Wafer Inspection Equipment Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440872 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Wafer Inspection Equipment Market Size

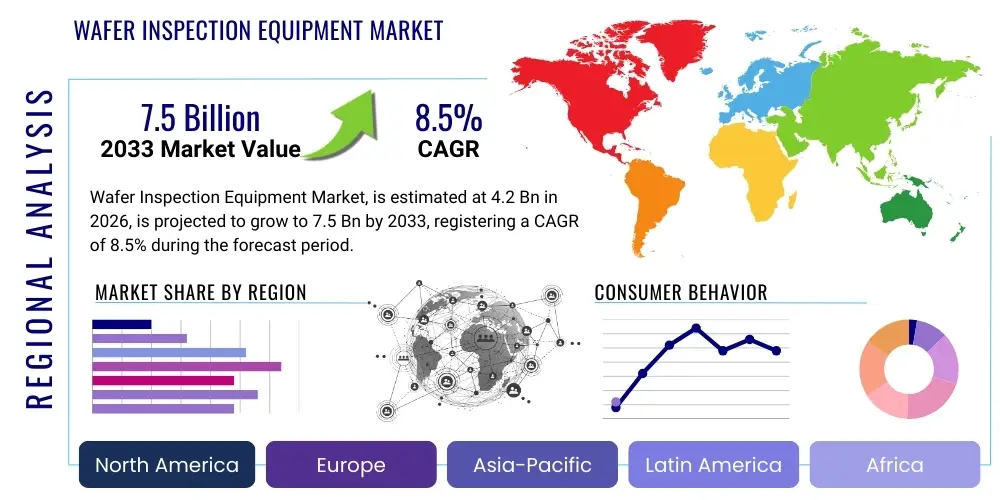

The Wafer Inspection Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 4.2 Billion in 2026 and is projected to reach USD 7.5 Billion by the end of the forecast period in 2033.

Wafer Inspection Equipment Market introduction

The Wafer Inspection Equipment Market is a critical segment within the semiconductor manufacturing industry, providing essential tools and technologies for detecting defects and ensuring quality throughout the wafer fabrication process. These sophisticated systems are designed to identify anomalies, particles, patterns, and electrical characteristics on semiconductor wafers, which are the foundational substrates for integrated circuits. The rigorous inspection is crucial for maximizing manufacturing yields, reducing costs associated with defective chips, and guaranteeing the reliability and performance of final electronic products. The market encompasses a broad range of equipment, from optical inspection systems using various light sources to advanced electron beam (e-beam) inspection tools capable of nanometer-scale defect detection.

Major applications of wafer inspection equipment span across the entire semiconductor production lifecycle, including front-end-of-line (FEOL) processes such like lithography and etching, where critical dimensions and pattern fidelity are paramount. They are equally vital in back-end-of-line (BEOL) processes such as metallization and dielectric deposition, and increasingly in advanced packaging stages. The benefits derived from these technologies are manifold: they enable early detection of process excursions, facilitate rapid root cause analysis, and provide invaluable feedback for process optimization. This leads to higher yields, faster time-to-market for new semiconductor products, and enhanced product quality, which are all non-negotiable in today's competitive electronics landscape.

Driving factors for the robust growth of this market include the relentless demand for smaller, more powerful, and energy-efficient electronic devices, fueled by the proliferation of smartphones, IoT devices, artificial intelligence (AI) applications, 5G technology, and high-performance computing. Furthermore, the increasing complexity of chip designs, the transition to advanced process nodes (e.g., 7nm, 5nm, 3nm), and the rising adoption of advanced packaging technologies like 3D ICs and chiplets necessitate more precise and comprehensive inspection capabilities. Geopolitical trends emphasizing localized semiconductor manufacturing and significant investments in new fabrication facilities worldwide are also providing substantial impetus to the market's expansion.

Wafer Inspection Equipment Market Executive Summary

The Wafer Inspection Equipment Market is experiencing substantial growth driven by persistent global demand for advanced semiconductors, which underpin virtually every modern electronic device. Business trends indicate a strong focus on automation, integration of AI and machine learning for enhanced defect detection and classification, and the development of in-line inspection systems to provide real-time process control. Semiconductor manufacturers are investing heavily in next-generation inspection tools to tackle the challenges posed by increasingly complex chip architectures, smaller feature sizes, and the stringent quality requirements for mission-critical applications in automotive, medical, and industrial sectors. Strategic collaborations between equipment suppliers and chip manufacturers are becoming more prevalent to co-develop tailored inspection solutions, optimizing for specific process nodes and material compositions. The industry also faces ongoing pressures to reduce the cost of ownership while delivering higher throughput and greater sensitivity.

Regionally, Asia Pacific continues to dominate the market, primarily due to the concentration of major semiconductor manufacturing hubs in countries like Taiwan, South Korea, China, and Japan. This region is witnessing significant capital expenditure on new fabs and expansion projects, directly translating into increased demand for wafer inspection equipment. North America and Europe are also experiencing growth, supported by government initiatives to bolster domestic semiconductor production, coupled with robust R&D activities and the presence of leading-edge technology developers. Investments in advanced packaging facilities in Southeast Asia further contribute to the regional market dynamics. Emerging markets are also slowly increasing their footprint in semiconductor assembly and test, leading to localized opportunities for certain types of inspection equipment.

From a segmentation perspective, the optical inspection segment maintains its market share due to its versatility and cost-effectiveness for various defect types, though e-beam inspection is gaining traction for its high-resolution capabilities crucial for sub-10nm nodes. The market is also seeing a shift towards integrated, multi-mode inspection platforms that combine different technologies to cover a wider range of defects and provide comprehensive wafer analysis. Foundries and Integrated Device Manufacturers (IDMs) remain the primary end-users, demanding state-of-the-art equipment to maintain competitive edge and achieve high yields. The trend towards larger wafer sizes, particularly 300mm, continues to drive demand for compatible, high-throughput inspection solutions, with future developments already exploring 450mm capabilities, although at a slower pace than initially anticipated.

AI Impact Analysis on Wafer Inspection Equipment Market

User inquiries regarding AI's impact on the Wafer Inspection Equipment Market frequently center on its potential to revolutionize defect detection accuracy, speed, and automation. Common questions include how AI can reduce false positives, whether it can handle the complexity of new defect types at advanced nodes, and its role in predictive maintenance and process optimization. Users are keen to understand the extent to which AI will integrate into existing inspection workflows, the benefits it offers in terms of cost reduction and yield improvement, and the challenges associated with its implementation, such as data management and algorithm development. Expectations are high for AI to enable more intelligent decision-making, moving beyond simple defect identification to comprehensive root cause analysis and proactive quality control in real-time.

- AI-powered defect classification significantly improves accuracy by learning from vast datasets of defect images, reducing human error and operator subjectivity.

- Machine learning algorithms enhance the speed of defect detection and analysis, enabling faster feedback loops for process control and increased throughput.

- Predictive analytics driven by AI allows for early identification of potential process excursions, facilitating proactive adjustments before significant yield losses occur.

- AI-driven automation reduces the need for constant human intervention, optimizing labor costs and allowing skilled personnel to focus on more complex tasks.

- Deep learning techniques enable the detection of subtle and complex defect patterns that might be missed by traditional rule-based inspection systems, particularly at advanced technology nodes.

- AI facilitates the creation of adaptive inspection recipes, allowing equipment to dynamically adjust inspection parameters based on real-time process variations and defect trends.

- Enhanced data integration and analysis capabilities, leveraging AI, provide a holistic view of manufacturing processes, connecting inspection data with other fab data for comprehensive process optimization.

DRO & Impact Forces Of Wafer Inspection Equipment Market

The Wafer Inspection Equipment Market is fundamentally shaped by a confluence of drivers, restraints, and opportunities, all influenced by various impact forces. The primary drivers include the exponential growth in demand for semiconductors across diverse industries like automotive, consumer electronics, telecommunications (5G), and artificial intelligence. The continuous pursuit of miniaturization and higher performance in integrated circuits necessitates increasingly sophisticated inspection capabilities to maintain yields at advanced process nodes (e.g., 7nm, 5nm, and beyond). Furthermore, the rising complexity of chip designs, including multi-layer structures and 3D integration, compounds the challenge of defect detection, thereby fueling demand for more precise and sensitive inspection tools. The imperative for faster time-to-market for new electronic devices also drives the adoption of advanced inspection technologies that can accelerate process qualification and yield ramp-up.

However, the market faces significant restraints. The exceptionally high capital investment required for cutting-edge wafer inspection equipment poses a barrier for smaller manufacturers and limits rapid adoption cycles. The rapid pace of technological obsolescence in the semiconductor industry means that equipment must be continuously updated or replaced, leading to substantial ongoing costs. Economic downturns and geopolitical uncertainties, such as trade disputes or supply chain disruptions, can significantly impact investment decisions in semiconductor manufacturing, consequently affecting the demand for inspection equipment. Additionally, the increasing difficulty of inspecting ultra-small defects at the atomic scale, coupled with the need for non-destructive methods, presents ongoing technical challenges that restrain the development and deployment of certain advanced solutions. A shortage of skilled personnel capable of operating and maintaining these complex systems also contributes to operational bottlenecks.

Despite these challenges, numerous opportunities exist. The advent of artificial intelligence and machine learning offers significant potential to enhance defect detection accuracy, automate analysis, and provide predictive maintenance capabilities, thereby optimizing inspection processes. The growing trend towards advanced packaging technologies, such as system-in-package (SiP), chiplets, and 3D stacked ICs, opens new avenues for specialized inspection solutions tailored for these complex assemblies. Emerging applications in quantum computing, specialized automotive electronics (e.g., autonomous driving), and high-reliability industrial control systems demand zero-defect manufacturing, thereby creating a strong pull for advanced inspection. The development of novel non-destructive testing methods, alongside collaborative research and development efforts between equipment manufacturers, foundries, and academic institutions, also presents significant growth opportunities. These dynamics are further influenced by impact forces such as technological advancements in optics, electron microscopy, and data analytics, as well as the competitive landscape which drives continuous innovation. Supply chain resilience, government incentives for domestic semiconductor manufacturing, and stringent quality control standards also act as powerful forces shaping the market's trajectory.

Segmentation Analysis

The Wafer Inspection Equipment Market is diverse, segmented across various parameters that reflect the technological nuances, application requirements, and end-user demands within the semiconductor industry. These segments are critical for understanding market dynamics, competitive landscapes, and future growth trajectories. The complex nature of semiconductor manufacturing necessitates specialized equipment for different stages of production and defect types, leading to a granular market structure that caters to a wide array of specific needs, from basic particle detection to advanced structural analysis at atomic resolutions.

- By Type

- Optical Inspection: Utilizes various light sources (broadband, DUV, UV) for surface defect detection, pattern inspection, and critical dimension measurement. It is widely used due to its speed and versatility.

- E-beam Inspection (Electron Beam Inspection): Employs electron beams for ultra-high-resolution defect detection, particularly critical for sub-10nm nodes where optical methods may lack sensitivity. Provides detailed structural and material information.

- X-ray Inspection: Used for detecting defects within multi-layer structures and advanced packaging, offering non-destructive volumetric analysis for hidden features.

- Infrared Inspection: Suitable for detecting subsurface defects or defects in opaque materials, often used in backend processes or for certain material characterizations.

- Acoustic/Ultrasonic Inspection: Employed for detecting delamination, voids, and other internal defects, especially relevant in packaging and bond inspection.

- Thermal Inspection: Used to identify thermal anomalies and hot spots, indicating potential electrical defects or performance issues in operational wafers.

- By Application

- Front-End-of-Line (FEOL) Inspection: Critical for early stages of wafer fabrication, including substrate inspection, lithography process control, and film deposition quality checks.

- Back-End-of-Line (BEOL) Inspection: Focuses on interconnect layers, metallization, and dielectric integrity, ensuring proper electrical pathways and insulation.

- Advanced Packaging Inspection: Specialized inspection for 3D ICs, SiP, WLP (Wafer Level Packaging), and other advanced packaging techniques to detect defects related to stacking, bumping, and bonding.

- Process Control and Monitoring: Integrated systems that provide real-time feedback for process optimization, defect trend analysis, and yield management.

- R&D and Failure Analysis: High-resolution tools used in laboratories for characterization of new materials, process development, and detailed investigation of device failures.

- By End-User

- Foundries: Independent semiconductor manufacturers that produce chips for fabless companies, requiring broad inspection capabilities for diverse product lines.

- Integrated Device Manufacturers (IDMs): Companies that design, manufacture, and sell their own chips, necessitating highly integrated and proprietary inspection solutions.

- Outsourced Semiconductor Assembly and Test (OSAT) Companies: Firms specializing in packaging and testing of semiconductors, demanding inspection tools for post-fabrication quality control.

- Memory Manufacturers: Companies focused on producing memory chips (DRAM, NAND), requiring high-throughput inspection for repetitive structures.

- Research Institutions and Universities: Utilize inspection equipment for academic research, material science studies, and training purposes.

- By Wafer Size

- 200mm Wafer Inspection: Continues to be relevant for legacy devices, power semiconductors, and niche applications.

- 300mm Wafer Inspection: The dominant wafer size for high-volume manufacturing of advanced logic and memory, driving demand for high-throughput, automated systems.

- 450mm Wafer Inspection: Future-oriented segment, though adoption has been slower than anticipated, represents potential for next-generation facilities.

- By Product Type

- Stand-alone Wafer Inspection Systems: Dedicated machines for specific inspection tasks, often used offline or for specialized analysis.

- In-line Wafer Inspection Systems: Integrated directly into the manufacturing line, providing real-time feedback and automated material handling, crucial for efficient production.

- Automated Optical Inspection (AOI) Systems: Highly automated optical systems for rapid, high-volume defect detection.

- Automated E-beam Inspection (AEI) Systems: Automated electron beam systems offering unparalleled resolution for advanced nodes.

Value Chain Analysis For Wafer Inspection Equipment Market

The value chain for the Wafer Inspection Equipment Market is intricate, involving various stages from raw material procurement to end-user deployment and service. Upstream activities primarily involve the research and development of core technologies such as advanced optics, electron microscopy, imaging sensors, software algorithms for defect detection, and precision mechanics. Key players in this segment are component manufacturers providing high-resolution cameras, lasers, electron sources, vacuum systems, robotics, and advanced materials. These suppliers are critical for the performance and innovation of the final inspection equipment. Intellectual property development and patents play a significant role here, as equipment manufacturers heavily invest in proprietary technologies to gain a competitive edge in sensitivity, speed, and accuracy.

Midstream activities are dominated by the Wafer Inspection Equipment manufacturers themselves. These companies integrate various components and technologies to design, assemble, and test the complex inspection systems. This stage involves sophisticated engineering, software development, and system integration to produce reliable, high-performance equipment. Manufacturing processes for these highly precise machines require specialized facilities, skilled technicians, and rigorous quality control protocols. Companies often engage in extensive R&D to continuously improve their products, developing new inspection methodologies, enhancing automation, and incorporating advanced analytical capabilities like AI and machine learning to address the evolving challenges of semiconductor manufacturing at smaller nodes. Customization of equipment for specific customer requirements, wafer sizes, and process steps is also a common practice at this stage.

Downstream activities focus on the distribution, sales, installation, and after-sales support of the wafer inspection equipment. Distribution channels include direct sales forces, regional sales offices, and sometimes third-party distributors or agents, particularly in regions where manufacturers do not have a strong direct presence. Direct channels allow for closer customer relationships, technical consultation, and quicker problem resolution, which are crucial for complex capital equipment. Indirect channels, while offering broader market reach, typically involve partners with specialized knowledge of the local semiconductor industry. After-sales service, including equipment maintenance, calibration, spare parts supply, and software upgrades, is a critical component of the value chain, ensuring high uptime and optimal performance for end-users. Technical training for customer personnel is also essential. The final end-users are primarily semiconductor foundries, IDMs, and OSAT companies, who integrate this equipment into their fabrication lines to ensure product quality and yield management. The entire value chain is characterized by a high degree of technical expertise, capital intensity, and a strong emphasis on continuous innovation.

Wafer Inspection Equipment Market Potential Customers

The primary potential customers for wafer inspection equipment are integral players within the semiconductor ecosystem, all operating with a common objective: ensuring the highest quality and yield for their semiconductor products. Leading the demand are semiconductor foundries, which are specialized manufacturing facilities that produce integrated circuits for numerous fabless design companies. These foundries, such as TSMC, Samsung Foundry, and GlobalFoundries, operate at the cutting edge of process technology and require an extensive array of advanced inspection tools to manage diverse customer designs, maintain tight process control, and achieve high yields across a wide range of product types and process nodes. Their continuous investment in new fabs and technology upgrades directly translates into significant demand for sophisticated wafer inspection equipment capable of detecting minute defects at sub-nanometer scales.

Another crucial customer segment comprises Integrated Device Manufacturers (IDMs) like Intel, Samsung Electronics (for its memory and logic divisions), and Micron Technology. IDMs design, manufacture, and sell their own semiconductor devices, ranging from microprocessors and memory chips to specialized ICs. For IDMs, in-house inspection capabilities are vital for proprietary process development, maintaining competitive advantages, and ensuring the quality and reliability of their own product lines. They typically seek highly integrated and customized inspection solutions that can seamlessly fit into their specific manufacturing workflows and R&D pipelines. The sheer volume and complexity of their production make advanced, high-throughput inspection equipment indispensable for achieving their yield and quality targets.

Outsourced Semiconductor Assembly and Test (OSAT) companies, including Amkor Technology, ASE Technology Holding, and JCET Group, represent a growing segment of potential customers. These companies specialize in the assembly, packaging, and testing of semiconductor components after the wafer fabrication process. As advanced packaging technologies become more complex, encompassing 3D stacking, wafer-level packaging, and heterogeneous integration, the need for robust inspection at the assembly and test stages intensifies. OSATs require specialized inspection equipment to detect defects related to bumping, bonding, molding, and interconnect integrity, ensuring the reliability and performance of the final packaged device before it reaches the end product manufacturer. Furthermore, research institutions and universities involved in semiconductor material science and process development also constitute niche but significant customers, requiring inspection tools for fundamental research and advanced prototyping.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.2 Billion |

| Market Forecast in 2033 | USD 7.5 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | KLA Corporation, Applied Materials, Hitachi High-Tech Corporation, JEOL Ltd., ASML Holding N.V., Nikon Corporation, ZEISS Group, Nova Measuring Instruments Ltd., Camtek Ltd., Onto Innovation Inc. (formerly Rudolph Technologies), Tokyo Electron Limited (TEL), Advantest Corporation, SCREEN Holdings Co., Ltd., Lasertec Corporation, Accretech (Tokyo Seimitsu), SEMES Co. Ltd., United Microelectronics Corporation (UMC) (as an end-user and technology partner), Samsung Electronics (as an end-user and technology developer), Intel Corporation (as an end-user and technology developer), Canon Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wafer Inspection Equipment Market Key Technology Landscape

The wafer inspection equipment market is characterized by a dynamic and continuously evolving technology landscape, driven by the relentless pursuit of smaller feature sizes, higher integration density, and stricter quality demands in semiconductor manufacturing. Optical inspection technologies form the backbone of the market, leveraging advanced illumination techniques such as deep ultraviolet (DUV) light sources, broadband plasma, and patterned light to detect surface defects and measure critical dimensions. These systems incorporate sophisticated imaging sensors, high-resolution lenses, and advanced algorithms for rapid defect detection and classification across large wafer areas. Innovations in optical inspection focus on improving sensitivity to ever-smaller defects, enhancing throughput, and developing multi-mode systems that combine different optical techniques for comprehensive defect coverage.

Complementing optical methods, electron beam (e-beam) inspection technologies are becoming increasingly vital, especially for advanced process nodes below 10nm. E-beam systems offer unparalleled resolution, enabling the detection of minute defects and analysis of complex structures that are beyond the capabilities of optical systems. Recent advancements include multi-beam e-beam architectures that significantly boost throughput, addressing a long-standing challenge of e-beam technology. Alongside these, technologies like X-ray inspection provide non-destructive analysis for subsurface defects and advanced packaging, while atomic force microscopy (AFM) and scanning electron microscopy (SEM) are used for high-resolution defect review and failure analysis. The integration of artificial intelligence (AI) and machine learning (ML) algorithms is a transformative trend across all inspection technologies. AI enhances defect classification accuracy, reduces false positives, enables predictive maintenance, and facilitates real-time process control by analyzing vast datasets of inspection images and process parameters. This allows for more intelligent decision-making and automated recipe optimization, significantly improving overall equipment efficiency and yield management.

Further technological developments encompass advanced robotics and automation for precision wafer handling, ensuring minimal contamination and damage during the inspection process. Sophisticated software platforms are being developed to manage and analyze the enormous volume of data generated by inspection tools, providing actionable insights for process engineers. Metrology capabilities are often integrated with inspection systems to provide precise measurements of film thickness, critical dimensions, and material properties. The ongoing research into novel inspection techniques, such as those based on acoustic waves or thermal properties, aims to address specific challenges in advanced materials and device architectures. Furthermore, the push towards 3D ICs and heterogeneous integration is driving the development of specialized inspection tools capable of analyzing stacked dies, micro-bumps, and through-silicon vias (TSVs). The industry is also exploring in-line inspection solutions that provide continuous monitoring and immediate feedback, moving away from purely offline or batch inspection processes to enable a more proactive and agile manufacturing environment.

Regional Highlights

- Asia Pacific (APAC): Dominates the Wafer Inspection Equipment Market, largely driven by the presence of major semiconductor manufacturing hubs in Taiwan, South Korea, China, and Japan. These countries are home to leading foundries, IDMs, and OSATs, which are continuously expanding their production capacities and investing in advanced process technologies. Government incentives and significant capital expenditure on new fabrication facilities across the region further fuel demand for state-of-the-art inspection equipment. China's ambitious goals for semiconductor self-sufficiency and substantial investments in domestic manufacturing are notable growth drivers.

- North America: A significant market for wafer inspection equipment, characterized by a strong ecosystem of innovation, research & development, and the presence of leading-edge technology companies. Initiatives to bolster domestic semiconductor manufacturing and supply chain resilience are driving investments in new fabs and upgrades, particularly for advanced logic and specialty devices. The region also hosts major equipment manufacturers, contributing to technological advancements and market growth.

- Europe: Exhibits steady growth, supported by a focus on niche high-value semiconductor applications in automotive, industrial, and communication sectors. Efforts to strengthen the European semiconductor ecosystem through public-private partnerships and substantial investments in R&D and manufacturing capacity are creating demand for advanced inspection solutions. Countries like Germany, France, and the Netherlands are key contributors due to their strong industrial bases and research capabilities.

- Latin America, Middle East, and Africa (MEA): Currently represent smaller market shares but are showing nascent growth, particularly in areas related to semiconductor assembly, packaging, and testing operations. Increased global interest in diversifying semiconductor supply chains and developing localized manufacturing capabilities could drive future demand for inspection equipment in these regions, though from a relatively lower base.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wafer Inspection Equipment Market.- KLA Corporation

- Applied Materials

- Hitachi High-Tech Corporation

- JEOL Ltd.

- ASML Holding N.V.

- Nikon Corporation

- ZEISS Group

- Nova Measuring Instruments Ltd.

- Camtek Ltd.

- Onto Innovation Inc. (formerly Rudolph Technologies)

- Tokyo Electron Limited (TEL)

- Advantest Corporation

- SCREEN Holdings Co., Ltd.

- Lasertec Corporation

- Accretech (Tokyo Seimitsu)

- SEMES Co. Ltd.

- Canon Inc.

- ASML HMI (a joint venture focused on e-beam metrology and inspection)

Frequently Asked Questions

What is wafer inspection equipment and why is it crucial for semiconductor manufacturing?

Wafer inspection equipment consists of specialized tools used to detect defects, anomalies, and contaminants on semiconductor wafers during various stages of the manufacturing process. It is crucial because it ensures the quality, reliability, and yield of integrated circuits, preventing defective chips from progressing further in production and thereby reducing overall manufacturing costs and improving product performance.

How does AI impact the performance and capabilities of wafer inspection equipment?

AI significantly enhances wafer inspection by improving defect detection accuracy, speeding up classification, and automating analysis. Machine learning algorithms enable systems to identify subtle patterns, reduce false positives, and provide predictive insights for process control, leading to higher efficiency, lower operational costs, and superior yield management.

What are the primary types of wafer inspection equipment?

The primary types include optical inspection systems (using DUV, broadband, or patterned light for surface and pattern defects), electron beam (e-beam) inspection systems (for ultra-high-resolution defect detection at advanced nodes), X-ray inspection (for subsurface and internal defects), and infrared inspection (for defects in opaque materials).

Which regions are leading in the demand for wafer inspection equipment?

The Asia Pacific (APAC) region leads the demand for wafer inspection equipment, driven by major semiconductor manufacturing operations in Taiwan, South Korea, China, and Japan. North America and Europe also represent significant markets due to advanced R&D and renewed investments in domestic semiconductor production.

What are the key drivers for growth in the Wafer Inspection Equipment Market?

Key drivers include the surging global demand for advanced electronics, the continuous miniaturization of chips, the increasing complexity of semiconductor designs, the expansion of 5G, AI, and IoT technologies, and the critical need for higher manufacturing yields and stringent quality control at advanced process nodes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager