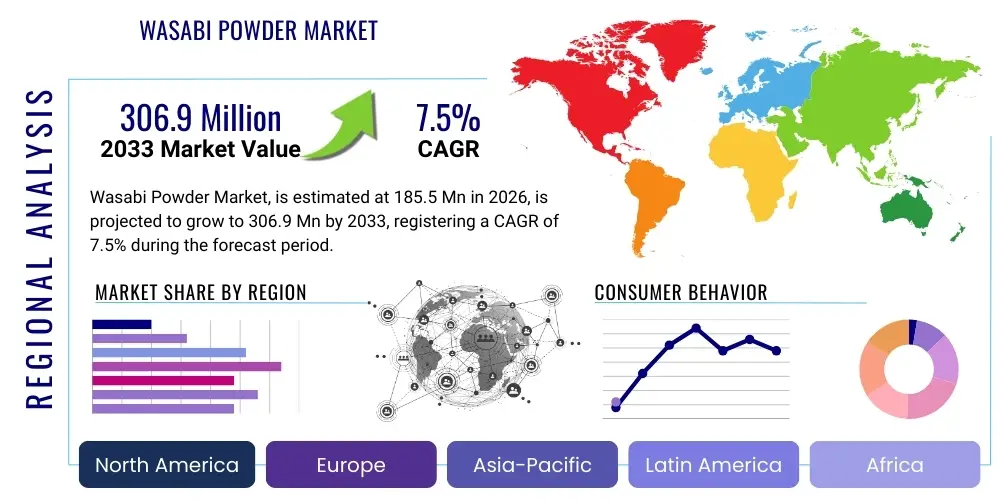

Wasabi Powder Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440892 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Wasabi Powder Market Size

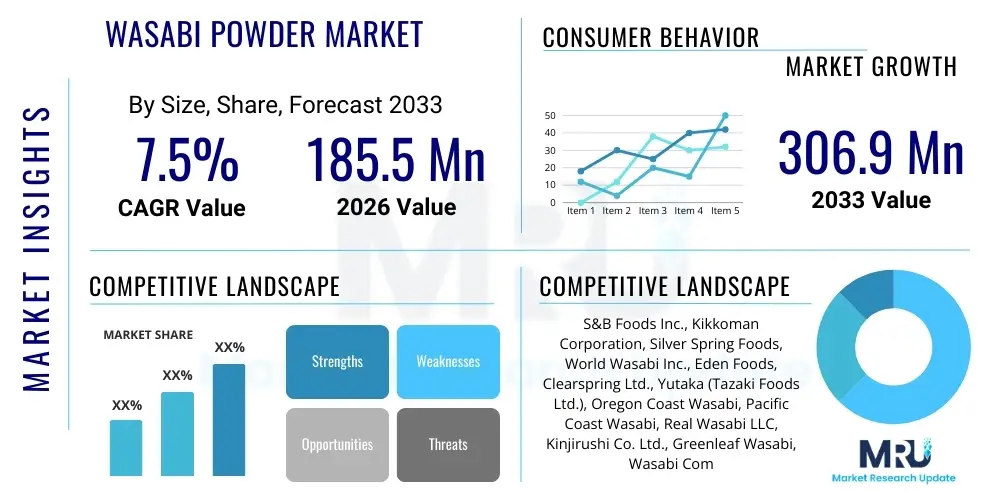

The Wasabi Powder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 185.5 Million in 2026 and is projected to reach USD 306.9 Million by the end of the forecast period in 2033.

Wasabi Powder Market introduction

The Wasabi Powder Market encompasses the production, distribution, and consumption of powdered substitutes for authentic Wasabia japonica paste. Real wasabi root is notoriously difficult and expensive to cultivate, making its powdered form—primarily derived from horseradish, mustard, and coloring agents—a cost-effective and shelf-stable alternative for widespread use in the global culinary industry. This market is fundamentally driven by the surging global popularity of Japanese cuisine, particularly sushi and sashimi, which rely heavily on the distinctive pungency and flavor profile associated with wasabi. Furthermore, the convenience and extended shelf life of the powdered format compared to fresh or ready-made paste facilitate its adoption across various sectors, including food service, retail, and packaged snacks.

Product descriptions typically involve a finely milled blend designed to be easily reconstituted with water, instantly forming a usable paste. While authentic wasabi powder derived solely from the root exists, the mass market is dominated by compounds formulated to mimic the taste, color, and texture. Major applications extend beyond traditional accompaniments, increasingly integrating into savory snacks, specialized sauces, dips, salad dressings, and meat marinades. This diversification is crucial to market growth, appealing to a broader consumer base seeking bold, functional flavor enhancements.

Key benefits driving market adoption include enhanced supply chain stability compared to volatile fresh wasabi harvests, significantly lower production costs, and superior logistics due to its lightweight and non-perishable nature. Driving factors involve rising disposable incomes in developing economies, rapid globalization of food culture, and continuous innovation in flavor encapsulation and processing technologies that improve the pungency and authenticity of the final powdered product, thereby meeting sophisticated consumer expectations.

Wasabi Powder Market Executive Summary

The Wasabi Powder Market is experiencing robust expansion, fundamentally propelled by two major business trends: the industrialization of flavor profiles in prepared foods and the increasing demand for convenient, long-shelf-life condiments. Regional trends indicate that while Asia Pacific (APAC) remains the largest consumption region due to its deep cultural integration of Japanese cuisine, North America and Europe exhibit the fastest growth trajectories. This growth is spurred by rapid adoption in the quick-service restaurant (QSR) sector and heightened consumer interest in unique international flavors. The segment trends highlight that the Food Service sector currently dominates demand, utilizing powder for bulk preparation, while the Retail segment, specifically focusing on small consumer packaging, is demonstrating accelerated growth as home cooking trends incorporating ethnic flavors gain traction globally. Furthermore, the segmentation by composition shows a clear shift toward high-quality mixed powders that offer better flavor stability and pungency consistency, addressing past criticisms regarding the variable quality of synthetic wasabi products.

AI Impact Analysis on Wasabi Powder Market

User queries regarding AI's influence on the Wasabi Powder Market predominantly center on how artificial intelligence can optimize the highly sensitive cultivation and processing of authentic wasabi (reducing reliance on powder substitutes), improve supply chain traceability, and refine flavor profile consistency in synthetic formulations. Key concerns revolve around whether AI-driven quality control can close the sensory gap between real wasabi and the powder substitute, potentially disrupting the demand for lower-quality powder. Expectations are high for AI to enhance predictive analytics for raw material pricing (horseradish/mustard seeds), automate complex blending ratios for optimal flavor matching, and personalize flavor delivery systems based on regional consumer preferences identified through machine learning analysis of sales data and social media trends.

- AI-driven precision agriculture for optimizing yield and quality of authentic wasabi root, potentially mitigating high costs and scarcity.

- Machine learning algorithms optimizing blending ratios and ingredient sourcing (horseradish, mustard, natural colorants) for consistent powder quality.

- Predictive supply chain analytics managing inventory levels and forecasting demand fluctuations in the food service and retail sectors globally.

- Automated quality control systems (computer vision, spectroscopic analysis) ensuring particle size uniformity and active compound stability (isothiocyanates) in the final powdered product.

- Personalized flavor profile recommendations for B2B clients (snack manufacturers, sauce producers) based on consumer segmentation and market data analyzed by AI.

DRO & Impact Forces Of Wasabi Powder Market

The dynamics of the Wasabi Powder Market are defined by a complex interplay of drivers, restraints, and opportunities. Primary drivers include the continuous expansion of the global sushi and Asian cuisine market, coupled with the inherent cost-effectiveness and logistical advantages of the powdered format over the fresh root. Restraints largely center on consumer perception issues, specifically the widespread knowledge that most commercially available wasabi powder is not derived from true wasabi but rather dyed horseradish, leading to skepticism about product authenticity and lower quality expectations. Opportunities arise from technological advancements in natural flavor encapsulation and microencapsulation techniques, which promise to deliver a more intense and prolonged pungency, closely mimicking the experience of fresh wasabi. These market forces collectively shape investment decisions, influencing manufacturers to focus on product differentiation through enhanced natural ingredient usage and improved shelf-stability techniques, ultimately maintaining market buoyancy despite inherent authenticity challenges.

Segmentation Analysis

The Wasabi Powder Market is comprehensively segmented based on its source material, application sector, distribution channel, and regional geography. This segmentation provides a granular view of market dynamics, revealing varying growth rates and consumer demands across different usage contexts. Source material segmentation differentiates between products based predominantly on high-grade horseradish derivatives and those that contain a percentage of actual Wasabia japonica, reflecting distinct price points and target markets. Application analysis clearly delineates between the dominant food service sector, which requires bulk, cost-efficient supply, and the consumer retail segment, which prioritizes convenience and aesthetically appealing packaging. Analyzing these segments is essential for stakeholders to tailor their product strategies, distribution networks, and marketing efforts to maximize market penetration across diverse global consumption environments.

- By Source:

- Horseradish-based Wasabi Powder

- True Wasabi (Wasabia japonica) containing Powder

- Mixed/Compound Wasabi Powders

- By Application:

- Food Service (Restaurants, Cafes, Catering)

- Retail (Supermarkets, Hypermarkets, Convenience Stores)

- Industrial Food Processing (Snacks, Sauces, Seasonings)

- By Distribution Channel:

- B2B (Direct Sales, Wholesalers)

- B2C (Online Retail, Specialty Stores)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Wasabi Powder Market

The value chain for the Wasabi Powder Market starts significantly upstream with the cultivation and sourcing of primary raw materials, predominantly high-quality horseradish root (Armoracia rusticana), mustard seed, and natural coloring agents such as spirulina or turmeric, essential for achieving the characteristic green hue. Due to the rapid decline in pungency after harvesting, the efficiency of the initial processing—drying, grinding, and stabilizing the primary ingredients—is critical. Middle-stream activities involve compounding and blending, where manufacturers utilize sophisticated mixing techniques to ensure uniform distribution of flavor and anti-caking agents, followed by stringent quality control checks for moisture content and isothiocyanate levels (the primary source of heat).

The distribution channel represents the transition to the downstream market. Wasabi powder relies heavily on both direct and indirect routes. Direct distribution involves large-scale bulk sales to industrial food processors and major international food service chains that require consistent, customized specifications. Indirect channels, which dominate the retail landscape, utilize complex networks of wholesalers, regional distributors, and ultimately, modern retail outlets and e-commerce platforms. The reliance on indirect channels is particularly pronounced in international markets where specialized food importers manage compliance with varied labeling and food safety regulations.

Downstream activities are focused on market penetration and consumer engagement. This includes the reconstitution of the powder into paste form by end-users (restaurants or home cooks) and its incorporation into processed foods. The efficiency and quality of the packaging (ensuring hermetic sealing to prevent moisture ingress and maintain flavor integrity) are paramount at this stage. Effective marketing that emphasizes convenience, cost-efficiency, and versatility is crucial for competing against fresh and pre-made paste alternatives, solidifying the powder's position as a staple ingredient in global Asian cuisine applications.

Wasabi Powder Market Potential Customers

The primary consumers and end-users of Wasabi Powder are highly diversified across the food industry, driven by the need for flavor consistency, cost control, and logistical ease. The largest segment remains the food service industry, specifically establishments specializing in Japanese, pan-Asian, and fusion cuisine, ranging from high-volume sushi chains to independent fine-dining restaurants. These buyers require bulk packaging and rely on the powder for consistent preparation quality across multiple outlets. Another substantial segment includes industrial food manufacturers who utilize wasabi powder as a key seasoning component in specialized snack foods (e.g., wasabi peas, flavored chips), instant noodle flavor packets, and ready-to-eat meal kits, where shelf stability is non-negotiable.

The retail consumer segment, encompassing individual households, represents a rapidly growing customer base. These buyers are typically purchasing smaller containers of powder through supermarkets, hypermarkets, or online grocery platforms. Their motivation stems from the desire to replicate restaurant-quality meals at home or to experiment with adventurous flavor profiles in their daily cooking. Furthermore, specialized distributors and import houses, acting as intermediaries, are crucial customers, purchasing large quantities to supply regional food service providers and managing the specific requirements of international trade.

The demand profile of these potential customers is characterized by a high sensitivity to price combined with an increasing expectation for quality that closely mimics authentic wasabi. Industrial customers prioritize functional aspects like solubility and resistance to caking, while retail consumers focus more on ease of use and perceived flavor intensity, often influenced by clean label trends that prefer natural colorants over artificial dyes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 185.5 Million |

| Market Forecast in 2033 | USD 306.9 Million |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | S&B Foods Inc., Kikkoman Corporation, Silver Spring Foods, World Wasabi Inc., Eden Foods, Clearspring Ltd., Yutaka (Tazaki Foods Ltd.), Oregon Coast Wasabi, Pacific Coast Wasabi, Real Wasabi LLC, Kinjirushi Co. Ltd., Greenleaf Wasabi, Wasabi Company Ltd., Yamamoto Foods Co. Ltd., Sushi Chef, Fuji Foods, Kenko Mayonnaise Co. Ltd., Yamasa Corporation, Daesang Corporation, Ajinomoto Co. Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wasabi Powder Market Key Technology Landscape

The technological landscape of the Wasabi Powder Market is primarily focused on enhancing two critical aspects: maintaining the volatility and intensity of the pungent flavor compounds (isothiocyanates) during drying and maximizing the shelf life without using excessive artificial stabilizers. Lyophilization, or freeze-drying, is a paramount technology utilized, particularly for powders containing actual wasabi root, as it minimizes heat exposure, thereby preserving the volatile flavor compounds more effectively than traditional high-heat spray drying methods. However, due to cost implications, spray drying remains the dominant method for mass-produced horseradish-based powders, necessitating the use of specialized carriers and encapsulation techniques to mitigate flavor loss during the process.

A major technological frontier is flavor microencapsulation. This advanced technique involves embedding the essential flavor molecules within a protective matrix (often carbohydrate or protein-based polymers). Microencapsulation ensures that the pungency is retained over extended periods and is only released upon hydration or mastication. This improves the sensory experience, bridging the quality gap between premium powders and fresh wasabi. Furthermore, advancements in specialized milling and particle size reduction technologies are essential to creating a powder that dissolves quickly and forms a smooth, consistent paste, which is vital for both industrial applications and consumer reconstitution.

The increasing focus on clean label ingredients is also driving technological innovation in natural pigment stabilization. Manufacturers are actively developing methods to utilize natural colorants (like spinach powder or spirulina extract) while preventing rapid fading or browning, which historically plagued natural alternatives to artificial dyes like FD&C Blue No. 1 and Yellow No. 5. These technological efforts are aimed at simultaneously improving product stability, sensory profile, and adherence to evolving consumer preferences for natural ingredients.

Regional Highlights

- Asia Pacific (APAC): APAC is the epicenter of wasabi consumption and production. Japan, as the origin of wasabi culture, maintains a sophisticated market, although much of the powder consumed is imported or highly refined. China and South Korea are experiencing massive growth, driven by expanding middle classes adopting diverse food preferences. India and Southeast Asian nations show high potential as Japanese cuisine penetrates mass market restaurants and packaged food segments.

- North America: This region is characterized by high consumption of prepared and ethnic foods. The Wasabi Powder Market here is driven by the extensive network of sushi restaurants and the strong demand for savory, bold-flavored snack items. The U.S. market is highly competitive, seeing innovation in non-traditional applications like wasabi-flavored sauces, dressings, and dips, moving the product beyond its traditional role as a simple condiment.

- Europe: Growth in Europe is substantial, fueled by increased travel exposure, culinary globalization, and the widespread popularity of high-street sushi outlets and international food festivals. Western European countries like the UK, Germany, and France are the largest consumers, exhibiting a strong preference for products that clearly indicate natural sourcing or provide assurance of flavor authenticity, driving demand for premium, true-wasabi-containing powders.

- Latin America (LATAM): While smaller than the major regions, LATAM shows steady growth, particularly in urbanized areas of Brazil and Mexico. The market is primarily served by imported products, used in high-end restaurants and a niche segment of industrial food processing focused on regional savory snacks, often blended with local spice profiles to create fusion flavors.

- Middle East and Africa (MEA): This region is an emerging market, largely reliant on imports. Growth is concentrated in the Gulf Cooperation Council (GCC) countries, propelled by high disposable incomes, tourism, and a strong expatriate population base that drives demand for international specialty foods. Wasabi powder is mainly utilized in premium food service establishments catering to cosmopolitan tastes.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wasabi Powder Market.- S&B Foods Inc.

- Kikkoman Corporation

- Silver Spring Foods

- World Wasabi Inc.

- Eden Foods

- Clearspring Ltd.

- Yutaka (Tazaki Foods Ltd.)

- Oregon Coast Wasabi

- Pacific Coast Wasabi

- Real Wasabi LLC

- Kinjirushi Co. Ltd.

- Greenleaf Wasabi

- Wasabi Company Ltd.

- Yamamoto Foods Co. Ltd.

- Sushi Chef

- Fuji Foods

- Kenko Mayonnaise Co. Ltd.

- Yamasa Corporation

- Daesang Corporation

- Ajinomoto Co. Inc.

Frequently Asked Questions

Analyze common user questions about the Wasabi Powder market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary ingredient in most commercial wasabi powder?

The vast majority of commercially available wasabi powder is primarily composed of dried, powdered horseradish root, mustard powder, starch fillers, and artificial or natural green food coloring agents, designed to mimic the flavor profile and appearance of authentic Wasabia japonica.

How is wasabi powder different from fresh wasabi paste?

Wasabi powder offers superior shelf stability and logistical convenience compared to fresh paste. Crucially, the flavor of the powder is often milder and less complex than fresh wasabi, which rapidly loses its pungent isothiocyanate compounds after grating or reconstitution.

Which geographical region dominates the consumption of wasabi powder?

Asia Pacific (APAC), led by traditional Japanese cuisine consumption in countries like Japan, China, and South Korea, currently holds the largest market share in terms of volume and value consumption due to the high integration of wasabi into regional food culture and massive industrial usage.

What are the key drivers for the Wasabi Powder Market growth?

Key drivers include the global expansion and mainstream adoption of Japanese cuisine (particularly sushi), the cost-effectiveness of powdered substitutes compared to expensive fresh wasabi, and technological advancements in flavor encapsulation improving product quality and shelf life.

What technological innovations are impacting the market?

The primary technological impact comes from flavor microencapsulation techniques, which protect the volatile pungent compounds during processing and storage, and specialized drying methods (like low-heat vacuum drying) aimed at preserving the natural integrity and intensity of the wasabi flavor.

The complexity of the Wasabi Powder Market extends far beyond its traditional role as a simple condiment. The market’s resilience is continually tested by the inherent disparity between consumer expectations for "wasabi" flavor and the reality of the ingredients used in cost-effective powdered alternatives. Manufacturers are increasingly investing in sophisticated extraction techniques that attempt to isolate and stabilize the volatile organosulfur compounds—specifically allyl isothiocyanate—which are responsible for the distinctive sinus-clearing heat. Success in this area is paramount for premium product lines seeking differentiation in a crowded market. The manufacturing process involves multi-stage grinding under controlled temperature environments to prevent degradation, followed by mixing with stabilizing agents (like maltodextrin or gum arabic) which facilitate efficient flow during packaging and help prevent caking over time, especially in humid climates.

Furthermore, regulatory standards concerning food authenticity and labeling are becoming significant factors, particularly in the European and North American markets. Consumers are demanding greater transparency regarding the actual percentage of Wasabia japonica included in products labeled "wasabi." This pressure is compelling key players to either develop dedicated, high-purity powder lines or clearly label their horseradish-based products as "Wasabi Substitute" or "Wasabi Style" powder. This regulatory environment acts as a natural constraint on low-quality products but simultaneously creates substantial opportunities for brands that can credibly market authenticity and superior ingredient sourcing, often focusing on sustainable cultivation practices for the horseradish components themselves.

The distribution network optimization is a continuous area of focus, leveraging modern logistics to maintain product integrity globally. Given that moisture absorption can quickly compromise the texture and flavor of the powder, packaging technologies are critical. This involves the use of specialized, multi-layer barrier films and moisture-absorbent packets within the container. E-commerce platforms are proving increasingly vital, allowing niche suppliers of genuine, high-ppurity wasabi powder—which may be too expensive for mass supermarket distribution—to reach specialized culinary enthusiasts and high-end restaurants directly, bypassing traditional brick-and-mortar retail constraints and facilitating better inventory control for highly perishable or premium lines.

The industrial application segment is demonstrating significant innovation in product development. Wasabi powder is being formulated into specialized blends optimized for flavor release in specific matrices, such as high-fat snack coatings or high-moisture meat marinades. For snack food manufacturers, the powder must be micronized to an exceptionally fine particle size to ensure even adherence to chips or nuts, requiring advanced jet milling technology. For use in sauces, solubility and suspension characteristics are prioritized, often achieved through careful selection of starch and gum stabilizers. This B2B focus on functional attributes ensures continuous, high-volume demand, shielding this market segment slightly from the consumer focus on ingredient authenticity, where utility and cost-efficiency often take precedence.

In terms of regional specificities, the North American market is highly adaptable to flavor fusions, seeing wasabi powder integrated into diverse product lines, including gourmet popcorn seasonings and innovative barbecue rubs, driving demand outside the traditional sushi context. European consumers, while appreciating convenience, often link product quality with sustainability and organic sourcing, pushing demand towards powders utilizing natural colorants and organically grown ingredients. Meanwhile, the core APAC market continues to prioritize intensity and traditional flavor profile accuracy, influencing manufacturers to invest heavily in sourcing high-grade mustard derivatives to maximize the perceived heat, a crucial metric for regional consumers.

Future growth projections are strongly correlated with advancements in synthetic biology and fermentation technologies. Researchers are exploring ways to biologically synthesize the pungent isothiocyanate compounds in a controlled lab environment, potentially offering a sustainable, high-purity, and cost-effective alternative to both the volatile fresh root and the horseradish-mustard composite. If successful, this technology could revolutionize the Wasabi Powder Market by delivering authentic flavor consistency at an industrial scale, significantly mitigating current supply chain risks and authenticity issues, thereby stimulating a massive surge in demand across all application segments, from retail to industrial food manufacturing. This paradigm shift would cement the position of high-tech flavor synthesis in the global spice and seasoning industry, offering a pathway toward premiumization through technological superiority rather than reliance solely on agricultural yield.

The influence of digitalization on the market is pervasive. Digital tools are not only assisting in sales and distribution but are profoundly impacting R&D. Data analytics and sensor technology are used to monitor the chemical composition of raw materials in real-time, allowing manufacturers to adjust blending formulas dynamically to counteract natural variations in horseradish or mustard quality, thus guaranteeing batch-to-batch consistency—a critical requirement for global brands. Furthermore, detailed geospatial analysis helps optimize sourcing strategies, identifying optimal regions for non-GMO horseradish cultivation that minimizes environmental impact and maximizes yield, linking sustainability goals directly to supply chain efficiency.

Risk mitigation within the Wasabi Powder supply chain is constantly evolving. Manufacturers face geopolitical risks that affect global horseradish supply, particularly from major producing regions. To counteract this, strategic sourcing involves diversifying suppliers across multiple continents (e.g., North America, Europe, and China). Furthermore, the risk of adulteration or mislabeling requires rigorous testing protocols, including sophisticated chromatographic and isotopic analysis to verify ingredient claims, especially for premium powders marketed as containing authentic wasabi. These high standards of quality assurance add overhead but are essential for maintaining brand trust in competitive international markets where authenticity is a consumer concern.

In conclusion, the Wasabi Powder Market is defined by a dynamic tension between the pursuit of authentic flavor and the necessity of industrial-scale convenience and cost management. Its growth is secure, driven by cultural diffusion, but its evolution will be characterized by technological breakthroughs focused on encapsulation, synthetic flavor creation, and regulatory adaptations demanding greater transparency. Stakeholders who prioritize research into higher quality natural ingredients and embrace cutting-edge flavor stability technology are best positioned to capture the accelerating value in the forecast period.

The increasing consumer awareness regarding food origins and processing methods necessitates a detailed focus on clean labeling and transparent sourcing within the wasabi powder industry. This trend compels producers to substitute artificial colorants, such as the widely used blend of FD&C Yellow No. 5 and Blue No. 1, with natural alternatives like spinach powder, spirulina, or chlorophyll extracts. While these natural pigments often present challenges regarding stability and potential fading when exposed to light, ongoing research into stabilized natural color systems is a critical investment area. Manufacturers who successfully integrate natural ingredients while maintaining the vibrant green appearance and acceptable shelf life gain a substantial competitive edge in health-conscious markets, particularly in Western Europe and North America.

Furthermore, the competitive landscape is intensely focused on achieving optimal flavor release kinetics. Unlike fresh wasabi, which delivers an immediate, intense burst of heat, many traditional powders offer a delayed or duller sensory experience. Advanced flavor technology, including specialized matrices designed to control the release rate of isothiocyanates when mixed with water or saliva, is being employed. This effort aims to replicate the powerful, volatile, and transient heat characteristic of real wasabi. This technological differentiation allows premium brands to justify higher pricing points, segmenting the market effectively between utility-grade, cost-focused powders for bulk industrial use and high-sensory, premium powders targeting gourmet retail consumers and specialized food service operations.

The adoption of advanced packaging technology is also crucial for maintaining market share. Oxygen absorbers and modified atmosphere packaging (MAP) techniques are being implemented to slow down oxidative degradation, which is a key factor in flavor loss and color deterioration over long distribution cycles. Effective moisture barrier packaging is mandatory, especially for sales in high-humidity climates in Southeast Asia and Latin America, where clumping and degradation occur rapidly. Investments in packaging automation also contribute to cost efficiency, allowing high-volume producers to maintain competitive pricing while ensuring the product remains fresh and potent until the point of consumption, thereby enhancing customer satisfaction and repeat purchase rates.

Finally, the growing trend of health and wellness impacts the Wasabi Powder Market through the perceived functional benefits of its active components. Isothiocyanates, the compounds responsible for wasabi’s pungency, are increasingly recognized for their potential anti-inflammatory and detoxifying properties. This is leading to a niche segment of wasabi powder being marketed not just as a flavoring agent but as a functional food ingredient, incorporated into health supplements, specialty teas, and fortified functional beverages. While this remains a smaller segment, it represents a high-margin opportunity for manufacturers focused on high-purity, standardized extracts, leveraging nutraceutical claims to expand the market beyond purely culinary applications and tapping into the broader global wellness trend.

The strategic imperative for companies operating within the Wasabi Powder Market must align with maximizing global supply chain flexibility while simultaneously tightening quality control parameters, specifically concerning volatile flavor stability. Given the dependence on primary agricultural commodities like horseradish, climate change and unpredictable weather patterns present increasing risks to supply security and price volatility. Leading market participants are responding by developing sophisticated hedging strategies and establishing long-term contractual agreements with multiple regional growers, effectively creating a geographically dispersed and more resilient raw material base. This decentralization helps mitigate localized crop failures and ensures a steady input of standardized raw materials necessary for continuous high-volume production, crucial for serving major global food processing contracts.

Moreover, the integration of enterprise resource planning (ERP) systems with real-time quality monitoring tools is revolutionizing operational efficiency. These systems allow manufacturers to track material batches from the farm gate through final packaging, providing unparalleled traceability, which is a major compliance requirement in many Western regulatory environments. This end-to-end transparency not only ensures rapid response in the event of a recall but also builds consumer trust, positioning compliant companies as reliable suppliers in a market frequently scrutinized for authenticity. The capital investment required for these integrated digital systems represents a significant barrier to entry for smaller manufacturers but solidifies the competitive advantage of established global players.

The competitive differentiation strategies are increasingly centered on sustainability credentials. Manufacturers are seeking certifications for responsible water usage, reduced energy consumption in drying processes, and ethical labor practices in raw material sourcing. For instance, the transition from high-temperature drying methods to more energy-efficient vacuum or freeze-drying, where feasible, contributes directly to reduced carbon footprint reporting. Marketing efforts often highlight these sustainable sourcing and production practices, particularly when targeting environmentally conscious consumer demographics in developed markets. This commitment to ESG (Environmental, Social, and Governance) principles is quickly moving from a desirable add-on to a fundamental expectation within the B2B supply chain, influencing procurement decisions by major international food corporations.

Finally, market expansion into emerging economies requires careful adaptation of product formulation and packaging. In regions where cold chain logistics may be less developed, highly robust, moisture-resistant packaging is non-negotiable. Furthermore, pricing strategy must be meticulously adjusted to align with local disposable incomes while maintaining acceptable profit margins. Often, this involves creating tiered product offerings—a cost-efficient, bulk powder for local QSRs and a premium, smaller-pack size for high-end retail. Understanding and catering to these localized distribution and pricing dynamics is essential for successfully unlocking the vast growth potential available in rapidly developing consumer markets in regions such as Southeast Asia and Latin America, solidifying the market's trajectory towards the projected 2033 valuation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager