VPN Server Software Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441778 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

VPN Server Software Market Size

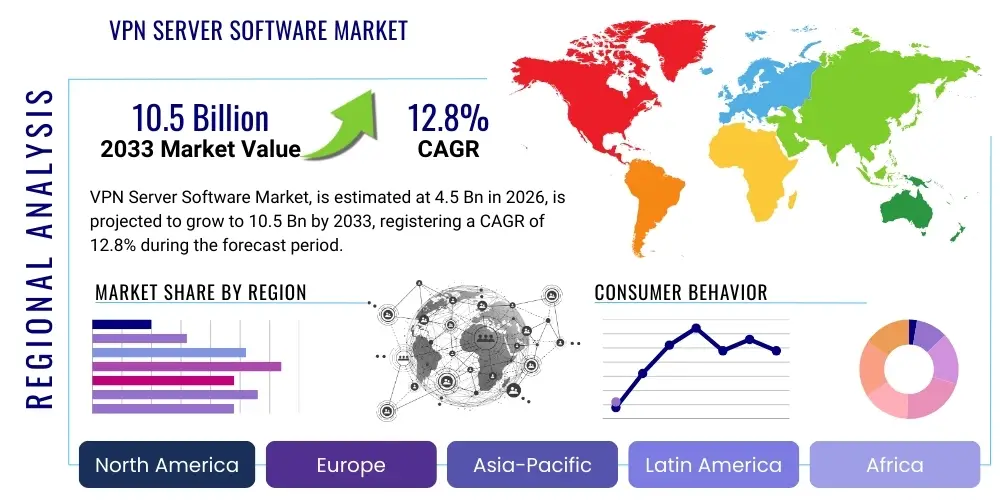

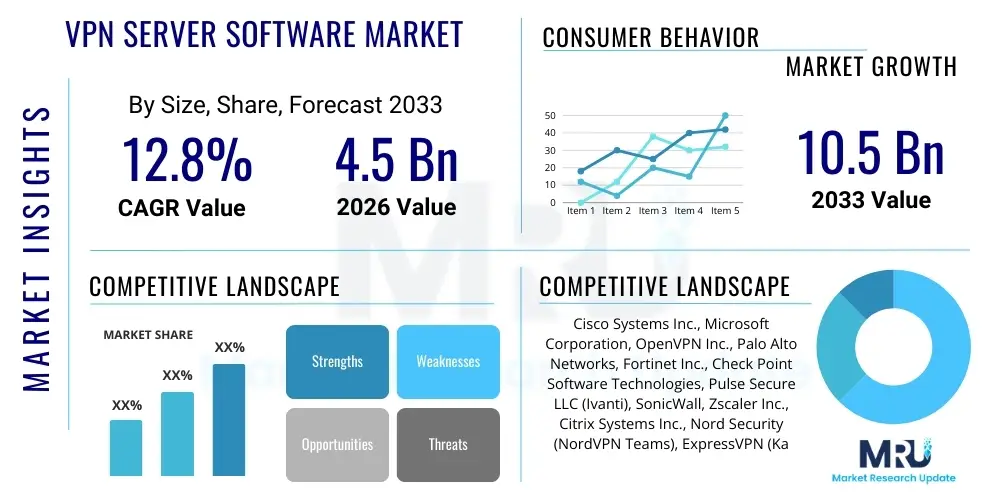

The VPN Server Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 10.5 Billion by the end of the forecast period in 2033.

VPN Server Software Market introduction

The Virtual Private Network (VPN) Server Software Market encompasses sophisticated solutions designed to establish secure, encrypted connections over public networks, facilitating safe remote access, data privacy, and organizational network extension. These software platforms are essential tools for modern enterprises seeking to safeguard sensitive data, ensure regulatory compliance, and support burgeoning remote workforces globally. The core function of VPN server software is to authenticate users, manage connection protocols (such as OpenVPN, IPSec, WireGuard), and maintain the integrity and confidentiality of data transmitted between the client device and the secure internal network. Market growth is fundamentally driven by the escalating frequency of cyber threats, particularly ransomware and corporate espionage, which necessitates robust, perimeter-less security architecture. Furthermore, the global shift towards cloud computing and hybrid work models has dramatically increased the demand for highly reliable and scalable VPN infrastructure that can seamlessly integrate across disparate cloud environments and physical locations. The necessity for geo-unblocking and secure media consumption also contributes significantly to the consumer segment, though enterprise demand remains the primary revenue driver, focusing heavily on zero-trust capabilities and centralized management.

Product descriptions within this market vary widely, ranging from open-source foundational software requiring extensive configuration (e.g., OpenVPN Community Edition) to highly commercialized, feature-rich enterprise solutions offering centralized logging, advanced intrusion detection features, and seamless integration with existing identity and access management (IAM) systems. Major applications span several sectors, including banking and financial services (BFSI), where secure transaction processing is critical; healthcare, necessitating compliance with strict data protection regulations like HIPAA and GDPR; and government and defense, requiring the highest levels of secure communication for sensitive operations. The inherent complexity of managing security in fragmented IT landscapes is continuously pushing vendors to develop user-friendly interfaces, automated deployment tools, and superior performance metrics, particularly latency reduction, which is vital for real-time applications and unified communications platforms.

Key benefits derived from implementing high-quality VPN server software include enhanced data encryption, anonymization of user activity, reliable remote access capability for employees and third-party contractors, and significant cost savings associated with leveraging public internet infrastructure rather than proprietary leased lines. Driving factors for market expansion include the proliferation of internet-connected devices (IoT), the exponential growth of data volume requiring protection during transit, and increasingly stringent global data sovereignty laws that mandate secure localized data handling. These combined factors solidify the VPN server software market's position as a foundational component of modern cybersecurity infrastructure, pushing continuous innovation in protocol efficiency and quantum-resistant encryption methods to stay ahead of evolving adversarial techniques. The rapid adoption of software-defined perimeter (SDP) solutions, often considered the next generation of VPN technology, is also influencing market dynamics by emphasizing identity-centric access control over traditional network-centric models, though traditional VPN architecture remains dominant for many core enterprise functions.

VPN Server Software Market Executive Summary

The VPN Server Software market is experiencing robust momentum, characterized by significant business trends pivoting around enhanced enterprise mobility, the zero-trust security framework, and the shift from monolithic appliances to agile, cloud-native deployments. Companies are moving away from traditional site-to-site VPN models toward more flexible, user-centric access solutions, driven by the necessity to secure access for remote workers utilizing personal devices (BYOD). Key business imperatives fueling growth include ensuring business continuity during disruptive events and maintaining competitive edge through fast, reliable access to internal resources regardless of user location. Furthermore, consolidation among major cybersecurity vendors is leading to integrated offerings where VPN functionality is bundled with comprehensive endpoint detection and response (EDR) or secure access service edge (SASE) platforms, simplifying procurement and management for IT departments. Investment flows are heavily directed toward R&D focused on proprietary VPN protocols that offer superior speed and resilience compared to legacy standards, ensuring that performance does not become a bottleneck for bandwidth-intensive cloud applications.

Regional trends indicate that North America currently dominates the market share, primarily due to the presence of numerous technologically advanced corporations, stringent regulatory environments (mandating strong data protection), and the early adoption of cloud and hybrid IT infrastructures. However, the Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) over the forecast period, driven by rapid digitalization initiatives in emerging economies like India and China, coupled with increasing governmental scrutiny regarding data privacy, prompting widespread enterprise adoption of secure access solutions. Europe maintains a strong presence, underpinned by the rigorous enforcement of GDPR, which compels organizations to invest heavily in secure communication channels. In Latin America and MEA, market growth is gradually accelerating, fueled by expanding internet penetration, rising awareness of sophisticated cyber threats, and the modernization of telecommunication infrastructure supporting advanced networking technologies, although cost sensitivity remains a key factor influencing procurement decisions in these areas.

Segmentation trends highlight the increasing prominence of cloud-based deployment models, favored for their flexibility, scalability, and operational ease compared to traditional on-premises solutions, particularly among Small and Medium Enterprises (SMEs). Within the technology segment, protocols like WireGuard are gaining traction rapidly due to their simplified code base and superior performance capabilities relative to established protocols like OpenVPN and L2TP/IPsec, although OpenVPN still retains a vast installed base due to its reputation for robust security and extensive auditing. Vertically, the BFSI sector consistently contributes the largest revenue share, given the extreme sensitivity of financial data, while the retail and e-commerce sector is showing significant acceleration in adoption, driven by the critical need to secure Point-of-Sale (POS) systems and vast customer databases against external breaches. The increasing demand for mobile VPN solutions tailored for mobile devices and specific applications also represents a significant sub-segment trend, acknowledging the pervasive use of smartphones and tablets in enterprise operations and demanding optimized, lightweight security clients.

AI Impact Analysis on VPN Server Software Market

User inquiries regarding AI's impact on the VPN Server Software Market primarily center on two critical areas: security enhancement through predictive threat detection and operational efficiency via automated network management. Common questions explore how AI can move VPN security beyond simple perimeter defense, specifically asking about AI's role in analyzing encrypted traffic metadata for anomalous behavior indicative of malicious activity, without compromising user privacy. Users also express concerns regarding the potential for AI-driven automation to replace human network administrators, while simultaneously seeking solutions where AI can optimize server load balancing, intelligently route traffic based on real-time latency metrics, and automate the provisioning and de-provisioning of user access based on organizational policy changes. A key expectation is the integration of machine learning (ML) models into VPN gateways to establish baseline user behavior profiles, allowing for instant flagging of deviations (e.g., unusual geographic login attempts or access to non-standard resources), thereby significantly reducing the response time to potential breaches and minimizing false positives, an endemic issue in traditional rule-based security systems.

The incorporation of Artificial Intelligence and Machine Learning is rapidly transforming the operational dynamics and security posture of VPN server software. AI algorithms are increasingly being deployed to analyze massive volumes of security logs and network telemetry data generated by VPN connections. This advanced analysis moves beyond simple signature matching to identify complex, multi-stage attack patterns that traditional firewalls and intrusion detection systems (IDS) might miss. For instance, ML can determine the difference between normal burst activity and a Distributed Denial of Service (DDoS) attack disguised as high legitimate traffic, allowing the VPN server to dynamically adjust resource allocation or reroute traffic to maintain service availability. This predictive security layer significantly bolsters the resilience of the VPN infrastructure against zero-day exploits and sophisticated persistent threats (APTs), offering a proactive defense mechanism rather than a reactive one.

Furthermore, AI is crucial in enhancing the user experience and administrative overhead associated with VPN management. AI-powered network optimization includes automated policy enforcement, where machine learning dictates the optimal access level for a user based on their identity, device posture, and the specific application being requested, aligning perfectly with Zero Trust Architecture (ZTA) principles. This intelligent decision-making reduces manual configuration errors and ensures least-privilege access is continuously maintained. However, the integration of AI also presents challenges, notably the need for extremely large, high-quality datasets to train effective ML models and the ethical concerns surrounding AI's ability to potentially analyze subtle patterns in encrypted metadata, raising user concerns about the absolute privacy assurances provided by the VPN solution itself. Vendors are responding by focusing on privacy-preserving AI techniques, such as federated learning, to optimize models without exporting raw sensitive user data, ensuring that performance gains do not come at the expense of end-user trust, which is paramount in the VPN market.

- AI drives proactive threat detection by analyzing encrypted metadata for behavioral anomalies.

- Machine Learning optimizes traffic routing, dynamically adjusting server load balancing and resource allocation.

- AI automates policy enforcement and user provisioning, minimizing human error and enhancing ZTA implementation.

- Predictive modeling helps in identifying and mitigating DDoS attacks disguised as legitimate traffic bursts.

- Challenges include data requirements for model training and maintaining user privacy while performing deep behavioral analysis.

- AI facilitates automated incident response, providing faster containment of breaches originating from compromised VPN sessions.

DRO & Impact Forces Of VPN Server Software Market

The market for VPN server software is driven by a powerful confluence of mandatory digitalization, global security concerns, and evolving workforce models, while simultaneously constrained by technological challenges and intense market competition. The primary drivers include the mandatory shift to remote and hybrid work environments, which inherently increases the attack surface for organizations, making secure remote access non-negotiable. Furthermore, stringent regulatory mandates, particularly those related to data protection (like GDPR, CCPA, and regional sovereignty laws), force organizations to adopt robust encryption and access control mechanisms, directly boosting the demand for high-compliance VPN solutions. The restraining forces largely revolve around the performance overhead inherent in encryption and decryption processes, which can negatively impact network speeds and user experience, especially in high-latency environments. Additionally, the increasing complexity and cost associated with integrating next-generation VPN solutions (like SASE components) into legacy IT systems can deter smaller businesses. However, significant opportunities exist in the rapid uptake of next-generation protocols (e.g., WireGuard) that address latency concerns, the potential for expansion into emerging markets requiring foundational cybersecurity infrastructure, and the massive shift toward software-defined perimeter (SDP) solutions that offer enhanced security granularity over traditional VPNs, representing a substantial upgrade cycle for existing customer bases.

Drivers in the VPN Server Software market are deeply rooted in macro-economic and technological shifts. The perpetual rise in sophisticated cyberattacks, including state-sponsored espionage and advanced persistent threats (APTs), necessitates constant investment in encrypted communication channels to safeguard intellectual property. The massive adoption of cloud computing platforms (IaaS, PaaS, SaaS) means that data is increasingly moving outside the traditional corporate network boundary, making traditional perimeter security obsolete and positioning the VPN as a critical 'security fabric' connecting scattered resources. The increasing demand for device-agnostic, seamless security, supporting the BYOD trend, further compels enterprises to invest in high-performance, identity-aware VPN server software. These drivers collectively ensure a continuous demand floor, irrespective of short-term economic fluctuations, as cybersecurity investment is viewed as a foundational operational expenditure rather than a discretionary IT cost, thereby stabilizing market momentum.

The impact forces influencing the trajectory of the market are multi-faceted. On the demand side, regulatory pressure exerts a strong influence, forcing rapid adoption timelines across regulated industries. On the supply side, technological innovation acts as a powerful disruptive force; vendors that fail to integrate new protocols or offer cloud-native deployment options risk losing market share to more agile competitors. Furthermore, geopolitical tensions and government-imposed restrictions on certain VPN technologies or service providers in various regions create fragmentation and compliance hurdles, impacting global market standardization. The availability of robust, high-quality open-source VPN solutions (like OpenVPN) also acts as a competitive pressure point, forcing commercial vendors to continuously justify their premium pricing through superior features, dedicated support, and enterprise-grade scalability, ensuring that the market remains dynamic and highly competitive across all segments, from specialized point solutions to comprehensive secure access offerings.

Segmentation Analysis

The VPN Server Software market is meticulously segmented based on components, deployment modes, end-user types, and core application areas, allowing vendors to tailor offerings to specific needs and regulatory requirements. The component segmentation includes software, hardware (appliances often running proprietary VPN software), and services (managed security services and professional support), with software and managed services exhibiting the fastest growth rates. Deployment mode analysis is crucial, distinguishing between on-premises solutions, traditionally favored by large enterprises with stringent control requirements, and cloud-based or hybrid deployments, which dominate the current growth trajectory due to their inherent scalability and lower initial investment costs. Furthermore, segmentation by end-user size, categorizing solutions for large enterprises versus SMEs, reveals divergent requirements; large enterprises prioritize integration with complex IAM systems, while SMEs seek ease of use and cost-efficiency. This detailed segmentation allows market players to accurately target their product development and strategic marketing efforts, focusing on high-growth verticals like healthcare and BFSI, which demand specialized compliance features and ultra-low latency performance capabilities.

- Component Type:

- Software

- Hardware Appliances

- Services (Managed Security Services, Consulting, Integration)

- Deployment Mode:

- On-Premises

- Cloud-Based

- Hybrid

- Enterprise Size:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

- Application/Protocol:

- SSL/TLS VPN

- IPsec VPN

- OpenVPN

- WireGuard

- Proprietary Protocols

- End-User Vertical:

- Banking, Financial Services, and Insurance (BFSI)

- IT and Telecommunication

- Government and Defense

- Healthcare

- Manufacturing

- Retail and E-commerce

- Others (Education, Media)

Value Chain Analysis For VPN Server Software Market

The value chain for the VPN Server Software Market commences with upstream activities centered on core technology development and cryptographic research. This includes firms specializing in security protocols (e.g., WireGuard developers), operating system kernel optimization, and specialized chipset manufacturing for high-performance VPN appliances. Upstream suppliers are responsible for providing the foundational security libraries and algorithms that ensure the integrity and robustness of the encryption tunnels. Innovation at this stage, particularly in developing quantum-resistant encryption standards and high-efficiency tunnelling protocols, is critical for maintaining long-term competitiveness. Strategic partnerships with silicon providers and open-source communities define the pace of technological advancement, allowing vendors to integrate hardware acceleration capabilities directly into their server software, significantly improving throughput and reducing processing overhead, a key factor in enterprise adoption.

Midstream activities involve the primary market players—the VPN server software developers and integrators—who transform foundational security components into marketable, scalable, and user-friendly products. This stage involves extensive software development, quality assurance, integration with third-party security ecosystems (like IAM and SIEM platforms), and the creation of deployment tools optimized for various environments (public cloud, private data centers). The distribution channel is bifurcated into direct and indirect routes. Direct sales are common for large enterprise contracts and custom solutions, where specialized negotiation and integration services are required. Indirect distribution, leveraging a network of channel partners, Value-Added Resellers (VARs), Managed Security Service Providers (MSSPs), and cloud marketplace aggregators (AWS Marketplace, Azure Marketplace), is crucial for achieving broad market reach, especially into the SME segment and across diverse international markets, capitalizing on local expertise and established client relationships.

Downstream activities focus on deployment, maintenance, and end-user support. This encompasses the physical or virtual installation of the VPN server software, configuration based on specific security policies, and continuous monitoring and patching to address emerging vulnerabilities. Direct involvement includes the vendor's internal support teams providing specialized technical assistance. Indirect downstream services are predominantly handled by MSSPs and system integrators who offer round-the-clock monitoring, patch management, and tailored security advice, essentially outsourcing the operational burden for end-user organizations. The efficiency of the downstream operations, particularly the speed and quality of post-sales support and vulnerability response, heavily influences customer retention and market reputation. Effective management of the value chain, from cutting-edge protocol development upstream to responsive managed services downstream, is paramount for securing sustainable growth and maintaining trust in a security-critical market segment.

VPN Server Software Market Potential Customers

Potential customers for VPN Server Software span nearly every industry that handles sensitive data, requires remote access for employees, or operates across geographically dispersed locations. Fundamentally, any organization moving beyond a purely localized network perimeter, or subject to data privacy regulations, constitutes a prime target. Large enterprises across critical infrastructure sectors—particularly Banking, Financial Services, and Insurance (BFSI)—represent the largest revenue generators due to the extreme sensitivity of transactional data and strict compliance requirements (e.g., PCI DSS, SOX). These buyers demand high availability, robust logging capabilities, seamless integration with proprietary legacy systems, and often require hybrid deployment models supporting both site-to-site connectivity and large-scale remote user access.

The secondary major buyer segment comprises Small and Medium-sized Enterprises (SMEs) and high-growth technology companies. While SMEs may have smaller budgets, their adoption rate is accelerating rapidly, primarily opting for flexible, cost-effective cloud-based VPN server solutions that minimize internal IT overhead. These buyers prioritize ease of deployment, intuitive management interfaces, and subscription-based pricing models. Technology and telecommunication firms, characterized by highly mobile technical teams, high bandwidth needs, and rapid product cycles, require VPN solutions optimized for low latency and supporting advanced developer workflows like secure access to DevOps environments and sensitive code repositories. The increasing sophistication of threats targeting these smaller, agile companies drives the need for enterprise-grade security features packaged for mid-market consumption.

Government and defense agencies are a highly specialized, high-security customer base, demanding solutions that often adhere to specific national security standards (like FIPS certification) and require extremely stringent access controls, typically favoring heavily vetted, on-premises or private cloud deployments to maintain absolute data sovereignty. Furthermore, the healthcare sector, including hospitals and pharmaceutical research firms, constitutes a critical customer segment driven by the mandatory protection of Protected Health Information (PHI) under laws like HIPAA. These organizations require secure communication channels for telehealth services, secure record access across facilities, and safeguarding proprietary research data. Ultimately, the modern potential customer is defined by their need to establish a secure, identity-driven perimeter for a fluid, decentralized workforce accessing mission-critical resources from any location globally.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 10.5 Billion |

| Growth Rate | 12.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cisco Systems Inc., Microsoft Corporation, OpenVPN Inc., Palo Alto Networks, Fortinet Inc., Check Point Software Technologies, Pulse Secure LLC (Ivanti), SonicWall, Zscaler Inc., Citrix Systems Inc., Nord Security (NordVPN Teams), ExpressVPN (Kape Technologies), Perimeter 81, NCP Engineering GmbH, NetMotion Software, PureVPN, Tunnello, Sophos Group plc, Huawei Technologies Co., Ltd., Array Networks. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

VPN Server Software Market Key Technology Landscape

The technological landscape of the VPN Server Software market is characterized by rapid evolution away from legacy protocols and towards high-efficiency, modern tunneling techniques integrated with advanced security frameworks. Historically, IPSec and L2TP/IPsec dominated the corporate environment, offering high stability but often presenting complex configuration challenges and susceptibility to network address translation (NAT) traversal issues. Today, the focus has fundamentally shifted towards SSL/TLS-based VPNs, notably OpenVPN, which offers superior firewall traversal capability and an open-source nature, fostering widespread trust and community auditing. However, the most disruptive recent innovation is the ascendance of the WireGuard protocol, characterized by its remarkably small codebase, high speed, and cryptographic simplicity, which provides significant performance advantages over older, bulkier protocols, making it exceptionally suited for cloud environments and mobile connectivity where low battery drain and quick connection times are paramount. These protocols form the backbone of modern VPN server software, with vendors competing primarily on implementation quality, speed optimization, and integration with zero-trust principles.

A parallel and increasingly vital technological trend is the convergence of VPN server software functionalities within the broader Secure Access Service Edge (SASE) and Zero Trust Network Access (ZTNA) frameworks. While traditional VPNs grant full network access upon connection, ZTNA solutions, which utilize advanced server software, enforce "never trust, always verify" policies, granting access only to specific applications or resources based on user identity, device posture, and context. This evolution requires VPN server software to integrate deep policy engines, micro-segmentation capabilities, and continuous authentication features. The technology landscape is thus moving towards a unified platform where secure tunneling is just one component of a holistic identity-centric access control solution. Furthermore, the integration of advanced encryption standards, including post-quantum cryptography research, is becoming a differentiating factor, preparing the market for future cryptographic vulnerabilities that could render current encryption methods obsolete.

Cloud-native architecture and API-driven deployment are also essential technological components defining the modern market. VPN server software must now be deployable via infrastructure-as-code (IaC) principles, allowing for automated provisioning and scaling within public cloud environments (AWS, Azure, GCP). This requires vendors to offer robust application programming interfaces (APIs) for seamless integration with orchestration tools like Kubernetes and Terraform. Another critical technology is the use of specialized tunneling techniques, such as proprietary stealth modes or obfuscation layers, designed to bypass sophisticated firewalls and Deep Packet Inspection (DPI) systems, particularly in regions with highly restrictive internet policies. The continuous development of cross-platform clients that maintain consistent security and performance across Windows, macOS, Linux, iOS, and Android is also a baseline expectation, driven by the ubiquity of multi-device usage in the modern enterprise environment.

Regional Highlights

Regional dynamics heavily influence the adoption and feature requirements of VPN Server Software, reflecting varying levels of technological maturity, regulatory environments, and threat landscapes. North America, comprising the United States and Canada, leads the global market in terms of revenue share. This dominance is attributed to the presence of global technology giants, high concentration of intellectual property, early and extensive adoption of cloud services, and mandatory compliance with privacy mandates (e.g., CCPA). The North American market is highly mature, characterized by strong demand for ZTNA solutions and SASE integration, with enterprises prioritizing advanced security features, automated orchestration, and ultra-low latency protocols to support complex, geographically dispersed operations.

Europe represents the second-largest market, primarily propelled by the strict enforcement of the General Data Protection Regulation (GDPR), which mandates robust security measures for personal data processing. European organizations exhibit a strong preference for data sovereignty and high-compliance solutions. Germany, the UK, and France are major contributors, demonstrating robust demand for solutions that offer transparent auditing, strong data logging controls, and certified security standards. The move toward hybrid deployment models is strong in Europe, balancing existing infrastructure investments with the scalability offered by modern cloud-based VPN architectures, leading to a strong focus on vendors providing unified management across diverse environments.

The Asia Pacific (APAC) region is forecasted to be the fastest-growing market globally. This accelerated growth is fueled by rapid digitalization, massive infrastructural development (especially 5G rollout), and increasing awareness of cyber risks across key economies such as China, India, Japan, and South Korea. While the consumer segment is significant in APAC due to geo-restrictions and censorship, the enterprise segment is rapidly professionalizing, driven by multinational corporations expanding their operations and local governments introducing new data protection and cybersecurity frameworks. However, market adoption faces fragmentation challenges due to diverse regulatory landscapes and infrastructure quality variations across the continent, necessitating flexible deployment options and region-specific compliance features from vendors.

- North America: Market leader; driven by advanced cloud adoption, ZTNA implementation, and compliance needs (CCPA). High demand for premium, integrated cybersecurity solutions.

- Europe: Strong revenue base, mandated by GDPR compliance; focus on data sovereignty, privacy-enhancing technologies, and certified security standards.

- Asia Pacific (APAC): Highest projected growth rate; fueled by rapid digitalization, 5G deployment, and expanding enterprise adoption across emerging economies.

- Latin America (LATAM): Developing market; increasing internet penetration and rising cybercrime rates driving foundational security adoption, with an emphasis on cost-effective solutions.

- Middle East and Africa (MEA): Growth accelerating due to government-led smart city projects and digitalization of the oil and gas sector; prioritizing resilience and secure government communications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the VPN Server Software Market.- Cisco Systems Inc.

- Microsoft Corporation

- OpenVPN Inc.

- Palo Alto Networks

- Fortinet Inc.

- Check Point Software Technologies

- Pulse Secure LLC (Ivanti)

- SonicWall

- Zscaler Inc.

- Citrix Systems Inc.

- Nord Security (NordVPN Teams)

- ExpressVPN (Kape Technologies)

- Perimeter 81

- NCP Engineering GmbH

- NetMotion Software

- PureVPN

- Tunnello

- Sophos Group plc

- Huawei Technologies Co., Ltd.

- Array Networks

Frequently Asked Questions

Analyze common user questions about the VPN Server Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the VPN Server Software Market?

The primary driver is the widespread, mandatory shift toward remote and hybrid work models globally, requiring organizations to implement secure, reliable, and scalable access solutions for their distributed workforce to maintain business continuity and protect sensitive corporate data from external threats.

How does Zero Trust Network Access (ZTNA) differ from traditional VPN Server Software?

Traditional VPN software grants broad network access upon successful authentication, establishing a large secured perimeter. Conversely, ZTNA, often utilizing advanced VPN technology, enforces granular, identity-centric 'least-privilege' access, meaning users are only granted access to specific applications they need, drastically reducing the attack surface and adhering to the principle of "never trust, always verify."

Which VPN protocol is considered the fastest and most modern for enterprise use?

WireGuard is widely considered the fastest and most modern protocol due to its streamlined, smaller codebase, enhanced cryptographic primitives, and superior performance characteristics, particularly in terms of connection speed and throughput, making it highly effective for cloud and mobile deployments where latency is critical.

What impact does AI have on the security of VPN server solutions?

AI significantly enhances VPN security by integrating machine learning models to analyze network telemetry and encrypted traffic metadata for behavioral anomalies. This enables predictive threat detection, automated policy adjustments, and intelligent routing, moving security defense from reactive rule-based systems to proactive, adaptive frameworks capable of identifying sophisticated attacks.

Which geographic region holds the largest market share for VPN Server Software and why?

North America holds the largest market share, driven by its technological maturity, the high density of global technology headquarters, substantial early adoption of advanced cloud infrastructure, and a robust regulatory environment that mandates strong cybersecurity and data protection measures, such as the CCPA.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager