Virtual Rehabilitation and Telerehabilitation Systems Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441029 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Virtual Rehabilitation and Telerehabilitation Systems Market Size

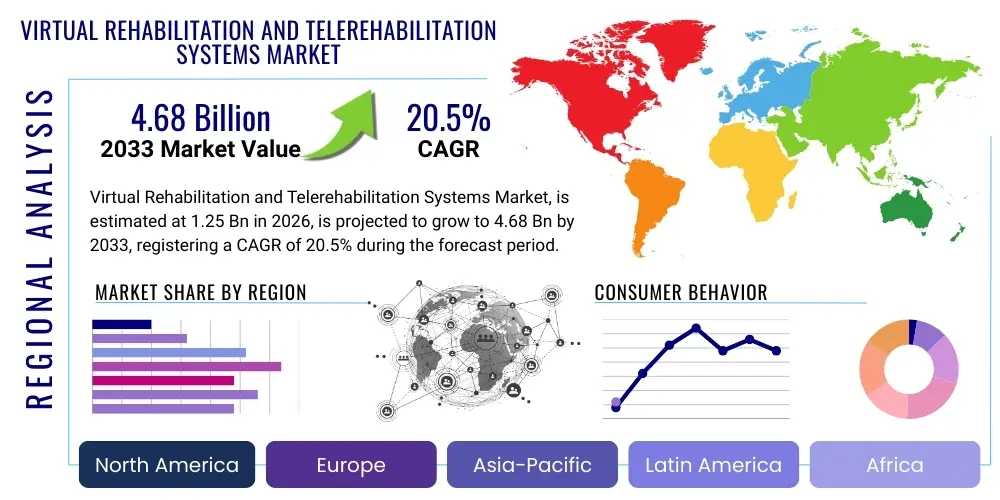

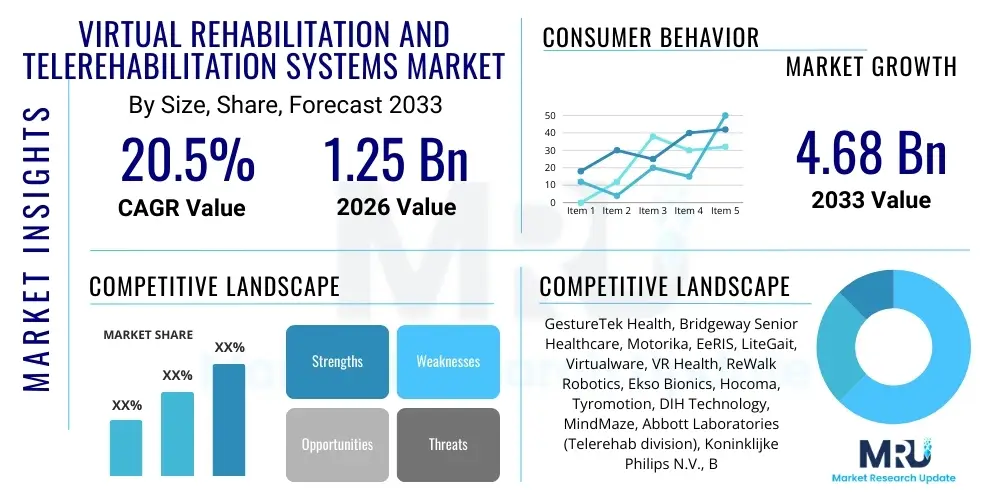

The Virtual Rehabilitation and Telerehabilitation Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 20.5% between 2026 and 2033. The market is estimated at $1.25 Billion in 2026 and is projected to reach $4.68 Billion by the end of the forecast period in 2033.

Virtual Rehabilitation and Telerehabilitation Systems Market introduction

The Virtual Rehabilitation and Telerehabilitation Systems Market encompasses sophisticated digital platforms and devices designed to deliver therapeutic interventions remotely or within an engaging virtual environment. Virtual rehabilitation (VR) utilizes immersive or non-immersive technology, such as specialized software, gaming interfaces, and motion sensors, to track patient progress and provide interactive exercises tailored for physical, occupational, and cognitive therapy. This methodology is particularly effective in treating conditions stemming from neurological disorders, orthopedic injuries, chronic pain, and age-related mobility decline, offering measurable feedback and personalized difficulty scaling. The core value proposition of VR systems lies in enhancing patient engagement and compliance, which traditionally pose significant challenges in long-term rehabilitative care.

Telerehabilitation, a broader category, leverages telecommunication technologies, including video conferencing and remote monitoring tools, to connect patients with therapists regardless of geographical distance. This significantly reduces barriers to access, especially for individuals in rural or underserved areas, or those with severe mobility limitations. Major applications span acute care follow-up, post-stroke recovery, pediatric rehabilitation, and mental health support, integrating seamlessly into existing healthcare infrastructures like hospitals, skilled nursing facilities, and increasingly, home settings. The synergy between VR's engaging content and Telerehabilitation's remote accessibility defines the rapid growth trajectory of this combined market, pushing the boundaries of traditional clinical practice towards decentralized, patient-centric models.

Key driving factors fueling market expansion include the escalating prevalence of chronic diseases and neurological conditions requiring long-term care, coupled with an aging global population demanding accessible and cost-effective alternatives to in-person therapy. Furthermore, technological advancements in sensors, haptic feedback devices, and increasingly realistic virtual environments are improving efficacy and user experience. The undeniable benefits, such as reduced overall healthcare costs, improved quality of life outcomes, and the ability to capture detailed, objective performance data for evidence-based practice, solidify this market’s position as a crucial component of future healthcare delivery strategies.

Virtual Rehabilitation and Telerehabilitation Systems Market Executive Summary

The market for Virtual Rehabilitation and Telerehabilitation Systems is experiencing robust expansion driven primarily by favorable reimbursement policies, technological integration, and the necessity for remote healthcare solutions accelerated by global events. Business trends highlight a strong movement towards subscription-based software services and integrated hardware-software packages, allowing healthcare providers to scale their rehabilitation services without massive upfront capital expenditure. Key vendors are focusing on strategic partnerships with academic institutions and specialized rehabilitation centers to validate clinical effectiveness and integrate machine learning algorithms for personalized patient pathways. Furthermore, there is a distinct trend towards developing compact, highly portable systems optimized for home use, shifting the rehabilitation locus away from centralized clinical facilities.

Regional trends indicate North America currently holds the dominant market share, attributed to sophisticated healthcare infrastructure, high technological adoption rates, and significant investments in digital health initiatives. However, the Asia Pacific region is poised for the highest growth rate, fueled by expanding access to high-speed internet, increasing healthcare expenditure in large economies like China and India, and a burgeoning elderly population requiring specialized long-term care. Europe remains a strong competitor, characterized by government support for eHealth programs and a mature regulatory framework conducive to the adoption of certified medical devices and software, particularly within public healthcare systems seeking efficiency gains.

Segment trends reveal that the physical rehabilitation application segment, particularly addressing musculoskeletal and neurological disorders (e.g., stroke recovery), accounts for the largest revenue share due to high incidence rates globally. Based on component type, software and services are experiencing faster growth than hardware components, reflecting the ongoing maturation of systems towards platform-agnostic solutions and the continuous need for updates, maintenance, and data management services. The shift toward hybrid delivery models combining in-clinic sessions with mandated home-based telerehabilitation exercises underscores the versatility and enduring demand across various end-user settings, including hospitals, clinics, and dedicated rehabilitation centers, with home settings showing the most dramatic increase in utilization.

AI Impact Analysis on Virtual Rehabilitation and Telerehabilitation Systems Market

User inquiries regarding the influence of Artificial Intelligence (AI) on the Virtual Rehabilitation and Telerehabilitation Systems Market predominantly revolve around three critical areas: personalization of therapy, predictive analytics for outcome measurement, and automation of clinical documentation. Users frequently ask how AI can tailor exercises in real-time based on subtle biomechanical feedback (beyond basic sensor data), thereby maximizing therapeutic effectiveness and preventing injury. There is also significant interest in AI's capacity to predict patient adherence and recovery milestones, allowing clinicians to intervene proactively. Furthermore, concerns are raised about the regulatory approval process for AI-driven diagnostic or prescriptive rehabilitation tools and the potential ethical implications concerning data privacy and algorithmic bias in diverse patient populations. Users expect AI to transcend simple data aggregation, transforming rehabilitation into a hyper-personalized, dynamically optimizing process that is scalable and clinically validated.

- AI algorithms enable real-time adjustment of exercise difficulty and parameters based on patient performance metrics and physiological responses, optimizing recovery pathways.

- Machine learning enhances diagnostic accuracy by analyzing complex motion capture data to identify subtle movement deficits often missed by human observation.

- Predictive modeling powered by AI forecasts long-term rehabilitation outcomes and patient adherence levels, facilitating proactive clinical adjustments and resource allocation.

- Natural Language Processing (NLP) streamlines clinical documentation and reporting by automatically summarizing session data and generating SOAP notes, reducing administrative burden.

- Computer Vision and deep learning facilitate automated grading and feedback on complex motor tasks, allowing for unassisted, high-quality home therapy sessions.

- AI integration into telerehabilitation platforms enhances accessibility by providing immediate, automated coaching and support, extending the therapist's reach beyond scheduled video calls.

- Intelligent data fusion allows for correlation of performance data with biometric inputs (heart rate, muscle activity) to create holistic recovery profiles.

DRO & Impact Forces Of Virtual Rehabilitation and Telerehabilitation Systems Market

The market dynamics are defined by a strong confluence of drivers rooted in demographic shifts and technological maturation, balanced by significant restraints related to infrastructure and cost. Opportunities predominantly lie in expansion into chronic disease management and proactive wellness applications, while the impact forces shape the competitive landscape by rewarding innovations that demonstrate superior clinical efficacy and scalability. Specifically, the necessity to manage rising healthcare costs globally drives the adoption of remote solutions, as telerehabilitation significantly reduces overheads associated with facility visits and lengthy hospital stays. This economic pressure, combined with the increasing number of individuals requiring long-term rehabilitation (e.g., stroke survivors, post-operative patients), creates a powerful demand environment that accelerates technological integration.

Restraints primarily encompass the initial high capital investment required for specialized hardware, particularly advanced robotic systems and high-fidelity VR rigs, which can be prohibitive for smaller clinical practices. Furthermore, significant variations in regulatory approval processes and reimbursement policies across different national jurisdictions introduce complexity and slow down market entry for innovative products. Another critical restraint is the digital divide and ensuring adequate bandwidth and technological literacy among both elderly patients and some segments of the clinical workforce, which can impede the effective deployment of remote systems. These friction points necessitate strategic government investment and focused professional training programs to mitigate market resistance.

Opportunities for growth are vast, particularly in leveraging 5G connectivity to improve the fidelity and responsiveness of real-time remote interactions, enabling highly sophisticated consultations and procedures. The expansion of applications beyond motor function into cognitive rehabilitation, mental health, and pain management represents untapped potential, driven by validated clinical evidence supporting virtual environments in these areas. Furthermore, the integration of these systems into preventative medicine and corporate wellness programs opens new, large-scale consumer markets beyond traditional clinical referral pathways. The impact forces are thus heavily weighted toward solutions that can demonstrate rapid Return on Investment (ROI) and seamless integration into existing Electronic Health Record (EHR) systems, pushing competitors towards open-architecture platforms and standardized data protocols.

Segmentation Analysis

The Virtual Rehabilitation and Telerehabilitation Systems Market is extensively segmented across application type, component, end-user, and technology platform, reflecting the diversity in therapeutic needs and technological deployment. This detailed segmentation allows market players to focus their research and development efforts on high-growth niche areas, such as cognitive VR platforms or specialized haptic devices for neurological recovery. Understanding these segments is crucial for strategic pricing and distribution, ensuring that complex robotic systems are targeted toward specialized rehabilitation centers while simpler, software-based systems reach the burgeoning home-based user market.

- By Application:

- Physical Rehabilitation (Neurological, Orthopedic, Musculoskeletal)

- Cognitive Rehabilitation (Traumatic Brain Injury, ADHD, Dementia)

- Occupational Therapy

- Speech Therapy

- Cardiopulmonary Rehabilitation

- Pain Management

- By Component:

- Hardware (Sensors, Haptic Devices, Robotic Exoskeletons, Virtual Reality Headsets, Wearable Devices)

- Software (Customized Therapeutic Programs, Data Analytics Platforms, Gamification Engines)

- Services (Implementation, Training, Maintenance, Consulting, Remote Patient Monitoring)

- By End-User:

- Hospitals and Clinics

- Rehabilitation Centers and Skilled Nursing Facilities

- Home Care Settings

- Outpatient Facilities

- By Technology Platform:

- Virtual Reality (VR) Systems (Immersive and Non-Immersive)

- Augmented Reality (AR) Systems

- Exoskeletons and Robotics

- Motion Capture and Sensor-Based Systems

Value Chain Analysis For Virtual Rehabilitation and Telerehabilitation Systems Market

The value chain for Virtual Rehabilitation and Telerehabilitation Systems is complex, starting with specialized upstream technology suppliers and culminating in the direct delivery of therapeutic services to the end-user. Upstream analysis focuses on the manufacturers of core enabling technologies, including advanced sensor producers (e.g., MEMS, inertial measurement units), specialized VR/AR hardware providers, and developers of high-fidelity haptic feedback mechanisms. These suppliers often operate in highly regulated tech markets and face continuous pressure to reduce latency, increase accuracy, and lower the cost of components while adhering to strict medical device standards. The quality and availability of these foundational technologies directly impact the performance and affordability of the final rehabilitation system.

Midstream activities involve the system integrators and application developers who transform raw components into clinically validated therapeutic platforms. This stage includes sophisticated software development, clinical trial management, medical certification, and system customization for specific rehabilitation needs (e.g., stroke vs. spinal cord injury). Downstream activities concentrate on distribution and service delivery. Distribution channels are highly fragmented, involving direct sales teams targeting large hospital networks, specialized medical device distributors focusing on regional clinics, and increasingly, direct-to-consumer models for home-based solutions, often through licensed practitioners or telehealth providers. The effectiveness of the service component, which includes training, technical support, and data hosting, is crucial for market penetration and customer retention.

The primary distribution channels involve both direct and indirect models. Large, established companies often utilize direct sales channels for major capital equipment like robotic systems to ensure specialized installation and training. Conversely, software subscriptions and consumer-grade telerehabilitation solutions frequently utilize indirect channels, including Value-Added Resellers (VARs) and partnerships with major telehealth platforms or insurance providers to achieve wider reach. The shift towards remote delivery necessitates strong technical infrastructure support from the distributors, ensuring patients can utilize the systems reliably in non-clinical environments. Successful integration often depends on seamless data exchange between the rehabilitation platform and the healthcare provider’s central EHR, making partnerships with health IT vendors increasingly critical.

Virtual Rehabilitation and Telerehabilitation Systems Market Potential Customers

The primary end-users and buyers of Virtual Rehabilitation and Telerehabilitation Systems span a broad spectrum of the healthcare ecosystem, ranging from large institutional entities to individual patients seeking specialized care. Hospitals, particularly those with dedicated rehabilitation units and advanced neurorehabilitation programs, represent significant buyers of high-end robotic and immersive VR systems due to their high patient volume and focus on cutting-edge treatment modalities. These institutions seek systems that can improve therapist efficiency, provide objective outcome measures, and reduce the overall length of stay for complex patient cases, positioning the technology as a vital tool for competitive differentiation and improved clinical metrics.

Specialized rehabilitation centers and skilled nursing facilities (SNFs) constitute another major customer segment. Unlike large acute care hospitals, SNFs often prioritize cost-effective, easy-to-deploy telerehabilitation solutions that enable consistent, monitored therapy for long-term care residents. For these customers, the systems act as crucial tools for maintaining patient function, preventing secondary complications, and ensuring compliance with payer requirements for documented therapy hours. They are particularly interested in software platforms offering comprehensive data logging and simplified user interfaces suitable for staff with varying levels of technological expertise.

Finally, the growing segment of potential customers includes home users and patients who purchase or lease systems for personal use, often driven by post-discharge care mandates or chronic disease management requirements. Payers and insurance providers are also increasingly influential customers, as they determine which systems and services are reimbursed. They drive market demand by prioritizing solutions that demonstrate superior efficacy in reducing readmission rates and overall episode-of-care costs. These individual and payer segments are particularly interested in portable, non-invasive systems that integrate seamlessly with telehealth services and offer robust remote monitoring capabilities.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.25 Billion |

| Market Forecast in 2033 | $4.68 Billion |

| Growth Rate | 20.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | GestureTek Health, Bridgeway Senior Healthcare, Motorika, EeRIS, LiteGait, Virtualware, VR Health, ReWalk Robotics, Ekso Bionics, Hocoma, Tyromotion, DIH Technology, MindMaze, Abbott Laboratories (Telerehab division), Koninklijke Philips N.V., BioInteractive Technologies, Reflexion Health, Penumbra Inc., Medtronic (Neuro Rehab focus), Zimmer Biomet. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Virtual Rehabilitation and Telerehabilitation Systems Market Key Technology Landscape

The technological landscape of the Virtual Rehabilitation and Telerehabilitation Systems market is rapidly evolving, driven by advancements in sensory input, processing power, and user interface design. Core technologies include sophisticated motion capture systems, which utilize depth cameras (like Microsoft Azure Kinect or specialized infrared sensors) and inertial measurement units (IMUs) embedded in wearable devices. These systems accurately track minute movements, range of motion, and kinetic data without the need for extensive physical markers, providing objective, quantifiable data that traditional manual assessments lack. The continuous refinement of these sensors improves data fidelity, crucial for early detection of deviations in patient progress and enhancing the precision of therapeutic feedback mechanisms.

Virtual Reality (VR) and Augmented Reality (AR) are fundamental to the experiential aspect of these systems. VR provides fully immersive environments that distract patients from pain and monotony, increasing motivation and adherence, particularly in populations requiring intensive, repetitive training, such as post-stroke patients. Non-immersive VR, utilizing standard screens and specialized controllers or sensors, remains popular due to lower cost and reduced risk of motion sickness. AR technology, however, is gaining traction by overlaying therapeutic exercises onto the patient's real-world environment, facilitating functional training in a familiar setting. This blending of real and virtual elements improves ecological validity, ensuring that skills learned transfer effectively to daily activities.

Advanced robotics and haptics technologies form the most capital-intensive segment, offering high-precision assistance and resistance. Robotic exoskeletons and end-effector robots assist patients with severe impairments in performing repetitive motor tasks, often exceeding the physical capabilities of a human therapist. Haptic feedback devices integrate realistic tactile sensations into virtual environments, crucial for tasks requiring fine motor control and dexterity, such as grasping or manipulating objects. The development trajectory is focused on making these robotic systems lighter, more intuitive, and increasingly connected via high-speed, low-latency networks (5G), enabling real-time remote control and parameter adjustment by clinicians located hundreds of miles away, fully realizing the potential of remote robotic rehabilitation.

Regional Highlights

The global market exhibits distinct regional dynamics shaped by varying levels of healthcare spending, technological infrastructure, and regulatory maturity. North America, comprising the United States and Canada, currently dominates the market in terms of revenue share. This leadership is fueled by high reimbursement rates for innovative medical technologies, extensive investment from both private venture capital and government research grants into digital health solutions, and a high density of specialized rehabilitation centers and major hospital networks adopting these systems early. The regulatory environment is generally favorable, allowing rapid introduction of validated devices and software, positioning the region as a primary hub for technological innovation and market uptake.

Europe represents a mature market characterized by governmental focus on digital transformation in healthcare, particularly through national eHealth strategies. Countries like Germany, the UK, and France show strong adoption rates, often subsidized by national health services seeking to manage the increasing burden of chronic disease and aging populations efficiently. While regulatory requirements (CE Mark) are rigorous, they provide a standardized pathway for market entry across the European Union. Growth in Europe is particularly robust in integrated telerehabilitation services aimed at reducing hospital stays and optimizing post-discharge care for geriatric and neurological patients.

The Asia Pacific (APAC) region is projected to register the fastest growth rate during the forecast period. This growth is underpinned by massive unmet needs in rehabilitation care, rapid expansion of private healthcare infrastructure, and escalating government investments in technology infrastructure (especially broadband and 5G). Japan, South Korea, and Australia are key early adopters, while populous economies like China and India present huge opportunities due to their large patient base and increasing consumer willingness to pay for modern rehabilitation solutions, often bypassing traditional infrastructure directly to remote and virtual modalities. The primary challenge in APAC remains bridging the gap between urban centers with high tech adoption and vast rural areas with limited access and connectivity.

- North America (Dominant Market Share): Driven by advanced infrastructure, strong reimbursement frameworks, high prevalence of neurological disorders, and significant R&D investment in telehealth and robotics.

- Europe (Mature Growth): Focused on government-backed eHealth integration, strong regulatory standards, and high adoption in skilled nursing and geriatric care settings.

- Asia Pacific (Fastest Growing Market): Exponential growth due to expanding healthcare access, rapidly increasing geriatric population, investment in 5G infrastructure, and unmet rehabilitation needs in highly populated countries.

- Latin America (Emerging Potential): Characterized by improving digital connectivity, growing healthcare expenditure, and increasing awareness of advanced rehabilitation methods, though challenged by economic volatility.

- Middle East & Africa (Niche Market): Adoption concentrated in technologically advanced Gulf Cooperation Council (GCC) countries, driven by high disposable income and efforts to establish medical tourism hubs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Virtual Rehabilitation and Telerehabilitation Systems Market.- GestureTek Health

- Bridgeway Senior Healthcare

- Motorika

- EeRIS

- LiteGait

- Virtualware

- VR Health

- ReWalk Robotics

- Ekso Bionics

- Hocoma

- Tyromotion

- DIH Technology

- MindMaze

- Abbott Laboratories (Telerehab division)

- Koninklijke Philips N.V.

- BioInteractive Technologies

- Reflexion Health

- Penumbra Inc.

- Medtronic (Neuro Rehab focus)

- Zimmer Biomet

Frequently Asked Questions

Analyze common user questions about the Virtual Rehabilitation and Telerehabilitation Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary clinical benefits of using virtual rehabilitation systems?

The primary clinical benefits include increased patient engagement and motivation through gamification, objective and quantifiable measurement of performance, enhanced compliance due to convenience of home use, and the ability to deliver high-intensity, repetitive therapeutic exercise essential for neurological recovery.

Is telerehabilitation typically covered by insurance or national healthcare providers?

Coverage for telerehabilitation is rapidly improving globally, driven by policy shifts accelerated by recent global health crises. In major markets like North America and Europe, many private payers and governmental programs (e.g., Medicare, NHS) now reimburse for remote therapeutic monitoring and synchronous video visits, significantly boosting adoption.

How does the integration of AI improve the efficacy of rehabilitation therapy?

AI integration improves efficacy by enabling highly personalized therapy protocols, automatically adjusting exercise difficulty in real-time based on subtle movement analysis, predicting adherence risks, and streamlining clinical reporting and documentation, allowing therapists to focus more time on patient interaction.

What is the difference between immersive VR and non-immersive VR systems in rehabilitation?

Immersive VR uses head-mounted displays to fully envelop the patient in a virtual environment, providing deep sensory distraction and presence, often used for pain management or complex balance training. Non-immersive VR uses standard screens, motion sensors, or webcams, is less costly, and minimizes potential motion sickness, making it widely suitable for simpler, home-based physical exercises.

What are the main technological challenges facing the expansion of telerehabilitation services?

Key technological challenges include ensuring reliable high-speed internet connectivity in all geographic areas (especially for high-fidelity data transmission), maintaining data security and HIPAA/GDPR compliance across remote networks, and developing user interfaces that are accessible and intuitive for the geriatric patient population.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager