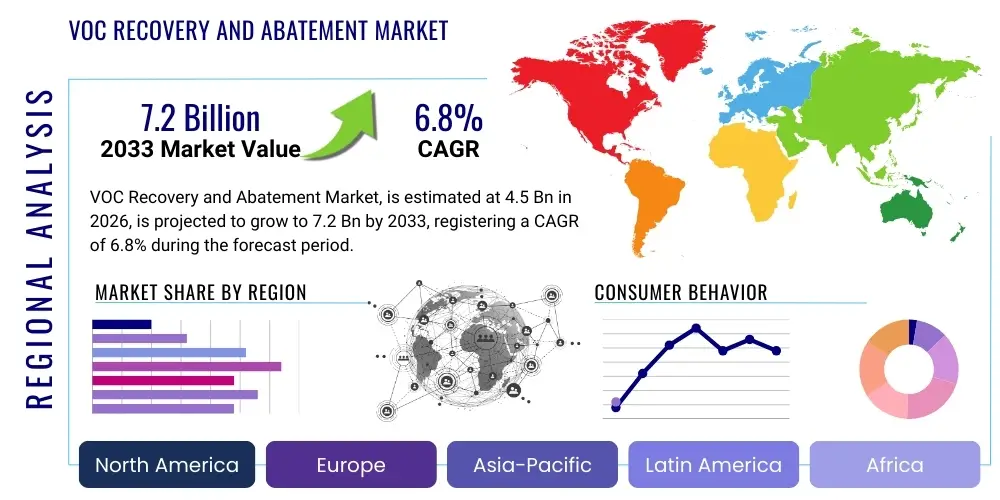

VOC Recovery and Abatement Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441987 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

VOC Recovery and Abatement Market Size

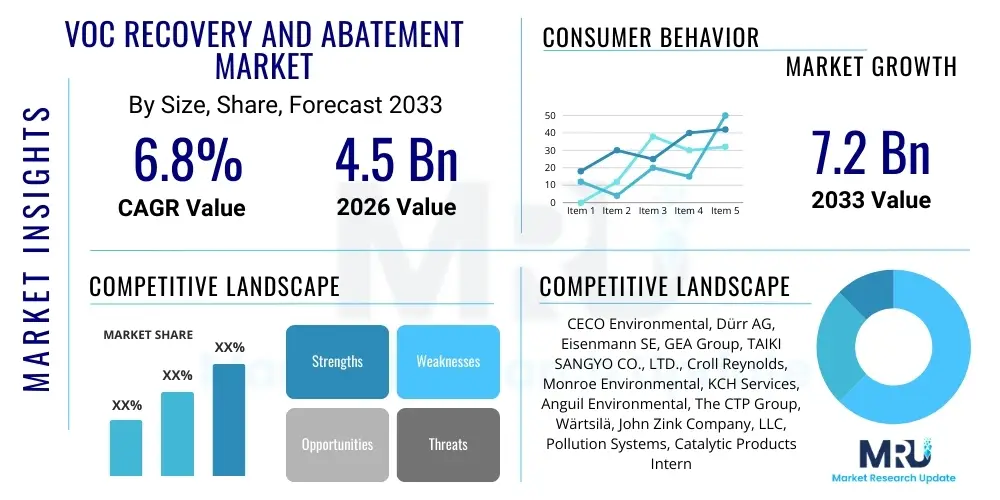

The VOC Recovery and Abatement Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $4.5 Billion in 2026 and is projected to reach $7.2 Billion by the end of the forecast period in 2033.

VOC Recovery and Abatement Market introduction

The Volatile Organic Compounds (VOC) Recovery and Abatement Market encompasses a specialized sector focused on controlling and mitigating the emission of VOCs generated across various industrial processes. VOCs are harmful airborne pollutants that contribute significantly to ground-level ozone formation, smog, and pose severe health risks, prompting stringent regulatory action globally. This market offers a suite of technological solutions designed to either capture and reuse (recovery) or destroy (abatement) these compounds before they enter the atmosphere. Key product categories include thermal oxidizers, catalytic oxidizers, adsorption systems, biofilters, and condensers, each tailored to handle different concentrations, flow rates, and types of VOCs emitted by industrial sources. The primary drivers fueling this market include escalating environmental compliance requirements, increasing awareness regarding air quality, and the rising industrial output, particularly in rapidly developing economies where manufacturing and chemical processing activities are concentrated. Furthermore, the economic viability of solvent recovery systems, which offer operational cost savings by recycling valuable chemicals, increasingly incentivizes adoption among large industrial players.

Major applications of VOC recovery and abatement technologies span across highly polluting industries such as oil and gas refineries, petrochemical plants, automotive paint shops, pharmaceutical manufacturing facilities, printing and packaging operations, and chemical synthesis processes. In the oil and gas sector, for instance, abatement systems are critical for managing emissions from storage tanks and loading terminals, while in the automotive industry, thermal oxidizers are essential for treating exhaust air from curing ovens. The benefits of utilizing advanced VOC control systems extend beyond regulatory compliance; they include improved worker health and safety, reduced odor complaints from neighboring communities, and in the case of recovery systems, the generation of a secondary revenue stream from recovered solvents. These systems represent crucial capital investments for industries striving toward sustainable operations and meeting international environmental standards such as those set by the EPA and regional regulatory bodies in Europe and Asia Pacific.

Driving factors for the market’s sustained growth are deeply rooted in global environmental policy harmonization and technological innovation. The continuous tightening of emission standards, especially in industrialized regions, mandates the adoption of best available control technologies (BACT), often leading industries to upgrade older, less efficient abatement infrastructure. Moreover, technological advancements, such as the development of high-efficiency catalytic systems that operate at lower temperatures, and sophisticated zeolite-based adsorption techniques offering higher recovery efficiency, are making abatement and recovery more cost-effective and energy-efficient. The increasing global focus on decarbonization and achieving net-zero emission targets further underscores the necessity of robust VOC mitigation strategies, positioning this market as a fundamental element of the broader environmental protection and industrial sustainability landscape.

VOC Recovery and Abatement Market Executive Summary

The VOC Recovery and Abatement Market is experiencing robust expansion driven primarily by global regulatory enforcement and the growing recognition of recovery systems’ economic benefits. Business trends indicate a strong shift towards integrated hybrid systems that combine multiple technologies—such as adsorption followed by catalytic oxidation—to handle complex, multi-component VOC streams efficiently and cost-effectively, particularly in industries dealing with high-volume, low-concentration emissions. Strategic mergers, acquisitions, and partnerships among key technology providers are shaping the competitive landscape, aiming to consolidate expertise in specialized industrial applications and expand geographical reach, especially into emerging markets that are implementing stricter environmental protocols. Furthermore, digitalization is integrating advanced monitoring and control systems, enabling predictive maintenance and optimizing system performance, thereby reducing downtime and operational expenditures for end-users.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, propelled by rapid industrialization, particularly in chemical and pharmaceutical manufacturing in countries like China, India, and South Korea, coupled with the introduction of comprehensive national air pollution control plans. North America and Europe maintain leading positions in terms of technology adoption maturity and regulatory stringency, driving demand for high-end, regenerative thermal oxidizers (RTOs) and advanced adsorption units. These regions prioritize energy recovery features in abatement systems to align with broader climate goals, thus encouraging innovation in heat exchanger design and energy efficiency optimization. Latin America and the Middle East and Africa (MEA) are emerging growth frontiers, fueled by significant investment in oil and gas infrastructure expansion and subsequent environmental remediation projects required by international lenders and local governments.

Segmentation trends highlight the dominance of thermal oxidation technologies, specifically RTOs, due to their versatility and ability to treat a wide range of VOC concentrations with high destruction efficiency, making them the preferred choice for large-scale operations in chemical processing and petrochemicals. However, the adsorption segment is gaining traction, driven by advancements in adsorbent materials like specialized activated carbons and zeolites, making recovery systems more viable for valuable solvent streams in the pharmaceuticals and printing industries. The application segment sees robust demand from the oil and gas sector, necessitated by flared gas minimization policies and fugitive emission control requirements, while the electronics and semiconductor manufacturing segments, characterized by extremely low emission limits, drive demand for highly efficient catalytic oxidation and specialized scrubbing systems. Overall market dynamics reflect a continuous trade-off assessment by industrial buyers between the higher capital cost of recovery systems versus the lower operating costs and potential solvent recycling revenue they offer compared to pure abatement technologies.

AI Impact Analysis on VOC Recovery and Abatement Market

User queries regarding the impact of Artificial Intelligence (AI) on the VOC Recovery and Abatement Market frequently center on themes of operational efficiency, predictive maintenance, real-time regulatory compliance, and optimization of energy consumption in large-scale abatement units. Users are keenly interested in how machine learning algorithms can analyze complex process data—such as gas composition, temperature fluctuations, and flow rates—to dynamically adjust oxidation parameters (e.g., fuel input in RTOs) or optimize regeneration cycles in adsorption systems, thereby minimizing energy waste and maximizing destruction or recovery efficiency. Concerns often revolve around the initial investment required for sensor infrastructure and integration complexity, alongside expectations that AI will enable seamless integration with existing Supervisory Control and Data Acquisition (SCADA) systems to ensure continuous, documented compliance with increasingly strict permit limits. The key expectation is that AI will transform abatement from a static, reactive process into a dynamic, predictive, and highly efficient operation.

The primary impact of AI adoption lies in enhancing the operational efficacy and reducing the total cost of ownership (TCO) for VOC control equipment. By deploying advanced sensor networks and utilizing machine learning models, operators can predict equipment failures, such as catalyst deactivation or heat exchanger fouling, significantly ahead of time, moving maintenance strategies from reactive to predictive. This proactive approach minimizes unplanned downtime—a critical factor in 24/7 industrial environments—and ensures continuous regulatory compliance, mitigating the risk of costly environmental fines. Furthermore, AI-driven control systems can manage the complex variables inherent in abatement processes, particularly optimizing the air-to-fuel ratio in thermal oxidizers or fine-tuning solvent recovery rates in adsorption systems, leading to substantial savings in natural gas consumption and reducing overall greenhouse gas emissions associated with the abatement process itself.

Another transformative effect of AI is its ability to process vast streams of environmental monitoring data instantaneously, providing real-time compliance assurance. AI algorithms can identify subtle, early indications of non-compliance, allowing immediate corrective action to be taken, which is crucial given the instantaneous penalties for exceeding short-term emission limits. In the context of VOC recovery, AI optimizes the scheduling of desorption and recovery cycles based on predicted feedstock concentrations and market demand for recovered solvents, maximizing both yield and purity while minimizing energy use during the regeneration phase. This sophisticated level of operational control, previously unattainable through traditional Programmable Logic Controllers (PLCs), significantly elevates the performance ceiling of modern VOC recovery and abatement infrastructure, making capital investments in these technologies more justifiable for end-users seeking maximal efficiency and documented environmental stewardship.

- Implementation of AI for predictive maintenance of catalysts and heat exchangers, minimizing unplanned downtime.

- Dynamic optimization of thermal oxidizer parameters (e.g., combustion temperature, air flow) to maximize Destruction Rate Efficiency (DRE) while minimizing fuel consumption.

- Real-time data analysis and anomaly detection to ensure immediate and continuous regulatory compliance with emission thresholds.

- Optimization of adsorption system regeneration cycles based on solvent loading and composition, increasing recovery purity and reducing energy expenditure.

- Integration of machine learning models for forecasting fugitive emissions, improving leak detection and repair (LDAR) program effectiveness.

DRO & Impact Forces Of VOC Recovery and Abatement Market

The VOC Recovery and Abatement Market is fundamentally shaped by a powerful confluence of drivers, restraints, and opportunities (DRO), which collectively form the critical impact forces steering its growth trajectory. The predominant drivers include increasingly stringent air quality regulations imposed globally, forcing industries to upgrade or install new abatement systems, coupled with the rising industrial output, particularly in chemical processing, oil & gas, and manufacturing sectors across emerging economies. Economic incentives arising from the potential recovery and reuse of expensive solvents act as a significant market accelerant, converting an environmental compliance cost into an operational savings or revenue stream. These positive forces are countered by major restraints, primarily the high initial capital expenditure associated with implementing sophisticated abatement technologies, especially advanced systems like RTOs or large-scale solvent recovery units, which can pose a significant barrier for small and medium-sized enterprises (SMEs). Furthermore, the high operational cost, particularly the energy required for high-temperature oxidation processes or complex desorption cycles, remains a limiting factor, compelling businesses to continuously seek energy-efficient alternatives.

Opportunities in this market are predominantly centered around the development and commercialization of next-generation, energy-efficient technologies. Significant potential exists in modular and standardized abatement systems that reduce installation complexity and cost, making sophisticated controls accessible to a wider range of industrial sizes. The expansion of biofiltration and bio-scrubbing technologies, which offer lower energy consumption alternatives for treating low-concentration, high-volume airstreams, represents a burgeoning opportunity, particularly favored by industries sensitive to operational expenditure. Moreover, the integration of Industry 4.0 principles, including smart sensors, IoT connectivity, and AI-driven control systems, presents a critical opportunity to enhance operational efficiency, ensure remote monitoring, and enable continuous documentation for compliance purposes, thereby adding value beyond mere pollution control. Investment in researching novel, highly selective, and durable catalyst materials for catalytic oxidation systems, which allow for lower reaction temperatures, also presents a substantial technological opportunity to significantly reduce energy dependence.

The impact forces within the VOC Recovery and Abatement market are inherently high, driven by non-discretionary spending mandated by law. Regulatory compliance acts as a non-negotiable pull factor, ensuring continuous market activity regardless of broader economic volatility. The competitive landscape is intensely focused on technological differentiation, with companies striving to offer systems that provide superior Destruction Rate Efficiency (DRE) or recovery purity while maintaining the lowest feasible Total Cost of Ownership (TCO). This competitive pressure accelerates innovation. The ongoing global shift towards sustainability and circular economy principles is amplifying the weight of the recovery component of the market, favoring technologies that turn waste streams into valuable resources over pure destruction methods. Consequently, the combination of regulatory mandate, economic benefit realization through recovery, and rapid technological advancement forms a robust and resilient market structure, ensuring sustained growth throughout the forecast period, especially as global environmental standards continue to converge toward stricter limits.

Segmentation Analysis

The VOC Recovery and Abatement Market is comprehensively segmented across technology, application, and process type, providing a detailed view of market penetration and growth opportunities across diverse industrial ecosystems. The segmentation by technology is critical, differentiating between systems designed for destruction (abatement) and those focused on solvent capture and reuse (recovery), with each technological category catering to specific characteristics of the volatile organic compound stream, such as concentration level, flow rate, temperature, and compound type. Key distinctions are drawn between high-temperature thermal processes, catalyst-enhanced oxidation, physical separation methods like adsorption and condensation, and biological treatment systems. This structural diversity allows end-users to select the optimal, most cost-effective solution tailored to their specific operational and regulatory requirements, driving distinct demand patterns across industrial sub-sectors.

Analysis by application reveals that the market heavily relies on demand from large, continuous process industries known for generating substantial VOC emissions. Segments like chemical manufacturing, petrochemicals, and the oil and gas sector are consistently high-volume users of large-scale thermal and catalytic oxidizers due to the sheer volume and often toxic nature of their emissions. Conversely, precision industries such as pharmaceuticals, electronics, and specialized printing often prioritize high-efficiency adsorption and condensation systems for recovery, driven by the high value and required purity of the solvents involved (e.g., acetone, toluene, ethanol). Furthermore, the trend toward modularization and decentralized abatement solutions is influencing procurement strategies, particularly in distributed manufacturing operations where smaller, localized units are preferred over centralized, large-capacity systems, impacting market share allocation among technology providers.

The interplay between technology maturity and regulatory shifts is a defining feature of the market segmentation. Mature technologies like Regenerative Thermal Oxidizers (RTOs) dominate due to their proven reliability and high destruction efficiency across varied streams, securing them a large share in the abatement segment. However, ongoing R&D in materials science is continuously enhancing the efficiency and durability of catalytic systems and biological treatments, leading to increased adoption in low-concentration applications where energy efficiency is paramount. The long-term segmentation forecast suggests a gradual shift towards recovery-focused solutions wherever economically viable, driven by sustainability goals and the circular economy mandate, potentially boosting the market share of adsorption and condensation technologies over the pure destruction methods.

- Technology:

- Thermal Oxidation (Regenerative Thermal Oxidizers (RTOs), Recuperative Thermal Oxidizers (RTOs), Direct Fired Thermal Oxidizers (DFTOs))

- Catalytic Oxidation (Regenerative Catalytic Oxidizers (RCOs), Recuperative Catalytic Oxidizers)

- Adsorption (Activated Carbon, Zeolites, Polymers)

- Absorption (Scrubbers)

- Condensation (Cryogenic, Refrigerated)

- Biofiltration and Bioscrubbers

- Application/End-Use Industry:

- Oil & Gas (Upstream, Midstream, Downstream)

- Chemical and Petrochemical Manufacturing

- Automotive (Paint Booths and Curing)

- Pharmaceuticals and Life Sciences

- Printing and Packaging

- Electronics and Semiconductor Manufacturing

- Food & Beverage

- Surface Coating (Plastics, Metal, Wood)

- Process Type:

- Abatement (Destruction)

- Recovery (Recycling/Reuse)

Value Chain Analysis For VOC Recovery and Abatement Market

The Value Chain for the VOC Recovery and Abatement Market begins with the upstream suppliers responsible for raw materials and core components, which are crucial for the effectiveness and longevity of the final systems. This includes specialized metals and ceramics for constructing high-temperature heat exchangers and combustion chambers, high-purity catalyst materials (like platinum or palladium) for catalytic oxidizers, and various porous media such as activated carbon and zeolite structures for adsorption systems. Innovation in the upstream segment, particularly the development of more durable catalysts or high-efficiency heat recovery materials, directly impacts the system's operational expenditure and capital cost. Manufacturers in this upstream layer often engage in proprietary material development to gain a competitive edge in performance and system lifespan, providing essential inputs to the equipment fabrication stage.

The midstream component involves the core activities of research, design, engineering, fabrication, and assembly of the VOC abatement and recovery units. This segment is dominated by specialized equipment providers who integrate upstream components into complex systems (RTOs, RCOs, scrubbers, etc.). Distribution channels in this capital equipment market are typically direct or rely on highly specialized engineering, procurement, and construction (EPC) firms and authorized distributors who possess deep technical expertise. Direct sales and technical consultation are common, particularly for highly customized, large-scale projects (e.g., a massive RTO for a petrochemical facility). Indirect channels, utilizing regional sales agents and integrators, are more prevalent for standardized, smaller modular units targeting SMEs in sectors like printing or specialty chemicals. The effectiveness of the distribution channel hinges on the ability to provide comprehensive pre-sales consultation, installation expertise, and robust after-sales technical support and maintenance.

The downstream analysis focuses on the end-users and the critical after-market services, which constitute a significant portion of the total lifetime value. End-users span the major industrial applications (Oil & Gas, Chemicals, Automotive), whose demands drive the customization of technology. The crucial downstream activities include installation, commissioning, maintenance, spare parts supply (e.g., replacement catalyst beds, filters), and system optimization. Given the regulatory scrutiny on VOC emissions, continuous maintenance and calibration services are mandatory, ensuring equipment reliability and compliance. Furthermore, the handling and remarketing of recovered solvents, particularly in recovery systems, form a specialized downstream segment, often requiring partnerships with solvent distributors or in-house recycling facilities. Therefore, long-term customer relationships and service contracts are key determinants of profitability in the latter stages of the value chain.

VOC Recovery and Abatement Market Potential Customers

Potential customers for VOC recovery and abatement solutions are defined by their propensity to generate significant quantities of volatile organic compounds during their manufacturing or processing activities, coupled with the mandatory need to comply with local, national, and international air quality standards. The primary buyers are large, multinational corporations within heavily regulated sectors, including major oil refiners and petrochemical producers who must manage vast, complex emission sources from storage tanks, flaring activities, and processing units. These customers prioritize high-capacity, reliable, and durable abatement technologies, often favoring highly efficient Regenerative Thermal Oxidizers (RTOs) or complex gas-processing scrubbers that can handle corrosive or high-temperature streams. Their purchasing decisions are driven by regulatory risk mitigation, operational scale, and the potential for substantial energy recovery to offset operating costs.

A second crucial customer segment encompasses the specialized manufacturing industries, notably pharmaceutical production, electronics and semiconductor fabrication, and precision printing operations. These sectors are characterized by using high-value solvents and requiring extremely low emission limits, making them prime candidates for advanced recovery systems such as specialized adsorption units or cryogenic condensers. For these customers, the economic benefit derived from solvent recycling—recovering solvents that can cost thousands of dollars per ton—often outweighs the initial capital investment in the recovery technology. Their focus shifts from pure destruction to maximizing solvent purity and minimizing loss, influencing technology choice toward high-efficiency separation processes and systems integrated seamlessly into closed-loop manufacturing environments.

The third tier of potential customers includes the vast array of mid-sized industrial players in general manufacturing, surface coating, and automotive component suppliers. These businesses often require modular, standardized, and easily scalable solutions, such as smaller-footprint catalytic oxidizers or biofilters, which offer a favorable balance between compliance effectiveness and initial investment cost. For these buyers, ease of maintenance, speed of installation, and adherence to regional (e.g., state-level EPA or European directive) requirements are critical buying factors. Consultants and Environmental, Health, and Safety (EHS) managers within all these industries act as crucial influencers and ultimate specifiers of the technology, ensuring that the purchased system meets specific permit requirements and long-term operational sustainability goals.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $4.5 Billion |

| Market Forecast in 2033 | $7.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | CECO Environmental, Dürr AG, Eisenmann SE, GEA Group, TAIKI SANGYO CO., LTD., Croll Reynolds, Monroe Environmental, KCH Services, Anguil Environmental, The CTP Group, Wärtsilä, John Zink Company, LLC, Pollution Systems, Catalytic Products International (CPI), Bay Environmental, Thermatrix, Dezair, Fives Group, MEGTEC Systems, Praxair Surface Technologies. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

VOC Recovery and Abatement Market Key Technology Landscape

The technological landscape of the VOC Recovery and Abatement Market is characterized by a mature base of high-performance thermal oxidation solutions complemented by rapidly evolving recovery technologies and niche biological treatment methods. Regenerative Thermal Oxidizers (RTOs) remain the workhorse of the abatement sector, prized for their ability to achieve destruction efficiencies exceeding 99% across a wide range of flow rates and variable VOC concentrations. The key technological advancement in RTOs focuses on improving heat recovery efficiency, often incorporating advanced ceramic media and optimized flow switching mechanisms to minimize auxiliary fuel consumption, thereby addressing one of the major restraints of the market—high operational energy cost. Similarly, Catalytic Oxidizers (RCOs) are gaining favor for applications where lower operating temperatures are feasible, utilizing precious metal catalysts to achieve high destruction rates with significantly less energy input than thermal systems, although they are sensitive to catalyst poisons like sulfur and siloxanes.

In the recovery segment, adsorption technologies, predominantly utilizing activated carbon and specialized zeolites, represent the cutting edge. Zeolite concentration wheels, for example, are highly efficient for treating high-volume, low-concentration air streams, concentrating the VOCs into a much smaller, high-concentration stream suitable for either efficient recovery via condensation or cost-effective destruction via a smaller oxidizer. Cryogenic condensation systems, while generally more expensive, are essential in specific high-purity recovery applications, particularly in the pharmaceutical and specialty chemical sectors, as they offer the advantage of not altering the chemical structure of the recovered solvent. The technological frontier here involves the development of novel adsorbent materials with higher selectivity and capacity, reducing the regeneration frequency and improving the overall economic feasibility of solvent reuse.

Furthermore, emerging and specialized technologies like biofiltration and bioscrubbers are securing a foothold, particularly in applications involving large air volumes with low, biodegradable VOC concentrations and where odor control is a primary concern (e.g., food processing, wastewater treatment). These biological systems offer exceptionally low operating costs and high sustainability profiles, relying on microorganisms to break down the VOCs at ambient temperatures, although they are constrained by the toxicity tolerance of the microbes. The overall trend is toward hybridization, where companies offer integrated systems, such as a concentration wheel coupled with an RTO or RCO, to provide a single, optimized solution for treating complex or highly variable industrial off-gases. This integration maximizes energy efficiency and DRE while maintaining compliance across diverse operational modes, representing the highest level of technological sophistication currently offered in the market.

Regional Highlights

- Asia Pacific (APAC): The APAC region is projected to register the highest growth rate, primarily driven by rapid industrial expansion in China, India, and Southeast Asian nations, coupled with the increasingly strict implementation of national air quality improvement plans (e.g., China’s 13th Five-Year Plan for environmental protection). The region is characterized by high demand for mid-to-large capacity abatement systems in the chemical, petrochemical, and manufacturing sectors. While initially favoring lower capital cost options, the shift is rapidly moving towards advanced, high-efficiency RTOs and catalytic systems, largely due to governmental mandates pushing for Best Available Technology (BAT) and stricter enforcement regimes, making compliance failure economically prohibitive for major industrial players.

- North America: North America represents a mature, high-value market characterized by stringent federal and state-level environmental regulations, particularly the EPA's Maximum Achievable Control Technology (MACT) standards. Demand is focused on system upgrades, replacements, and high-tech integration, prioritizing energy efficiency and remote monitoring capabilities (driven by AI/IoT) for continuous compliance documentation. The oil and gas sector remains a significant driver, demanding highly reliable solutions for tank vents and pipeline compressor stations. The market showcases a preference for custom-engineered, large-scale regenerative oxidizers and advanced, high-purity solvent recovery systems in pharmaceutical and specialty chemical hubs.

- Europe: Europe exhibits strong demand fueled by the Industrial Emissions Directive (IED) and strict national regulations promoting circular economy models, leading to a pronounced focus on VOC recovery over destruction wherever feasible. European customers prioritize minimizing the energy footprint, favoring advanced catalytic oxidation, efficient heat recovery in RTOs, and the widespread adoption of biofiltration for low-concentration sources. Germany, Italy, and the UK are key hubs, characterized by a sophisticated industrial base and a high propensity to invest in sustainable, low-emission technologies, often acting as global standard setters for energy-efficient abatement solutions.

- Latin America: This region is an emerging market with demand primarily concentrated in Brazil, Mexico, and Argentina, driven by expanding petrochemical, automotive manufacturing, and resource extraction industries. Market growth is stimulated by the harmonization of local environmental laws with international standards and pressure from multinational corporations operating within the region. Initial adoption often focuses on addressing easily quantifiable sources using proven, cost-effective abatement technologies, though solvent recovery is becoming increasingly important in the pharmaceutical and coating sectors due to imported solvent costs.

- Middle East and Africa (MEA): Growth in the MEA region is intrinsically linked to massive investments in the oil, gas, and petrochemical sectors, particularly in the Gulf Cooperation Council (GCC) countries. The demand is heavily skewed towards large-scale, robust abatement systems capable of handling harsh operating conditions and complying with international standards required by foreign partners and major global energy firms. Focus areas include flare gas recovery, fugitive emission control in refineries, and odor management in major industrial zones, driving procurement of specialized thermal oxidation and advanced scrubbing solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the VOC Recovery and Abatement Market.- CECO Environmental

- Dürr AG

- Eisenmann SE

- GEA Group

- TAIKI SANGYO CO., LTD.

- Croll Reynolds

- Monroe Environmental

- KCH Services

- Anguil Environmental

- The CTP Group

- Wärtsilä

- John Zink Company, LLC

- Pollution Systems

- Catalytic Products International (CPI)

- Bay Environmental

- Thermatrix

- Dezair

- Fives Group

- MEGTEC Systems

- Praxair Surface Technologies

Frequently Asked Questions

Analyze common user questions about the VOC Recovery and Abatement market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between VOC abatement and VOC recovery?

VOC abatement refers to the destruction of volatile organic compounds, typically through high-temperature oxidation (thermal or catalytic), converting them into harmless substances like carbon dioxide and water vapor. VOC recovery involves capturing and concentrating the compounds for reuse or recycling, often using adsorption, absorption, or condensation techniques, offering both environmental compliance and potential economic benefit from recovered solvents.

Which VOC abatement technology offers the highest energy efficiency for high-volume air streams?

Regenerative Thermal Oxidizers (RTOs) generally offer the highest energy efficiency for high-volume, low-to-moderate concentration VOC air streams. RTOs utilize ceramic media beds to capture and reuse thermal energy from the oxidized exhaust, achieving thermal efficiencies up to 95%, significantly minimizing the need for supplemental fuel once operating temperature is reached.

How do stringent environmental regulations influence market growth in the APAC region?

Stringent environmental regulations, such as those implemented in China and India, significantly accelerate market growth in APAC by mandating that expanding industrial sectors, especially chemical and automotive, adopt high-efficiency VOC control technologies. This regulatory pressure forces industries to move beyond basic compliance toward advanced, non-discretionary capital investment in both recovery and abatement systems.

What are the main drawbacks of using catalytic oxidizers (RCOs) for VOC destruction?

The main drawbacks of RCOs include their sensitivity to catalyst poisons, such as sulfur, phosphorus, and silicon compounds (siloxanes), which can deactivate the catalyst and necessitate expensive replacement. Furthermore, RCOs are generally less effective for heavily halogenated or complex, highly variable VOC streams compared to high-temperature thermal systems.

What role does the circular economy play in driving the adoption of VOC recovery systems?

The circular economy mandate strongly drives the adoption of VOC recovery systems by promoting resource efficiency and waste minimization. Recovery technologies allow industries (like pharmaceuticals and printing) to recycle high-value solvents back into their production cycles, reducing reliance on virgin materials, lowering waste disposal costs, and transforming a waste stream into a secondary, sustainable resource.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager