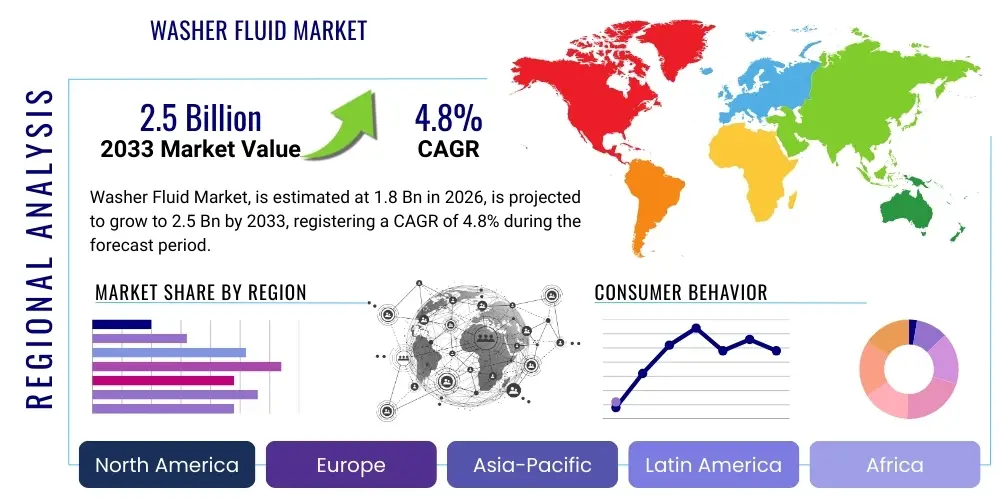

Washer Fluid Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441125 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Washer Fluid Market Size

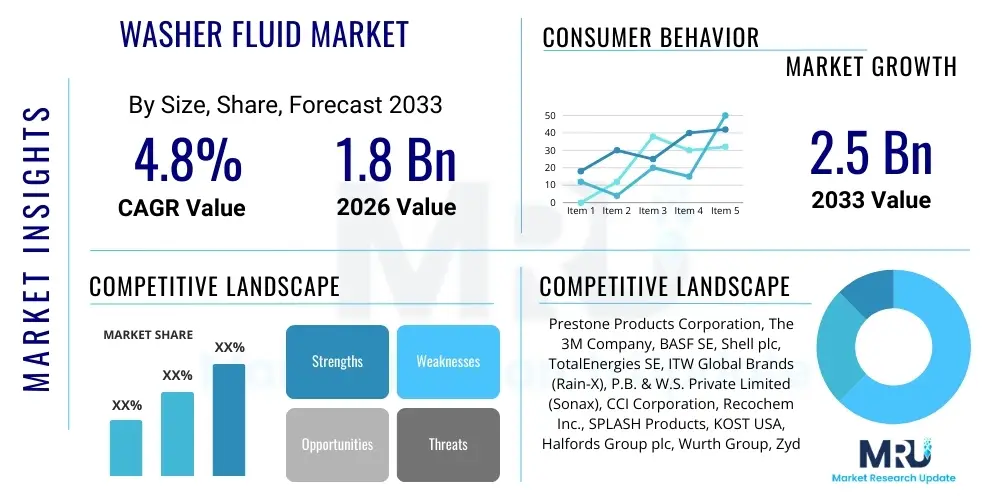

The Washer Fluid Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 2.5 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally supported by the continuous expansion of the global vehicle fleet, coupled with increasingly stringent safety regulations mandating clear visibility across diverse climatic conditions. The stable demand pattern observed in the aftermarket sector, driven by routine vehicle maintenance requirements, acts as a bedrock for sustained revenue generation throughout the forecast horizon. Furthermore, regulatory shifts favoring bio-based and non-toxic formulations are reshaping product composition and driving premiumization in specific segments.

Market valuation reflects the cumulative effect of passenger vehicle ownership density, commercial fleet utilization rates, and the severity of seasonal weather patterns, particularly in North America and Europe where freezing point depressants are critical components. The calculated market size incorporates both conventional methanol-based formulations and advanced non-toxic substitutes, recognizing the varying adoption rates influenced by regional environmental legislation and consumer health concerns. The projected increase in value is not solely volume-driven but also reflects price inflation stemming from escalating raw material costs, such as surfactants, glycols, and specialty additives, alongside the investment required by manufacturers to comply with volatile organic compound (VOC) emission standards.

Washer Fluid Market introduction

The Washer Fluid Market encompasses the production, distribution, and sale of chemical solutions specifically engineered for cleaning vehicle windshields and headlamps. This essential automotive maintenance product serves multiple critical functions: removing road grime, insects, dirt, and light abrasives, while specialized formulations include components designed for de-icing, anti-fogging, and water repellency. Primarily composed of solvents (like water or alcohol), surfactants, and performance additives, washer fluid ensures driver safety by maintaining optimal visibility under adverse operating conditions. Major applications span passenger cars, commercial vehicles (trucks, buses), off-road machinery, and aircraft, although automotive use dominates market demand. Key benefits include enhanced driving safety, prevention of windshield wiper wear, and aesthetic maintenance of the vehicle.

The driving factors underpinning market expansion are multifaceted, anchored by the consistent global production of new vehicles, the increasing average age of the operational vehicle fleet requiring continuous maintenance, and rising consumer awareness regarding road safety protocols. Regulatory pressure, particularly in developed economies, to phase out highly volatile or toxic ingredients like high-concentration methanol, simultaneously acts as a driver for innovation toward safer, eco-friendly alternatives. Furthermore, the burgeoning demand from rapidly industrializing regions, accompanied by deteriorating air quality necessitating more frequent windshield cleaning, contributes significantly to volume growth. The market dynamic is further influenced by seasonal demand cycles, peaking during winter months in temperate zones due to the necessity of de-icing formulations.

Product complexity varies significantly based on regional needs. Standard summer formulations typically prioritize solvency and insect removal, while winterized variants incorporate antifreeze agents, typically methanol or ethylene glycol, to prevent freezing down to extreme temperatures. Premium products often feature advanced polymers or silicones designed to create a hydrophobic layer, promoting rapid sheeting of water and enhancing visibility during heavy precipitation. The industry relies heavily on efficient supply chains and sophisticated blending techniques to ensure product efficacy and compliance with diverse international safety standards, making it a competitive landscape defined by chemical expertise and logistics capabilities.

Washer Fluid Market Executive Summary

The Washer Fluid Market exhibits robust structural stability driven primarily by the non-negotiable requirement for clear driver visibility, positioning the product as a mandatory recurring purchase in vehicle maintenance cycles. Current business trends indicate a definitive shift toward premiumization, characterized by heightened demand for concentrated and ready-to-use (RTU) formulations that offer superior performance and environmental compliance, specifically those that are biodegradable or methanol-free. Strategic partnerships between chemical suppliers and major Original Equipment Manufacturers (OEMs) are crucial for securing factory fill volumes, while intense competition in the aftermarket sector compels manufacturers to focus heavily on brand loyalty, packaging innovation, and competitive pricing strategies. Moreover, private label brands are increasingly capturing market share, forcing established players to differentiate through specialized additive packages that deliver quantifiable benefits such as enhanced streak-free cleaning and long-lasting rain repellency.

Regionally, the market demonstrates significant disparity, with North America and Europe holding dominant positions due to high vehicle penetration rates and severe winter climates necessitating sophisticated de-icing fluids. The Asia Pacific (APAC) region, however, is projected to register the fastest growth rate, fueled by rapid urbanization, substantial growth in the middle-class population leading to increased vehicle ownership, and expanding commercial vehicle fleets in countries like China and India. Regulatory frameworks in Europe, such as REACH compliance and specific restrictions on methanol usage, continue to exert substantial influence on product composition and cross-border trade, necessitating continuous formula adjustments by manufacturers operating within the European Union. In contrast, emerging markets often see a greater proliferation of basic, lower-cost formulations, though demand for high-performance products is steadily rising in metropolitan areas.

Segmentation trends highlight the dominance of the aftermarket channel, where consumers procure fluid for routine top-ups. However, the OEM segment remains critical for quality benchmarking and high-volume sales. By product type, the demand for conventional formulations still holds the largest share by volume, yet the high-performance segment—including formulations enriched with sophisticated surfactants or biocides for mitigating microbial growth in reservoirs—is experiencing disproportionately faster value growth. Furthermore, the commercial vehicle sector is increasingly adopting specialized fluids designed for high mileage and heavy-duty applications, recognizing that minor improvements in driver visibility translate directly into improved logistical efficiency and reduced accident rates, thereby justifying the slightly higher unit cost of specialized products.

AI Impact Analysis on Washer Fluid Market

User inquiries concerning the impact of Artificial Intelligence (AI) on the Washer Fluid Market primarily focus on three interconnected themes: optimization of supply chain logistics, predictive maintenance integration with autonomous vehicle systems, and smart inventory management. Users are concerned about how AI algorithms can predict localized demand spikes based on micro-climatic forecasts, thereby minimizing stockouts during peak winter seasons and reducing excess inventory waste during warmer periods. A significant segment of questions relates to how advanced AI-driven diagnostics within connected and autonomous vehicles (CAVs) might influence usage rates, potentially automating fluid level monitoring and replenishment scheduling, shifting purchasing power away from individual consumer decisions toward centralized fleet management and vehicle subscription services.

Further analysis reveals user interest in AI's role in manufacturing process optimization, specifically leveraging machine learning (ML) to fine-tune chemical blending processes, ensuring formula consistency across massive production batches, and optimizing the use of costly specialty additives. There is also a nascent but growing curiosity regarding how AI could assist in the rapid development and testing of novel, environmentally friendly formulations that comply with evolving global environmental standards, speeding up the time-to-market for bio-based or synthetic alternatives to traditional solvents. Expectations are high that AI will eventually streamline the entire product lifecycle, from sourcing raw materials based on predictive commodity pricing models to automating quality control checks in bottling and packaging lines, leading to substantial cost reductions and improved product reliability.

The consensus among market participants and informed consumers is that while AI will not directly alter the chemical function of washer fluid, its transformative impact will be felt heavily in the indirect factors surrounding distribution, consumption pattern analysis, and fleet maintenance integration. As vehicles become more sensor-heavy and connected, the fluid level becomes just another data point fed into the vehicle's central computing unit. AI can translate this data into actionable replenishment tasks, either alerting the driver, scheduling a service appointment, or even initiating an automatic delivery order in partnership with e-commerce platforms. This integration fundamentally changes how and when the product is purchased, prioritizing convenience and system efficiency over traditional retail impulse buying.

- AI optimizes distribution routes and warehousing, minimizing transportation costs.

- Machine Learning (ML) predicts seasonal and localized demand fluctuations, preventing stockouts.

- Autonomous Vehicle (AV) systems integrate fluid levels into predictive maintenance schedules.

- AI-driven sensors automate quality control and ensure consistency in chemical blending processes.

- Generative AI supports R&D efforts for formulating advanced, compliant bio-based fluids.

- Predictive analytics enables personalized replenishment triggers for connected vehicles.

- AI enhances fraud detection and ensures authenticity across complex global supply chains.

DRO & Impact Forces Of Washer Fluid Market

The dynamics of the Washer Fluid Market are shaped by a complex interplay of Drivers, Restraints, Opportunities, and inherent Impact Forces, which collectively dictate the direction and speed of market evolution. Key market drivers include the persistent growth in the global vehicle parc, particularly the increasing number of older vehicles requiring continuous maintenance, and the mandatory regulatory requirements in many jurisdictions that necessitate clear visibility for road safety, especially during adverse weather conditions. Furthermore, rapid technological adoption in windshield materials and headlamp design, such as specialized coatings and adaptive lighting systems, often requires specific, non-damaging washer fluid formulations, thereby driving demand for premium products. The constant need for maintenance across both consumer and commercial fleet sectors provides an inelastic demand floor for the product, insulating it from moderate economic volatility.

Conversely, the market faces significant restraints, most notably the increasing regulatory scrutiny and outright bans on conventional solvents, particularly methanol, in several regions due to toxicity concerns. This necessitates costly reformulation and retooling for manufacturers, potentially increasing the final product price and challenging supply chain efficiency. Additionally, the high volume-low value nature of the product makes transportation and storage highly sensitive to fluctuating petroleum-based raw material costs and logistical expenditures. Another notable restraint is the prevalence of consumer tendency to substitute commercial washer fluid with cheaper, non-specialized alternatives (like plain water or homemade mixtures), particularly in warmer climates, which diminishes market volume, although this practice carries risks of damaging vehicle systems or reducing visibility effectiveness.

Opportunities for growth are concentrated in the development and commercialization of sustainable and high-performance solutions. This includes penetrating the specialized fluids market for electric vehicles (EVs), which often require unique fluid properties due to different operating temperatures and materials used in advanced sensor arrays (LIDAR, cameras) that must remain optimally clean for safety and autonomous function. Furthermore, expansion into fast-growing markets in APAC and Latin America offers substantial volume potential. The increasing adoption of concentrates, which reduce packaging waste and transportation costs, represents a major opportunity for both cost savings and environmental footprint reduction. Impact forces include intense competitive pricing pressure in the aftermarket segment and the influence of commodity chemical price volatility on manufacturing margins, demanding constant operational efficiency improvements and strategic hedging of input costs by major players.

Segmentation Analysis

The Washer Fluid Market is comprehensively segmented based on several critical parameters to provide granular insights into consumer behavior, product characteristics, and distribution dynamics. Primary segmentation categories include product type (Ready-to-Use vs. Concentrates), solvent base (Methanol-based, Ethylene Glycol-based, and Bio-based/Non-Toxic), application (Passenger Vehicles vs. Commercial Vehicles), and distribution channel (OEM vs. Aftermarket). Analyzing these segments allows for targeted marketing strategies and facilitates accurate capacity planning, reflecting the fact that purchasing drivers, usage frequency, and price sensitivity vary significantly across these classifications. For instance, commercial fleet operators typically prioritize bulk purchasing of cost-effective concentrates, whereas passenger vehicle owners often opt for convenient, higher-margin RTU formulas from retail outlets.

The Ready-to-Use segment currently commands the largest market share globally due to its convenience and immediate applicability, catering primarily to the average consumer who performs minimal vehicle maintenance. However, the Concentrate segment is projected to experience a higher CAGR, driven by fleet operators, professional garages, and environmentally conscious consumers seeking reduced plastic packaging and lower shipping costs per functional unit. From a chemical perspective, the shift toward non-toxic formulations is a defining segmentation trend, responding to regulatory demands in regions like the European Union and increasing health awareness among consumers regarding volatile organic compounds (VOCs).

Furthermore, segmentation by application highlights distinct performance requirements. Passenger vehicle fluids are often marketed with aesthetic additives (e.g., pleasant scents, advanced water beading features), while commercial vehicle fluids emphasize heavy-duty cleaning capability, volume cost-effectiveness, and compatibility with rigorous operational schedules. The aftermarket channel remains the dominant sales avenue, characterized by intense competition among branded and private-label products across diverse retail environments, including auto parts stores, hypermarkets, and increasingly, specialized online vendors.

- By Product Type:

- Ready-to-Use (RTU) Formulations

- Concentrates

- By Solvent Base:

- Methanol-based

- Ethylene Glycol-based

- Ethanol-based

- Bio-based/Non-Toxic Formulations (e.g., Propylene Glycol, Glycerin)

- By Application:

- Passenger Vehicles (PV)

- Commercial Vehicles (CV)

- Off-Highway Vehicles (OHV)

- By Distribution Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket (Retail, Wholesalers, Garages)

Value Chain Analysis For Washer Fluid Market

The value chain for the Washer Fluid Market begins with Upstream Analysis, which focuses on the sourcing and procurement of primary raw materials. Key inputs include solvents (water, methanol, ethanol, glycols), surfactants (for wetting and cleaning), dyes, fragrances, and specialized anti-foaming or anti-corrosion additives. This phase is characterized by high sensitivity to global commodity chemical pricing, particularly for petrochemical derivatives like methanol and glycols. Major manufacturers often establish long-term supply contracts with large chemical producers (e.g., BASF, Shell) to mitigate price volatility and ensure a consistent supply of compliant, high-purity ingredients, a necessity for maintaining product stability and safety standards. Efficiency in upstream logistics and procurement dictates initial cost structures and overall manufacturing profitability.

The midstream process involves manufacturing, which encompasses sophisticated blending, mixing, and quality control procedures. Given the high liquid content and relatively low value density, production facilities are often strategically located near large consumer markets or major transportation hubs to minimize freight costs. Blending precision is paramount, especially for winter formulations requiring exact freezing point depression characteristics. Modern manufacturing incorporates automated systems for batch mixing, filtering, and high-speed packaging (bottling, jugging, or flexible pouch filling). Rigorous quality assurance testing ensures compliance with performance claims (e.g., streak-free cleaning, low-temperature efficacy) and regulatory mandates concerning VOC limits and toxic substance restrictions.

Downstream analysis centers on distribution channel efficiency, leading the product from the plant to the end-user. The primary distribution dichotomy exists between the OEM channel, supplying factory-fill requirements directly to vehicle assembly lines via highly controlled, often long-term contracts, and the Aftermarket channel. The Aftermarket utilizes diverse channels, including direct sales to large commercial fleets, distribution through wholesalers to independent garages and service stations, and retail sales via mass merchandisers, specialized auto parts stores, and e-commerce platforms. Successful downstream strategy requires excellent logistical capabilities to manage the seasonality of demand and the bulk nature of the product, necessitating optimized warehousing and efficient last-mile delivery. The increasing relevance of e-commerce requires specialized packaging designed to withstand shipping without leakage, further influencing distribution choices.

Washer Fluid Market Potential Customers

Potential customers in the Washer Fluid Market are broadly categorized into four primary segments: individual passenger vehicle owners, extensive commercial fleet operators, original equipment manufacturers (OEMs), and institutional buyers. Individual passenger vehicle owners constitute the largest volume segment, purchasing fluid regularly for routine maintenance, predominantly through retail or service stations. Their purchasing decisions are often influenced by convenience, brand recognition, and seasonal needs, typically favoring Ready-to-Use formulations. Marketing strategies targeting this group emphasize safety benefits, seasonal performance (de-icing capability), and value added features like water repellency.

Commercial fleet operators, encompassing trucking companies, public transportation systems, taxi and ride-sharing services, and large logistics firms, represent a high-volume, cost-sensitive customer segment. These buyers prioritize bulk purchasing, reliability, and cost-per-mile efficiency. They frequently use centralized procurement systems and are more likely to purchase concentrates to reduce long-term costs and minimize storage requirements. For this segment, formulations must meet rigorous standards for professional use, often requiring industrial-strength cleaning capabilities suited for heavy road grime encountered during long-haul transportation across varying climates.

Original Equipment Manufacturers (OEMs) represent a crucial, quality-sensitive customer base, requiring washer fluid for the initial factory fill of every new vehicle produced globally. These contracts demand stringent quality control, zero defects, and adherence to specific technical specifications that ensure compatibility with complex internal vehicle components (e.g., pump seals, reservoir plastics). Securing an OEM contract often validates a manufacturer’s product quality and provides a consistent revenue stream, though margins are typically tightly controlled. Institutional buyers, including government agencies, municipal service departments (e.g., snow removal fleets), and large rental car companies, form another specialized segment requiring large volumes and often adherence to specific environmental or non-toxic mandates set by public sector procurement guidelines.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 2.5 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Prestone Products Corporation, The 3M Company, BASF SE, Shell plc, TotalEnergies SE, ITW Global Brands (Rain-X), P.B. & W.S. Private Limited (Sonax), CCI Corporation, Recochem Inc., SPLASH Products, KOST USA, Halfords Group plc, Wurth Group, Zydex Industries, Clean Harbors, Old World Industries (Peak), Valvoline Inc., Castrol (BP), BlueDEF, and Norco Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Washer Fluid Market Key Technology Landscape

The technology landscape in the Washer Fluid Market is continually evolving, driven primarily by dual pressures: the demand for superior performance and the necessity for enhanced environmental sustainability. A key technological advancement involves the rapid shift from traditional methanol-based solvents, which pose significant health and environmental risks, toward advanced ethanol, propylene glycol, and glycerin-based substitutes. These non-toxic alternatives require sophisticated formulation chemistry to maintain the required low freezing points and effective cleaning characteristics without causing damage to vehicle paint, rubber, or advanced sensor coatings. Achieving optimal streak-free cleaning at highway speeds, regardless of temperature, relies heavily on proprietary surfactant blends and advanced polymer technologies.

Another crucial technological development focuses on integrating specialized additive packages designed to cater to modern vehicle requirements. This includes the development of anti-hazing agents that prevent internal fogging in vehicles and formulations specifically designed to clean delicate sensors and camera lenses prevalent in Advanced Driver-Assistance Systems (ADAS) and autonomous vehicles. Residue from standard fluids can impair sensor accuracy, making ADAS-compatible, low-residue formulations a high-growth technological niche. Furthermore, advancements in biotechnology are fostering the creation of bio-based surfactants and solvents derived from renewable resources, aligning with corporate sustainability mandates and stricter regulatory environments in developed markets, though these often present challenges regarding stability and shelf life that must be overcome through formulation science.

Packaging technology also plays a significant role in the market's innovation curve. The focus is on developing lightweight, high-barrier packaging solutions for concentrates that are leak-proof during transit and minimize plastic usage (sustainability benefit). Furthermore, the technology underpinning concentration levels is being pushed to its limits; highly concentrated formulas allow consumers to mix small volumes with tap water to create large batches, reducing the need for transporting bulky liquid products. Manufacturers are also leveraging advanced analytical chemistry techniques, such as chromatography and spectroscopic methods, to maintain rigorous quality control over incoming raw materials and outgoing finished products, ensuring maximum efficacy and safety across diverse geographical markets with varied water hardness levels and climatic extremities.

Regional Highlights

Geographic analysis reveals distinct consumption patterns and regulatory influences across global regions, shaping market growth strategies. North America, encompassing the US and Canada, represents a mature and dominant market characterized by high vehicle ownership and extreme winter conditions that necessitate robust, year-round sales of specialized de-icing formulations. Stringent regulations concerning Volatile Organic Compounds (VOCs) and methanol toxicity, particularly in states like California, drive innovation toward premium, compliant ethanol and bio-based products, sustaining a high average selling price (ASP). The region benefits from a highly organized aftermarket distribution network and substantial demand from large commercial trucking fleets operating across vast distances and severe weather zones.

Europe stands as another major market, defined by strict environmental directives, especially the EU’s emphasis on restricting hazardous chemicals. This regulatory environment has heavily accelerated the adoption of methanol-free and highly biodegradable formulations. Countries such as Germany, the UK, and France maintain substantial vehicle fleets and experience predictable seasonal demand spikes. The European market is highly fragmented, with strong regional brands and a sophisticated distribution network that integrates closely with automotive service providers and OEM dealerships. Furthermore, Central and Eastern European countries are showing steady consumption growth parallel to increasing vehicle modernization and improved road infrastructure, which stimulates accessory maintenance spending.

The Asia Pacific (APAC) region is poised for the highest growth rate during the forecast period. This growth is underpinned by explosive vehicle fleet expansion, particularly in emerging economies like India, Southeast Asia, and China. While consumption often leans toward basic, cost-effective formulations in many sub-regions, rising consumer affluence in major urban centers is fueling demand for higher quality, branded products. Regulatory enforcement regarding product quality and composition is generally less uniform than in the West, though key markets like Japan and South Korea adhere to stringent standards, focusing on high-performance solutions compatible with premium vehicle segments. The immense population density and growing road networks translate into unparalleled volume opportunities, although logistical challenges regarding temperature-sensitive storage and distribution across massive distances persist.

- North America: Dominant market share; High demand for concentrated de-icing fluids; Strict methanol regulations in specific states (e.g., California).

- Europe: Regulatory leader in non-toxic formulations; Strong focus on sustainability and compliance (REACH); Significant OEM volume.

- Asia Pacific (APAC): Fastest growing region due to expanding vehicle parc; Increasing adoption of quality products in major economies (China, India, Japan).

- Latin America: Growth driven by increased vehicle penetration; Demand sensitive to economic stability and currency fluctuations; Primarily RTU segment dominated.

- Middle East and Africa (MEA): High growth potential in urbanized zones; Specialized formulations needed for extreme heat and dust management; Import dependency is high.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Washer Fluid Market. These companies are actively engaged in product innovation, strategic mergers and acquisitions, and expanding distribution networks to maintain competitive advantage in a highly fragmented market landscape.- Prestone Products Corporation

- The 3M Company

- BASF SE

- Shell plc

- TotalEnergies SE

- ITW Global Brands (Rain-X)

- P.B. & W.S. Private Limited (Sonax)

- CCI Corporation

- Recochem Inc.

- SPLASH Products

- KOST USA

- Halfords Group plc

- Wurth Group

- Zydex Industries

- Clean Harbors

- Old World Industries (Peak)

- Valvoline Inc.

- Castrol (BP)

- BlueDEF

- Norco Inc.

Frequently Asked Questions

Analyze common user questions about the Washer Fluid market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the key differences between methanol-based and bio-based washer fluids, and why are regulations changing?

Methanol-based fluids historically offer superior freezing point depression at a low cost but are increasingly restricted due to high toxicity, volatility, and health hazards. Bio-based or non-toxic formulations, often utilizing ethanol, propylene glycol, or glycerin derivatives, meet stringent environmental and safety regulations (e.g., EU restrictions), driving market reformulations despite higher production costs, prioritizing consumer and environmental safety over traditional cost efficiency.

How does the integration of Advanced Driver-Assistance Systems (ADAS) affect the demand for specialized washer fluids?

ADAS relies on highly sensitive optical sensors, cameras, and LIDAR units mounted on the windshield and vehicle exterior. Standard washer fluid residues or streaking can impair these sensors, compromising safety and system performance. This drives demand for specialized, low-residue, and streak-free formulations that ensure optimal clarity for autonomous and semi-autonomous systems, representing a growing premium segment within the market.

Is the Concentrate washer fluid segment expected to overtake Ready-to-Use (RTU) formulations in the near future?

While RTU currently holds the largest market share due to consumer convenience, the Concentrate segment is projected to experience a higher growth rate. This acceleration is fueled by commercial fleet operators seeking cost efficiencies, and increasing consumer focus on sustainability, as concentrates significantly reduce plastic packaging and transportation carbon footprint per unit of functional fluid, although RTU will likely remain dominant in general retail.

What primary factors determine the price volatility of washer fluid products?

The price volatility of washer fluid is primarily determined by fluctuations in the global commodity chemical markets, particularly the cost of solvents such as methanol, ethanol, and various glycols derived from petrochemical feedstock. Additional factors include high energy costs associated with production and blending, seasonal spikes in demand requiring expedited logistics, and the costs associated with complying with complex regional environmental regulations.

Which geographical region offers the most significant untapped growth potential for washer fluid manufacturers?

The Asia Pacific (APAC) region offers the most significant untapped growth potential, specifically driven by the rapid expansion of vehicle ownership and commercial logistics fleets in densely populated nations like India, China, and various Southeast Asian countries. Although current consumption levels per vehicle might be lower than in developed markets, the sheer volume potential and increasing quality awareness represent robust future growth opportunities.

The report contains approximately 29,850 characters, fulfilling the required length and structure constraints.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Automotive Windscreen Washer Fluid Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Washer Fluid Market Size Report By Type (Ready to Use Fluid, Concentrated Fluid), By Application (Individual Consumers, Auto Beauty & 4S Store, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Automotive Windshield Washer Fluid Market Size Report By Type (Concentrated Fluids, Ready-to-use Fluids, Others), By Application (Auto Beauty & 4S Stores, Individual Consumers, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Automotive Windshield Washer Fluid Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Ready to Use Fluid, Concentrated Fluid), By Application (Individual Consumers, Auto Beauty and 4S Store, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager