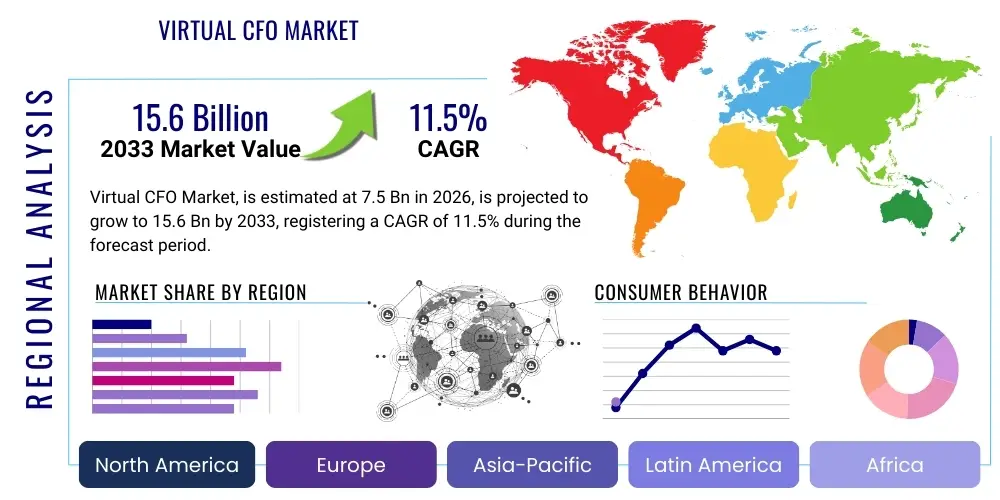

Virtual CFO Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443614 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Virtual CFO Market Size

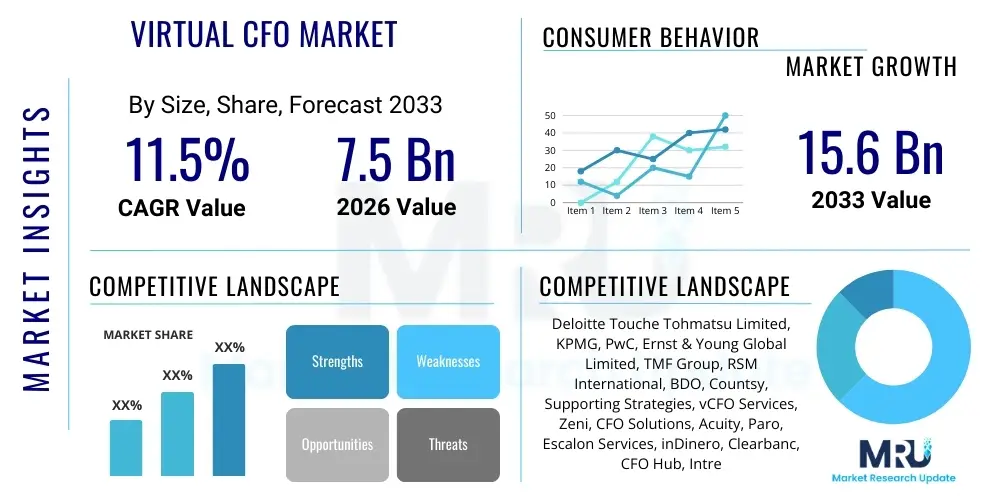

The Virtual CFO Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% (CAGR) between 2026 and 2033. The market is estimated at USD 7.5 Billion in 2026 and is projected to reach USD 15.6 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the increasing digital adoption among Small and Medium-sized Enterprises (SMEs) and the necessity for high-level financial strategic expertise that traditionally only large corporations could afford. The outsourced financial leadership model provides agility and scalable solutions critical for navigating complex economic environments and rapid growth phases.

Virtual CFO Market introduction

The Virtual CFO (Chief Financial Officer) Market encompasses the provision of high-level financial strategy, planning, and operational oversight delivered remotely by external experts or specialized firms, primarily targeting SMEs and burgeoning enterprises that do not require or cannot afford a full-time, in-house CFO. These services span crucial financial management functions, including cash flow forecasting, budgeting, financial modeling, risk management, capital structure planning, and strategic guidance for fundraising or mergers and acquisitions. Virtual CFOs utilize advanced cloud-based platforms and robust communication tools to integrate seamlessly with client operations, delivering actionable insights that translate directly into improved profitability and sustainable growth trajectories.

Major applications of Virtual CFO services are found across sectors characterized by high growth and fluctuating financial needs, such as technology startups, e-commerce platforms, professional service firms, and specialized manufacturing companies. The core product offered is not merely transactional accounting but rather strategic financial leadership aimed at maximizing enterprise value. Key benefits driving market adoption include significant cost reduction compared to hiring a salaried executive, access to diverse, specialized expertise on an as-needed basis, enhanced operational efficiency through standardized best practices, and improved compliance posture. These benefits enable smaller organizations to gain a competitive advantage by professionalizing their financial function quickly and effectively.

The driving factors underpinning the robust growth of this market involve several macro-level trends. First, the widespread acceptance of remote work and cloud infrastructure has made remote delivery of sensitive financial services viable and secure. Second, increasing regulatory complexity globally compels businesses to seek expert guidance to ensure adherence. Third, the dynamic startup ecosystem, particularly in emerging economies, generates continuous demand for strategic financial planning vital for securing venture capital and scaling operations. Finally, the growing sophistication of financial technology (FinTech) tools allows Virtual CFO providers to automate routine tasks, thereby focusing their efforts on high-value, strategic advising, further enhancing the attractiveness and effectiveness of their services.

Virtual CFO Market Executive Summary

The global Virtual CFO market exhibits strong momentum, characterized by fundamental shifts toward subscription-based, modular service offerings and aggressive technological integration, particularly leveraging AI for predictive analytics. Business trends highlight a strong preference among clients for outcome-based fee structures and customized service bundles tailored to specific industry verticals, such as SaaS or biotechnology, driving specialization among providers. The shift from basic transactional outsourcing (like bookkeeping) towards high-level strategic financial planning signifies the market’s maturation. Furthermore, consolidation among smaller regional firms through strategic acquisitions by larger, technology-focused financial consultancies is reshaping the competitive landscape, aiming to build comprehensive, global service delivery networks.

Regionally, North America maintains market leadership due to its high concentration of venture-backed startups and mature cloud infrastructure, driving rapid adoption of sophisticated financial oversight solutions. However, the Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR), fueled by aggressive digital transformation initiatives in economies like India, China, and Southeast Asian nations, coupled with government support for SME growth and entrepreneurship. European adoption remains steady, anchored by strict regulatory frameworks (e.g., GDPR, IFRS standards) which necessitate expert financial compliance services, pushing mid-market companies toward specialized virtual solutions. Latin America and MEA are emerging as high-potential markets, driven by the increasing need for formal financial governance to attract foreign direct investment.

Segment trends underscore the dominance of the SME segment (organizations with 50-500 employees), which represents the largest user base seeking interim or fractional CFO support to manage growth without incurring significant overhead. By industry vertical, the IT and Telecom sector, followed closely by the Banking, Financial Services, and Insurance (BFSI) sector, leads in adoption, primarily due to their intrinsic digital nature and high demands for precise financial forecasting and compliance management. The shift towards technology-enabled services (utilizing platforms like RPA and Machine Learning for financial modeling) is rapidly becoming the standard, displacing traditional consulting models and improving service scalability and cost-effectiveness across all segments.

AI Impact Analysis on Virtual CFO Market

User inquiries regarding the impact of Artificial Intelligence on the Virtual CFO market primarily center around the themes of automation efficiency versus human expertise, the integrity and security of AI-driven financial forecasts, and the potential displacement of junior accounting and analysis roles. Users frequently ask how AI can enhance strategic decision-making beyond basic data processing, whether AI platforms are secure enough to handle proprietary financial data, and what the optimal balance is between human oversight and algorithmic execution. The overwhelming expectation is that AI will transform the Virtual CFO role from retrospective analysis to proactive, predictive strategic partnering, demanding higher-level cognitive skills from human advisors while offloading routine, repetitive tasks.

The integration of AI technologies, including Robotic Process Automation (RPA), machine learning algorithms, and natural language processing (NLP), is fundamentally redefining the value proposition of Virtual CFOs. AI drives significant efficiency gains by automating core functions such as invoice processing, expense categorization, reconciliation, and initial variance analysis, freeing up valuable time for the human CFO to focus on strategic initiatives like mergers, acquisitions, capital expenditure planning, and stakeholder communication. Furthermore, machine learning models analyze vast datasets far more rapidly and accurately than traditional methods, providing sophisticated risk assessments, identifying previously unseen cost optimization opportunities, and generating highly reliable predictive financial models, thus elevating the quality of strategic advice provided to clients.

However, the ethical deployment and governance of these AI tools remain a crucial focus. While AI handles the transactional load, the Virtual CFO's role increasingly pivots towards interpreting the complex outputs of these systems, applying qualitative business context, and communicating strategic recommendations effectively to non-financial stakeholders. This hybrid model ensures that services remain highly personalized and client-centric, mitigating concerns about dehumanization or data misinterpretation. Successful firms are those that invest heavily in integrated AI platforms that prioritize data security, transparency in algorithmic decision-making, and seamless integration with existing Enterprise Resource Planning (ERP) and accounting systems.

- AI automates up to 70% of routine bookkeeping and transactional accounting tasks, significantly reducing operational costs.

- Machine Learning algorithms enable advanced predictive forecasting and scenario planning, improving budgetary accuracy by up to 20%.

- Natural Language Processing (NLP) enhances reporting efficiency by summarizing complex financial data into digestible, narrative reports for non-financial executives.

- AI-driven anomaly detection strengthens risk management protocols by instantaneously identifying fraudulent activities or unusual financial fluctuations.

- Automation of compliance checks ensures adherence to evolving regulatory requirements across different geographical jurisdictions.

- Integration of RPA and AI necessitates specialized cybersecurity protocols to protect sensitive financial data residing on cloud platforms.

- AI transforms the human Virtual CFO role into a higher-level strategist, focusing on interpreting data insights rather than compiling raw data.

DRO & Impact Forces Of Virtual CFO Market

The Virtual CFO market is heavily influenced by dynamic economic factors and rapid technological advancements, creating a complex interplay of Drivers, Restraints, and Opportunities. Key drivers include the overwhelming need for cost optimization among SMEs, particularly in a volatile economic climate, making the fractional, high-expertise model highly attractive. Concurrently, the proliferation of sophisticated cloud-based accounting and finance software has lowered the technical barrier for remote service delivery. Restraints predominantly revolve around the inherent challenges of data security and privacy compliance, especially when dealing with proprietary financial information across multiple jurisdictions, compounded by a lingering perception of lack of direct accountability compared to an in-house executive. Opportunities lie primarily in expanding service offerings through deep vertical specialization and integrating cutting-edge technologies like blockchain for immutable auditing records and AI for predictive scenario modeling, allowing providers to move further up the value chain from compliance to strategic partnership.

Impact forces stemming from these dynamics include intensified competition leading to price pressure in commoditized service tiers, forcing providers to differentiate through niche expertise and superior client engagement models. The shift towards subscription-based pricing models introduces volatility in revenue streams but stabilizes long-term client relationships. Furthermore, talent acquisition is a critical impact force; as technology automates routine tasks, the demand for highly skilled Virtual CFOs capable of interpreting complex AI-generated insights and offering nuanced strategic guidance surges, creating a shortage of high-end expertise and increasing labor costs for specialized roles. Regulatory divergence across major regions also impacts scalability, compelling international providers to invest heavily in localized compliance expertise and robust governance structures, adding friction to global expansion efforts.

The long-term sustainability of the market hinges on overcoming trust deficits related to data integrity and establishing standardized cybersecurity benchmarks across the industry. Providers who successfully achieve SOC 2 and ISO 27001 compliance, coupled with transparent operational protocols, will significantly outpace competitors. The most significant positive impact force remains the democratization of high-level financial strategy: Virtual CFOs enable ambitious small businesses to execute advanced financial strategies previously reserved only for Fortune 500 companies, thereby accelerating global economic growth and fostering entrepreneurial success. Conversely, the failure to adapt to new regulatory changes, such as emerging global minimum tax rules or data localization mandates, poses a severe constraint on providers operating globally.

Segmentation Analysis

The Virtual CFO market is primarily segmented based on Service Type, Organization Size, Industry Vertical, and Regional Outlook, reflecting the diverse needs and operational scales of clients globally. The Service Type segmentation differentiates between transactional services (such as tax compliance and ledger management), strategic advisory services (including M&A support and capital raise planning), and fractional CFO engagements (long-term, periodic high-level oversight). Organization Size remains critical, distinguishing between small startups needing basic compliance and larger mid-market enterprises (MMEs) requiring comprehensive, integrated financial department support. Industry Vertical segmentation highlights specialization, recognizing that the financial planning needs of a SaaS company differ significantly from those of a healthcare provider, necessitating industry-specific expertise and tooling for effective engagement and maximized client value.

- By Service Type:

- Strategic Advisory (Financial modeling, M&A support, Capital raising)

- Operational and Tactical Support (Budgeting, Forecasting, Performance metrics)

- Compliance and Reporting (Tax filing, Regulatory adherence, Audit preparation)

- Fractional Engagement (Ongoing, periodic strategic oversight)

- By Organization Size:

- Small and Medium-sized Enterprises (SMEs) (Less than 500 employees)

- Mid-Market Enterprises (MMEs) (500 to 5000 employees)

- By Industry Vertical:

- IT and Telecom

- BFSI (Banking, Financial Services, and Insurance)

- Healthcare and Life Sciences

- E-commerce and Retail

- Manufacturing and Industrial

- Professional Services

- Non-Profit Organizations

- By Region:

- North America (U.S., Canada)

- Europe (U.K., Germany, France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, India, South Korea, Southeast Asia, Rest of APAC)

- Latin America (Brazil, Mexico, Rest of Latin America)

- Middle East and Africa (GCC Countries, South Africa, Rest of MEA)

Value Chain Analysis For Virtual CFO Market

The value chain for the Virtual CFO market is structured around specialized knowledge and technological integration, beginning with upstream software and talent provision and concluding with the highly customized delivery of strategic financial insights to the end client. Upstream activities involve the development and licensing of core financial management software (ERP systems, accounting platforms like QuickBooks or SAP), specialized AI/ML tools for predictive analysis, and cybersecurity infrastructure providers. The quality and integration capabilities of these software vendors directly impact the efficiency and scalability of the Virtual CFO services offered downstream. Crucially, the talent supply chain—recruiting and retaining highly certified and experienced financial strategists with specific industry knowledge—forms the intellectual capital bedrock of the entire service delivery model. Providers must continuously invest in professional development and certifications to maintain relevance.

Midstream activities involve the actual service creation and packaging, where Virtual CFO firms utilize the upstream technologies and their internal expertise to develop proprietary methodologies, standardized reporting formats, and modular service packages. This includes establishing secure data pipelines, implementing robust project management frameworks, and defining client onboarding and off-boarding processes. The distribution channel is predominantly characterized by direct client engagement facilitated through digital marketing and referrals, although strategic partnerships with accounting firms, legal practices, and industry accelerators (incubators/VC funds) play an increasingly important role in lead generation and indirect distribution. Digital platforms act as the primary interface, enabling seamless communication, document exchange, and data visualization between the service provider and the client executive team.

Downstream analysis focuses on the end-user interaction and value realization, particularly for SMEs and MMEs who are the primary buyers. Direct channels allow for highly customized and personalized service, critical for complex strategic engagements (e.g., pre-IPO financial structuring). Indirect channels, often involving referral networks or integrated services offered via FinTech marketplaces, help reach a broader base of small businesses seeking standardized compliance and bookkeeping support alongside strategic advice. The success at this stage is measured by client satisfaction, tangible improvements in financial performance (e.g., cash flow optimization, successful fundraising), and long-term client retention, reinforcing the need for continuous performance monitoring and adaptation of the virtual service delivery model to the client's evolving business lifecycle stages.

Virtual CFO Market Potential Customers

The primary potential customers for Virtual CFO services are characterized by high growth potential, resource constraints regarding executive hiring, and a critical need for external, objective financial oversight. The largest cohort includes technology startups and fast-growing Scale-ups (Series A through D funding rounds) across sectors like SaaS, FinTech, and biotech, which require rapid, sophisticated financial modeling to manage investor expectations, optimize capital structure, and navigate complex international expansion. These entities often have sufficient operating funds but lack the permanent requirement or budget for a USD 300,000+ per year in-house CFO, making the fractional, expert-level service an ideal fit. Virtual CFOs serve as essential partners in preparing businesses for due diligence, fundraising pitches, and eventual exit strategies, such as acquisition or initial public offering (IPO).

The secondary segment comprises established Mid-Market Enterprises (MMEs) that are undergoing significant transformation, such as global expansion, post-merger integration, or internal systems overhaul. These companies often seek external expertise to manage specialized, temporary financial challenges without disrupting their existing finance teams. Additionally, specific sectors with inherent financial complexity, such as regulated industries (e.g., specialized manufacturing, energy, and healthcare providers dealing with complicated reimbursement models), represent high-value potential customers. These businesses require Virtual CFOs not only for strategy but also for expert navigation of stringent industry-specific compliance and reporting standards, leveraging the provider's specialized vertical knowledge.

Another rapidly expanding segment of potential customers includes specialized Professional Service firms (legal, architectural, consulting) and mature e-commerce businesses. These entities often exhibit fluctuating revenue streams and complex partnership structures, demanding highly adaptable financial planning and profit-sharing models. For e-commerce businesses, in particular, the need for real-time inventory cost analysis, cross-border tax management, and optimization of supply chain financing makes sophisticated Virtual CFO services invaluable. The underlying commonality among all potential customers is the recognized gap between their current internal financial capability and the strategic financial complexity required for sustained, aggressive growth, a gap that the agile Virtual CFO model is perfectly positioned to fill.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 7.5 Billion |

| Market Forecast in 2033 | USD 15.6 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Deloitte Touche Tohmatsu Limited, KPMG, PwC, Ernst & Young Global Limited, TMF Group, RSM International, BDO, Countsy, Supporting Strategies, vCFO Services, Zeni, CFO Solutions, Acuity, Paro, Escalon Services, inDinero, Clearbanc, CFO Hub, Intrepid Ascent, MyCFO |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Virtual CFO Market Key Technology Landscape

The technological backbone of the Virtual CFO market is defined by a confluence of cloud computing, advanced data analytics, and automation tools, enabling remote, real-time, and highly accurate service delivery. Cloud-based ERP and accounting platforms (such as NetSuite, Microsoft Dynamics 365, and sophisticated versions of QuickBooks or Xero) form the essential infrastructure, providing centralized data access, automated data feeds, and compliance-ready general ledgers. The ubiquity of these cloud solutions allows Virtual CFOs to operate seamlessly across different geographical locations and manage diverse client portfolios efficiently, significantly reducing the turnaround time for critical reporting and analysis. Furthermore, robust data security technology, including end-to-end encryption, multi-factor authentication, and secure document storage protocols, is non-negotiable, serving as the foundation of client trust in the remote model.

The competitive edge in the Virtual CFO market is increasingly derived from the adoption of intelligent automation technologies. Robotic Process Automation (RPA) tools are utilized extensively to handle high-volume, repetitive tasks like bank reconciliations, expense report processing, and preliminary data validation, thereby shifting human effort towards high-value analysis and strategic input. Beyond RPA, predictive analytics and machine learning (ML) models are transforming forecasting capabilities. These technologies analyze historical financial and operational data, external market indicators, and macroeconomic trends to generate highly accurate cash flow projections and budget variance analyses, allowing Virtual CFOs to identify potential financial distress or growth opportunities months in advance, moving the engagement from reactive firefighting to proactive strategic guidance.

Emerging technologies like blockchain and specialized visualization platforms are also shaping the landscape. Blockchain technology holds significant promise for creating immutable audit trails and securely managing complex cross-border financial transactions, potentially streamlining compliance and reducing fraud risk in supply chain finance and international taxation. Additionally, sophisticated Business Intelligence (BI) and data visualization tools (e.g., Tableau, Power BI) are critical for translating complex financial data outputs from AI models into understandable dashboards and key performance indicator (KPI) summaries for non-financial executives. The successful Virtual CFO provider must master the orchestration and integration of these disparate technologies into a cohesive, secure, and user-friendly client platform, making continuous investment in technological proficiency a prerequisite for market leadership.

Regional Highlights

- North America: North America, particularly the United States, remains the largest and most technologically advanced market for Virtual CFO services. This dominance is attributed to a high concentration of venture capital funding, creating a perpetually high demand for expert financial guidance among startups and high-growth technology companies aiming for rapid scale and sophisticated exit strategies. The region benefits from a mature cloud infrastructure ecosystem and widespread regulatory acceptance of digital financial service delivery. Competition is intense, driving innovation in service bundling and pricing models, with a strong focus on AI-enabled predictive advisory services tailored specifically to SaaS metrics and IPO readiness.

- Europe: The European Virtual CFO market is characterized by robust demand, primarily driven by complex, fragmented regulatory environments (e.g., localized tax laws, IFRS, and GAAP variations), compelling mid-sized companies to seek specialized external support for compliance and cross-border operations. The UK and Germany are leading adopters, often integrating Virtual CFOs into operational efficiency mandates. The market is slowly consolidating, with firms increasingly leveraging centralized technology hubs to efficiently serve clients across multiple EU member states, emphasizing data privacy (GDPR compliance) as a key differentiator in service delivery.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by booming entrepreneurial activity, massive investment in digital infrastructure (especially 5G), and supportive government policies aimed at empowering SMEs in nations like India, China, and Southeast Asia. The demand here is dual-natured: basic financial governance and compliance for rapidly formalizing startups, alongside sophisticated treasury and capital management for multinational expansions. Price sensitivity is higher, pushing providers towards highly scalable, technology-driven service models leveraging localized AI tools and mobile-first platforms to cater to diverse linguistic and regulatory landscapes.

- Latin America (LATAM): The LATAM market is emerging, driven by economic stabilization efforts and increasing foreign investment, which necessitates improved financial transparency and adherence to international accounting standards. Key markets like Brazil and Mexico show strong growth potential. Virtual CFO services are instrumental in helping businesses navigate high inflation, currency volatility, and complex labor regulations. Providers often focus heavily on establishing strong internal controls and automating manual processes to stabilize financial reporting within volatile local conditions.

- Middle East and Africa (MEA): Growth in MEA is primarily concentrated in the Gulf Cooperation Council (GCC) countries, spurred by diversification away from oil economies and major national development visions (e.g., Saudi Vision 2030, UAE's digital initiatives). There is high demand for expertise in international tax regimes and sophisticated financial structuring to manage large infrastructure projects and nascent technology ecosystems. South Africa represents the leading market in Sub-Saharan Africa, where Virtual CFOs assist MMEs in managing regulatory compliance and accessing international capital markets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Virtual CFO Market.- Deloitte Touche Tohmatsu Limited

- KPMG

- PwC

- Ernst & Young Global Limited

- TMF Group

- RSM International

- BDO

- Countsy

- Supporting Strategies

- vCFO Services

- Zeni

- CFO Solutions

- Acuity

- Paro

- Escalon Services

- inDinero

- Clearbanc

- CFO Hub

- Intrepid Ascent

- MyCFO

Frequently Asked Questions

Analyze common user questions about the Virtual CFO market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a Virtual CFO and a traditional accountant or bookkeeper?

A Virtual CFO (vCFO) provides strategic financial leadership, focusing on long-term planning, forecasting, budgeting, cash flow optimization, and investor relations, acting as a strategic partner to the CEO. Traditional accountants primarily focus on recording historical transactions, compliance, and basic tax filing, which is tactical rather than strategic in nature.

How much cost savings can a business realistically achieve by utilizing a Virtual CFO?

Businesses, particularly SMEs, can typically achieve 40% to 60% savings compared to the fully burdened cost of hiring a full-time, in-house Chief Financial Officer. These savings stem from eliminating executive salaries, benefits, office space overheads, and the ability to scale services up or down based on current business needs.

Is data security a significant concern with remote Virtual CFO services, and how is it mitigated?

Yes, data security is a primary concern. Mitigation involves strict adherence to industry standards like SOC 2 and ISO 27001, utilizing secure, encrypted cloud platforms for data storage (e.g., private cloud environments), implementing multi-factor authentication, and ensuring compliance with regional data privacy laws such as GDPR or CCPA.

Which industry vertical shows the highest current adoption rate for Virtual CFO services?

The IT and Telecom sector, particularly high-growth Software as a Service (SaaS) companies, demonstrates the highest adoption rate. This is driven by their reliance on subscription-based revenue models, complex valuation methods, and the continuous need for sophisticated financial modeling crucial for attracting venture capital investment.

Will Artificial Intelligence replace the need for human Virtual CFOs in the future?

AI is augmenting, not replacing, the Virtual CFO role. AI automates routine data compilation and transactional tasks (RPA), but the strategic interpretation, ethical decision-making, stakeholder communication, and application of nuanced business judgment remain exclusively human functions, thereby elevating the human vCFO to a higher strategic level.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager