Voltage Multipliers Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442299 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Voltage Multipliers Market Size

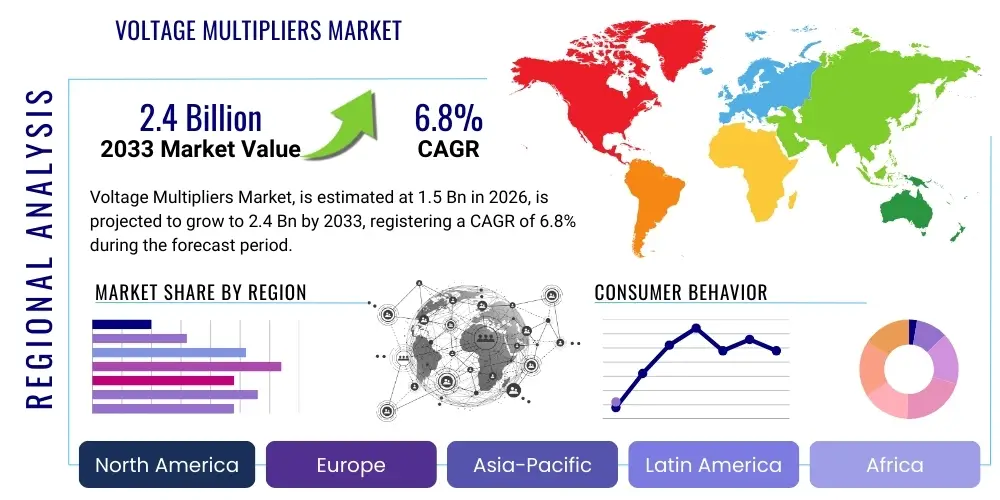

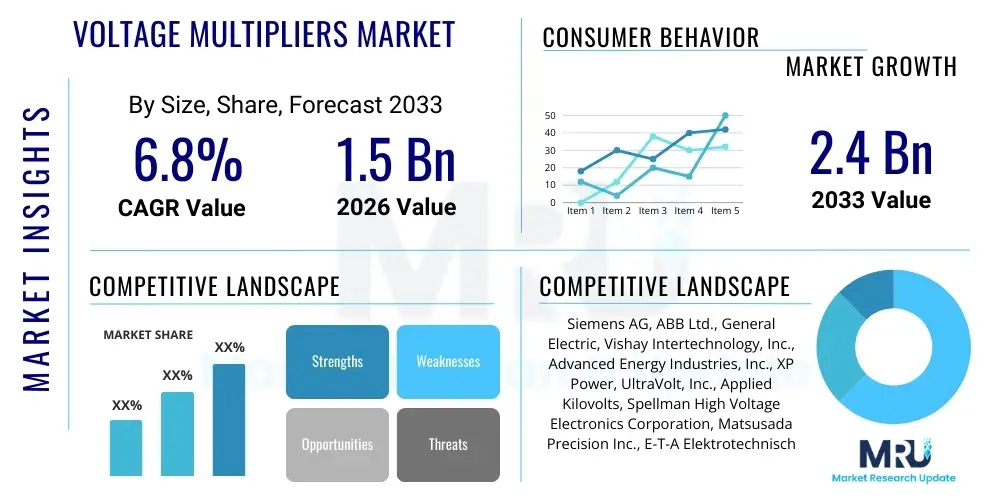

The Voltage Multipliers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.4 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the escalating global demand for high-voltage testing equipment, advancements in medical imaging systems requiring precise high-voltage supplies, and the rapid expansion of semiconductor manufacturing infrastructure, which relies heavily on controlled, high-DC voltage generation for various processes including plasma generation and ion implantation. Furthermore, the integration of voltage multipliers into renewable energy infrastructure, particularly in high-efficiency DC-DC converters for solar and wind power, contributes substantially to the market expansion. The miniaturization trend in power electronics, seeking higher power density in smaller footprints, favors advanced multiplier designs over traditional transformer-based solutions, solidifying the market's robust financial outlook through the forecast period.

Voltage Multipliers Market introduction

Voltage multipliers are specialized electrical circuits designed to convert alternating current (AC) or low-level direct current (DC) into a much higher DC voltage output, often utilizing a network of capacitors and diodes. These devices operate on the principle of charge pumping, where stages of capacitors are successively charged in parallel and then discharged in series to accumulate voltage, allowing for the generation of extremely high potentials without the bulk or cost associated with high-turns-ratio transformers. They are crucial components in modern power systems where high DC voltage, precise regulation, and compact size are paramount design considerations, thereby facilitating technological advancements across a spectrum of industries that require reliable high-voltage sources.

The primary applications of voltage multipliers span critical sectors such as healthcare, where they are integral to X-ray machines, computed tomography (CT) scanners, and magnetic resonance imaging (MRI) equipment, ensuring the high-energy operation required for diagnostic imaging. In the industrial sector, they are vital for electrostatic precipitators, electron beam welders, high-voltage testing apparatus, and non-destructive testing (NDT) methodologies. Furthermore, the aerospace and defense industries utilize them extensively in radar systems, specialized power supplies for electronic warfare, and satellite propulsion systems. The major benefits of voltage multipliers include significantly reduced physical size and weight compared to equivalent high-voltage transformers, improved operational efficiency, and inherent scalability, allowing for customization across a wide range of output voltages and power levels.

Key driving factors propelling market growth include the increasing complexity and voltage requirements of modern electronic devices, particularly the need for reliable high-voltage DC sources in electric vehicle (EV) charging infrastructure and high-efficiency solid-state lighting. Technological advancements, such as the adoption of Gallium Nitride (GaN) and Silicon Carbide (SiC) based components in the multiplier circuitry, are enabling higher switching frequencies and enhanced power density, further accelerating their adoption. Additionally, the tightening of global regulatory standards regarding power efficiency and component size in high-tech manufacturing encourages the shift toward compact and efficient voltage multiplier solutions, positioning them as essential elements in the infrastructure supporting high-power applications globally.

Voltage Multipliers Market Executive Summary

The Voltage Multipliers Market is experiencing robust expansion driven primarily by key business trends emphasizing miniaturization, efficiency optimization, and integration into advanced systems like industrial automation and medical diagnostics. Business trends indicate a strong move toward solid-state designs leveraging wide-bandgap semiconductors (SiC and GaN) to improve operational frequency and reduce the overall physical footprint, addressing the crucial need for high power density in constrained environments. Mergers and acquisitions are observable strategies among major players aiming to consolidate technological expertise, especially in pulsed power and high-frequency design capabilities, ensuring market competitiveness and expanding patent portfolios focused on proprietary multiplier topologies such as Marx generators and specialized Cockcroft-Walton variations optimized for ripple suppression. Furthermore, strategic partnerships between component manufacturers and large-scale system integrators (e.g., X-ray system manufacturers) are defining the supply chain landscape, standardizing component specifications, and ensuring reliable high-volume production, reflecting a mature yet rapidly evolving technological ecosystem.

Regionally, the market dynamics are highly concentrated in the Asia Pacific (APAC) region, which serves as the global manufacturing hub for consumer electronics, automotive components, and, increasingly, advanced semiconductor fabrication facilities, creating immense localized demand for precise high-voltage sources. North America and Europe maintain a critical role due to significant investment in research and development (R&D), particularly in high-end applications like aerospace, advanced medical imaging technology, and grid infrastructure modernization, driving the premium segment of the market focused on ultra-high voltage and high-reliability components. The regional trends also highlight growing opportunities in emerging economies across Latin America and the Middle East & Africa (MEA), primarily fueled by infrastructure development projects, including expansions in healthcare facilities and industrial automation initiatives requiring foundational high-voltage equipment, though adoption rates lag behind developed economies due to varying regulatory landscapes and capital expenditure constraints.

Segmentation trends reveal that the Cockcroft-Walton topology remains the dominant segment due to its reliability and proven performance across medium to high-voltage applications, although series multipliers are gaining traction in specialized low-voltage, high-frequency consumer applications. The High Voltage (>10 kV) output segment commands the largest market share, directly linked to its necessity in applications like medical accelerators, particle physics research, and large-scale industrial processes, showing consistent growth driven by increasing regulatory requirements for thorough electrical testing. End-user analysis underscores the Industrial segment's market leadership, followed closely by the Healthcare sector, where constant innovation in diagnostic imaging technology necessitates specialized, highly reliable voltage multiplication systems. The increasing focus on portability and efficiency across all segments, particularly in defense and portable electronics, is driving innovation toward micro-voltage multiplier integration and system-on-chip (SoC) solutions, indicating a strategic shift toward highly integrated power delivery architectures.

AI Impact Analysis on Voltage Multipliers Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Voltage Multipliers Market frequently revolve around design optimization, predictive maintenance, and quality control. Users often inquire whether AI algorithms can autonomously generate more efficient multiplier topologies, how machine learning can minimize unwanted ripple voltage in high-frequency operation, and the potential for AI-driven fault detection in large industrial voltage generation systems (e.g., Marx generators used in pulsed power research). The key themes emerging from this analysis confirm high expectations for AI to dramatically improve the simulation and design phase, reducing the traditionally lengthy and iterative process of optimizing capacitor-diode networks for specific load characteristics. Furthermore, system operators are highly concerned with leveraging AI and Machine Learning (ML) to monitor operational parameters—such as temperature, current harmonics, and environmental factors—to predict component failure and maximize uptime, particularly in mission-critical applications like semiconductor manufacturing and medical diagnostics where unplanned downtime results in significant financial losses. The consensus is that while AI will not replace the fundamental physics of voltage multiplication, it will become indispensable in enhancing efficiency, reliability, and precision control, fundamentally changing how voltage multiplier systems are designed, monitored, and maintained throughout their operational lifecycle.

- AI-driven optimization of voltage multiplier circuit topologies for maximum power density and minimal footprint.

- Machine Learning algorithms deployed for real-time ripple voltage suppression and output stability enhancement under dynamic load conditions.

- Predictive maintenance analytics utilizing sensor data to forecast diode or capacitor failure, significantly increasing system reliability and lifetime.

- Automated quality control systems integrating computer vision and ML for defect detection during the high-volume manufacturing of multiplier stages.

- Enhanced thermal management systems optimized by AI simulations to manage heat dissipation effectively in high-frequency SiC/GaN-based multipliers.

- Optimization of charging and discharging cycles in pulsed power applications through reinforced learning for precise energy delivery.

DRO & Impact Forces Of Voltage Multipliers Market

The Voltage Multipliers Market is governed by a complex interaction of pivotal drivers, inherent restraints, and significant opportunities, collectively forming the key impact forces shaping its trajectory. A primary driver is the accelerating demand from the medical sector for increasingly sophisticated and higher resolution imaging technologies, such as advanced CT and PET scanners, which necessitate ultra-stable, high-voltage power supplies to achieve superior image clarity and dose control, thereby mandating the use of precision voltage multipliers. Concurrently, the global push toward electrification and sustainable energy solutions, particularly the widespread adoption of electric vehicles and the development of high-voltage DC (HVDC) transmission systems, creates sustained demand for efficient, compact high-voltage conversion components to manage complex power architectures. Furthermore, the stringent quality and precision requirements within the semiconductor industry, including ion implanters and electron beam lithography systems, where voltage stability directly impacts wafer yield and integrity, serve as a non-negotiable driving force for the highest quality voltage multiplier solutions, ensuring continuous investment in this technology across advanced manufacturing regions.

However, the market faces significant restraints that dampen immediate growth potential, chief among them being the intrinsic engineering challenge of managing high ripple voltage and voltage drop under heavy load conditions, which limits the use of conventional multiplier designs in extremely sensitive applications requiring pristine DC output. The physical size constraints, despite the advantages over transformers, still pose integration challenges in highly miniaturized consumer electronics or portable medical devices, demanding continuous, resource-intensive research into micro-scale integration techniques. Additionally, the potential for catastrophic failure in high-voltage environments, particularly regarding capacitor degradation and arcing in high-altitude or vacuum conditions, requires specialized, costly manufacturing processes and materials, raising the overall unit cost and complexity, potentially leading end-users to consider alternative power topologies for non-critical applications, thereby restricting market penetration in cost-sensitive segments.

The market opportunities are substantial, predominantly revolving around the application of voltage multipliers in emerging technologies such as plasma sterilization, ozone generation for industrial water purification, and focused high-energy beam delivery systems in defense and scientific research. The advent of wide-bandgap (WBG) materials like Silicon Carbide (SiC) and Gallium Nitride (GaN) presents a transformative opportunity, enabling multipliers to operate at dramatically higher frequencies, reducing the size of required components (capacitors), increasing power density, and vastly improving overall efficiency, opening new markets in high-frequency switching and compact power delivery. Furthermore, the increasing requirement for robust, reliable high-voltage power in space exploration technologies and advanced pulsed power research offers niche, high-value opportunities for manufacturers capable of producing radiation-hardened, extreme-reliability voltage multiplier systems. These interwoven drivers, restraints, and opportunities establish a dynamic equilibrium where technological innovation is essential for overcoming inherent limitations and capitalizing on new application spaces, dictating the competitive landscape and investment priorities.

Segmentation Analysis

The Voltage Multipliers Market is primarily segmented based on Type, Output Voltage, and End-User, reflecting the diverse application landscape and specific technical requirements across different industries. Segmentation by Type allows manufacturers to cater to differing complexity and voltage needs, ranging from the highly scalable Cockcroft-Walton topology, known for high voltage and stages, to the simple series multipliers favored for compactness in moderate voltage applications. Output Voltage segmentation is crucial for defining the target applications, with the High Voltage segment (primarily used in industrial and scientific research) dominating the market in terms of value, while the Low and Medium Voltage segments address critical needs in consumer and specialized industrial controls. The comprehensive end-user segmentation highlights the market's dependence on capital-intensive sectors such as Healthcare (X-ray and CT systems), Industrial (testing equipment and electrostatic applications), and Aerospace & Defense (radar and pulsed power), ensuring product development aligns with sector-specific reliability and performance metrics.

- By Type:

- Cockcroft-Walton Multipliers

- Series Multipliers (Doublers, Triplers)

- Marx Generators (Pulsed Power Applications)

- Others (Greinacher circuits, hybrid topologies)

- By Output Voltage:

- High Voltage (>10 kV)

- Medium Voltage (1 kV - 10 kV)

- Low Voltage (<1 kV)

- By End-User:

- Industrial (Non-Destructive Testing, Electrostatic Applications, Power Supplies)

- Healthcare (X-ray Systems, CT Scanners, Radiation Therapy Equipment)

- Aerospace & Defense (Radar Systems, Electronic Warfare, Pulsed Power)

- Consumer Electronics (CRT replacement, specialty displays)

- Telecommunications

- Research & Scientific (Particle Accelerators, High Energy Physics)

Value Chain Analysis For Voltage Multipliers Market

The value chain for the Voltage Multipliers Market begins with upstream analysis centered on the sourcing and quality control of critical passive and active electronic components, specifically high-voltage diodes, high-stability capacitors (often ceramic or film based, requiring high dielectric strength), and advanced semiconductor switches like MOSFETs, SiC, or GaN devices used in the driving circuitry. The reliability and performance of the final multiplier unit are inherently dependent on the quality of these raw materials and components, making supplier qualification and long-term contracts for specialized high-voltage components a critical upstream activity. Manufacturing involves highly technical processes, including precision assembly of multi-stage multiplier circuits, rigorous encapsulation techniques (potting) to manage partial discharge and insulation integrity, and extensive high-voltage testing procedures to ensure compliance with stringent safety and performance standards, representing the core value addition point where intellectual property surrounding circuit topology and packaging expertise is materialized.

The distribution channel analysis emphasizes a mixed model incorporating both direct sales and specialized indirect channels. Direct sales are predominantly used for highly customized or ultra-high voltage systems destined for large industrial users, military contracts, or scientific research laboratories, where close consultation and post-installation support are mandatory. Conversely, indirect distribution utilizes established networks of specialized power electronics distributors and system integrators who possess the necessary technical expertise to integrate standard or semi-custom voltage multiplier modules into broader industrial systems, such as automated testing rigs or OEM medical equipment. These distributors play a vital role in localized inventory management, technical support, and navigating regional regulatory compliance, ensuring timely delivery and service across diverse geographical markets.

Downstream analysis focuses on the end-user integration and after-sales support, crucial aspects for maintaining market reputation and achieving customer loyalty in high-reliability applications. Integration involves careful pairing of the voltage multiplier output characteristics (voltage stability, current limits, ripple) with the specific load requirements of the end application, often requiring application-specific engineering support from the manufacturer. Post-sales services, including long-term maintenance contracts, calibration services, and rapid replacement of specialized modules, are critical, particularly in sectors like medical imaging and aerospace where operational reliability is non-negotiable. The efficiency of this downstream segment directly influences the total cost of ownership (TCO) for the end-user and acts as a significant differentiator in a market characterized by high technical barrier to entry and long product life cycles, ensuring that the complete value chain from component sourcing to field service contributes optimally to the overall market ecosystem and customer satisfaction.

Voltage Multipliers Market Potential Customers

The primary potential customers and buyers of voltage multipliers are highly specialized entities operating within industries characterized by critical high-voltage requirements, strict regulation, and reliance on precision power delivery. End-users span capital equipment manufacturers (OEMs) who integrate these components into their final products, large industrial testing and maintenance service providers, and governmental or academic research institutions. Within the industrial sector, key buyers include manufacturers of electrostatic painting equipment, high-voltage cable testing systems, and specialized material processing machinery like electron beam equipment. These customers prioritize high reliability, extended operational lifetime, and resistance to environmental stress, given the punishing environments where their equipment often operates, making product longevity and robust design critical purchasing factors.

In the healthcare sphere, the major potential customers are global manufacturers of advanced diagnostic imaging systems, including major players producing X-ray generators, CT gantry power supplies, and linear accelerators for radiation therapy. For these buyers, precision, stability, and compactness are paramount, as the multiplier must deliver highly accurate and repeatable voltage pulses to ensure diagnostic quality and patient safety, necessitating highly customized, certified modules that meet strict medical device regulatory standards (e.g., FDA, CE marking). Furthermore, research and scientific laboratories, particularly those involved in particle physics, fusion research, and high-energy material science, represent a specialized customer base requiring ultra-high voltage Marx generators and custom multiplier stacks for experimental pulsed power and accelerator systems, where the need for custom, one-off high-power solutions justifies significant capital expenditure and close collaboration with specialized component suppliers.

A rapidly expanding customer segment includes the emerging electric vehicle (EV) charging infrastructure developers and renewable energy system integrators. These customers require robust voltage multipliers and converters for DC fast charging stations and for efficiently managing the high voltages generated by large solar arrays and wind turbines, optimizing power transfer to the grid or battery storage systems. For these buyers, factors such as power conversion efficiency, thermal management capabilities, and compliance with grid interconnection standards are decisive. The defense and aerospace sectors also maintain a consistent demand for multipliers integrated into radar transmitters, high-powered microwave systems, and specialized drone power supplies, demanding ruggedized, lightweight, and radiation-hardened solutions capable of withstanding extreme operational conditions, confirming the broad yet technically demanding spectrum of potential buyers in the market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.4 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Siemens AG, ABB Ltd., General Electric, Vishay Intertechnology, Inc., Advanced Energy Industries, Inc., XP Power, UltraVolt, Inc., Applied Kilovolts, Spellman High Voltage Electronics Corporation, Matsusada Precision Inc., E-T-A Elektrotechnische Apparate GmbH, TDK Corporation, Murata Manufacturing Co., Ltd., Analog Devices, Inc., ROHM Semiconductor, KiloVolt Technologies, Inc., L3Harris Technologies, Inc., Thales Group, Toshiba Corporation, Maxwell Technologies (now part of Tesla) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Voltage Multipliers Market Key Technology Landscape

The current technology landscape in the Voltage Multipliers Market is dominated by the pursuit of higher frequency operation, greater power density, and superior output stability, moving beyond traditional low-frequency designs. A core technological trend involves the aggressive integration of Wide Bandgap (WBG) semiconductors, specifically Silicon Carbide (SiC) and Gallium Nitride (GaN) devices, into the inverter and driver stages that feed the multiplier circuit. These WBG materials allow for significantly faster switching speeds—often into the MHz range—which, based on the fundamental principles of charge pumps, directly translates to a reduction in the required capacitance and inductance values, thereby achieving drastic reductions in the physical size and weight of the overall unit. This miniaturization capability is crucial for portable medical devices and aerospace applications where size, weight, and power (SWaP) constraints are extremely tight. Furthermore, the higher temperature tolerance of SiC and GaN aids in improving thermal management, allowing for operation in challenging industrial environments without excessive cooling requirements, thereby enhancing overall system reliability and efficiency.

Another significant technological advancement focuses on sophisticated control and packaging techniques designed to mitigate parasitic effects and enhance operational longevity. Manufacturers are increasingly utilizing planar magnetics and multilayer ceramic capacitor (MLCC) arrays to reduce stray capacitance and inductance, which are primary causes of inefficiency and ripple voltage at high frequencies. High-vacuum encapsulation and specialized epoxy potting materials are standard practices to minimize partial discharge (corona effect) and ensure insulation integrity, particularly for multipliers operating above 50 kV, where air breakdown is a critical concern. Furthermore, patented or proprietary circuit topologies are being developed, moving beyond the simple Cockcroft-Walton ladder toward resonant, switched-capacitor, and flyback-based multiplier designs that offer improved load regulation and reduced output ripple, often incorporating active feedback and sophisticated Pulse Width Modulation (PWM) control loops to dynamically manage the multiplication stages for superior output precision under varying load conditions, a necessity for modern high-precision scientific instruments.

The emerging technological focus is on fully integrated, system-on-chip (SoC) voltage multiplier solutions for low-power applications and digital control for high-power systems. For consumer electronics and specialized communication devices, monolithic integration of the multiplier circuit on a single chip drastically reduces component count and assembly complexity. For high-power industrial and medical systems, the shift is towards digital control interfaces that enable remote monitoring, precise voltage tuning, and comprehensive diagnostic capabilities, allowing end-users to optimize the multiplier’s performance in real-time and integrate seamlessly with modern Industrial IoT (IIoT) platforms. These digital controls often incorporate built-in test and calibration routines, significantly reducing maintenance downtime. This duality—miniaturization through WBG for size and digitization for control—defines the competitive edge in the market, pushing manufacturers towards advanced fabrication processes and software-defined power delivery architectures to meet the escalating demands for high-efficiency, highly controlled high-voltage power.

Regional Highlights

- North America: This region maintains a dominant position in the high-end and research-intensive segments of the Voltage Multipliers Market, characterized by significant R&D spending in aerospace, defense, and advanced medical device manufacturing. The United States, in particular, hosts numerous research institutions and defense contractors requiring customized, ultra-reliable pulsed power systems and high-voltage modules for radar and electronic warfare applications. The stringent regulatory environment and high demand for advanced diagnostic equipment (MRI, CT, X-ray) necessitate investment in high-precision, low-ripple voltage multiplier systems. Furthermore, the robust infrastructure for semiconductor manufacturing and testing drives sustained demand for high-stability voltage sources. Manufacturers in North America often focus on leveraging proprietary encapsulation techniques and advanced material science to achieve radiation hardening and extreme reliability, positioning the region as a leader in technological innovation but with relatively high manufacturing costs. The early adoption of SiC/GaN technology in high-frequency power supplies is also highly concentrated here.

- Europe: The European market is characterized by a strong emphasis on industrial automation, renewable energy integration, and high-voltage grid infrastructure development. Countries such as Germany, Switzerland, and Italy host major industrial manufacturing hubs and critical power electronics firms, driving demand for robust voltage multipliers used in electrostatic applications, non-destructive testing (NDT), and specialized welding equipment. Europe is also a key center for high-energy physics research (e.g., CERN), creating specialized demand for Marx generators and highly precise accelerators requiring advanced high-voltage systems. Regulatory frameworks promoting energy efficiency and decarbonization, particularly the push for efficient HVDC transmission lines and EV infrastructure across the continent, further stimulate the market for high-performance voltage multipliers essential for power conversion and testing equipment. The region balances technological innovation with practical industrial application, prioritizing long-term stability and compliance with stringent environmental standards.

- Asia Pacific (APAC): The APAC region, led by China, Japan, South Korea, and India, is the fastest-growing market segment and commands the largest share in terms of volume, primarily due to its status as the global epicenter for consumer electronics manufacturing, automotive production, and semiconductor fabrication. The exponential growth in wafer manufacturing facilities (fabs) across China and Taiwan necessitates massive investment in high-voltage equipment, including ion implanters and plasma deposition tools, which are heavily reliant on highly stable voltage multipliers. Japan and South Korea lead in advanced medical device manufacturing and R&D, creating strong domestic demand for high-precision components. Furthermore, the rapid expansion of EV adoption and associated charging infrastructure, especially in China, is fueling unprecedented demand for efficient, low-cost voltage multipliers used in DC-DC converters and fast chargers. The competitive manufacturing environment in APAC drives technological focus toward cost-effective, high-volume production, gradually closing the gap with Western technology leaders in terms of material science and efficiency optimization.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions represent emerging opportunities, with market growth tied closely to governmental infrastructure investments and the development of core industrial and healthcare sectors. In MEA, the diversification of economies away from oil dependency, particularly in the UAE and Saudi Arabia, includes significant investments in industrial automation and new healthcare facilities, increasing the need for imported, reliable high-voltage equipment. LATAM's market expansion is driven by localized manufacturing growth and modernization of electrical grids and mining operations, requiring robust industrial testing equipment. While currently smaller in market value, these regions show high growth potential, characterized by the import of standardized voltage multiplier units from APAC and European manufacturers, with purchasing decisions heavily influenced by initial cost and proven reliability in challenging operational climates.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Voltage Multipliers Market.- Siemens AG

- ABB Ltd.

- General Electric

- Vishay Intertechnology, Inc.

- Advanced Energy Industries, Inc.

- XP Power

- UltraVolt, Inc.

- Applied Kilovolts

- Spellman High Voltage Electronics Corporation

- Matsusada Precision Inc.

- E-T-A Elektrotechnische Apparate GmbH

- TDK Corporation

- Murata Manufacturing Co., Ltd.

- Analog Devices, Inc.

- ROHM Semiconductor

- KiloVolt Technologies, Inc.

- L3Harris Technologies, Inc.

- Thales Group

- Toshiba Corporation

- Maxwell Technologies (now part of Tesla)

Frequently Asked Questions

Analyze common user questions about the Voltage Multipliers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of voltage multipliers over high-voltage transformers?

Voltage multipliers offer significant benefits over traditional transformers, including much lower weight and physical size, higher efficiency in DC output conversion, and superior scalability to achieve extremely high voltages (into the MV range) without requiring bulky high-voltage winding insulation. They are preferred in applications requiring compact, high-precision DC sources such as portable X-ray systems and specialized industrial controls.

How is the adoption of SiC and GaN technologies impacting voltage multiplier design?

The integration of Silicon Carbide (SiC) and Gallium Nitride (GaN) components allows voltage multipliers to operate at significantly higher switching frequencies (megahertz), which directly enables the use of smaller capacitors and overall circuit miniaturization. This results in higher power density, reduced ripple voltage, improved thermal performance, and greater energy efficiency, particularly critical for compact and high-reliability systems like those used in aerospace and medical diagnostics.

Which end-user segment drives the highest demand for High Voltage (>10 kV) multipliers?

The Industrial and Scientific Research segments drive the highest demand for High Voltage (>10 kV) multipliers. Industrial applications include large-scale electrostatic systems, high-voltage testing equipment for cables and insulators, and electron beam processes. Scientific research utilizes these high-voltage sources extensively in particle accelerators, pulsed power experiments, and specialized material testing, where ultra-high potential is essential for function.

What is the main challenge in designing ultra-high voltage multiplier systems?

The main challenge in designing ultra-high voltage systems (e.g., above 100 kV) is effectively managing parasitic capacitance, suppressing partial discharge (corona effect) and arcing within the circuit stages, and ensuring long-term insulation integrity. This requires specialized encapsulation techniques, high-purity insulating materials, and complex circuit topologies to maintain output stability and reliability under extreme electrical stress and environmental variations, which adds substantial cost and manufacturing complexity.

How does the Voltage Multipliers Market relate to the Electric Vehicle (EV) industry?

The Voltage Multipliers Market supports the EV industry by supplying high-efficiency DC-DC conversion units and high-voltage power supplies necessary for fast-charging infrastructure and on-board battery management systems. These components ensure the reliable and efficient transfer of power at high voltage levels, managing the demanding requirements of modern high-capacity EV battery packs and minimizing charging times while maintaining system safety and grid compatibility.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager