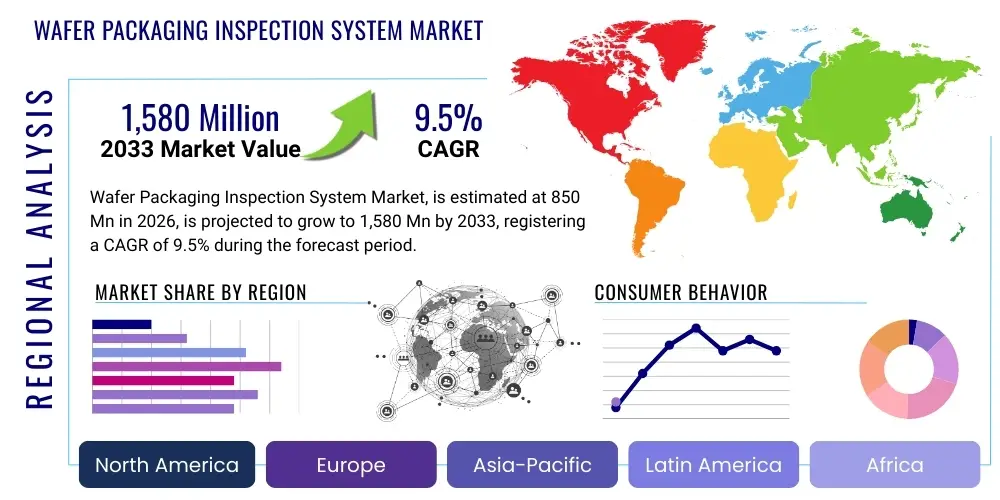

Wafer Packaging Inspection System Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441505 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Wafer Packaging Inspection System Market Size

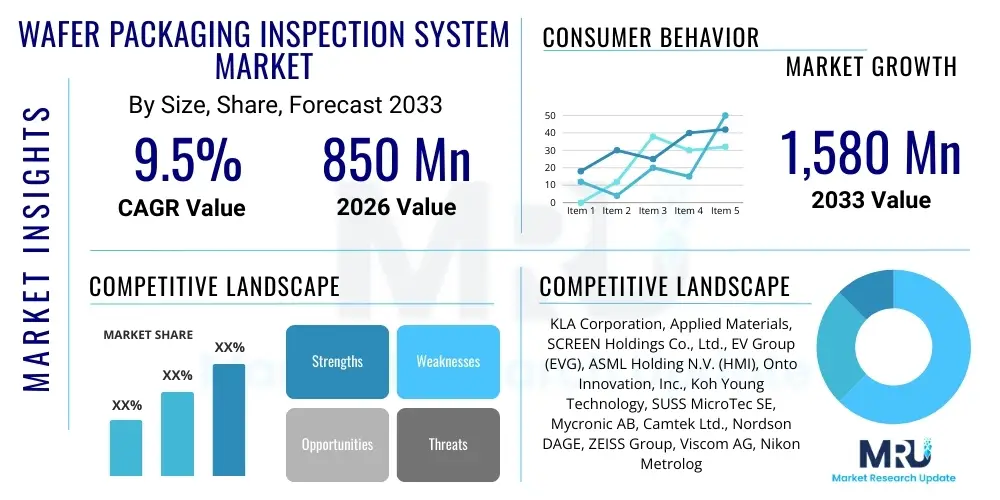

The Wafer Packaging Inspection System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. This robust expansion is primarily driven by the escalating demand for high-performance, miniaturized semiconductor devices, necessitating stringent quality control in advanced packaging technologies like 2.5D, 3D stacking, and Fan-Out Wafer-Level Packaging (FO-WLP). The market is estimated at $850 million in 2026 and is projected to reach $1,580 million by the end of the forecast period in 2033.

Wafer Packaging Inspection System Market introduction

The Wafer Packaging Inspection System Market encompasses sophisticated technological solutions designed to meticulously examine semiconductor wafers and packaged chips for structural defects, contamination, and alignment issues prior to final assembly and testing. These systems are critical components in the back-end semiconductor manufacturing process, ensuring the reliability and functional integrity of complex integrated circuits (ICs). The primary product categories include automated optical inspection (AOI), X-ray inspection systems, and specialized metrology tools that utilize advanced imaging algorithms and machine learning for high-speed, high-resolution defect detection.

The core function of these inspection systems is to facilitate zero-defect manufacturing, addressing the challenges posed by decreasing feature sizes and the complexity introduced by heterogenous integration. Major applications span across consumer electronics, automotive components (especially in advanced driver-assistance systems or ADAS), high-performance computing (HPC), and telecommunications infrastructure (5G/6G). Key benefits derived from adopting these systems include significantly reduced yield loss, enhanced manufacturing throughput, and the ability to maintain compliance with increasingly stringent quality standards demanded by high-reliability end-use sectors like aerospace and medical devices.

Driving factors propelling market growth include the global transition towards advanced packaging methods, which inherently require multi-layer and highly precise interconnection inspection; the persistent demand for faster data processing capabilities requiring high-density interconnects; and substantial capital investments made by leading foundries and outsourced semiconductor assembly and test (OSAT) providers into next-generation production lines. Furthermore, the necessity for sophisticated three-dimensional defect mapping capabilities in advanced memory and logic components acts as a constant catalyst for innovation within the inspection system sector.

Wafer Packaging Inspection System Market Executive Summary

The Wafer Packaging Inspection System Market is characterized by intense technological competition, with a predominant focus on integrating artificial intelligence and deep learning methodologies to enhance defect classification accuracy and minimize false positives during high-volume production runs. Key business trends include the consolidation of inspection providers offering integrated metrology solutions, alongside a strong push toward providing comprehensive software suites that allow for predictive maintenance and real-time process control across disparate manufacturing stages. Strategic alliances between equipment manufacturers and leading semiconductor foundries are pivotal for developing application-specific inspection algorithms tailored for emerging packaging types, such as chiplets and silicon interposers.

Geographically, the Asia Pacific (APAC) region dominates the market, primarily fueled by the presence of major semiconductor manufacturing hubs in countries including China, Taiwan, South Korea, and Japan, which are aggressively expanding their capacity for advanced packaging. North America and Europe maintain critical roles as centers for technological innovation, particularly concerning advanced AI integration and the development of highly specialized X-ray and acoustic microscopy systems, driven by stringent quality requirements in their respective defense and high-tech industrial sectors. The expansion of OSAT operations into Southeast Asia is simultaneously driving localized demand for efficient inspection infrastructure in emerging manufacturing nations.

In terms of segment trends, the Automated Optical Inspection (AOI) segment maintains the largest market share due to its cost-effectiveness and high throughput in standard wafer-level processes. However, the X-ray Inspection Systems segment is projected to exhibit the fastest growth rate, necessitated by the proliferation of opaque defects hidden beneath multiple layers in 2.5D and 3D stacked packages, where traditional optical methods are insufficient. The Fan-Out Wafer Level Packaging (FO-WLP) application segment is also demonstrating accelerated growth as it becomes the preferred packaging solution for high-density mobile and automotive processors, demanding ultra-high precision inspection capabilities for reconstituted wafers and fine pitch redistribution layers (RDLs).

AI Impact Analysis on Wafer Packaging Inspection System Market

Common user questions regarding the impact of Artificial Intelligence (AI) frequently center on its ability to overcome the limitations of traditional rule-based inspection systems, specifically concerning the detection of subtle or novel defects (known as 'nuisance defects') and the reduction of human intervention during defect review. Users are keenly interested in how AI-powered tools, leveraging deep learning and computer vision, can achieve near-perfect classification accuracy while significantly accelerating inspection cycle times. Another major area of inquiry revolves around the computational infrastructure required to support these algorithms and the necessity of generating vast, labeled datasets for effective model training, particularly for non-standard or custom packaging architectures. Expectations are high that AI will transform defect classification from a statistical control process into a precise, predictive quality assurance mechanism, thereby revolutionizing yield management strategies across the industry.

The integration of AI, particularly via deep neural networks, into wafer packaging inspection systems is paramount for handling the exponential increase in data volume generated by high-resolution sensors and for interpreting the complex, nuanced patterns associated with nanoscale defects. AI algorithms excel at identifying subtle variations that may evade human operators or predetermined thresholds, offering superior sensitivity to critical defects such as micro-cracks, voiding in solder bumps, and slight misalignments in micro-bumps and Through Silicon Vias (TSVs). This enhancement leads directly to improved manufacturing yields and reduces the operational cost associated with manual review stages.

Furthermore, AI is instrumental in facilitating truly predictive maintenance and process optimization. By correlating inspection data across multiple production steps and employing machine learning models, manufacturers can predict potential future failure points or process drifts before they lead to catastrophic yield loss. This transition from reactive defect detection to proactive yield management represents a fundamental shift in semiconductor manufacturing quality control, solidifying AI’s role not just as an inspection tool, but as a core component of overall manufacturing intelligence platforms, enabling closed-loop feedback systems for equipment adjustment and process refinement.

- Enhanced Defect Classification Accuracy: Deep learning significantly improves the distinction between critical defects and non-critical noise (false positives).

- Accelerated Throughput: AI enables real-time, high-speed image processing and automated decision-making, reducing inspection cycle times.

- Predictive Yield Management: Machine learning models analyze historical defect data to forecast process deviations and potential yield threats.

- Reduced Human Bias: Automation of defect review minimizes reliance on human operators, ensuring consistent inspection standards across shifts and sites.

- Enabling Heterogeneous Integration: AI is essential for inspecting complex 3D structures and non-uniform materials in advanced packaging.

DRO & Impact Forces Of Wafer Packaging Inspection System Market

The market dynamics are significantly influenced by the continuous technological escalation within the semiconductor industry, characterized by the persistent push toward miniaturization and higher integration density, acting as the primary driver. Simultaneously, the market faces strong headwinds from the extremely high capital expenditure required for acquiring and maintaining these sophisticated inspection tools, coupled with the need for highly specialized technical expertise to operate and interpret the results. Opportunities abound in the burgeoning adoption of 5G/6G technology and the electrification of the automotive sector, which necessitate exceptionally reliable chip packaging. The impact forces are currently skewed towards high market growth potential, mandated by the critical necessity of zero-defect quality assurance in emerging high-reliability applications, thus making investment in advanced inspection technologies unavoidable for competitive players.

Drivers: The transition from planar 2D integration to advanced 2.5D and 3D stacking mandates non-optical, high-resolution inspection capabilities, fundamentally driving system complexity and adoption. The relentless consumer demand for smaller, faster, and more power-efficient devices, such as flagship smartphones and sophisticated IoT devices, directly translates into the need for high-quality Fan-Out Wafer-Level Packaging (FO-WLP) and Flip Chip packaging, which in turn requires rigorous inspection at the wafer level. Furthermore, the increasing complexity of Redistribution Layers (RDLs) and the use of Through Silicon Vias (TSVs) make traditional inspection inadequate, accelerating the requirement for integrated metrology and advanced Automated X-ray Inspection (AXI).

Restraints: The primary restraint remains the prohibitive cost associated with the procurement and maintenance of state-of-the-art inspection systems, which can represent a significant financial barrier, particularly for smaller and mid-sized OSATs. Furthermore, the development of universal inspection algorithms is challenging due to the high degree of customization and variation in packaging materials and designs across different manufacturers and process nodes. The substantial computational requirements and the necessity for highly specialized technical personnel to manage and interpret data from AI-powered systems also restrict broader accessibility and faster deployment rates globally.

Opportunities: Significant market opportunities exist in emerging applications, specifically the rapid proliferation of electric vehicles (EVs) and autonomous driving systems, where semiconductor failures can have catastrophic consequences, driving demand for superior reliability verification. The ongoing global expansion of outsourced semiconductor assembly and test (OSAT) infrastructure, especially in emerging economies, creates localized demands for new inspection capacity. Moreover, the development of hybrid inspection systems that combine the strengths of AOI, X-ray, and Scanning Acoustic Microscopy (SAM) into a single platform offers attractive value propositions for comprehensive defect coverage.

Segmentation Analysis

The Wafer Packaging Inspection System Market is meticulously segmented based on the technology deployed, the specific type of advanced packaging being inspected, and the ultimate end-use industry that utilizes the packaged chips. This multi-dimensional segmentation allows market participants to tailor their technological offerings to specific requirements, such as high-throughput optical inspection for general wafer bumping versus detailed non-destructive X-ray analysis required for multi-layered 3D packages. Understanding these segments is crucial for identifying areas of accelerated growth, particularly within the advanced packaging application segment which is dictated by leading-edge foundry investment cycles and evolving consumer technology demands.

- By Type:

- Automated Optical Inspection (AOI)

- X-ray Inspection Systems (AXI)

- Scanning Acoustic Microscopy (SAM)

- Confocal Microscopy

- Hybrid/Integrated Systems

- By Packaging Technology:

- Fan-Out Wafer Level Packaging (FO-WLP)

- Fan-In Wafer Level Packaging (FI-WLP)

- 2.5D/3D Packaging (using TSV and Micro-bumps)

- Flip Chip and BGA Packaging

- Wafer Bumping Inspection

- By End-Use Industry:

- Consumer Electronics (Mobile Devices, PCs)

- Automotive (ADAS, Power Electronics)

- Industrial and Manufacturing

- Telecommunications (5G Infrastructure)

- Healthcare and Medical Devices

- Aerospace and Defense

Value Chain Analysis For Wafer Packaging Inspection System Market

The value chain for Wafer Packaging Inspection Systems begins with upstream activities focused on the sophisticated design and manufacturing of critical components, including high-resolution sensors, specialized optics, advanced robotics for wafer handling, and high-speed computational units necessary for data processing. Key upstream players include specialized sensor manufacturers and software developers who create the fundamental algorithms for image recognition and metrology. This stage is characterized by high intellectual property barriers and intense R&D investment focused on enhancing resolution and speed. Procurement of exotic materials for robust system construction and ensuring supply chain resilience for critical components like lasers and high-speed cameras are vital determinants of upstream operational efficiency and product differentiation.

The midstream involves the core activities of the major equipment vendors, encompassing the assembly, integration, calibration, and final testing of the complex inspection machinery. This stage requires seamless integration of hardware and software components, coupled with comprehensive quality control procedures before deployment. Distribution channels are predominantly direct, given the high complexity and cost of the equipment, requiring specialized sales engineers and extensive post-sale support. Direct engagement ensures that customized solutions, necessary for specific foundry or OSAT process requirements, are implemented effectively. Indirect channels, primarily through local agents or distributors, are sometimes utilized for penetration into smaller or geographically challenging markets, though this typically applies more to ancillary equipment rather than the flagship inspection platforms.

Downstream activities involve the end-users—primarily Integrated Device Manufacturers (IDMs), Foundries, and Outsourced Semiconductor Assembly and Test (OSAT) providers—who deploy the systems within their manufacturing lines. The effective utilization of the equipment relies heavily on ongoing service agreements, software updates, and training provided by the equipment vendor. The downstream segment is defined by the high uptime requirements and the necessity for continuous calibration to ensure reliable defect detection across various production batches. Feedback from these end-users regarding new defect types and performance metrics is crucial for driving the R&D and future product iterations of the upstream manufacturers, ensuring a continuous loop of innovation dictated by real-world manufacturing challenges.

Wafer Packaging Inspection System Market Potential Customers

The potential customer base for Wafer Packaging Inspection Systems is highly concentrated within the semiconductor ecosystem, primarily comprising entities directly involved in the back-end processing and assembly of semiconductor devices. Integrated Device Manufacturers (IDMs) represent a significant customer segment as they seek full control over their process quality, often requiring custom inspection solutions tailored to their proprietary chip architectures and process flows. These IDMs utilize the systems for in-line quality control during their own captive packaging operations, especially for high-value components like CPUs, GPUs, and specialized memory devices where yield management is paramount.

Outsourced Semiconductor Assembly and Test (OSAT) providers form the largest and fastest-growing customer group. As semiconductor fabrication becomes increasingly fragmented, OSATs handle a vast majority of the world's packaging needs, encompassing everything from traditional wire bonding to cutting-edge 3D integration. Their need for high-throughput, flexible inspection systems capable of handling diverse package types efficiently drives their purchasing decisions. Given the competitive nature of the OSAT industry, investment in state-of-the-art inspection technology is a mandatory prerequisite for securing contracts with major fabless semiconductor companies seeking stringent quality adherence.

Additionally, specialized Foundries that focus on advanced technologies, such as silicon photonics or specialized MEMS (Micro-Electro-Mechanical Systems), also constitute critical buyers. Research institutions and university labs engaging in advanced semiconductor material science or novel packaging technique development occasionally procure these systems for academic or pre-commercial R&D purposes. The continuous push towards advanced packaging driven by the automotive industry's electrification trend means that Tier 1 automotive component suppliers are becoming increasingly influential in dictating inspection requirements and system specifications, indirectly driving demand.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $850 Million |

| Market Forecast in 2033 | $1,580 Million |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | KLA Corporation, Applied Materials, SCREEN Holdings Co., Ltd., EV Group (EVG), ASML Holding N.V. (HMI), Onto Innovation, Inc., Koh Young Technology, SUSS MicroTec SE, Mycronic AB, Camtek Ltd., Nordson DAGE, ZEISS Group, Viscom AG, Nikon Metrology, Toray Engineering Co., Ltd., Rudolph Technologies, Accretech, Yield Engineering Systems (YES), Nanometrics Incorporated, Scientech Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wafer Packaging Inspection System Market Key Technology Landscape

The technological landscape of the Wafer Packaging Inspection System market is rapidly evolving, driven by the necessity to inspect structures at ever-decreasing dimensions and through opaque materials. The current focus is on integrating multi-modal sensing capabilities within a single platform to maximize defect coverage. Automated Optical Inspection (AOI) remains foundational but has evolved significantly, incorporating high-speed, high-magnification optics, specialized illumination techniques (such as dark field, bright field, and multiple angle lighting), and advanced 3D topographical reconstruction methods to accurately measure height and profile variations in solder bumps and redistribution layers (RDLs). Furthermore, the trend toward combining AOI with sophisticated spectroscopy is gaining traction for material composition analysis alongside visual defect detection.

A critical shift is the increased prominence of non-destructive testing technologies. X-ray Inspection Systems (AXI), particularly those utilizing computed tomography (CT) and laminography, are essential for penetrating multiple layers in 2.5D and 3D packages to detect defects like voids, head-in-pillow defects, and micro-cracks hidden beneath the surface of the chip or within Through Silicon Vias (TSVs). Similarly, Scanning Acoustic Microscopy (SAM) plays a crucial role in non-contact inspection for detecting internal flaws such as delamination, voids, and non-bonds between material interfaces, which are common failure modes in stacked die structures and molding compounds. The performance metrics for these systems—resolution, throughput, and repeatability—are continuously being pushed to meet the demands of advanced process nodes.

The true technological differentiator lies in the software and data analytics layers, specifically the pervasive adoption of Artificial Intelligence (AI) and Machine Learning (ML). These computational tools are deployed not just for basic image processing but for complex tasks like unsupervised defect clustering, anomaly detection, and providing real-time feedback loops to process tools (known as metrology-for-control). Additionally, the implementation of big data infrastructure to manage and analyze the massive amounts of inspection data generated daily is a crucial technological component. The future trajectory involves integrating these inspection systems directly into factory automation networks, enabling seamless communication and automated decision-making for yield optimization across the entire packaging facility.

Regional Highlights

- Asia Pacific (APAC): APAC is the global epicenter of semiconductor manufacturing, holding the largest market share due to the concentration of major foundries (TSMC, Samsung) and OSAT giants (ASE, Amkor). The region’s aggressive expansion of advanced packaging capacity, driven by high demand from consumer electronics and 5G infrastructure, mandates significant capital investment in cutting-edge inspection systems, particularly those tailored for Fan-Out and 3D stacking. Countries like Taiwan, South Korea, China, and Japan are the core drivers of regional market growth, investing heavily in domestic manufacturing capabilities and striving for technological self-sufficiency in semiconductor production and quality assurance.

- North America: North America represents a crucial market for innovation and high-reliability applications, driven by prominent fabless companies and defense contractors. Growth here is focused on developing and implementing highly specialized, proprietary inspection technologies, including advanced AI algorithms and sophisticated metrology solutions for niche markets like high-performance computing (HPC) and aerospace components. The recent governmental push to revitalize domestic semiconductor manufacturing (e.g., the CHIPS Act) is expected to significantly boost demand for domestic inspection system deployment over the forecast period.

- Europe: The European market is characterized by strong emphasis on automotive electronics, industrial automation, and specialized research in semiconductor materials. Key growth is fueled by the stringent quality and safety standards imposed by the automotive sector, requiring extremely reliable packaged chips inspected by advanced AXI and SAM systems. European equipment vendors often focus on highly precise, customizable solutions, catering to high-mix, low-volume production environments typical in European industrial applications and specialized power electronics manufacturing.

- Latin America, Middle East, and Africa (LAMEA): This region currently holds a smaller market share but is poised for gradual growth, primarily driven by investments in telecommunication infrastructure and localized assembly operations aimed at regional consumer markets. While adoption of cutting-edge 3D inspection technology is lower than in APAC or North America, there is steady demand for conventional AOI systems supporting established packaging techniques, particularly as government initiatives focus on increasing technological self-sufficiency and digital transformation across various sectors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wafer Packaging Inspection System Market.- KLA Corporation

- Applied Materials, Inc.

- SCREEN Holdings Co., Ltd.

- EV Group (EVG)

- ASML Holding N.V. (HMI Product Line)

- Onto Innovation, Inc. (formerly Rudolph Technologies)

- Koh Young Technology Inc.

- SUSS MicroTec SE

- Mycronic AB

- Camtek Ltd.

- Nordson DAGE (A division of Nordson Corporation)

- Carl Zeiss AG (ZEISS Group)

- Viscom AG

- Nikon Metrology, Inc.

- Toray Engineering Co., Ltd.

- Accretech (Tokyo Seimitsu Co., Ltd.)

- Yield Engineering Systems (YES)

- Hesse GmbH

- MRSI Systems

- Scientech Corporation

Frequently Asked Questions

Analyze common user questions about the Wafer Packaging Inspection System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technological challenge in inspecting 3D stacked integrated circuits?

The main challenge is achieving non-destructive, high-resolution inspection of hidden interfaces (like micro-bumps and TSVs) buried under multiple opaque layers, necessitating the use of advanced techniques such as X-ray computed tomography and Scanning Acoustic Microscopy (SAM).

Which packaging segment is driving the fastest growth in inspection system demand?

The Fan-Out Wafer Level Packaging (FO-WLP) and the 2.5D/3D Packaging segments are experiencing the fastest growth, primarily due to their critical role in enabling high-density, high-performance processors required for 5G, AI acceleration, and autonomous vehicles.

How does Artificial Intelligence (AI) improve wafer inspection systems?

AI, leveraging deep learning, significantly improves defect classification accuracy, reduces false positives (nuisance defects), accelerates inspection throughput, and enables predictive process control by analyzing complex patterns in high-volume metrology data.

Why is the Asia Pacific region dominant in the Wafer Packaging Inspection System market?

APAC dominates due to the high concentration of major semiconductor foundries (Fabs) and Outsourced Semiconductor Assembly and Test (OSAT) providers who are rapidly expanding their advanced packaging capacity to meet global demand for miniaturized and high-performance chips.

What are the typical end-use applications for advanced wafer inspection systems?

Key end-use applications include high-end consumer electronics (smartphones, servers), automotive electronics (ADAS, power management), industrial automation systems, and advanced telecommunications infrastructure (5G/6G base stations).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager