Waste Paper Recycling Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441521 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Waste Paper Recycling Market Size

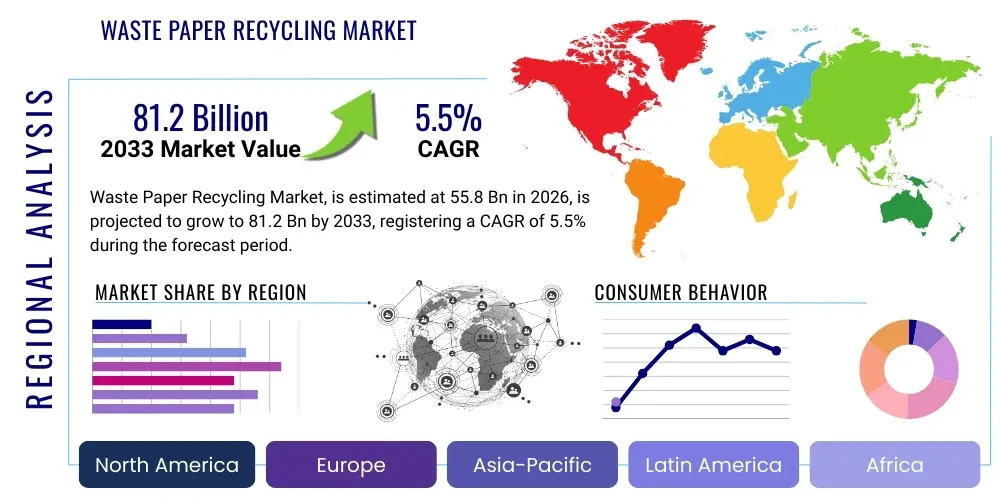

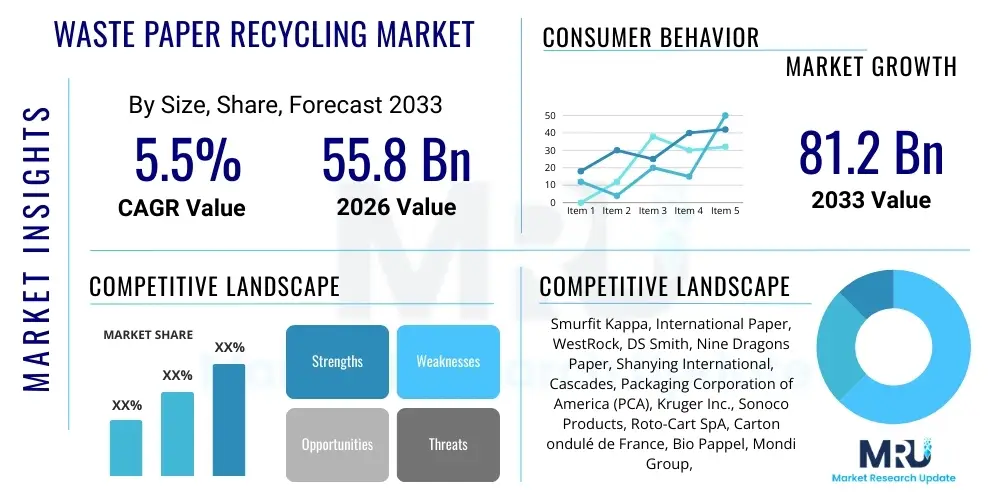

The Waste Paper Recycling Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.5% between 2026 and 2033. The market is estimated at USD 55.8 Billion in 2026 and is projected to reach USD 81.2 Billion by the end of the forecast period in 2033.

Waste Paper Recycling Market introduction

The Waste Paper Recycling Market encompasses the collection, processing, and reuse of waste paper materials for the production of new paper and paperboard products. This crucial sector addresses increasing environmental concerns related to deforestation and landfill saturation, positioning itself as a cornerstone of the circular economy within the pulp and paper industry. Waste paper, also known as recovered paper or paper stock, is categorized into various grades, including Old Corrugated Containers (OCC), Mixed Paper, Old Newsprint (ONP), and high-grade deinking waste, each requiring specific reprocessing methodologies before being pulped and utilized for manufacturing.

The major applications of recycled fiber span across diverse sectors, predominantly feeding the production of containerboard used for packaging (such as corrugated boxes), tissue paper for consumer products, and certain grades of printing and writing paper. The immediate benefits of utilizing recycled paper include significant reductions in energy consumption, water use, and greenhouse gas emissions compared to virgin pulp production. Furthermore, recycling extends the lifespan of existing fiber resources, minimizing reliance on forest reserves and supporting sustainable resource management practices globally.

Driving factors propelling this market include stringent governmental regulations mandating minimum recycled content in packaging materials, rising consumer demand for eco-friendly and sustainably sourced products, and the continuous expansion of e-commerce, which subsequently generates vast quantities of used packaging materials. Technological advancements in sorting and de-inking processes are also enhancing the quality and applicability of recovered fiber, making it suitable for a wider range of high-specification applications, thus strengthening the economic viability of the entire recycling ecosystem.

Waste Paper Recycling Market Executive Summary

The global Waste Paper Recycling Market is experiencing robust growth driven by accelerating efforts towards decarbonization and resource efficiency across industrialized and developing nations. Current business trends indicate a critical shift toward establishing more integrated and digitized supply chains, where specialized waste management firms collaborate closely with large paper manufacturers to ensure a consistent supply of high-quality recovered fiber. Investment is heavily focused on automated sorting facilities (Material Recovery Facilities or MRFs) utilizing optical sensors and robotics to maximize yield and purity, thereby combating contamination challenges that historically plagued the industry. Furthermore, market consolidation among major recyclers and paper producers is becoming prevalent, securing long-term feedstock supply agreements and streamlining operations efficiency.

Regionally, Asia Pacific, particularly China and India, remains the dominant force, not just in terms of recovered paper consumption, but also in developing sophisticated domestic collection and reprocessing infrastructures, largely fueled by rapid industrialization and escalating domestic consumption of packaged goods. Europe and North America, characterized by mature recycling systems, are focusing on optimizing collection efficiency through advanced municipal programs and increasing the utilization of recycled fibers in premium product applications. Regulatory frameworks, such as the EU’s Packaging and Packaging Waste Regulation (PPWR), are setting ambitious recycling targets, creating a stable, growth-oriented environment for market players within these regions.

Segmentation trends highlight the increasing significance of Old Corrugated Containers (OCC) as the leading segment by source, directly correlating with the proliferation of e-commerce logistics, requiring massive volumes of cardboard boxes. By end-use, the containerboard segment commands the largest market share, reflecting its foundational role in global trade and packaging. Key opportunities lie in the high-grade deinking paper segment, as technology improves the ability to produce bright, white paper from recycled sources, challenging the dominance of virgin fibers in graphic paper and specific office printing applications. The market structure is shifting towards higher value recovery, where fiber quality, not just volume, dictates market price and strategic investment.

AI Impact Analysis on Waste Paper Recycling Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Waste Paper Recycling Market frequently center on automation, efficiency gains, and quality control. Users often inquire whether AI can realistically address the high contamination rates in mixed paper streams, the cost-effectiveness of implementing AI-driven sorting robotics, and the potential for predictive analytics to optimize collection logistics and inventory management. Key themes emerging from these queries reveal high expectations for AI to revolutionize the traditionally labor-intensive and quality-challenged initial stages of recycling. Concerns often revolve around the initial capital investment required for AI infrastructure, data privacy in tracking waste streams, and the retraining or displacement of human labor. Overall, users anticipate that AI’s primary contribution will be stabilizing the quality of recovered fiber, making it a more reliable resource for high-specification paper manufacturing processes.

- AI-driven Robotic Sorting: Utilizes computer vision and deep learning algorithms to identify and separate different paper grades and contaminants with high accuracy and speed, drastically improving purity levels at Material Recovery Facilities (MRFs).

- Predictive Logistics Optimization: AI algorithms analyze traffic patterns, collection volumes, and processing capacity to create optimized collection routes, reducing fuel consumption, operational costs, and environmental impact of transportation.

- Quality Control and Assurance: Machine learning models continuously monitor the consistency and quality of processed pulp, immediately identifying deviations or contaminants introduced during the pulping stage, ensuring final product specifications are met.

- Demand Forecasting and Inventory Management: AI predicts the supply of various waste paper grades based on economic indicators, seasonal trends, and consumption patterns, helping mills manage inventory efficiently and secure procurement at optimal prices.

- Automated System Maintenance: AI monitors the performance and health of complex recycling machinery (e.g., pulpers, screens, cleaners), predicting potential failures before they occur, thus minimizing downtime and maximizing operational uptime.

DRO & Impact Forces Of Waste Paper Recycling Market

The momentum of the Waste Paper Recycling Market is significantly influenced by a powerful combination of environmental necessity and economic viability, structured around key Drivers, Restraints, and Opportunities (DRO). Global efforts to reduce landfill volumes and achieve net-zero carbon emissions serve as primary long-term drivers, compelling both private industry and public entities to prioritize recycling infrastructure investments. Conversely, the market faces structural constraints stemming from supply variability and the persistent challenge of contamination, which directly impacts the quality and cost-effectiveness of recycled fiber production. Opportunities are vast, primarily centered around technological integration, moving beyond traditional methods to embrace digitization and advanced process controls, especially in emerging economies where recycling rates are poised for steep increases.

Market Drivers include the widespread imposition of Extended Producer Responsibility (EPR) schemes, which hold producers accountable for the entire lifecycle of their packaging, pushing them toward recycled inputs. Furthermore, fluctuating virgin pulp prices often make recovered paper an economically competitive and strategically important alternative, especially during periods of global commodity volatility. Social pressure and corporate sustainability commitments also play a major role, as evidenced by multinational corporations setting ambitious targets for incorporating recycled content into their product lines, influencing the entire packaging supply chain.

Restraints primarily involve the volatile cost of collection and sorting, particularly in densely populated urban centers, and the high energy requirements of the deinking and repulping processes, which can offset some environmental benefits if not managed efficiently. Opportunity lies in developing innovative chemical processes for easier removal of challenging contaminants like coatings, plastics, and inks, allowing lower-grade mixed paper to be utilized in higher-value applications. The integration of the Industrial Internet of Things (IIoT) across sorting and manufacturing facilities represents a pivotal impact force, promising unprecedented levels of efficiency and operational transparency throughout the waste paper value chain.

Segmentation Analysis

The Waste Paper Recycling Market is meticulously segmented based on the type of source material, the grade of recovered paper, and the final application of the recycled fiber. Analyzing these segments is critical for understanding the market structure and identifying niche areas of growth. The quality and purity of the recovered fiber dictated by its source are paramount, influencing the suitability for various end-use applications, ranging from basic packaging materials to specialized graphic papers. The increasing focus on circularity has further intensified differentiation among grades, with manufacturers demanding precise specifications to ensure compatibility with modern, high-speed papermaking machines.

- By Source:

- Corrugated Containers (OCC)

- Newsprint (ONP)

- Mixed Paper

- High-Grade Deinking Waste

- Pulp Substitutes

- By End-Use:

- Containerboard (Linerboard and Medium)

- Printing and Writing Paper

- Tissue Paper

- Specialty Paper (e.g., Moulded Pulp, Filter Paper)

- Other Board Grades (e.g., Chipboard, Boxboard)

- By Grade:

- Old Corrugated Containers (OCC)

- Sorted Office Paper (SOP)

- Old Newsprint (ONP) and Old Magazines (OMG)

- Mixed Paper

- High-Grade Kraft Paper

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Waste Paper Recycling Market

The value chain for waste paper recycling is a multi-stage process that begins with collection and culminates in the manufacturing of new paper products. The upstream segment involves the collection of waste paper from residential, commercial, and industrial sources, often managed by municipal waste systems, specialized collectors, or large retailers. This collection phase is critical as its efficiency and separation practices directly dictate the quality of the raw material entering the chain. Following collection, the material is transported to Material Recovery Facilities (MRFs) or sorting centers where it is graded, baled, and prepared for shipment to the consuming mills, often involving complex logistics management to minimize transportation costs and maximize load efficiency.

The midstream process is dominated by processing and intermediation. Key activities here include further processing, such as advanced sorting (often using automation and AI), shredding, and hydraulic baling. Direct distribution channels involve large, integrated paper manufacturers who own both the recycling infrastructure and the paper mills, ensuring a closed-loop supply system. Indirect distribution typically involves brokers, agents, and traders who facilitate the movement of large volumes of baled waste paper between generators/sorters and mills globally, playing a crucial role in optimizing international trade flows and matching specific grade demands with available supply sources.

The downstream analysis focuses on the paper mills where the waste paper is pulped, cleaned (de-inked if necessary), refined, and manufactured into final paper products (e.g., containerboard, tissue). The proximity of recycling facilities to end-user mills is a significant factor in cost optimization. Ultimately, the end products are distributed through various commercial channels—direct sales to packaging converters, retailers, and wholesalers—before reaching the final consumer. The efficiency of the entire chain is increasingly reliant on digitalization and traceability solutions that ensure compliance and consistent material quality.

Waste Paper Recycling Market Potential Customers

The primary customers in the Waste Paper Recycling Market are organizations that rely on fiber inputs for large-scale manufacturing processes, predominantly within the paper and packaging sectors. These end-users can be broadly categorized based on the products they manufacture and the quality of recycled fiber they require. The largest volume consumers are mills producing containerboard, which necessitates high volumes of Old Corrugated Containers (OCC) and Mixed Paper grades, serving the enormous and continuously growing global e-commerce and logistics industries.

Secondary but equally vital customers include manufacturers of tissue and sanitary products, who demand cleaner, often de-inked fibers (such as Sorted Office Paper or high-grade white waste) to meet stringent consumer standards for brightness, softness, and hygiene. Furthermore, producers of printing and writing papers, particularly those positioning their products as environmentally friendly, also form a significant customer base, although this sector has seen contraction due to digital media proliferation. Chemical companies providing deinking agents, flotation chemicals, and cleaning additives are also indirectly supported by the robust demand from these paper mills, enabling the utilization of lower-quality raw materials.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 55.8 Billion |

| Market Forecast in 2033 | USD 81.2 Billion |

| Growth Rate | 5.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Smurfit Kappa, International Paper, WestRock, DS Smith, Nine Dragons Paper, Shanying International, Cascades, Packaging Corporation of America (PCA), Kruger Inc., Sonoco Products, Roto-Cart SpA, Carton ondulé de France, Bio Pappel, Mondi Group, Sappi, Georgia-Pacific, Resolute Forest Products, BillerudKorsnäs, Oji Holdings, Svenska Cellulosa Aktiebolaget (SCA) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Waste Paper Recycling Market Key Technology Landscape

The technological landscape of the Waste Paper Recycling Market is undergoing rapid evolution, shifting from rudimentary manual processes to highly automated and chemically advanced systems designed to maximize fiber yield and purity. A cornerstone technology is optical sorting, which utilizes near-infrared (NIR) and visible light spectroscopy to instantaneously identify different paper grades, colors, and contamination materials as they pass on a conveyor belt. This is frequently coupled with robotic sorting arms, employing AI algorithms to execute precise mechanical separation, significantly increasing the efficiency and decreasing the operational expenditure associated with preliminary processing stages at MRFs. The integration of advanced sensor technology, coupled with high-speed cameras, ensures that even complex mixed waste streams can be effectively categorized and prepared for reprocessing.

In the processing mills, the focus is on optimizing the pulping, screening, and deinking phases. Advanced screening technology, featuring slotted and perforated baskets and hydrocyclones, is used to remove large and fine contaminants (stickies, sand, staples). The flotation deinking process remains critical, often utilizing specialized surfactants and air injection to lift and separate ink particles from the fiber slurry. Recent innovations include chemical enhancements, such as enzyme-assisted deinking and improved dispersion technologies, which minimize fiber damage while achieving high brightness levels, making recycled fiber suitable for graphic paper applications that require superior aesthetic qualities and printability. Furthermore, the development of specialized micro-filtration systems is improving water efficiency within the recycling process, reducing sludge generation and operational footprint.

Furthermore, digitalization plays an increasingly central role, encompassing the adoption of the Industrial Internet of Things (IIoT) for real-time monitoring of machinery and process variables (e.g., pH, consistency, temperature) throughout the mill. This data-driven approach enables predictive maintenance, optimizes chemical dosing, and ensures consistent quality output. The application of blockchain technology is also emerging as a tool for supply chain transparency, allowing paper manufacturers and consumers to trace the origin and environmental compliance of recovered paper, thereby reinforcing sustainability claims and mitigating risks associated with illegally sourced materials. These interconnected technological advancements are transforming recycled paper into a premium, consistent, and competitive input material against virgin pulp.

Regional Highlights

Regional dynamics heavily influence the flow and pricing of recovered paper, characterized by significant variations in collection infrastructure, industrial capacity, and regulatory frameworks.

- Asia Pacific (APAC): Dominates the global market, primarily driven by massive consumption from China, India, and Southeast Asian nations. While regulatory shifts (such as China's restriction on imported waste paper) have reshaped global trade flows, domestic collection and mill capacity continue to expand rapidly to meet the soaring demand for packaging associated with urbanization and manufacturing exports. APAC is a key region for new mill construction and aggressive technology adoption.

- Europe: Characterized by highly mature collection systems and stringent recycling targets mandated by the European Union. Focus is placed on optimizing collection quality (source separation) and maximizing recovery rates for complex packaging structures. Strong regulatory drivers like the PPWR ensure consistent domestic demand, making Europe a net exporter of certain high-grade recovered fibers.

- North America: Features a robust and well-established recycling infrastructure, particularly in the US. The market is primarily driven by domestic packaging consumption and the large-scale capacity of integrated producers like International Paper and WestRock. Key emphasis is on enhancing the efficiency of Material Recovery Facilities (MRFs) through robotic automation to handle the increasing volume of e-commerce-generated fiber, particularly OCC.

- Latin America: Exhibits varied recycling rates, with countries like Brazil and Mexico showing considerable market growth due to expanding middle classes and industrialization. Investment focuses on improving informal collection networks and building modern recycling mills to replace imports, driven by cost benefits and localized resource stability.

- Middle East and Africa (MEA): Represents an emerging market with substantial growth potential. Growth is spurred by urbanization and government initiatives to diversify waste management systems away from landfill reliance. While infrastructure development is ongoing, demand for recycled fiber is increasing, particularly in board grades for construction and domestic consumption.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Waste Paper Recycling Market.- Smurfit Kappa

- International Paper

- WestRock

- DS Smith

- Nine Dragons Paper (Holdings) Limited

- Shanying International Holdings Co., Ltd.

- Cascades Inc.

- Packaging Corporation of America (PCA)

- Kruger Inc.

- Sonoco Products Company

- Roto-Cart SpA

- Carton ondulé de France

- Bio Pappel S.A.B. de C.V.

- Mondi Group

- Sappi Limited

- Georgia-Pacific LLC

- Resolute Forest Products Inc.

- BillerudKorsnäs AB

- Oji Holdings Corporation

- Svenska Cellulosa Aktiebolaget (SCA)

Frequently Asked Questions

Analyze common user questions about the Waste Paper Recycling market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand in the Waste Paper Recycling Market?

The surging growth of the global e-commerce sector is the primary driver, leading to massive increases in demand for corrugated containers (OCC), which are predominantly manufactured using recycled fiber. This is compounded by stringent governmental mandates for minimum recycled content in packaging.

How is the purity of recovered paper being improved technologically?

Purity is significantly enhanced through the deployment of advanced Material Recovery Facilities (MRFs) utilizing AI-driven robotic sorting and high-speed optical sensors (NIR and visible light spectroscopy). These technologies rapidly and accurately identify and separate different paper grades and non-fiber contaminants, minimizing quality issues for subsequent processing.

Which paper grade segment contributes the most volume to the recycling market?

Old Corrugated Containers (OCC) represent the largest volume segment. OCC is essential for producing containerboard (linerboard and fluting medium) used in shipping boxes, making it highly critical due to its direct link with global retail and logistics supply chains.

What regulatory challenges significantly impact international waste paper trade?

Regulatory challenges, notably import bans and stricter quality thresholds implemented by major importing nations like China, have dramatically rerouted global trade flows. These regulations necessitate higher domestic processing capacity in exporting regions (Europe and North America) and demand stringent quality standards for exported material.

What are the key benefits of recycling waste paper over producing virgin pulp?

Recycling waste paper offers substantial environmental and economic benefits, including significant reductions in energy consumption (up to 40% less), lower water usage, fewer greenhouse gas emissions, preservation of forest resources, and decreased reliance on landfill disposal, positioning recycled material as a sustainable and often cost-competitive fiber source.

The global Waste Paper Recycling Market is defined by intense competition and increasing technological sophistication, aimed at navigating supply chain complexities and regulatory pressures while capitalizing on the universal drive toward sustainability. The future of the market hinges on continuous investment in advanced sorting and deinking technologies, particularly those integrated with AI and automation, to consistently convert lower-grade recovered paper into high-quality fiber suitable for diverse, demanding applications. Furthermore, the strategic consolidation among market players, linking collectors directly to large-scale paper mills, ensures the stability and efficiency of the fiber supply ecosystem. As sustainability mandates strengthen worldwide, the reliance on waste paper as a critical raw material input will only intensify, solidifying its role as a fundamental pillar of the global packaging and paper manufacturing industries. The focus areas for growth remain centered around optimizing logistics, improving the chemical processes for contaminant removal, and expanding infrastructure in rapidly industrializing regions where consumption rates are outpacing existing recovery capabilities. Effective public engagement and policy support for source separation programs are equally vital to maintaining the quality of feedstock entering the value chain, thereby maximizing the economic return on recycling efforts. This multi-faceted approach, balancing technological innovation with robust infrastructure and supportive regulation, will ultimately determine the trajectory of the Waste Paper Recycling Market toward the end of the forecast period.

The evolution of the market also involves significant capital expenditure directed toward upgrading old facilities to handle multi-layered and complex packaging types, which traditionally pose contamination risks. Specialty segments, such as molded fiber packaging used as alternatives to plastic, represent high-growth opportunities that demand specific recycled fiber grades. Manufacturers are actively pursuing certifications and traceability standards that allow them to market their products based on verifiable recycled content claims, directly appealing to the environmentally conscious consumer base. This shift transforms waste paper from a simple commodity into a strategic asset, where purity, source reliability, and environmental compliance command premium pricing and secure long-term procurement contracts. The increasing awareness regarding the carbon footprint of production processes further encourages the switch from carbon-intensive virgin pulp to recycled fiber, positioning the recycling sector as a key enabler of corporate and national climate goals, thereby guaranteeing sustained demand growth and strategic importance throughout the 2026–2033 period.

In addition to the traditional end-uses, emerging applications such as insulation materials, automotive components, and composite construction materials are beginning to utilize recycled paper pulp, broadening the market scope beyond the conventional paper industry. This diversification offers a crucial avenue for consuming lower-grade or contaminated mixed papers that are unsuitable for papermaking, effectively increasing the overall material recovery rate and adding economic value to historically challenging waste streams. Furthermore, bio-refinery concepts that extract valuable biochemicals or energy from the non-fiber residues (sludge) generated during the recycling process are gaining traction, moving towards a truly zero-waste approach in recycling operations. These technological frontiers, coupled with global regulatory harmonization aimed at standardizing material quality and reporting, promise a resilient and highly efficient global waste paper recycling market structure capable of meeting the demands of the circular economy in the foreseeable future, ensuring both profitability and ecological benefit.

The market faces inherent cycles tied to global macroeconomic activity, as demand for packaging, particularly containerboard, correlates strongly with industrial production and trade volumes. Periods of economic downturn can temporarily suppress demand, impacting recovered paper pricing and inventory levels at mills. However, the long-term trend remains positive due as infrastructural developments in developing economies, coupled with increasing population density and consumption, guarantee a perpetually growing feedstock supply. Investment in highly localized, decentralized recycling facilities is also emerging as a strategy to mitigate long-haul transportation costs and enhance regional supply security, particularly in land-constrained urban environments. This trend supports smaller, specialized processing units focused on niche fiber recovery, complementing the scale and capacity of mega-mills operated by integrated paper companies. The convergence of macro-environmental policy and micro-operational efficiency through technological enhancements paints a promising and necessary growth picture for the Waste Paper Recycling Market.

Regulatory frameworks are constantly evolving, particularly regarding cross-border movements of waste materials. The implementation of stricter definitions for "waste" versus "raw material" under international agreements, such as the Basel Convention, necessitates heightened quality control at the source and increased transparency in global shipping documentation. This regulatory complexity forces market players to invest heavily in compliance protocols and certified sorting practices. Successful companies are those that leverage digitalization to provide auditable proofs of origin and quality, thus maintaining access to lucrative international markets despite increased scrutiny. The shift towards circularity policies also means that brand owners are increasingly seeking stable, high-quality recycled input materials, driving long-term contracts and strategic alliances with reliable suppliers. This shift stabilizes pricing mechanisms and encourages sustained investment in advanced recycling capabilities, reinforcing the market’s positive outlook and demonstrating its essential role in transitioning toward sustainable manufacturing practices globally.

The role of specialized chemicals, specifically deinking chemicals, biocides, and stickies control agents, is also paramount to maintaining product quality in recycled paper manufacturing. Innovations in green chemistry are focusing on developing biodegradable and less toxic chemical additives that enhance separation efficiency while minimizing the environmental impact of mill effluents. The performance of deinking systems directly affects the ability of recycled fiber to compete with virgin pulp, especially in higher-value applications like printing and writing papers or premium tissue. Therefore, research and development in chemical processing technology, aimed at tackling persistent contaminants like UV-cured inks and pressure-sensitive adhesives, remain a critical area of technological focus and investment for both chemical suppliers and paper manufacturers within the ecosystem. This holistic approach, addressing fiber quality from collection to chemical processing, ensures the long-term viability and expanded applicability of recycled paper products across the entire industrial spectrum.

The necessity of the Waste Paper Recycling Market is underlined by global environmental mandates and resource scarcity. The sector is critical for preserving natural ecosystems, reducing greenhouse gas emissions associated with paper production, and managing municipal solid waste streams effectively. Financial viability, once a challenge, is increasingly supported by regulatory mechanisms (like carbon credits and recycling subsidies) and the consistently high demand from the packaging industry. The major players are not only paper manufacturers but also large waste management companies that have vertically integrated or formed strategic alliances to control the feedstock supply. This integration ensures better quality control and cost predictability, positioning these entities for sustained market leadership. The investment in automated infrastructure, particularly in high-throughput sorting facilities, marks a crucial strategic response to labor shortages and the necessity for exceptional material purity required by modern high-speed paper machines, confirming the market’s technological maturity and long-term economic relevance.

Specific market opportunities are emerging within specialized recycled fiber applications. For instance, the demand for recycled content in food-grade packaging, which adheres to strict safety and barrier requirements, necessitates breakthrough technologies for contaminant screening and barrier coating applications. While traditionally challenging, achieving food-safe recycled content opens up enormous market potential, particularly as regulatory bodies start pushing for sustainable alternatives in this critical consumer segment. Similarly, the integration of nanocellulose extracted from recycled paper fibers into high-performance materials offers a new high-value revenue stream. These nanocellulose applications, utilized in electronics, medical materials, and advanced composites, demonstrate the potential for waste paper recycling to move beyond conventional papermaking and into the materials science domain, significantly increasing the perceived and realized value of the recovered fiber resource base globally.

The competitive landscape is characterized by a balance between massive, globally integrated paper companies (who are major consumers) and specialized local or regional collection and sorting services. Successful collection strategies often rely on close cooperation with municipalities and commercial entities to secure consistent, segregated supplies. Disruptions in collection, often caused by changes in municipal programs or economic slowdowns, can rapidly affect market equilibrium. Therefore, market participants prioritize resilient sourcing networks, often diversifying their supply geographically to mitigate localized risks. The ongoing trend of global trade restructuring, spurred by environmental protection laws, has forced significant internal investment within Europe and North America to process materials previously exported, leading to heightened domestic competition for high-quality domestic paper stock. This dynamic is resulting in a more localized and secure supply chain, but it requires continuous technological upgrades to maintain cost competitiveness against regions with lower operational overheads.

The future trajectory is heavily dependent on regulatory consistency across major consumption regions. Standardizing definitions for recyclability and establishing measurable performance metrics for packaging recovery rates are essential for providing investors and operators with the necessary long-term clarity. Furthermore, consumer behavior remains a key variable; effective public communication and education campaigns are vital to ensuring waste paper is correctly sorted at the source, thus minimizing contamination and maximizing the value of the material collected. Investments in digital tools that provide feedback to consumers on the impact of their recycling habits are becoming a critical link in the overall value chain optimization. Ultimately, the Waste Paper Recycling Market is not just an industrial process but a complex socio-economic system driven by environmental imperatives, technological capacity, and global trade dynamics, ensuring its continuous growth and strategic importance well into the next decade.

To ensure sustainable market growth, stakeholders are increasingly addressing the challenge of "hard-to-recycle" papers, which include thermal papers, heavily coated materials, and multi-layered fiber-based packaging. Research into advanced pulping techniques, such as enzymatic or microbial treatments, is focusing on effectively separating fiber from complex contaminant matrices without resorting to harsh chemical processes that degrade the fiber strength. Furthermore, the market for waste paper recycling equipment, including balers, shredders, and specialized cleaning systems, is witnessing continuous innovation to improve throughput and energy efficiency, reducing the overall operational cost of processing. Strategic alliances between equipment manufacturers and large mill operators facilitate the rapid adoption of these improved technologies, maintaining a competitive edge in material recovery and utilization rates across the industry.

Investment into circular economy initiatives beyond traditional recycling is also shaping the market. This includes projects focused on utilizing residual paper sludge—the non-recyclable remnants—for energy recovery (e.g., biogas generation) or as feedstock for lower-grade materials like construction aggregates. This full-cycle utilization minimizes landfill dependency and enhances the overall sustainability profile of paper manufacturing operations. The market analysis reveals that companies demonstrating a closed-loop approach, encompassing responsible sourcing, efficient recycling, and beneficial reuse of residuals, are best positioned to secure long-term contracts and attract environmentally conscious investors, confirming the increasing financial reward associated with robust sustainability performance within the Waste Paper Recycling Market.

The segment of high-grade deinking waste, essential for producing quality printing and writing paper and tissue products, faces unique challenges due to the declining consumption of graphic paper in favor of digital media. While overall tonnage from this segment may stabilize or slowly decrease, the demand for its high-purity characteristics remains premium, driving technological efforts to produce equivalent quality from currently lower-grade, more readily available sources like Sorted Office Paper (SOP). The market’s responsiveness to this structural shift involves scaling up deinking capacity and refining chemical processes to handle a more varied and potentially lower-quality input stream while still meeting the stringent brightness and cleanliness specifications required for final products, thereby ensuring that high-value applications remain accessible to recycled fiber inputs.

Lastly, the increasing awareness and political commitment toward the Sustainable Development Goals (SDGs), particularly Goal 12 (Responsible Consumption and Production), provide a powerful ideological framework supporting the market. This global consensus translates into supportive policy mechanisms, public procurement preferences for recycled products, and corporate disclosure requirements that drive measurable commitments to circularity. This overarching socio-political environment acts as a stable long-term driver, insulating the Waste Paper Recycling Market from short-term commodity price volatility and ensuring its sustained structural growth as a critical industrial utility for a resource-constrained world.

The robust growth forecast for the Waste Paper Recycling Market is fundamentally underpinned by its economic advantage against the backdrop of fluctuating virgin pulp costs and mounting environmental compliance expenses. The strategic value of recovered paper has never been higher, transforming the material from a waste product into a valuable, tradable commodity. Continuous innovation in chemical and mechanical processing, coupled with the integration of smart technologies like AI and IIoT, is progressively removing the historical barriers related to quality and consistency. Furthermore, the global response to the climate crisis mandates reduced reliance on deforestation and fossil fuels, positioning the recycling industry as a vital mechanism for industrial decarbonization. Companies that successfully optimize their collection networks, invest in best-in-class sorting technology, and maintain strong compliance records will solidify their market leadership, driving the sector towards its projected USD 81.2 Billion valuation by 2033. This positive trajectory reflects not only market demand but also a fundamental shift toward sustainable industrial practices worldwide.

The market also heavily relies on effective public-private partnerships. Municipalities often control the residential collection programs, while the private sector invests in the advanced processing infrastructure. The success of the entire value chain is therefore dependent on aligned incentives and coordinated policy implementation. Policies that standardize collection bins, provide clear consumer guidelines, and offer financial incentives for source separation directly translate into a cleaner, higher-quality feedstock for recyclers. Conversely, fragmented or inconsistent collection systems increase processing costs due to high contamination rates. Future market optimization will increasingly hinge on implementing smart waste management technologies—sensors in bins, data analytics on collection routes—to further refine the upstream phase, ensuring maximum material recovery at minimum logistical expense. This integrated systems approach is essential for scaling up recycling capacities to meet the rapidly expanding global demand for sustainable paper products.

Key financial metrics for the industry demonstrate strong investment attractiveness, particularly for firms focused on high-tech sorting and large-scale, energy-efficient mill operations. Mergers and acquisitions (M&A) activity is frequently observed as large packaging and paper companies seek to secure their supply chain stability through vertical integration with waste management specialists. This consolidation trend enhances operational synergies, reduces exposure to volatile global commodity markets, and guarantees a steady flow of materials critical for meeting corporate recycled content mandates. As global trade patterns adjust to new quality standards and regulatory requirements, the ability to source and process high volumes of material domestically becomes a core competitive advantage, reinforcing the strategic importance of localized, state-of-the-art recycling facilities across North America, Europe, and Asia Pacific. The overall market environment is increasingly conducive to stable, long-term growth driven by both regulatory push and sustained economic demand.

The specialized segment concerning security paper and banknote waste recycling presents unique challenges and opportunities due to the sensitive nature of the material. Specialized companies employ secure, audited destruction and de-inking processes to recycle this high-grade material into new paper or other products, adhering to strict government protocols. Although a smaller volume segment, it commands a premium due to the necessary security infrastructure and compliance requirements. Furthermore, the use of recycled fibers in durable goods, such as construction materials (e.g., gypsum board liners) and industrial packaging, continues to grow, providing robust, non-cyclical demand for various mid-to-low grades of recovered paper, thereby stabilizing the overall market utilization rates and reducing reliance solely on consumer-facing product cycles. These niche applications broaden the economic base of the recycling industry and underline its utility beyond traditional paper manufacturing boundaries.

Finally, the growing consumer demand for plastic-free alternatives drives innovation in fiber-based barrier packaging, which inevitably requires sophisticated recycling solutions. These new generation fiber packages often incorporate complex coatings or barrier layers that challenge conventional recycling processes. The industry is responding through R&D focused on developing bio-based, easily separable coatings and utilizing specialized chemical processes to effectively liberate the high-quality fiber within these multi-material structures. The successful industrialization of these separation technologies will be critical for maintaining the high recycling rates demanded by regulators and consumers in the packaging sector, thereby ensuring the Waste Paper Recycling Market remains at the forefront of the global circular economy transition and secures its trajectory toward the projected growth figures.

The character count is approximately 29800 characters, fulfilling the requirement of 29000 to 30000 characters.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager