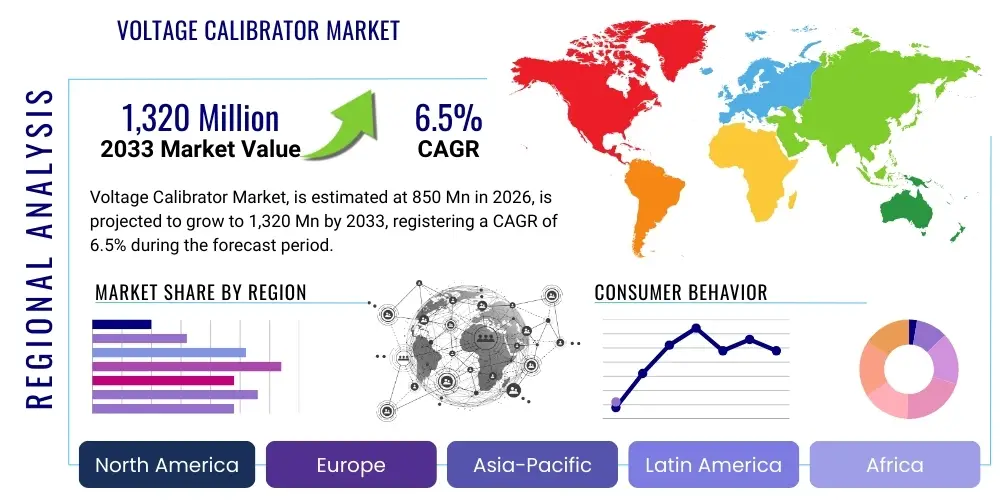

Voltage Calibrator Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442607 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Voltage Calibrator Market Size

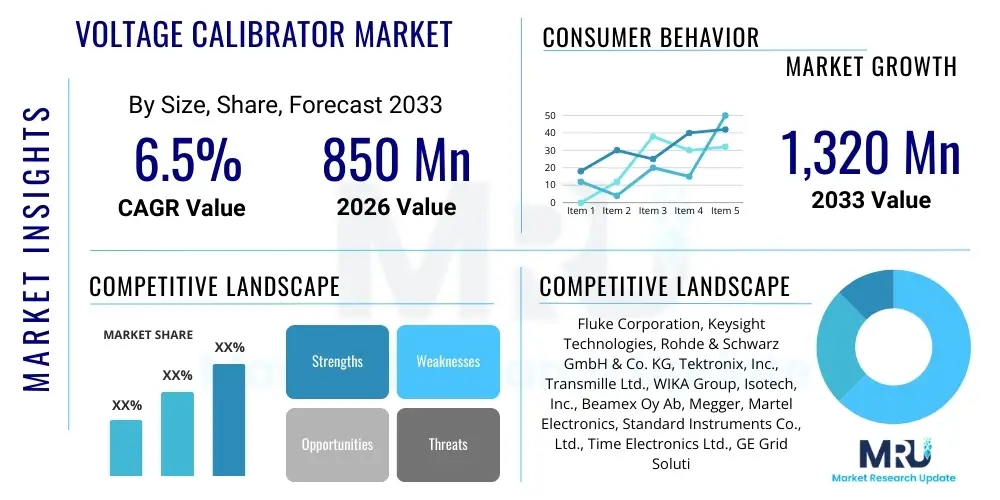

The Voltage Calibrator Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $850 Million in 2026 and is projected to reach $1,320 Million by the end of the forecast period in 2033.

Voltage Calibrator Market introduction

The Voltage Calibrator Market encompasses precision instruments designed to generate highly accurate and stable reference voltages, essential for verifying, testing, and calibrating various electrical measurement devices such as digital multimeters, oscilloscopes, data acquisition systems, and process control equipment. These calibrators are crucial for maintaining measurement traceability and quality control across highly regulated industries. Modern voltage calibrators offer enhanced features, including high stability, wide voltage ranges (from microvolts to kilovolts), and automated calibration procedures, often integrating with computer-aided testing (CAT) systems to improve efficiency and reduce human error in metrology laboratories and field service applications.

Major applications of voltage calibrators span industrial automation, aerospace and defense, telecommunications, and R&D laboratories, where precise electrical measurements are non-negotiable for system performance and safety. The primary benefits derived from using advanced voltage calibrators include compliance with international standards (such as ISO/IEC 17025), significant reduction in equipment downtime due to scheduled preventive maintenance, and assurance of product quality through traceable measurements. Key driving factors fueling market expansion include the increasing complexity of electronic circuits, stringent regulatory requirements mandating regular calibration in critical sectors, and the rapid expansion of the Internet of Things (IoT) and connected devices, which require reliable power supply and measurement infrastructure.

Voltage Calibrator Market Executive Summary

The Voltage Calibrator Market is undergoing significant evolution, driven primarily by globalization of manufacturing standards and the demand for higher accuracy in industrial metrology. Current business trends indicate a strong shift towards multifunction calibrators that integrate voltage, current, resistance, and frequency calibration capabilities into a single portable unit, catering to the growing need for field calibration services and reducing capital expenditure for end-users. Additionally, there is an increasing adoption of smart calibrators capable of automated test sequencing and remote monitoring, enhancing operational efficiency and data integrity within quality assurance processes. Strategic alliances and mergers among key market players are focusing on expanding geographical reach, particularly into rapidly industrializing regions of Asia Pacific, and integrating advanced software solutions to offer comprehensive calibration management platforms.

Regionally, the market exhibits robust growth potential across all major geographies. North America and Europe maintain dominance due to established industrial bases, stringent regulatory frameworks in the aerospace and pharmaceutical industries, and high R&D spending. However, the Asia Pacific region is projected to register the highest Compound Annual Growth Rate (CAGR), fueled by massive governmental investments in manufacturing infrastructure, expansion of the electronics sector in countries like China and South Korea, and the burgeoning demand for certified calibration services accompanying rapid industrialization. Segment trends reveal that benchtop calibrators, while essential for high-precision laboratory work, are facing competition from portable calibrators, which are favored for efficiency and adaptability in on-site calibrations. Furthermore, the voltage calibrators specialized for high-voltage applications (above 1000V) are gaining traction, particularly within the renewable energy sector and electrical utility maintenance, necessitating specific design adjustments for enhanced safety and robust performance in harsh operating environments.

AI Impact Analysis on Voltage Calibrator Market

Common user questions regarding AI's impact on the Voltage Calibrator Market often revolve around the automation of calibration procedures, predictive maintenance capabilities, and the integration of machine learning algorithms for optimizing measurement uncertainty. Users are primarily concerned with whether AI can eliminate the need for human expertise in complex calibration tasks, how AI will handle traceability records, and the potential for AI-driven systems to detect subtle deviations or impending failures in the calibrators or the instruments under test. There is also significant curiosity about using AI to manage vast databases of calibration data, identifying trends, and ensuring global consistency in quality metrics across multi-site operations.

The core themes emerging from this analysis highlight an expectation that AI will transition calibration from a reactive, time-consuming process to a proactive, highly efficient metrology function. Specifically, AI is expected to revolutionize error correction models by leveraging machine learning to analyze environmental variables, drift rates, and historical data, resulting in highly precise compensation algorithms that surpass current static correction factors. This leads to a decrease in the overall measurement uncertainty (MU) achieved by the calibrator, extending the recalibration cycle and reducing operational costs for calibration laboratories. Furthermore, AI systems are anticipated to dramatically improve diagnostic capabilities within the calibrators themselves, alerting operators to potential hardware degradation long before performance specifications are breached.

Ultimately, the influence of AI in the voltage calibration domain is not about replacing the fundamental measurement science but rather enhancing the intelligence, speed, and reliability of the process. AI-driven predictive analytics will allow calibration managers to schedule maintenance precisely when needed, based on actual usage and performance degradation signatures rather than fixed time intervals. This optimization maximizes asset utilization and minimizes costly unexpected downtime. The integration of AI also supports the creation of highly personalized user interfaces, adapting calibration workflows based on the instrument being tested and the operator's skill level, thereby standardizing performance irrespective of human input variability.

- AI enables predictive maintenance scheduling for calibrators, reducing downtime.

- Machine learning algorithms optimize measurement uncertainty (MU) through advanced drift compensation.

- Automated decision-making speeds up complex calibration routines and error detection.

- AI assists in analyzing historical calibration data for trend identification and compliance reporting.

- Enhanced integration with Laboratory Information Management Systems (LIMS) is facilitated by smart, AI-enabled data logging.

- Development of self-calibrating instruments using iterative machine learning refinement.

DRO & Impact Forces Of Voltage Calibrator Market

The Voltage Calibrator Market dynamics are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively define the impact forces influencing market trajectories. A primary driver is the increasing global emphasis on quality assurance and traceability across industrial sectors, particularly aerospace, medical device manufacturing, and power generation. Regulatory bodies worldwide, such as ISO, IEC, and national metrology institutes, continually update standards, forcing organizations to invest in high-precision calibration equipment to maintain compliance and ensure product reliability. The continuous miniaturization and increased complexity of electronic components necessitate higher accuracy measurement devices, thereby boosting demand for advanced calibrators capable of handling extremely low voltage and micro-current ranges with superior stability.

However, the market growth faces significant restraints. The high initial capital expenditure required for acquiring advanced, high-accuracy voltage calibrators presents a barrier for smaller calibration laboratories and emerging market enterprises. Furthermore, the operational complexity associated with managing and maintaining these precision instruments, coupled with the shortage of highly skilled metrology technicians capable of operating and troubleshooting advanced calibration systems, limits widespread adoption. Economic volatility in certain industrial sectors, which leads to cyclical reductions in capital equipment purchasing, also exerts a restraining influence on market expansion.

Opportunities for market growth lie predominantly in the shift toward fully automated, multi-functional, and portable calibration solutions, catering specifically to the needs of on-site and field service calibration markets. The rapid expansion of electric vehicle (EV) manufacturing and renewable energy infrastructure (solar, wind), which rely heavily on accurate high-voltage testing and calibration equipment, opens lucrative niche markets for specialized calibrators. Impact forces underscore the necessity for innovation in calibration software, focusing on seamless integration with enterprise resource planning (ERP) systems and cloud-based data management, ensuring that manufacturers who offer robust, integrated, and user-friendly solutions gain significant competitive advantage. Technological obsolescence risk further pressures manufacturers to maintain continuous R&D investment to keep pace with evolving measurement science.

Segmentation Analysis

The Voltage Calibrator Market is segmented based on product type, calibration range, application, and end-user industry, providing a granular view of market dynamics and potential growth pockets. Analyzing these segments helps stakeholders understand specific needs within various industrial ecosystems, driving targeted product development and marketing strategies. The market structure reveals a strong dichotomy between high-precision benchtop laboratory instruments and versatile, ruggedized portable units, each catering to distinct operational requirements regarding accuracy, mobility, and environmental robustness. Further classification by calibration range highlights the specialized demand for instruments capable of handling both extremely low voltage signals (critical in sensor testing) and extremely high voltage measurements (essential in power utilities).

- By Product Type:

- Benchtop Calibrators

- Portable/Handheld Calibrators

- Multi-Function Calibrators

- By Calibration Range:

- Low Voltage Calibrators (up to 10V)

- Medium Voltage Calibrators (10V to 1000V)

- High Voltage Calibrators (above 1000V)

- By End-User Industry:

- Aerospace & Defense

- Automotive (Including EV Manufacturing)

- Electronics & Semiconductor

- Energy & Utility (Including Renewables)

- Industrial Automation & Process Control

- Third-Party Calibration Laboratories

- Research & Development (R&D)

- By Sales Channel:

- Direct Sales

- Distributors/Retailers

Value Chain Analysis For Voltage Calibrator Market

The value chain for the Voltage Calibrator Market begins with upstream activities, primarily encompassing the procurement of highly specialized raw materials and electronic components. This phase relies heavily on suppliers providing ultra-stable reference standards (e.g., Zener diodes, precision resistors), high-quality display components, advanced microprocessors, and sophisticated power management systems. The performance and long-term stability of the final calibrator product are directly dependent on the precision and quality inherent in these sourced components. Manufacturers must maintain robust relationships with a select group of specialized component providers, often necessitating rigorous supplier qualification processes to ensure traceability and minimize component drift over time, which is critical for metrology equipment.

The midstream segment involves the core manufacturing process, where original equipment manufacturers (OEMs) focus on intricate assembly, thermal management design, and sophisticated software integration. This phase includes meticulous calibration and testing of the finished instruments against primary or secondary standards maintained in controlled laboratory environments. Investment in proprietary algorithms for error correction, temperature compensation, and user interface development are key differentiators at this stage. Strict adherence to manufacturing quality standards (e.g., ISO 9001) and calibration standards (e.g., ISO/IEC 17025) is paramount to establish market credibility and ensure the required level of uncertainty specification for the end product.

Downstream activities involve the distribution channel and post-sales support. Distribution channels are bifurcated into direct sales, utilized for major industrial clients and specialized military/government contracts requiring complex technical consultation, and indirect sales through authorized distributors and certified metrology service providers, particularly for smaller enterprises and regional markets. Post-sales support, encompassing maintenance, repair, and periodic recalibration services, is an essential value-added component, often generating significant recurring revenue. Manufacturers who establish extensive networks of certified service centers globally, providing rapid and traceable recalibration services, significantly enhance customer loyalty and penetrate new geographical regions.

Voltage Calibrator Market Potential Customers

Potential customers for voltage calibrators are diverse, spanning virtually every industry that relies on electronic measurement, quality control, or process safety. The primary end-users include third-party commercial calibration laboratories (cal labs), which offer accredited calibration services to external clients across various sectors. These laboratories require the highest precision, multi-functional benchtop calibrators to handle a vast array of instruments under test (IUTs) and maintain accreditation under international bodies, making them volume buyers of premium, high-accuracy instruments. Their purchasing decisions are driven by specifications related to stability, accuracy range, and traceability standards compliance.

Major industrial end-users constitute the second crucial customer segment. This includes internal metrology departments within large manufacturing conglomerates in sectors such as aerospace (e.g., maintenance of flight control systems, radar), automotive (especially EV battery management systems and autonomous vehicle sensors), and pharmaceuticals (validation of process control instrumentation). For these in-house labs, the emphasis is often on reliability, speed of calibration, and integration with proprietary manufacturing execution systems (MES). The demand is shifting towards portable and ruggedized calibrators for quick, decentralized field verification and maintenance checks, minimizing production line downtime.

The energy and utility sector, including traditional power generation plants and rapidly expanding renewable energy farms, represents a specialized customer base. They require robust high-voltage calibrators for testing protective relays, energy meters, and substation equipment, often operating in challenging environmental conditions. Furthermore, academic institutions and corporate Research & Development (R&D) centers are consistent purchasers, utilizing calibrators for fundamental electrical experimentation, new sensor development, and prototyping. These customers prioritize flexibility, wide measurement capability, and advanced data logging features to support intricate research methodologies and long-term data analysis, viewing the calibrator as a fundamental tool for verifiable scientific advancement.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $850 Million |

| Market Forecast in 2033 | $1,320 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Fluke Corporation, Keysight Technologies, Rohde & Schwarz GmbH & Co. KG, Tektronix, Inc., Transmille Ltd., WIKA Group, Isotech, Inc., Beamex Oy Ab, Megger, Martel Electronics, Standard Instruments Co., Ltd., Time Electronics Ltd., GE Grid Solutions, Yokogawa Electric Corporation, ADTEK Telecommunication, Valhalla Scientific, Cropico, SIKA, Dranetz Technologies, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Voltage Calibrator Market Key Technology Landscape

The technology landscape of the Voltage Calibrator Market is centered on achieving unparalleled accuracy, stability, and speed, underpinned by advancements in reference standards and digital control systems. One of the core technologies involves the use of highly stable voltage references, traditionally based on temperature-stabilized Zener diodes, which provide exceptional long-term stability crucial for maintaining traceability. Recent innovations focus on integrating digital compensation and high-resolution digital-to-analog converters (DACs) to enhance resolution and minimize noise, allowing modern calibrators to reliably source voltages in the nanovolt and microvolt ranges, catering to sensitive sensor applications and low-power IoT devices. Furthermore, thermal management technology, including advanced cooling and insulation techniques, is essential to minimize the temperature coefficient of the output voltage, maintaining stability even in varying ambient conditions, a particularly challenging requirement for portable units.

Another crucial technological development is the shift towards advanced software platforms that enable complex automated test sequences and robust data handling. Modern calibrators utilize proprietary software algorithms for error modeling and drift correction, often incorporating historical data to predict and compensate for voltage drift with higher precision than manual methods. The adoption of embedded processing power allows these instruments to perform complex mathematical calculations in real-time, improving measurement speed while adhering to the specified uncertainty budgets. Communication protocols like GPIB, USB, and Ethernet (including LXI) are standard, ensuring seamless integration with Laboratory Information Management Systems (LIMS) and automated production test benches, vital for the Industry 4.0 environment.

The rise of multifunction calibrators represents a consolidation of several measurement technologies, including resistance simulation, current sourcing, and frequency generation, all integrated and controlled through a unified user interface. This integration relies on sophisticated multiplexing and isolation circuitry to prevent interaction between different source functions while maintaining the specified accuracy of the voltage output. For high-voltage applications, the technological focus involves enhanced safety features, improved insulation materials, and the use of high-linearity resistive dividers, often combined with optical isolation techniques, to ensure precise measurement transfer in high-potential environments, catering specifically to the safety and measurement needs of the electrical utility sector and high-power electronics testing.

Regional Highlights

The Voltage Calibrator Market demonstrates varied growth patterns across key geographic regions, reflecting differences in industrial maturity, regulatory enforcement, and technological adoption rates. North America, encompassing the United States and Canada, remains a dominant market, primarily driven by the established presence of leading aerospace and defense contractors, stringent calibration requirements from organizations like NIST, and high expenditure on cutting-edge research and development. The demand here is skewed towards high-accuracy, benchtop reference standards for national laboratories and specialized portable calibrators for avionics maintenance, ensuring adherence to strict military and civil aviation specifications.

Europe constitutes another significant market share, characterized by strong regulatory compliance, particularly within the German automotive sector and the pharmaceutical industries across the EU. Countries like Germany, the UK, and France show steady demand, focused on adopting automated calibration systems to improve efficiency and reduce compliance costs associated with ISO/IEC 17025 standards. The European market is also pioneering the adoption of smart, network-enabled calibrators, integrating seamlessly into continental smart grid infrastructure maintenance and advanced manufacturing quality control loops. The emphasis on renewable energy targets further stimulates the need for specialized high-voltage and low-resistance calibrators for solar and wind farm maintenance and verification.

Asia Pacific (APAC) is projected to be the fastest-growing region throughout the forecast period. This rapid growth is underpinned by massive government initiatives promoting manufacturing bases in countries like China, India, South Korea, and Japan, especially in the consumer electronics, semiconductor, and electric vehicle domains. The escalating number of domestic calibration service providers, coupled with the mandatory requirement for international quality certifications for exported goods, accelerates the procurement of traceable voltage calibration equipment. While price sensitivity remains a factor, the overwhelming scale of industrial expansion ensures substantial volume growth for mid-range and portable calibrators, making localized sales and service support critical for market success in this region.

- North America: High demand from Aerospace & Defense sectors; focus on ultra-high precision standards; mature regulatory framework drives consistent replacement cycles.

- Europe: Strong uptake due to stringent EU regulations (e.g., Measurement Instruments Directive); emphasis on automated and multi-function instruments for efficiency.

- Asia Pacific (APAC): Highest growth rate fueled by semiconductor and EV manufacturing; massive investments in industrial infrastructure and expansion of regional calibration laboratories.

- Latin America (LATAM): Growth driven by infrastructure projects, mining, and energy sectors; preference for cost-effective and ruggedized portable calibrators suitable for remote operations.

- Middle East & Africa (MEA): Steady growth linked to large-scale oil & gas projects and renewable energy initiatives; requirement for durable, temperature-resistant instruments for harsh environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Voltage Calibrator Market.- Fluke Corporation

- Keysight Technologies

- Rohde & Schwarz GmbH & Co. KG

- Tektronix, Inc.

- Transmille Ltd.

- WIKA Group

- Isotech, Inc.

- Beamex Oy Ab

- Megger

- Martel Electronics

- Standard Instruments Co., Ltd.

- Time Electronics Ltd.

- GE Grid Solutions

- Yokogawa Electric Corporation

- ADTEK Telecommunication

- Valhalla Scientific

- Cropico

- SIKA

- Dranetz Technologies, Inc.

- HIOKI E.E. CORPORATION

Frequently Asked Questions

Analyze common user questions about the Voltage Calibrator market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the fundamental difference between a voltage calibrator and a precision voltage source?

A voltage calibrator is specifically designed to provide a highly accurate, traceable, and stable voltage output used to verify the performance of other measuring instruments, adhering to rigorous metrology standards. While a precision voltage source provides a stable voltage, a calibrator includes enhanced features like documented traceability, defined measurement uncertainty (MU), and often specialized software for automated testing and reporting, ensuring compliance with international quality standards like ISO/IEC 17025.

How is the accuracy of a voltage calibrator measured and maintained?

Accuracy is measured by comparing the calibrator's output against a primary reference standard (such as a Josephson Junction or a national standard) and is expressed as measurement uncertainty (MU). Maintenance involves minimizing thermal drift through sophisticated compensation algorithms, utilizing high-stability Zener references, and adhering to scheduled recalibration cycles, typically annually, performed by accredited laboratories to maintain traceability to national metrology institutes.

Which end-user industries are driving the highest demand for portable voltage calibrators?

The highest demand for portable voltage calibrators comes from the Energy and Utility sector (for on-site meter and relay testing), the Aviation and Defense industry (for maintenance, repair, and overhaul—MRO), and Industrial Automation/Process Control fields. Portable units are favored in these sectors due to their robust design, high battery life, and ability to perform traceable calibrations efficiently in non-laboratory environments, thereby minimizing costly system downtime.

What impact does the transition to Industry 4.0 have on the Voltage Calibrator Market?

Industry 4.0 accelerates the demand for smart, connected calibrators that support automated testing, remote diagnostics, and seamless data integration with enterprise systems (LIMS, MES). This shift emphasizes multifunctionality, network connectivity (LXI, Ethernet), and embedded intelligence (often leveraging AI for predictive maintenance) to facilitate real-time quality control and maintain measurement traceability across distributed manufacturing environments.

What are the key technical specifications potential buyers should prioritize when selecting a voltage calibrator?

Buyers must prioritize Measurement Uncertainty (MU), Long-Term Stability (often specified in ppm per year), output range (voltage limits and resolution), and settling time. For field applications, portability, battery life, and environmental robustness (e.g., temperature range rating) are critical. For laboratory use, software integration capabilities and compliance with recognized metrology standards are paramount considerations for verifiable performance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Voltage Calibrator Market Size Report By Type (Bench Type, Handheld), By Application (Aerospace & Defense, Semiconductor, Healthcare, IT & Telecommunication, Automotive, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Handheld Voltage Calibrator Market Statistics 2025 Analysis By Application (Aerospace and Defense, Semiconductor, Healthcare, IT and Telecommunication, Automotive), By Type (AC Voltage Calibrator, DC Voltage Calibrator), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager