to raw material volatility, primarily the sourcing and pricing stability of phosphorus precursors, which directly affects VPA manufacturing economics. Geopolitical factors influencing trade routes and the supply of key intermediates can create supply chain disruptions, reinforcing the need for geographically diversified production centers. Despite these hurdles, the superior functional performance VPA offers over competing carboxylic acid monomers in high-stress environments, particularly high temperatures and high acidity, ensures its continued demand in specialized high-value applications, guaranteeing sustained growth through the forecast period, provided manufacturers can navigate the complexities of cost management and regulatory adherence efficiently.

Segmentation Analysis

The Vinylphosphonic Acid market is primarily segmented based on Purity Grade, End-Use Application, and Manufacturing Process, reflecting the diverse requirements of the various industrial sectors utilizing VPA. Segmentation by Purity Grade is critical because applications like fuel cells and microelectronics require VPA with extremely low levels of impurities (99% and above), whereas standard industrial applications such as water treatment can utilize lower-purity grades, impacting both pricing and production techniques. Analyzing the market through these segments provides critical insights into consumption patterns, technological requirements, and regulatory compliance differences across various geographical and industrial landscapes, allowing market players to tailor their product offerings and strategic investments toward the most profitable and fastest-growing niches globally. This structured approach helps in identifying target customers and optimizing distribution channels based on the required material specifications.

- By Purity Grade:

- Standard Grade (90% - 95%)

- High Purity Grade (96% - 98%)

- Ultra-High Purity Grade (>99%)

- By Application:

- Water Treatment Chemicals (Antiscalants, Corrosion Inhibitors)

- Polymers and Resins (Adhesives, Coatings, Dispersants)

- Fuel Cell Membranes (Proton Exchange Membranes - PEMs)

- Dental and Medical Adhesives

- Textiles and Fire Retardants

- Other Specialty Applications (e.g., Lithography, Oilfield Chemicals)

- By Manufacturing Process:

- Phosphorylation of Vinyl Alcohol

- Arbuzov Reaction Methods

- Other Advanced Synthesis Routes

Value Chain Analysis For Vinylphosphonic Acid Market

The value chain for Vinylphosphonic Acid begins with the upstream sourcing of crucial raw materials, primarily phosphorus trichloride ($\text{PCl}_3$), ethylene, and related organic intermediates, which are synthesized into precursor chemicals. The complexity and high cost of handling and reacting with $\text{PCl}_3$, a highly corrosive and reactive substance, characterize this initial phase, placing significant emphasis on safety and specialized infrastructure. Midstream activities involve the intricate chemical synthesis of VPA itself, utilizing various proprietary processes, with the Arbuzov reaction being a common but technologically demanding pathway. This stage encompasses purification processes, such as crystallization or distillation, required to achieve the necessary high-purity grades demanded by specialized end-users like fuel cell manufacturers, adding considerable value and cost to the final product. Efficiency in midstream manufacturing dictates the overall competitiveness of the producers, demanding continuous optimization through process engineering and catalysis advancements.

Downstream activities focus on the transformation of VPA into final products, which include specialized polymers, copolymers, and proprietary formulations designed for specific applications like antiscalant blends for water treatment, protective marine coatings, or dental cements. This phase involves extensive compounding, mixing, and formulation expertise, often requiring close collaboration between VPA manufacturers and end-product developers to meet highly specific performance requirements. The distribution channel for VPA is bifurcated: high-volume, standard-grade VPA often moves through large chemical distributors (indirect channel) catering to the water treatment and general coatings industries. Conversely, ultra-high-purity VPA, destined for critical applications such as PEMs or microelectronics, typically involves direct sales and specialized supply chain logistics (direct channel) to ensure quality maintenance and timely delivery, necessitating stringent quality assurance protocols at every point.

The efficiency of the entire value chain is heavily influenced by intellectual property surrounding synthesis methods and application formulations. Upstream volatility in phosphorus pricing necessitates robust hedging strategies, while downstream differentiation hinges on technical support and application-specific product development capabilities. The direct distribution channel allows manufacturers to capture higher margins and maintain tighter control over product integrity, crucial for customer segments with zero tolerance for impurities. Meanwhile, the indirect channel, leveraging global chemical distribution networks, ensures broad market access for large-scale industrial consumers, optimizing logistics and reducing regional inventory requirements. The increasing complexity of regulatory compliance, particularly regarding transport and handling of corrosive chemicals, adds a persistent cost burden throughout the entire value chain.

Vinylphosphonic Acid Market Potential Customers

The primary customers for Vinylphosphonic Acid span several highly diversified industrial sectors, driven by the unique bifunctional properties that VPA imparts to materials. Manufacturers of advanced water treatment chemicals represent a major customer base, purchasing VPA derivatives for formulating highly effective scale and corrosion inhibitors essential for municipal water systems, industrial cooling circuits, and desalination plants. Polymer and specialty resin manufacturers are also crucial customers, incorporating VPA monomers to enhance the adhesion, flame retardancy, and thermal stability of engineering plastics, coatings, and specialized packaging materials used extensively in the construction and automotive industries. These customers prioritize bulk availability and consistency of the standard and high-purity grades of VPA.

Another significant and fast-growing customer segment is the clean energy technology sector, particularly companies involved in manufacturing Proton Exchange Membranes (PEMs) for hydrogen fuel cells and redox flow batteries. These high-technology customers require ultra-high purity VPA, which is copolymerized into membranes to achieve superior proton conductivity and mechanical stability under operational stress, defining the performance limits of next-generation energy devices. Furthermore, the dental and medical industries are strong buyers, utilizing VPA as a key component in sophisticated adhesive systems, dental cements, and bone repair materials, valued for its biocompatibility and potent bonding capability to dentin and bone structures. Identifying and segmenting these customers based on their specific purity needs and application performance metrics is critical for optimizing marketing and sales strategies across the VPA market landscape.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 155.4 Million |

| Market Forecast in 2033 | USD 230.1 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Merck KGaA, Clariant AG, Solvay S.A., LANXESS AG, BASF SE, Wuxi Eastsun Chemical Co., Ltd., Changzhou Tronly Chemical Co., Ltd., Zibo Wankai Chemical Co., Ltd., Shandong Xingguang Chemical Co., Ltd., Jiangsu Luyue Chemical Co., Ltd., Dalian Richon Chemical Co., Ltd., Hangzhou Dayang Chemical Co., Ltd., Hubei Jusheng Technology Co., Ltd., TCI Chemicals (India) Pvt. Ltd., Tokyo Chemical Industry Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Vinylphosphonic Acid Market Key Technology Landscape

The technological landscape for the Vinylphosphonic Acid market is dominated by advancements in synthesis efficiency, purification methods, and specialized formulation techniques aimed at achieving high purity and reducing environmental impact. Historically, VPA production relied heavily on multi-step batch processes, often involving hazardous intermediates. The current focus is shifting towards continuous flow chemistry and catalytic methods, which offer significantly improved safety profiles, higher yields, and better energy efficiency compared to traditional batch reactors. For instance, optimized catalytic phosphorylation routes are being increasingly adopted to circumvent the harsh conditions and by-product issues associated with older methods like the Arbuzov reaction when applied to industrial scale VPA synthesis. These technological enhancements are crucial for meeting the stringent cost and quality requirements of high-volume industrial consumers while minimizing waste generation, aligning with global green chemistry initiatives.

Purification technology plays an equally critical role, especially for Ultra-High Purity VPA destined for fuel cell or semiconductor applications, where even trace metallic or organic impurities can severely compromise performance. Advanced separation techniques, including fractional distillation under vacuum and specialized ion-exchange chromatography, are essential for removing challenging oligomeric and polymeric by-products formed during the polymerization and synthesis stages. Ongoing R&D is dedicated to developing less resource-intensive purification steps, possibly leveraging membrane separation technologies, to reduce operational costs and energy consumption associated with the current reliance on high-vacuum distillation systems. This push for superior purification is directly linked to the market premium achievable for specialized VPA grades, ensuring technological investment remains a critical competitive differentiator among major producers globally.

Furthermore, the market's technological evolution encompasses application-specific formulation expertise. For water treatment, research focuses on creating synergic blends of VPA derivatives with other antiscalants and dispersants to optimize performance under specific water hardness and temperature conditions. In the field of PEMs, technological breakthroughs involve tailoring the molecular architecture of VPA copolymers, often achieved through controlled radical polymerization techniques, to enhance proton conductivity and improve membrane longevity, particularly under variable humidity and high-temperature operating conditions required for automotive fuel cell stacks. These formulation technologies transform basic VPA monomer into high-value specialty chemical products, requiring deep material science knowledge and advanced polymer engineering capabilities within the leading market entities.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing market for Vinylphosphonic Acid, primarily driven by massive industrial expansion across China, India, South Korea, and Southeast Asian nations. The region benefits from lower manufacturing costs, making it a global production hub for VPA and its derivatives. High consumption rates are attributed to booming construction activities, rapidly expanding industrial water treatment needs, and the region's dominant position in automotive manufacturing and electronics production, all of which rely heavily on VPA for coatings, adhesives, and specialty polymers. Government initiatives promoting domestic chemical production and investment in sustainable infrastructure further solidify APAC’s market dominance, though regulatory diversity across nations poses a complexity challenge.

- North America: The North American market is characterized by high demand for specialty, high-purity VPA, particularly from the advanced materials and energy sectors. The United States leads in the adoption of VPA polymers for sophisticated applications such as high-temperature fuel cell membranes and advanced dental restorative materials, where performance and regulatory compliance are paramount. Investment in R&D and strict environmental regulations drive innovation towards cleaner synthesis processes and high-efficiency formulations. While volume consumption is lower than in APAC, the value realized per unit of VPA is significantly higher due to the focus on niche, high-performance end-uses and a well-established intellectual property framework protecting proprietary formulations.

- Europe: Europe holds a mature, high-value market position, heavily influenced by stringent chemical regulations such as REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals). This regulatory environment necessitates substantial investment in product safety and environmental performance, favoring manufacturers capable of demonstrating compliance and sustainability credentials. Key demand drivers include the large automotive sector requiring advanced protective coatings and the emphasis on renewable energy technologies, specifically hydrogen fuel cells. European manufacturers often focus on developing specialized VPA derivatives for high-end industrial coatings, fire retardancy solutions, and additives that comply with strict circular economy directives.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions represent emerging markets exhibiting steady growth, largely spurred by infrastructural investments, particularly in large-scale water treatment projects and the development of petrochemical and mining sectors. VPA is crucial in MEA for corrosion and scale inhibition in desalination plants and oilfield chemical processes, where water scarcity and harsh operating conditions demand robust chemical solutions. Growth in LATAM is tied to the expansion of construction and agricultural chemical sectors. Market development in these areas is often dependent on stable commodity prices and foreign direct investment in large industrial projects, driving increased consumption of standard and industrial grade VPA.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Vinylphosphonic Acid Market.- Merck KGaA

- Clariant AG

- Solvay S.A.

- LANXESS AG

- BASF SE

- Wuxi Eastsun Chemical Co., Ltd.

- Changzhou Tronly Chemical Co., Ltd.

- Zibo Wankai Chemical Co., Ltd.

- Shandong Xingguang Chemical Co., Ltd.

- Jiangsu Luyue Chemical Co., Ltd.

- Dalian Richon Chemical Co., Ltd.

- Hangzhou Dayang Chemical Co., Ltd.

- Hubei Jusheng Technology Co., Ltd.

- TCI Chemicals (India) Pvt. Ltd.

- Tokyo Chemical Industry Co., Ltd.

- Nantong Lida Chemical Co., Ltd.

- Kunshan Huahong Chemical Co., Ltd.

- Yixing City Yutong Chemical Co., Ltd.

- Taihe Group

- Shandong Luba Chemical Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Vinylphosphonic Acid market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications of Vinylphosphonic Acid (VPA) and its main market drivers?

VPA is primarily used in water treatment as a highly effective corrosion and scale inhibitor, in specialty polymers for coatings and adhesives due to its strong bonding capability, and in high-performance Proton Exchange Membranes (PEMs) for hydrogen fuel cells. Key market drivers include stringent demand for superior water treatment solutions and growth in the sustainable energy sector requiring advanced PEM technology.

Which purity grade of Vinylphosphonic Acid is most critical for the clean energy sector?

The clean energy sector, specifically manufacturers of Proton Exchange Membranes (PEMs) for fuel cells, demands Ultra-High Purity Grade VPA (typically >99%). High purity is essential to ensure maximum proton conductivity, mechanical integrity, and long-term durability of the membrane, as trace impurities severely degrade fuel cell performance and lifespan.

How do high production costs restrain the Vinylphosphonic Acid market growth?

High production costs result from complex and specialized synthesis processes, such as the multi-step Arbuzov reaction, which requires specialized equipment and stringent safety measures due to the nature of the phosphorus precursors used. These costs limit price competitiveness against alternative chemical monomers and impose significant capital requirements on new market entrants.

What role does the Asia Pacific region play in the global VPA market?

Asia Pacific (APAC), led by China and India, is the dominant global market, acting as both the largest manufacturing base and the largest consumer of VPA. This leadership is driven by rapid industrialization, high volume requirements for water treatment and construction sectors, and comparatively lower operational costs, solidifying APAC's central role in the global VPA supply chain.

What are the innovative technological trends impacting VPA manufacturing?

Key technological trends include the adoption of continuous flow chemistry over traditional batch processes to enhance safety and efficiency, the use of advanced catalytic methods to improve yield and purity, and the implementation of sophisticated purification techniques like chromatography to meet the ultra-high purity demands for specialized, high-value applications such as microelectronics.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Vinylphosphonic Acid Dimethylester Market Statistics 2025 Analysis By Application (Coating, Lithography, Construction Chemicals, Corrosion Inhibitor), By Type (Purity: 97-98 Percent, Purity above 98 Percent), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Vinylphosphonic Acid Market Statistics 2025 Analysis By Application (Printing, Coating, Water Treatment & Oil Well, Fuel Cells), By Type (VPA 90 Percent, VPA 80 Percent, Other), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager