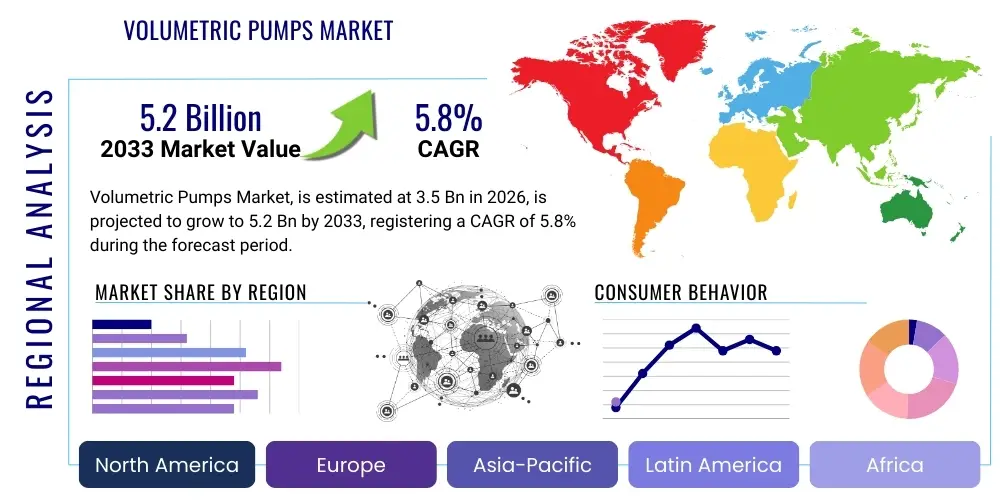

Volumetric Pumps Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443422 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Volumetric Pumps Market Size

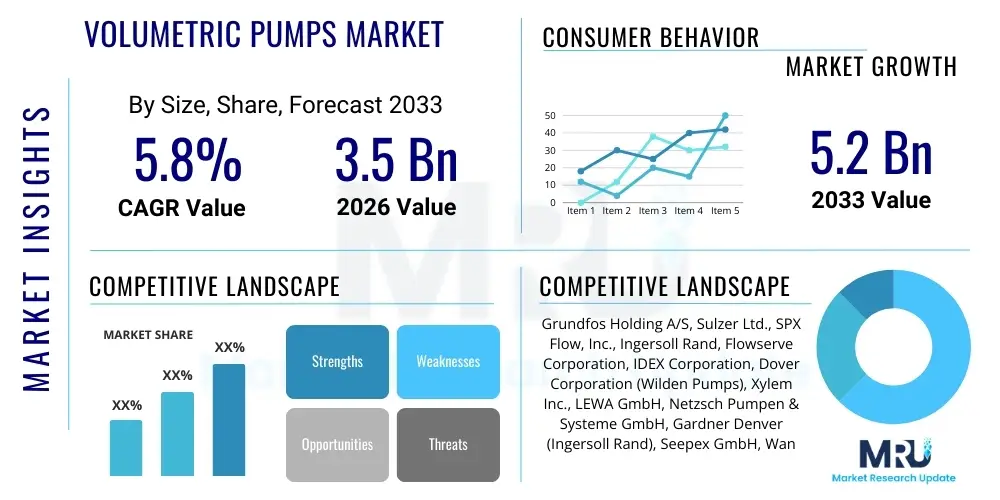

The Volumetric Pumps Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.2 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the escalating demand for highly accurate fluid handling and dosing systems across critical industrial sectors, coupled with advancements in material science enabling pumps to handle abrasive and high-viscosity fluids more effectively.

Volumetric Pumps Market introduction

The Volumetric Pumps Market, often referred to as the Positive Displacement (PD) Pumps Market, encompasses a diverse range of machinery designed to move a fixed amount of fluid for each rotational cycle, irrespective of the discharge pressure. These pumps differ significantly from centrifugal pumps by offering consistent flow rates and high-pressure capabilities, making them indispensable in applications requiring precise metering, dosing, and handling of viscous or sensitive fluids. Key product types include rotary pumps (such as gear, lobe, and screw pumps) and reciprocating pumps (such as piston, plunger, and diaphragm pumps), each tailored to specific operational requirements related to fluid properties and system pressure.

Major applications of volumetric pumps span critical industries where reliability and accuracy are paramount. In the pharmaceutical and biotechnology sectors, PD pumps are crucial for sterile filling, chromatography, and reagent dosing, demanding high levels of cleanability and precision. Within the oil and gas industry, these pumps facilitate complex tasks such as crude oil transfer, chemical injection (e.g., corrosion inhibitors), and metering in refining processes. The food and beverage sector relies heavily on these pumps for moving shear-sensitive products like sauces, purees, and batters without degradation, ensuring product integrity and quality control throughout the production chain.

The market’s expansion is primarily fueled by stringent regulatory requirements for process control and environmental protection, particularly in chemical processing and wastewater treatment, necessitating reliable, high-efficiency pumping solutions. Benefits derived from utilizing volumetric pumps include superior energy efficiency when handling high-viscosity fluids, lower net positive suction head (NPSH) requirements, and the ability to generate very high pressures. Driving factors include ongoing industrialization in emerging economies, increased investment in chemical manufacturing capacity, and the continuous trend toward automation and digitalization in production environments, which demand integrated, intelligent pumping systems capable of real-time monitoring and adjustment.

Volumetric Pumps Market Executive Summary

Global business trends indicate a strong market shift towards customized and modular volumetric pump solutions that can integrate seamlessly with Industry 4.0 infrastructure. Manufacturers are focusing on developing pumps with smart monitoring capabilities, predictive maintenance features, and enhanced material compatibility to reduce downtime and Total Cost of Ownership (TCO). The necessity for hygiene in sensitive sectors like food, beverage, and pharmaceuticals is accelerating the adoption of pumps designed under strict EHEDG and 3A standards, leading to innovations in seal-less designs and magnetic drive technologies to prevent leakage and contamination. Furthermore, sustainability pressures are driving demand for energy-efficient motor systems and optimized pump hydraulics that minimize operational energy consumption, particularly in large-scale chemical processing plants.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, largely due to rapid industrial growth, substantial infrastructure development, and increasing foreign direct investment in manufacturing capabilities, particularly in China and India. North America and Europe, characterized by mature industrial bases, are focusing on replacement cycles, modernization of existing infrastructure, and the adoption of high-end, specialized pump solutions tailored for complex processes like shale gas extraction and advanced pharmaceutical manufacturing. Regulatory harmonization in Europe, particularly concerning environmental discharge and process safety, further dictates the move toward highly reliable and leak-proof positive displacement technologies.

Segment trends reveal a robust growth in the diaphragm and peristaltic pump segments, primarily driven by their application in dosing chemicals and highly abrasive slurries, as well as their inherent advantage in achieving contamination-free fluid transfer in medical and biotech settings. The gear pump segment maintains strong dominance in high-pressure and high-viscosity fluid handling, especially in the petrochemical and polymer industries. Technology advancements are miniaturizing components, enabling micro-dosing applications crucial for laboratory automation and analytical instrumentation, thereby expanding the potential scope of volumetric pump use beyond traditional heavy industrial applications and into precision microfluidics.

AI Impact Analysis on Volumetric Pumps Market

Users frequently inquire about how Artificial Intelligence (AI) can enhance the efficiency, longevity, and predictive capabilities of volumetric pump systems. Key themes revolve around the transition from scheduled maintenance to predictive failure detection, the optimization of pump performance parameters based on real-time process inputs, and the potential for autonomous control loops in complex manufacturing environments. Concerns often center on the security of IoT-connected pumps and the necessity for robust, specialized algorithms capable of handling the high-frequency vibration and pressure data unique to positive displacement mechanics. Expectations are high regarding AI’s ability to drastically reduce operational costs, minimize unplanned downtime through early anomaly detection, and streamline the calibration processes required for precision dosing applications, ultimately leading to a 'smart pumping' ecosystem.

- AI-driven Predictive Maintenance (PdM): Utilizing machine learning algorithms to analyze vibration, temperature, and pressure data streams, predicting potential component failures (e.g., diaphragm rupture, worn gears) significantly before conventional monitoring systems.

- Optimized Dosing Accuracy: Employing AI to compensate for fluid viscosity fluctuations or temperature changes in real-time, ensuring optimal volumetric dispensing precision critical in pharmaceutical filling and chemical mixing processes.

- Energy Consumption Optimization: Implementing neural networks to dynamically adjust pump speed and operation cycles based on overall plant demand, minimizing energy wastage specific to PD pump operation profiles.

- Autonomous Operation Control: Integrating AI controllers to manage complex cascade control systems, allowing volumetric pumps to adjust discharge parameters autonomously in response to upstream or downstream process variations.

- Enhanced Process Digital Twins: Using AI to build high-fidelity digital models of pump performance, facilitating virtual testing of operational scenarios and accelerated design optimization for customized applications.

DRO & Impact Forces Of Volumetric Pumps Market

The Volumetric Pumps Market dynamic is shaped by a confluence of influential factors: robust industrial growth, regulatory demands for precise fluid control, and significant technological constraints. The primary drivers include rapid industrialization in emerging markets necessitating reliable process equipment, coupled with stringent environmental regulations mandating leak-free and accurate chemical dosing in water treatment and pollution control. However, the market faces significant restraints, notably the high initial capital expenditure associated with precision PD pumps compared to centrifugal alternatives, and the complex maintenance required due to numerous moving parts susceptible to wear, particularly when handling abrasive fluids. Opportunities arise from the burgeoning demand for highly specialized pumps in microfluidics, additive manufacturing, and high-purity applications in biotechnology, pushing manufacturers toward advanced materials and miniaturization. The combined impact forces center on regulatory rigor and the adoption of smart manufacturing technologies, which collectively accelerate the replacement of outdated equipment with highly precise, connected, and compliant volumetric systems.

Drivers: A key driver is the increasing complexity of industrial processes across sectors such as petrochemicals and specialized chemicals, which require pumping highly viscous or sensitive media that centrifugal pumps cannot handle efficiently or safely. Volumetric pumps offer inherent stability and performance predictability necessary for maintaining tight process tolerances. Furthermore, the global expansion of infrastructure projects, particularly in water and wastewater management, places significant emphasis on accurate chemical injection (e.g., chlorine, coagulants), cementing the necessity for reliable diaphragm and metering pumps. The drive towards product quality consistency, especially in high-value manufacturing like specialty coatings and high-end cosmetics, mandates the precise metering capabilities that are the hallmark of volumetric technology.

Restraints: The market’s growth is frequently challenged by the operational drawbacks of positive displacement technology, primarily the sensitivity to blockages and the potential for pulsation, which necessitates costly dampening equipment. Moreover, many volumetric pump designs are subject to higher maintenance intervals and greater complexity in field service due to intricate mechanical assemblies (seals, valves, gears). This complexity translates to higher operational expenditure (OPEX) over the pump’s lifecycle. Economic volatility in core industrial sectors, such as oil and gas, can lead to deferred capital expenditure on new equipment, favoring temporary repairs or extensions of existing centrifugal pump lifecycles, thus slowing the uptake of new, higher-precision volumetric units.

Opportunities: Significant market opportunities are emerging from the integration of advanced diagnostics and IIoT capabilities into volumetric pumps, transforming them from simple mechanical devices into smart nodes within a process network. This enhances their appeal by offering predictive maintenance and real-time performance optimization. Furthermore, the development of new materials resistant to extreme temperature, pressure, and chemical corrosion is opening doors for volumetric pumps in previously inaccessible niche markets, such as handling molten salts or highly aggressive acids. The trend toward decentralized manufacturing and point-of-use dosing systems in medical facilities and municipal services also represents a fertile ground for compact, highly reliable metering pumps.

Segmentation Analysis

The Volumetric Pumps Market is comprehensively segmented based on product type, discharge mechanism, material of construction, end-user industry, and region, allowing for detailed analysis of market dynamics across diverse application scopes. Segmentation by product type—encompassing rotary, reciprocating, and specialized pumps—provides insights into design preference based on fluid viscosity and pressure requirements, with rotary pumps dominating high-flow, viscous applications, and reciprocating pumps leading high-pressure, low-flow operations. End-user segmentation highlights the critical reliance of sectors like Oil and Gas, Chemical, and Pharmaceutical on these precision instruments for their core operational integrity and regulatory compliance. Understanding these segments is crucial for manufacturers tailoring their technological offerings and market penetration strategies to specific industrial needs and regulatory landscapes.

- By Product Type:

- Rotary Pumps (Gear, Lobe, Vane, Screw, Circumferential Piston)

- Reciprocating Pumps (Piston, Plunger, Diaphragm, Metering/Dosing Pumps)

- Specialty Pumps (Peristaltic, Progressive Cavity)

- By Mechanism/Function:

- Dosing Pumps

- Metering Pumps

- Transfer Pumps

- By Material:

- Cast Iron

- Stainless Steel

- Exotic Alloys (e.g., Hastelloy, Titanium)

- Plastics (e.g., PTFE, PVC, PP)

- By End-User Industry:

- Oil and Gas (Upstream, Midstream, Downstream)

- Chemical and Petrochemical

- Water and Wastewater Treatment

- Pharmaceutical and Biotechnology

- Food and Beverage

- Pulp and Paper

- Power Generation

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Volumetric Pumps Market

The value chain for the volumetric pumps market begins with the upstream sourcing of high-grade raw materials, including specialized metals (stainless steel, exotic alloys), engineering plastics, and complex sealing materials, where material reliability and quality assurance are critical due to demanding application environments. Manufacturers then engage in precision engineering and assembly, focusing heavily on R&D for pump hydraulics, material compatibility, and integration of smart sensing technologies. This upstream focus on material science and intellectual property protection is paramount, as performance superiority often hinges on proprietary design geometries and surface finishes, particularly in hygienic applications. Supply chain resilience, ensuring the timely availability of critical components like seals, bearings, and specialized motors, significantly influences production efficiency and cost structures.

The downstream activities involve distribution and extensive post-sale services. Volumetric pumps, being critical assets, require specialized distribution channels—often technical distributors or direct sales teams—capable of providing consultative selling, detailed application engineering, and system integration support. Direct channels are prevalent for large, customized capital projects in the oil and gas or chemical sectors, whereas distributors handle standardized maintenance, repair, and operations (MRO) supplies. Crucially, the aftermarket services, including spare parts supply, maintenance contracts, and specialized repair capabilities (especially for complex reciprocating pumps), represent a substantial and highly profitable segment of the downstream market, emphasizing the Total Cost of Ownership (TCO) for end-users.

The distribution channel is dichotomous: direct sales dominate high-value, bespoke installations where manufacturers provide comprehensive commissioning and performance guarantees. Conversely, indirect channels (authorized agents and value-added resellers) manage standard product lines and localized service support. A strong focus is placed on digital enablement of the supply chain, facilitating remote diagnostics and expedited parts delivery, which significantly improves customer satisfaction and operational continuity. The trend towards digitalization is making the downstream phase increasingly data-driven, allowing manufacturers to move toward proactive service models rather than reactive maintenance calls.

Volumetric Pumps Market Potential Customers

Potential customers for volumetric pumps are diverse yet share a common requirement for precise, reliable, and consistent fluid transfer under challenging operational conditions. Key buyers include large multinational chemical companies that require durable pumps for transferring corrosive, high-viscosity reagents and polymers under high pressure. These companies purchase pumps in large volumes for greenfield projects and continuous replacement cycles, often prioritizing reliability and material integrity over initial cost. Another significant customer base lies within the food and beverage industry, which heavily procures positive displacement pumps (especially lobe and circumferential piston types) for moving shear-sensitive products like yogurt, creams, and doughs, where hygiene standards (CIP/SIP capability) and gentle handling are the primary buying criteria.

The pharmaceutical and biotechnology sectors are high-value customers, focusing intensely on small-volume metering and sterile transfer applications. Buyers here, including contract manufacturing organizations (CMOs) and research laboratories, prioritize peristaltic and diaphragm metering pumps capable of ultra-precise, contamination-free dosing in regulated environments. Purchasing decisions are heavily influenced by documentation, validation packages, and adherence to regulatory standards such as FDA and GMP guidelines. The rapid expansion of biologics manufacturing globally further drives demand for highly specialized, single-use volumetric pump components to mitigate cross-contamination risks and simplify cleaning validation processes.

Furthermore, municipal and industrial water treatment plants constitute a foundational customer segment, relying on robust diaphragm and piston pumps for injecting essential chemicals like flocculants, disinfectants (hypochlorite), and pH modifiers. These end-users prioritize durability, ease of maintenance, and resistance to scaling or harsh chemicals, given the continuous, often outdoor operational demands of these facilities. Oil and gas companies, both upstream exploration/production and downstream refining operations, are also major buyers, utilizing robust reciprocating pumps for high-pressure injection (e.g., water or chemicals into wells) and precision metering during complex blending and refining processes. The purchasing cycle in this sector is intrinsically tied to global commodity price trends and capital investment cycles.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.2 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Grundfos Holding A/S, Sulzer Ltd., SPX Flow, Inc., Ingersoll Rand, Flowserve Corporation, IDEX Corporation, Dover Corporation (Wilden Pumps), Xylem Inc., LEWA GmbH, Netzsch Pumpen & Systeme GmbH, Gardner Denver (Ingersoll Rand), Seepex GmbH, Wanner Engineering, Watson-Marlow Fluid Technology Solutions, PCM Group, Coperion K-Tron, Milton Roy, Graco Inc., Viking Pump (IDEX), Nikkiso Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Volumetric Pumps Market Key Technology Landscape

The technological landscape of the volumetric pumps market is rapidly evolving, driven primarily by the need for higher precision, extended operational life, and greater integration capabilities within modern digital factories. A significant area of focus is on material science innovation, particularly the development of highly wear-resistant ceramics, advanced polymers (like PEEK), and composite materials used in impellers, gears, and diaphragms. These materials are crucial for improving pump performance when handling highly abrasive slurries or extremely corrosive chemicals, thereby extending Mean Time Between Failures (MTBF) and reducing maintenance costs, which is a major restraint for positive displacement technologies. Furthermore, hygienic design is paramount, leading to innovations like magnetic drive technology for seal-less operation in rotary pumps and specialized surface treatments to facilitate Clean-in-Place (CIP) and Sterilize-in-Place (SIP) processes, minimizing the risk of biological contamination.

Another dominant technological trend is the pervasive adoption of smart pumping solutions enabled by the Industrial Internet of Things (IIoT). Modern volumetric pumps are increasingly equipped with integrated sensors for real-time monitoring of vibration, temperature, pressure, and fluid flow metrics. This data is fed into sophisticated control systems, often utilizing Variable Frequency Drives (VFDs), which allow for precise control over flow rate and pressure, optimizing energy consumption dramatically. The integration facilitates advanced diagnostic capabilities, allowing operators to detect small anomalies indicative of impending failure, shifting maintenance philosophy from reactive to predictive, thereby maximizing asset utilization and minimizing costly unplanned downtime across industrial complexes.

Furthermore, advancements in metering and dosing technologies are refining the core value proposition of volumetric pumps. High-precision diaphragm metering pumps now utilize sophisticated electronic stroke control and multiple head designs to ensure extremely accurate, reproducible dosing, critical for expensive chemicals or potent pharmaceutical ingredients. Peristaltic pump technology is benefiting from improved tubing materials that offer higher pressure tolerance and chemical compatibility, expanding their use beyond low-pressure laboratory environments into industrial dosing applications. The development of compact, modular pump systems that allow for quick configuration changes and reduced installation footprints is also a key innovation, meeting the flexible production needs of modern manufacturers in sectors like specialty chemicals and food processing.

Regional Highlights

-

Asia Pacific (APAC)

APAC is projected to be the engine of growth for the volumetric pumps market, owing primarily to aggressive industrial expansion and significant investments in water management infrastructure and chemical manufacturing capacity, particularly in China, India, and Southeast Asian nations. The region’s burgeoning population and rising middle-class disposable income are driving unprecedented growth in the food and beverage and pharmaceutical sectors, requiring extensive installations of hygienic and precision dosing pumps. Governmental policies supporting 'Made in China 2025' and 'Make in India' initiatives stimulate local manufacturing and modernization, leading to high procurement rates of advanced pumping equipment for new facility setups and efficiency upgrades. While the market exhibits strong demand for cost-effective solutions, the increasing regulatory oversight, particularly regarding environmental discharge in industrialized zones, is simultaneously pushing demand toward higher quality, leak-proof, and technologically advanced volumetric pumps that meet international standards.

The Oil and Gas sector, especially in countries like Malaysia, Indonesia, and Australia, remains a consistent buyer of robust reciprocating and screw pumps for pipeline transfer, high-pressure injection, and refining operations. However, competitive pressure from local manufacturers offering lower-cost alternatives is a persistent feature of the APAC market landscape. Nevertheless, the sophisticated requirements of the nascent but rapidly growing biotechnology and high-purity chemical sectors are ensuring continued strong demand for high-end, imported volumetric technologies from established global players who can provide necessary certifications and service excellence. This dual-market nature—high-volume standardized pumps versus high-precision specialty pumps—defines the region’s complexity and vast potential.

-

North America

North America holds a substantial share of the global volumetric pumps market, characterized by technological maturity and a high concentration of sophisticated end-users in the Oil and Gas, Pharmaceutical, and Chemical industries. Demand in this region is primarily driven by rigorous safety and environmental regulations, leading to a focus on replacing older, less efficient equipment with integrated, intelligent pump systems capable of seamless communication within advanced Supervisory Control and Data Acquisition (SCADA) environments. The growth in unconventional oil and gas extraction (shale drilling) mandates the use of highly durable, high-pressure reciprocating pumps for fracking and water management, sustaining consistent demand within the upstream segment.

The pharmaceutical sector, bolstered by significant R&D spending, requires state-of-the-art metering and peristaltic pumps for complex drug formulation and filling applications, emphasizing pumps compliant with FDA validation protocols. Market growth here is less about volume expansion and more about value addition through digitalization, predictive analytics integration, and specialization. Manufacturers in North America are therefore heavily invested in developing IIoT-enabled pumps and offering comprehensive service contracts that leverage AI and data analytics to optimize customer operations and reduce lifecycle costs, positioning the region as a leader in smart pumping technology adoption.

-

Europe

The European market is defined by stringent adherence to environmental protection standards (e.g., REACH, specific EU directives on industrial emissions) and strong emphasis on operational efficiency and sustainability. This regulatory landscape strongly favors high-integrity, leak-free volumetric pumps, particularly those utilizing magnetic drive or canned motor technologies in chemical and petrochemical handling to mitigate fugitive emissions. Germany, Italy, and France are core industrial hubs driving demand for precision dosing pumps in water treatment and the automotive manufacturing supply chain.

Innovation in Europe is centered around energy efficiency and modular design. Many European manufacturers are pioneers in developing pumps with exceptionally high energy efficiency ratings, aligning with the EU’s climate and energy goals. Furthermore, the robust food and beverage industry demands extensive use of hygienic lobe and circumferential piston pumps that comply with EHEDG (European Hygienic Engineering & Design Group) standards, ensuring rapid and effective cleaning processes. The market growth is stable, primarily driven by industrial modernization, infrastructure upgrades, and the continuous need to meet escalating environmental compliance benchmarks.

-

Latin America (LATAM) and Middle East & Africa (MEA)

Growth in LATAM is variable, tied closely to capital investments in infrastructure, mining, and oil production, especially in countries like Brazil and Mexico. The market shows solid potential for metering and transfer pumps in municipal water services and agricultural chemical applications. The primary focus for procurement often balances technological capability with cost constraints. Investment cycles are heavily influenced by commodity prices, leading to fluctuating demand for high-end industrial pumps.

The MEA region, particularly the Gulf Cooperation Council (GCC) countries, remains a high-value market driven predominantly by the massive oil and gas and desalination industries. Volumetric pumps are essential for crude oil transfer, high-pressure injection, and chemical dosing in complex refining and petrochemical operations. Furthermore, the region’s vast water scarcity necessitates significant investment in large-scale desalination plants, which require highly reliable, corrosion-resistant reciprocating pumps for chemical preparation and high-pressure duties. Infrastructure projects in rapidly urbanizing areas also contribute to steady demand for water and wastewater treatment dosing equipment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Volumetric Pumps Market.- Grundfos Holding A/S

- Sulzer Ltd.

- SPX Flow, Inc.

- Ingersoll Rand

- Flowserve Corporation

- IDEX Corporation

- Dover Corporation (Wilden Pumps)

- Xylem Inc.

- LEWA GmbH

- Netzsch Pumpen & Systeme GmbH

- Gardner Denver (Ingersoll Rand)

- Seepex GmbH

- Wanner Engineering

- Watson-Marlow Fluid Technology Solutions

- PCM Group

- Coperion K-Tron

- Milton Roy

- Graco Inc.

- Viking Pump (IDEX)

- Nikkiso Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Volumetric Pumps market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of volumetric pumps over centrifugal pumps in industrial applications?

Volumetric (Positive Displacement) pumps deliver a constant flow rate regardless of pressure changes, making them superior for high-viscosity fluid handling, precise metering, and high-pressure requirements. They also offer higher efficiency when handling fluids with high viscosity and possess stronger suction capabilities (NPSH required).

Which volumetric pump type is most commonly used in the pharmaceutical industry for sterile dosing and filling?

Peristaltic and Diaphragm pumps are predominantly used in pharmaceuticals. Peristaltic pumps ensure high sterility by isolating the fluid within the tubing, avoiding contact with pump mechanisms, while diaphragm pumps offer precise, pulse-free dosing crucial for accurate formulation.

How is Industry 4.0 influencing the design and operation of modern volumetric pumps?

Industry 4.0 drives the integration of IIoT sensors and smart controls into volumetric pumps, enabling predictive maintenance (PdM) through real-time data analysis, remote monitoring, and optimization of flow and energy consumption, significantly improving overall asset utilization and reliability.

What is the estimated Compound Annual Growth Rate (CAGR) for the Volumetric Pumps Market between 2026 and 2033?

The Volumetric Pumps Market is projected to experience a Compound Annual Growth Rate (CAGR) of 5.8% during the forecast period of 2026 to 2033, driven by increasing regulatory demand for precise fluid handling in key industrial sectors globally.

What material considerations are critical when selecting a volumetric pump for chemical processing applications?

Material selection must prioritize chemical compatibility and corrosion resistance, often utilizing specialized materials like 316 Stainless Steel, PTFE, Hastelloy, or ceramics. The material must withstand the specific media, temperature, and pressure profiles to ensure pump integrity and prevent premature failure or fluid contamination.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager