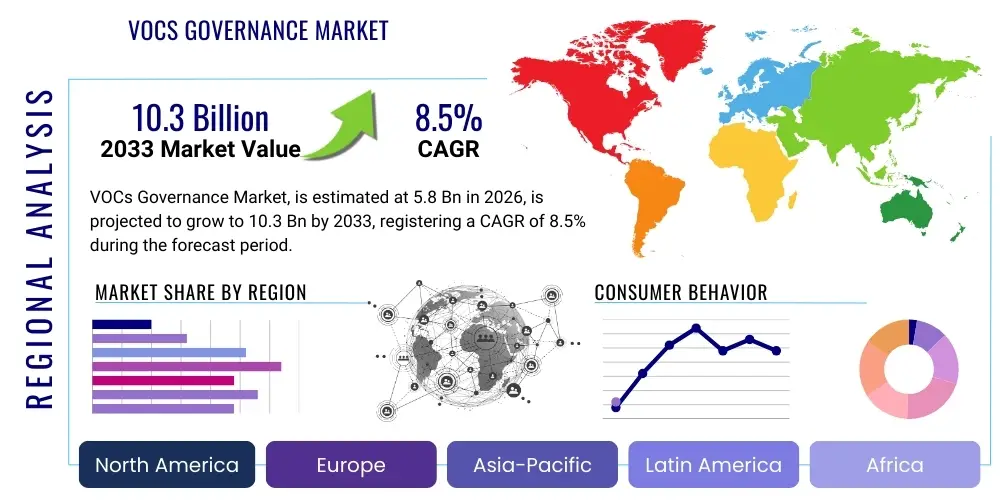

VOCs Governance Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440741 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

VOCs Governance Market Size

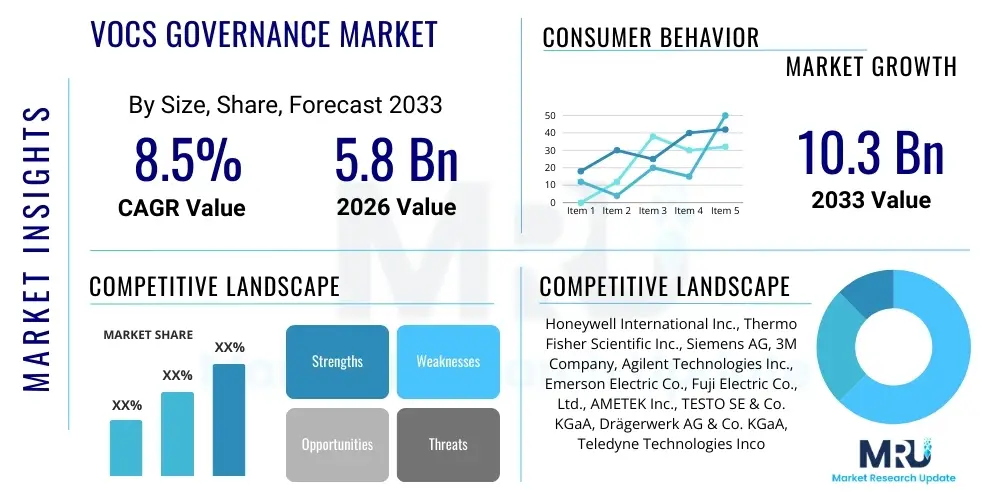

The VOCs Governance Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 5.8 Billion in 2026 and is projected to reach USD 10.3 Billion by the end of the forecast period in 2033.

VOCs Governance Market introduction

The Volatile Organic Compounds (VOCs) Governance Market encompasses a broad spectrum of solutions and services designed to monitor, control, and mitigate VOC emissions across various industrial and commercial sectors. VOCs are a diverse group of organic chemicals that readily evaporate at room temperature, contributing significantly to air pollution, smog formation, and adverse health effects. Effective governance of VOCs is paramount for environmental protection, public health, and regulatory compliance. This market addresses the urgent need for industries to meet stringent emission standards set by global and regional environmental agencies, driving the adoption of advanced technologies and strategic management practices.

Products within this market range from sophisticated real-time monitoring devices and analytical instruments to comprehensive software platforms for data management, reporting, and predictive analytics. Abatement technologies, such as catalytic oxidizers, thermal oxidizers, biofilters, and activated carbon adsorption systems, form another critical segment, providing solutions to reduce or eliminate VOCs before they are released into the atmosphere. The market also includes consulting services that assist organizations in developing robust VOC management strategies, navigating complex regulatory landscapes, and implementing best practices for emission reduction and process optimization. These offerings collectively aim to empower businesses to achieve environmental stewardship while maintaining operational efficiency.

Major applications of VOCs governance solutions span a wide array of industries, including chemicals, oil and gas, pharmaceuticals, paints and coatings, automotive, manufacturing, and waste management. The benefits derived from effective VOCs governance are multifaceted, encompassing enhanced regulatory compliance, improved indoor and outdoor air quality, reduced health risks for workers and communities, minimized environmental footprint, and often, increased operational efficiency through optimized processes and reduced waste. Key driving factors propelling market growth include the intensification of environmental regulations globally, a heightened public and corporate awareness regarding sustainability and health impacts, ongoing technological advancements in sensing and abatement, and the continuous expansion of industrial activities, particularly in developing economies.

VOCs Governance Market Executive Summary

The VOCs Governance Market is experiencing dynamic growth, propelled by a confluence of evolving business trends, stringent regional regulatory frameworks, and rapid advancements across key segments. A pivotal business trend is the increasing emphasis on digitalization and automation in environmental management, leading to a surge in demand for integrated software platforms that offer real-time monitoring, predictive analytics, and automated reporting capabilities. Enterprises are increasingly investing in robust VOCs governance solutions not only for compliance but also as a core component of their broader Environmental, Social, and Governance (ESG) strategies, aiming for greater transparency and reduced environmental impact. Furthermore, there is a growing trend towards proactive risk management, where businesses seek solutions that can identify potential emission excursions before they become compliance issues, thereby mitigating financial penalties and reputational damage. The integration of IoT and cloud technologies is making remote monitoring and centralized data management more accessible and efficient, transforming how organizations approach environmental compliance. This shift underscores a broader industry movement towards preventative and data-driven environmental stewardship.

Regional trends significantly shape the VOCs governance landscape, reflecting diverse regulatory priorities and industrial bases. North America and Europe, with their well-established environmental protection agencies and stringent emission limits, represent mature markets characterized by high adoption rates of advanced monitoring and abatement technologies. The European Union's ambitious Green Deal, for instance, drives significant investments in sustainable industrial practices and emission reduction. Conversely, the Asia Pacific region is emerging as a high-growth market, driven by rapid industrialization, increasing urbanization, and a growing recognition of the severe health and environmental consequences of unchecked VOC emissions. Countries like China and India are enacting and strengthening their environmental regulations, creating substantial demand for VOCs governance solutions. Latin America, the Middle East, and Africa are also witnessing gradual market expansion, primarily influenced by investments in extractive industries and developing manufacturing sectors, leading to a nascent but expanding regulatory push for emission control. These regional disparities create distinct opportunities and challenges for market participants, requiring tailored strategies for market penetration and solution deployment.

Segment trends within the VOCs governance market highlight significant shifts in technological preference and service demand. The software and services segments are experiencing particularly strong growth, as companies seek comprehensive, integrated solutions for data interpretation, compliance management, and strategic environmental planning. Advanced analytics, AI-powered insights, and user-friendly dashboards are becoming standard expectations. In hardware, there is a clear trend towards more compact, highly sensitive, and cost-effective sensor technologies, including portable and wearable devices for personal exposure monitoring. Abatement technologies are evolving towards greater energy efficiency and reduced operational costs, with innovative designs and materials improving removal efficiencies. The market is also seeing increased demand for specialized solutions tailored to specific industries, addressing unique emission profiles and regulatory requirements of sectors such as pharmaceuticals, petrochemicals, and food and beverage. This move towards customization and comprehensive, integrated solutions underlines the market's maturity and its responsiveness to diverse industrial needs. The convergence of these trends points towards a future where VOCs governance is not merely a compliance burden but an integral component of sustainable and competitive industrial operations.

AI Impact Analysis on VOCs Governance Market

Users frequently inquire about how Artificial Intelligence (AI) can revolutionize VOCs governance, focusing on its potential to enhance the accuracy and efficiency of emission monitoring, prediction, and control. Common questions revolve around AI's ability to process vast datasets from sensors, identify emission patterns, predict potential excursions, and optimize abatement strategies in real-time. There is significant interest in AI's role in automating compliance reporting, reducing manual intervention, and providing more actionable insights for environmental managers. Concerns often raised include the reliability and robustness of AI models in diverse industrial environments, the initial investment required for AI infrastructure, and the need for skilled personnel to manage and interpret AI-generated data. Users are keen to understand how AI can move VOCs governance beyond reactive compliance to proactive, predictive environmental management, ensuring safer operations and a healthier environment. The overarching theme is the expectation that AI will bring unprecedented levels of precision, speed, and intelligence to the complex challenge of managing volatile organic compounds.

- Real-time Predictive Analytics: AI algorithms analyze continuous sensor data to predict VOC emission spikes, allowing for proactive intervention before regulatory limits are breached.

- Automated Anomaly Detection: Machine learning models can quickly identify unusual emission patterns or equipment malfunctions, flagging issues that might be missed by traditional monitoring.

- Optimized Abatement Strategies: AI can determine the most efficient operating parameters for abatement systems, reducing energy consumption and operational costs while maintaining high removal efficiencies.

- Enhanced Data Interpretation: AI-powered platforms synthesize complex environmental data, transforming raw readings into clear, actionable insights for compliance and operational decision-making.

- Smart Sensor Network Management: AI optimizes the placement and calibration of VOC sensors, improving coverage and accuracy across large industrial sites.

- Automated Compliance Reporting: AI systems can automatically generate detailed compliance reports, minimizing manual effort and ensuring accuracy and timeliness.

- Risk Assessment and Management: AI provides advanced risk modeling by correlating emission data with meteorological conditions and operational parameters, identifying high-risk scenarios.

- Resource Optimization: By predicting maintenance needs for abatement equipment or identifying process inefficiencies contributing to VOCs, AI helps optimize resource allocation.

- Early Warning Systems: AI facilitates the development of sophisticated early warning systems for potential environmental hazards, protecting worker safety and community health.

- Personalized Exposure Monitoring: AI integrated with wearable sensors can provide personalized VOC exposure data and alerts for workers in high-risk environments.

DRO & Impact Forces Of VOCs Governance Market

The VOCs Governance Market is significantly shaped by a powerful interplay of drivers, restraints, and opportunities, all underscored by critical impact forces that dictate its trajectory. A primary driver is the global escalation of stringent environmental regulations aimed at mitigating air pollution and its adverse effects on human health and ecosystems. Governments and international bodies are continuously tightening emission standards for industries, mandating comprehensive monitoring, reporting, and abatement strategies for VOCs. This regulatory push compels industries to invest in advanced governance solutions to avoid hefty fines, operational shutdowns, and severe reputational damage. Furthermore, increasing public awareness about environmental sustainability and corporate social responsibility (CSR) initiatives pressure companies to adopt greener practices, including effective VOCs management. Technological advancements, particularly in sensor technology, IoT, and AI, are also key drivers, offering more accurate, real-time, and cost-effective monitoring and abatement solutions. The ongoing global industrialization and urbanization, especially in emerging economies, lead to a larger base of potential VOC emitters, further amplifying the demand for governance frameworks. Finally, the growing understanding of the direct link between VOC exposure and various health issues, such as respiratory diseases, neurological damage, and certain cancers, acts as a profound societal driver for more robust governance.

Despite these strong drivers, the VOCs governance market faces several formidable restraints. One significant barrier is the high initial capital investment required for implementing sophisticated VOC monitoring equipment, abatement technologies, and integrated software platforms. Many small and medium-sized enterprises (SMEs) find these costs prohibitive, limiting widespread adoption. Another challenge is the lack of globally harmonized regulations, which creates complexity for multinational corporations operating in diverse regulatory environments. The inherent complexity of VOCs themselves, including their vast number, varying chemical properties, and diverse emission sources, makes their comprehensive analysis and management inherently difficult. Additionally, economic slowdowns or uncertainties can lead to deferred investments in environmental compliance, as companies prioritize core business operations. There can also be resistance to adopting new technologies and methodologies within traditional industrial sectors, often due to perceived operational disruptions or a lack of understanding regarding long-term benefits. Finally, a shortage of skilled personnel capable of operating, maintaining, and interpreting data from advanced VOC governance systems poses a practical constraint on market growth.

Opportunities within the VOCs governance market are abundant and promising, driven by innovation and expanding needs. The rapid growth of emerging economies, characterized by burgeoning industrial sectors, presents significant untapped market potential for VOCs governance solutions as these regions strengthen their environmental regulatory frameworks. Advancements in low-cost, high-precision sensor technologies are making monitoring more accessible and affordable, democratizing access to crucial data for a wider range of industries and even public monitoring initiatives. The increasing integration of VOCs governance with broader smart manufacturing and Industry 4.0 initiatives offers avenues for seamless data flow, predictive maintenance, and optimized environmental performance within a holistic operational framework. The burgeoning market for environmental consulting services, specializing in regulatory compliance, risk assessment, and sustainability reporting, represents a substantial opportunity for service providers. Furthermore, the development of innovative, energy-efficient abatement technologies that can recover valuable byproducts from VOC streams, aligning with circular economy principles, opens new avenues for economic benefits alongside environmental protection. These opportunities are poised to transform the market from one driven primarily by regulatory compliance to one focused on strategic environmental management and sustainable value creation.

The overall impact forces on the VOCs Governance Market are profoundly influenced by a combination of regulatory impetus, technological innovation, and public health imperatives. Regulatory frameworks act as the primary external force, dictating minimum compliance standards and driving initial market adoption. However, beyond mere compliance, the force of technological advancement, particularly in areas like AI, IoT, and advanced materials for sensors and catalysts, significantly shapes the market by introducing more effective, efficient, and proactive solutions. Public health concerns and increasing societal demand for cleaner air exert a powerful ethical and reputational pressure on industries, often pushing them to exceed minimum regulatory requirements. Economic viability, encompassing both the cost of non-compliance (fines, lawsuits, reputational damage) and the return on investment from improved efficiency or resource recovery, remains a crucial internal impact force that influences the pace and scale of adoption. The interaction of these forces creates a complex, evolving landscape where market players must continuously innovate and adapt to remain competitive and relevant.

Segmentation Analysis

The VOCs Governance Market is meticulously segmented to provide a granular understanding of its diverse components, applications, and end-user industries. This segmentation is crucial for market players to identify specific growth opportunities, tailor their offerings, and develop targeted strategies. The market can be broadly categorized by component into hardware, software, and services, each playing a distinct yet interconnected role in the comprehensive management of VOC emissions. Hardware includes a range of physical devices from advanced sensors and monitoring systems to large-scale abatement technologies. Software solutions encompass data acquisition, analysis, reporting, and predictive modeling platforms. Services, meanwhile, cover everything from initial consultation and system integration to maintenance, training, and ongoing compliance support. This component-based breakdown helps in understanding the technological and operational investments across the market.

Further segmentation by application highlights the varied contexts in which VOCs governance is crucial. Key applications include industrial emissions monitoring, where the focus is on compliance with stack emission limits from manufacturing processes; environmental monitoring, which involves broader ambient air quality assessments and regional pollution control; and indoor air quality (IAQ) management, vital for health and safety in commercial buildings, residential spaces, and specific workplaces. Each application area demands distinct approaches and technologies, reflecting the specific types of VOCs present, the scale of monitoring required, and the regulatory nuances involved. The diversity of applications underscores the pervasive nature of VOC challenges and the wide scope of solutions required to address them effectively.

The market is also segmented by end-user industry, recognizing that different sectors have unique VOC emission profiles, operational complexities, and regulatory landscapes. Major end-user industries include chemicals and petrochemicals, oil and gas, pharmaceuticals, paints and coatings, automotive, food and beverage, and manufacturing. For instance, the oil and gas industry often deals with large-scale fugitive emissions and requires robust leak detection and repair (LDAR) programs, while the pharmaceutical sector focuses on controlling emissions from solvent use in drug synthesis, often with stricter health-related thresholds. Understanding these industry-specific needs allows solution providers to develop specialized products and services that effectively address the particular challenges and compliance requirements of each sector, thereby maximizing market penetration and client satisfaction. This detailed segmentation offers a comprehensive map of the market's structure and its operational dynamics.

- By Component

- Hardware

- Sensors (PID, FID, IR, Electrochemical, Metal Oxide Semiconductor)

- Analyzers (GC-MS, FTIR, Photoacoustic)

- Monitoring Systems (Fixed, Portable, Continuous Emission Monitoring Systems - CEMS)

- Abatement Systems (Thermal Oxidizers, Catalytic Oxidizers, Regenerative Thermal Oxidizers - RTO, Carbon Adsorption, Biofilters, Scrubbers)

- Software

- Data Acquisition & Management

- Reporting & Compliance Management

- Predictive Analytics & Modeling

- Control & Optimization Software

- Environmental, Health, and Safety (EHS) Software Integration

- Services

- Consulting & Advisory

- Installation & Integration

- Maintenance & Support

- Training & Calibration

- Sampling & Laboratory Analysis

- Leak Detection and Repair (LDAR) Services

- Hardware

- By Application

- Industrial Emissions Monitoring

- Environmental Air Quality Monitoring

- Indoor Air Quality (IAQ) Management

- Process Control & Optimization

- Personal Exposure Monitoring

- Fugitive Emissions Detection

- By End-User Industry

- Chemicals & Petrochemicals

- Oil & Gas

- Pharmaceuticals

- Paints & Coatings

- Automotive

- Manufacturing (General)

- Food & Beverage

- Waste Management

- Power Generation

- Building & Construction

Value Chain Analysis For VOCs Governance Market

The value chain for the VOCs Governance Market is a complex ecosystem, starting from the upstream suppliers of raw materials and specialized components, extending through the manufacturing and integration of advanced technologies, and culminating in the delivery of comprehensive solutions to end-users. Upstream activities involve the development and supply of critical components such as advanced sensors (e.g., photoionization detectors, metal oxide semiconductors, electrochemical cells), specialized chemicals for calibration and analysis, and high-performance materials for abatement technologies like catalysts for oxidizers or activated carbon for adsorption systems. Key technology providers developing sophisticated analytical instruments, IoT modules, and AI/ML platforms also form a crucial part of the upstream segment. These suppliers invest heavily in R&D to produce components that are increasingly sensitive, durable, and cost-effective, forming the foundational technology upon which the entire governance market relies. Their innovations directly influence the capabilities and performance of downstream products and services.

Midstream activities involve the integration and assembly of these components into complete VOCs governance solutions. This includes the manufacturing of monitoring systems, CEMS, portable analyzers, and various abatement units. Software developers create the necessary platforms for data acquisition, analysis, visualization, and reporting, ensuring seamless operation and compliance management. System integrators play a vital role here, combining hardware, software, and sometimes third-party services to deliver bespoke solutions tailored to specific industrial needs. Engineering and design firms contribute to the custom development of abatement systems for unique industrial processes. The efficiency and quality of these midstream processes are critical for producing reliable, accurate, and scalable VOCs governance systems that meet stringent industrial and regulatory requirements. This segment also includes the rigorous testing and certification of equipment to ensure performance and compliance with relevant standards.

Downstream activities focus on the distribution, implementation, and ongoing support of VOCs governance solutions. Distribution channels are varied, including direct sales forces for large industrial clients, a network of specialized distributors and resellers for broader market reach, and increasingly, online platforms for standard components or software subscriptions. Consulting firms specializing in environmental compliance, engineering, and EHS management play a crucial role in advising clients, conducting site assessments, and assisting with regulatory navigation and strategy development. Post-sales services, such as installation, commissioning, maintenance, calibration, and technical support, are vital for ensuring the long-term effectiveness and reliability of the deployed systems. Direct interaction with end-users, through sales teams and service engineers, is paramount for understanding evolving needs and delivering customized solutions that contribute to optimal environmental performance and regulatory adherence. The efficiency of these downstream operations directly impacts customer satisfaction and the overall perceived value of VOCs governance investments.

VOCs Governance Market Potential Customers

The potential customer base for the VOCs Governance Market is remarkably diverse, encompassing a wide array of industrial, commercial, and governmental entities that either produce or are affected by VOC emissions. At the forefront are large-scale manufacturing facilities across sectors such as chemicals, petrochemicals, oil and gas refining, and pharmaceuticals. These industries inherently utilize significant quantities of organic solvents and raw materials that are sources of VOCs, making stringent governance essential for regulatory compliance, process safety, and environmental stewardship. For these customers, solutions must be robust, capable of handling complex emission profiles, and often integrated into their existing operational control systems. They are typically seeking comprehensive packages that include continuous emission monitoring systems (CEMS), advanced abatement technologies, and sophisticated data management software to ensure ongoing compliance and optimize their environmental performance.

Beyond heavy industry, a substantial segment of potential customers includes companies in the paints and coatings, automotive manufacturing, food and beverage processing, and general manufacturing sectors. These industries, while potentially having different emission scales and types, are equally bound by VOC regulations and motivated by the need to protect worker health and improve indoor air quality. For instance, automotive paint shops require advanced solutions to capture and treat VOCs from spraying operations, while food processing plants might focus on specific flavor compounds or cleaning solvents. Furthermore, commercial buildings, schools, and healthcare facilities are increasingly investing in VOCs governance solutions, particularly for indoor air quality management, driven by public health concerns and employee well-being initiatives. This segment often seeks solutions that are less intrusive, energy-efficient, and easy to operate, such as advanced air purification systems and continuous IAQ monitors with user-friendly interfaces.

Governmental agencies at local, regional, and national levels also represent significant potential customers, often needing VOCs governance solutions for environmental monitoring, public health protection, and enforcement of air quality standards. This includes environmental protection agencies, municipal waste management authorities, and public health departments that utilize ambient air quality monitoring networks and rely on data to formulate policies and assess compliance. Research institutions and academic bodies are another niche but important customer group, acquiring advanced analytical instruments for studies on air pollution, climate change, and toxicology. Additionally, any business or organization that seeks to achieve specific environmental certifications or adhere to voluntary sustainability standards, irrespective of direct regulatory mandates, represents a growing segment of potential buyers, showcasing a proactive approach to environmental responsibility. The wide spectrum of these potential customers underscores the universal challenge posed by VOCs and the broad applicability of governance solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.8 Billion |

| Market Forecast in 2033 | USD 10.3 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Honeywell International Inc., Thermo Fisher Scientific Inc., Siemens AG, 3M Company, Agilent Technologies Inc., Emerson Electric Co., Fuji Electric Co., Ltd., AMETEK Inc., TESTO SE & Co. KGaA, Drägerwerk AG & Co. KGaA, Teledyne Technologies Incorporated, ABB Ltd., Spectris plc, Environics Inc., Shimadzu Corporation, Sick AG, PerkinElmer Inc., California Analytical Instruments, Inc., VWR International, LLC, Halma plc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

VOCs Governance Market Key Technology Landscape

The VOCs Governance Market is characterized by a rapidly evolving technology landscape, driven by the demand for greater accuracy, real-time data, and cost-effectiveness in emission control. At the core of monitoring are advanced analytical instruments such as Gas Chromatography-Mass Spectrometry (GC-MS), which provides highly precise identification and quantification of individual VOCs, essential for complex mixtures. Photoionization Detectors (PIDs) and Flame Ionization Detectors (FIDs) are widely used for broad-spectrum VOC detection, offering rapid response times for field monitoring and leak detection. Infrared (IR) spectroscopy, including Fourier Transform Infrared (FTIR) and Photoacoustic Infrared (PAIR) gas analyzers, offers continuous, multi-component analysis with high sensitivity, particularly valuable for industrial process control and CEMS applications. Electrochemical sensors and Metal Oxide Semiconductor (MOS) sensors provide compact, low-cost solutions for general VOC detection, often integrated into portable or indoor air quality monitors, while laser-based detection systems offer ultra-high sensitivity and selectivity for specific VOCs, suitable for critical applications and research.

Beyond individual sensing technologies, the integration of Information and Communication Technologies (ICT) is profoundly transforming VOCs governance. The Internet of Things (IoT) enables the deployment of vast networks of interconnected sensors across industrial sites and urban environments, facilitating continuous, wide-area monitoring and data collection. Cloud computing platforms provide the necessary infrastructure for storing, processing, and managing the massive datasets generated by these IoT networks, offering scalability and remote accessibility. Data analytics software, including sophisticated statistical tools and visualization dashboards, translates raw sensor data into actionable insights, helping environmental managers identify trends, predict excursions, and track compliance. These software solutions are becoming increasingly intelligent, moving beyond simple data aggregation to offer advanced pattern recognition and predictive capabilities, crucial for proactive environmental management and reducing the reliance on manual data interpretation.

Artificial Intelligence (AI) and Machine Learning (ML) are emerging as transformative technologies within the VOCs governance domain, elevating capabilities from reactive monitoring to proactive and predictive control. AI algorithms can analyze complex datasets from various sources (sensors, meteorological data, operational parameters) to identify subtle correlations, predict emission events with high accuracy, and optimize the performance of abatement systems in real-time. This includes predictive maintenance for equipment and dynamic adjustment of operating conditions for thermal oxidizers or carbon adsorbers to maximize efficiency and minimize energy consumption. Furthermore, AI is critical in developing automated compliance reporting systems, reducing administrative burden and ensuring accuracy. Remote sensing technologies, such as Differential Optical Absorption Spectroscopy (DOAS) and tunable diode laser absorption spectroscopy (TDLAS), are gaining traction for monitoring large areas and plumes from a distance, offering another layer of data for AI-driven analysis. The synergy of these advanced monitoring, data management, and intelligent automation technologies is driving the market towards more efficient, accurate, and autonomous VOCs governance solutions.

Regional Highlights

- North America: This region is a mature market driven by stringent environmental regulations, particularly those enforced by the U.S. Environmental Protection Agency (EPA) and Environment and Climate Change Canada. The presence of numerous petrochemical, chemical, and manufacturing industries necessitates robust VOCs governance. High adoption rates of advanced monitoring technologies, sophisticated abatement solutions, and a strong emphasis on continuous emissions monitoring (CEMs) characterize this market. Innovation in sensor technology, AI-driven analytics, and comprehensive EHS software solutions further fuels growth, alongside increasing public demand for cleaner air quality.

- Europe: Europe stands as a leader in environmental protection, with a strong regulatory framework like the Industrial Emissions Directive (IED) and the ambitious European Green Deal pushing for significant reductions in industrial emissions, including VOCs. Countries like Germany, the UK, France, and the Netherlands exhibit high demand for VOCs governance solutions, driven by a mature industrial base and a proactive approach to sustainability. The market here is characterized by a strong focus on energy-efficient abatement technologies, integration with circular economy principles, and advanced real-time monitoring to meet stringent national and regional air quality standards.

- Asia Pacific (APAC): The APAC region is the fastest-growing market for VOCs governance, propelled by rapid industrialization, urbanization, and increasing awareness of air pollution's severe health impacts. Countries such as China, India, Japan, and South Korea are progressively enacting and strengthening environmental regulations. While historically focused on basic compliance, there is a growing shift towards adopting advanced monitoring and abatement technologies. The region presents significant opportunities for market players due to its large industrial base, burgeoning manufacturing sectors, and escalating investments in environmental infrastructure and cleaner production technologies.

- Latin America: This region is an emerging market for VOCs governance, with growth influenced by expanding industrial activities, particularly in oil and gas, mining, and manufacturing sectors in countries like Brazil, Mexico, and Argentina. Regulatory frameworks are gradually strengthening, driving initial demand for basic monitoring and abatement solutions. However, the market faces challenges related to economic volatility and varying levels of enforcement, which can impact the pace of adoption. Nevertheless, increasing foreign investment and a growing focus on sustainable development are expected to spur future growth.

- Middle East and Africa (MEA): The MEA region's VOCs governance market is primarily driven by its extensive oil and gas industry and burgeoning petrochemical sector, particularly in countries like Saudi Arabia, UAE, and Qatar. Environmental concerns related to industrial emissions are growing, leading to the development and enforcement of new regulations. Investments in new industrial complexes and mega-projects often integrate advanced environmental management systems, including VOCs governance. However, the market's growth is selective and dependent on specific country-level regulatory initiatives and economic diversification strategies, with a strong emphasis on technologies suitable for harsh environmental conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the VOCs Governance Market.- Honeywell International Inc.

- Thermo Fisher Scientific Inc.

- Siemens AG

- 3M Company

- Agilent Technologies Inc.

- Emerson Electric Co.

- Fuji Electric Co., Ltd.

- AMETEK Inc.

- TESTO SE & Co. KGaA

- Drägerwerk AG & Co. KGaA

- Teledyne Technologies Incorporated

- ABB Ltd.

- Spectris plc

- Environics Inc.

- Shimadzu Corporation

- Sick AG

- PerkinElmer Inc.

- California Analytical Instruments, Inc.

- VWR International, LLC

- Halma plc

Frequently Asked Questions

What are VOCs and why is their governance important?

Volatile Organic Compounds (VOCs) are organic chemicals that readily evaporate at room temperature, contributing to air pollution, smog formation, and various adverse health effects. Their governance is crucial for protecting public health, ensuring environmental quality, preventing regulatory non-compliance, and mitigating the climate impact of industrial and commercial activities. Effective VOCs governance helps industries meet emission standards, improve worker safety, and enhance overall sustainability performance, thereby reducing environmental footprints and avoiding potential penalties.

What are the key technologies used in VOCs governance?

The VOCs governance market utilizes a blend of advanced monitoring and abatement technologies. Key monitoring technologies include Gas Chromatography-Mass Spectrometry (GC-MS), Photoionization Detectors (PIDs), Flame Ionization Detectors (FIDs), Infrared (IR) spectroscopy, and a range of IoT-enabled sensors. For abatement, common technologies comprise thermal oxidizers, catalytic oxidizers, biofilters, and activated carbon adsorption systems. These are increasingly integrated with data analytics, cloud computing, and AI/Machine Learning platforms for enhanced efficiency, real-time insights, and predictive capabilities.

How does AI impact the VOCs Governance Market?

AI significantly impacts VOCs governance by transforming it from reactive to proactive. It enables real-time predictive analytics to forecast emission spikes, automated anomaly detection for early problem identification, and optimized control of abatement systems for maximum efficiency and reduced costs. AI-powered platforms enhance data interpretation, automate compliance reporting, and provide advanced risk assessment, leading to more precise, efficient, and intelligent management of VOC emissions. This shift helps organizations maintain compliance more consistently and effectively.

What are the primary drivers and restraints for the VOCs Governance Market?

The market is primarily driven by stringent environmental regulations globally, increasing public and corporate awareness of health and environmental impacts, ongoing technological advancements in sensing and abatement, and continuous industrial expansion. Restraints include high initial capital investment requirements for advanced systems, the lack of globally harmonized regulatory standards, the inherent complexity of VOCs analysis, and potential economic slowdowns that can defer environmental investments. Overcoming these restraints through innovation and supportive policies is crucial for sustained market growth.

Which industries are the major end-users of VOCs governance solutions?

Major end-user industries for VOCs governance solutions include chemicals and petrochemicals, oil and gas, pharmaceuticals, paints and coatings, automotive manufacturing, and general manufacturing. Other significant sectors comprise food and beverage processing, waste management, and power generation. Commercial buildings and healthcare facilities also increasingly adopt solutions for indoor air quality management. These diverse industries rely on VOCs governance to comply with regulations, protect worker health, and reduce their environmental footprint, often requiring tailored solutions for their specific emission profiles.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager